Good morning!

Quindell (LON:QPP)

FCA investigation - big news this morning, as Quindell shares have been suspended - the main reason looks likely to be that they won't be able to file 2014 audited accounts by the deadline of 30 June 2015.

There are two announcements today, the first one from Quindell, which I have summarised below;

- Changes to 2013 & 2014 accounts will "materially impact" previously reported figures, following the accounting review by PWC.

- Accounting changes are of historic interest only, since the main division has already been sold to Slater & Gordon.

- A further review of historic transactions & acquisitions will soon reveal "more complete information", and "ensure that any related party transactions are fully disclosed, and make associated corrections". These are "largely non-cash items".

- Shares have been suspended until this work is complete, and will be restored to trading once the 2014 accounts are published.

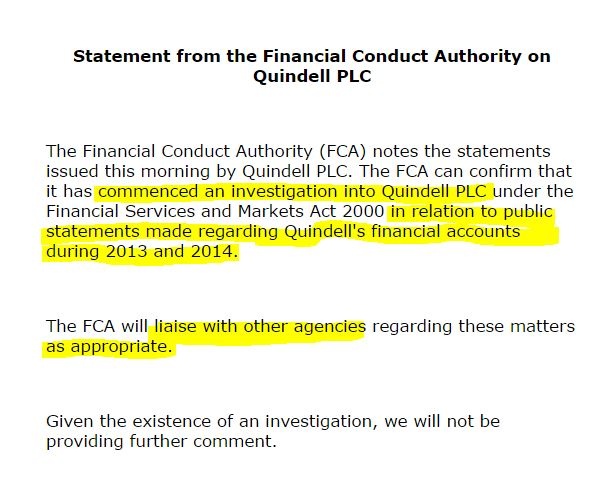

- The FCA has recently begun an investigation into public statements made by Quindell re its accounts, in 2013 and 2014.

Furthermore, the FCA was hot on the heels with their own RNS this morning, confirming their investigation, and the possible involvement of "other agencies" - hopefully the SFO.

My opinion - obviously I don't want to pre-judge the investigations into QPP, but it seems to me that this investigation has been a long time coming. Tom Winnifrith did some remarkable investigative work on QPP last year, unearthing all sorts of peculiar & suspicious things.

Now it's true that Tom's style may not appeal to everyone - he's a bit over the top. Which is like saying that the Titanic was a bit wet! However, he deserves enormous praise for correctly identifying that things were badly wrong at QPP, and that fundamentally the company had a dishonest culture, and that the accounts could not be relied upon.

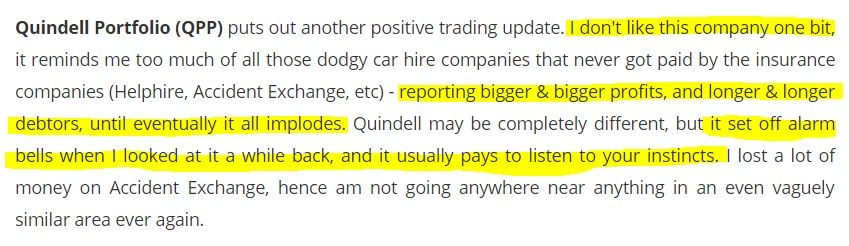

Without wishing to blow my own trumpet too much, I think I was the first commentator to point out red flags about Quindell's accounts, and indeed I warned readers here as early as Dec 2012 that my instincts were telling me that something wasn't right at Quindell, specifically (and prophetically) from my report of 18 Dec 2012:

I flagged rising debtors as a concern in my SCVR of 15 Jan 2013, then in my report of 9 May 2013 I unearthed details of how Quindell had used a derivative contract to guarantee the share price for a Placing (totally underhand, and possibly even illegal?)

There are numerous other reports from me on Quindell throughout 2013 and 2014, the archive link is here, it's well worth revisiting, as my concerns about the accounts, and the pattern of misleading behaviour by management, have been very much vindicated.

After Quindell ran out of cash, and nearly went bust late last year, they were saved by Slater & Gordon, with a bizarrely generous takeover bid for the legal services part of Quindell, despite its chronic inability to generate cash.

I shall await the results of the FCA investigation, but I very much hope it involves people being disqualified as Directors, and imprisoned, and have their assets confiscated, if wrongdoing can be proven. UK corporate governance is rotten to the core, and to start fixing things, we need to see wrongdoing punished properly. If people lie & cheat, they should go to prison. Simple.

What does this mean for Quindell's share price when it resumes trading? That depends. The S&G deal is probably a done deal, so Quindell has plenty of cash. However, there could be legal actions coming out of the woodwork, so it's conceivable that some of the cash might need to be held back for dealing with that perhaps?

I see that the artificially pumped up prices of Daniel Stewart Securities (LON:DAN) and Imaginatik (LON:IMTK) (two of the lousiest companies on the market) are starting to fall, as speculators begin to realise that having Rob Terry involved as a major shareholder might not be quite such a good thing, after all!

