Good morning!

I'm hoping for a quiet news day today, so that I might cover some backlog stories from yesterday (or from even earlier in the week, if there are any stories you'd like to suggest).

The discussion Megan and I had last night on "Stock Market Sector Trends for 2025" is available here, covering two UK themes (National Insurance and the Strategic Defence Review) and two US themes (Trump's trade policies/protectionism and deregulation).

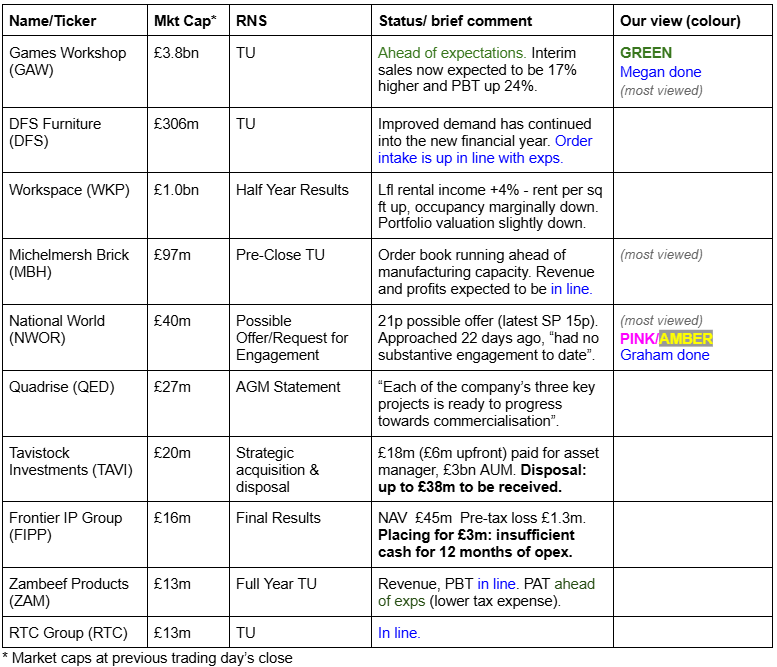

Now let's see what the RNS has in store for us today.

All done for now (12.45pm). Have a nice weekend everyone.

Explanatory notes

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day. We usually avoid the smallest, and most speculative companies, although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We have a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Add your own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing. Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023

Companies Reporting

Summaries

National World (LON:NWOR) - up 22% to 18.25p (£49m) - Request for engagement from National World board - Graham - PINK (AMBER/GREEN)

NWOR’s largest shareholder is interested to buy the rest of the company for 21p, and asks the NWOR Board for substantive engagement. At first glance it might seem that it’s an opportunistic bid, but this sector does tend to trade very cheaply.

Games Workshop (LON:GAW) - up 12% to 13,010p (£4.33bn) - Trading Update - Megan - GREEN

GAW has announced it is trading ahead of relatively uninspiring consensus expectations. Revenue is now expected to be 17% higher than the first half of FY2024 and pre tax profits up 20%. No word yet on any TV series from its licensing agreement with Amazon, but there is exciting potential from other licensing agreements. Licensing revenue is forecast to more than double in the first half.

CMC Markets (LON:CMCX) - down 4% today to 276.75p (£782m) -Interim Results (yesterday) - Graham - GREEN

As this one is still attracting a lot of interest, I thought I’d do a follow-up section mentioning and responding to some reader comments, and providing further conclusions.

Short Sections

Michelmersh Brick Holdings (LON:MBH)

Up 2% to 105.9p (£99m) - Pre-Close Trading Update - Graham - AMBER/GREEN

We’ve been reasonably positive on this premium brick maker - see Paul’s coverage in September when it issued a profit warning that didn’t seem to affect the share price very much. It’s up by 9% since then.

Today’s trading update is in line with expectations.

Q4 performance has continued to be “resilient”:

Our order intake continues to run ahead of manufacturing capacity as we have focused on growing a well-balanced forward order book with appropriate pricing to support demand. While the inflection point in activity levels within the construction sector remains uncertain, we are working closely with our customers on the expected timing of despatches…

Estimates: thanks to Canaccord for an adj. PBT estimate of £9.7m this year, rising to £13m next year. They suggest that the company may seek to offset c. £0.5m of higher NI costs through “cost and productivity efficiencies”.

Graham’s view: not much to talk about here and I leave AMBER/GREEN unchanged.

It passes 3 bullish screens, including Ben Graham’s Deep Value Screen.

Bodycote (LON:BOY)

Unch. today at 610.5p (£1.1bn) - Trading Statement (Tuesday) - Graham - AMBER/GREEN

Tuesday saw a trading update from Bodycote, “the world’s leading provider of heat treatment and specialist thermal processing services”. The update covered the four months from July to October (year end is December).

The main takeaway is that adj. operating profit this year is expected to be in line with consensus, at £127.9m (last year: £127.6m).

Organic revenue growth is very limited: 1% year-to-date, and lower than that (0.2%) in the last four months.

