Good morning from Paul & Graham!

All done for today.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia. More stock screening strategies here (possible bargains?) - 21/9/2024.

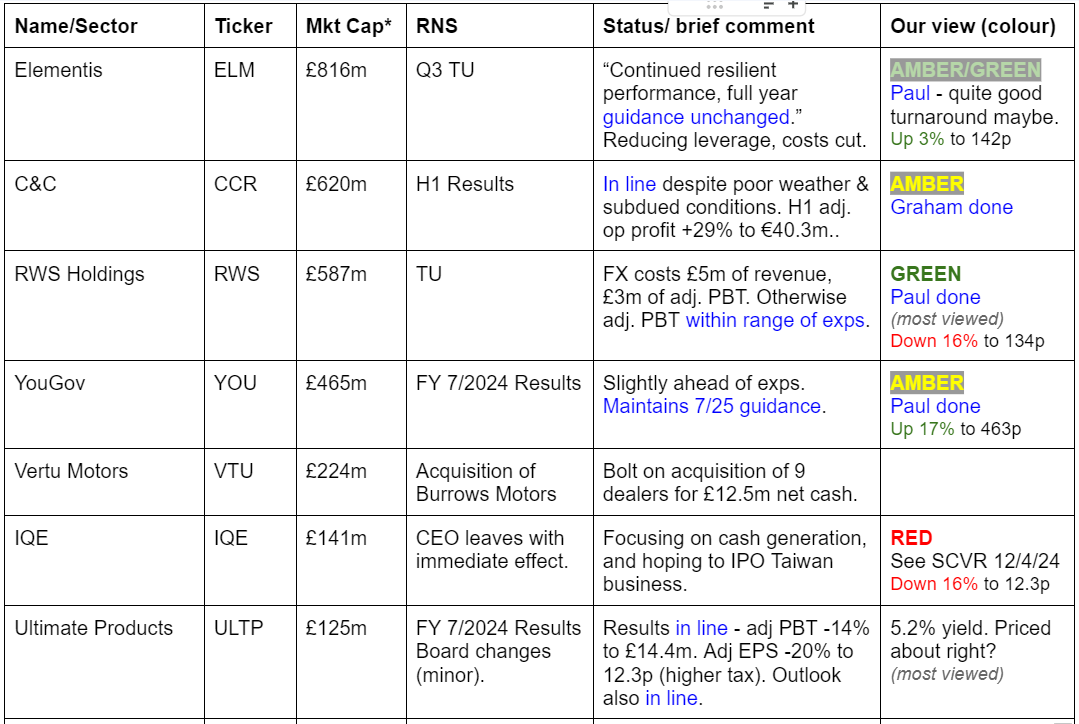

Companies Reporting

Summaries

RWS Holdings (LON:RWS) - down 16% to 134p (£493m) - Trading Update - Paul - GREEN

More-or-less in line TU for FY 9/2024, if we ignore some forex headwinds. Surprisingly large share price drop today, for what I thought was an OK update. Although broker consensus for FY 92/2025 looks too high relative to the cautious outlook comments. Is this business now structurally challenged by AI possibly (it mentions continuing pricing pressure)? It's difficult to know. OK balance sheet with negligible net debt, and a c.9% dividend yield look very appealing.

C&C (LON:CCR) - down 3.1% to 156.6p (£600m / €721m) - Interim Results - Graham - AMBER

Results are in line with expectations as the company targets €100m of underlying operating profit in FY 2027. If the results were a little cleaner I'd be more interested, but for now I'm neutral.

YouGov (LON:YOU) - Up 13% to 448p (£523m) - FY 7/2024 Results - Paul - AMBER

Weak numbers, as expected, but turnaround actions underway should improve performance in FY 7/2025, and expectations are confirmed. I quite liked it until I looked at the weak balance sheet & poor cashflows, so I do have some reservations. Being AIM, watch out for volatility in the budget tomorrow.

Paul’s Section:

Possible Rebound Watchlist?

Given turmoil in small caps, especially AIM (due to budget worries), I think it’s time for us to all swap some watchlist ideas of potential bargains again. We did this before on market jitters earlier this year, and it threw up some good ideas that did bounce (albeit getting whacked again more recently in many cases).

