Good morning! These markets are extraordinary - the S&P rose 9.5% yesterday and the FTSE is this morning scheduled to open up by 5% after Trump announced a 90-day pause on his "reciprocal" tariffs - with the exception of China.

Comment from Mark:

Good morning! Mark here. It’s going to be a good day! The FTSE futures are up over 5% as Trump tweeted last night that tariffs on everywhere but China would be “paused” for 90 days at 10%. Unfortunately, the UK was already at 10%. However, oil rose around 10%, Gold was up 4% and the NASDAQ almost 10%, so these factors have dragged the FTSE higher.

I can’t help feeling that this isn’t all over, though. Even 10% tariffs embed inflation into the US economy, perhaps meaning rates stay higher for longer. Plus, who would make a major investment decision when policies are changing so rapidly? So we may see a US recession anyway. 90 days is long enough for a brief respite and then markets to start to worry about the upcoming “cliff edge”.

However, today isn’t a day for such a curmudgeonly reality. Enjoy the rise for as long as it lasts!

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

Tesco (LON:TSCO) (£22.4bn) | Preliminary Results | FY25 guidance: adj. operating profit £2.7 - 3.0bn (FY25: £3.1bn). Increase in competitive intensity. | AMBER (Megan) Despite the slightly tempered outlook, I’d argue that some trends are still on Tesco’s side (lower propensity of Brits to spend out, economic turbulence favouring defensives). It’s a tempting option in markets like these, but neither exciting, nor cheap enough for me at these levels. |

Anglo American (LON:AAL) (£21.4bn) | Update on Sale of Coal Business | Working towards satisfying customary conditions. | |

JD Sports Fashion (LON:JD.) (£3.6bn) | Share Buyback | Initial £100m buyback starting today. | AMBER (Mark - I hold) [No section below] Technically, this news was announced as part of the midday trading update yesterday but RNS'ed this morning. Seems mistimed to start a buyback on a day the shares are up 11%, but this is just the tariff news, which is positive for JD. This is a great business on a modest rating, so buying back shares makes sense. With guidance of being net cash after the buyback by the end of the year, this doesn’t place them in any difficulty either. Some doubts over strategy and reliance on brands remain, hence the AMBER rating overall. |

Great Portland Estates (LON:GPE) (£1.0bn) | Q4 Business Update | Strong end to year. 32 leases & renewals, 9.9% above their March 2024 estimated rental value. | |

Rank (LON:RNK) (£365m) | Trading Statement | Like-for-like net gaming revenue up 10.9% in Q3, up 12.2% YTD. Full year profit expected in line. | GREEN (Graham) Very pleasant growth rates, a rising trend of earnings forecasts, and a modest earnings multiple. I'm a fan of this one at current levels. |

Foresight group (LON:FSG) (£348m) | FY TU | Expect FY25 core adj. EBITDA to be in line (£62.2 - 63.8m). New buyback: up to £50m over 3 years. | |

Mears (LON:MER) (£324m) | Final Results | Strong start to 2025. Increases 2025 guidance, revenue >£1,050m, adj. PBT >£50m. | |

Petrotal (LON:PTAL) (£300m) | Q1 Ops and Financial Update | Q1 production 23,280 bopd. Tracking ahead of annual guidance. Cash flat at $114m. | |

Treatt (LON:TET) (£195m) | Trading Update & Share Buyback | Profit warning. H1 lower than last year. Now expect FY25 revenues £146-153m, PBTE £16-18m. | AMBER/RED (Graham) Downgrading this after a serious profit warning. I do perceive value on a fundamental basis given the assets on the balance sheet, the lack of debt and the track record of profitability. However I do need to downgrade my stance to reflect that one profit warning is rarely the beginning and the end of the bad news. |

Norcros (LON:NXR) (£178m) | FY Trading Update | FY25 adj. profit in line. Net debt flat at c. £37m. Strategic review of Johnson Tiles South After. | AMBER/GREEN (Mark) [no section below] This is on a low P/E, and these results confirm that they are in line on an adjusted basis. However, LFL revenue is flat, so this perhaps shouldn’t be on a high rating. When I look at measures that include the debt, and adjust for the ongoing pension contributions, this isn’t as cheap as it first appears. Getting rid of their loss-making tile business in South Africa may give a further uplift, and the algos like it, giving it a Superstock classification due to its consistent score across all three QVM measures. |

