Good morning! It's Graham and Roland with you today, plus we have some catch-up items from Mark that are ready to go.

Wrapping it up there for today (12.30pm). Thanks!

Explanatory notes

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day. We usually avoid the smallest, and most speculative companies, although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We have a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Add your own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023

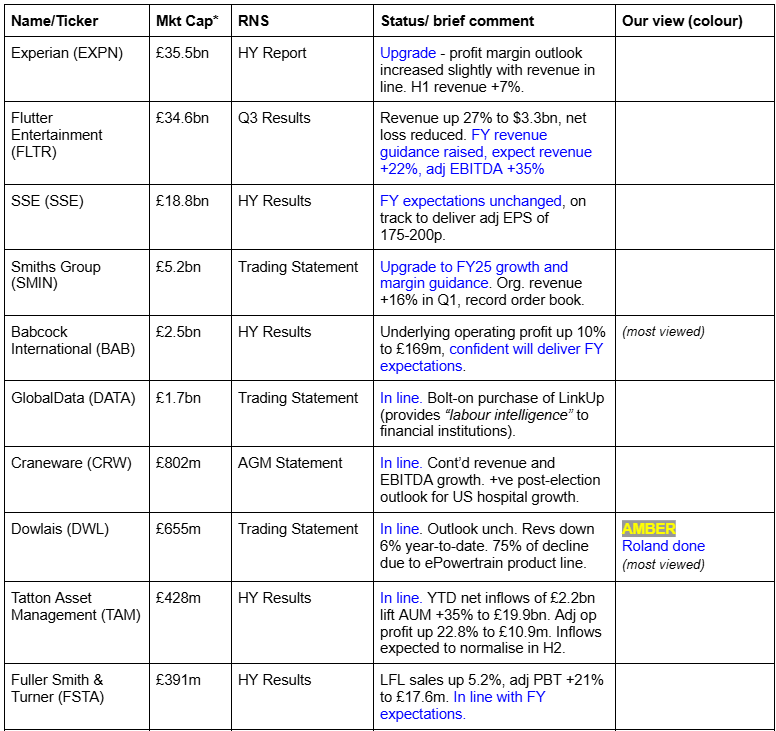

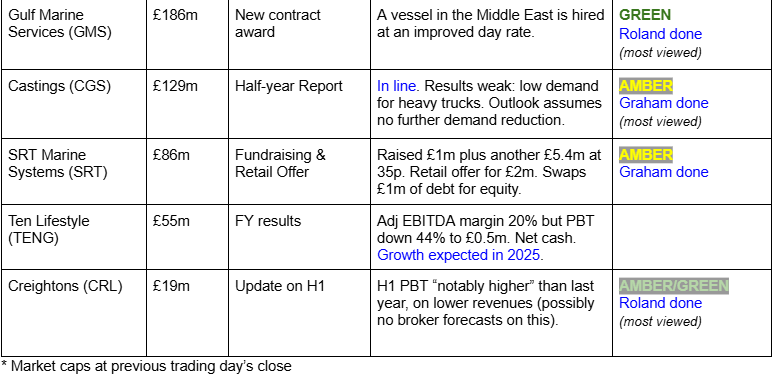

Companies Reporting

Summaries

Castings (LON:CGS) - down 2.5% to 271p (£118m) - Half-year Report - Graham - AMBER

FY March 2025 is in line with expectations, but shareholders who access broker notes will find that FY March 2026 has been downgraded due to ongoing weak demand from the heavy truck industry, offset by temporary cost cuts as CGS adapts to lower volumes. Cash falls to £16m.

Creightons (LON:CRL) - up 16% to 33p (£22.5m) - H1 trading update - Roland - AMBER/GREEN

Half-year profits have been boosted by cost cutting. This consumer goods company now expects H1 operating profit of >£1.5m, exceeding last year’s full-year result. It’s a strong start to the year but with no forward guidance, I think a measure of prudence is sensible ahead of H1 results later this month.

Dowlais (LON:DWL) - up 14.5% to 55p (£748m) - FY trading statement - Roland - AMBER

Full-year results are expected to be in line with expectations, albeit with revenue down. Weakness in EV sales appears to be a particular headwind. The FY25 outlook appears to have weakened and debt levels seem a little high to me. This market leader could be cheap at the right price, but I’d want more information to take a stronger view.

