Good morning!

Welcome back to another week. Today's Agenda is complete.

2pm: let's wrap it up there, thank you!

US-China Trade Talks & Agreement

When I wrote The Week Ahead last week, I mentioned that there would be "ice-breaker" talks between the United States and China in Switzerland over the weekend.

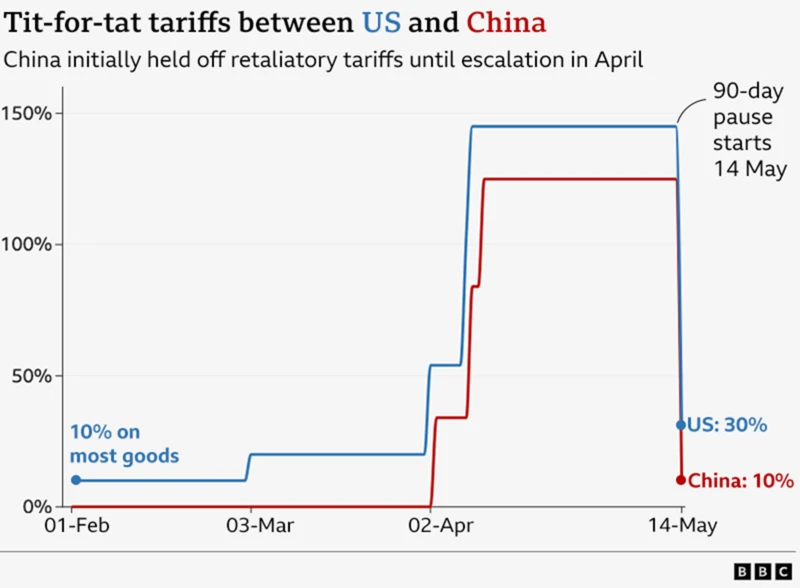

I did not expect - and I don't think anybody else anticipated it - that the two countries would almost immediately agree to reduce their tariffs by anything like this:

Source: BBC

For 90 days, starting on Wednesday, the US tariff on China is reduced to 30%, and the Chinese tariff on the United States is reduced to 10%.

These are still much higher than they were a few months ago. But I would expect the majority of trade to resume at these rates.

The two countries "will establish a mechanism to continue discussions about economic and trade relations". Perhaps this may lead to further progress and a normalisation of tariffs back to where they were before this episode began?

As I've been saying from the start, I think Trump's main objective is to be able to point to concessions he achieves from other countries. If he gets that, I think he's quite happy to drop tariffs.

The FTSE hasn't moved much today (+0.4%) but the S&P is set to open up nearly 3%.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

| Rio Tinto (LON:RIO) (£73bn) | Definitive Agreement for Winu Project joint venture | Press Release, not an RNS. Sumitomo Metal Mining will pay up to $430m for 30% JV equity share. | |

IG group (LON:IGG) (£3.8bn) | Ahead. FY25 revenue & adj PBT now expected to “meet or slightly exceed” top end of consensus. | GREEN (Graham holds) With accounting changes, a larger credit facility and a bond issuance, IG are going to have a great deal of flexibility when it comes to M&A, investment in their existing business and share buybacks. I remain a happy shareholder but will monitor their next moves carefully. | |

| Cranswick (LON:CWK) (£2.9bn) | Daily Mail abuse claims | SP down 8% Daily Mail article claims “horrific abuse” at one of Cranswick’s farms. | RED (Megan) I’d be inclined to steer clear of this one until it is clear that all of the rest of Cranswick’s farms are operating free of suspicion. |

Victrex (LON:VCT) (£788m) | Volume +16%, adj PBT -17% to £23.2m. Various headwinds. FY profit: “range of outcomes” | AMBER (Roland) A recovery in volumes has been driven by low-margin sales, with additional pressure from problems ramping up the group’s new China factory. The impact of tariffs remains uncertain and I can’t help feeling today’s outlook is potentially a slight cut to guidance. On balance, I’ve decided to moderate my view and turn neutral until clarity improves. | |

Frp Advisory (LON:FRP) (£336m) | Financial reporting advisory firm. £5.6m for business (5.1x EBITDA) plus £2.5m for net assets. | ||

Capita (LON:CPI) (£235m) | Support services for NHS England primary care practitioners. First 18 months worth £82.5m. | ||

Caledonia Mining (LON:CMCL) (£202m) | Revenue +46% to $56.2m, net profit +493% to $8.9m. Prod +9.3%. FY outlook unchanged. | ||

Tristel (LON:TSTL) (£188m) | Ophthalmic disinfectant foam approved. Positive signs of early adoption. | ||

