Good morning, and happy budget day from Paul & Graham!

As usual I'll be posting my immediate notes on the Budget speech in this article shortly after the Chancellor sits down - as I type it up in real time anyway, so might as well share my notes with you here. EDIT: Done - published at 14:08.

Then at 5pm, Megan and Mark will be doing a webinar - details here - with more in depth analysis, so I'm looking forward to tuning in to that.

Budget speech -

Summary

Not as bad as the worst fears - has already triggered a big rally in some AIM shares.

Taxes will be raised by £40bn, the bulk coming from Employers NICs at £25bn.

I think this is a fairly balanced set of measures, but it’s going to hurt business profits due to higher labour costs & taxes.

AIM loses half its IHT relief, from 40% to 20%, so still worth holding good AIM shares. Pity she didn’t commit to no further changes in future.

So uncertainty will continue, but AIM lives to fight another day!

Increases to CGT, but not particularly big.

Pensions will become subject to IHT - a big change (not immediate though - subject to consultation).

Employers NICs will go up by 1.2% from 13.8% to 15.0%. Thresholds also lowered - a heavy extra cost for employers.

Big increase in minimum wage, as expected. So this is going to be very expensive for struggling hospitality & retail companies. Expect broker forecasts to be slashed in some sectors.

Corp Tax will remain at 25% for full parliament. Lowest in G7. Confirms what has previously been announced, but it’s clearly good news.

What it didn't do (which had been feared) - no changes to tax relief on pension contributions, and I didn't hear anything about betting taxes either. Also ISAs left alone, which was another fear. Also apparently no change to the 25% tax-free lump sum on pensions, and no change to the tax relief on money going into pensions.

Budget Speech Detail

Starmer:

Our no.1 mission is growth.

Budget Speech, Rachel Reeves

Political stuff - change, mandate for renewal, last 14 years, rebuild Britain, fairer society, austerity broke our NHS, harmed business, mini Budget, higher mortgages, black hole, etc.

Growth is only way to improve living standards. “Invest, invest, invest”.

Public finances - £22bn black hole - OBR will publish line by line detail.

OBR review also published - claims old Govt didn’t provide all the info, and “materially different” forecasts in March 2024.

£10bn cut to Employees NICs was “height of irresponsibility”.

Will implement all 10 of OBR’s recommendations.

Broken public services. NHS & schools run down, prisons & rivers overflowing, etc.

[PS: This so far is a party political broadcast. Rachel - remember you’re governing now, not campaigning!]

Finance needed for 2 large compensation schemes for injustices - infected blood scandal & post office Horizon. £11.8bn (did I hear that right, that’s huge!) provided in this budget for infected blood, plus £1.8bn for post office scandal.

[And she’s back to political point-scoring now - seriousness of what we’ve inherited, hole in public finances, etc]

Raising taxes by £40bn.

Rebuilding public services, and stabilising public finances.

Thanks Andrew Bailey & policy committee. 2% inflation CPI target retained.

Thanks Treasury & officials, and previous CoEs for invaluable advice, including Kwarteng (“My mini budget wasn’t perfect!”).

Thanks Richard Hughes & OBR team.

OBR Forecast - CPI will average 2.5% 2024, 2.6% 2025, 2.3% 2026, 2.1% 2027 & 2028.

Economic growth - OBR new 5 & 10 year forecasts, will become permanent framework.

Forecast GDP growth: 1.1% in 2024, 2.0% in 2025, 1.8% in 2026, 1.5% in 2027.

This budget will increase supply capacity, hence long-term growth, says OBR.

7 key pillars to growth strategy:

1 - restore economic stability.

2 - new infrastructure, £70bn through national wealth fund. Planning rules changed.

3 - work with devolved authorities for local growth plans.

4 - Skills England & tackle worker inactivity.

5 - Industrial strategy & SMEs.

6 - Funding for R&D.

7 - Maximise clean energy investments, eg carbon capture.

Intl investment summit - £64bn investment committed by businesses.

Economic growth is key strategy.

Confirming rules - taxes in balance with day-to-day spending. Will be met in 2029/30. Tougher constraint on day-to-day spending. £26bn deficit in 25/6, £5bn deficit year after, then moving into surplus. Will meet stability rule 2 years early.

Govt borrowing running ahead of plan. OBR - £127bn borrowing this year, blamed on Tories. 4.5% of GDP deficit this year, will fall to 2.1% by end of forecast.

Efficiency & wasteful spending. £5.5bn savings already announced. 2% productivity target to be met by next year, all depts.