TT electronics (LON:TTG) (£148m) | FY Results, Management Changes & Business Update | Rev -13% CCY, EPS down 34% to 11.0p. Net debt £97.4m (1.8x leverage) CEO falls on his sword, with immediate effect. CFO designate becomes acting CEO. | AMBER (Mark) |

Tharisa (LON:THS) (£142m) | Q2 Production Report | PGM production +8.7%, Chrome Production +1.8%. PGM price +2.9%, Chrome price -13.3%. Net Cash $79.3m. | AMBER (Mark) |

Savannah Resources (LON:SAV) (£113m) | FY Results | Loss of £4.4m, Cash £17.7m. | |

hVIVO (LON:HVO) (£100m) | Final Results | Rev +12% to £62.7m, EPS +33% to 1.69p. Orderbook £67m vs £80 million at FY2023. Outlook: Revenue guidance £73m, with H2-weighting. continued profitability and cash generation. | |

Devolver Digital (LON:DEVO) (£93m) | Preliminary Results | Rev +13.5% to $104.8m, loss $6.4m in line with previous guidance. Outlook: Strong pipeline but H2-weighted, single-digit revenue growth, similar bottom line to FY24. | |

Iqe (LON:IQE) (£93m) | Joint Development Agreement | JDA with X-FAB to create a European-based GaN Power device platform solution. | |

Marks Electrical (LON:MRK) (£60m) | FY25 Pre-close TU | Rev +2.6%, Net Cash £8.8m. Adjusted EBITDA down 16% to £4.2m. Maintained 2026 guidance. | AMBER/RED (Mark) |

Enwell Energy (LON:ENW) (£59m) | Quarterly Ops Update | 1,865 boepd, down 12%. Cash $101.8m of which $15.9 is in USD/GBP/EUR. Ceased all field operations following suspension order. | |

Inspecs (LON:SPEC) (£40m) | Final Results | Flat revenue on CCY basis, Op profit up 17% to £3.4m. Net debt excl. Leases slightly reduced to £22.9m. 25Q1 in line with expectations. | AMBER/RED (Mark) [no section below] |

Brave Bison (LON:BBSN) (£30m) | Final Results & Strategic Acquisition | Acquisition of “The Fifth Group” for £1m of shares at 2.5p, cash of £0.575m and up to £6m contingent consideration. | AMBER/GREEN (Mark) |

Renalytix (LON:RENX) (£25m) | Q3 TU | In line. 20% Q-Q revenue growth. | |

Cambridge Cognition Holdings (LON:COG) (£14m) | Contract Win | £1m over 6 years. |

Graham's Section

Rank (LON:RNK)

Up 4% to 81.4p (£381m) - Trading Statement - Graham - GREEN

Let’s take a look at this brief trading statement.

Like-for-like numbers for Q3 are encouraging, with >10% growth in the major categories of Grosvenor (casinos) and Digital:

At the Digital business, I note a big divergence between the UK (+18%) and Spain (down 2.9%).

At Grosvenor casinos, investment has paid off with 14.5% growth in table gaming (poker, blackjack, etc.).

CEO comment:

"Since announcing our interim results in January, we have continued to deliver strong growth and expect to deliver Group like-for-like operating profit for the full year in line with expectations. This is notwithstanding the uncertain economic environment and the significant cost and regulatory headwinds that we face from the start of Q4 (1 April 2025).

We expect the Government to publish the statutory instruments for land-based casino reforms in the coming weeks and anticipate the roll out of additional machines and sports betting to commence during the summer.