As mentioned in my weekend podcast, it’s important to keep our nerves in turbulent markets, and if people are panic or tax selling good companies at low prices, their decisions could selectively be providing us with buying opportunities. After all, BLASH (buy low and sell high) is a fairly reliable way to make money in any commercial enterprise, including running a shares portfolio.

It’s been a strange market of late, with obvious and significant disruption from fears about tomorrow’s Budget tax raid. Given that it’s customary for details to be widely leaked to the press (perhaps to test the water, or just because too many people know the details and the press worms the information out of them?!) we seem to have fairly clear details of what’s likely to happen - here are my guesses (based on press coverage mainly) -

Capital Gains Tax - probably going up, but maybe not by a disastrous amount (evidence Starmer’s “wide of the mark” comment)

ISAs - probably some new restrictions, because they were designed for ordinary people to save and build up a tax-free pot, but not for people to become multimillionaires and avoid tax on substantial portfolios - so the argument might go from the Chancellor, I suspect.

Pensions - I imagine tighter restrictions might be introduced on the very generous higher rate tax relief on money going in. Maybe reducing the rate of tax relief, or lowering the annual maximum people can put in? Annoying for high earners, but probably not likely to impact share prices. The abolition of the lifetime limit seems secure, as Reeves has publicly U-turned on her initial reaction to bring it back in. Why should SIPPs be exempt from IHT? That looks an easy target, along with other IHT changes.

EDIT: I forgot to mention speculation over the £250k maximum tax-free lump sum from pensions being reviewed. We've discussed this recently here, in that there's lots of anecdotal evidence that some investors are selling shares (AIM and fully listed) to raise cash to grab their 25% tax-free lump sum ahead of the budget. End of edit.

Employers NICs - seems to be the big one, with a 1-2% increase mooted, and lowering the thresholds - raising up to £20bn. If so, this would be a disaster for the hospitality and retail sectors in particular, combined with another large mooted increase in minimum wage, and potentially losing business rates relief measures. Hence I think these sectors are a complete avoid at the moment - and note that broker forecasts have not been lowered yet for any tax hikes. How will companies react? They’ll have to reduce staff numbers and hours somehow without damaging their customer service too much. They’ll have to raise prices to mitigate the extra costs, if they can. EDIT: it's also likely to mean employers will resist further demands for pay rises from employees. End of edit. Plus some weaker businesses are likely to go bust sadly. I think we’ll see widespread broker forecast reductions (not yet factored in) across almost all sectors due to this possible tax rise.

AIM IHT relief - if this is abolished, then I think we’ll have a period of absolute carnage on AIM. Some companies would be likely to move to the main market, to attract new investors that don’t look at AIM, so those could be OK. Meanwhile IHT portfolio providers would probably see lots of redemptions, spread over quite a while, leading to probable market price dislocation as share prices drop to entice new owners of those redundant shares. If it’s not abolished, then I think we could see a powerful and quick rally, as buyers dive in for the bargains. Hence why I think having a watchlist & some ready cash to deploy now is a really good idea.

My AIM share ideas - as always, these are just some ideas for you to properly research. Last night I just sorted AIM by recent % falls, and manually picked out the companies I think are potentially interesting, based on our SCVR coverage. Here they are - I think a lot of these have seen budget/tax related, fear-driven selling recently, not connected that much (if at all) to company fundamentals. Or things that have disappointed on fundamentals, then overshot on the downside possibly - in no particular order -

Kooth (LON:KOO) - high risk, speculative (I’m not brave enough personally, but it’s tempting!)

Beeks Financial Cloud (LON:BKS) (I hold) - excellent recent newsflow, with several more large contracts said to be close to signing. Also NASDAQ contract set to launch.

Intercede (LON:IGP) (I hold) - likely to beat exps in H2. Good newsflow of contract wins. Doing a small buyback to mop up loose sellers.

Alumasc (LON:ALU) - strong recent update, and modestly priced still. Recent sell-off doesn’t make sense on the fundamentals.

Advanced Medical Solutions (LON:AMS) - no detail, just an interesting company that has fallen recently.

Johnson Service (LON:JSG) - I was surprised how much it has fallen recently.

James Halstead (LON:JHD) - quality company, cyclical recovery likely, price is now reasonable. Widely held by IHT funds.