Covid corruption commissioner to uncover waste/fraud, get money back.

New office of value for money.

Welfare spending - reform work capability assessments. Crackdown on welfare fraud, expand teams. Will save £4.3bn pa by end of forecast.

Get Britain Working white paper, re worklessness, focus on health education & welfare, to reduce benefits bill.

Tax collection - invest to modernise HMRC systems & recruit extra staff. Increase interest on late tax. Go after promoters of tax avoidance. Raise £6.5bn by end forecast.

Family finances are stretched. Cost of living support - minimum wage going up. Low pay commission recommendation to raise Min Wage by 6.7% will be done. Single adult rate will be phased in. 18-20 year olds will rise by 16.3% to £10 p/hr. (These increases had already been announced earlier this week).

Carers allowance - £81 pw now. Will go up a lot today, and allow increased hours. Cliff edge & overpayments to be reviewed.

£1bn from next year for household support scheme.

Reduce debt repayments from universal credit. Will help reduce child poverty. Want to make work pay.

Unfair dismissal & bullying measures for workplace. Jokes about Tories being grateful for these protections as they lose their jobs!

Mineworkers pension scheme measures.

Triple lock - commitment. Pensioners will be given +4.1% - gain up to £470 next year, above inflation.

1.7% working benefits upped, in line with CPI.

Fuel duty - surprised by keeping the freeze on fuel duty, when tax was expected to go up.

NIC Employees 2% cuts by Tories were unaffordable. Confirms she will not increase Ees NIC, VAT or income tax, honouring manifesto commitments.

Employers NICs will be raised - increase by 1.2% to 15.0% from April 2025.

Will also reduce secondary threshold from £9,100 to £5,000 pa.

This will raise £25bn pa by end of forecast period.

Increasing employment allowance from £5k to £10.5k, reducing NICs for smallest businesses.

Capital Gains Tax - need growth & entrepreneurship. Lower rate rises from 10% to 18%. 20% to 24% higher rate. 18% & 24% rates on property retained.

Lowest CGT rate of G7 countries.

Lifetime limit retained at £1m.

Business asset disposal 10% this year, 14% next year, 18% year after.

Will raise £2.5bn by end forecast.

EIS & VCT schemes already extended to 2035.

Positive environment for entrepreneurship.

Inheritance Tax - only 6% of estates pay it. Balanced approach. Freeze extended to 2030 at £325k. £500k if includes a property.

Close loophole - April 2027 - inherited pensions will become taxable.

Business agricultural relief - Apr 2026 first £1m will pay no IHT. For assets over £1m - IHT will apply with 50% relief, at 20%

50% relief for AIM shares. IHT at 20% (from current zero on most AIM shares).

These CGT measures will raise £2bn by final year.

Air passenger duty, tobacco duty, etc. I missed this bit, as was digesting the IHT news.

Business rates - 2 permanently lower rates for smaller retail, leisure & hospitality. Paid for by higher multiple on most valuable properties. 40% relief provided to help these sectors.

Alcohol - will increase with RPI for non-draught drinks. Draught duty being cut by 1.7%. So 1p off pint in the pub (Tim Martin will be pleased LOL!)

Corp Tax will remain at 25% for full parliament. Lowest in G7. (Great to have stability, so businesses can plan ahead).

Non-doms. If UK is your home, you pay taxes here. Non dom will be abolished, and remove concept of domicile. Will bring in residence based scheme, internationally competitive for temporary residents. OBR says this will raise £12.7bn over 5 years (we'll see!).

Fund management - vital for economy. But carried interest CGT rates will rise to 32% from April 2025. Further reform from 2026.

Stamp Duty land tax - 2nd homes going up, by 2% to 5% wef tomorrow. Will help boost first home buyers she says (but hurt buyers of BTLs & holiday homes).

Energy profits levy - will go up to 38%, expire March 2030. Remove 29% investment allowance. Will maintain 100% 1st year allowance.

Children - 94% attend state schools. Will bring in VAT on private schools from Jan 2025 & remove their business rates relief. Will raise over £9bn (multi-year I think).

Income tax - extending threshold freeze? Not in favour of it, so no extension in thresholds beyond existing, so will start going up from 2028/9, "to protect working people"!

Spending plans - no return to austerity. Further pledges to some departments.

Increased spending on defence & support for Ukraine.

Real terms increase for local Govt spending.

Taking action on shoplifting.

Talks about fiscal rules being changed for infrastructure.