SRT Marine Systems (LON:SRT) - unch. at 38.6p (£85m) - Fundraising - Graham - AMBER

SRT continues to prepare its finances for the delivery of a large ($213m) Kuwaiti contract over the next two years. Historically, I found SRT’s dilution of its share count to be off-putting. Tens of millions of new shares are now proposed for creation. Hopefully this time it’s different and the company delivers for its shareholders!

Short Sections

Oxford Instruments (LON:OXIG)

Down 3% to 2070p - HY Results - Mark - AMBER

When Graham looked at this, following Prelims in June, the shares were up 9% on an inline statement, and he commented that:

[the results] which don’t look particularly exciting to me, with adj EPS down 3% to 109p (in line with expectations), a PER of nearly 25x, which looks a punchy rating.

Since then, the shares are down over 20%, so they may be better value now. In June, the outlook at the time was:

Given our strong order book and pipeline, coupled with positive business improvement actions, we expect to make good constant currency progress in the full year ending March 2025.

The Half Year results show good top-line growth, but like many companies at the moment, the results look worse as you go down the income statement:

A slight reduction in gross margin and an increase in sales and marketing costs are the primary reasons for the drop.

The difference between the adjusted and unadjusted figures isn’t too large, and consists mainly of the amortisation of acquired intangibles, which is fairly standard. However, there is a big jump in restructuring costs:

During the first half the Group commenced a restructuring programme to deliver productivity and efficiency benefits following the new divisional structure, as well as yielding cost savings where we are seeing short-term order weakness. This resulted in restructuring costs of £2.2m.

This has a decent balance sheet with net cash and net working capital. Although net cash has declined by £43m in H1, this includes £15.4m due to an acquisition and £9.2m paid out as dividends. However, their willingness to make acquisitions makes the growth forecast unimpressive. The StockReport has 8% CAGR revenue growth and 10% EPS, suggesting that there is little operational gearing. This needs to accelerate faster than it is currently forecast in order to justify the current P/E of almost 20. The long-term ROCE here is very reasonable:

But unless they have opportunities to reinvest capital in similar assets in the future to generate stronger growth, this does them no good. A flat order book also doesn’t give the impression that this is a coiled spring.

Their segmental analysis may reveal a glimmer of hope. Imaging and Analysis currently generate all the operating profit with Advanced Technologies loss-making but faster growing. If they can continue this trajectory and Advanced Technologies becomes profitable, this may have a big impact on the bottom line.

It may well be worth researching this possibility further.

Mark’s view

This is a decent company. However, unless there are signs that growth can accelerate in the future, and these results don’t give any indication that that is the case, the shares appear to be fully priced. Like most good but expensive companies, this gets an AMBER rating.

Tpximpact Holdings (LON:TPX)

Up 16% to 36p - H1 Trading Update & Contract Win - Mark - AMBER/GREEN

TPXImpact Holdings is the new slightly daft name for the previously very daftly named “The Panopoly”. Revenue here grew rapidly from 2019 to 2022:

But this never made it into consistent profitability:

Forecasts are for this to change, though. While revenue remains flat, they are forecast to break into profitability. This update re-affirms how they guided the market at the start of September:

The Board expects to report first-half revenues of almost £38 million, down approximately 9% on H124. Adjusted EBITDA margins are expected to increase to c. 6% (H124: 4.8%).

However, this didn’t prevent the shares from slipping back, in what I presume was tax-selling worries:

This works out to be around £2.3m adjusted EBITDA. A level that is likely to be break-even, at best. However, things are looking better for H2:

Our confidence in the Company's long-term growth prospects therefore remains strong and the Board reaffirms its FY25 target of flat revenue growth, with an adjusted EBITDA target of £7-8 million in line with consensus estimates.

Things are even better better for 2026:

The Board also remains positive about the outlook for FY26, with like-for-like revenue growth targeted at 10-15% and an Adjusted EBITDA margin target of 10-12% compared to 5.5% in FY24.

This works out to be £10.4m EBITDA at the mid-point of the range.

