Good morning!

I hope you've been enjoying the comment notifications rolled out by the team earlier this week.

In other news, Megan and I will be having a chat this evening in an open webinar: Stock Market Sector Trends for 2025. We'll be looking at some of the most topical investment themes and how they are affecting certain sectors as we head into 2025. I look forward to seeing some of you there!

Wrapping it up there (12.15pm). See you at the webinar later if you can make it!

Explanatory notes

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day. We usually avoid the smallest, and most speculative companies, although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We have a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Add your own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing. Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023

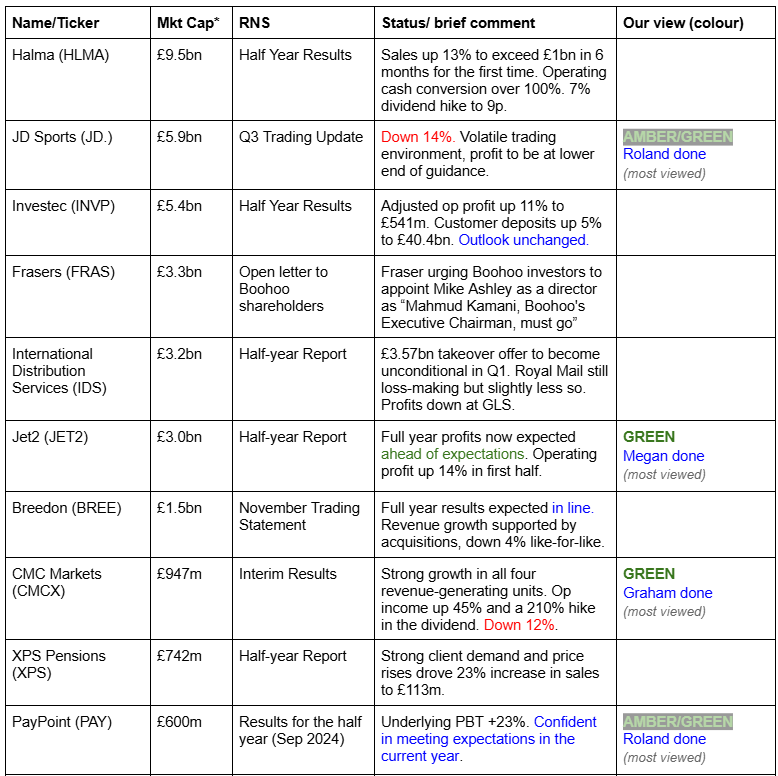

Companies Reporting

Summaries

Jet2 (LON:JET2) - up 10% to 1557p (£3.34bn) - Half-Year Report - Megan - GREEN

Strong results from the UK’s largest package holiday operator. Strong revenue growth thanks to greater fleet capacity and a slight uptick in prices. Jet2 is also seeing a rapid rise in demand for flight-only tickets, which puts it into interesting competition with easyJet (especially once Jet2 opens its new base in Luton next year). The overhaul of the fleet to the more fuel efficient Airbus planes remains on track and the company is well managed and financed.

CMC Markets (LON:CMCX) - down 12% to 297p (£829m) - Interim Results - Graham - GREEN

The market seems disappointed that CMCX would not upgrade its full-year expectations given fabulous H1 numbers including nearly £50m of PBT and £177m of net operating income (full-year forecast: £233m). I don’t have a problem with management sticking to conservative forecasts and therefore am happy to keep my positive stance.

PayPoint (LON:PAY) - down 5% to 790p (£570m) - interim results - Roland - AMBER/GREEN

A solid set of results showing progress in most areas and a respectable 23% increase in underlying PBT. Margins remain impressively high, but a slight cut to earnings forecasts by broker Panmure Liberum suggests to me that after a strong run, the share price may be approaching fair value for now.

JD Sports Fashion (LON:JD.) - down 14% to 97p (£5.0bn) - Q3 trading update - Roland - AMBER/GREEN

A seemingly mild profit warning, with full-year results now expected to be at the lower end of expectations. The company blames “volatile” trading from October onwards. While I’m cautious, today’s update doesn’t seem disastrous to me. The modest valuation means I think cautious optimism is still justified here.