Graham’s view

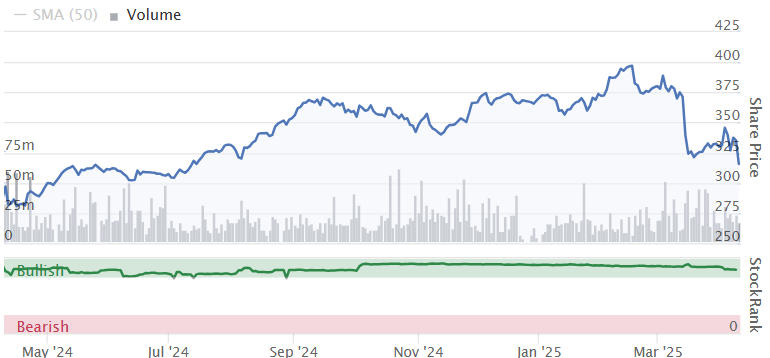

This stock has been depressed since the inflationary period of a few years ago:

I’ve been GREEN on it for a while, in anticipation of profit margins recovering with improved consumer sentiment and with lower inflation.

This seems to be playing out:

Recent interim results showed an underlying like-for-like operating profit of £32.9m (previous year: £21.2m).

Expectations were raised for the full year:

Given the pleasant trend in earnings forecasts and the cheap earnings multiple (9x), I think I can have few qualms about keeping my positive stance on this one.

The StockRank is a healthy 86:

Being a largely physical rather than online business, it does carry more risks than its purely online equivalents - exposure to fluctuating wage costs, energy, tourism trends, etc. But when it’s firing on all cylinders it is highly profitable, and I tend to think that the risks are priced in at these levels.

Treatt (LON:TET)

Down 26% to 237.5p (£143m) - Trading Update - Graham - AMBER/RED

Treatt, the manufacturer and supplier of a diverse and sustainable portfolio of natural extracts and ingredients for the beverage, flavour and fragrance industries, announces the following trading update for the half year ended 31 March 2025 (the "Period").

Unfortunately I was AMBER/GREEN on this one last time, when I looked at Treatt’s full year results in December.

Today’s update contains little positivity. Let’s start with some H1 highlights:

Revenue £64.2m (H1 last year: £72.1m)

Adj. PBT £6.6m (H1 last year: £10.6m)

Net cash £0.9m.

Outlook:

Whilst the order book and pipeline are robust, including some exciting new customer wins in Premium, we now expect full year PBTE to be between £16m and £18m, reflecting an ongoing softening of consumer confidence in North America, recent geopolitical uncertainty and sustained high citrus prices, resulting in lower customer demand

The new full-year revenue forecast is £146 - 153m. At the midpoint, that's about 8% lower than the previous consensus forecast.

The company's “Heritage” segment seems to be suffering from particularly weak demand - this segment includes their main “Citrus” category (56% of total sales last year) and “Synthetic aroma” (14% of total sales).

The “Premium” segment is smaller and includes “Fruit & Vegetables”, “Health & Wellness” and Tea.

An overview of the categories from the 2024 annual report:

Treatt says that US consumer confidence “has softened, impacting demand for carbonated soft drinks and the overall beverage market in North America”, and they don’t expect it to get better given recent macro developments.

They’re not wrong about that: see this update from the US Consumer Confidence Index two weeks ago.

The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—dropped 9.6 points to 65.2, the lowest level in 12 years and well below the threshold of 80 that usually signals a recession ahead.

Turning back to Treatt’s announcement:

Notwithstanding these trading challenges which we expect to moderate, we are encouraged by some exciting wins in Premium, including securing a large new customer in North America, and capitalising on the low and no sugar trend. Additionally in New Markets, we have a healthy pipeline of opportunities for H2 and are progressing distribution arrangements to expand our reach.

Buyback: it’s a strange sort of day to announce this, but Treatt announces a £5m buyback which reflects their “strong cash performance together with the Board's confidence in Treatt's strategy and medium term outlook”. They did successfully eliminate nearly all of their net debt in the previous financial year.

Graham’s view

To be consistent with our understanding of profit warnings - that they tend to be followed by a protracted period of poor performance - I’m going to have to downgrade our stance on Treatt today.

That said, I do think that the stock might be close to a “deep value” sort of price.

The balance sheet for September 2024 showed net assets of £142m, around the same level as the current market cap. This value was almost fully tangible, consisting in the main of PPE and working capital, and with almost no debt.

I also note that (before today) the stock passed 5 bullish stock screens, including some old favourites such as Ben Graham’s Deep Value Checklist.

If it was already in deep value before today, it surely must be there now after a 30% fall!