Optima Health (LON:OPT) (£173m) | FY March 25 revenue down 4.5% to £105m, with H2 growth of 7%. There were two large contract reductions in late 2023. EBITDA to be in line with expectations. A note from Panmure Liberum today forecasts £17.6m of adj. EBITDA (consensus: £17.4m). | AMBER (Graham) [no section below] We checked in on this occupational health and wellbeing company for the first time in April - the stock has only been listed since last year, when it demerged from Marlowe. At 10x adj. EBITDA it doesn’t strike me as a bargain but I’m happy to keep an open mind for the time being. Earnings estimates have been stable/rising. It will be worth seeing how successful they are with bolting on a number of small acquisitions made in recent months, and I'm also keen to see how much adj. EBITDA converts to real profits and cash. The StockRanks seem to agree with my neutral stance (55/100), although they also categorise it as a "Momentum Trap". | |

Batm Advanced Communications (LON:BVC) (£69m) | $1.5m order from longstanding customer. Expects to apply this tech to its commercial products. | ||

Synectics (LON:SNX) (£58m) | Contract with Stagecoach to pilot a new “On-Board Hub” solution for vehicle tracking and safety/surveillance. | AMBER/GREEN (Roland holds) [no section below] | |

Venture Life (LON:VLG) (£58m) | Cash sale of contract development and manufacturing operations to a P/E-backed Italian company. Company now aims to be a pure-play branded consumer healthcare business. | AMBER (Roland) This disposal looks fairly priced and will allow VLG to deleverage and invest in future growth. However, near-term earnings could fall by a third and shareholders will receive no immediate benefit. So the acid test of this will be whether management can deliver on their aim of becoming a higher-margin, capital-light consumer brand business. Given the poor track record of shareholder value creation, I’m staying neutral for now. | |

Likewise (LON:LIKE) (47m) | FY December 2024: sales +7.4% (£149.8m). Adj. PBT £2m (LY: £2.3m). Confidence to achieve current mkt forecasts for FY25. Adj. PBT is forecast to increase to £4m this year and then £5.2m in 2026 (Zeus). Balance sheet strength: the company owns freehold properties worth £23.5m. Today’s balance sheet also shows total tangible net assets of £30m. | AMBER (Graham) [no section below] We’ve been AMBER on this one (e.g. see coverage by Roland in Feb). The growth prospects of this upstart company (rivalling Headlam) are interesting under CEO and 11% shareholder Tony Brewer, but from a sector point of value the valuation at a forward PER of 17.5x is off-putting. However, as the company executives on its plans, we should start to see positive operational leverage. So it does have the clear potential to grow into this valuation. | |

Iofina (LON:IOF) (£43m) | Rev +9% ($54.5m). PBT $4.8m (2023: $8.3m). Net cash $2.9m. “Investment for growth continues.” | ||

MTI Wireless Edge (LON:MWE) (£42m) | €1m contract from long-term customer in Italy to be delivered within 2025. | ||

Cyanconnode Holdings (LON:CYAN) (£29m) | Confirmation of award from Government of Goa’s Electricity Department (worth c. £70m). | ||

Cordel (LON:CRDL) (£14m) | Design & engineering group for rail transport buys Cordel’s LiDAR/AI tech. No financial figures given. | ||

Tan Delta Systems (LON:TAND) (£14m) | “A leading provider of intelligent monitoring and maintenance systems for commercial and industrial equipment.” Revenue down 16% (£1.2m). Loss before tax £1.17m. Cash £3.1m. Pipeline £35m (?!) | RED (Graham) [no section below] | |

Mycelx Technologies (LON:MYX) (£5.6m) | Rev halves to $4.9m due to sale of Saudi ops. Loss $2.6m. Cash $1.3m & $1.25 Saudi earn-out. | ||

Malvern International (LON:MLVN) (£4.8m) | Underlying revenue +38% to £14.7m. Underlying loss £0.1m (2023: profit £0.15m). |

Graham's Section

IG group (LON:IGG)

Up 1% to £10.98 (£3.9bn) - Update on trading and balance sheet management - Graham - GREEN

At the time of publication, Graham has a long position in IGG.

The last update from IG Group in March stated that the company was “confident of meeting FY25 consensus”.

That was before the tariff earthquake hit the financial markets, sending volatility to levels not seen for five years:

One of the attractions of financial trading platforms for me is their counter-cyclical nature: when markets move down suddenly, this spurs trading activity which is good for platforms like IG.