Warpaint London (LON:W7L) - one of our favourites here, taken a whack recently. Although mgt did sell some of their still large holdings earlier this year.

Tracsis (LON:TRCS) - tends to look expensive usually, but has fallen a lot lately - buying opp possibly? Or is it just coming back down to a more realistic valuation?

Focusrite (LON:TUNE) - has under-performed, but possibly getting near the bottom? Forecast profits have fallen a lot though.

Tribal (LON:TRB) - horrible share, but a bidder was rebuffed at almost double the price it is now.

Gaming Realms (LON:GMR) - I can’t see any reason for its recent sell-off. Although not sure if hikes in gambling duties would impact it or not.

CVS (LON:CVSG) - has all the problems of CMA investigation, but recent share price fall has brought fwd PER down to only 9.5x

YouGov (LON:YOU) - could bounce, maybe profit warning fall overdone, and it’s cost-cutting to drive partial profit recovery. Too much debt though. EDIT: Just spotted that its FY 7/2024 results were issued today, so I'll review those later today (up 14% in early trades)

Gattaca (LON:GATC) (I hold) - only valued at £5m more than its own cash pile, and performing surprisingly well in very tough markets.

SDI (LON:SDI) - down to only 50p. Getting into punting price range maybe?

Tristel (LON:TSTL) - very nice company performing well, but shares are expensive. Recent dip might be an opportunity maybe, who knows?

Somero Enterprises (LON:SOM) - another old favourite, shares very beaten up now, worth a fresh look. Cash machine.

Character (LON:CCT) - recent update seemed OK, but share price battered.

Oxford Metrics (LON:OMG) - disappointed recently, but valuation now looks attractive I think.

Fevertree Drinks (LON:FEVR) - still looks expensive, but shares have dropped a lot, could be worth checking out maybe?

Next 15 (LON:NFG) - another disappointer with a PW, but I wonder if it could bounce?

Let's have your watchlist ideas for AIM possible bargains (if the Chancellor doesn't impose punitive measures of course).

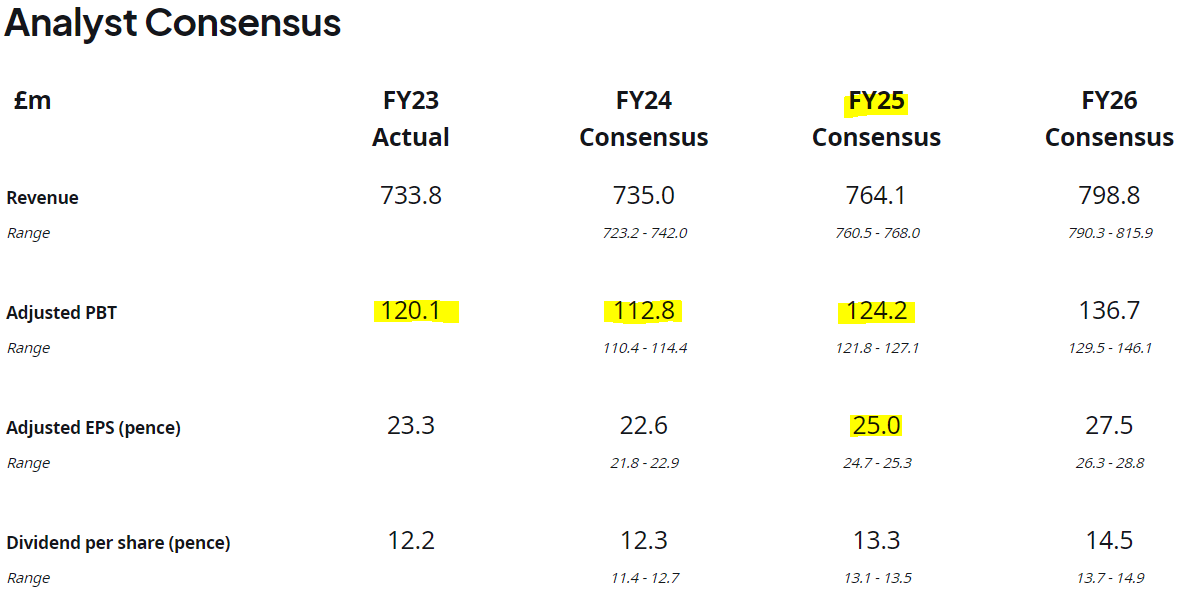

RWS Holdings (LON:RWS)

Down 16% to 134p (£493m) - Trading Update - Paul - GREEN

RWS Holdings plc ("RWS" or "the Group"), a unique world-leading provider of technology-enabled language, content and intellectual property services, today provides an update on trading for the year ended 30 September 2024 ("FY24") ahead of the announcement of its full year results on 12 December 2024.