The company has been profitable every year for decades, although its profitability does tend to be volatile. As a result, its quality metrics are volatile, too. There is clearly a substantial amount of economic sensitivity at play.

Based on the new profit forecast, I think it’s trading at around 11x adjusted after-tax earnings.

I would bet that Treatt’s profitability will bounce back from this period of weak consumer confidence. It has recovered in the past from similar setbacks. And with a sound balance sheet, I’d argue that the stock offers above-average value at current levels.

However, I have to respect the fact that there’s been a profit warning, so I’m going to be AMBER/RED on this today.

It has been quite the journey from a high of over £13:

Megan's Section

Tesco (LON:TSCO)

Down 6% to 316p (£21bn) - Final Results - Megan - AMBER

There is one line in final results from supermarket giant Tesco which has caused the blip in the share price this morning:

“In the last few months, we have seen a further increase in the competitive intensity of the UK market.”

It seems as though this competition is forcing the company to chip away at prices, which means adjusted operating profits are expected to be between £2.7bn and £3bn next year (down from the £3.1bn reported in these numbers). It’s not a profit warning as such (the company hadn’t previously issued any clear guidance for the 2026 financial year), but it’s a downturn in trajectory that analysts had previously forecast.

None of that takes away from the fact that Tesco has done a phenomenal job at keeping competition at arms length. The company’s share of the UK market has now climbed for 21 consecutive months and is now at its highest level since 2016.

Looking at data from Kantar Media suggests that the market share has been taken from Asda, Morrisons and Sainsbury (all of which have seen their market share decline). And while it has had to share that newly available market share with Aldi and Lidl, the momentum of those European discounters has slowed in the last couple of years.

Tesco can thank its Clubcard for such impressive resilience. In FY2025, 84% of sales were clocked on a Clubcard and there are now 18m Tesco Clubcard app users in the UK. This loyalty scheme is built on the premise that Clubcard customers can get their basic goods at cheap prices (and basic goods normally are cheaper than the likes of Aldi and Lidl). Then, having been brought into store for the cheap weekly shop, loyal customers will be tempted by higher priced items. In FY2025, Tesco’s ‘finest’ range rose 15% to £2.5bn. This helped send adjusted operating margins up slightly to 5% (from 4.6% last year).

There is, however, only so much heavy lifting that the Clubcard can do. And as market penetration rises, the opportunities for the loyalty scheme to make a difference begin to diminish.

Throw in the fact that cost pressures are rising, and the outlook for the business is not as sunny as investors would have liked.

In FY2025, the company was forced to take a £289m non-cash impairment on the current fair value of assets, most notably, its stores. This was a result of an increase in both costs and discount rates (owing to a rise in government bond rates) which has undercut the current value of future cash flows expected from these stores. The impairment dented reported profits in FY2025.

Megan’s view

At first glance, there’s not an awful lot to be excited about here. Margins and return on investment aren’t especially high, while growth is as good as can be expected for the country’s largest supermarket chain.

But Tesco has been well managed. That is shown in the fact that while revenues have only risen at a compound annual rate of 1.5% in the last five years, earnings CAGR is almost 10%.

Investors who bought at the nadir in 2016 will have doubled their money. But that nadir was not hugely tempting. At the time, the company was facing bankruptcy risk, having reported its biggest loss in 100 years of trading following a major accounting scandal. At their low point, shares were trading on 18 times forecast earnings.

The stock still hasn’t reclaimed its highs of pre-2008 financial crisis, but after decent momentum in the last few years (barring the market-driven declines of the last couple of months), shares are now trading on 12 times forecast earnings. Although it’s worth noting that these forecasts might decline after today’s update.

So it’s not really a value play and it’s certainly not a growth stock. But it is the market leader in a sector for which trends are currently supportive. It’s also defensive, which is what investors need in times like these. On balance, it’s not for me, but for investors looking to deploy their cash into a stock that can weather international economic turbulence, it might not be a bad option. AMBER

Mark's Section

Brave Bison (LON:BBSN)

Up 17% to 2.7p - Final Results & Acquisition of The Fifth Group - Mark - AMBER/GREEN

This highly acquisitive company continues to make good deals. This time, it is “The Fifth Group” which is described as:

…the award-winning influencer marketing division of News UK. The Fifth was founded in 2019 and delivers influencer marketing, social strategy and end-to-end creator-led campaigns for brands including YouTube, Disney+, UKTV, FOX Entertainment, Tommee Tippee, The Times, TSB & SamsungTV.

