Good morning from Paul & Graham!

That's it for today, see you tomorrow!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

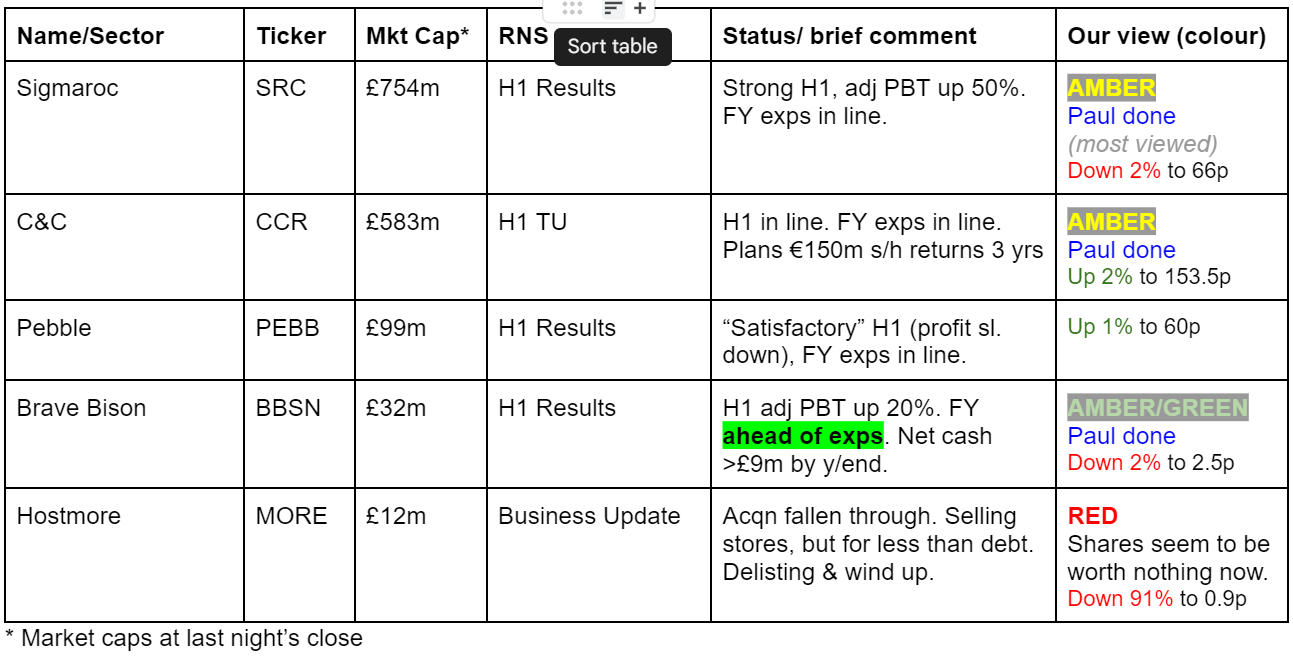

Companies Reporting

Summaries

Brave Bison (LON:BBSN) - up 2% to 2.6p (£34m) - H1 Results - Paul - AMBER/GREEN

A strong result for H1, and ahead of expectations for FY 12/2024. However, there's little organic growth, so this looks more about cost control than growth. Sound balance sheet with plenty of net cash, expected to rise to >£9m by year end. I still like it, but shift down from green to AMBER/GREEN, due to the lack of any significant organic growth. Low tax charges seem to be flattering EPS.

Sigmaroc (LON:SRC) - down 5% to 64p (£716m) - H1 Results - Paul - AMBER

Rapid revenue, and good profit growth from this consolidator of European lime quarries. Debt has soared from its latest deals, but seems well within the bank covenants. Very capital-intensive business, as you would expect from quarrying & processing minerals. An unfamiliar sector, so this has to go in my don't know tray, with another AMBER.