CMC Markets (LON:CMCX) - down 12% to 297p (£829m) - Interim Results - Graham - GREEN

The market appears to be disappointed that no upgrade has been communicated by CMCX despite producing net operating income of £177m, vs. full-year expectations of only £333m. As NOI and profits are inherently uncertain, I don’t mind CMCX taking a conservative stance on this and leave my GREEN perspective unchanged.

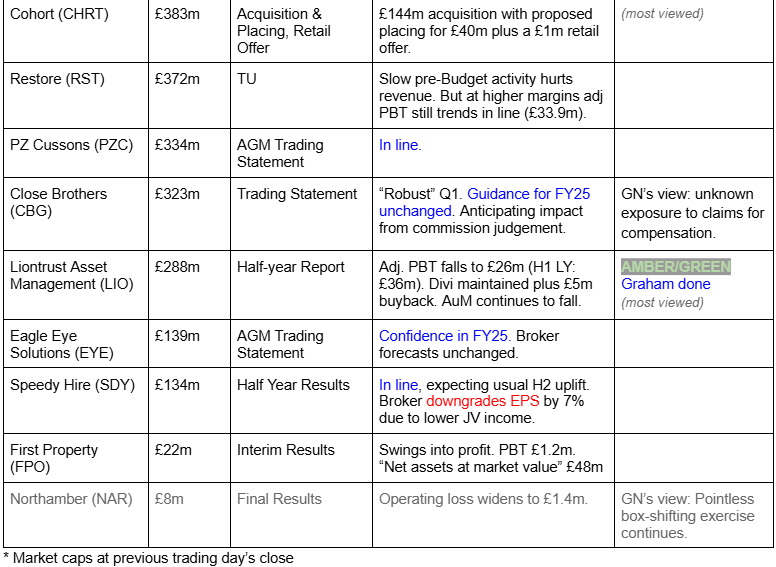

Short Sections

NVIDIA (NSQ:NVDA)

Down 4% pre-market to $142 ($3.6trn) - Financial Results for Q3 - Megan - AMBER

The world’s largest company has delivered another set of barely-believable quarterly results.

In the three months to the end of October, the company reported just over $35bn of revenue. That’s 17% higher than the previous quarter and 94% up on the revenue reported in the third quarter of 2023.

Reported operating income has also doubled, up to $21.9bn - equivalent to an operating margin of 62%.

Earnings per share of 78¢ came in 8% ahead of analysts’ already lofty expectations. Management has now forecast fourth quarter sales of $37.5bn, which compared to $22.1bn in the same period last year, and typically wide margins.

So why then are the shares likely to open down?

There will be some degree of profit taking. Nvidia’s shares are up almost 200% in the last year - well ahead of its peers in the US tech sector and the wider market.

There are also some concerns that the highly anticipated new chip Blackwell (which has run times more than 30 times faster than its older siblings), is still struggling with overheating problems. The chips have been smoking when they’re loaded onto server racks, which has thrown the Q1 launch into some doubt. There are a lot of large customers which are relying on these chips and won’t be happy with any delays.

The incoming president Donald Trump might also be causing some nervousness. Nvidia already battles with its supply chains to keep up with whopping demand. Increased restrictions on trading with China or mounting geopolitical tension in Taiwan, where one of the company’s largest suppliers TSMC is based, won’t help.

And, there’s the ongoing question of competition. Nvidia has existed in a chip making bubble for most of the last few years. This means it has access to almost the entirety of the market which is reliant on chips to support AI (a phenomenally fast growing market). But surely the dominance can’t last forever. Yesterday we saw management from Sage suggesting that its own AI demands might be diverging - some of its products don’t actually need such super fast performing chips as those Nvidia is seeking to provide. A broadening of demands and an improvement in capabilities of peers could eventually encroach on Nvidia’s growth and margins.

Megan’s view:

For now, there is very little not to like about Nvidia. Sure, if you use traditional valuation ratios, its share price might cause a bit of anxiety, but market dominance and growth like this can’t be measured on traditional ratios.

