Good morning!

Some readers were asking about the spreadsheet for this report - here's the link. I've updated it to the middle of March, and will bring it further up to date soon. Cheers!

Graham

The Agenda is complete.

1.30pm: I'm afraid I've run out of time there. Have a nice weekend!

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

| Land Securities (LON:LAND) (£4.5bn) | Final Results | EPRA earnings £374m (FY March 2024: £371m). NAV 877p (share price 589.5p). LTV ratio now 38%. | |

Vesuvius (LON:VSVS) (£930m) | Full year results to be slightly lower than previous guidance although high level of uncertainty. End markets remain challenging. Direct effect of tariffs expected to be neutral. | AMBER (Graham) [no section below] I’m reluctant to give this a BLACK as a fully-fledged profit warning, as new guidance is only “slightly” below, with a high degree of uncertainty, and they say that “the year has started as we expected”. With limited growth apparent, we have been struggling to get excited about this one. I’ll leave the AMBER from our last coverage unchanged. | |

| Dowlais (LON:DWL) (£904m) | Update on Combination and Secondary Listing | American Axle announces that it intends to seek a secondary listing on the LSE after the acquisition. | PINK (Graham) [no section below] |

| Workspace (LON:WKP) (£872m) | Post-close Financial Update | Profit warning. SP down 8% FY March 2026: several factors causing £7m headwind versus trading profit consensus £66-72m. | BLACK (AMBER) (Graham) Cutting my stance on this in light of the profit warning. If we take the long view this may still be too cheap, but management need to sort out the occupancy problem to prove this. |

| Future (LON:FUTR) (@794m) | Half Year Results | Profit warning. Given macro uncertainty, it is prudent to adopt a more cautious view on H2. Expects low single digit decline in FY 2025 organic revenue. | BLACK (AMBER/GREEN) (Megan) |

| Craneware (LON:CRW) (£726m) | Statement re Possible Offer | SP +9% Bain Capital notes the recent share price movement and confirms it is assessing a possible offer for Craneware. The evaluation is highly preliminary in nature. | PINK (Graham) [no section below] It’s probably no surprise that an American private equity outfit would potentially put a higher value on Craneware than the stock exchange will. Craneware’s area of focus is the US healthcare industry and perhaps it makes sense for it to ultimately have American owners. |

| Character (LON:CCT) (£47m) | Half-year Financial Report | SP down 5% Revenue down 8%. 20% of revenue is from the US and the company previously withdrew market guidance for FY August 2025. Customers have become increasingly cautious and are not committing orders to expectations, impacting sales in all key territories. | BLACK (not technically a profit warning as there is no guidance!) (AMBER) (Graham) Great cash and asset backing underpins the market cap, and in the long-term I’m still a believer. In the short-term, the outlook is cloudy to say the least. |

Volvere (LON:VLE) (£46m) | Revenue +14% (£49m), PBT +74% (£6.34m), thanks to the strong performance of Shire Foods. Net assets per share +16% (£17.20). Cash and liquid investments covering 60% of the market cap based on yesterday’s close. Shire Foods outlook: food price inflation is inevitable in 2025. Could lead to a reduction in volumes but “we expect the business to deliver a creditable performance”. New equipment will be installed to increase capacity and reduce labour costs wherever possible. | AMBER/GREEN (Graham holds) | |

| Staffline (LON:STAF) (£34m) | Contract Win | Significant strategic partnership with food and drink supply chain management and logistics provider. Financial details not given. | |

| Eenergy (LON:EAAS) (£19m) | £100m Partnership with Redaptive | SP +27% Redaptive is a US-based Energy-as-a-Service and data solutions provider. It will fund up to £100m to support eEnergy customer projects in the UK. |

Graham's Section

Volvere (LON:VLE)

Unch. at £20.60 (£45.4m) - Final Results - Graham - AMBER/GREEN

At the time of publication, Graham has a long position in VLE.

I’ll try keep this brief as I’ve already outlined my view in the summary table and there are other stories to cover today.

Today’s results from Volvere are excellent in every respect.

Shire Foods, the company’s only operating subsidiary, is an Aldi supplier and has gone from strength to strength thanks to its own successful execution along with Aldi’s UK expansion.

And while today’s 2024 results are excellent, I’d like to think that 2025 won’t be any worse. Consider that Aldi is set to invest £650m this year in 30 new stores.