In my view, honesty is the best policy. People who are wired the opposite way always end up coming a cropper, sooner or later. Hence why it's so important to only invest in companies where management have a culture of basic decency, and honesty. There's not enough of it about, I'm afraid.

James Latham (LON:LTHM)

Share price: 659p (down 3.4% today)

No. shares: 20.2m

Market Cap: £133.1m

Results for y/e 31 Mar 2015 - this is a smashing company, and its shares have six-bagged since the lows of Mar 2009, at the bottom of the cycle. It's a family-run business, with no less than four Lathams on the Board. For me, that's a positive - I like steady, conservatively managed family businesses, as they tend to survive recessions, and take a long term approach to running the business.

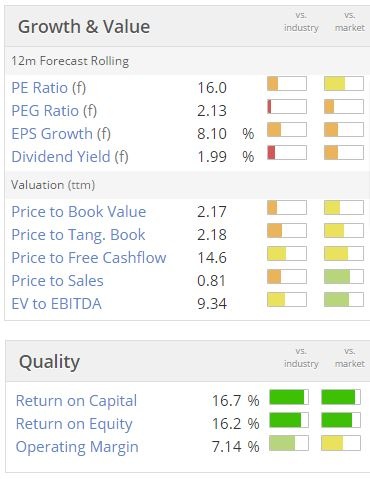

Results today look to be slightly ahead of broker consensus - adjusted EPS has come in at 40.3p, versus 39.5p showing on Stockopedia. So far, so good! This is up 9.2% on prior year.

Turnover rose 7.2% to £174.9m, and operating profit rose 11.5% (I've stripped out the £1.8m exceptional profit from last year's figures, which related to the pension scheme).

So that looks an encouraging, but not spectacular performance.

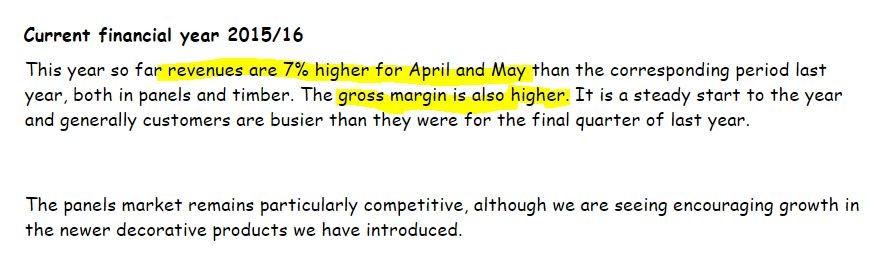

Outlook - the new financial year seems to be following a very similar pattern:

Two older sites are to be upgraded, and in the "development strategy" section I think they are perhaps dropping hints about potential acquisitions? They talk about new product introductions too.

Balance Sheet - absolutely lovely, as always. There is lots of surplus working capital - the current ratio is a tremendous 3.05 - current assets exceed current liabilities by an astonishing £52.9m. That's highly material considering the market cap is £133.1m, and very much needs to be factored into our sums on valuation.

In my view this business could easily be geared up a bit - either to pay a special dividend, or for acquisitions. I estimate that the company could safely spend up to £30m on acquisitions, by using its existing net cash of £10.6m, and a further say £20m in additional bank debt, which would not present a problem in my view.

So they have plenty of scope to do interesting things to expand the business, but the question is whether management will do so? Maybe it's easier to just run a manageable business, and leave things as they are? I don't know how ambitious management are to expand? Expansion isn't always the best thing to do. If you have a nice, profitable business, then often sticking to your knitting, and doing it well, can be the best option in the long run.

Note that there is a £10.4m pension deficit, but as we have seen with both AGA Rangemaster (LON:AGA) and Thorntons (LON:THT) recently receiving takeover approaches, despite having horrible pension liabilities, pension funds do not seem to be the poison pill that they once were. As investors we need to take changing circumstances into account in our own calculations & assumptions.

The narrative says that the latest actuarial valuation on the pension fund (which differs from the accounting treatment, and usually shows a worse deficit) has seen the actuarial deficit almost disappear, from £9.0m at 31 Mar 2011, to just £1.5m at 31 Mar 2014. The two year recovery plan is for £1.155k to be paid this year, and then £420k next year, at which point it looks like the scheme will be fully funded. That's really good news, although I don't quite understand how this has happened!

Valuation - at 659p these shares are on a PER of 16.4 times, which looks a bit on the warm side, for a business that has only delivered earnings growth of 9.2%. So the PEG rating is quite high. This business is normally valued on a PER of about 10-12, so I'm finding it too much of a stretch to value it on a PER of 16.4, but this is true for so many companies at the moment.

We're in a bull market, where earnings multiples have risen a lot, compared with say 2 or 3 years ago. That is partly justified I think, given that the economy is improving, so investors should be prepared to pay more for shares when the outlook for earnings is better than it was.

In this case, I think you could adjust the PER down by say 10-20% to allow for the terrific balance sheet, and the potential use of that financial strength to enhance earnings from acquisitions. Also we should base valuation on the current year's earnings, so forecast is 42.7p. Let's be generous, and say they might do 45p, as we're in a very positive environment for building & home improvements.