Net Debt is coming down quickly, too, and a quick look at the last balance sheet suggests that the working capital position isn’t too bad, either. Which can be a problem with this sort of IT contractor. The presence of a large cash balance as well as large debt means that there may be big swings in working capital during the year, but the company has ample facilities in place to manage this.

If we take the 2026 targets at face value, this works out at an EV/EBITDA of around 4, even after the rise. You can forgive the market its scepticism when the brokers’ trend looks like this:

But it is easy to see why there has been a 16% relief rally today. A contract win, also announced, adds to the momentum behind the business:

The award from MHCLG of up to £19 million over three years provides TPXimpact with a pivotal role in supporting the delivery of MHCLG's ambitious digital reform programme to modernise the planning systems utilised across England.

Mark’s view

This sort of IT contracting business will never be particularly highly rated. However, if the company’s guidance is to be believed, which has now been consistently re-iterated, this is now too cheap. Some scepticism is still deserved given the chequered past and broker consensus trend. Hence, an AMBER/GREEN rating feels about right.

Franchise Brands (LON:FRAN)

Down 10% to 165p (£320m) - Q3 Trading Update - Graham - AMBER

Yesterday’s update from FRAN was almost a fully-fledged profit warning.

Despite “resilient underlying demand”, we have the following news:

…the anticipated recovery in project work is now not expected until next year due to continued macroeconomic uncertainty and challenging conditions in some markets. This supports the Board's expectation that Group Adjusted EBITDA for the year ending 31 December 2024 will be within the range of market expectations, albeit at the lower end.

Estimates: going into the update, the range of expectations for 2024 adj. EBITDA was £35.7 - 37m.

Thanks to Allenby for publishing a note with updated forecasts: they have also reduced their 2025 adj. EBITDA forecast by 6% to £39.3m.

FRAN’s Divisions

Pirtek (hose repair, hose replacement): the issue is that “project work and other discretionary spending has remained subdued”, which is consistent with FRAN’s view that the underlying cause is macroeconomic. The UK Budget is mentioned. Perhaps now that the Budget is in the rear view mirror, conditions can improve?

Filta UK (cooking oil management, fryer cleaning): “continued to successfully transition from a direct labour organisation to a franchise model”. In the US, where it is already franchised, Filta saw “strong growth in system sales”.

Exec Chairman comment:

Demand for our essential reactive services continues to drive a resilient performance despite softer demand for non-essential work. We expect this deferred work will be required, albeit the exact timing is uncertain and so we are cautiously assuming a recovery beyond the current year.

Graham’s view

We’ve been neutral on this one. I covered it as recently as 23rd October, when we had a double announcement that A) the company recruited a CEO to take on some of Exec Chairman’s responsibilities (good news, in my view), and B) FRAN was considering a move from AIM to the Main Market (I don’t think this matters until FRAN is big enough to join the FTSE-350).

After yesterday’s share price fall, it is back where it was on 23rd October. I’m inclined to stay neutral. Their main projects now are de-gearing (net debt last seen at almost £75m) and integration (a central IT platform will help all companies to work together). If and when we see signs that these projects are succeeding, I’m open to upgrading my stance here to a shade of green.

Gulf Marine Services (LON:GMS)

Closed yesterday at 17.4p (£186m) - Contract award - Roland - GREEN

A short update on a new contract award from this Main Market small cap this morning.

Gulf Marine Services hires jack-up platforms used by oil and gas operators and – increasingly – offshore wind operators.

New contract: the company has secured a new contract at improved rates for one of its vessels operating in the Middle East:

“We are delighted to have secured this contract at an improved day rates for one of our small-class vessels. This confirms the continuous demand for all the vessel classes we operate.”

Roland’s view

No financial details are provided in today’s update and there is no indication as to whether this will affect the full-year outlook. On this basis, my assumption would be that this is business-as-usual and already reflected in current forecasts.

The investment case here is built around GMS deleveraging while benefiting from strong market demand for its relatively modern fleet. Paul has covered this extensively in the past and I share his view that there has been an attractive opportunity here.

With the stock still trading around 30% below book value, I think it’s fair to argue that some value remains.

However, I don’t think this is a stock I’d want to pay a high multiple for, given the cyclical exposure and capital intensity.

Return on equity seems to have stabilised at around 13% as GMS’s recovery has progressed:

Given this level of profitability, I would be inclined to view book value (H1 24: c.25p) as a proxy for fair value.