Shire’s long-term trajectory is terrific. Since 2020, revenues are close to doubling and profits have multiplied:

(Side note: 20% of Shire is owned by employees, which is great for alignment but does reduce the value of VLE when we calculate its sum-of-parts.)

Cash and liquid investments: £27.8m, of which £25m is cash and £2.8m is “a liquid FTSE stock”. Volvere has made an unrealised gain of £1.19m on this position.

Outlook at Shire: The Cliff Notes version of this section is that the food industry is under pressure from cost inflation, which means that price inflation is inevitable. It’s possible that Shire Foods might suffer from lower volumes if this hurts consumer demand, but Volvere will continue to invest for additional capacity and greater labour efficiency.

Strategy:

We are continuing to review potential acquisition opportunities across all sectors. Whilst no transaction of interest has been identified for further investment, we remain committed and poised to do so for the right proposition. The strength of our balance sheet unpins this readiness and willingness to invest…

I have met with many shareholders over the last 18 months who have expressed their support for our strategy and approach. It is that support, much of it over a very long period, which has given us the confidence to pursue our aims and deliver the shareholder value that we have, albeit that there is further work to do in that regard.

Graham’s view

In March, I suggested that Volvere’s break-up value should be at least £50m, or £22.70 per share.

That was based on a trailing earnings multiple of 6x for Shire, which I consider to be very much a low-ball estimate of Shire’s worth. A multiple of 12x could be attainable, in my view.

As I did in March, let’s take 80% of Shire’s underlying PBT for 2024 (£6.2m). Apply tax to that and then a multiple of 6x and we get a value of £22m.

Add the value of the cash and liquid investments and we again get a £50m break-up value for Volvere. With 2.2 million shares outstanding, the value per share is again in the region of £22.70.

If we value Shire at 12x trailing earnings, this improves to £32.85 per share.

So this is my fair value range for Volvere, ranging from a low-ball estimate to something more reasonable.

So why am I interested in selling my Volvere shares? A lot of it has to do with the fact that it’s now 32% of my single-stock portfolio. I never intended for it to get this big. If it was 5% (or even 10%!) I’d be much more relaxed about it. The share price has more than quadrupled during my holding period, for which I am very grateful.

The second reason I’m interested in selling, as I explained here last time, is due to the management situation and the tragic loss of Jonathan Lander in 2023. I wish his brother Nick Lander every possible success.

But I don’t know for how much longer I will be a Volvere shareholder.

I’m AMBER/GREEN on the stock as I still think it offers plenty of value and has the potential to generate good returns for shareholders, although with less conviction than I had before.

Stockopedia rates it as a Super Stock, with a StockRank of 95.

Character (LON:CCT)

Down 4% to 245p (£45m) - Half-Year Financial Report - Graham - BLACK (AMBER)

It’s an interesting results table from Character, with revenue down 8% but adjusted PBT holding unchanged at £2.1m (vs. H1 last year).

The company provides a nice summary:

Overall, despite the harsh trading conditions experienced in the lead up to and through the all-important Christmas period, the Group's performance is testimony to the management's ability to read the market and produce and distribute products that capture the imagination of, and enable quality play by, the children that ultimately determine the success or failure of toy products.

Actual, unadjusted PBT is up from £2.2m last year to £3.2m this year.

The reason is that the company made some FX hedging trades that were profitable on paper during the period, boosting results by £1.1m. These profits are excluded from the adjusted results, so the adjusted results end up being much lower than the actual results.

(This might be counterintuitive - but perhaps it makes sense not to exclude hedging profits from adjusted results? Assuming that the trades were used only to reduce the company’s exposure to currency movements, then any profits from these trades should be offset by corresponding FX losses - losses that were not the company’s fault. So I think you can make an argument that it’s fine to include profits from hedging activities in your analysis.)

One reason for the good performance, despite the revenue decline, was a strong gross margin of 29%, higher than last year.

Net cash: £16m. This covers a nice chunk of the market cap.

Net assets: £38.7m, almost fully tangible, and not far off the market cap.

Buyback:a £2m buyback announced back in October 2024 still has some unutilised capacity.

Outlook: this section is a little spooky, as the company has already withdrawn from providing any guidance for investors, but management themselves sound disappointed by current trading.

