Good morning from Paul!

I got up early today to finish my half-written section on N Brown (LON:BWNG) from yesterday, but haven't quite finished it yet. I'm 90% done now, so that should be up a little later this morning. EDIT at 08:49 - now published below.

Thanks very much to Ed for a superb webinar last night. I jotted down some key points which chime with ideas I've independently had, after mulling over the consequences of the last 2 years' bear market. If you didn't attend last night, then make sure you watch the recording, it was full of incredibly useful reminders (which we all need from time to time), but also some great insights too from the data. I was delighted that Ed highlighted Graham & my stock-picking successes in 2023 and 2024, where we've trounced the markets, and the various automated systems!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

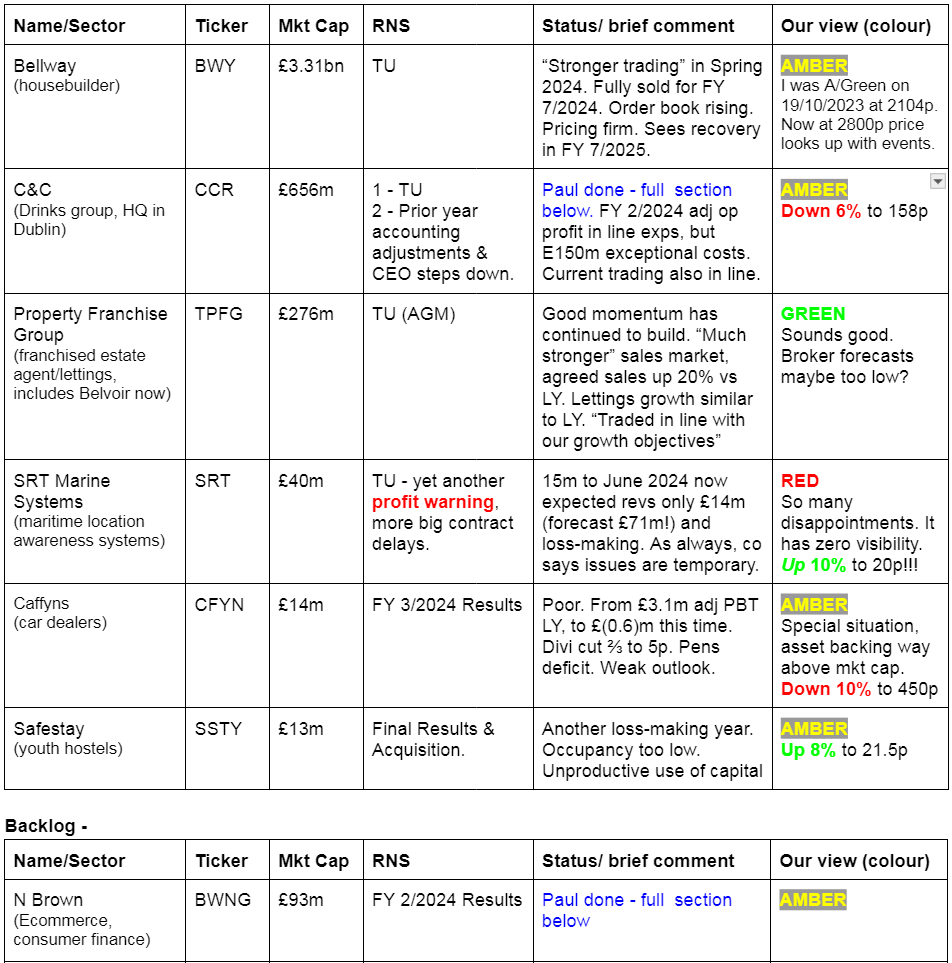

Companies Reporting

Other mid-morning movers (with news)

SysGroup (LON:SYS) - down 6% to 33p (£17m pre-fundraise) - Placing & Retail Offer - Paul - AMBER

SysGroup (AIM:SYS) the technology partner for delivery and management of cloud, data and security to power Artificial Intelligence ("AI") and Machine Learning ("ML") transformation…

This is noteworthy for a good reason. My antennae were previously picking up signs that rampy RNSs looked likely to be followed by a fundraise to repair its weak balance sheet (negative NTAV of £(7)m), hence I flagged SYS as AMBER/RED here on both 30/4/2024 and 29/5/2024. That’s exactly what has happened, with an equity fundraise announced last night.