That would put it on a forward PER of 14.6, so take off 10-20% for the balance sheet strength, and it's down to about 12-13, which is the correct price in my view.

Dividends - not very attractive any more, it's only yielding about 2%.

StockRank - the Stockopedia computers love it! It scores an outstanding 98.

My opinion - I started out looking at the figures thinking that the shares were perhaps a tad over-valued, but after crunching the numbers a bit more, have come round to the view that it looks priced about right.

I think it's a nice long term hold, but do bear in mind cyclicality. If you look at the long term chart, you can see that this share steadily rises in the good times, but then tanks when the economy goes into recession - so a classic cyclical share really.

So my question really is, how much further upside is there to go? Investors need to be clear how long you think positive market conditions for wood products will continue, and how bad the next recession will be? What will earnings for Lathams be when averaged over the whole cycle? That is probably more important than valuing it on what earnings are at the moment.

Will the next recession be as bad as the one in 2008? It may not be, who knows, in which case maybe long term investors might be happy to ignore the cycle, and just hold forever?

Or it might be better to identify which forward economic indicators most closely relate to Lathams, and watch them like a hawk, so that you know when to sell.

Braemar Shipping Services (LON:BMS)

Share price: 464p (down 3.3%)

No. shares: 30.0m

Market Cap: £139.2m

AGM trading update - this shipping services group has issued an update saying it has traded "in line with the Board's expectations" for Mar-May 2015 inclusive (since it has a 28 Feb year end).

Additional details on divisional performance are given.

Outlook - they say "remains favourable".

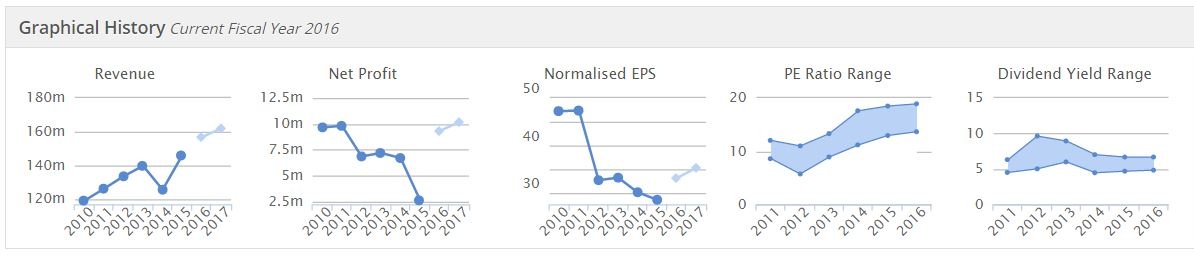

Valuation - it's valued at 14.2 times current year earnings, which looks sensible. I don't know what the longer term growth prospects are, so I can't really comment on whether it deserves a richer rating or not. Looking at the historic graphs, profit performance looks pedestrian, but appears to be improving now, based on broker forecasts (the lighter blue blobs below):

Dividends - of particular note is the generous, but not well covered, 5.4% dividend yield. The payout has been stuck at 26p for 5 years now, which suggests that it's probably a bit higher than management are comfortable with.

My opinion - it's not a sector I understand really, so no opinion. The valuation looks about right probably.

I've been feeling a bit under the weather this week, with a bug I caught from some prole on an Easyjet flight, who was streaming with cold. Grrrr. Anyway, as there's a backlog of companies I wanted to review, have done a very quick view of things of interest on today's SCVR Extra video, covering;

2:20 - Daniel Stewart Securities (LON:DAN) - share is plummeting, as I predicted in my report here of 19 Jun 2015

3:30 - Xeros Technology (LON:XSG) - missed opportunity for a quick trade. Impossible to value. We're in a trader's market right now, not a stock-picker's market.

4:52 - Accsys Technologies (LON:AXS) - recap on one of my favourite GARP shares - I read results statement on the beach over lunch today!

9:00 - update on my Bargepole List

9:46 - Nomad Foods (NHL) - big rise on re-admission, very brief comment

10:08 - Benchmark (BMK) - recent results, too complicated, difficult to value, not for me.

11:50 - Clean Air Power (CAP) - out of cash again, not looking good.

12:20 - Tangent Comms (TNG) - profit warning

13:00 - Tandem (TND) - says market conditions tough for independent cycling shops

14:14 - Bilby (BILB) - good recent results, worth a look in my view.

14:45 - Immunodiagnostic Systems (IDH) - poor results, but strong balance sheet. Turnaround potential possibly?

14:50 - Hayward Tyler (HAYT) - looks like quite a good turnaround. Worth a deeper look maybe?

That's it for today, see you in the morning!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in AXS, and no short positions. A fund management company with which Paul is associated may also hold positions in companies mentioned.

Paul NEVER gives recommendations or financial advice. These reports are personal opinions only. Our ethos here on Stockopedia is on readers DYOR - doing your own research)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.