After explaining that 20% of their sales are to the United States, and with substantially all of their products manufactured in China, they say:

The 90-day reduction in tariffs between the USA and China announced on 11 May 2025 gives hope for a negotiated resolution, although this remains uncertain at this time. The uncertainty flowing from the imposition of these tariffs has been felt in other parts of the world as customers have become increasingly cautious and are not committing to orders to our expectations. This is impacting sales in all our key territories. Despite this, the Board remains confident that the Group will be profitable in the current financial year as a whole, although it is too early to forecast short to medium term trading at this juncture.

Graham’s view

I downgraded this by one notch last time and I’ll downgrade it again today, again by one notch, in light of the commentary that customers in all of their key territories are not committing orders to their expectations.

That strikes me as a serious statement and would in ordinary circumstances produce a profit warning - except that a profit warning isn’t technically possible here, as there is no profit guidance!

On the positive side, the company remains very well capitalised in terms of balance sheet strength and the cash balance. It should almost certainly be able to afford a couple of tough years, if necessary.

Another positive for me is their reporting style: nice and simple, and to the point, as small-cap reporting should be.

The longer the timeframe, the more attractive this one appears to me. But in the short-term the prognosis is extremely cloudy - proceed with caution.

Workspace (LON:WKP)

Down 8% to 417p (£801m) - Post-Close Financial Update - Graham - BLACK (AMBER)

Workspace Group PLC ("Workspace"), London's leading owner and operator of sustainable, flexible work space, provides an unaudited post-close financial update for the financial year ended 31 March 2025 and expectations for the year ending 31 March 2026.

Workspace has 60 locations across London including offices, studios, "light industrial", and workshops.

I looked at it for the first time last month (share price that day: 428p) and after a quick review I was happy to give it the default “AMBER/GREEN” that I give to most REITs and investment trusts in the current environment.

The year just finished, FY March 2025, is in line for trading profit.

Workspace does face some challenges, however, and it quantifies that today with the statement that there is a headwind of £7m against FY March 2026 trading profit. The consensus for this was £66-72m, so that’s a 10% downgrade.

Factors affecting performance are stated as: “a lower opening rent roll, further large unit vacations, additional costs associated with macroeconomic pressures including higher national insurance and higher living wages and additional refinancing costs”.

A new strategic update will be published with full-year results in June.

That appears to be badly needed. As I noted last time, the company is not achieving an acceptable level of occupancy across its portfolio - only 83% according to the previous update, and under pressure from new vacations.

Unfortunately today’s update necessitates that I downgrade our stance, although this is another instance where long-term holders might be able to stick around long enough to see a recovery.

There is going to be a “marginal” fall reported in the value of the company’s properties, but net tangible assets were last reported at £7.85 (Sep 2024). From that figure I’ll deduct the recent interim dividend, to get c. £7.76.

With the share price languishing at only £4.17, a discount of 466% to that figure, there is a case to be made that too much pessimism has been priced in. But now it’s over to management to fix the problems and improve occupancy.

Megan's Section

Future (LON:FUTR)

Down 4% to 716p (£764m) - Interim results - Megan - BLACK (AMBER/GREEN)

As a financial journalist, I have always had a keen interest in the publishing industry. And Future is a company which I have tended to steer well clear of - my former colleagues in the print publishing world used to talk about the risks of getting a job at a Future publication, such was the rate of staff turnover and redundancies.

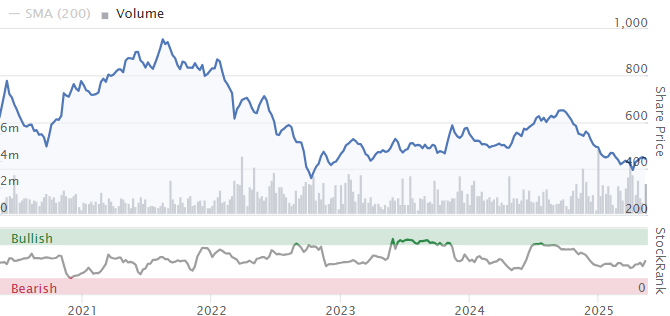

In my book, culling content producers is not a good way for a content producing company to grow. And so it has proved. Future has been a shocker of a stock in the last five years, falling from a post-pandemic peak of 3,804p to 716p following this morning’s profit warning.

