Good morning from Paul & Graham!

Another key week for global markets, with the US election for us to focus on, or completely ignore, whichever you prefer.

All done for today.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia. More stock screening strategies here (possible bargains?) - 21/9/2024.

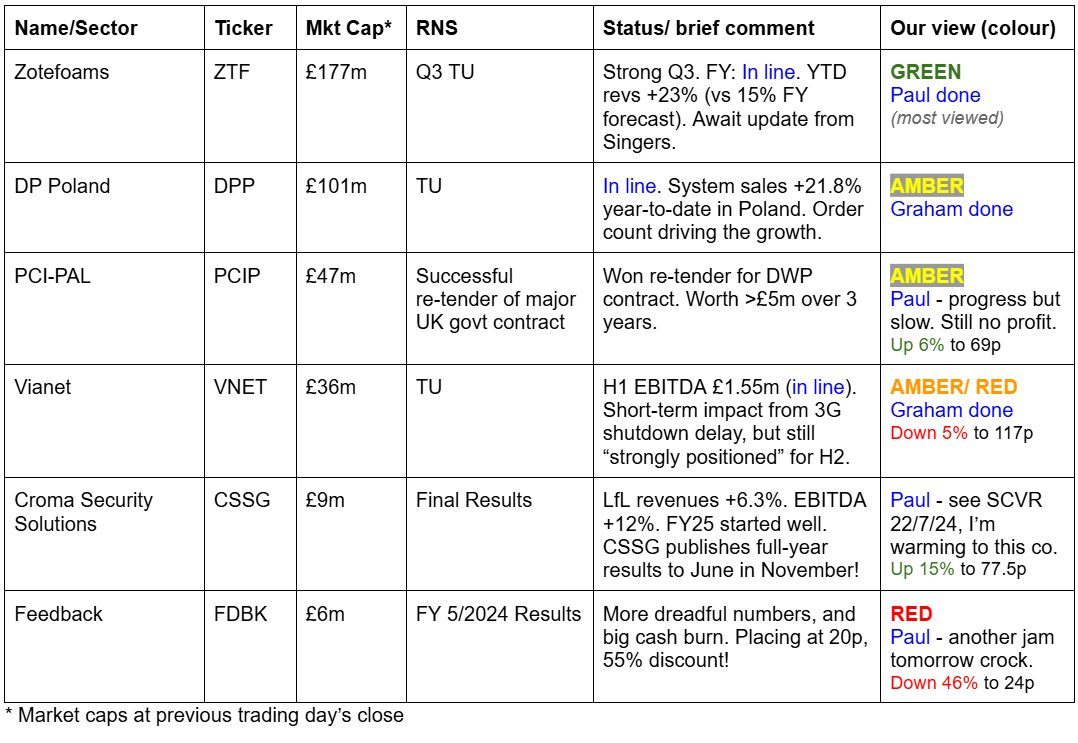

Companies Reporting

Summaries

DP Poland (LON:DPP) - up 1% to 11.1p (£102m) - Trading Update - Graham - AMBER

Forecasts are unchanged following this Q3 update with sales up 19% year-to-date in Poland. With a nice cash pile, a big increase in production capacity and a new franchising strategy, I’m happy to be neutral on this despite a very high valuation relative to current earnings.

Zotefoams (LON:ZTF) [Paul holds] - up 7% to 379p (£186m) - Q3 Trading Update [in line] - Paul [I hold] - GREEN

There seems a striking change of tone from the new CEO over the ReZorce development project, with it being de-emphasised, and apparently close to being abandoned, or at least put on hold. The core business is trading well, and overall it's in line with expectations for FY 12/2024. Less exciting now for multibagger potential, but I think the core business looks good, and shares seem good value, hence I remain positive, and have no current intention of selling my personal position [as always, subject to change].

Vianet (LON:VNET) - down 9% to 111.12p (£33m) - Trading Update - Graham - AMBER/RED

No change to forecasts at Vianet with the company showing reasonable growth in H1 revenue (+7.5%) and operating profit (+10%). The company has ambitious growth plans for the next two years but the statutory profit figures strike me as rather small so I think a mildly negative stance is justified.