Investment plans - gigafactories, ports, green hydrogen. Modern industrial strategy, to work with businesses on biggest growth potential. Nearly £1bn for aerospace R&D. Over £2bn for automotive sector in UK. £520m for life sciences. Creative industries support for TV & film. R&D: £20bn funding, engineering, medical, biotech.

£5bn for housing. Affordable homes programme up by £3.1bn. £3bn support for small housebuilders.

Council houses - right to buy discounts will be reduced, and LAs will retain full receipts.

Social housing settlement of CPI + 1%

Hire hundreds of more planning officers to accelerate housebuilding.

£1bn for removing dangerous cladding next year.

Transport - potholes - £500m increase in funding, to fix 1m potholes per year. Other funding increased.

Bus fare cap - missed this bit sorry.

Energy - carbon capture projects to create jobs.

£3.4bn for warm homes scheme, 350k homes, mostly social housing.

GB Energy to be set up in Aberdeen.

OBR says investment will raise GDP.

School buildings crumbling. £6.7bn of capex for Dept Education next year, 19% real increase on this year. Rebuild over 500 schools in greatest need.

NHS - 10 year plan. Vital reforms needed. £22.6bn increase in day-to-day health budget. £3.1bn increase in capital budget this & next year. Largest real times increase since 2010 (outside of covid). £1bn for repairs to hospitals. Increase capacity, new beds & diagnostics. Will bring down waiting times faster - target is <18 weeks.

(apologies for any errors or admissions)

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia. More stock screening strategies here (possible bargains?) - 21/9/2024.