This is a high quality, momentum play which continues to smash earnings expectations, whilst benefiting from multiple expansion (the two clearest hallmarks of multibaggers).

The only black mark on the horizon is the potential delay in Blackwell, so I would be happy to enjoy watching the ride from the sidelines until there is more clarity on launch dates. AMBER

Graham's Section

CMC Markets (LON:CMCX)

Down 12% to 297p (£829m) - Interim Results - Graham - GREEN

The bull thesis has played out here in spectacular fashion. A loss of £2m in H1 last year becomes a profit of nearly £50m in H1 this year:

CMC’s share price has trebled from the low it reached last year, as it now trades at a reasonable PER on much higher earnings expectations:

The 50% increase in trading net revenue (to £131m) shows a significant uptick in trading activity. When we read about the constant outflows from UK active fund managers, it’s easy to forget that there is still a great deal of appetite to invest and to trade - just perhaps not always in the way that it was done before.

One key opportunity for CMC is its partnerships: it is providing back-end trading infrastructure for Revolut, and more recently announced a long-term strategic partnership with the Kiwi bank ASB, for whom it will provide its stockbroking technology and execution.

Outlook: much of CMC’s recent financial success has been down to its ruthless cost control. It sounds like this attitude will continue:

Management maintaining pragmatic approach to investment with a focus on profit margin expansion, whilst continuing to explore and invest in opportunities for incremental growth.

Full-year net operating income (NOI) is expected to be in line with external expectations, with the consensus forecast currently £333m.

Note that NOI was £177m in H1 and if this repeated in H2, we’d beat the consensus forecast by £20m+ with £354m.

But it’s a volatile figure as trading activity levels tend to fluctuate unpredictably.

To get operating profit, we deduct operating expenses from net operating income.

So for example let’s suppose net operating income hits the £333m forecast exactly.

H1 operating expenses were £124m. Suppose they rise to £130m in H2.

We would then have:

NOI £333m

Full-year opex £254m

Operating profit is the difference between these two, or £79m.

A few (hopefully small) items are deducted from operating profit, such as finance costs and any impairments of intangibles, to arrive at pre-tax profit (PBT).

Actual H1 operating profit was £53.5m, with actual PBT of nearly £50m.

Graham’s view

This morning’s 12% fall in the share price demands an explanation and the best I can come up with is that the market was hoping for an upgrade that didn’t happen.

As I noted above, a repeat of H1’s NOI in H2 would see NOI beat expectations by £20m+. But CMC have not indicated that they are going to beat expectations, which implies a very conservative (but perhaps realistic?) outlook.

Looking at the chart, today’s fall takes back to the bottom of the range for the past 3 months. Which is perhaps fair enough, as expectations have not been upgraded yet. But with four months left until the end of the financial year, perhaps there is still a good chance of a beat?

I remain a big fan of this one and am happy to stay GREEN. The stock is supported by over £400m of very liquid balance sheet equity.

Disclosure: while I am not a shareholder in CMCX, at the time of writing I do have a long position in a competitor, IGG.

Liontrust Asset Management (LON:LIO)

Up 7% to 447.5p (266m) - Half Year Report - Graham - AMBER/GREEN

Assets under management just keep falling at this fund manager, and profitability is affected, but it continues to look very cheap.

AUM fell by 7% in six months to just shy of £26 billion (Sep 2024), despite some positive market movements.

By mid-November it had fallen further to £25.2 billion.

Adj. PBT falls to £25.8m (H1 last year: £36m)

Divis & Buybacks

The interim dividend is unchanged at 22p. That payment alone is 5% of the current share price.

And this is remarkable:

The Directors intend to target a dividend of at least 72 pence per share for the year ending 31 March 2025.

It’s a yield of 16% on the current share price.

The market had already pencilled it in but now we have it in black and white that LIO are going for 72p per share in dividends.

Based on the current share count, 72p in dividends will cost £46m.

On top of that we have a share buyback for up to £5m.