What’s good about it then? It’s a big fundraise relative to the market cap at £11m gross. Huge discount? No - a very impressively small discount of about 6%, with the new funds being raised at 33p. Maybe appetite for small cap fundraisings is returning?

33.2m new shares are being issued in the placing/subscription, which increases the share count from 51.5m to 84.7m, an enlargement of a hefty 64%.

There’s also a small £0.5m open offer, which I’ve not included in the figures above, as we don’t know what (if any) take up there will be.

However, it’s a proper refinancing that fully resolves my balance sheet concerns, hence I’m happy to move up to AMBER.

It’s interesting to see that a micro cap refinancing has been so well supported, so SYS must be telling a compelling story to investors keen to jump onto the AI bandwagon?! Now it’s refinanced, this might turn into an interesting punt, who knows? SYS is a proper business, that has credible rising revenues, and only small losses. Now it has cash in the bank too, I wouldn’t try to stop anyone who wanted to have a little punt on this. As we go into a new bull market, stuff like this can re-rate nicely once animal spirits return. Hence why I think this is actually quite a good time for risk-tolerant punters to be looking at more speculative ideas, selectively, and providing the company is properly funded, which SYS now is.

Summaries

N Brown (LON:BWNG) - up 34% to 20p (£93m) - FY 2/2024 Results - Paul - AMBER

I get properly stuck into the detail below, and overall found this better than I expected (especially balance sheet, liquidity, and cashflow, which all look improved). Trouble is, there are also plenty of negatives and risks. Huge discount to NTAV might prove a lucrative trade, or a value trap, who knows?! I'll sit on the fence for now.

C&C (LON:CCR) - down 9% to 155p (£600m) - Trading Update - Paul - AMBER

Reveals accounting problems in previous years' accounts, which are not a big deal in my opinion. CEO has fallen on his sword though, as he was CFO when the problem numbers happened. Current trading is in line. Debt has come down a fair bit. All in all it's just a middling, unremarkable, low margin cider maker. I can't see why anyone would want to invest in this really, when there are better & cheaper companies available elsewhere.

Paul’s Section:

N Brown (LON:BWNG)

Up 34% to 20p yesterday (£93m) - FY 2/2024 Results - Paul - AMBER

A strange business, that sells items online (eg clothing, homewares) and tries to generate profit from offering high cost instalment payment terms (with high rates of customer defaults). Its brands include Jacamo, Simply Be, and JD Williams.

The free float is small, with Lord Alliance & family having a controlling stake, and Frasers (LON:FRAS) owning 20%.

Sentiment towards this share has collapsed in the long-term, but the 34% bounce yesterday in a positive market reaction to FY 2/2024 results compels me to take a look at it, unfortunately.

Headlines sound encouraging -

Adjusted EBITDA above market expectations and return to profit

Strong balance sheet and liquidity

Revenues are substantial at £601m, down 10% on the 52-week comparable.

Revenues are split 63% for products, and 37% for financial services (interest charged to customers)

Adj EBITDA is down 13% to £47.6m, but ahead of market expectations -

3 The market consensus for FY24 Adjusted EBITDA is £44.7m as at 5 June 2024.

Adj PBT is up 171% to £13.3m

Statutory PBT is £5.3m, so the massive write-offs it had last year are much smaller this time.

Adj EPS is 1.65p (LY: 1.81p), but it’s so close to zero (hence volatile) that I don’t think it makes sense to use PER as a valuation measure, but for completeness it’s 10.3x.

Adj net debt is down 21% to £236m

Dividends - stopped in 2020 and not resumed.

The reason why adj PBT rose, when adj EBITDA fell, is mainly due a much lower depreciation & amortisation charge of £20.7m, compared with £35.7m last year. So the higher adj PBT is not due to improved trading, just a lower non-cash charge for depreciation - helped by big write-offs in last year’s accounts.

It looks as if the accounts were kitchen-sinked last year, with only £7.5m of adjustments this year (FY 2/2024).