This brings us to today’s update. Note that their year-end is May, so Q4 is from March to May:

The business has performed strongly in Q4 FY25 as elevated volatility across a range of asset classes, particularly in April, has resulted in higher levels of client trading activity than expected in typical market conditions. As a result of the strong performance, the Group currently expects FY25 total revenue and adjusted profit before tax to meet or slightly exceed the upper end of the current range of consensus of £1,051.0 million and £516.3 million respectively.

The market correctly anticipated that IG would trade well in this environment: its shares are up 15% since the end of March.

I think the shares continue to trade at a P/E ratio of about 10x after this update.

Balance sheet management

The second half of today’s update is about the company’s plans for its surplus cash.

There is an ongoing £200m share buyback programme.

The company is now working on increasing its “distributable reserves by reducing its share premium account and merger reserve, with a corresponding increase in retained earnings”.

Let me explain what this means for anyone who might need clarity on it:

Every company’s balance sheet equity is divided into different categories, depending on where it comes from. Only the equity generated by the company’s profits is categorised as “retained earnings”.

When a company wants to declare dividends or buy back its own shares, it is supposed to do this using its retained earnings, not any of the other categories.

But when companies have more surplus cash than the notional value sitting in “retained earnings”, this can create a difficulty for them, as they can’t send all of this surplus cash back to their shareholders..

The solution (if they are legally allowed to do so) is to adjust their balance sheet, so that more of their equity is categorised as retained earnings.

Note that there are no real-world effects of this adjustment. It’s purely a change in the company’s financial statements. But once the adjustment is made, the company can legally send more cash to its shareholders.

The November 2024 balance sheet for IG had over £700m of equity classified within “share capital and share premium” and “merger reserve”:

Nearly all of this could potentially be freed up for shareholders, in addition to the company’s “retained earnings” of £1bn. That’s £1.7bn that in theory could be returned to shareholders.

However, that isn’t going to happen any time soon.

Firstly, the company doesn’t have £1.7bn sitting in cash. Own funds as of Nov 2024 were £1.05bn.

Secondly, there is a regulatory capital requirement of £300m+, and it’s prudent to keep significantly more than that on hand.

So I’m not expecting a £1.7bn windfall for IG’s shareholders any time soon. But it does sound like we could get some more aggressive dividends or buybacks. The existing yield on the StockReport is given as 4.6%.

In addition to the accounting change described above, the company might borrow to increase cash resources:

It has refinanced its credit facility from £400m to £600m.

It intends to issue “a senior unsecured bond to provide long-term financing”.

They conclude:

These actions provide IG with additional liquidity to continue investing in accretive growth opportunities and evaluate returning capital through share buybacks, all while safeguarding the Group's strong financial position.

IG has a well embedded capital allocation framework which has served the Group well. As previously announced, the Group is evaluating if the framework can be further refined and an update will be provided with the full year results on 24 July 2025.

Graham’s view

This is an important shareholding for me - my third largest holding - and my first priority is that they remain extremely safe from a balance sheet point of view. So I’ll be watching their next actions with great interest. I do agree that they can probably afford to boost shareholder returns, at least in the short-term or on a one-off basis.

The shares are at all-time highs but I still consider them to offer some value at a PER of 10x, given its status as a market leader, with a high-quality client base and a trusted brand name. So I don't have any major objection to share buybacks at this level.

The current CEO was previously COO of Paddy Power and CEO of Betfair, and was involved in the merger of those two companies. I think it’s a strong background to bring to IG.

In summary: I’m very much a happy shareholder, but I intend to keep a close eye on what they are about to do with their balance sheet, to make sure that I remain comfortable!

Megan's Section

Cranswick (LON:CWK)

Down 8% to 4960p (£2.7) - Allegations of abuse by Mail on Sunday - Megan - RED

The report from the Mail on Sunday following an undercover investigation at one of Cranswick’s farms in Lincolnshire makes for harrowing reading. The animal abuse which has been caught on camera by an undercover investigator for the animal rights organisation Animal Justice Project (AJP) is horrific and seems to have been carried out by multiple members of staff and the farm’s manager.

Major supermarkets have suspended supplies from the farm pending an investigation. While the AJP has filed a formal complaint to trading standards and is seeking prosecution of members of staff at Cranswick. The group’s founder told the Mail on Sunday: “This marks the start of a national, sustained campaign to expose the violent realities of pig farming in Britain. We will not be pulling any punches.”

This isn’t the first blow for Cranswick. Last month the company had plans for a mega-farm in Norfolk rejected after locals raised concerns about the conditions animals including pigs and chickens were being forced to live in.

The company is the biggest producer and supplier of pork in the UK, ‘finishing’ more than 34,000 pigs every week from its many thousands of farming locations across the country. This year marks Cranswick’s 50th anniversary and executives had been making plans to step up investment in genetics to continue improving the quality and efficiency of pork production. But an investigation into animal welfare even at one of the company’s farming locations is likely to throw a spanner in the celebrations.

