Good morning,

Quite a large table today - we are in results season!

All done for today, thanks!

Spreadsheet accompanying this report: link (last updated: 30th June).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

AstraZeneca (LON:AZN) (£167bn) | Reiterates FY25 guidance at CER: total rev (high single-digit %) & core EPS (low double-digit %). | ||

Barclays (LON:BARC) (£51bn) | 2025 guidance: RoTE c. 11%. 2026 guidance: RoTE greater than 12% (I think this is unchanged). | ||

Entain (LON:ENT) (£6.4bn) | BetMGM jointly owned with MGM Resorts. Strong Q2/H1, H1 rev +35% y/y. Upgraded guidance. | ||

Games Workshop (LON:GAW) (£5.0bn) | “Exciting times”. FY25 revenue +14%, licensing rev £52.5m (LY: £31m). PBT +29% to £262.8m. | GREEN (Graham) Another set of sparkling results and lucrative licensing income continues to grow at an impressive pace. As this is such a unique company, and I would argue that it has extraordinary management, I therefore don't consider it to be overvalued at this level. | |

ConvaTec (LON:CTEC) (£4.9bn) | Confident in FY25 outlook, core organic rev growth +5.5-7%. On track for medium-term targets. | ||

Croda International (LON:CRDA) (£4.1bn) | H1 in line and FY25 outlook unchanged. H1 sales +4.9%, H1 adj. operating profit +8.3%. | ||

Unite (LON:UTG) (£3.9bn) | Adjusted earnings +15%, adj. EPS +3%. Reiterated guidance for adjusted EPS 47.5-48.25p. | ||

Shaftesbury Capital (LON:SHC) (£3.0bn) | “Continued strong performance.” High occupancy (2.4% of ERV to let). Leasing 9% ahead of ERV. | ||

Inchcape (LON:INCH) (£3.0bn) | FY25 outlook reiterated, expecting growth at prevailing currency rates. H2 weighting. | ||

Canal+ SA (LON:CAN) (£2.3bn) | H1 In line with upgraded guidance. Outlook: revenue in line, EBITA c. €515m in line. | ||

Morgan Sindall (LON:MGNS) (£2.1bn) | H1 rev +7%, adj. PBT +37% (£95.9m). Net cash £390m. 2025 outlook in line. | AMBER/GREEN (Graham) [no section below] There has been little change in the market here since last month, when Roland decided to moderate his stance on it slightly, due to the higher valuation it has achieved. Checking the analyst consensus EPS chart, I see that the recent EPS upgrade for 2025 was indeed around the 10% mark (12% to be precise), as predicted by Roland. The upgrade to 2026 EPS expectations was more modest at around 7%. I tend to be cautious in this sector and P/E multiples in the teens make me nervous, so I’m inclined to agree with AMBER/GREEN here. That said, there is no denying that the numbers being published are excellent and the period-end net cash balance is comforting at £390m. I also note that the medium-term targets for two major divisions (Fit Out and Construction) have been upgraded. So I doubt that holders will be in any rush to close out their positions. | |

Paragon Banking (LON:PAG) (£1.88bn) | FY25 guidance unchanged except mortgage advances at lower end of £1.6-1.8bn range. | ||

Greatland Resources (LON:GGP) (£1.8bn) | Transformational FY25. $600m cash flow from ops in 7 months, 198,319 gold oz at AISC $1,849. | ||

Greggs (LON:GRG) (£1.7bn) | Challenging footfall, weather disruption, and cost headwinds. Expectations consistent with last TU. H1 rev +7% to £1,027.7m. H1 PBT -7% to £70.4m | AMBER (Roland) Today’s results are in line with the guidance provided in the recent profit warning and leave the full-year outlook unchanged. To get a fresh perspective, I’ve taken a broader look at the returns that have been generated so far by the elevated capex of recent years. I’m cautiously encouraged by the results and feel more positive than I thought I would about this business. One caveat to this is that I think it’s too soon to be sure if profits have bottomed out following a series of broker downgrades. On balance, I’m remaining neutral, but I think there’s scope for an upgrade here if the company can maintain an improved outlook for FY26 and beyond. | |

WH Smith (LON:SMWH) (£1.4bn) | Consistent with strategic focus on travel retail. Enterprise value £26m, net cash proceeds £21m. | ||