Remember it had a large cost related to litigation with Allianz, which went against BWNG, costing £26m last year.

Outlook - not madly exciting - this doesn’t suggest to me that we can expect any step change (up or down) in BWNG’s future performance -

Broker forecasts - many thanks to Shore Capital for an update note yesterday. It’s forecasting flat revenues and EBITDA for FY 2/2025, which turns into £12.2m adj PBT or 1.9p adj EPS. That’s a painfully thin 2% PBT margin on £601m revenues, which increases the risk that there could be wide variances between actual & forecast. A wide range of possible outcomes. Hence why I’m reluctant to value this share on a PER multiple. Low margins like this don’t leave any scope for a repeat of previous legal & regulatory problems, which have been substantial costs. Low margins, and high risks, is not a good business model.

Balance sheet - as always, is large and complicated. NAV is large at £379m, about 4x the market cap.

Software - note that BWNG capitalises £20m pa of what it calls “software”, of which £15.4m is internal IT spending (disclosed in note 10). This needs to come off EBITDA to make that figure more meaningful. A criticism levelled at BWNG is that it uses outdated and inefficient legacy IT, which is very costly to maintain. Capitalising £20m pa in software & IT spending does seem excessive to me, so I think that argument holds water.

The depreciation charge was slightly lower than the additions, at £17.3m in FY 2/2024. This seems to be the source of the large overall drop in depreciation, since amortisation of software charge was much higher at £30.6m last year (FY 2/2023). Note that year ends slip slightly into the first few days of March each year, but I refer to them as Feb year ends. Total intangible assets were £60.9m at FY 2/2024. So deducting this £60.9m from NAV gets to NTAV of a huge £318m - that’s more than 3x the market cap of £93m. This does seem an excessive discount to NTAV, so clearly the market is implying that because BWNG doesn’t generate any significant return from its large assets, and doesn’t pay any divis, then this discount is justified.

It makes me wonder if the best way to create shareholder value might simply be to shut down the operating business, and let the customer receivables book run off. Providing shutdown costs were not too huge, then this would create more shareholder value than continuing with a business that ties up £318m of assets, but generates little to no actual return for shareholders.

Fixed assets total £47m (see note 11), and includes £33.5m “Land and buildings” which is usually freehold, although I can’t find any mention of freeholds in this RNS, or the last annual report. It would be interesting to find out what this property is, if it’s freehold (very likely I’d say), and what its market value now is. It’s probably the headquarters.

Pension scheme - had a £17.1m accounting surplus, down a little from £20.0m last year.

All of the above is really just a sideshow. The biggest numbers by far on the balance sheet relate to its customer instalments receivables book, which is huge - it’s £517m gross, less a £73m allowance for expected credit losses, giving £444m net receivable. Other debtors and prepayments are £25m, taking the balance sheet total receivables to £469m.

The big problem is, how do we know that the £73m bad debt allowance is enough? What if it’s wildly out, and far more customers default? Why is BWNG sending goods to so many customers who are going to default on the payments, how does that make sense?

Note that the annual P&L charge for bad debts was a huge £106m in FY 2/2024, albeit down from an even larger £122m last year. For me, this business model just doesn’t make sense. Surely BWNG needs to use better credit scoring methods to largely eliminate orders from customers who can’t, or maybe even have no intention of paying? There seems a major problem with the business model here, and maybe quality of management too?

As we saw with S&U yesterday (another sub-prime lender), it only takes fairly small changes to the bad debt provisions to clobber profits. BWNG doesn’t have much profit to start with, so the risk of a big write-off to the receivables book is clearly something the market is worried about. Also regulatory risk. High cost credit is an area that regulators have been all over, and look at the legal mess BWNG got into with Allianz, which turned out to be very costly to settle. Could more regulatory credit-related liabilities emerge in future maybe? PPI hasn't gone away yet either (see below).

Cash was a healthy £65m at 2/3/2024, up from £35.5m a year earlier.

The middle section of the balance sheet is incredibly good, with £617m current assets, and only £72m current liabilities, so a colossal £545m net current assets.

