Good morning!

Wrapping this up at 12.40. We'll try and mop up some of the extras for short sections tomorrow, so get your requests in if there is anything you would like for us to look at. Have a good afternoon.

Explanatory notes

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day. We usually avoid the smallest, and most speculative companies, although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We have a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Add your own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing. Links:

Daily Stock Market Report: records from 5/11/2024 (format: Google Sheet).

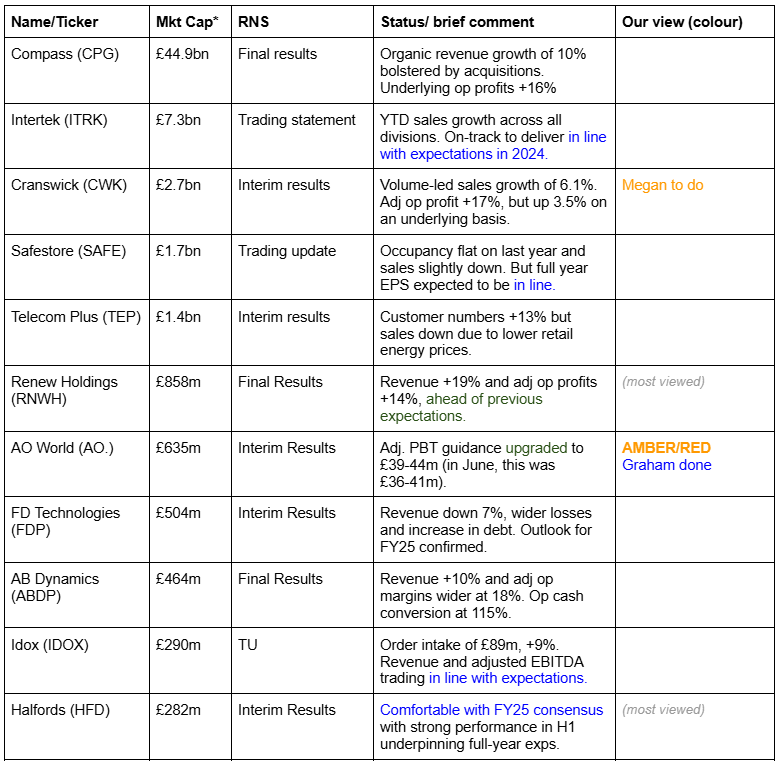

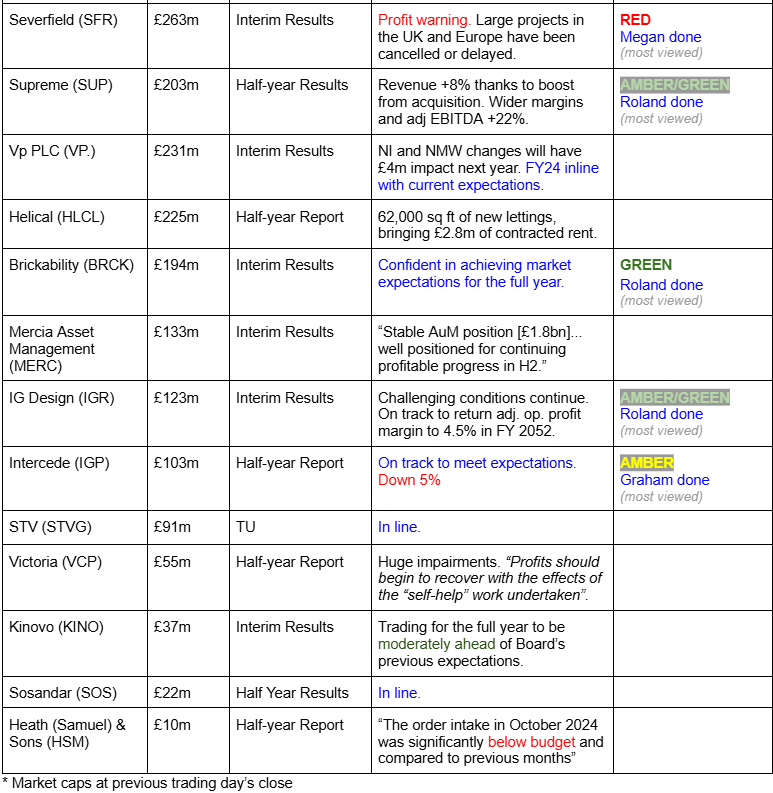

Companies Reporting

Summaries

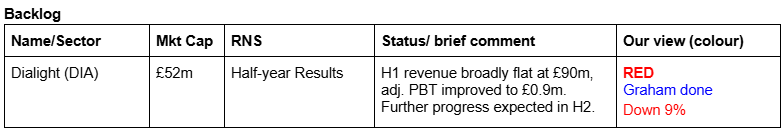

Dialight (LON:DIA) - down 9% to 118p (£47m) - Half-Year Report - Graham - RED

I’m taking a negative stance on this one due to a terrible “going concern” statement that talks of a potential covenant breach (although I expect that the bank will be forgiving) and potential difficulty in paying costs associated with a recent court decision in the United States. They have no CFO: the lights are on but no one is at home.

Brickability (LON:BRCK) - up 9% to 61p (£194m) - Interim Results - Roland - GREEN

Broadly reassuring results from this construction materials group suggest to me that the business could perform well when the construction market recovers. Management confirms that full-year expectations are unchanged. I’m happy to stay positive here, given the modest valuation and useful 6% dividend yield.

AO World (LON:AO.) - down 1% to 108.2p (£628m) - Interim Results - Graham - AMBER/RED

A fine report from AO World where there has been no shortage of interesting news flow. The £10m acquisition of Musicmagpie is imminent and at the same time, Frasers have been building a position. Perhaps too cautious, I leave our mildly negative stance unchanged on valuation grounds.

Supreme (LON:SUP) - up 1% to 175p (£203m) - Interim Results - Roland - AMBER/GREEN

Supreme has upgraded its full-year EBITDA guidance by around 10% today, but the share price has been strangely unmoved. My review of today’s half-year results does not suggest any serious problems, but I note that brokers expect a shortfall in earnings in FY26 as the ban on disposable vapes kicks in.