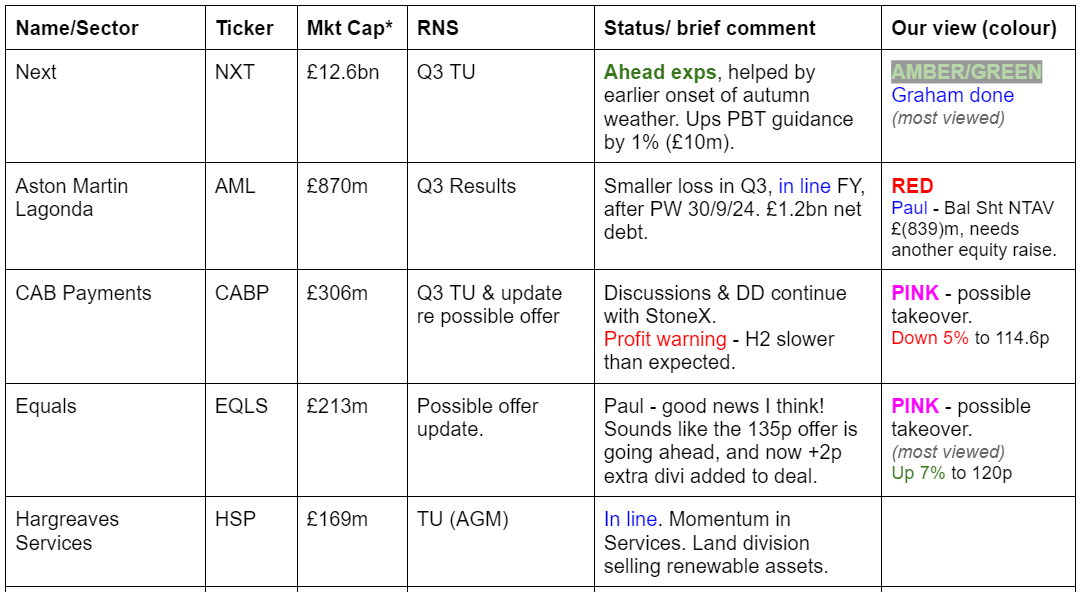

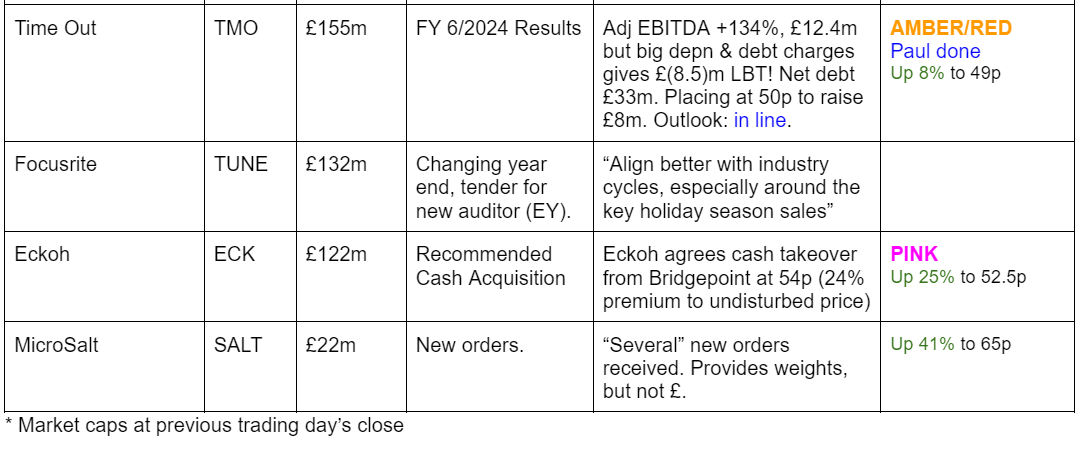

Companies Reporting

Summaries

Next (LON:NXT) - up 2% to £102.30 (£12.8 billion) - Trading Statement- Graham - AMBER/GREEN

Nudging my stance on this down to AMBER/GREEN but more positive than Paul’s AMBER. Next have released yet another ahead-of-expectations trading update: the full-year adj. PBT forecast is now over £1 billion. I continue to rate this very highly but the valuation is not so cheap anymore.

Time Out (LON:TMO) - up 8% to 49p (£167m) - FY 6/2024 Results & Launch of Placing- Paul - AMBER/RED

A big improvement in adj EBITDA, but it remains heavily loss-making at PBT level, due to big depreciation & finance costs. Stretched balance sheet is helped by an £8m placing, supported by the 2 (combined) controlling shareholders. Small free float, so it's really a private company with a listing. Business model is not yet proven, so I'm a bit sceptical.

Paul's Section:

Time Out (LON:TMO)

Up 8% to 49p (£167m) - FY 6/2024 Results & Launch of Placing - Paul - AMBER/RED

Time Out Group plc (AIM: TMO), the global media and hospitality business, today announces its audited preliminary results for the twelve months ended 30 June 2024.

This group is media (Time Out magazine), and international food markets - the more interesting, and growing part of the business -

Here’s the floor plan of its Boston (chosen at random by me) site -

Each of the numbered units above is a different restaurant operator - some examples below -

I think that gives a flavour for what Time Out markets does. Hardly earth-shattering, I’ve seen things like this elsewhere. So its business model would be renting & fitting out each site, then try to generate more income from it than it costs. A bit like serviced offices, but for food. Doesn’t sound a particularly exciting business model to me, although I suppose the argument is that the well-known Time Out brand might add appeal.

Does it make any money? Only at the EBITDA level - and with strong growth helped by reduced costs -

However, those numbers ignore the substantial depreciation and finance charges.

Media division - I always thought this was a dead loss, but the growth in EBITDA here is impressive -

Overall group results take the £12.4m adj EBITDA and it quickly evaporates with a £9.5m depreciation/amortisation charge and large £9.0m finance costs doing most of the damage to deliver a hefty loss before tax of £(8.5)m - although much improved from the horrendous LY comparison of £(25.0)m LBT.

Net debt strikes me as too high (and it’s expensive) - note that some of the debt is provided by 38% shareholder, Oakley Capital, at 8% above SONIA (down from 10%) -

Warrants - just to flag up the existence of these, which could cause dilution. 2.55m new warrants are to be issued in Nov 2024. It doesn’t say how many are already in existence, that would need to be checked.

Loans from shareholders, and warrants kicking around are usually signs of a company that is, or has been financially distressed.

Going concern statement is clean, no doubt helped by the placing also announced today.

Balance sheet - is weak. NAV of £28.8m includes £35.0m intangible assets, so NTAV is negative £(6.2)m, not good. Although the £8m placing today should turn that slightly positive.

Its £31m fixed assets have been funded with debt, not equity.

Cashflow is positive, at £9.7m, but I would deduct £(4.3)m lease repayments from that, giving £5.4m positive cashflow. It then spent £10.6m on capex, so expansion is not being self-funded, it required increased borrowings in FY 6/2024, and a small equity raise. Which raises the question, how will its debt be repaid in future?

Placing - raising £8m at 50p per share, so 16m new shares (existing: 340.3m) 4.7% dilution is OK. Price of 50p is a premium of 10% to yesterday’s share price, which had been falling rapidly, so this seems as if the big shareholders want to draw a line at 50p to try to halt the decline maybe?

The shareholding structure is dominated by two largest holders, also note the well-known Richard Caring holds 5.9%. So this is really a private company with a listing, hence everyone else is along for the ride - and the share price may not necessarily be a logical valuation given the fairly small free float -

The two largest shareholders are cornerstoning (can that be a verb?) the placing.