Coats (LON:COA) (£1.45bn) | Info re: previously announced acquisition, enterprise value $770m. £246m placing last week. | ||

SSP (LON:SSPG) (£1.4bn) | Remain on track for results within planning assumption ranges. Operating profit £230-260m. | ||

Uniphar (LON:UPR) (£850m) | H1 EPS ahead of expectations. Enters H2 with strong momentum. Lower interest rates are a tailwind. | ||

A G Barr (LON:BAG) (£789m) | Full year expectations unchanged. H1 revenue +3%. Boost (energy drinks) growing at double gifts, IRN-BRU flat. H2 to see strong y/y revenue growth. Acquisition: 50.1% equity stake in Innate-Essence Ltd, for £15m. Innate-Essence is the home of “The Turmeric Co.”, a specialty health drinks brand. | GREEN (Graham) [no section below] This IRN-BRU maker received a glowing review from me in March. It’s far too early to get clarity on the full-year outcome (e.g. will adjusting items be lower than last year?) but today’s update confirms that the company remains on track. H1 revenue growth is modest (3%) and some improvement will be needed in H2 to meet full-year expectations (nearly 5%), with higher marketing spend planned to achieve this. It’s the quality and resilience of the business that keeps me positive and I note the improvement in the H1 adjusted operating margin to 15% (H1 last year: 13%). The forecast P/E multiple is 15x for a stock with a QualityRank of 96 and a healthy net cash position. | |

James Halstead (LON:JHD) (£673m) | FY25 sales and profits to be slightly below FY24 levels, but within range of market exps. | ||

Forterra (LON:FORT) (£391m) | SP +11% Rev +20%, adj PBT +82% to £16.6m. Market share remains below 2022 levels, but “demand for most products” is now expected to be ahead of expectations. FY25 guidance upgraded: - Adj PBT to be “significantly ahead of previous expectations” | AMBER/GREEN (Roland) [no section below] | |

Restore (LON:RST) (£350m) | Rev +15%, adj PBT +10% to £18m. Leverage 1.9x. FY outlook unchanged. | ||

Filtronic (LON:FTC) (£332m) | Rev +121% to £56.3m | AMBER (Roland) | |

Card Factory (LON:CARD) (£311m) | SP +9% | GREEN (Roland) [no section below] Card Factory’s online performance has been mixed in the past and I think it’s fair to say the company has underperformed in this segment relative to its market share on the high street. Acquiring this well-established brand looks logical to me and will hopefully help Card Factory to develop a better-scaled online presence. The purchase price doesn’t look excessive, although funkypigeon.com has slightly lower operating margins and ROCE than CARD (based on last year’s Companies House accounts). CARD’s management believe they can achieve £5m of cost savings which should help to address this. The purchase will be debt funded and I estimate will leave CARD with leverage of c.1.0x EBITDA, which I think should be manageable. The outlook for FY26 is unchanged today leaving CARD with a P/E of 6 and a dividend yield of c.6%. I’m happy to retain our positive view today. | |

SThree (LON:STEM) (£309m) | SP -7% Rev -14% LFL, PBT -74% to £10.1m. In Contract recruitment, “Continued softness in new business activity was partially offset by strong contract extensions”. Some improvement in US/Japan. FY25 exps unchanged. | AMBER (Graham) [no section below] We already had a H1 trading update last month, so we knew that H1 net fees would be down 14%. That update kept full-year expectations unchanged, as does today’s outlook statement. However H1 PBT is only £10.1m and this leaves the company with a lot to do in H2, and I’m therefore not surprised to see the share price under some pressure this morning. The interim dividend (5.1p) is only barely covered by H1 EPS (5.6p). I think I can (just) maintain my AMBER stance on this for now, but if we interpret today’s share price reaction and the implied H2 PBT weighting as precursors to a full-blown profit warning, AMBER/RED might be more appropriate. I still rate this as my favourite recruitment stock (due to its STEM-sector and Contract focus), but even this one is not immune to what it describes as “a persistently challenging market environment”. Negative operational leverage has kicked in and I think investors are right to worry: it’s difficult to imagine this recovering to prior levels of profitability in the near-term. There appear to be structural, not just economic problems for the recruitment sector. | |

Essentra (LON:ESNT) (£298m) | Rev -4.6%, adj PBT -29.4% to £125m. H1 in line w/ improving LFL sales. FY25 exps unch. | ||