I’ve not looked at RWS since 24/4/2024, at 162p, when I thought the value metrics looked cheap but the vague outlook comments made me wonder if it was limbering up for another profit warning. Also concerns over whether AI is a help or a hindrance? It did bounce about 20% after that, but has more recently fallen down to a new multi-year low - with shares back down to 2015 prices (and there are more in issue, following a fundraise in 2021). Ten year roundtrip for this share -

Today’s update is for FY 9/2024.

“A return to growth in the second half, driven by encouraging performance in AI-led solutions”

H2 constant currency revenue up 2%, vs -2% in H1.

Full year revenues in line with last year. That also seems to be in line with market expectations, checking on the StockReport.

Adverse forex means FY reported revenues will be down 2% vs LY.

Profit guidance -

“The Group expects to deliver adjusted PBT within the range of market expectations² before adjusting for these currency movements.³

³ Reflecting exchange rate movements, primarily during the last two months of FY24, the currency headwind impact on market consensus is estimated to be c.£5m on reported revenue and c.£3m on adjusted PBT.”

Debt isn’t a problem - they exclude leases, which is fine by me -

“The Group had modest net debt⁴ of c.£14m at the end of September 2024 (31 March 2024: £39m net debt), supported by an improvement in receivables since the mid-year.”

Outlook - I don’t like the ongoing pricing pressure comment - so this sounds like no overall profit growth is likely in FY 9/2025 -

“For FY25 we expect to deliver modest organic revenue growth at constant currency, with growth in volumes offsetting ongoing price pressure. We expect foreign exchange to continue to be a headwind to reported revenue and adjusted PBT. “

"Our range of AI-centred solutions are gaining encouraging traction, with TrainAI and Language Weaver in particular seeing strong growth. These solutions, combined with our investment in sales effectiveness and our continued focus on efficiency, enabled by our unique LXD platform, mean we are well placed to emerge from the current market transition in a position of strength."

That’s way too vague for me to understand whether AI is a threat or an opportunity. Some of these language models are now so good, that I can’t help feeling it must mean cheaper, automated competition could be mainly a threat. That’s purely my hunch, not anything near an expert opinion.

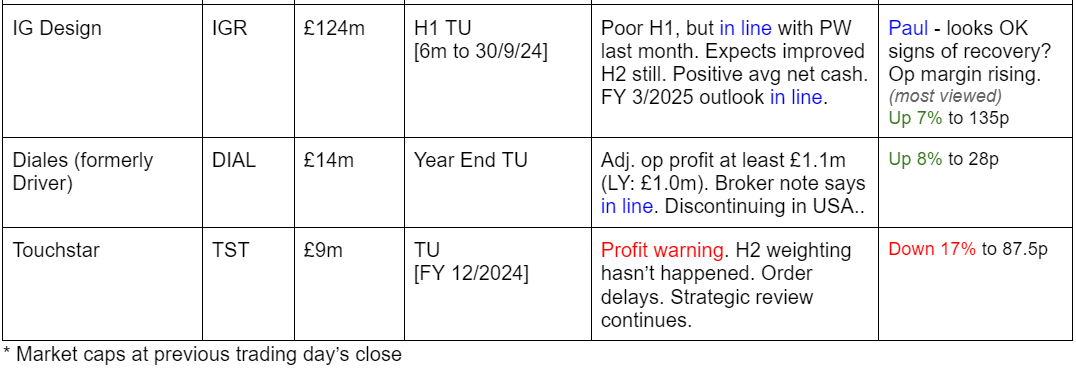

Valuation - helpfully, RWS publishes broker consensus on its website, wouldn’t it make life easier if all companies did this?