C&C (LON:CCR) - up 2% to 153.7p (£595m) - H1 Trading Update - Paul - AMBER

H1 performance has been in line with expectations, and FY guidance confirmed. Reaffirms shareholder returns of E150m over next 3 years. Plan is to raise margins in future years. Overall it looks OK, low margin business in a competitive sector, so doesn't madly interest me.

Paul’s Section:

C&C (LON:CCR)

Up 2% to 153.7p (£595m) - H1 Trading Update - Paul - AMBER

Dublin-headquartered drinks group has performed in line with expectations in H1 -

“Dublin, London, 9 September 2024: C&C Group plc ('C&C' or the 'Group') announces that earnings in the first half of the financial year to 31 August 2024 have been in line with expectations…

Underlying Operating Profit is expected in the range of €39m-€41m, in line with our expectations, principally reflecting the phased rebuilding of our Distribution business profitability following last year's ERP disruption.”

More detail is given about the different brands and business units which I would summarise as: mixed.

Outlook -

“While current market conditions remain challenging, improving efficiencies, business simplification, winning customers and brand distribution remain our top priorities. We remain confident on achieving our operating profit target for the current financial year and making progress towards the operating profit target of €100m by FY2027.”

Shareholder returns - uses the word “reaffirms”, so doesn’t sound price-sensitive info -

“The Board reaffirms its intention to distribute at least €150million to shareholders over three years while maintaining the Group's financial leverage target of approximately 1x EBITDA on a pre-IFRS16 basis. The second €15m tranche of our share buyback programme will commence today, 9 September 2024.”

Paul’s opinion - it looks an OK business, nothing remarkable really - eking out quite low margins from selling cider and other drinks in competitive markets.

Checking my previous notes, I was amber before, and flagged accounting problems on 7/6/2024 which caused the CEO to resign (as he had been previously CFO when the problems happened). Shares today are about the same price as then, so the market seemed to agree with my assessment that those issues were not very important.

Broker forecasts have been dropping steadily for CCR, and it talks about some difficult markets. So I can’t muster much enthusiasm for this share I’m afraid. The forward PER of 13.2x looks about right to me, once you factor in the net debt (not excessive though). Divis are OK at 4.2% yield, plus buybacks.

It’s got to be another AMBER from me - which is OK, bear in mind that our performance stats show ambers collectively do well, only slightly below amber/greens. So I do urge people to look at everything from amber upwards.

The 10 year chart shows a poor long-term track record I'm afraid. So why would that suddenly change?

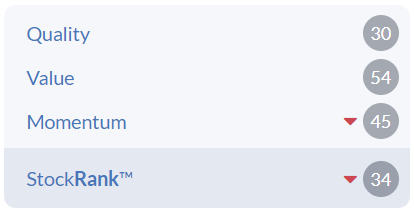

Stockopedia doesn't like it, with a low StockRank. Although I note that the negative quality scores come from exceptional losses booked in last year's accounts.

Sigmaroc (LON:SRC)

Down 5% to 64p (£716m) - H1 Results - Paul - AMBER

SigmaRoc, the European lime and minerals group, announces unaudited results for the six months ended 30 June 2024 ('H1 2024').

We don’t usually cover things in the natural resources sector here, but I started looking at SRC earlier this year, so might as well carry on. It’s buying up lime & limestone quarries, and this seems to be used in numerous sectors - agriculture, building products, and some environmental things like producing batteries, and other industrial uses.

Previously our thoughts on SRC were -

12/4/2024 - AMBER at 64p - AGM TU - In line Q1 2024 trading. Lot of acquisitions, but both share count and debt have risen significantly.

30/7/2024 - AMBER at 69p - H1 TU - ahead of exps, but FY 12/2024 exps unchanged.

H1 results to 30/6/2024 are out today, and look pretty good (as indicated previously) -

“Strong first half performance underpins confidence in our full year expectations”

Some numbers for H1 -

Revenue up 60% to £469m

Improved EBITDA margin rises 240bps to 21.3%, and EBITDA up 82% to £100m

Adj PBT up 50% to £49.1m

Adj EPS down 20% to 3.18p

Net debt rockets 190% to £534m (incl IFRS 16 leases of £34m), so £499m net bank debt (mainly Santander).