However, the bank borrowings are also substantial at £302m gross, which is in the non-current liabilities section of the balance sheet. Net off the £65m cash pile, and net financial debt (excl leases) is £236m, down a useful 21% from last year.

Liquidity looks fine, as note 15 explains the facility limit is £400m, and has been extended to Dec 2026.

Covenants look unusual and we’re not given specific details -

The key covenants applicable to the Securitisation facility include three-month average default, return and collection ratios, and a net interest margin ratio on the total and eligible pool. Throughout the reporting period all covenants have been complied with.

There’s also an undrawn RCF & overdraft totalling £87m, to Dec 2026.

Overall then this looks a business in good order, and not financially distressed.

Provisions include £9.2m marked as “other litigation” (see note 18). This relates to ongoing PPI claims. I would have expected this historic matter to be dwindling, but the provision was actually increased by £2.5m in the year.

At least the big litigation with Allianz seems to have been settled now, with only a £0.2m balance sheet provision remaining.

Cashflow statement - looks remarkably strong at £92.2m (up hugely from only £6.3m LY), helped by inventories and receivables coming down by a combined £56m, whilst trade payables only fell by £7.5m, so there’s a £48.5m positive cashflow there from working capital.

Capex of £23.2m is nearly all capitalised IT, hence why EBITDA is a nonsense number. Interest costs were £15.4m. There was a £7.7m positive move from forex forward contracts.

Put that lot altogether, and BWNG was able to reduce its bank debt by £31.4m, and increase its cash pile by £29.7m to £65.2m.

This looks very good, and I’m sure the bank will be a lot happier seeing the borrowings coming down.

However, the shrinking debtor book is what’s driving a lot of this, which means lower revenues from interest charged to customers in future.

Paul’s opinion - the main (only?!) attraction to BWNG shares is the large discount to NTAV, which does seem excessive - NTAV is £318m, market cap is £93m. However, since BWNG doesn’t actually generate any meaningful returns from all those assets, then a large discount is reasonable, surely? Shutting the business down and putting the receivables into run-off looks by far the best way to generate shareholder value. I wonder if that has been considered?

Years ago BWNG was a decently profitable, dividend paying business. Can it get back to that? I can’t see any reason to anticipate that. Product revenues are declining, and so is the customer receivables book. It has a feel of managed decline, not a growth business.

However, decline is not necessarily bad. As I highlight above, the cash generation has been highly impressive, due to the loan book shrinking. I would argue that shrinking the business, and hence releasing all that cash unproductively tied up in receivables, is the best way to create shareholder value. Imagine if it say halved the receivables book, enabling it to pay off most of the debt. It could then start paying divis again. Much stricter lending criteria are needed to shrink the ludicrous >£100m pa write offs when non-paying customer receivables are sold to debt collectors at a discount.

Overall, at this market cap, I think there are credible bull and bear cases, and it’s very difficult to predict what will happen in future. It’s clearly a poor quality business, and if it didn’t exist nobody would invent it. That said it’s dirt cheap on an asset basis.

I’m much happier with the balance sheet and cashflows now than before, so even though it’s not something that I personally would invest in, I can see that with a bit of luck, there could be a nice trade here. Or something could go horribly wrong, like it did at competitor Studio Retail (which went bust when its accounts turned out to have a c.£100m black hole in them). That said, BWNG proved resilient in absorbing the substantial costs of its Allianz legal dispute. I genuinely can’t decide, so will sit on the fence with AMBER.

The long-term chart is telling us this is a business that has had its day. Still, that doesn't mean there won't be lucrative trades for short-term bounces along the way.

C&C (LON:CCR)

Down 9% to 155p (£600m) - Trading Update - Paul - AMBER

Its branded drinks seem to mainly be ciders, e.g. Blackthorn, Bulmers, Magners, and others listed here.

I’ve called it a trading update, but the title of the RNS is actually “Summary of FY2024 Unaudited Financial Performance”. What’s that then? It says this is not a preliminary results announcement, because it’s not yet been agreed with the auditors. The purpose of this announcement seems to be to help neutralise a second RNS this morning, revealing accounting problems that have arisen with historical results.

Actually, let’s do it the other way around, and I’ll look first at what the historical problems are, and whether they’re serious or not.