Dividends are expected to resume over the coming year, which could provide a further attraction for investors.

With the stock trading on a forward P/E of 6 and a P/B of 0.7, I’m happy to retain a positive view for now.

Castings (LON:CGS)

Down 2.5% to 271p (£118m) - Half-year Report - Graham - AMBER

I like Castings for its concise reporting style and the Half-Year Report today is no different.

Without any introductory blurb, they get straight into it:

H1 sales £89m (H1 last year: £111m)

H1 PBT £4.1m (H1 last year: £10.3m)

The reason for the sharp decline is simple enough: much lower demand for heavy trucks, which are responsible for 75% of CGS; revenue.

OEM customers have reported demand normalisation throughout the period which, as expected, has flowed through to the schedule reductions we have seen from them. The US market is a notable exception where we have seen increased penetration with existing customers.

The problem of volatile demand for trucks in the post-Covid environment has been mentioned before - see our coverage of Castings in June (when I downgraded to AMBER/GREEN), followed by a profit warning in August (when Paul downgraded it further, to AMBER).

Ductile Castings: CGS bought the assets of an iron foundry out of administration in June (here’s the website). The price paid was just £0.4m, which was less than the operating profit the Scunthorpe-based foundry had recorded in FY 2023.

Today we learn that this renamed business (“Castings Ductile”) commenced production in July and “is now trading profitably” (to be precise: it has generated an overall loss since it started trading, but it started to turn a turn from its third month).

It would be terrific if this very cheap acquisition could make a meaningful contribution, but given the price paid it doesn’t owe CGS very much. Importantly, it has diversified CGS into gas/wind power generation and infrastructure.

Foundry operations: output is down 18%, or 20% on a like-for-like basis excluding Castings Ductile. The profit margin has unfortunately collapsed to 2.7%, vs. 7% in H1 last year.

It seems that weaker economies of scale are the main issue; the company was accustomed to higher volumes and had a cost base to reflect that. Or in the company’s words:

Profitability in the period reflects the lower levels of sales and the time-lag to realise the benefits of the actions taken to right size the cost base. Management believe that the necessary actions have now been taken such that the foundries can operate more efficiently at the lower levels of demand during the second half of the year. Importantly, the changes have not been of a structural nature and so can be quickly reversed to take advantage of the upturn in volumes when they come through.

Machining: similar to the foundry operations, profit margins from machining are sharply lower (falling from 10.6% to 6.6%) due to lower volumes. Older equipment has been replaced.

Cash is over £16m but I must note that this has halved compared to March 2024. Even so, the company has declared a new interim dividend of 4.2p (total cost is around £2m). Based on current levels of profitability, these dividend payments don’t look comfortable - I think an upturn in trading is needed to backstop them.

The balance sheet is very strong as usual, with very little going on in terms of liabilities, but I do find the fall in cash disconcerting.

Outlook doesn’t offer much in terms of improved demand, only that CGS will be better able to turn a profit at lower volumes: They do say that they expect to trade in line with expectations for the full year (these expectations reflecting prior profit warnings).

Estimates: despite the "in line" statement relating to the current year, there are cuts to forecasts at the brokers for future years.

Perhaps this isn't worth getting upset about, but I'd appreciate it if companies would tell the public themselves when they need to downgrade expectations for future years, instead of assuming that everyone has a broker note.

With thanks to Canaccord, I see that FY March 2026 has suffered a 3% reduction in its revenue estimate (to £190m) and a 16.7% reduction in its PBT estimate (to £12.5m). This does still imply a modest improvement on the year that is soon to finish, FY March 2025. The ongoing challenging backdrop in Heavy Trucks is the main reason for the cuts, along with higher NI contributions.

Zeus already had more conservative expectations and they only make a £1m cut to their PBT estimate, reflecting higher NI contributions only. Their new PBT estimate for FY March 2026 is £12.1m.

Graham’s view

This was one of my favourite industrial stocks, and I continue to appreciate certain aspects of its management style (e.g. strong balance sheet, cheap bolt-on acquisitions).

However, I feel obliged to stay at a neutral stance now given the lower cash balance and the weaker levels of demand which are apparently here to stay for the foreseeable future.

