Good morning! It's Roland and Graham with you today, plus an overnight section from Megan.

US Election - Donald Trump is destined to be sworn in as the 47th president of the United States. The FTSE has responded positively as of 11am this morning and Megan has covered the response in more detail here.

This report is all done for today (just before 1pm). Phew!

Explanatory notes

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

Akey assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices).

My video explaining/reviewing it. My other video (June 2024) - How to screen for broker upgrades on Stockopedia. More stock screening strategies here (possible bargains?) - 21/9/2024.

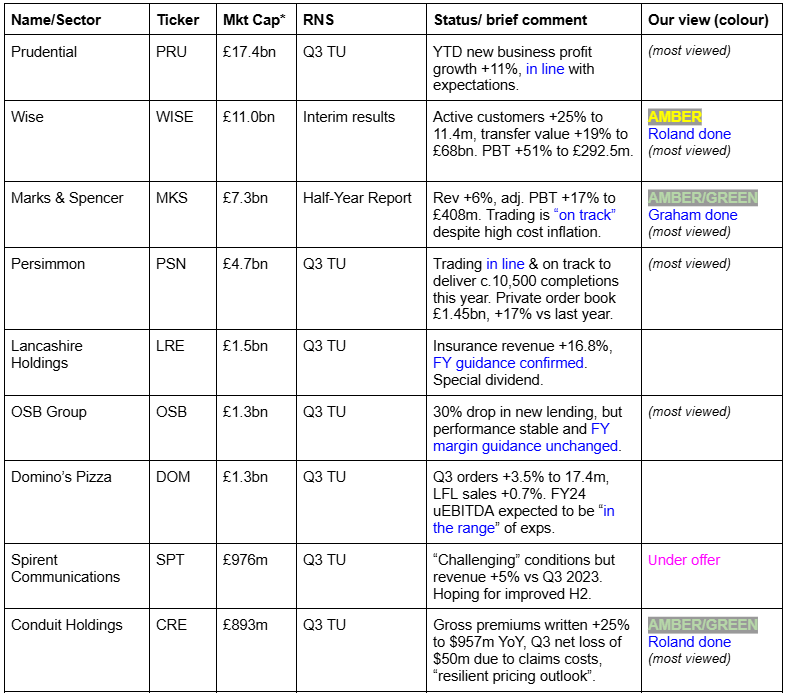

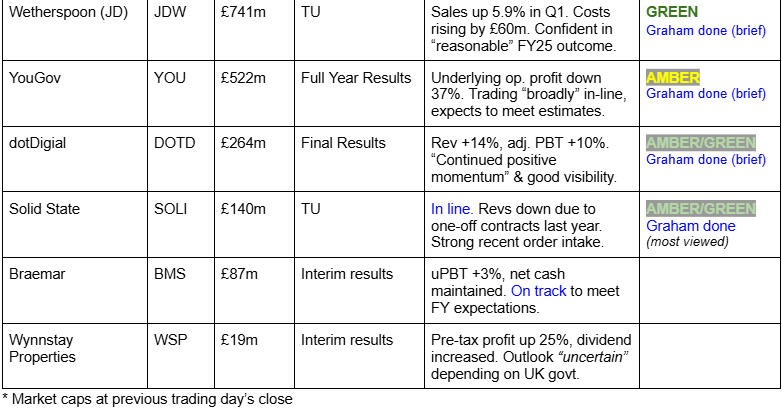

Companies Reporting

Backlog

Summaries

Solid State (LON:SOLI) - down 10% to 221p (£140m) - Trading Update - Graham - AMBER/GREEN

This update is in line but the market seems unimpressed: H1 revenues (£62m) and adjusted profits (£2.5m) are significantly down on last year, due to the loss of one-off contracts, and hitting this year’s expectations relies on orders that have not yet been secured. I downgrade my stance from GREEN.

Wise (LON:WISE) - up 4% to 801p ( £8.3bn) - Interim results - Roland - AMBER

A strong set of results from the currency transfer specialist. The benefit from higher interest rates has provided a big boost, but as I discuss I think there are reasons to expect profitability to start to normalise. I like the business but think the shares are probably already fairly priced.