Literacy Capital (LON:BOOK) (£268m) | NAV +1.6% to 519.5p (£312.6m). Deployed £3.4m of new capital in Q2. Cash inflows exp in H2 25. | ||

Sylvania Platinum (LON:SLP) (£195m) | FY prod ahead of guidance at 81koz. EBITDA +98% to $12.9m, strong outlook in Q1 FY26. | ||

Tristel (LON:TSTL) (£179m) | Y/E 30 June to be in line with exps. Rev +11%, adj PBT +23% to <£10.1m. | ||

James Fisher And Sons (LON:FSJ) (£177m) | H1 adj op profit exp c.£11m, leverage 1.7x. FY exps unch with strengthening defence orders. | ||

Gaming Realms (LON:GMR) (£158m) | H1 in line with exps, rev +18%, adj EBITDA +30% to £7.5m. Launched 6 new Slingo games. | ||

Amedeo Air Four Plus (LON:AA4) (£155m) | FY25 op profit +3.6% to $57.9m. Positive outlook for Thai Airways & Emirates assets. NAV £294m. | ||

NWF (LON:NWF) (£84m) | FY25 slightly ahead w/ adj PBT +5.6% to £13.2m. Profits up in all 3 divisions. YTD trading in line. | ||

IG Design (LON:IGR) (£74m) | Adj PBT -93% to $1.9m. Net cash $84.8m. Outlook ex-US: FY26 rev $270-280m, 3-4% op margin | ||

Journeo (LON:JNEO) (£65m) | SP -3% H1 rev -4%, adj PBT flat at £2.8m. On track for record year, FY25 outlook in line (adj PBT £5.2m). Cash £18m. Cavendish forecasts: FY25 revenue £52m, adj. PBT £5.2m. FY26 revenue £55m, adj. PBT £5.8m. | GREEN (Graham) [no section below] Leaving our positive stance on this unchanged after an in-line trading update. The revenue growth figure is slightly uncomfortable at minus 4%: the company explains that its New York subway contract benefited H1 last year, and will benefit H2 this year, but did not generate anything in this most recent H1 period. Cash covers a decent chunk of the market cap and provides plenty of dry powder for bolt-on M&A. In the big picture, I can't help noticing that the overall growth figures aren't too pacey, with adj. PBT set to grow by less than 10% this year, and then maybe 12% next year. But then the valuation isn't excessive either, with the stock trading at a 13.5x next year's EPS estimate (before adjusting for cash). As this is a Super Stock, I remain happy with GREEN. | |

Staffline (LON:STAF) (£60m) | H1 rev +8.7%, PBT +100% to £0.6m. Strong new business momentum, higher temp hours. | ||

Colefax (LON:CFX) (£45m) | FY25 ahead of exps due to Q4 surge to avoid tariffs. Adj EPS 108.4p vs consensus 79.4p. | ||

Flowtech Fluidpower (LON:FLO) (£36m) | H1 in line with exps with improved trading vs H2 24. FY25 outlook in line with exps. | ||

PCI- PAL (LON:PCIP) (£32m) | FY25 adj PBT in line with exps (£0.8m). FY26 rev seen below exps at £23.5-24m (prev. £25.5m) | ||

| Novacyt SA (LON:NCYT) (£29m) | HY Trading Update | H1 rev exp £9.8m (H1 24: £10m), +2% underlying. Cash £23.8m, enough to reach +ve EBITDA. | |

Maintel Holdings (LON:MAI) (£29m) | Rev flat at £46.5m due to contract churn. Adj EBITDA -29% to £3.4m. FY25 exps unch w/ H2 weighting. | ||

Renalytix (LON:RENX) (£24m) | Contracted to undertake a kidney disease research programme with Joslin and leading pharma co. | ||

Southern Energy (LON:SOUC) (£11m) | Completed Gwinville GH LSC 13-13 #2 well, initial production averaged 3.6MMcfe/d (99% gas) | ||

Smarttech247 (LON:S247) (£10m) | Various contracts from 6mo to 3y. Cavendish broker estimates unchanged today. |

Graham's Section

Games Workshop (LON:GAW)

Up 6% to £161.70 (£5.3bn) - Annual Report - Graham - GREEN

It’s not possible to criticise these results:

I note in particular the sharp year-on-year increase in licensing revenue and licensing operating profit. This is even higher quality revenue and profit than the core operations, as it’s effectively royalties on their intellectual property.