Megan’s view:

From a purely moral perspective, this weekend’s revelation at Cranswisk is a major red flag. I have no interest in a company which cannot hold all members of staff accountable to basic levels of humanity.

From a financial point of view, the allegations also aren’t great. Suspension of trading from one farm isn’t a big deal, but supermarkets will be quick to sever ties with any farm where there is just a whiff of animal cruelty. And it’s likely that all of the company’s farms will now be subject to more intense scrutiny.

It doesn’t make for great optics when the company’s four executive directors paid themselves just shy of £10m (including £3.3m for the CEO) last year and have been profiting handsomely from recent share price gains.

I’d be inclined to steer clear of this one until it is clear that all of the rest of Cranswick’s farms are operating free of suspicion. RED

Roland's Section

Venture Life (LON:VLG)

Up 18% to 53p (£68m) - Cash sale of CDMO operations - Roland - AMBER

Sale of contract development and manufacturing operations and certain non-core products for €62m in cash on a cash free, debt free basis

Consumer healthcare group Venture Life is a big mover today after announcing the sale of its operations for a cash payment of €62m (c.£53m) – equivalent to over 90% of its £57m market cap prior to today’s open.

The assets being sold are Venture Life’s contract manufacturing and manufacturing operations and some non-core products.

The buyer is Italian firm BioDue, a contract development and manufacturing operation. BioDue is owned by private equity group Riverside.

Financial impact: based on the financial details provided today, the assets being sold contributed around 40% of Venture Life’s revenue last year and a similar proportion of its profits. The key figures for the disposal are:

Net carrying value: £28.9m

2024 revenue: £20.5m

2024 adjusted EBITDA: £4.9m

2024 pre-tax profit: £0.3m

On these figures, today’s deal values the assets at 10.8x EBITDA or 2.6x sales, which seems like a reasonably good result to me.

The majority of proceeds from this deal will be used to repay the drawn balance on Venture Life’s credit facility, which stood at £20.6m on 30 April 2025. Remaining cash will be used to invest in its existing brands and potentially pursue further acquisitions.

Strategic rationale: these disposals will leave Venture Life as a capital-light business that’s focused on its core, owned consumer healthcare brands. These are said to be higher margin and with superior growth potential.

The company seems to be following the recent playbook of consumer giants Unilever (I hold) and Reckitt by focusing on a group of “Power Brands”. For Venture Life, these are Balance Activ, Health & Her, Lift, Earol, Pomi T, Gelclair.

Venture Life will continue to employ the manufacturing services of the divested business to produce its products and has signed a 10-year deal with BioDue for “development and manufacturing services”.

Outlook & Estimates: broker Cavendish has kindly provided an updated note today with revised forecasts reflecting today’s news.

Cavendish’s analysts expect to see a significant drop-off in revenue and earnings this year before a return to growth, but are projecting improved operating profit margins from continuing operations:

FY25 new: revenue £43m / EPS 4.2p (previously: £66m/6.3p)

FY26 new: revenue £47.1m / EPS 5.8p (previously: £71.6m/7.7p)

These estimates price the stock on around 12.5x FY25E earnings following this morning’s gains.

Roland’s view

Today’s disposals appear to have been made at a fairly attractive price and will substantially strengthen Venture Life’s finances.

However, as a result of this disposal, near-term earnings could fall by a third and the need to repay debt means that shareholders will not receive any kind of direct return to compensate them for this loss of earnings.

In my view, the success of this deal (for shareholders) will depend on whether Venture Life can now transform itself into a more profitable business.

At a statutory level, Venture Life’s profitability has been extremely poor in recent years:

Without further research, I’m not sure if this reflects weak pricing power, lack of scale, or simply poor management, but it’s not been a good outcome for shareholders.

A business that generates such low returns will struggle to create any long-term value for its shareholders.

Compare the two charts below showing Venture Life’s revenue growth and its share price performance over the last 10 years – revenue has gone up, but the shares have gone down. Shareholders have also suffered significant dilution:

I can see some positives from today’s deal, but I’d like to know more about the performance of the group’s continuing operations before taking a positive stance. Can this leopard really change its spots?

At this point, I’m going to echo the StockRanks and remain neutral.

Victrex (LON:VCT)

Down 4% to 870p (£757m) - Interim Results - Roland - AMBER

Victrex plc is an innovative world leader in high performance polymers, delivering sustainable products which enable environmental and societal benefit. This announcement covers interim results (unaudited) for the 6 months ended 31 March 2025.