There is wide divergence across market sectors:

Bodycote refer to “the low level of global industrial activity” as hampering heat treatment revenues, and also to ongoing softness in the medical market.

Buyback: a £60m buyback is underway with £46m bought so far. Net debt at the end of October was little changed over the period at £68m despite £20m spent on the buyback during that time.

Graham’s view: I have a generally positive view of Bodycote, which is now 101 years old and has an excellent, consistent track record of profitability. I’ll leave the AMBER/GREEN stance unchanged at this moderate valuation.

Graham's Section

National World (LON:NWOR)

Up 22% to 18.25p (£49m) - Request for engagement from National World board - Graham - PINK (AMBER)

NWOR is arguably another “melting ice cube” type of legacy media stock, along with Reach (LON:RCH) (in fact, NWOR and RCH are advertising partners). It’s a consolidator of small newspapers and magazines.

We learn today that it has been approached by its largest shareholder, Media Concierge.

Media Concierge already owns 25.5% of NWOR. Along with those acting in concert with it, nearly 28% of NWOR’s shares are spoken for.

It has a Possible Offer at 21p per share in cash.

That’s a 40% percent premium to last night’s closing price (15p).

Strangely, Media Concierge says that it submitted its proposal 22 days ago and “has made every effort to engage privately with National World and its advisers, but has had no substantive engagement to date.”

I don’t know about you, but I would have thought that a company should be very responsive to a shareholder who owns a 28% stake and has an offer to buy the entire thing.

Perhaps the NWOR board did respond - and simply said No? Now that Media Concierge has gone public, I guess that will provoke a public response from NWOR.

Valuation - according to Media Concierge, the 21p offer represents a multiple of 7.2x trailing EBITDA and 3.8x adjusted trailing EBITDA.

Graham’s view - the latest interim results at NWOR showed good financial progress with net cash of £13m, adj. PBT of £4.8m, and actual PBT of £2.3m.

According to Dowgate’s analysis on the back of those results, the company was forecast to produce adj. EPS of 3p this year.

This suggests to me that the 21p offer represents a cash-adjusted PER of only about 5.4x (using adjusted EPS).

21p market cap

Minus 5p per share in cash = 16p enterprise value

Divide by 3p EPS forecast = 5.4x adj. PER.

However, I can’t say that I fully trust the adjusted earnings numbers, as the amortisation of intangibles strikes me as a real, ongoing cost in this case (the company spends internally on “digital intangible assets” and then strips out the amortisation of this spending from adjusted earnings).

Profits are unfortunately a matter of opinion and it seems to me that NWOR’s real EPS this year is more likely to be in the region of 2p-2.5p.

This increases the PER that I calculate Media Concierge are offering to more like 6.5x-8x. This sector does trade cheaply.

Perhaps RCH would consider a counter-offer?

As I’m fully GREEN on RCH (see here), I think I can reach to AMBER/GREEN on NWOR.

CMC Markets (LON:CMCX)

Down 4% today to 276.75p (£782m) -Interim Results (yesterday) - Graham - GREEN

This one is still causing controversy so I thought I’d mention a couple of things that didn’t make it into yesterday’s report. This might be a little dense in terms of numbers but that seems unavoidable as we try to figure out the reason for the share price weakness and where the full-year result might be heading.

Net Operating Income

Readers have helpfully brought up some of the following points - thank you.

In the H1 update in October, CMC said that H1 NOI was c. £180m.

H1 NOI has actually turned out at £177m, slightly below what the H1 update said.

Additionally, in the Q1 update back in July, they guided for full-year NOI within a range of £320-£360m.

Yesterday, they guided that the full-year result would be “in line with” the consensus forecast of £333m, which is below the midpoint of the original range.

So yesterday’s NOI result and forecast could be seen as disappointing A) from the point of view that the full-year forecast is below the midpoint of the original range, and B) that the actual H1 result was below the approximation given in the recent H1 update.

From my point of view, as I expressed yesterday, the biggest disappointment is that they did not simply upgrade the NOI forecast, as they already achieved 53% of the full-year forecast in H1 and we are already well into H2.

PBT/PAT

In the H1 update, they said they expected H1 PBT of c. £51m.

The actual H1 result was less than this, only £49.6m. So another disappointment there.

For the full-year result, let’s consider profit after tax (PAT). The consensus forecast on the StockReport is £58m. I think we might be able to touch that up by a few million pounds. But CMC itself didn’t give us any sense of an upgrade here either, or any guidance, despite generating an actual PAT of £35m in H1, which seems to be well over half of any full-year forecast.

They did say that full-year operating cost guidance (before bonuses and non-recurring charges) was unchanged at £225m.

If they achieve NOI of £333m this year and operating costs are only £225m, that leaves a massive £108m of potential operating profit (before bonuses, non-recurring charges, finance costs and taxes).

As pointed out in the comments, the H1 performance was sequentially much lower than the H2 performance of the previous financial year (PAT £35m vs £49m, NOI £177m vs NOI £210m). So perhaps this is the beginning of a downslope.