Most importantly, this is another deal where most of the payment is contingent on performance:

On completion of the Acquisition, News UK will be issued with 40 million new Brave Bison ordinary shares (the "Consideration Shares"), worth £1 million at an issue price of 2.5 pence per ordinary share, and will receive cash consideration of £0.575 million. News UK will also receive 25% of profits generated by The Fifth over the next three years, capped at £6 million (the "Contingent Consideration").

Their broker Cavendish today say:

Following the recent acquisitions of Engage, Builtvisible and The Fifth, we are confident in raising our net revenue forecasts by 18% to £25.5m, and nudge up adj PBT by £0.1m to £3.9m. The acquisitions are likely to contribute positively to profits in the first year, but are partially offset by National Insurance rises from April 2025. Net cash reduces by £4.7m, but remains healthy at £5.3m.

We also get final results today, which are presented in a very handy table:

However, the thing that stands out is that almost none of the adjustments here are exceptional. This company doesn’t look like it will stop acquiring businesses that need restructuring. Plus, the key management intentionally caps their salaries and gives themselves options at 3p/share. While this undoubtedly makes them strongly aligned to shareholders, it also makes that SBP charge a real cost. A more realistic EPS figure is probably around 0.2p.

Cavendish also says:

Brave Bison’s valuation looks highly compelling given it trades on an FY1 adj P/E of just 8.1x versus peers on 9.3x, whilst retaining significant net cash and growing net revenues by 20% in FY25E.

This seems nonsense. How can a slight discount to peers be “highly compelling”, especially as the revenue growth is all inorganic, and the rating becomes a premium if one includes all the costs associated with the acquisitions?

Outlook: They remain positive, highlighting their long-term track record of growth. Saying:

We continue to win new clients, expand our capabilities ahead of the competition and make accretive acquisitions that drive us forward. We are excited for the future and look forward to updating shareholders throughout the year.

Share consolidation: a 100:1 consolidation also announced today will make the share price look more normal for UK companies, but, of course, it doesn’t change the fundamentals.

Mark’s view

It is hard to be too harsh on this business as it is cash-generative and is putting that money to work by getting some very good deals where they have to put up little cash up front. After the last acquisition, I rated this AMBER/GREEN at 2.4p. With the shares having nudged up since, but forecasts remaining largely flat, despite another acquisition, it is tempting to downgrade this. However, I think the long-term growth story remains intact, as demonstrated by today’s deal, so I am happy to leave the stance as it is.

TT electronics (LON:TTG)

Down 11% to 74p - Final Results & Management Changes - Mark - AMBER

Management changes: CEO Peter France to leave with immediate effect. Eric Lakin, CFO designate, to be appointed acting CEO. This leaves quite a management gap. Their former CFO is retiring, so they appointed a CFO designate, and no sooner has he got his feet under the table than he is running the show. All this during difficult times.

Business changes: It looks like consultants are being used at the Cleveland manufacturing facility to try to turn this around. They are also likely to be closing or selling their components manufacturing in the US, saying:

The downturn in the Components market and the associated impact on our dedicated manufacturing facilities servicing that market, mostly in North America, has highlighted the sub-scale nature of this business. Accordingly, the Board has determined that the Company will now assess all options in respect of this business segment.

Their Final Results also released today reveal the issues:

In North America, distributor de-stocking, which has continued for longer than originally expected, had a significant impact on demand for our components products. We took cost action, reducing headcount by almost 400 in the first half equating to £9 million of annualised benefit, to offset the lower demand; the £1.7 million severance costs were incurred within adjusted operating profit in the period. In the second half we took further cost action reducing headcount by a further 100 heads (severance costs of £0.6 million) and bringing the annualised benefits to £12 million in total. Furthermore, we experienced operational execution issues in two North American sites, Cleveland and Kansas City. This, combined with the performance of the component business created a significant profit shortfall in North America. In light of this trading performance and reflecting a revised view of recovery, we have booked a £52.2 million non-cash write-down being a £36.7 million non-cash impairment of goodwill for the region and £15.5 million write-down in respect of assets within a North American components site.