Can they afford this? Here’s an excerpt from the capital management section:

As at 30 September 2024 the Company had surplus capital after foreseeable dividends of over £45 million

With the following table in the footnotes:

The first interim dividend of 22p is the current “foreseeable dividend”, i.e. £45.5m of surplus capital will be left after paying that dividend.

Or looking at it another way, the entire £51m package is coming out of the £59.6m “Surplus capital” as of Sep 2024.

It’s a brazen move but I think it is affordable - not on an ongoing basis, but on a one-off basis.

The company will pay out most of its surplus capital to shareholders this year and it will be replaced by whatever this year’s profits amount to.

For H1, let’s check the quality of LIO's profits. A reconciliation from adj. PBT to actual PBT:

PBT gets inflated to twice its original size with these adjustments, and I’m afraid I’m not on board with most of them. There is an argument to write off intangible asset amortisation but staff reorganisation costs and “professional and other services” seem to me a fairly regular expense.

H1 Adj. EPS is 30p, vs. actual EPS of 14p (rounded figures).

CEO comment excerpt:

"The last six months have continued the challenging period for active managers including Liontrust. There are a number of reasons, however, why we are confident that we are moving into a more positive environment and the outlook is improving…

Our confidence is reflected in the fact that we are targeting the same dividends as last year and have announced a share buyback programme.

He makes some worthwhile points, especially that passive funds have contributed to the outperformance of a “small number of mega cap stocks”, leaving passive funds particularly exposed to concentration risk.

Performance: unfortunately this has not been very good.

Some of the investment strategies at Liontrust have gone through a difficult period for performance. This was notably the case in 2022 for quality growth and UK small and mid-cap equities and that year's performance is still impacting three-year numbers. Shorter term performance for Liontrust's funds, however, has been stronger.

Graham’s view

I’m astonished to see that this share has fallen by another 28% since I covered it last (in July).

Since early July, I have been AMBER/GREEN on it, even though I am GREEN on every other fund manager I can think of.

The problems with LIO:

Its accounts are dirty

Fund performance is generally not impressive in recent years

It has no niche it commands

Management seem to embrace complexity and expansion when (in my opinion) they should be looking for simplicity and acting with caution.

Their aggressive stance on dividends doesn’t change my mind on any of this. In my view, it just means that the company will have less asset backing next year than it does now. I’d have been more impressed by a larger share buyback instead of an unchanged dividend, as that would have really said something about the valuation here.

I’m happy to leave my AMBER/GREEN stance unchanged as it does still have a profit margin and it is cheap, but it’s certainly not the first fund management stock I’d be adding to my portfolio.

Megan's Section

Jet2 (LON:JET2)

Up 10% to 1557p (£3.34bn) - Half-Year Report - Megan - GREEN

The UK’s largest package holiday operator seems to be unaffected by any concerns about a possible cost of living squeeze on spending. Sales in the first half of the 2025 financial year rose 15% to £5.1bn thanks to a record number of passengers and higher prices.

The continued investment in the company’s new fleet of Airbus planes has helped to boost capacity. These planes have 20% more seats than the old Boeing fleet and they’re more fuel efficient and quieter, so that seems like it’s a big chunk of money well spent. Capital expenditure rose to £229m in the period as the company paid for two of its new Airbus planes. First half capex is expected to remain at this level for the next few years as the remainder of the 146-strong fleet of planes gets delivered.

In early 2025, Jet2 will open two new UK bases in Luton and Bournemouth airports, adding to the 11 domestic locations it currently operates out of.

In the six months to September, the company reported a slight increase in the average price of a package holiday (to £904), while flight-only prices were marginally lower at £130.81.

Appetite for flight-only tickets was materially higher, which more than offset this slight decline in prices. Management have seen increased demand for last minute flights, which is a trend they expect to continue for the remainder of the winter season. With winter seat capacity 14% higher than last year, continued demand for last minute booking and a material volume of Winter24/25 tickets still to sell, revenue for the full year is now expected to come in ahead of previous forecasts.

The strong increase in operating profits to £702m (up14%) and basic earnings per share (up 21% to 279p) is good news as the company heads into its more cost intensive second half. As is typical, the company is expected to be loss making in the second six months of the financial year as it books fleet, fuel, marketing and staff costs. On an annual basis, the company has reported operating profit CAGR of 16% over the last five years.