Marks and Spencer (LON:MKS) - up 7% to 409p (£8.4bn) - Half-year Report - Graham - AMBER/GREEN

MKS reports that it’s on track for a good year and brokers have upgraded forecasts with Shore Capital now pencilling in PBT of £830m for FY March 2025. Additional costs of around £120m are on the cards as a result of the recent Budget, but the company is finding cost savings elsewhere to pay for this.

Conduit Holdings (LON:CRE) - down 9% to 493p ( £813m) - Q3 TU - Roland - AMBER/GREEN

This specialist reinsurer has revealed chunky losses for Q3 and potentially Q4, driven by an active US hurricane season. There is likely to be a big hit to earnings this year, but Conduit’s capital position appears to be robust and I can see some potential value here if the company can develop a longer record of successful underwriting.

Short Sections

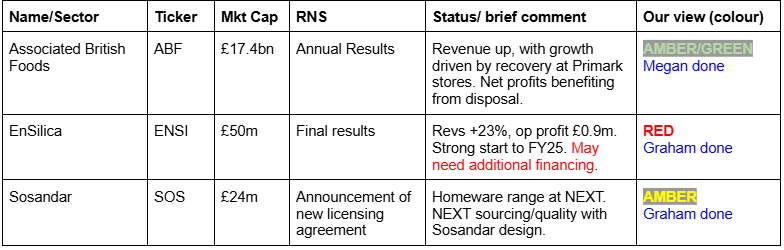

Associated British Foods (LON:ABF)

Up 2.8% yesterday to 2,353p (£17.4bn) - Annual results - Megan - AMBER/GREEN

I have never paid Associated British Food (ABF) the attention it perhaps deserves. The company for me has always been synonymous with Primark - and to be fair, the ‘retail’ division which makes up Primark’s contribution to the business does account for 47% of group revenues and 55% of group profits. In my mind, this makes the company more of a retailer than a diversified wholesaler and brand owner. One that operates in the same market as Next and Marks & Spencer, rather than Unilever and Nestle.

I have also often questioned the purpose in housing a distinctly retail focused business within the same walls as an FMCG, agriculture and ingredients business. High quality FMCG companies come with far higher margins and returns than retail businesses.

And yet, these annual results have given me pause for thought.

Revenues rose 4% at constant currencies to £20.1bn. This is consistent with the sales growth of the last five years which have seen a CAGR of just under 5%. Revenue growth was strongest in the retail (Primark) and sugar divisions of the business, which together contributed 60% of the top line.

More significant was the increase in operating margins. Adjusted operating margins were wider in all five business divisions, most notably a 3.5pp increase in adjusted operating margins in retail. Group operating margins have recovered to 10%, from 7% last year and 6.9% on average over the last five years.

The return on capital employed (a key measure of quality) is also ticking up year on year. In these numbers, ROCE was 10.5% from 9.1% last year. And the company is converting its profits to cash. All hallmarks of a quality company that I like to see.

Megan’s view: A price to earnings multiple of 12 times isn’t especially attractive for a retailer, but as ABF continues to tick up the quality scale, that multiple isn’t looking especially prohibitive. Especially with the momentum heading in the right direction. Earnings forecasts for 2025 were tempered earlier in the year, which gives me some pause for thought, but this is one that I won’t overlook so readily in the future. AMBER/GREEN

Sosandar (LON:SOS)

Up 1.5% yesterday to 9.9p (£25m) - Licensing agreement with NEXT - Graham - AMBER

We had a short update from Sosandar on Tuesday morning with the news that it has signed a licensing agreement with Next (LON:NXT) (disclosure: at the time of writing, Graham has a long position in NXT).

In more detail:

Following the success of Sosandar's clothing range sold through NEXT, NEXT is extending its partnership to licensing the Sosandar brand to develop a homeware range… the licensing deal will combine NEXT's sourcing and quality expertise with Sosandar's design inspiration. The range will include a full set of living room furniture and accessories, including sofas, accent chairs, rugs and lighting. It will be sold online exclusively at NEXT.co.uk and expects to launch in Autumn 2025.

Licensing is amazing when it works - a “licence” to print money!. As Sosandar highlight today, this agreement requires no capex. But in order to work, you need to have very strong brand equity. Does Sosandar have this? At least NEXT must see the potential for it to work, which is saying something.

Graham’s view: the most recent H1 trading update from SOS showed the company’s revenue retreating as it focused on full-price sales at higher margins (62% vs 55% the previous year). The pre-tax loss for H1 reduced in size and was a more manageable £0.7m. Net cash stood at £7m.

