Good morning!

Greece

Grexit now appears to be off the table, with an all-night EU leaders conference apparently having thrashed out an outline agreement. So we're seeing a bit of a relief rally in UK shares this morning, although I think the market had correctly anticipated that a compromise would in all probability be reached.

No doubt the next panic will be whether the Greek Govt is able to pass the necessary legislation internally, or whether the Govt collapses, triggering elections? So I'll be keeping an eye on things, but personally it's only having a marginal effect on my portfolio decisions. Let's hope they get things properly sorted, so that Greece doesn't descend into a humanitarian crisis. Although things are bad in Greece, it's nothing compared with the terrible conditions being endured by people elsewhere, e.g. Syria - evidenced by the large numbers of people risking the dangerous crossing by sea, and arriving in packed dinghies in e.g. Lesbos - there was a fascinating TV programme about that last week.

M&A

Another interesting investment theme which I've mentioned recently is the surge in M&A activity - in particular, the high ratings for US companies means that they are hunting for relatively cheap acquisitions in the UK.

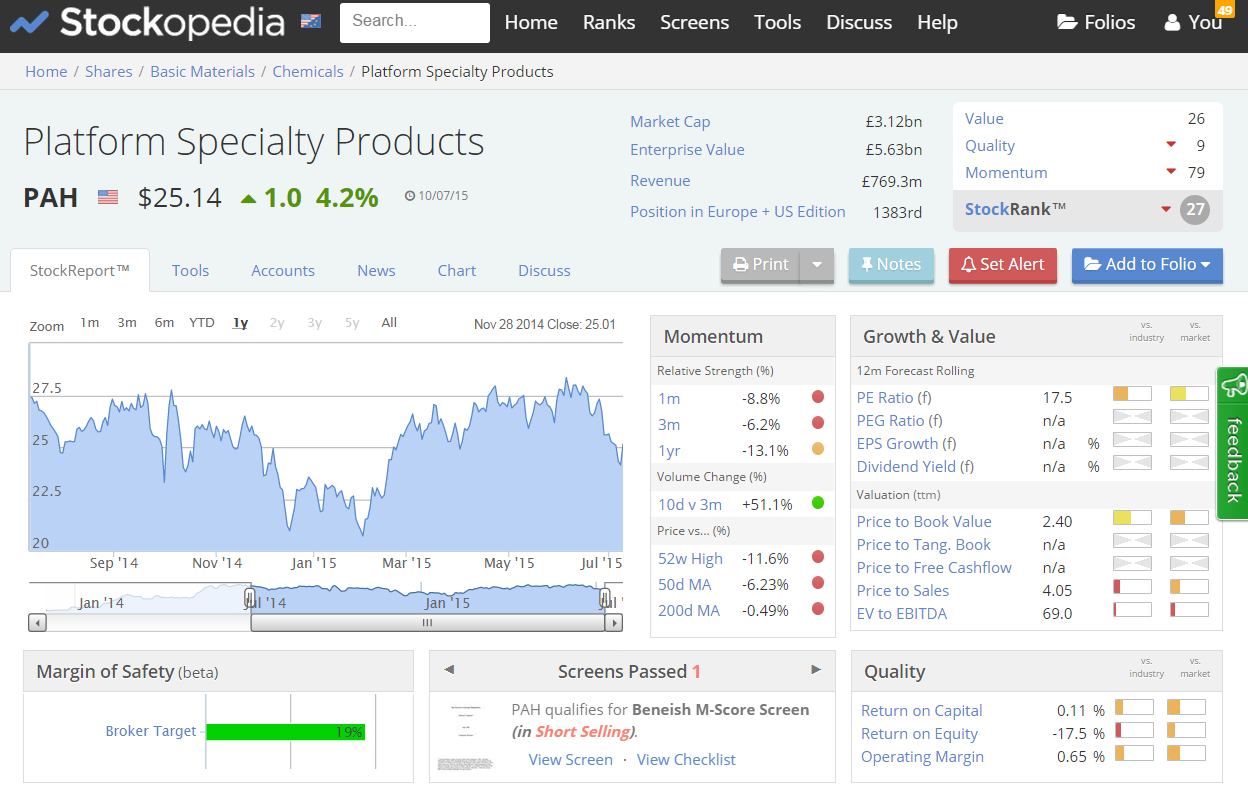

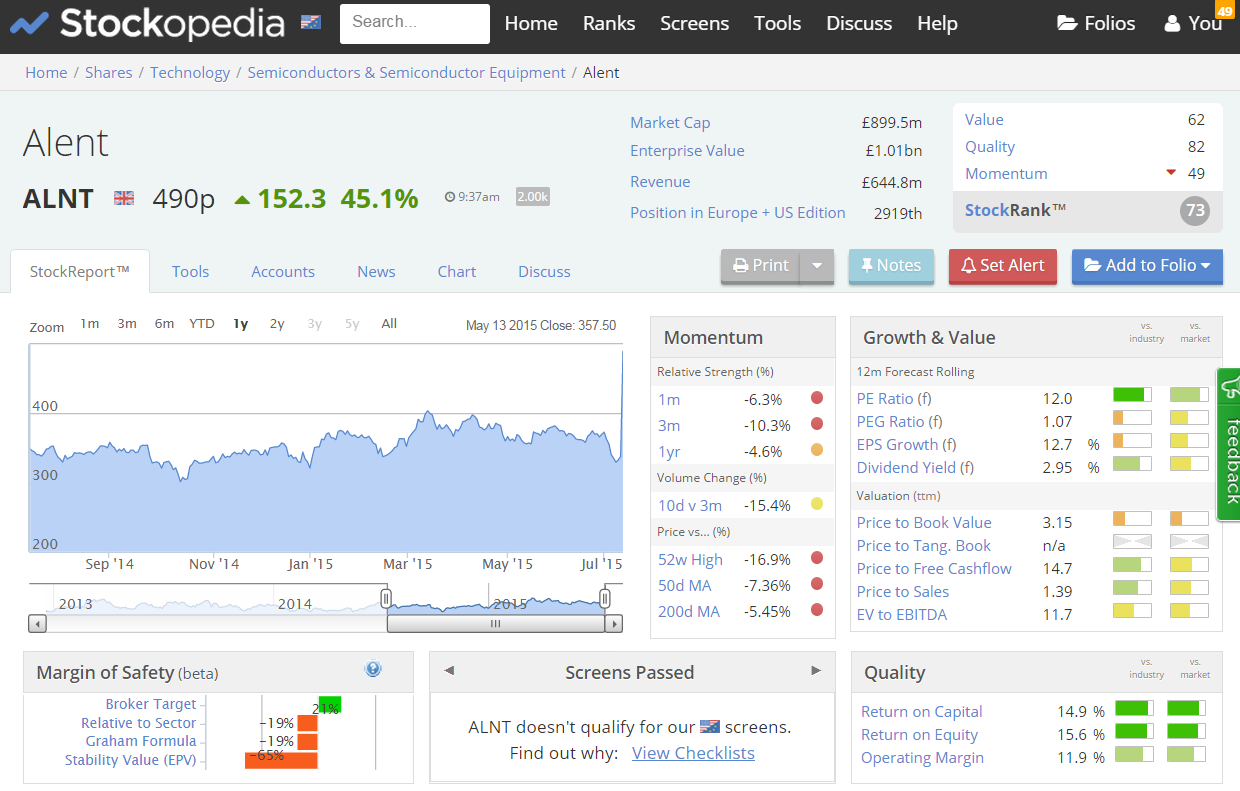

Today there is another deal announced - Alent (LON:ALNT) is up 45% this morning on news of a cash bid at 503p per share from a US company called Platform Specialty Products Corp. I'm lucky enough to have the European & US data on Stockopedia, so I've had a quick look at the StockReport for Platform Specialty Products (LON:PAH) and it looks pricey - a fwd PER of 17.5 looks high, given that Platform has a lot of debt, and a weak balance sheet (which is negative once you write off intangibles). Although scanning the news announcements from the company, it seems to have raised fresh equity and bonds since the last balance sheet date of 31 Dec 2014.

Here's the top part of the StockReport for Platform:

Contrast that with the target company it's buying, Alent (LON:ALNT) and you can see why the highly rated & heavily indebted US company sees the UK company as a bargain:

So I hope some of the M&A activity spills over into the bottom end of the market too, where I rummage around for bargains. Having a focus on value, and GARP, my investing approach does tend to happily see takeover bids quite often, which providing they are at a decent premium, is a good way to exit, and free up more money for new investment ideas.

Although I'm not at all happy at the latest takeover happening in my portfolio, that of Essenden (LON:ESS) - which is at a very poor price, where a major shareholder has obviously twisted the arms of management to agree a deal which seems very poor for other shareholders.

Sprue Aegis (LON:SPRP)

Share price: 330p (up 9% today)

No. shares: 45.5m

Market cap: £150.2m

Trading update - today's statement from this smoke alarms company reads well, and patient bulls have been rewarded with a strong share price recovery over the last 3 weeks. This got me thinking about charts - some investors swear by the chart - saying that it will indicate to you in advance how the company is performing, because insiders will be buying or selling.

However, the chart at SPRP disproves this, and I can think of lots of other examples where big rises and falls in share price have been completely spurious. The only conclusion I can come to, is that large movements in share price may, or may not be related to fundamentals! Which isn't a lot of use really, is it?!

Note also the huge spike down (as indicated by the spikes on the candlestick chart below) in late Apr 2015, where a trading update seemed to cause investor confusion (hence the wild gyrations in share price on the day):

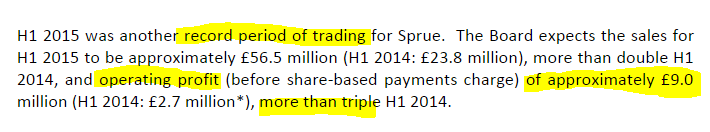

Today's statement reports excellent profits growth for H1:

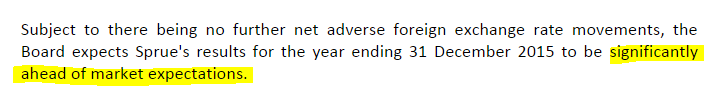

Bear in mind that the broker forecast shown on Stockopedia is for full year profits of £8.46m, but they have done more than that in just H1. So it's no surprise that the outlook statement today says (inter alia):

Net cash - has risen significantly, helped by a number of factors beyond just strong trading, such as extended credit terms with a supplier.