This table shows the impact on their North American operations:

In contrast, European revenue was up 14%, excluding divestments they made, with a 66% improvement in operating profit. Asia had a 6% underlying revenue decline but an operating profit improvement of 27%. This is very much a North American problem for the company.

“Project Dynamo”: This is the name they have given their efforts to fix the problem. This is wide-reaching with eight workstreams spanning cost savings (£17m net), working capital (£27.8m by the end of 2026), commercials and innovation. These all seem sensible actions, but it will take some time to see the benefits.

Going Concern: In their Severe Downside scenario they would need to take mitigating actions:

This severe downside scenario reduces EBITDA by £11.7 million, £23.9 million and £29.3 million for the 12 months to 30 June 2025, year ended 31 December 2025 and 12 months to 30 June 2026, respectively. At these levels of EBITDA, the modelling shows that the Group would need to implement some mitigating actions in order to meet the financial covenants. These mitigations could include but are not limited to reducing incentive payments, wage and salary savings, reduced dividends, capital expenditure and additional working capital measures. In this severe downside scenario, to remain compliant with covenants, the Group would need to implement mitigating actions with a EBITDA impact of circa £5 million or cash flow impact of circa £16 million, which the Board believes would be readily achievable from the range of mitigating actions available to the Group. After the impact of these mitigations, the modelling shows that severe downside scenario passing the financial covenants.

These do at least look severe compared to the covenant EBITDA of £45.6m that is calculated in these results. However, none of these actions are yet in response to the tariff announcements, which are specifically mentioned as an additional risk in the going concern statement:

However, the recent introduction of US global tariffs and certain retaliatory tariffs provide an uncertain and volatile macroeconomic backdrop which could have an impact beyond that assumed in the severe downside case. This has led the Board to conclude that it is not possible to be certain of meeting the covenant test in certain extreme scenarios, in particular where customer reticence in placing orders against the backdrop of tariff uncertainty reduces order intake. Even in this scenario, the Company would seek to negotiate an adjustment to its covenants. These matters represent a material uncertainty which may cast doubt upon the Group's ability and the Company's ability to continue as a going concern for the period up to 30 June 2026. The financial statements do not contain the adjustments that would result if the Group and Company were unable to continue as a going concern.

This will worry many investors as there is a real and unquantified risk from tariffs to this business. Unsurprisingly, with this going on, they are not paying a dividend.

Debt: Indeed, it seems they probably can’t pay a dividend as they have agreed on a relaxation of debt covenants that prohibits it if interest cover falls or is forecast in the next two testing periods to fall below 4.0 times. At 31st December 2024, interest cover was 4.4x, so this is fairly tight against this restriction. The leverage ratio is better at 1.8x versus a covenant of 3.0. The overall net debt has been improving and stands at £97.4m, including lease liabilities, versus £126.2m the year before.

Pension: This is one defined benefit scheme that was actually in surplus, and not just on an accounting basis. They got a buy-in for the UK scheme in 2022, and a buyout is being finalised. This will probably see the remaining £7.1m surplus returned to the company.

Adjustments: The bulk of these were goodwill and asset write-downs, which means that it is probably reasonable to take their adjusted figures. Operating cash flow exceeds operating profits, and with capex running below depreciation, this is at least generating cash to pay down their debt.

Outlook: There is no research available to individual investors, but this reads like a profits warning:

We remain resolutely focused on our operational improvement plan, Project Dynamo, and our clear action plan to improve operational efficiency and productivity however the current uncertainty has increased the downside risk for the Group and the board now expects adjusted operating profit to be in the range of £32 million to £40 million.

This year’s adjusted operating profit is pretty much bang in the middle of that range, suggesting that the mid-case EPS will be around 11p again. This is around 30% below the consensus in Stockopedia:

Hence, the drop today is fully understandable. However, it does mean the forward P/E is now around 7x, which may be cheap. However, with the sizeable net debt, it is also worth looking at other measures, such as EV/EBITDA. Here, the Market Cap is £132m at 74p, and the EV around £230m. EBITDA is given as £50.9m, giving an EV/EBITDA of 4.5. This isn’t particularly cheap, but if we consider this the nadir in terms of trading, there is scope for this to look like good value on any recovery.