Short Sections

Intercede (LON:IGP)

Down 5% to 166.5p (£98m) - Half-year Report - Graham - AMBER

Intercede is “the leading specialist in digital identity, credential management and secure mobility”. It trades richly (PER 40x) due to long-term growth expectations.

Today’s interims show 22% revenue growth (to £8.5m), 55% PBT growth (to £1.7m), and a year-on-year rise in the cash balance to £16m (if I was being really fussy, I’d point out that the cash balance fell from where it was six months previously).

Outlook

…the Group has various opportunities in the pipeline which, when converted, have the ability to solidify and embed the growth ambitions of the Group in the coming years…

…The Company's overall pipeline has continued to expand and geo-diversified with the weighted pipeline being materially ahead of last year and together with no debt and a strong cash position the Group has the foundations in place to build and grow for the future, both organically and through M&A.

Share buyback

I find the company’s decision to launch a £1m buyback in October quite odd.

On the one hand, £1m is not a hugely material figure in the context of this company and its market cap.

And it could be interpreted purely as a means of satisfying future share-based payments for employees.

But the company itself said that it had been prompted into this decision by its share price volatility, and that it was being done at least partially in order to “take advantage of current market conditions” and “improve shareholder returns”. So it must really believe that it’s undervalued.

Estimates at Cavendish are unchanged: revenue of £16.1m in FY March 2025 (down from £20m in FY24) and adj. PBT of £3.7m (down from £6.2m in FY24). They say there is “potential” for upgrades, but also that “the timing of contract completions remains out of IGP’s control”.

Graham’s view: Paul has been a huge supporter of this one, but personally I’m struggling to see how it is worth c. £100m, at least based on the financial forecasts for the next 18 months. The justification for the current market cap must lie in FY27 and beyond. I’m afraid I don’t “get it” and therefore I’m downgrading this all the way to AMBER.