Unfortunately, I can’t tie in the cautious outlook above with the rise in adj PBT forecast. So it looks to me as if broker consensus forecasts for 2025 at least need to come down, c.10% maybe? I think it’s now looking as if RWS has gone ex profit growth. Maybe c.23p adj EPS is the new normal, or may even be in a falling trend to say 20p in FY 9/2025? It’s not looking like a growth company any more, anyway. Hence the PER should be low. It’s already massively de-rated though, as you can see from graph 4 below - also note the divis becoming the main event now! -

I suspect that graph 3 might deteriorate somewhat as likely broker downgrades feed through, so I’ll treat 20p EPS as my estimate.

Shares are only 134p today, so the PER is only 6.7x even on my cautious 20p estimate. It’s even lower than that on market consensus.

Bear in mind there’s no debt to speak of, and this is a high margin business - very unusual to see a value share price on what seems a quality business.

Note that it has done a lot of acquisitions previously, so there’s a gulf between adjusted and reported profit.

Balance sheet - checking back, the last one at 3/2024 showed huge intangible assets, so taking them off results in £(30)m NTAV. However, I could also deduct deferred tax liabilities, which takes it positive to NTAV of £23m. Bear in mind it has only small tangible fixed assets, and no inventories, and that is more than adequate overall. So it’s a fairly decent balance sheet.

Dividends - I’ve only just noticed Stockopedia has a forecast yield of 8.4%, which will be nearer 9% after today’s share price fall. That’s getting into territory where the market thinks it’s not sustainable. Yet it’s nearly twice covered by forecast earnings, and with a sound balance sheet, who knows that might be a sustainable yield?

Paul’s opinion - I think more broker forecast downgrades are likely, and the hike in employers NICs is likely to be a nasty extra cost. So let’s work on 20p EPS rather than consensus of 25p for FY 9/2025. That gives me a PER of only 6.7x, and a yield of over 9% - with a sound balance sheet, and negligible debt.

This seems to me a very conservative valuation, but I said that last time and it’s carried on going down!

Who knows what the future holds, but based on the facts & figures today, RWS shares look appealing value. So it has to be GREEN, and I’ll accept the risk that another profit warning could leave me with egg on my face! Ideally the company should be quietly urging brokers to soften their 2025 forecasts, since even I can see they’re unlikely to be met. Rather than leaving optimistic forecasts out there, then dropping another profit warning. After all, profit warnings are not necessarily a sign of poor performance, they’re more a failure to give realistic guidance.

To get the PER up from mid single digits, I think RWS management needs to convincingly demonstrate that AI is a benefit, not a threat. If they can’t do this, then a low PER is likely to continue. Mention of ongoing pricing pressure is not good, and suggests to me that there could be a structural problem at RWS from cheaper, AI-driven competition. Do any readers have specific knowledge of this sector?

YouGov (LON:YOU)

Up 13% to 448p (£523m) - FY 7/2024 Results - Paul - AMBER

A turbulent year for this specialist market research & data analytics group -

We picked up the story here on 20/6/2024 when YOU shares plunged 39% to 501p on a profit warning. I had to mark it AMBER/RED on the day, since I couldn’t find any revised broker forecasts, and the company’s update was too vague. Plus it had clearly taken on too much debt to fund a large acquisition.

On 6/8/2024 it issued a more reassuring update, indicating cost-cutting had been done, and that trading had slightly improved, and it had headroom on the banking covenants. So my concerns were eased, hence moving up to AMBER at 535p to reflect the improved situation (remember we’re only reporting on the facts/figures/forecasts on one particular day, we’re not trying to predict the future usually).

Today’s full results for FY 7/2024 reassure again with these headlines -

“- Revenue and operating profit slightly ahead of revised guidance

- Execution of cost optimisation plan is on track

- Maintaining FY25 guidance and mid-term ambitions”

Note that YOU shares are AIM listed, so that might help explain the almost constant drift down in Aug-Oct 2024. Coincidentally, I mentioned this share this morning in my list of AIM shares that might be oversold due to budget worries, before I’d realised it had published results today. The StockReport as of last night shows it on a forward PER of 11.0x, on broker forecasts that have stabilised after the lurch down after June’s profit warning. Hence why I thought it was starting to look interesting as a potential recovery trade.

Audit - YOU has gone ahead and published its FY 7/2024, despite the audit not having yet been completed. It says the audit should be completed soon, and don’t expect any material changes.