Mark’s View

The good news is that the problems here are primarily restricted to the North American operations. The actions taken in Europe and Asia, including non-core divestments, have significantly improved profitability there. The plan for a similar turnaround in North America is far-reaching and looks very sensible. If this goes to plan, the business will look cheap. Volex recently made a partial share offer for TT that valued the business at around 130p, which was rejected as undervaluing the business. During the rebuff, management revealed that they had received higher cash offers that they also turned down. With a now-reduced board, they may be more amenable to considering one of these. However, the bad news is that tariffs have the potential to throw a spanner in the works, and these are specifically mentioned in their qualified going concern statement. Any impact here is highly uncertain and possibly significant. Graham went with an AMBER stance in February, and given the risks, I’m going to take the cop-out option and go for the same.

Tharisa (LON:THS)

Up 8% to 53p - Q2 Production Report - Mark - AMBER

Weather interruptions meant that reef mining was down about 12%. However, higher recoveries saw a slight production increase for both PGMs and Chrome:

However, pricing was under pressure this quarter, particularly for chrome concentrate. Looking further forward, worries over auto production have impacted spot prices for PGMs, but Chrome has strengthened. How long this will remain, given the US tariffs on China, is uncertain.

Production guidance remains steady with that given with Q1 production, which means that barring a huge collapse in commodity prices, this will remain one fo the cheapest stocks on the UK market:

However, the market still has significant doubts over their strategy of investing into developing the Karo PGM mine in Zimbabwe. Even on a reduced development plan this is taking up all their operating cash flow and more, which sees net cash falling:

Group cash on hand of US$175.1 million (30 September 2024: US$217.7 million), and debt of US$86.1 million (30 September 2024: US$108.8 million), resulting in a net cash position of US$89.0 million (30 September 2024: US$108.9 million)

Mark’s view

I had this as AMBER following their FY results last year due to the large capex committed to developing Karo. Since then, the share price is down from 65p to 53p. However, the company’s strategy looks even riskier in a world where tariffs have the potential to significantly curtail commodity demand, so I maintain my wait-and-see stance.

Marks Electrical (LON:MRK)

Flat at 57p - Trading Update - Mark - AMBER/RED

Marks issues a multi-year profits warning in November with several issues contributing to their problems:

An new ERP system was reducing their capacity for deliveries

A move away from more premium products, which reduced order value per van.

I commented that this left them between a rock and a hard place; in order to try to recover profitability, they are going to have to forgo sales growth, and there may be a limit to the number of premium brand customers in the current market. They continue with this strategy saying:

We are actively pivoting the business back to our historically successful premium focus, in order to deliver an uplift in margin performance. This strategy is on-track and margins improved in the second half of FY25, despite a weak peak trading period. Our objective in FY26 is to continue to drive this sustainable margin recovery and this focus may be at the expense of revenue growth.

At the time of the profits warning, Canaccord cut 2025 revenue from £126m to £119.6m and EPS from 3.5p to 1.5p. So this appears to be a further revenue miss:

Record full year revenue of £117.2m (FY24: £114.3m) representing a growth rate of 2.6%.

They talk about margin improvements, so things may look better for the bottom line but I don’t think we can rule out this also being an EPS miss.

Outlook: They say:

As predicted, our H2-25 growth rate was impacted by the ERP switchover, resulting in a decline in revenue during the period of October to December, but this was quickly followed by a return to growth from January to March. This improvement in underlying growth momentum, with a strong exit rate in March of 6.6%, provides us with the confidence to maintain our guidance for the year ahead.

They will need to keep up this March exit rate over the next 12 months to hit Canaccord’s FY26 revenue forecasts, in tricky market conditions. Even if they do, it will put them on a 34x 2026 P/E.

Mark’s view

This still looks materially overvalued on any medium-term forecasts. That the share price hasn’t sold off further is probably because Frasers Group have been actively buying and are now the second-largest holder. Mike Ashley clearly thinks he can run things better, but with founder Mark Smithson still holding over 70% of the shares, it seems unlikely he can force the issue. Hence, it’s an AMBER/RED for me.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.