On the basis of the very latest updates, the stock is trading at a forward PER of 12.6x (271p share price divided by 21.5p EPS estimate for FY March 2026). I can’t argue that it deserves to trade at a much higher level than this, so I’m neutral.

SRT Marine Systems (LON:SRT)

Unch. at 38.6p (£85m) - Fundraising - Graham - AMBER

The track record here is volatile, to say the least:

As reported earlier this month and at the end of October, SRT is going ahead with a fundraising to support an enormous ($213m) contract in Kuwait.

The contract is for “an integrated SRT maritime surveillance system”, for use by the Kuwait Coast Guard and other agencies. Implementation will take up to 2 years, and then there will be 10 years of support/maintenance. So that $213m figure is not all going to be earned on day one.

Please once again note that SRT’s financial forecasts are currently suspended by Cavendish.

Financial supports: getting the Kuwaiti deal signed was not so easy and some of the details are worth mentioning. From today’s announcement:

In order to secure the Kuwait contract which was signed on 30 October 2024, the Company was required to provide a performance bond in short order prior to signing the contract. Due to the short timeframe, traditional methods of financing the performance bond were unavailable to the Company. As such, the Company had very few options.

I’ll attempt to summarise the arrangements:

Performance guarantee. Major shareholder Ocean Infinity provided a cash loan of $21m, enabling the issuance of a contract performance bond. It is planned that this will be replaced by a bank guarantee and then by a guarantee from UK Export Finance.

Fresh equity of up to £8.5m is issued at 35p per share, conditional on shareholder approval. Ocean Infinity are partially underwriting the retail offer, i.e. they will pick up some shares if retail investors don’t take up the full amount offered to them.

The new equity of up to £8.5 is from the following sources: £5.4m from Ocean Infinity, £1.1m from certain existing shareholders, and £2m available to retail investors.

There are also quite a lot of warrants floating about.

The share count is currently 222 million, quite a step up from where it was before. The company already raised £10.5m at the start of this year.

The new fundraise means an additional c. 24 million shares.

On top of that, there is a debt for equity swap releasing another 3 million shares.

And then there are 10 million warrants which were granted to Ocean Infinity at the end of October, plus another 10 million warrants to be granted if shareholders approve this fundraising package, all exercisable at 35p.

If SRT fails to replace Ocean Infinity’s contract performance guarantee within 8 months, SRT will issue another 4 million warrants every month to Ocean Infinity, with a new strike price based on whatever SRT’s share price is at the time.

Here’s a comment from the CEO of Ocean Infinity, who is joining the SRT Board. OI create robotics technology for underwater use:

"We're excited at the possibilities for SRT, and Ocean Infinity, founded on our investment in the company. The burgeoning partnership we have formed allows us both to better serve our clients in the maritime data and services market. We firmly believe in the company and its management to deliver as well as in the commercial opportunities for us to work together for the benefit of both businesses."

Graham’s view

Shareholder support for SRT (especially from shareholders other than OI) is admirable given that the company’s future financial performance is, in my view, anyone’s guess.

OI are a strategic investor and have been rewarded for their assistance with potentially very valuable warrants, so they are a special case.

We know that the Kuwaiti deal is enormous in terms of the revenue opportunity, and we know that SRT are seeking more contracts of this size. But how to value all of this? I don’t think it’s possible, not yet anyway.

Financial accounts here will be extra complicated as the year-end has changed from March to June. The next set of results to be published are the 15 months from March 2023 to June 2024.

This stock is firmly in my “too difficult” tray.

Historically, I viewed it as a company that over-promised and under-delivered. I also felt that shareholders got a bad deal in terms of regular dilution, without ever seeing much of a financial reward.

The first part of that statement remains as true as ever: more dilution is firmly on the cards, with more than 45 million new shares being printed if OI exercises all of the warrants that SRT proposes to create.

Perhaps this time it will lead to financial reward, but it's too high-risk for my own tastes.

Roland's Section

Creightons (LON:CRL)

Up 16% 33p (£22.5m) - H1 trading update - Roland - AMBER/GREEN

“the Group estimates that its profit before taxation for the unaudited interim period to 30 September 2024 will be notably higher than that of the comparable period in the previous year.”