Highlights table below shows that it’s complicated with a large acquisition blowing the large cash pile and replacing it with substantial net debt, which I really don’t like at all.

Also note that large adjustments create nearly all the adjusted PBT -

If you accept the adjustments, then despite a 21% drop in adj PBT, it’s still quite a high margin business, not a basket case.

Adjustments are -

“largely due to exceptional costs of £38.7m in relation to the acquisition of CPS, the change in accounting treatment of amortisation costs of acquired customer relationship intangible assets and restructuring charges.”

This table below shows how the poor performance of the two existing divisions dissipated all the profit made by the CPS acquisition.

There’s since been hefty cost-cutting, as announced before, since it went into a downturn in customer demand with excessive staffing for a planned increase in demand. There’s a new CEO in charge.

Acquisition - actually it was a huge deal, buying CPS for 315m Euros in Jan 2024. Let’s hope they haven’t screwed up. This bit today reassures -

“The CPS business is continuing to perform well, in line with expectations and the integration is progressing well.”

Another acquisition of Yabble, was done post July year end, but is not material at only £4.5m initial cash consideration.

Cost-cutting of £20m annualised has mostly seen “initial action taken”, with most benefit kicking in H2 of FY 7/2025. £20m is a material number compared with the £45m adj PBT reported above. Assuming no detrimental impact from presumably getting rid of staff mostly, then this suggests a useful increase in profit should be possible in future.

Outlook - key points for FY 7/2025 -

“Our clients continue to value the quality of our products and services, this is reflected by our high renewal rates and strong customer relationships. As we enter FY25, we anticipate that momentum will build throughout the year, weighted towards the second half, as the benefits of our cost optimisation plan and new commercial leadership are realised. We consequently expect YouGov to achieve growth for FY25 in line with current market expectations, and remain confident in the Group's ability to deliver on its long-term ambitions."

I can live with an H2 weighting, as there’s a clear reason for it - as cost-saving measures gradually feed through.

Balance sheet - the usual delusional reporting of this, see my comments below on what the balance sheet is actually like! -

“We maintain a disciplined approach to cash management, and as of 31 July 2024, the Group has a robust balance sheet, with approximately £74 million in cash and cash equivalents and €16 million of the revolving credit facility remains undrawn.”

But at least it seems to have enough liquidity there (assuming bank covenants are met).

Results presentation - there’s a video and slide deck available on its website here - very helpful.

Balance sheet - NAV is £183m, but intangible assets have ballooned in FY 7/2024, with goodwill up from £82m to £244m, and other intangibles up from £36m to £184m. This gives NTAV of negative £(245)m! IF we’re kind and eliminate deferred tax of £(32)m, then this improves a bit to a still-awful £(213)m NTAV. For YOU to claim it has a strong balance sheet is just ridiculous.

However, since it has almost nothing in physical fixed assets, and zero inventories, it’s an asset-light business model, which doesn’t need balance sheet strength. I’ve mentioned this before I think - management should not be telling us their obviously weak balance sheet is strong. Instead they should be saying that their business model is asset-light, hence they can operate fine with a negative balance sheet net tangible asset position.

Something else to bear in mind is that the bank borrowings are mostly a £202m term loan, spread over 4 years (see note 13). That means hefty loan repayments fall due each October. Hence YOU needs to generate a lot of free cashflow to meet these bank loan repayments. So don’t expect generous divis, with the forecast yield only about 2%. Note 14 says that it hedged interest rates on the variable rate borrowings.

Cashflow statement - given the hefty loan repayments due over the next 4 years, cash generation is key.

My interpretation of the FY 7/2024 cashflow statement is that it’s not good. Operating cashflow after tax & interest paid was £37.7m. But it spent nearly half of that (£17.3m) on capitalised “purchase of intangible assets”, which I think is costs related to recruiting for its consumer panels. Take off lease payments of £3.9m, and divis of £10.1m, and treasury shares purchased of £1.9m, and I make that only £4.5m cash generated remaining. That’s nowhere near enough to make the c.£50m pa loan repayments that will now be necessary. In fact it seems obvious to me that the divis will need to be scrapped, because they are unaffordable.

That said the net debt position is not so bad, given that it also has £73.6m in cash - see slide 9 -

Paul’s opinion - the market likes these numbers & commentary, with it up 17% now to 466p at the time of writing (15:24).