CEO comment (and also the Outlook statement):

'After a record year, we remain focused on delivering our operational plans and working tirelessly to overcome any significant obstacles that get in the way. We will continue to give ourselves the freedom to make some mistakes, constantly working on improvements in product quality and manufacturing innovation. Despite our recent successes we will never take our hobbyists' support for granted. I wish to thank all of them together with our staff, trade accounts and broader stakeholders for their ongoing support. Exciting times.'

The strategic report contains the usual mission statements that are in no way superfluous: I wish every company could explain what it does, and why, with such clarity.

Due to time constraints, I’ll merely try to pick out a few interesting parts of this report for you.

Tariffs: no major impact.

Our current estimate is that if we did nothing, new tariffs could impact profit before tax by c.£12 million in 2025/26. This new problem will be dealt with in our normal pragmatic way. We will not change our operational plans too much… it is business as usual for Games Workshop, once again a new normal has to be accepted. It's mostly out of our control…

Tariff costs are likely to reduce our reported gross margin next year. We have a detailed operational plan to make up the c.2% gross margin shortfall through efficiencies. This is not a simple task when we are already very efficient; it may take longer than one year.

Actually, I need to add this bit because it’s hilarious:

We have been pretty solid during the year managing our cash costs and investments. Net cash generation from our core operations is at planned levels and dividends have been paid at record levels from our truly surplus cash. All in line with our detailed operational plans and policies. The exception was the news about tariffs and the cute looking pipistrelle bat that is delaying our work on our new temporary car park. We are carefully looking after the bat and we hope the uncertainty around tariffs is resolved soon.

Cash: their target “cash buffer” has increased to £85m to reflect the new three-monthly cash cost of running the company. Actual cash as of June 2025 was £133m.

Licensing: because this is so lucrative, let’s get an update.

On 10 December 2024 we announced the conclusions of our negotiations with Amazon for the adaptation of Games Workshop's Warhammer 40,000 universe into films and television series, together with associated merchandising rights. The project continues in line with our contractual agreement with Amazon. This same contract prohibits us from sharing any specific details or commercial terms…. This is a long-term partnership with Amazon and there won't be any significant news in the short term - these things take several years to bring to market.

Video games:

During the period our licensing partners launched three new PC/console games and one mobile….

We are actively exploring further console and mobile opportunities, including Space Marine 3, without losing sight of the significant long-term revenue provided by PC games…

The general backdrop still remains challenging for this market in the short term. We therefore remain cautious when forecasting royalty income. Our dedicated team, with the full support of the Warhammer Studio resources, continues to promote the depth of our IP and its unique lore and settings to potential licensing partners. Four new games were announced in the period…

And an end-note on licensing:

As a reminder, the viability and ongoing success of any of our licensing deals is broadly out of our control; they are reliant on the successful development and delivery of projects by our licensing partners.

Estimates: estimates for GAW aren’t worth too much. There are moving parts that the company itself admits can’t be forecasted, and it has never seemed too concerned about making sure that City analysts get the numbers right. In fairness to it, I think this is consistent with a business that is focused on its long-term success rather than short-term targets.

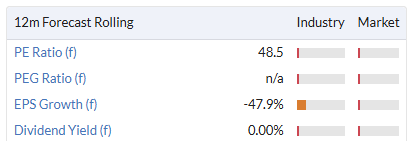

For what it’s worth, here are value metrics based on forecast numbers currently:

Graham’s view

I’m happy to maintain the GREEN on this as it’s a unique company with IP that can’t easily be replicated (I don’t think anyone could replicate it credibly). And it’s still sufficiently niche that I don’t think we can argue that its current success is just a fad: it owns this niche, and I don’t think that’s going to change.

I calculate ROE from these results at 74%, an increase from the 65% on the StockReport. Exciting times indeed!

Roland's Section

Greggs (LON:GRG)

Down 4% to 1,564p (£1.6bn) - Interim Results - Roland - AMBER

Today’s results from Greggs have met with a cautious response from the market. But they do appear to be in line with recently-reduced expectations (Megan covered the company’s recent profit warning here).