It’s a High Flyer with Quality and Momentum, but not much in the way of Value:

Severfield (LON:SFR)

Down 40% to 52p (£160m) - Interim Results - Megan - RED

As expected, trading in the period under review at structural steel contractor Severfield (LON:SFR) was pretty good. Sales rose 17% to £252m, to make a decent dent in the order book which stood at a total of £659m in June (£478m in the UK and Europe division, £181m in India).

But it’s the outlook which has caused the whopping share price collapse this morning. Market conditions (which management had said were looking up when it announced its results in the summer) have taken a turn for the worst.

Now,

“[the] previously anticipated recovery in some sectors has been slower than expected and tighter prices are continuing to impact our profitability in the short-term.”

That means some of the large projects that had been anticipated in the year to March 2025 and also in FY26 have been delayed or cancelled entirely. The UK and Europe order book is £68m lower than it was in June at £410m.

To make matters worse, since the last announcement, the company has discovered that some of its bridge structures fell short of the compliance requirements of its clients and has therefore booked a one-off charge of £20m. There are still four more dodgy bridges (out of a total of 12) that the company has yet to estimate the total cost of repair, so the £20m figure is likely to increase by the end of the financial year.

The cost of bridge repair work has also impacted cash flows, with operating cash inflows £25m lower in the first half at £6.8m. This impacted the company’s cash position which was half of what it was at the end of the financial year. The company took out a loan to pay for its acquisitions last year of which £16.9m is still outstanding. However, there is still considerable headroom in the total credit facility. Net gearing is just 13%. So I think the balance sheet is still sound.

The company is currently £6.8m through its £10m share buyback programme, so further buybacks (at a much cheaper price following this morning’s fall) could provide some support to the share price in the coming months.

Megan’s view

What I don’t particularly like about this statement is the fact that management has revealed that in July the UK and Europe order book was already £18m smaller than it had been only a month earlier, so why it has taken until November to reveal the extent of the disappointment is a mystery. The bridge remedial work, which has had a major impact on profits, was also known several months ago.

The 40% share price fall this morning is perhaps a bit of an over-reaction, but it does show the extent to which the market feels burned by surprises. Perhaps management could have handled this situation better.

Some may see this morning’s fall as an opportunity. Wiping £80m of value in one swipe does feel a bit drastic, especially given the widening margins and strengthening balance sheet that the company had been reporting up until today.

The bridge repair work is likely to remove almost all of the company’s reported profits for the FY25 financial year, so a valuation based on earnings is going to be difficult to calculate.

Optimism in recent months was largely thanks to the expected improvement in market conditions; these seem to have disappeared. Add this to management’s reluctance to keep investors informed about the challenging market conditions and I think this is one to steer clear of for now. RED.

IG Design (LON:IGR)

Down 10% to 112p (£110m) - interim results - Roland - AMBER/GREEN

Today’s half-year results from giftware firm IG Design have received a poor reception, sending the stock down a further 10%. As a quick recap, IG issued a profit warning in September, which Paul covered here.

The good news, as far as it goes, is that today’s half-year results do not appear to contain another profit warning. The bad news is that the results aren’t great, and external conditions do not seem to be improving as quickly as might have been hoped for.

The challenging market conditions and retail trends experienced in the period are expected to continue in H2

Taking a quick look at today’s results, the company reports revenue down by 11% to $393.1m, with adjusted pre-tax profit down by 62% to $13.3m. A nasty example of operating leverage in reverse.

Fortunately, the balance sheet appears to remain in reasonable health, with net cash of $7.4m at the end of September (Sept 23: net debt of $15.1m). Given that working capital tends to peak in H1 as stock builds ahead of Christmas, this looks reassuring to me.

Unfortunately, trading conditions in the US remain difficult, with revenue down by 14% to $241.8m. This compares to a 6% fall in sales in the international business.

The US situation is made more complicated by ongoing restructuring and the reshoring of manufacturing operations from China, where IG Design is closing its factory.

Outlook: the company has maintained its main financial target for the current year following today’s results:

Remain on track to return adjusted operating profit margins to proforma pre-pandemic levels of at least 4.5% in FY2025

This is confirmed in an updated broker note from Canaccord Genuity, which leaves full-year forecasts for adjusted earnings of $0.21 per share unchanged.