My stance on this one is instinctively sceptical as management’s unexpected (to me) decision to open physical stores goes against the grain in an era of online shopping. However, I’m intrigued to see if it might work as the chosen locations are “affluent, thriving locations where Sosandar customers over-index”.

The main point that prevents me from taking a negative stance on this one is the £7m cash balance, covering a large chunk of the market cap. However, if store-related capex and ongoing losses eat away at that cash pile, I’ll be quick to downgrade my stance.

EnSilica (LON:ENSI)

Down 16.5% to 43p (£41.5m) - Audited Full Year Results - Graham - RED

We last covered this chip-maker in May, when Paul analysed a £4.9m equity fundraise it carried out at 45p.

The share price has been reasonably stable since then:

On Monday, it announced a new debt facility for up to £9m, replacing its existing facilities.

On Tuesday, it announced full-year results with some positive-sounding figures: revenues +23% (£25m), EBITDA up slightly to £1.7m, and operating profit up slightly to £0.9m.

But these full-year results only take us to May 2024. It is already November, and H1 is nearly over!

In the outlook section, ENSI says that FY25 started strongly with the achievement of key milestones and new business momentum.

But there is a fly in the ointment:

Whilst the Board is confident of the short-term revenue pipeline, additional external financing may be required should the Company experience further delays in contracted customer receipts

Footnotes to the report explain that the company failed a covenant on its previous lending facility, as it did not receive funds from a customer that it had expected to receive (although this failure was due to a delay on a customer signing a contract, so was the payment really “contracted”?)

The going concern statement includes the following blunt assessment (emphasis added):

Due to the Company's investment in the co-development of ASICs with customers in order to achieve long term future recurring revenues from supply, the Company requires additional financing in the form of loan financing or equity financing, or advance contract payments in order to continue its operations and current capabilities.

It goes on to concede that there is a material uncertainty around the assumption that the company can continue as a going concern.

Net debt as of May 2024 was as follows:

Loans £4m

Leases £2.1m

Offset by cash of £5.2m.

Result: Net debt £1m.

However, considerable time has passed since then. And the net debt figure of only £1m doesn’t tell the whole story, if the company lacks headroom on its lending facility and if the gross cash pile (£5.2m) is needed for use inside the business.

Graham’s view: as there is a stated need for additional financing, I’m going to be RED on this for now. I can switch back to AMBER when this problem is fixed, but not before.

J D Wetherspoon (LON:JDW)

Up 3% to 616p (£762m) - Trading Update - Graham - GREEN

This appears to be a very solid update with like-for-like (LfL) sales up 5.9% in Q1 (it’s actually Q1 plus an extra week, but who’s counting!).

There have been a small number of pub disposals, reducing total sales.

A monthly tracker of the hospitality industry puts LfL sales growing at 1.3% in August and 1.7% in September, far below JDW’s numbers. JDW says it has outperformed the tracker for 25 consecutive months.

Costs - set to rise by £60m following the recent Budget, of which two-thirds are due to higher NI contributions.

Outlook - the company is “confident of a reasonable outcome for the year, although forecasting is more difficult given the extent of increased costs”.

Graham’s view - Paul was positive on this at 729p as recently as October, and I don’t see any need to change the stance on this based on today’s update. It could still offer decent value here despite increased uncertainty:

YouGov (LON:YOU)

Up 3% to 458p (£532m) - Full year Results - Graham - AMBER

YouGov already published full-year results (to July) last week covered by Paul here. It’s back today with results that don’t carry this disclaimer:

Although the audit procedures are substantially complete and the Group does not expect any material changes to the results, the Group's auditor has requested more time to complete the audit. As a result, YouGov is today publishing its results on an unaudited basis.

Numbers at YouGov have always been a little complicated, but recently they have become even more complicated. These full-year results include £38.7m of adjustments, which is an enormous increase on last year. It’s a lot to process:

Without these adjustments, operating profit for the year is a mere £10.9m. But if you allow for them, you get £49.6m.

Cash flow analysis is also complicated, as the company has always capitalised much of its spending on intangibles. And this year there has been a large acquisition (€315m), bringing lots more intangible assets in, for the accountants to keep track of.

Net debt at YouGov is now £148m (July 2024), vs a net cash position of £105m the previous year.