That’s a huge increase in debt, as I flagged last time. It again raises the question of whether these acquisitions are adding shareholder value, given that finance charges are shooting up from debt soaring, and adj EPS actually fell. These are the adjusted numbers too, presenting the most favourable picture they can.

It also provides pro forma numbers, which show the run rate of revenue & profit if acquisitions had been included for the full year. This comes out at a higher adj EPS of 4.27p - if we double this for a full year, then 8.5p = PER 7.5x - not that cheap when you consider net bank debt is 70% of the market cap.

Balance sheet - huge fixed assets of £1.25bn, plus growing intangibles of £436m, funded by over £600m of gross debt.

For me the high debt makes this close to uninvestable. Although the ratio is not dangerous, with the covenant at 3.95x, and actuals being well below that -

“Covenant Leverage at 2.57x with pro-forma5 leverage 2.29x, on target to close the year below 2.3x”

Outlook -

“Trading conditions in Europe present both head and tailwinds which the Board is actively managing. Industrial minerals will see areas of outperformance and possible challenges in relation to expected softness in automotive demand. Environmental markets have been consistently strong in the food and agricultural segments, with weather-related pockets of lower demand in power generation. A rebound in residential construction has not yet materialised given prevailing high interest rates and relatively low new planning applications although we are well placed for market recovery.

The Board remains confident in the Group's ability to deliver on the integration of the Polish assets, and to continue to build on SigmaRoc's position as a European leader in lime and limestone.

The Board's current outlook for FY24 remains unchanged with EBITDA in line with consensus1.

1. Consensus expectations for SigmaRoc, being the average of forecasts for the year ending 31 December 2024 provided by Analysts covering the Company, are revenue of £1,060.0m and underlying EBITDA of £219.3m.

Synergies should mean further improvement in EBITDA margins, assuming everything else remains the same -

“Our synergy program, initially targeting €30m-€60m by 2027, has been increased to €35m to €60m, even before allowing for potential benefits from the Polish lime business. We are now targeting €15m and €25m to be delivered in 2025 and 2026 respectively, rising to €35m in 2027. We expect to report further progress following the integration of the Polish assets.”

Paul’s opinion - where do we start with this? I know literally nothing about lime, its markets, or the competition, etc. So I don’t have any confidence that I would be able to pick winning shares in this sector.

SRC has grown rapidly from repeated acquisitions, building a £1bn+ revenues group from almost nothing, but that’s been done by issuing a lot of new shares, and taking on c.£500m in net bank debt, delivering very little share price appreciation in 10 years - probably a negative return if we factor in 10 years' inflation. And of course, no divis paid.

It stands to reason that construction, infrastructure, and industrial demand in Europe could pick up as (hopefully) economies recover from the twin shocks of the pandemic, and energy crisis.

This is a long shot, but do we have any lime industry experts in the house who can give a more informed view on SRC and its sector?

My inspection of the numbers brings me to a conclusion that it’s a capital-intensive business, with heavy ongoing capex. After paying finance charges too, there’s nothing left for shareholders, so no divis. The hope being that once it’s stopped the rapid series of acquisitions, then there could be a strongly cash generative business that can reduce debt, and start paying divis.

There’s no way I can assess its future prospects, so I have little choice other than to stick at AMBER - which in this case is a don’t know. My main concern is the scale of the net debt, but it’s not dangerous providing EBITDA holds up at levels keeping it well within the bank covenants. If something untoward were to happen, then debt might become an issue.

The only lime I know about is the stuff we squeeze into our cocktails, so I'll leave this share for someone else.

Brave Bison (LON:BBSN)

Up 2% to 2.6p (£34m) - H1 Results - Paul - AMBER/GREEN

Both Graham and I have looked at BBSN earlier this year, and in both cases we viewed it positively, with GREEN.