That puts IG Design shares on a P/E of about seven after today’s slump – potentially cheap if the company can deliver on its turnaround plans.

Roland’s view

IG Design appears to be a great example of the dangers of transformative acquisitions. Since acquiring CSS Industries in 2020, the group has suffered a series of problems. It’s now in the third year of its turnaround plan.

External conditions in the US and the perceived necessity to move manufacturing away from China are making life even more difficult. I think there’s a chance this business could continue to struggle.

However, forecasts have been held unchanged today and IG Design still has a net cash position. On this basis, I think I can just about justify holding onto our previous AMBER/GREEN stance, ahead of the key seasonal trading period.

Cranswick (LON:CWK)

Down 4% to 4877p (£2.8bn) - Interim Results - Megan - GREEN

The farming industry has not been far from the headlines in recent weeks after the nation’s farmers took to the Westminster streets to bemoan the inheritance tax changes proposed in last month’s budget, which pour more heat on an already embattled industry.

Wherever you stand on the political debate swirling around agricultural relief from IHT, it’s hard to deny that farming is tough. The industry is tightly regulated with prices set by policy rather than supply and demand economics, meaning farmers can’t pass rising input costs onto their customers. The UK’s weather makes things a whole lot worse.

But Cranswick, whose Yorkshire roots are firmly embedded in the farming industry, remains resistant to these challenges. Rising demand for its farmed animal products sent revenue in the UK food business up 6.4%, despite a decline in average prices. Volumes of fresh pork (which contributes just under a quarter of total revenues) rose 13% year-on-year in the UK. Poultry revenues rose 16% and now contribute just under a fifth of the group total. Gourmet products (including its pigs in blankets range, which is expected to have a busy Christmas season) had a strong first half, with sales up 9%. Convenience foods (which include the company’s range of cooked meats and its halloumi-centered mediterranean offering) was up a slightly less impressive 1%. Convenience foods is the single largest contributor to group revenue.

The company has bolstered its core farm-led growth with a recent expansion into the pet food business, where sales rose 71% in the first half, thanks to the ongoing roll-out of a major contract with Pets at Home. In its core food offering its customers include most of the major UK supermarkets, which is an enviable position to be in.

Meanwhile, investment in farm efficiency has helped support company margins, which were 67bps wider at the operating level at 7.5% in the first half. Cranswick now boasts the largest herd of pigs in the UK, with almost 900,000 “on the ground” at any one time. Over 34,000 “finished pigs” are produced every week, which is an 18% increase on the same period last year, thanks to improved efficiency and acquisitions.

The company remains very cash generative, converting 111% of net profits into free cash inflows in the first half. And the strong cash position brings capacity for additional investments. In the first six months, total capital expenditure reached £48m, £20m of which was spent on ‘earnings enhancing projects’ across three distinct areas of the business.

Megan’s view

I carry some reservations about companies in the farming sector because of the challenges in controlling price. It’s also worth noting the shift in consumer demand in favour of plant-based proteins in recent years. Cranswick is currently investing £25m in its humous processing factory, but overall it remains a distinctly carnivorous company.

But despite the challenges posed by the market, growth remains strong across the top and bottom line. Analysts have upgraded their FY25 earnings expectations for the company from 240p in January to 261p following today’s results.

Based on those forecasts, shares are trading on 19 times forecast earnings, which is rich for companies operating in the sector. But not too unreasonable for those with such impressive quality metrics. The company’s return on capital employed has averaged 15% in the last five years.

Importantly, Cranswick is the market leader in the UK with a completely domestic supply chain which keeps it sheltered from pesky tariffs currently dominating business headlines. With its earnings enhancing investments likely to deliver more in the coming years, I am giving this one a cautious green rating.

Graham's Section

Dialight (LON:DIA)

Down 9% yesterday to 118p (£47m) - Half-Year Report - Graham - RED

I note in passing that DIA’s CFO recently stepped down “for personal reasons and will be leaving the Company, with immediate effect, by mutual agreement with the Board” (Nov 11th). This caused a rescheduling of the interim results.