Graham’s view - there’s no need for me to change stance, I just wanted to flag that audited results have now been published. This one is in my “too difficult” tray.

dotDigital (LON:DOTD)

Up 3.5% to 90.1p (£276m) - Final Results - Graham - AMBER/GREEN

It’s a pleasant set of numbers from “the leading SaaS provider of an all-in-one customer experience and data platform”. Or as I called it in July, a provider of online marketing tools to businesses.

Revenue +14% to £79m, with organic revenue up 9% at constant currencies.

Adj. EBITDA +10% to £24.3m.

Cash at year-end (June) of £24m. Dividend gets a top-up to 1.1p (from 1p).

Outlook:

The Group enters the new financial year with continued positive momentum and a good level of visibility of future revenues. While economic conditions remain challenging across our end markets, the impact on trading has been limited to date

Graham’s view: I was AMBER/GREEN on this in July (share price at the time: 93p) and am happy to leave that unchanged today at a share price of 90p. I like the company and the stock but others do too, and it’s priced accordingly.

Graham's Section

Solid State (LON:SOLI)

Down 10% to 221p (£140m) - Trading Update - Graham - AMBER/GREEN

Solid State plc (AIM: SOLI), the specialist value added component supplier and design-in manufacturer of computing, power, and communications products, announces a trading update for the six months ending 30 September 2024…

It’s surprising to see that this is down 10% when SOLI is trading “in-line with market expectations for the full year”.

These expectations do imply a substantial fall in revenues and profits in the current year (FY March 2025):

The previous financial year ended 31 March 2024 was characterised by two very sizable defence orders which whilst welcome at the time, could not be expected to reflect normalised annual trading for the business as reflected by market expectations for the current year.

For H1, revenues are forecast at c. £62m (H1 LY: £88m) and adj. PBT of c. £2.5m (H1 LY: £7.3m).

For the full-year, it looks like things might be a little rushed, if the company is to meet expectations?

Management expects (based upon the visible order pipeline) that orders, particularly from the defence sector, will be secured and delivered in the second half of the year to enable the Group to meet market expectations.

So orders will need to be received, contracts will need to be signed and product delivered in the next few months, for the company to meet expectations.

“Systems” - weaker order intake as a result of political uncertainty, leading to delays to various programmes..

“Components” - this market is normalising. Billing in H1 (nearly £27m) will be below last year (£31.4m). Should be strong in H2.

Outlook:

The October orderbook has increased to £84m (with ~ 60% billable in FY24-25). The significant improvement in order intake in the most recent months, combined with the opportunities in security and defence, means we are confident we will deliver a much stronger second half.

Estimates: Cavendish have made no change to forecasts. Full year revenues are expected to fall from £163m last year to £144m. Adj. EPS to fall from 20p to 13.1p.

Graham’s view

The archives confused me a little bit, until I realised that SOLI has multiplied its share count by five with a bonus share issue! It issued four new shares for every existing share, to improve liquidity.

Unfortunately the shares have been in reverse in recent months:

I was positive on the stock last year at a share price of 1168p (equivalent to 234p in new money, I believe).

The PER at the time was 13x and the company was enjoying very strong momentum in orders and EPS estimates.

Today, the current-year PER is about 17x (dividing the current share price by the adj. EPS estimate).

Stockopedia comes up with the same number using its rolling calculation:

So the valuation on current/forecast earnings is at a higher PER than it was a year ago, and I don’t have total confidence that these earnings estimates will be achieved.

It therefore seems reasonable to adjust my position on this slightly lower to AMBER/GREEN.

The balance sheet should still be fine, with net debt last seen at £5m (March 2024) and only a few tiny acquisitions carried out since then.

Plus with UK and US elections out of the way, spending programmes might start ramping up again to their usual speed.

So I still have a positive impression of this one, even if it’s not looking quite as attractive as it did a year ago.

Marks and Spencer (LON:MKS)

Up 7% to 409p (£8.4bn) - Half-year Report - Graham - AMBER/GREEN

There are some excellent comments in the thread below about the impact of the Budget on companies such as MKS and JDW.

Let’s take a look at the MKS perspective.

Firstly, an overview of H1:

Sales +5.8% to £6.5 billion

Adj. PBT +17% to £408m

PBT +20% to £392m

All very encouraging on its face. We also have an unchanged dividend of 1p and a move from net debt (£320m) to net cash (£22m), excluding leases.