Prior Year Accounting Adjustments and Directorate Changes

Inventory and balance sheet items need to be adjusted.

No change to earnings for FY 2/2024, or future years.

This actually looks relatively minor - E5m total profit reduction spread over 3 years to FY 2/2023. Plus a €12m exceptional charge for “onerous apple contracts” (not heard that one before!) in FY 2/2023 which had been booked in H1 of FY 2/2024 I think.

More details here, again these sound fairly minor for a company valued at £600m (having lost £56m of its market cap in today’s 9% share price fall) -

“These adjustments relate principally to five items, inventory related matters at Clonmel (€10m charge), goods received not invoiced ("GRNI") (€3m credit), the timing of release of customer discount liabilities (€3m credit), change in accounting treatment of glassware (€1m charge) together with additional items (net €nil) over the three-year period in question.2

CEO Patrick McMahon had been previously CFO when these accounting problems occurred, so he’s taken responsibility for it, and will step down as CEO. Chairman Ralph Findlay becomes interim CEO for an expected 12-18 months whilst a permanent successor CEO is sought.

Paul’s view - there doesn’t seem to be any indication of fraud, just sloppy accounting procedures & controls. Or possibly the failure to book an onerous contract provision for its apples might have been brushed under the carpet deliberately in order to hit profit targets? I’m just guessing there. I hope it’s not one of those situations where an apparently modest first reveal then deepens into something much more serious. Maybe that’s why today’s £56m market cap hit is over 3x the actual financial hit to the company?

Trading Update - summary of FY 2/2024 performance

7 June 2024 | C&C Group plc ('C&C' or the 'Group'), a leading, vertically integrated premium drinks company which manufactures, markets and distributes branded beer, cider, wine, spirits and soft drinks across the UK and Ireland issues a summary of unaudited financial performance in respect of the year ended 29 February 2024 (FY2024) following a delay in the preparation of the Group's Annual Report and Accounts for FY2024.

These numbers are unaudited, so audit adjustments could yet happen.

My comments on the above table -

Big revenues of €1,652m, but small underlying PBT of only €39m (down 41% on LY)

PBT margin is very low at 2.4%

Net debt excl leases looks modest at €58m - that’s well down from €107m reported at end H1.

Huge difference in the statutory figures, which show a €(111)m loss, that’s €150m lower than the adjusted numbers. This is mostly a goodwill write-off for UK (“crowded and competitive cider market”) brands, here’s a breakdown -

Importantly, it says these numbers are “in line with market expectations”

Claims to have a strong balance sheet, so I have to check now! At H1 its 31/8/2023 balance sheet only had €93m NTAV, which includes a €38m pension asset, so €55m excluding pensions. I would call that adequate, rather than strong.

There’s been some disruption caused by a new ERP system botch up, previously announced.

Dividends - a 3.97 Euro cents final divi is proposed, on top of a 1.9 cents interim paid in Dec 2023. That’s about 4.97p, so a yield of c.3.2% - not madly exciting. The share count seems to have reduced by about 2% recently thanks to buybacks, with another €15m buyback starting in Sept 2024.

“Commitment to return €150m to shareholders by end of FY27 remains unchanged.”

Current trading - is in line with expectations.

The football this summer is expected to help.

Paul’s opinion - not a company I know particularly well, but I’m left underwhelmed generally by this low margin business.

They’ve done a great job today in damage limitation, by rushing out draft FY 2/2024 results, and confirming trading is in line with expectations. The accounting errors (let’s be kind) are not significant overall, but obviously it raises a question mark over management competence and/or honesty. The CEO’s fallen on his sword, which is the right thing to do, people have to take responsibility for things that go wrong on their watch.

Overall C&C just seems a middling company. Fairly average PER and dividend yield. Operating in low margin, competitive markets. Adequate balance sheet, etc. I can’t see why anyone would get excited about the potential for this company/share. So it’s an AMBER from me. Why get involved?

The long-term track record looks poor too - see chart below. Does anyone know what caused the boom & bust from 2005-7?

Zooming in to the last 5 years, it’s not really made any progress from the pandemic lows -

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.