Creightons is a consumer goods company producing a range of hair care and wellbeing products. We last looked at this small cap in July, when Paul covered the full-year results for the year to March and upgraded his view from AMBER to GREEN.

Today’s half-year trading update has prompted a double-digit share price gain at the market open, so it looks like Creightons’ turnaround may be continuing. Let’s take a look.

Half-year update: today’s update is brief, but provides several bits of useful information:

Small reduction in H1 revenue

Tight control on costs, cost base aligned with activity levels

H1 operating profit will be in excess of FY24 adjusted operating profit of £1.5m

Creightons doesn’t have any analyst coverage available on Research Tree (surely an own goal for such a small company?). This means that investors are reliant on today’s guidance for their forecasts until the full-year results are published on 28 November.

What can we learn from today’s update?

Lower revenue: no detail is given about the cause or size of the H1 revenue drop.

However, we do know that Creightons’ FY24 revenue (y/e 31 March) fell by 9.2% due to cost cutting and “product portfolio rationalisation”.

Checking back to last year’s results, the company reduced its brand portfolio product offering from 334 products to 184 products – a reduction of 45%! I would guess that the impact of this is still flowing through the numbers, so the H1 drop in revenue is not necessarily a big concern.

Cost cutting: today’s update mentions cost control, but does not make any mention of sales volumes or general trading conditions.

This suggests to me that the improvement in profitability seen in H1 has been driven by cost cutting.

This would also be consistent with lower revenue. Short term, I don’t see this as a problem. Rebuilding profitability before pursuing volume makes sense to me. But as the saying goes, a company can’t cut its way to greatness.

FY profit outlook & valuation: we are told that half-year operating profit before exceptional items will be “in excess” of £1.5m.

At 32p, Creightons has a market cap of £22m. Assuming net debt remains unchanged at under £1m, I estimate an enterprise value for the business of around £23m.

If I assume an unchanged profit performance for the second half of the year, I get an FY25 operating profit of £3m. I would estimate this might translate into earnings of around £2.3m, giving a possible FY25e P/E multiple of 10x.

Roland’s view

Today’s update provides no information on trading and no forward guidance. Further details are promised when the half-year results are published on 28 November.

It may be worth noting that although the StockReport shows exceptionally strong free cash flow last year, this was driven by inventory reductions and favourable working capital movements. By its nature this isn’t necessarily sustainable, so I’d be reluctant to rely on this too heavily as a valuation measure until we see some accounts for this year.

Ahead of the half-year results, I’d be cautious about extrapolating recent improvements in Creightons’ profitability too much further. But I’d hope that the performance achieved in H1 should be broadly sustainable over the remainder of the year.

My impression so far is that the newish management have right-sized the cost base, repaid debt and consolidated the group’s product offering into a more sustainable portfolio.

The next step should be to start rebuilding sales growth and volumes.

The valuation still looks reasonable to me and if I held the shares, I’d be happy to continue doing so ahead of the half-year results on 28 November.

However, Creightons’ track record of single-digit operating margins would make me wary about paying too much. This business isn’t Unilever (I hold) or Proctor & Gamble.

Given the recent increase in valuation, falling revenue and lack of forward guidance, I think a measure of caution makes sense. I’m going to moderate our last view and take a stance of AMBER/GREEN.

Dowlais (LON:DWL)

Up 14.5% to 55p (£748m) - FY trading statement - Roland - AMBER

The Group has delivered performance in line with expectations and our full year outlook remains unchanged.

Dowlais is made up from the former GKN Automotive Powder Metallurgy businesses. The company was created when it was spun out of Melrose Industries (LON:MRO) in 2023.

The main business is GKN Automotive, which makes parts such as propshafts, AWD systems and other powertrain parts. According to the company’s website, it’s the market leader in global drive systems. 50% of all vehicles worldwide contain GKN Automotive parts and 90% of global OEMs are customers.

The Powder Metallurgy business is under strategic review for a possible sale, but it is apparently the number one “sintered metal components supplier”.

Checking back in the archives, we don’t seem to have covered this stock yet, perhaps because the market cap was much larger when the shares were listed:

However, today’s trading statement has been met with a rapturous reception, despite merely confirming that results for the year to 31 October 2024 should be in line with expectations.