CEO comment excerpts:

"Executing our strategy to 'Reshape M&S for Growth' has again delivered an increase in customers, sales value and volume, market share, profit and returns. Both Food and Clothing have now delivered market share growth for four consecutive years…

The easy thing to do today would simply be to say that these are good results, but that wouldn't be the right thing to do. In the spirit of being positively dissatisfied, we have so much to do over this year and beyond…

The business remains in robust financial health. We have improved our return on capital employed to 15% and further strengthened our balance sheet, giving us the capacity and flexibility to invest for growth and deliver structural cost reduction, demonstrating our ability to deliver value for shareholders.

And now let’s skip ahead to the outlook section where we get a view on costs:

During the first half of the year, cost inflation has continued to be elevated, running well ahead of price inflation and the consumer environment has been uncertain. Despite this, the business has traded well growing volume and value market share.

As we enter the second half, we expect this backdrop to persist. Nevertheless, in the first five weeks of the second half overall trading remains on track and we are confident of making further progress in the remainder of the year.

Elsewhere in today’s report, MKS says that it’s still targeting £500m of cost savings by FY28 in stores, the support centre and the supply chain.

However cutting labour costs is proving more difficult with labour cost inflation currently running at 10%. They say that “structural cost savings have largely offset the impact of operating cost inflation”.

This is something I’ve become more cautious of. When a company says that it’s targeting cost savings of X, as many companies do, this doesn’t neatly translate into a financial gain for shareholders, as it might only be a partial mitigation for a cost increase somewhere else! Or it might give management the impetus to upgrade software or invest in something else. So the outcome of cost savings is rarely as neat and tidy as I might have hoped for.

Anyway, getting back to MKS, CEO Stuart Machin is said to have told reporters today that the recent Budget changes to national insurance and minimum wage will each cost MKS £60m, for a total cost of £120m. So it’s clear that structural savings and savings in the supply chain will be needed purely to offset this.

Estimates: fortunately, according to brokers, MKS is set to have an excellent financial year. Shore Capital have today upgraded their FY March 2025 forecasts by 9%. Their PBT estimate shoots up from £760m to £830m, with EPS of 28.7p.

FY March 2026 also gets an 11% upgrade, with a new PBT estimate of £894m and EPS of 30.9p.

Balance sheet: MKS has bought back £190m of its medium-term bonds. This action alone doesn’t change net debt, as cash and debt are both reduced by the same amount, but it does reduce net debt if the cash might otherwise have been spent on something else!

MKS has four bonds outstanding, one of which isn’t due until 2037. MKS will need to manage the repayment or refinancing of the other three over the next three years:

There is balance sheet equity of £3 billion, almost fully tangible, and including £5.2 billion of property, plant and equipment. Physical retailing is capital intensive but MKS has succeeded in generating an attractive return on capital in recent years, as trading has improved. Today it reports an adjusted ROCE of 15% (H1 last year: 13.2%). Stockopedia awards it a remarkable QualityRank of 97 thanks to some nice quality metrics:

Graham’s view

Paul was GREEN on this at 288p in May. With the shares up by over 40% since then, and now commanding a respectable PER that’s back in the teens, I’m inclined to nudge the stance on this slightly lower to AMBER/GREEN. Not because the company has done anything wrong - to the contrary, it has done brilliantly - but because perhaps most of the easy money has been made now.

The share price has already quadrupled in two years. For traders who like momentum, it’s currently scoring a perfect 99 in momentum according to the StockRanks.

When MKS does poorly, it does very poorly - and we see the dangers inherent in low profit margins and high operational leverage. But for now it’s doing very well and the sun is shining - long may this continue.

Roland's Section

Wise (LON:WISE) - up 4% to 801p ( £8.3bn) - Interim results - Roland - AMBER

..another six months of strong financial performance with YoY growth in active customers of 25%, underlying income of 19%, cross border volume of 19% and a 31% increase in customer holdings...

This currency transfer and payments business has had something of a rollercoaster ride since its IPO in 2021, but it’s intrigued and impressed me. Not least because it’s been consistently profitable, while growing fast.

Profitability has soared as interest rates have risen, but this is not entirely intentional and may not be sustainable, as I’ll explain below.