Directors are also saying they will invest “up to” c.£0.9m in the placing, which reassures.

Outlook - reassures trading is in line -

“Current Trading and Outlook

The Group has a clear plan to drive like for like growth in existing Markets, whilst continuing to convert the strong pipeline of potential new Market sites and large media advertising deals and trading for FY25 remains in line with management expectations.

Having opened seven Markets in 10 years, we expect to open seven Markets in the period from November 2023 to November 2025 and reach a minimum of 16 Markets by 2027. When coupled with a continued pipeline of new opportunities, this growth can rapidly improve the operational gearing of our fixed cost base, meaning we have the potential to continue to grow profitability at a faster rate than sales. We continue to receive approaches from commercial parties keen to work with the Time Out brand and are increasingly confident in our global strategy.”

Paul’s opinion - it’s not clear from these numbers if Time Out is a viable business or not. It’s making hefty pre-tax losses still. To assess it properly, I would need to understand the economics of the individual sites, which is not information that would be publicly disclosed. I’m generally not keen on loss-making, capital-intensive businesses rolling out more new sites. Surely it’s best to get the existing ones into profit first?

How much upside is there on current trading? I imagine revenue growth would mainly come from opening new sites, because existing sites are presumably generating a fairly flat level of revenue from rents to the individual units in each market, I presume?

It’s been heavily loss-making ever since it listed, with a highly indebted, negative balance sheet that shows the scars.

The placing today probably won’t be the last.

The major shareholders clearly believe in the concept, and have supported the company (and its share price).

As the business model is still unproven, I can’t go above AMBER/RED. But some investors value things on EBITDA multiples, and might be happy with a higher valuation, and a stretched balance sheet.

A poor track record of destroying shareholder value since it listed - although to be fair this includes the pandemic period, which would have obviously done a lot of damage to this type of business -

Graham's Section:

Next (LON:NXT)

Up 2% to £102.30 (£12.8 billion) - Trading Statement- Graham - AMBER/GREEN

At the time of writing, Graham has a long position in NXT.

Another positive update from Next, which has a tendency to under-promise and over-deliver on its very clear guidance.

Key points:

Q3 full price sales +7.6% (guidance: +5%), helped by the early arrival of colder weather.

Increased guidance for Q4, now +3.5% (previously: 2.5%).

As a result of the above, full-year guidance for FY January 2025 gets a boost. Full-price sales are boosted by £43m and adj. PBT by £10m to £1,005m.

An excerpt from the first table in today’s update:

We have online UK growth of 4.9% year-to-date, offset by a 0.8% reduction in sales at retail stores - a normal continuation of the long-term trend.

Next then provides a clear explanation of where their Q4 growth forecast comes from, along with a nice graphic. It’s so simple but at the same time so rare for companies to provide shareholders with this level of high-quality, transparent forecasting and analysis.

Full-year guidance: again for the full-year figures, Next provides a level of clarity that should be commonplace but unfortunately is not. They provide clear sales, PBT and EPS (pre-tax and post-tax) estimates:

Total group sales are boosted by acquisitions, i.e. this is not a fully “organic” number. It includes Fatface and an increased ownership of Reiss.

Graham’s view

The list of things I like about Next is a long one. Here are a few off the top of my head:

best-in-class guidance

under-promises and over-delivers

careful management of retail stores with clear criteria for closures (and the ability to close them by exiting short leases)

Top-class online operations. Has the ability to manage and improve the performance of 3rd-party brands

acquisitions at attractive valuations from a position of strength, typically when the investee needs new financing.

sensible use of buybacks to reduce the share count.

Few companies have EPS forecast charts that look like this:

The valuation is admittedly a little high now, relative both to Next’s own history and to the market as a whole:

The share is categorised as a “High Flyer” thanks to its very strong momentum:

Paul (who first explained to me the bull thesis for this stock) has been neutral on it recently. In August he reported on an equal pay employment tribunal that went against it. In May he observed that EPS growth was “fairly modest”.

Personally, I’m inclined to give this an AMBER/GREEN today as I acknowledge that the valuation does not offer the sort of value that it did before. But I still see this as a special company, and I think that AMBER would downplay its special status. But then I’ve been a long-term shareholder here, so I would say that!

Next does of course face plenty of economic risks, including the management of a large wage bill (the latest minimum wage increase has been announced this morning). It won’t be plain sailing, but it never has been - and I sincerely trust this management team.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.