Good morning!

(at the time of writing, I hold a long position in ENTU)

For anyone who missed it, Entu (UK) (LON:ENTU) rushed out their interim results two days early, yesterday afternoon, presumably because the share price was in freefall. I interrupted my siesta to update to yesterday's report, reviewing the figures and outlook.

It's funny how different people see things differently. Reading the comments from other investors, some seemed reassured that the figures were not as dire as the plunging share price suggested. Others thought the fall in profits in H1 was terrible, and that the cashflow looked suspiciously weak.

My view is that the most important thing is the outlook statement. In this case the company confirmed that it's trading in line with full year expectations, and that they expected a soft H1 - if so, why didn't they previously communicate that to the market, I wonder? So it seems to me that the company has bungled its investor communications (which can perhaps be forgiven this once, since the company is still in its inaugural year as a listed company).

The share price has dropped from a peak of around 145p to 107p at the time of writing, yet none of the disaster scenarios that investors were fretting about has come to pass. In fact, the company says it's trading in line with full year expectations, which I think suggests about 13p EPS (so a PER of only about 8), and a dividend yield of just below 8% too. It's not often (any more) that you find companies where the PER and yield are the same number.

So taking things at face value, I think this is a good buying opportunity, so I've increased my position size about five fold at the recent lows, and just hope there's no more bad news to come out. Given that the company is nearly three quarters of the way through this financial year, they should have a good handle on how the results are likely to look, so confirming the full year forecasts at this stage should hopefully be relatively low risk.

Finally it has to be noted that, yet again, a UK stock which was about to report poor results was aggressively sold off by insider dealers (i.e. trading illegally, having been tipped off that the results were likely to disappoint) in the days preceding the results announcement. If the insider dealing laws are not going to be enforced, then it makes me wonder why we have them at all? It just means that honest people lose out, whilst crooks flout the law with impunity.

Of course, not everyone selling was an insider dealer - once a share starts dropping sharply, then other people twig that insiders are bailing out ahead of bad news, and they pre-emptively sell too. It's all a bit ridiculous. Note the sharp sell-off on the chart below, in the days before publication of disappointing H1 results yesterday. Let's hope the market abuse team at the FCA are investigating who was selling, and why:

VP (LON:VP.)

Share price: 780p (up 2% today)

No. shares: 40.2m

Market cap: £313.6m

AGM trading update - this AGM trading update was announced at 11:50 this morning, which I suppose is to coincide with the timing of the AGM. That might seem logical - i.e. everyone getting the same information at the same time, whether at the AGM, or not. However, I think it is a mistake to put out trading updates when the market is open, since that gives potentially split-second advantages to people who can read and interpret the statement correctly, and happen to be at a computer screen, or have access to a news service on their mobile at the time of the announcement.

In my view, unless there are pressing reasons to do otherwise, trading updates should always be issued at 7am, to give everyone a level playing field, then the Chairman should just read out the same statement at the AGM.

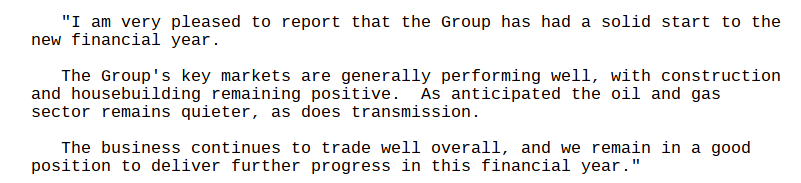

Anyway, this sounds encouraging:

I note that the company doesn't say anything about trading relative to market expectations, which seems a bit odd. I'm not keen on "further progress" outlook statements, as it's too vague. There really should be a reference to trading versus market expectations in every trading update - maybe this is an area where legislation is needed to make trading updates more formulaic, and less relilant on PR spin?!

Anyway, the market seems to like this update, with the shares up 2% today.

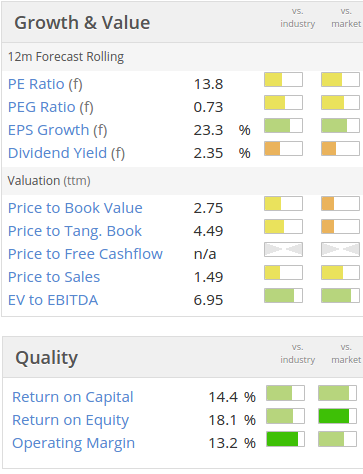

Valuation - the shares look priced about right to me. Equipment hire companies are benefiting from low interest rates at the moment, and buoyant construction, so I think that needs to be taken in to account when valuing them - i.e. not getting too carried away with a high PER. This looks about right to me on a PER basis, but maybe rather too expensive on a PTBV of 4.49?

Galasys (LON:GLS)

Share price: 30.6p (up 2% today)

No. shares: 76.6m

Market cap: £23.4m

Trading update - this is a Malaysian stock listed on AIM, so that makes it an automatic bargepole for me. However, for anyone interested, the company today reports "solid" trading in H1, and expects the full year to be "in line with market expectations".

It's worth checking out the ownership structure here - it seems to be majority owned by Malaysian investors. Therefore outside investors have no control - this is the trouble with many overseas stocks on AIM - you have no way of knowing whether you actually own part of a business, or whether you just hold a worthless piece of paper which purports to show that you own part of a business. Audits aren't worth the paper they are written on either.

One by one, overseas AIM stocks are unravelling, and are sometimes exposed as essentially devices to extract money from gullible British investors. Maybe this one is different, who knows? The company seems to be an Asian version of accesso Technology (LON:ACSO) doing ticketing systems for theme parks.

Amino Technologies (LON:AMO)

Interim results - these look good, and come with an outlook statement confirming full year expectations. The balance sheet is stuffed full of cash still. So worth a closer look - I don't have time at the moment, so am just flagging it as potentially interesting.

Acquisition - this looks like a major deal, and a Placing has been done at 130p to help raise the additional monies required. The company being acquired is profitable, and they mention cost synergies.

Escher Group (LON:ESCH)

Trading update - this reads quite positively, but it's a pity they only mention EBITDA (as Charlie Munger described as follows (and I apologise for his colourful language):

Anyway, adjusted EBITDA is rising 66% to $2.68m in H1, which sounds encouraging.

Net debt has reduced to $2.7m, and the Directorspeak sounds upbeat, so it might be worth having a closer look at this one.

Right, I have to dash. See you tomorrow!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in ENTU, and no short positions. A fund management company with which Paul is associated may also hold positions in companies mentioned.

NB. These reports are only Paul's personal opinions. They are NEVER recommendations or advice)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.