H1 results summary: today’s half-year results from Wise have been well received and the shares are up in early trading. The headline figures certainly seem quite impressive to me:

Revenue up 19% to £591.9m

Underlying pre-tax profit (before interest income) up 57% to £147.1m

Interest income on customer balances up 42% to £300.7m

Pre-tax profit (inc. net interest income) up 51% to £292.5m

Underlying PBT margin (pre-interest): 22.2% (H1 23: 16.8%)

One point worth highlighting is that the company expects this underlying PBT margin to fall back to its target range of 13-16% in H2 as price cuts take effect. So the 22% underlying margin achieved in H1 shouldn’t be seen as the new normal.

These financial metrics were driven by strong operational growth:

Total active customers +25% to 11.4m

Cross border volumes +19% to £68.4bn

Cross border revenue +9% to £419.1m

Card and other revenue up 52% to £172.8m (mostly interchange fees from card use)

Cross-border take rate -5bps to 0.62% (H1 23: 0.67%)

Trading commentary: the company says that continuing upgrades to its infrastructure mean that 63% of transfers are now completed instantly (within 20 seconds) and 83% within an hour.

New regulatory approvals were received allowing the company to integrate directly into domestic payments systems in Brazil, Japan and the Philippines. A 5,000USD cap on outward transfers was lifted in India.

Wise’s strategy is to integrate as deeply as possible into domestic payment systems so the company can control transactions from end-to-end, cutting costs and improving speed. However, while the company currently operates in 160 countries and 40 currencies, it only has six direct connections to local payment systems currently live. So I’d imagine there’s considerable scope for the network to continue developing.

Cash generation: this business is cash generative, but it’s worth pointing out that the free cash flow metrics on the StockReport are boosted by cash deposited by new customers. This explains the difference between the elevated P/E and super-low P/FCF ratios:

The company provides a free cash flow figure used internally of £257m, up from £192m for the same period last year. The majority of this was used to repay £200m of debt, leaving Wise’s own cash balance of £1.1bn broadly unchanged from the end of FY24.

Borrowings have now been reduced to £52.4m at the end of September and Wise says it has “group eligible capital of £883m”, significantly above regulatory requirements. The situation looks comfortable to me.

Interest rates: Wise’s strategy is to continually cut its fees to provide the best possible pricing. The average take rate fell from 0.67% to 0.62% in H1 and was apparently down to 0.59% by the end of September.

However, rising interest rates have dramatically increased the profitability of this business, regardless of fee income growth:

I have to admit that my first assumption was that (like many other platforms), the company was happy to retain the majority of interest income to boost profits.

But it looks like I was being unfair. At least, I think so.

Wise’s interest rate strategy appears to be to retain the first 1% yield and then return 80% of any excess above this to customers. The problem is that in the UK, the company’s licence does not allow it to pay interest directly to Wise Account holders.

For this H1, Wise’s interest income above 1% was £230.2m. So the company would have returned £184m to customers, but was only actually able to return £84.8m. The remaining £99.4m was “incidentally retained”.

Wise does not say if it expects this situation to change. But perhaps it will, over time.

Roland’s view

Wise’s growth continues to be driven mainly by new customer acquisition. Customers numbers have risen by 2.8x in four years, while cross-border volume growth is almost identical, at 2.9x. This seems logical to me – changing service provider is not likely to result in an increase in transfer requirements.

According to Wise, the company currently has a 5% share of the personal market and 1% share of SME. I would imagine there’s still plenty of further growth potential.

However, my feeling from today’s results is that the current level of profitability – with statutory operating margin of 51% – may be a peak. Interest rates have stayed higher for longer, providing a boost. The company’s apparent inability to return interest with many UK customers is also contributing to this.

Over time, I suspect we may see operating margins return to a mid-teens level.

Profitability may stay above this range for a while yet though, especially if interest rates don’t come down.

Outlook & valuation: the company expects underlying income (revenue) to rise by 15%-20% in the year ending 30 March 2025. This appears to be close to the consensus figure shown on Stockopedia, which implies 15% revenue growth.

I don’t think today’s results imply any significant change to earnings expectations.

Wise’s FY24 basic earnings were 34p per share. Stockopedia shows similar figures for FY25 and FY26:

With the shares now trading on a forward P/E of 23, my feeling is that Wise’s share price is probably about right for now, so I’m going to remain neutral.