However my deeper delve into the numbers has put me off, because YOU actually has a fragile and over-geared balance sheet, and is a poor cash generator.

That said, it had a bad year, and performance should improve in FY 7/2025 due to the cost-cutting.

Plenty of investors don’t even look at the balance sheet or cashflows, so my concerns may not matter to Mr Market, but I’m just flagging the full facts to you. Given that it capitalises a fair bit into intangibles, and now has hefty debt, then the EBITDA numbers are particularly unreliable in my view.

Growth has come from a large acquisition, and is not organic. So should we be valuing this as a growth company? Probably not.

After today’s 17% rise, I wonder if this is the start of a recovery in YOU shares? It could be maybe, as performance seems to be stabilising.

However, my view is that this isn’t as good quality a business as people seem to think it is. A very weak, overly indebted balance sheet, used to fund acquisitions, and poor cashflows, mean it’s not something I would want to own as anything more than a short-term trade.

I can’t get above AMBER.

Graham's Section:

C&C (LON:CCR)

Down 3.1% to 156.6p (£600m / €721m) - Interim Results - Graham - AMBER

This drinks company reports results that are in line with expectations “despite poor summer weather and subdued market conditions”.

Comparisons with H1 last year are complicated by some accounting errors that depressed last year’s H1 profits. Last year’s H1 results needed to be restated (i.e. corrected).

Instead of comparing H1 this year against the corrected numbers for last year, however, CCR leads with the growth rates against the originally published, incorrect figures.

Let’s focus on the correct growth rates:

Net revenue decline 2% at constant currencies

Underlying operating profit +4% at constant currencies to €40.3m

Leverage multiple is 1.1x which is down from 1.5x a year ago. Over the past 12 months, there has been a €26m reduction in net debt (excluding leases) to €81m. This should be a safe level of debt.

Dividend gets a 6% increase. The forecast yield is 3.8% according to Stockopedia.

Outlook: should make €80m of (underlying) operating profit in FY Feb 2025 and the target is for €100m in FY Feb 2027.

CEO comment:

"I am pleased to report earnings in-line with expectations in HY2025 as we rebuild performance and momentum within the business. Despite unfavourable summer weather, our brands demonstrated inherent appeal and resilience with both Tennent's and Bulmers growing market share and Menabrea and Orchard Pig achieving double digit revenue growth.

Tennent’s increased market share by 5 percentage points in the summer period, despite its volumes declining 7%. In addition to the weather, the company notes that “the 200,000 Scottish fans who travelled to Germany will also have had a temporary impact on the market”.

Magners/Bulmers cider did poorly, again due to the weather. Volumes down around 10%.

Distribution: the distributors Matthew Clark and Bibendum were picked up back when Conviviality plc went into administration in 2018. Management seems very pleased with recent growth in customer numbers but this hasn’t translated into revenue growth yet. This business operates on the tightest of margins and cost efficiencies are expected to boost profits in H2.

Balance sheet: about €50m in tangible equity, and a huge chunk of PPE (€265m). It has struggled to generate a strong return on all of this capital: see below for the ROCE numbers since 2019. Admittedly there are some Covid years included in this series.

Adjustments: CCR has counted over €12m of costs as exceptional in H1, i.e. they are excluded from the underlying profit of €40m.

€7.6m of “strategic restructuring programmes” following the closure of distribution centres and a depot, and redundancy costs.

€4m for “risk management and control reviews” after the accounting errors.

This may be a little harsh but I wouldn’t be inclined to allow the exclusion of all of these costs. There were €5m of exceptional costs in H1 of the previous financial year. FY 23 saw a €12m exception cost for “onerous apple contracts”. I would be delighted and surprised to see CCR get through a period without suffering any big “exceptionals”.

Graham’s view

I’ve been a fan of this business in the past and went GREEN on it in May 2023 at a share price of 134p.

Paul has been less impressed and was neutral on it in September and in June this year.

Two year chart:

At a PER of 14x, I think I can accept a neutral rating on it, although I’m tempted by AMBER/GREEN.

However, the results have been messy, returns are mediocre, and growth is limited. Maybe things will look different next summer with better weather, but I can accept an AMBER on this for now.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.