Paul’s Section:

Zotefoams (LON:ZTF) (Paul holds)

Up 7% to 379p (£186m) - Q3 Trading Update [in line] - Paul (I hold) - GREEN

Zotefoams, a world leader in supercritical foams, today provides a trading update for the nine months ended 30 September 2024 ("year to date") and in respect of its financial year ending 31 December 2024.

"Strong performance in a volatile market - profit in line with market expectations"

Key points -

Barn-storming revenue growth in Q3 of +54%, but it says this was against a soft prior year.

YTD revenue growth has accelerated from +13% in H1, to +23% YTD 9 months to end Sept.

“Strong margins have been maintained year to date”

Latest broker note from Singers forecasts +15% revenue growth for FY 12/2024, so at end Q3 +23% is well ahead of that - hence it looks as if forecasts are more likely to be beaten than missed.

Outlook - sounds as if FY 12/2024 results are pretty much in the bag -

“With the exception of T-FIT, which is generally heavily weighted to Q4, the Group has good visibility of confirmed orders across most business units for the remainder of the year. As a consequence, and while we remain mindful of the risk of some continued demand volatility in certain sectors, we expect to deliver significant revenue growth in 2024 over 2023.

Across our two foams business units, margins are expected to be in line with the prior year, with mix and growth benefits offset by our investment in Shincell and increased people costs.

In our MEL business unit, the full year loss will be slightly above that of the previous year, as expected, reflecting further ReZorce development costs.

The Board is confident in the Group's ability to carry positive momentum through the remainder of the year. Based on its current sales forecasts and foreign exchange rates, and subject to there being no material disruption to the business, it expects revenue and adjusted profit before tax to be in line with current market expectations.*

* Current Zotefoams-compiled consensus expectations for revenue is £145.5m and adjusted profit before income tax and separately disclosed items, for the year ending 31 December 2024, is £14.9m.

ReZorce - as several readers also noticed in the comments section, there seems a significant change of tone re the ReZorce recyclable single material drinks cartons project. Looking back at the interim results commentary published 6 August, it was given prominence, and called a “transformative opportunity”. Refresco (“the world’s largest independent beverage packager”) was named as joint development partner. Also it was “preparing for market trial…”, and “exploring strategic investment partnership during H2 2024 to facilitate the scale-up and delivery of the ReZorce solution globally”.

Today it says this - I've just noticed it uses the word "transformative" below too, but with "technology" rather than "opportunity" -

“Zotefoams has continued its investment in the development of ReZorce® recyclable barrier technology, with year-to-date operating costs slightly higher than the prior-year comparative period. We continue to work towards the key technical milestones, including endurance and sterility testing, which we are targeting to complete before the year end. The commercial scale production of ReZorce requires significant capital investment and, therefore, the priority of the Board and executive management has been to find a strategic partner that will enable the commercial development of this transformative technology. The process to identify a such a partner has been underway since May this year and we will provide a further update to the market when appropriate."

As others have identified, the next paragraph sounds a lot more cautious -

“While we continue to progress the development of ReZorce and explore potential strategic partnerships for its commercialisation, our primary focus remains on expanding our leadership in our core supercritical foam technologies, where we see significant growth opportunities. “

This is further reinforced in Singers note this morning, which says a “crunch point is near”, and that ZTF management has indicated it will not continue incurring further development costs past the end of FY 12/2024. Well that’s news to me! I don’t recall that being publicly stated before. Looking back at the interims, ReZorce seems to be incurring losses of about £4m annualised, which is material to the overall forecast result of £14.7m adj PBT for FY 12/2024.

Maybe this is why Singers forecast a big jump in profits to £20.3m in FY 12/2025? Eliminating £4m of ReZorce development costs in 2025 is the only way I can see the 2025 forecast being realistic, as forecast revenue is only a modest increase from £146m (2024 forecast) to £150m (2025 forecast), yet a large increase in adj PBT from £14.7m to £20.3m could only be achieved by stopping the losses on ReZorce, I imagine. I'm not keen on there being an arbitrary date of end Dec 2024 to make a decision on ReZorce - maybe it's to focus minds internally, and get things moving?