BBSN tried to launch a takeover for Mission (LON:TMG) earlier this year, but was thwarted by TMG management, who declined a mostly paper offer, and refused to provide access for due diligence. So BBSN withdrew.

Moving on to today’s news -

“Brave Bison, the digital advertising and technology services company, today reports its unaudited interim results for the six months ended 30 June 2024.”

Positive headlines -

“20% increase in adjusted profit before tax

FY24 trading ahead of market expectations”

Although note that the 20% profit increase has all come from margins/costs, there’s no top line revenue growth -

Broker upgrade - Cavendish ups FY 12/2024 from adj PBT of £3.2m, to £3.7m, but this is based on no change to forecast revenue of £21.0m.

New forecast for FY 12/2025 is a modest increase to £21.7m revenue, and slightly higher at £3.8m adj PBT (0.28p adj EPS).

My problem with this is that improving margins through cost control is a one-off gain. There needs to be top line growth, which seems to be lacking here. So it’s actually a lot less exciting than it originally looked from the headlines.

Although it says there has been some growth, masked by shutting down US operations -

“Brave Bison did not renew a number of large, low margin / loss-making client contracts serviced from New York and has mothballed operations in the US. Excluding these mothballed operations, net revenue grew by 7% year-on-year on a like-for-like basis”

TMG aborted acquisition - pleasingly, they only spent £33k in costs, so no harm done, because the due diligence gravy train for advisers didn’t leave the station, being refused access by TMG.

With large retained previous losses, it looks as if BBSN might be benefiting from a low or negative tax charge, which boosts EPS. So that needs careful checking, as EPS could drop once normalised tax charges are incurred.

Outlook -

Balance sheet - looks good. I’ll eliminate £14.0m in goodwill and deferred tax assets & liabilities, so that takes NAV down from £20.0m to £6.0m - which is adequate for a people business with modest physical fixed assets of £2.2m.

Net cash is healthy at £6.7m, and it says this will go up to over £9m by year end.

Cashflow statement - not very good, because profits were sucked into increased working capital. Something similar happened last year in H1, but it reversed in H2, so let’s hope a similar outcome happens this year. The company sounds confidence about cashflow, saying its net cash should rise to >£9.0m by year end, so that will need checking when the FY figures come out in spring 2025. I don’t see any cause for alarm, it’s fairly normal for working capital to fluctuate.

Paul’s opinion - this is a good performance from BBSN, although it’s looking as if the revenue & profit growth of recent years is now reducing. Growth has been previously fuelled by acquisitions, but that’s also meant big increases in the share count, from 613m average in 2020, to 1.29bn today. I think investors are less excited about digital advertising agencies these days, as the seemingly limitless growth potential of a few years ago has changed to it being a more mainstream activity now. Look at what a disaster Sir Martin Sorrell’s debt-fuelled acquisition frenzy turned out to be at S4 Capital (LON:SFOR).

BBSN is trading fairly well, and has sound finances, with a forward PER of only about 9.0x, although I think earnings are being flattered with low or negative tax charges. Normalising corporation tax to 25%, for 2024 forecast, I get 0.215p adj EPS, which gives a PER of 12.1x, not quite so cheap, but still reasonably-priced.

It’s an ahead of expectations update, and by year end there should be over a quarter of the market cap in net cash. Hence this share remains attractive I think. It’s reasonably priced now, and is really a bet on management using the cash pile (and maybe some future borrowings?) wisely to make further acquisitions. Hence checking the background and previous experience/performance of management is likely to determine whether or not they know what they’re doing re acquisitions. We don’t want to see them making an expensive mistake. The proposal to acquire TMG was audacious, and made a lot of sense to me, but was rejected.

On balance I think shifting down a little to AMBER/GREEN makes sense for the time being. So still positive, but it doesn’t strike me as a compelling buy for me personally.

I’d also like to learn more about what the company actually does. Digital marketing is a large space with any number of competing companies, so what (if anything) makes BBSN stand out?

Shares have done quite well in recent years - and it currently has a middling StockRank of 57 -

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.