CFO resignations are often seen as potential bear signals. DIA’s CFO had only joined the company in February of this year, and she was not thanked for her contribution in the announcement of her departure.

Today’s interim results show a small reduction in revenue (£90.3m vs £91m in H1 last year) and an improvement in underlying operating profit (£0.9m vs a loss of £2.5m in H1 last year).

Unfortunately, the “non-underlying” costs are enormous, so the statutory result is deeply in the red:

The “underlying” result was impacted by challenging market conditions in the Lighting segment - one thing I’ve learned over the years is that the demand for lighting products tends to be very volatile, and more often than not, conditions are challenging.

Weakness in lighting was partially offset by increased revenues in Signals & Components.

Overall group orders fell 7%.

The “non-underlying” costs were:

“Sanmina litigation” ($22.3m provision): a dispute with a former manufacturing partnering, dating back to 2018, went to trial in September. A mixed verdict was returned and $22.3m is management’s best estimate of the cost.

I have no problem with treating this as a one-off expense, but it does hit DIA’s balance sheet.

Transformation project ($3.1m cost): I don’t treat these as one-off expenses. DIA itself says that the transformation plan is a “multi-year change programme”.

Offsetting these costs, DIA benefited from the sale of a business in North America ($5.2m).

Therefore, despite the income statement showing an underlying profit ($0.9m), I would treat it as an underlying loss after deducting the costs of the transformation project ($3.1m).

On the balance sheet, the net effect of everything that occurred in H1 sees a reduction of net assets from $64m (March 2024) to $46m (Sep 2024).

Net current assets fall from $27m to $7m, if we exclude the fact that the company’s borrowing facility (RCF) was reclassified during the period, from a current liability to a non-liability.

Going concern: the footnotes to the financial statements describe a potential breach of an RCF covenant in Q3, due to the weak trading performance. And it continues with more bad news:

At the balance sheet date the Group does not have sufficient liquidity to settle the [Sanmina] provision without taking mitigating actions or securing additional funding within the going concern period which may include seeking to agree a payment plan with Sanmina and/or new equity funding. The amount, timing, and receipt of any such funding is uncertain at the date of the approval of the interim financial statements.

These circumstances give rise to material uncertainty, which may cast significant doubt on the entity's ability to continue as a going concern, meaning it may be unable to realise it assets and discharge its liabilities in the normal course of business.

Graham’s view: it’s an automatic RED from me. I dislike this sector and if you throw in an abrupt CFO departure plus (most importantly) a going concern warning, I’m out.

AO World (LON:AO.)

Down 1% to 108.2p (£628m) - Interim Results - Graham - AMBER/RED

Nice results from AO World, which has been transformed since it pivoted to focus on profit and cash generation - the previous business model was allergic to both of those things!

H1 revenue is up 6% to £512m, while adj. PBT is up 30% to £17m.

As observed by Paul in June, it’s a fundamentally low-margin business. That’s the nature of electrical retailing: AO achieved a PBT of 3.3% in H1 (H1 last year: 2.7%). The company’s medium-term ambition is to increase this to over 5%.

I appreciate the efforts by founder John Roberts to inject some life into his comments:

"We've had a Morecambe and Wise summer sales period; all the right volumes just not in the right categories. The wet summer weather meant we sold fewer fridges and air conditioning units and more tumble driers than we had planned. Overall, our team did a fantastic job to play this out as a satisfying score draw.

Outlook: FY March 2025 adjusted PBT is upgraded to £39-44m (in June, the range given was £36-41m).

Checking Equity Development’s note published in June, they put out a forecast of £38.7m.

Of course the PBT forecast is not the only thing that matters, but I note that the share price has made little progress since June despite the upgrade, and is even down today:

M&A: AO is buying Musicmagpie for £10m of cash. We never liked Musicmagpie in this report but at £10m, AO can afford to pick it up and try to improve it (net funds £38m as of Sep 2024).

Separately, let’s take a note that Frasers have been building their position in AO World and are now over 24%.