Today’s half-year results from Victrex are a little weaker than I was hoping to see following December’s full-year results, which I covered here. The market also seems a little disappointed, as the shares are down despite a general rise for industrial stocks reflecting hopes for a US-China deal.

Following December’s results, I was hopeful that signs of improved volumes would translate into a recovery to profits.

Today’s half-year results do report a further improvement in volumes, but there’s no evidence yet of this translating into a recovery in profitability. Instead, various headwinds appear to be holding back profitability.

Half-year results summary: I’ve pasted in the financial highlights table below to show the different moving parts at work here.

I think it’s worth noting how the lower average selling price means gross profit is lower, despite the increase in volume and revenue. This highlights the relatively commoditised nature of Vixtrex’s core PEEK business. While the company is trying to move away from this by selling more added-value finished products, this transition clearly remains a work-in-progress.

Management say there were a number of reasons for the lower gross margin and fall in underlying pre-tax profit:

Adverse currency rates (-£5m on revenue);

Changes to sales mix (see below);

Slower-than-expected ramp up of new China factory, which is now only expected to sell 50 tonnes this year, versus 100t-200t previously.

Looking at the divisional breakdown, my feeling is that the main reason for the fall in average selling prices and gross margin was the unfavourable selling mix:

VARs are value-added resellers. These are customers who buy PEEK from Victrex as a raw material at lower average selling prices than industrial customers buying finished parts. VARs then process the PEEK into products for further resale.

Victrex wants a bigger share of this business and has product development ‘Mega Programmes’ underway in various key segments. But as the table above shows, the group is still dependent on commoditised sales to VARs for more than 40% of its volumes, a situation that worsened in H1.

In fairness, performance across most other customer segments was respectable during H1. The only real weak spot was the automotive sector, which offset gains in aerospace. That seems unsurprising, given the broader backdrop for car manufacturers at the moment.

Balance sheet/dividend: net debt was £40.7m at the end of March, up from £21.1m at the end of September 2024. This looks manageable enough to me and cash generation remains good, with my sums suggesting more than 100% of net profit for the period was converted into free cash flow.

On this basis, I suspect the dividend will remain sustainable despite the slender level of earnings cover:

Outlook: management expects profitability to improve during the second half of the year:

We are targeting a substantial improvement in H2 PBT compared to H1. This is supported by the typical second-half weighting of profits, as well as the current volume momentum driven by Sustainable Solutions.

However, they also warn that the headwinds seen in H1, particularly the ramp up of the new China factory, will continue to affect profitability in H2. Victrex then provides full-year guidance that in my view, is unnecessarily confusing:

These factors, and other previously guided headwinds, including FX, will constrain PBT growth for H2, compared to H2 2024, though we expect these to ease into the next financial year. Given macro-uncertainty, together with the effects noted, we have a range of outcomes for full year profit. For H2, our target is to deliver PBT similar to H2 2024, driving some PBT growth in constant currency on a full year basis.

I think this is an interesting contrast with February’s AGM update, when Victrex made a clear statement that “full-year expectations are unchanged”.

Expectations are not mentioned in today’s results. I don’t have access to broker notes for Victrex, so I can’t be sure. But my feeling is that today’s results could prompt a slight downgrade to earnings expectations for the full year.

Prior to today, consensus forecasts suggested earnings would rise by 18% to 61.1p per share this year.

Roland’s view

In situations like this, identifying whether the problems are transient external issues or more structural problems can provide useful insight on valuation.

In this case, I think there’s a mix of issues. Problems with the ramp-up of the new China factory will presumably ease over time. FX movements also tend to balance out over long periods.

However, the company admits to some uncertainty over the impact of tariffs. At this stage, it’s probably difficult to be sure how this will play out. I wonder if there’s a risk that the economics of the new China plant could end up being less favourable than originally expected.

Similarly, while the company is making progress with its higher-margin industry-specific programmes, it’s the lower-value VAR segment that’s driven most of the recent recovery in volumes.

I’m still optimistic that Victrex can expand its higher-value offerings over time, but I think it faces more competition than – say – a decade ago. I suspect it may struggle to regain some of the profitability that’s been lost over the last five years:

I’m also not sure whether today’s outlook guidance was a slight profit warning in disguise.

The 6%+ dividend yield is still tempting for me. But Victrex’s subdued profitability and increased net debt position are less appealing. With the shares still trading on c.14x FY25 earnings, I don’t think Victrex is necessarily cheap based on near-term expectations.

On balance, I’m going to take a slightly more cautious view than I did in December, moving my view down to neutral (AMBER).

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.