But there is no denying that it is now cheap, especially considering its cash flow credentials. As Roland pointed out at the annual results, the company generated free cash flows of £156m in FY24, which left the company yielding 15% on a free cash flow basis. The share price has fallen even further since then, despite the fact that management and brokers are confident in a recovery in earnings in the current financial year. Shares are trading on a PE ratio of just 5x forecast earnings.

This has certainly got the hallmarks of a good contrarian stock (and that is the current StockRank designation). So is it time for me to hang up my hang-ups about Future?

Little reassurance from interim results

Starting with today’s interim results announcement.

New chief executive Kevin Li Ying has issued a profit warning. It’s not a major ‘rip up the expectations, start with a clean slate profit warning’ that could be expected of a new CEO. Instead the announcement is:

Given ongoing macroeconomic uncertainty, the Group believes it is prudent to adopt a more cautious view on the second half and expects a low single-digit decline in FY 2025 organic revenue.

That compares to previous expectations of:

Revenue down 1.4% to £776.9m (range £758.5m to £785.4m)

Adj operating profit down 2% to £217.8m (range £197.3m to £223.0m)

In the first half, sales fell 3% to £378m (or a 1% decline after excluding the impact of FX movements). Reported operating profits were up after a decline in sales costs (£212m), amortisation (£33m) and the mysteriously labelled ‘other administrative expenses’ (£39m) which presumably includes marketing activities, because I can’t see them written down anywhere else.

The company insists on stripping out a lot of these costs from its chosen profit metrics ‘adjusted operating profit’ and ‘adjusted EBITDA’, both of which were down by 3% and 4% respectively. Management blames this on something called the ‘annualisation of investment’ which, if you do a bit of digging, translates into ‘paying staff slightly more’.

Now, aside from the horrible jargon, I like the fact that the management team who have been in charge since 2023 (and who Kevin Li Ying seems to be a continuation of) have bucked the trend of culling staff, which was the key business strategy of the previous executive team. Incidentally, the previous CEO but one, Zillah Byng-Thorne (who oversaw the stingy investment in staff), was ousted over controversy surrounding her own multi-million pound pay packet.

It baffles me how many leadership teams, especially those whose businesses rely on people, choose to cut costs via redundancies of the people who are required to power growth. And instead justify their exorbitant pay packets by bulking the top line with acquisitions. Let’s hope we have seen the end of that activity at Future.

I digress. Back to the numbers.

B2C sales, which make up the bulk of the top line at Future, were down 3% (flat after excluding FX) at £129m. This came from another difficult fall in digital advertising, which is a continuation of the trend seen by Future and its peers in the last few years. There is better news from e-commerce (when the company gets paid for clicks through their articles) and magazine sales, both of which were up in the period. Of all its 200 magazines, management calls out The Week Junior as its star performing title, which doesn’t surprise me. It’s a brilliant publication, which the company has evidently rallied around to help boost circulation.

GoCompare, which was acquired in 2021, is struggling in a weak car market. Car insurance provides the majority of the revenue at this price comparison site. It remains highly profitable though - adjusted operating margins were 35% in the first half.

But it’s B2B which seems to be really troubling. The contribution to the top line is small, but a 15% decline in sales to £27m isn’t great. It’s also barely profitable, with adjusted operating profits of £6.7m in these numbers.

More stable financial footing

Having borrowed exorbitantly to fund ten years of pay-packet boosting acquisitions, Future is now in the business of paying down its debt. Last year, the company paid back a total of £93m in borrowings and in these numbers total debt (excluding lease liabilities) stands at £297m. Cash and cash equivalents are £56m.

Future’s debt doesn’t come cheap, with an interest rate of 6.39%. Interest payments have therefore started to decline as the company pays back some of its borrowings.

Cash inflows from operations remain decent and the company seems to be investing quite sensibly in capital expenditure, including £6m on all important web development. I’m not sure that the buyback scheme is the best use of £40m of cash (which is equivalent to 71% of the cash generated from operations in the period), but perhaps the finance team are seeking to benefit from the current low share price.

Megan’s view

I really struggle to be dispassionate about Future. Perhaps because I believe it has been poorly managed and is thus doing a disservice to an industry that I love and believe in.

But these numbers aren’t bad. It’s good to see the company returning some of its borrowing, investing in staff and rallying around its key assets.

This morning’s announcement is a profit warning, but it’s not a major one. I’ll await more details in the annual numbers before turning fully positive, but am (perhaps surprisingly) happy to stick with Roland and Graham’s AMBER/GREEN.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.