Conduit Holdings (LON:CRE)

Down 9% to 493p ( £813m) - Q3 TU - Roland - AMBER/GREEN

Activity across smaller and mid-size natural catastrophe and risk events has been elevated

Conduit is holding an Investor Meet Company presentation at 16.00 today for retail investors.

Conduit Holdings is a Bermuda-based reinsurance business that listed on the London market in late 2020. The company says its main business is quota share reinsurance. This means it is responsible for a fixed share of an insurer’s losses, in return for a matching percentage of the relevant premium income.

Conduit is a new business that’s in its fifth year of operation. It’s grown quickly and achieved profitability last year:

However, today’s trading update has been poorly received. Q3 and expected Q4 losses seem to suggest a significant downgrade in earnings expectations for this year.

Let’s take a look.

Conduit says gross premiums written during the first nine months of 2024 rose by 25.2% to $957.3m.

Reinsurance revenue over the same period rose by 30.3% to $588.2m.

Risk-adjusted pricing (excluding claims inflation) rose by 1%

Estimated undiscounted Q3 net loss of $50m

Continued top-line growth appears encouraging and was driven by property and specialty insurance categories, where pricing has been stronger than in casualty:

However, as Warren Buffett may once have said, collecting insurance premiums is much easier than generating an underwriting profit. So let’s take a look at the firm’s disclosure on Q3 and Q4 losses.

Impact of catastrophe losses: today’s share price slump highlights concern at the potential impact of this year’s catastrophe losses, primarily driven by an active US hurricane season.

Today’s statement provides some insight into the company’s current assessment of its exposure:

Q3 net loss: $50m

Undiscounted combined ratio* “in the mid-90s on a year-to-date basis” to 30 Sept 24 (worsened from 85.7% at the end of June 2024)

Q4: undiscounted loss from Hurricane Milton (Florida) in October estimated at $30m-$50m

We also know that Conduit suffered an undiscounted net loss of $19.8m due to the Baltimore bridge collapse in H1

*this measures underwriting profitability, lower is better. A combined ratio of 100% = breakeven

Prior to today’s result, only the Baltimore loss was reflected in broker forecasts. So we can see there’s probably going to be an extra $80-$100m of losses to factor into this year’s results.

With Stockopedia showing an expected net profit of $206m for Conduit this year, I think it’s fair to expect a significant downgrade.

Fortunately there’s an updated note from Panmure Liberum available on Research Tree this morning - many thanks.

PanLib’s analysts have crunched the numbers and cut their earnings forecasts for FY24 by 38% to 59p per share. That’s equivalent to a FY24e P/E of 8.

Earnings forecasts for FY25 and FY26 have been left unchanged and the (house) broker is confident that Conduit’s capital position will allow it to absorb this year’s expected losses without any adverse effects.

Checking the RNS, Conduit’s available capital was $1.05bn at the end of September, unchanged from the H1 accounts at the end of June. This seems fairly reassuring to me.

Panmure Liberum’s confidence is expressed in an unchanged forecast for a dividend of 28.1p per share (£46m) this year, giving a useful 5.7% yield.

Roland’s view

These relatively large losses are coming on the back of several years of strong pricing. So the impact on profitability is much less than it might have been at a softer point in the cycle.

I would guess that Conduit may still be able to generate a respectable c.10% return on equity this year (FY23: 22%).

It’s always worth remembering that unpredictable, large losses are a normal part of business for insurers. As CEO Trevor Carvey admits, the company expects to pick up “our fair share” of catastrophe losses.

Carvey says he believes the company has a “well-diversified” portfolio and can continue to grow the business in a “measured and balanced manner”.

However, it’s perhaps not surprising that the company says it is focusing on “non-catastrophe elements of both Property and Specialty” at the moment, where it sees “good opportunities for selective growth”.

I’m not an expert on this sector, but my impression is that today’s update is not a disaster. It may however help to explain why Conduit shares were trading on a P/E of five ahead of today’s earnings downgrade.

On balance, I’m happy to go AMBER/GREEN on Conduit today, on the basis that the valuation still seems reasonable and the company’s capital position appears to be robust.

However, one caveat I’d add is that Conduit has a very short track record so far. We don’t yet know how profitably it will navigate complete insurance cycles.

For this reason, if I was investing in this sector, I might be more inclined to consider companies with longer records such as Lancashire Holdings (LON:LRE) (not a recommendation). That’s just a personal preference, though.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.