Megan’s view:

Jet2 remains the pick of the bunch in an otherwise volatile UK travel sector. It is consistent in its ability to attract customers from other package holiday operators and, increasingly, flight-only companies. The new base in Luton airport puts it into even more direct competition with easyJet (LON:EZJ) and it will be interesting to see how demand takes off.

Shares are trading on a forecast PE ratio of 7.8 times, keeping Jet2 firmly in GARP (growth at a reasonable price) territory.

The balance sheet still looks robust, with a NAV of £1.8bn (only £26.8m of which is in intangible assets), that’s equivalent to a little over half of the market capitalisation. Cash generative with debt headroom so there shouldn’t be any financial dramas in the event of another global travel-related incident. GREEN

Roland's Section

PayPoint (LON:PAY)

Down 5% to 790p (£570m) - interim results - Roland - AMBER/GREEN

This has been a strong half year for PayPoint where we have delivered a positive financial performance and made further progress towards our medium-term target of delivering £100m underlying EBITDA by the end of FY26.

This many-faceted payments business has confirmed that it’s on track to meet full-year expectations in this morning’s half-year results. But investors appear to have expected a little more, with the shares down by around 5% at the time of writing.

I’ve followed this business intermittently for years and have admired its strong profitability and cash generation. But analysing the business and its growth prospects has always been made quite difficult due to the sheer number of moving parts. As PayPoint has made a number of acquisitions in order to reduce its dependency on its legacy cash bill payments business, this complexity has only worsened.

However, over the last year my view has increasingly been that the company’s transformation is (probably) working well. PayPoint’s share price action over the period suggests that other investors have also been taking this view. The stock doesn’t look quite such a bargain to me as it did 12 months ago:

Let’s take a look at today’s results to see what’s new.

Half-year results summary: today’s accounts cover the six months to 30 September 2024 and show revenue up 6.7% to £135m, with net revenue up 6% to £84.6m. Broadly, net revenue excludes commission payments and pass-through revenue such as retail vouchers.

Underlying pre-tax profit rose by a creditable 23.4% to £26.9m.

Underlying earnings per share rose by 24% to 27.4p, while the interim dividend climbs 2.1% to 19.4p per share. That puts PayPoint shares on track to offer a 4.7% dividend yield this year.

Adjustments to these figures don’t look too outrageous to me, although personally I would prefer to see costs such as legal fees (£2.5m) included within ordinary operating expenses. Even so, statutory interim earnings are up by 35% to 23.5p, covering the dividend sufficiently.

Progress seems to have been made in most areas of the business:

Shopping net revenue up 2.5% to £32.9m, with the number of installed PayPoint One/Mini sites up to 19,855 (Mar 24: 19,297). These terminals are typically located in convenience stores and provide the payment infrastructure for most store activities, including Ecommerce and Payments (see below)

E-Commerce (Collect+ parcels) net revenue up 56.9% to £8.0m. This was supported by a 47% increase in parcel transactions to 61.9m, so revenue per parcel improved from 12.1p to 12.9p. The Collect+ network expanded by 14% to 13,421 sites during the half year.

Payments & Banking net revenue down 0.8% to £24.9m. This fall was driven by the cash payments business where revenue fell by 1.3% to £15.2m. This includes the core legacy business of bill payments and top ups, which are generally seen to be in structural decline.

This weakness was offset by continued growth in digital revenue through PayPoint’s MultiPay platform (+3.6% to £2.9m), while digital net revenue delivered underlying growth excluding a £0.3m drag from the cessation of last year’s Energy Bill Support Scheme.

Love2shop net revenue up 7.4% to £8.8m. The company says underlying billings for Love2shop rose by 4.5% to £67m while Park Christmas savings billings are expected to be broadly flat this year, but should benefit from improved technology support in 2025.

There’s also a third arm to this business, gift card operator MBL which apparently supports clients such as Greggs and B&M. Gift card value processed during the half year rose by 38% to £40.9m.