Graham’s view: I used to find this company an appealing short and did indeed short it. That was in the old days. It’s now being run as a proper business: I’ve been amazed by the evolution of John Roberts into a profit-focused, hard-nosed businessman and I applaud the change in strategy. He continues to own more than 16% of the company, so is very well-aligned with other shareholders.

Perhaps the reason the share price is struggling to get any higher is due to an already high valuation for a retailer:

Purely in terms of my improved sentiment towards this company, I’d like to give it an upgrade. But I can’t avoid the conclusion that it remains expensive for what it is, so I’ll leave AMBER/RED unchanged

Roland's Section

Brickability (LON:BRCK)

Up 9% to 61p (£194m) - Interim Results - Roland - GREEN

This morning’s half-year results from building materials distribution group Brickability seem broadly reassuring to me, and the market seems to agree, as the shares are up nearly 10% at the time of writing. A clear outlook statement helps to set a positive tone:

The business remains committed to growing in a sustainable manner, the Board's outlook for the 2025 full year remain unchanged, and is consistent with market expectations.

Today’s results cover the six months to 30 September and seem broadly positive, against a market backdrop of subdued activity, especially in housing.

Revenue for the six months rose by 1.9% to £330.9m, while adjusted pre-tax profit was 0.5% higher, at £21.9m. Encouragingly, gross profit rose by 14.5% to £63m, lifting the company’s gross margin to 19% (H1 24: 16.9%).

Management says this improvement was driven by the contribution from recently acquired specialist cladding and fire remediation businesses, which have lifted overall margins. This market is of course benefiting from structural demand from unsafe cladding remediation projects, work that’s expected to continue for some years.

Another highlight was the contribution from the Upowa renewables business, where sales of solar panels doubled during the half year.

While Brickability’s buy-and-build model is not without risk, diversification does seem to be helping to support the group’s performance at the moment.

This business is relatively capital light and should benefit from operating leverage as volumes recover. So I’d hope higher margins from acquisitions might help to support higher operating margins for the whole group when volumes recover in the core brick business.

Drilling down a little further there are a couple of points worth noting. Reported profits were held back by a £5.3m impairment charge relating to a joint venture that’s been allowed to fall into administration.

Net debt ended the six month period largely unchanged at £56.3m, but is significantly higher than the £30.9m reported one year ago. This level of borrowing looks reasonable to me against expected net profit of £28m, but it’s worth remembering this distribution-focused business runs a big balance sheet.

Receivables and payables were both c.£120m at the end of September (around 2.5 months’ revenue). This means that movements in stock levels or slower sales can lead to big swings in cash flow. Good liquidity is important in this model, so I would not want to see too much more debt.

Roland’s view

Brickability shares have slipped lower since our last look at the shares in July, perhaps because of a slower-than-expected reduction in interest rates.

However, today’s results suggest to me that this business remains in decent shape and may well offer value at current levels.

I’m also encouraged by comments from CEO Frank Hanna, who has now been in the role for six months. Hanna says his focus will be on “improving systems and processes” to provide a stronger platform for growth and improved cyclical resilience. This sounds like a prudent approach to me to maintain good controls as the group scales.

Hanna’s previous role was as co-CEO at Michelmersh Brick Holdings, which I see as a well-run and good quality business. So I’m hopeful he’ll bring the same discipline and careful execution to Brickability.

After this morning’s gains, Brickability shares trade on around seven times forecast earnings and offer a 6% dividend yield. I’m happy to maintain our GREEN stance on this stock.

Supreme (LON:SUP)

Up 1% to 175p (£203m) - Interim Results - Roland - AMBER/GREEN

Supreme styles itself as a consumer goods group, but the majority of revenue and profits come from its vaping business, both as a manufacturer and distributor.

Without taking a view on vaping, this market undeniably carries political and regulatory risks. These are now starting to come into focus, with disposable vapes to be banned from June 2025 and the introduction of excise duty on vape liquid from October 2026.