Therefore my conclusion is that ReZorce sounds as if it’s likely to be put on hold, if they can’t get a deal done soon. So blue sky, exciting upside from ReZorce now seems to be in managed decline, but the good news is that eliminating the development costs will substantially boost profitability in 2025 onwards. That’s what the bull case always said - great if ReZorce works, but if it fails then profits actually rise considerably, from eliminating the costs.

Singers has 22.2p adj EPS for 2024, and 30.7p for 2025. That gives PERs of 17.1x and 12.3x

It seems to me that the change of CEO might have driven this considerable change in tone re ReZorce. The interim results (very upbeat on ReZorce) were published when the new CEO had only just joined (11 weeks). Today he’s been in the job another 3 months, and is obviously a lot less excited about ReZorce than the previous CEO!

Another point to note is that the strong performance this year by the core business has been boosted by some tailwinds - Olympics (boosting high end trainers for the key customer NIKE), and customer inventory rebuild.

It sounds as if ZTF has plenty of opportunities, and it mentions a recovery in aviation (after Boeing stoppages) as being a likely future boost.

I don’t really understand the Shincell licensing deal, and would like a clearer explanation of this from management.

Paul’s opinion - my initial reaction was that this is a good trading update, and shares could bounce. However, on further thought I can’t help feeling some disappointment that ReZorce appears to be declining as an opportunity. That said, it’s still live, and who knows what deals could yet happen? I want to remain in this share just in case it does announce a development/finance deal, as it would be horrendous to have sold out just before the bulk jam delivery arrives!

The core business sounds like it’s doing really well, albeit helped by some temporary boosts. I also like the commentary about further growth opportunities.

Valuation looks really attractive on 2025 forecasts.

The balance sheet is fine. Yes ZTF is quite capital-intensive, but I understand its factories have been updated in recent years, and remember it owns freeholds for the main sites, which for me offsets the bank debt.

It seems that the share price correctly anticipated a declining opportunity for ReZorce, but I think (and Singers makes this point too) that the core business is now very attractively priced, so there’s literally nothing in the current share price for ReZorce, making risk:reward quite attractive I think. Hence I’m happy to stick with GREEN, but with less emphasis on ReZorce, and a correspondingly lower valuation. So it’s now more of a value/GARP share, than a potential major multibagger I think.

Graham’s Section:

DP Poland (LON:DPP)

Up 1% to 11.1p (£102m) - Trading Update - Graham - AMBER

The owner of Dominos Pizza in Poland and Croatia has a long history of making losses, but a new strategy and new funding of £20m in March of this year has given it a fresh chance of success.

2-year chart:

Today we have a Q3 update. Key points:

Like-for-like system sales are up 21.8% year-to-date in Poland (up 21.0% in Q3). Total system sales up 19% year-to-date.

Growth is mostly driven by an increased number of orders (LfL up 17.3% year-to-date), not by inflation or larger order sizes.

Orders for delivery account for the majority of sales and they are growing at a much faster rate than orders for non-delivery.

The Croatian business is much smaller than the business in Poland, and is growing from this low base. Total sales in Croatia (including the contributions from new store openings) are up 65% to €2.7m year-to-date.

For contrast, sales in Poland year-to-date are equivalent to c. €44m. So I wouldn’t spend too much time analysing the Croatian business yet.

Store openings: DPP is on track to open 16 new stores this year (including 4 relocations) to end the year with c. 122 stores.

The transition to being a sub-franchised business continues with 5 stores sold to franchisees.

New silos/dough-making equipment have been added at the central commissary in Lodz. DPP originally set out to double their capacity at this site.

CEO comment excerpt:

I am delighted to report that DP Poland continues to experience exceptional growth across both Poland and Croatia…

We're fully committed to our strategy of delivering quality pizza quickly and providing great value to our customers. By opening 12 new locations this year and transitioning to a sub-franchised business model, we're rapidly gaining market share and setting the stage for even greater success.