Incidentally, for investors who would like a more in-depth understanding of this business, I would recommend looking at today’s results directly as they include far more detail than I can cover here. Additionally, today’s note from broker Panmure Liberum (available on Research Tree) makes an interesting read, with a useful breakdown of revenue growth in different areas of the business and in-depth commentary.

Profitability: at a group level, PayPoint’s profitability remains excellent. My sums show half-year adjusted operating margin improved from 22.2% to 24.8% this year. Assuming a similar result for the full year suggests a result towards the upper end of the range achieved in recent years:

However, the relative profitability of PayPoint’s different activities has never been clear to me. The company only reports its profits under two segments, PayPoint and Love2Shop.

This year’s half-year results tell us that Love2Shop generated a segmental underlying PBT of £2.3m, representing a 12% margin on net revenue or a 4.7% margin on total revenue.

The remaining PayPoint business fared better. Underlying PBT of £24.6m translated into a net revenue margin of 37.4% or a margin on total revenue of 28.7%.

Balance sheet & cash flow: net corporate debt (excluding lease liabilities) rose by £19.3m to £84.6m during the half year. This was due to a £15m investment in parcel operator Yodel and the launch of a £20m share buyback programme in July 2024.

Underlying cash flow appears to have been quite strong. Operating cash flow before movements in working capital rose by 14% to £35.7m in H1.

The current level of debt looks comfortable to me relative to forecast FY25 net profit of £51m.

Outlook: the company says full-year results should meet expectations, but I note that Panmure Liberum has cut its FY25 earnings forecast by 1.4% to 69.0p per share today. That’s slightly lower than the 69.5p consensus shown in Stockopedia prior to today’s results.

Panmure Liberum has also cut FY26 and FY27 EPS estimates by c.3%.

While PayPoint shares still don’t look expensive on 11 times forecast earnings, this more cautious outlook may account for the share price drop today – I guess investors might have been hoping for a modest upgrade.

Roland’s view

PayPoint remains a complicated business to analyse and understand. But my general impression remains that most of the things the company is doing to diversify and grow are probably working well.

The key risk, I would say, is how much of Paypoint’s profit is still generated from the legacy cash payments business. Not knowing this may help to account for the stock’s relatively modest valuation despite its high returns on equity:

On balance, I think the shares are fairly priced, but not as compellingly cheap as they were a year ago. On this basis, I think it makes sense to moderate our view slightly to AMBER/GREEN.

JD Sports Fashion (LON:JD.)

Down 14% to 97p (£5.0bn) - Q3 trading update - Roland - AMBER/GREEN

The trading environment remains volatile though and, following October trading, we now anticipate full year profit to be at the lower end of our guidance range.

Unfortunately it’s a profit warning this morning from sportswear retailer JD Sports Fashion.

What’s gone wrong? Today’s update covers the 13 weeks to 2 November. The company says that after a strong back-to-school period, trading became more volatile in October, especially in North America and the UK. Like-for-like sales fell by 1.5% and 2.4% respectively in these regions.

JD says it maintained pricing discipline and actually increased its gross margin by 0.3% to 48.1%, while delivering organic sales growth of 5.4%. The company also opened 79 new JD stores during the period.

However, elevated promotional activity (from competitors), mild weather and cautious consumer spending ahead of the US election are said to have held back sales.

Volatile trading conditions have continued and management now expect profits for the full year to be “at the lower end of our guidance range”. This is helpfully stated as £955m–£1,035m.

FX headwinds also appear to have worsened due to USD strength, and are expected to reduce PBT by a further £15m versus the original guidance.

Roland’s view

No updated broker notes are available to me, but today’s share price drop suggests to me the market might be pricing in a 5%-10% cut in earnings per share.

Stockopedia was showing a figure of 13.1p per share ahead of today’s results, so I would guess an updated figure of perhaps 12p per share may be likely.

That would price the stock at around eight times forecast earnings – not obviously expensive for a successful and profitable retailer.

Although I’d personally be wary about buying after today’s profit warning, I think JD’s modest valuation suggests that I can still justify a cautiously optimistic stance ahead of the company’s full-year results. AMBER/GREEN

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.