This may help to explain the market’s muted valuation to today’s upgraded profit guidance for the current year (my bold):

The Group has made a strong start to the second half of FY 2025 and expects trading for FY 2025 to be ahead of expectations, with revenue guidance of around £240 million and Adjusted EBITDA guidance of at least £40 million.

Checking back, in September Supreme cited market expectations for adjusted EBITDA of £37m. So today’s new guidance represents an upgrade of c.10% to full-year expectations.

Half-year results summary: there are no obvious concerns in the headline numbers:

Revenue up 8% to £113m

Gross margin up 3% to 30%

Adjusted pre-tax profit up 25% to £14.7m

Reported pre-tax profit up 5% to £12.9m

Adjusted earnings up 37% to 11.1p per share

Interim dividend up 20% to 1.8p per share

Net cash exc leases of £2.3m (Sept 23: net debt £4.8m)

Trading commentary also seems mostly positive. The acquisition of Clearly Drinks for £15.6m earlier this year has been achieved without debt. This soft drinks business is expected to generate £3.5m of annualised EBITDA and provide additional cross-selling and growth opportunities.

As a result of this deal, Supreme says that non-vape annualised revenue should rise to around £100m, or 45% of group revenue.

However, this still means that 55% of revenue will be vaping related. In addition, today’s note from Equity Development suggests that vaping remains a much higher margin business than the majority of Supreme’s other operations. This means vapes may contribute significantly more than 55% of group profit at the moment.

Supreme is already scaling back sales of disposable vapes to reflect next year’s ban. This led to a 13% reduction in total vaping sales during the half year:

However, some of this spend was redirected to the company’s Branded Distribution segment, which distributes the popular ElfBar and Lost Mary disposable brands. Revenue in this segment rose by 12% to £34.4m, partially offsetting the decline in Supreme’s own-branded disposable sales.

Over time, management believes that greater vaping regulation is likely to lead to sector consolidation and could favour larger, well-run businesses. I share this view, although I think it’s too soon to know whether positives will outweigh the negatives.

Diversification remains on the cards and the company currently has plenty of financial firepower for further acquisitions:

Supreme has developed a stable, highly profitable and growing core business, is currently pursuing a buoyant and diverse M&A pipeline, has a healthy balance sheet and has more than £50 million of unutilised borrowing facilities, providing the Company with a strong base for further growth in the long term.

Outlook: Supreme is bullish about the possibilities for growth in its soft drink and sports nutrition businesses, citing opportunities to combine the expertise of these two divisions. This seems fair to me, but for now vaping remains a key driver of near-term profits.

Today’s upgrade to guidance should translate into a modest increase in adjusted earnings for this year.

While we often complain that no broker notes are available to private investors for some of the companies we cover, today’s results from Supreme have been accompanied by no fewer than three new notes available via Research Tree.

This almost feels like a PR campaign to me, but the additional insight does provide some useful benefit.

Equity Development expects today’s upgrade to translate into FY25 adjusted earnings of 20.2p per share. I assume management has approved this estimate, as it’s a paid note.

Zeus and Shore Capital take a slightly more bullish stance, estimating FY25 eps of around 21p.

In either case, this leaves Supreme shares trading on around 8.5 times FY25 earnings, with a c.2.8% dividend yield.

However, the outlook for FY26 seems a little more muted. Depending on which note you read, the ban on disposable vapes is expected to lead to a c.10% fall in EBITDA to c.£36-37m in FY26, with adjusted earnings falling to 19-20p per share. That’s roughly in line with last year’s earnings.

There are no FY27 forecasts yet, but the introduction of excise duty in October 2026 could potentially have a further impact on sales and profits.

Roland’s view

This isn’t the place for a discussion about the merits (or otherwise) of vaping. But to me, it seems that a business with this level of evolving regulatory exposure is probably fairly priced on a relatively low P/E multiple, despite very attractive quality metrics:

Having said that, I think Supreme is generally a good operator and I would not bet against CEO (and 56% shareholder) Sandy Chadha to continue finding opportunities for growth.

On balance, I think it’s reasonable to take a moderately positive view on this stock at current levels. I’m going to maintain our previous view of AMBER/GREEN.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.