Estimates: Singers have left their forecasts unchanged. They see adj. EBITDA (on the old accounting basis, i.e. including the full cost of leases) turning positive this year to £1.6m, rising to £3.8m next year.

They don’t see adj. PBT turning positive until next year (£1.1m).

Graham’s view

This is a complicated story but let me break down some of the key points.

Inflation - this is currently running at 4.9% in Poland, much lower than the double digit rates seen last year. I think this can give investors far more confidence in this year’s results, that it’s not purely inflation-driven. DPP mentions today that there has been upward pressure on food costs this year, but they do not quantify it.

Balance sheet - net cash was £12.7m in June, thanks to the fundraising earlier this year. Tangible NAV was about £17m at the time. While this is not enough to support the current market cap, the company should feel very secure with this level of cash.

Profitability - as usual I’m not inclined to value the company on the basis of adj. EBITDA. Adj. PBT is seen turning positive next year and then rising to £3.3m in 2026 (give or take exchange rate movements). Even that level is not enough to justify the current market cap.

Franchising - for me, the most exciting development is the promise that this will become a franchise-led business (implying less capital needed, less risk for DPP, and a higher return on investment). But remember that the official plan (covered here) is for 45% of the store network to be franchised by the end of 2026, i.e. another two years from now. And even then, most of the stores will still not yet be franchised.

Given all of the above, I think it makes sense to stay neutral on this share. I think it’s worth keeping an eye on, and it could be a long-term winner, but I would have some doubts that it’s currently worth £100m+.

The StockRanks share these doubts:

If I was basing my view purely on the current valuation then I’d have to be negative, but in my view the new strategy has created the real possibility that they can create a long-term winner. So neutral makes the most sense to me.

Vianet (LON:VNET)

Down 9% to 111.12p (£33m) - Trading Update - Graham - AMBER/RED

Vianet’s self-description these days is a bit of a mouthful:

…the international provider of actionable data and business insights through an integrated ecosystem of connected hardware devices, software platforms and smart insights portals…

Today we have an H1 update to September.

Headline numbers:

Revenue +7.5% year-on-year.

EBITDA +27% to £1.55m

Operating profit +10% to £1.4m

Net debt falls from £2m to £1m.

The company highlights “good operational cash generation” but Paul has previously noted that the company puts a lot of payroll into development spending, i.e. not in the operational section of the cash flow statement.

Market developments: the transition from 3G to 4G is relevant for Vianet’s “unattended retail division”, i.e. vending machine technology.

This transition isn’t happening as quickly as anticipated but Vianet don’t seem too concerned:

The anticipated 3G network shutdown, initially anticipated for December 2024, is now expected in summer 2025, however our contract extensions and footprint expansion with both new clients, such as Lucozade, and existing clients leaves us strongly positioned for H2 2025 and FY2026.

CEO Comment excerpt:

"We are witnessing a notable improvement in the Group's performance, driven by our strategic investments in sales, technology, new market verticals, and expanded product lines. These initiatives, along with our strategic partnerships, have established a strong foundation for growth, unlocking exciting commercial opportunities across all areas of our business…

While the slow pace of the 3G network shutdown presents certain short-term challenges, it has not impeded our ability to build a strong pipeline. We remain optimistic about our capacity to double the size of this business within the next 18-24 months.

Estimates: Cavendish have left their forecasts unchanged, with adj. EBITDA forecast to come in at £5.2m, and adj. PBT at £2.2m. They argue that the company is trading at a cheaper EBITDA multiple than its peers and a higher free cash flow yield.

Graham’s view:

I hope I’m wrong, but I fear that this meme will apply as soon as we start looking for Vianet’s unadjusted, after-tax net income:

The most recent full-year results (to March 2024) showed an adj. EBITDA of £3.47m, but after-tax net net income was only £801k (23% of adj. EBITDA). The company paid out £150k in dividends during the year.

I’m not inclined to be RED on this as I try to reserve that colour for companies with fundamental problems. VNET strikes me as being quite expensive and probably overvalued, but that’s all. So I’ll be AMBER/RED on it.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.