Currency movements - what's all the more remarkable, is that this excellent performance has been achieved despite currency movements being particularly costly. This reduced the gross margin from 37.4% to 29% in this period, which is a huge impact. The company quantifies this by saying that profits would have been an astonishing 68% higher, at constant currency.

I am surprised that the company left itself so exposed to currency movements, although it sounds as if they are addressing that by having agreed to buy in sterling from 1 Apr 2015. Although there's always the risk that companies put in place currency hedging arrangements after a heavy loss, and then miss out on the profit from that currency move reversing.

Sales in France - the company reiterates today that the bumper H1 trading was due mainly to surging sales in France, which look to be a one-off factor, driven by a legal requirement for landlords to fit smoke alarms in rented properties:

Also note that the order book for France has already "softened considerably".

Valuation - this is tricky, because it would be wrong to value the company based on EPS for 2015, since this is likely to be a one-off good year. It's more important to ascertain what the ongoing level of profitability will be.

So whilst broker forecast EPS of 18.0p for this year is likely to be thrashed - it wouldn't surprise me if the company delivers say 25p EPS this year. However, that is very likely to fall sharply next year. So the existing broker forecast of 17.0p EPS for 2016 is probably the more sensible figure to use as a basis for valuation.

Bearing in mind the significant cash pile, I think you could justify a valuation in the range of about 15-20 times 2016 earnings. That arrives at a valuation of between 255p to 340p. So at 330p the current share price is near the top of that range.

My opinion - with hindsight, it would have been a cracking buy 3 weeks ago at about 260p, indeed it was getting close to the point where I was interested in buying - my report here on 3 Jun 2015 concluded that there might be about 10-20% upside on the share price of 287p, but it wasn't sufficiently compelling.

Given the likelihood of earnings having peaked, and set to fall next year as demand in France dries up, I'd be more inclined to think about selling rather than buying, given the recent strong surge in price.

Conviviality Retail (LON:CVR)

Share price: suspended on 9 Jul 2015 at 155p

No. shares: 66.9m

Market cap: £103.7m

Results 52 wks ending 26 Apr 2015 - this company is not one I follow closely, so hadn't spotted that its shares were suspended last week, pending the issue of a prospectus for a reverse takeover deal (i.e. where the target company is bigger than the company buying it).

I'll come back to that later, but firstly looking at the results, they don't look madly impressive to me. Pre-exceptional profit fell slightly, from £10.0m last year, to £9.8m this year. Profit before tax rose vs last year, but that was due to the reduced finance costs line on the P&L.

Note that it's a low margin business, wholesaling alcoholic & other drinks to a chain of mainly franchised stores. So the operating margin is only 2.7% on turnover of £364.1m for the year. That doesn't leave a lot of scope for bad debts, if & when franchisees go bust.

Balance sheet - not madly impressive, but not worrisome either. Net tangible assets are only £8.0m, although it's very much what I think of as an "in & out" balance sheet - i.e. they buy stock, then sell it on in smaller parcels to their franchisees. So they just have continuously rotating stock and debtors on the assets side, and trade creditors on the credits side.

The current ratio looks a bit weak to me, at only 1.0, so this could mean that the company is not able to negotiate early payment discounts from suppliers - which could be a material benefit for a high turnover, low margin business like this. So there is a good case for them strengthening their balance sheet with an equity raise.

Reverse takeover - details are scarce at the moment, but the target company is a drinks wholesaler called Matthew Clark (Holdings) Ltd. Thanks to Companies House now giving completely free access to data on their website (a wonderful development!), I've had a quick look at the accounts of MCH, and it's over double the size of CVR.

MCH's latest accounts show turnover £811.2m, and an operating profit of £18.0m, for the year ended 28 Feb 2015. It has a sound balance sheet (better than CVR's!) so this is clearly not a distressed sale. There would be obvious benefits from combining the two businesses, with increased negotiating power for purchasing, so it looks a sensible deal to me, depending on the price to be paid.

I can't see anything in the results statement today about the proposed acquisition of MCH, and since that will dramatically increase the size of the group, I'll hold fire on any further comments until the prospectus has been published. Clearly there will have to be a substantial equity fundraising, since CVR doesn't have the firepower to buy MCH from its existing resources, and it would be crazy to try to buy it using debt.

I have to leave it there for today, as am returning to Hove from London, due to seeing the dentist tomorrow - one of my molars disintegrated last week, so needs fixing. Therefore tomorrow's report will be earlier, but a bit shorter than usual.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions. A fund management company with which Paul is associated may hold positions in companies mentioned.

NB. These reports are only Paul's personal opinions, and are never financial advice nor recommendations. We urge readers to do your own research, and not rely on Paul's opinions).

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.