Graham’s view

I posted in yesterday’s comments section that in reality I don’t think the consensus forecasts are really worth focusing on, because nobody seems to have any idea what NOI is going to be, and CMC's guidance hasn't been accurate in the past. Look at what happened last year:

In August 2023, the company itself put out a forecast for full-year NOI of £250-£280m for FY March 2024.

At last year's interims, they reiterated this guidance. It was mid-November 2023, almost exactly a year ago. They again said NOI would be £250-£280m. There were only 4.5 months left in the financial year.

They did not upgrade until January, when they said it would be £290-£310m.

It turned out to be £333m.

In conclusion: NOI is too volatile to make sensible predictions, and CMC themselves don’t seem too concerned with trying to make accurate predictions or with keeping City consensus forecasts accurate. So I wouldn’t read too much into any of this.

The bottom line for me is that the company is performing well and the long-term outlook remains positive and arguably quite exciting (for example the partnership with Revolut).

With a large chunk of the market cap (now less than £800m) still backed up by c. £400m of balance sheet strength, and with a cash-adjusted PER that’s probably quite cheap (e.g. if net income is around £60m this year), I have no reason to change my GREEN stance on this.

Megan's Section

Games Workshop (LON:GAW)

Up 12% to 13,010p (£4.33bn) - Trading Update - Megan - GREEN

This is the second trading update Games Workshop (LON:GAW) has announced since its annual results in July. Management tends not to give its own guidance during its results, but at the time of the results, analysts were forecasting FY May 2025 earnings of 466p falling to 456p in FY2026. Both figures are down from the 478p reported in the 2024 financial year.

I don’t fully understand where those relatively gloomy forecasts came from - Games Workshop has reported an increase in its annual earnings in every one of the last 10 years and management remains committed to global, profitable growth. Thus, it was a little disappointing in September when the first of the company’s trading updates came in “in line”.

Not so this morning. Trading update number two confirms that revenue and profits for the first half of FY2025 are expected to be ahead of current forecasts. Sales from the core retail business are now expected to be not less than £260m (from £235m in the first half of FY2024) and licensing revenue is forecast to more than double to £30m (just shy of the £31m the company made in the whole of last year).

Pre-tax profits are forecast to rise more than 20% to £120m.

Interestingly, there is no mention of the rise in National Insurance or the national living wage which is set to increase from £11.44 to £12.21 from April 2025. Games Workshop employs over 3,500 staff globally although not many of them fall into the bracket most likely to be impacted by the NI changes (part-time, low wage staff). The company operates 134 stores in the UK, 83 of which are single staff stores and boasts very high staff retention rates.

Investors have very little reason to be concerned about any rise in staff costs. Operating margins have averaged 37% over the last five years. And with net profit margins widening over time, the company’s bottom line is growing at a faster rate than its top line. Net profits have risen at a compound annual rate of 18% over the last five years.

Where can the growth come from next?

With a forecast price to earnings multiple of 24x it is right to question if the company can continue to grow at pace. Margins can’t widen forever and there are some concerns that the market for fantasy figurines could be barrelling towards saturation.

On the latter point, I don’t believe there is any reason for concern. Games Workshop’s fantasy worlds continue to grow, sustaining demand from customers who have followed the brand for years. The company’s presence online is also helping it reach broader audiences than ever before. And the company can satisfy those audiences with the use of its trading partners and its online store - which is undergoing a major investment project.

And then there is the IP licensing. Last December, the company announced it had signed a multi-year agreement with Amazon to potentially launch a film or TV series based on the company’s IP. This deal is contingent on the company reaching an agreement about the nature and tone of the potential series, which the two companies have been working on this year. Management says it will update us when there is some news.

The potential for a film series based on the Warhammer IP could be a major new source of revenue for the group, even if the company can’t come to an agreement with Amazon. There is clearly appetite for films and series in this genre. In 2022, the US giant spent $465m on a TV series based on the Lord of the Rings - a budget that included the cost of buying the rights to the book. At the time it was reported that both Netflix and HBO were also interested in the series, but were out-priced by Amazon.

For now, all of the company’s licensing sales come from video games, the majority of which are sold in the US. Video games also have the potential to be turned into major TV franchises. Netflix spent $317m on two seasons of The Witcher. HBO’s budget for just one season of The Last of Us was $100m.

Megan’s view

Games Workshop has delivered spectacular results for its investors in the last few years. Since 2017, the share price has risen 12-fold.

This is a wonderful company with an impressive management team who put the company’s substantial cash generation to great use.

I am excited about the potential of further licensing deals, which could provide further growth stimulus (a TV series would also likely boost retail sales as well - what better marketing than a TV series on Amazon?) But from a factor perspective (the bread and butter of Stockopedia’s investment mantra), there are also reasons to be optimistic. The company’s StockRank has just climbed into the top 20%. Historically our ranks have been a pretty good predictor of Games Workshop outperformance. GREEN

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.