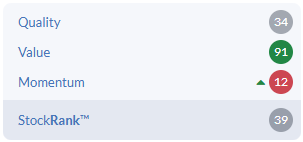

This suggests to me that market confidence in this business may have been quite low. This is a view reflected in a bleak StockRank and some remarkable valuation ratios (prior to today’s gains):

Let’s take a look at today’s trading statement.

Trading update for y/e 31 October 2024: the global automotive sector is in a tough place at the moment and this is reflected in Dowlais’ commentary. However, management do appear to be in control of the business and acting to mitigate weaker demand.

Here’s a summary of the main points:

FY adjusted revenue down 6.1% to £4.2bn, excluding a £173m FX headwind

FY adjusted operating margin of 6.1%, this is 0.3% lower than last year

Operating margin +0.2% vs H1, reflecting cost controls

Automotive: this division generates around 80% of revenue and is split into two reporting segments, Driveline and ePowertrain.

Driveline saw revenue fall by 2.4%, outperforming a 3% decline in light vehicle production outside China.

However, the ePowertrain business, which is more focused on electric vehicles, suffered a 19% year-on-year revenue decline due to a slowdown in demand for AWD and ePowertrain components. Presumably this reflects the wider slump in electric car sales.

Overall, Automotive adjusted revenue fell by 7% in the year to 31 October 2024.

Powder Metallurgy: this business generates about 20% of sales.

Performance was more stable last year, with adjusted revenue down 1.9% year-on-year and adjusted operating margin stable at 9%. Weakness was mainly due to an “unfavourable customer mix in North America”.

“Planned performance initiatives” are said to have offset the impact of weaker market volumes.

Outlook: Dowlais expects FY24 results to be in line with prior guidance.

Since August, industry forecasts excluding China have been revised downwards. S&P is now projecting a 3.9% decline in light vehicle production excluding China for 2024, or 1.9% decline globally.

Consensus estimates on Stockopedia suggest the company could report adjusted earnings of 10.9p per share for FY24. That would price the shares on five times earnings after today’s gains.

With thanks to Edison, an updated note on Research Tree today reinforces this guidance with estimates for FY24 earnings of 11p per share and a 4.2p per share dividend. That implies a useful 7.7% dividend yield, even after today’s gains.

However, management strike a more cautious tone about the year ahead:

Since August, industry forecasts excluding China have been revised downwards. S&P is now projecting a 3.9% decline in light vehicle production excluding China for 2024, or 1.9% decline globally.

This downbeat view is reflected in Edison’s FY25 forecasts for earnings of 12.1p per share, versus Stockopedia’s consensus for 12.9p per share. I’d watch for any downgrades to consensus following today’s statement.

Net debt: I have not looked at the accounts in much depth, but I wonder if one possible reason for the stock’s modest P/E rating may be the level of debt on Dowlais’ balance sheet.

The half-year results showed net debt of £915m, excluding lease liabilities. At the time, the company reported this as leverage of 1.6x EBITDA, well within the covenant limit of 3.5x.

However, depreciation and amortisation are real costs, especially in a manufacturing business. For this reason, I prefer to compare net debt with net profit. This gives me a quick view on how easily a company might be able to repay its debt if necessary.

On this basis, Dowlais’ net debt looks a little high to me, at almost six times FY24 forecast net profit of £154m. I generally prefer this ratio to be less than four times.

Roland’s view

The market leadership of the Automotive business suggests to me that this could be an attractive business to own, if one could buy at the right price, at a low point in the cycle.

I’m not sure if that’s true right now, however. According to the company, the outlook for 2025 appears to have weakened in recent months.

Personally, I’m also a little uncomfortable with the level of debt here.

On the other hand, the market’s favourable reaction to today’s "in line" statement suggests to me that a lot of pessimism was already baked into the price. If today’s statement was better than expected, then perhaps that is a sign the shares are already priced for a cyclical low?

Management also appear to be maintaining profit margins despite weaker volumes, which seems encouraging to me.

On balance I’m happy to mark the start of our coverage by taking a neutral (AMBER) view here. While this may prove to be overly cautious, I think this is a reasonable reflection of the apparent value on offer, tempered by risks from macro conditions and debt levels.

I’d expect to be able to take a more committed view after Dowlais publishes its full-year accounts and updated guidance in March 2025.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.