Today’s accounts over the 26 weeks to 28 June 2025 and show the impact of cost inflation and lower footfall, with sales up but profits down:

Revenue up 7% to £1,027.7m

Like-for-like sales in company-managed shops +2.6%

Like-for-like sales in franchised stores +4.8%

Pre-tax profit down by 14% to £63.5m

Diluted earnings 16% to 45.3p per share

Interim dividend unchanged at 19p per share

Positive LFL sales are encouraging but sales growth was not enough to overcome the pressure from higher costs – Greggs’ distribution and selling costs rose by 10% to £511m during the half year, in part presumably due to store openings.

I’m not sure what to make of the weaker LFL performance of company-managed stores, which account for around 80% of the store estate. Are franchisees selling more successfully or perhaps situated in more exciting locations?

The company says that it’s continuing to develop its menus to support growth in the post-4pm ‘daypart’. Sales made in the later part of the day now comprise 9.3% of sales (H1 24: 8.4%) and are growing faster than average. Recent menu “standout” menu introductions include the Red Pepper, Feta and Spinach Bake and Korean BBQ Chicken Flatbread.

Store openings vs profitability

One element of Greggs’ secret sauce has always been its skill at locating its stores in exactly the right places to capture passing footfall. As high street usage and out-of-town leisure locations have developed, the ‘right’ place for stores has evolved and this is reflected in the group’s changing store estate.

The company opened 87 new shops during the first half of the year, but also closed 56 (including 27 relocations). Net openings were 31, leaving the company with 2,649 shops at the end of June.

CEO Roisin Currie remains confident in the “clear opportunity” for over 3,000 UK shops in the longer term, but this is a topic that is starting to divide investors. The risk is that newer stores may start to cannibalise existing shops, resulting in cumulatively lower profitability.

The company acknowledges this in today’s results but says that in cases where a new store is opened within a mile of an existing shop, transfer of sales (cannibalisation) is just 5%, on average:

Analysis of our Greggs App customers shows that those who visit a new shop increase the overall frequency with which they visit Greggs, maintaining their visits to existing shops. In 2024 60% of our new shop openings (excluding relocations) were in areas with no other Greggs shop within a mile, with 2025 openings having a similar profile. For openings in areas with existing access to Greggs within a mile of the new shop, the transfer of sales from existing shops averaged just 5%.

To some extent, cannibalisation isn’t a problem if the company can achieve an increase in overall volumes, or sales per customer. Greggs seems confident that it’s achieving this.

From a financial point of view, what interests me is whether the extra growth is achieving satisfactory returns on capital employed – or whether further growth could end up diluting the group’s profitability.

Profitability has remained stable in recent years at a group level and Greggs’ ROCE of c.20% is certainly a respectable figure:

However, the size of the store estate means that the new store openings will only have a very slight impact on overall group results – at least initially. This means that we might not be able to recognise overexpansion until it’s too late to easily reverse it.

To try and get a feel for the extra profitability generated by these capital additions, I’ve estimated the increase in capital employed since 2021 and compared this with the increase in operating profit over the same period.

Greggs’ capex has been relatively high in recent years. Today’s H1 results reiterate FY25 capex guidance of £300m, up from £249m last year. Expenditure is expected to peak this year as investment in new national distribution centres is completed alongside store openings.

Capital employed in the business has risen from around £680m to £1,045m since 2021. To date, operating profit has risen by £51m over the same period.

My sums suggest that the return on this incremental capital employed has been around 14%. That is a reasonable figure, but it is below the c.20% group average.

In fairness, I think it’s probably reasonable to argue that some of this additional capital (e.g. store openings and new manufacturing and logistics infrastructure) has not yet achieved full profitability.

On balance, I think Greggs’ growth and capex plans are worth keeping a critical eye on. There’s a risk the company will grow at the expense of profitability. But this my quick review today suggests to me that Greggs has (probably) not yet reached the stage where it’s destroying shareholder value by overexpanding.

If capex eases after this year and profits continue to rise, then this period of higher investment could start to deliver attractive returns, potentially justifying a higher rating for the shares.

FY Outlook

Today’s results include a clear statement from CEO Roisin Currie reiterating recent guidance:

The Board's expectations for the full year are consistent with the guidance provided in our last trading update on 2 July.

Unfortunately, this guidance does mean that operating profit for the current year is expected to be “modestly below” the £209m achieved last year.

I expect consensus forecasts to be largely unchanged after today, suggesting that Greggs is currently trading on a forward P/E of 13, with a 4% dividend yield:

Roland’s view

I think Greggs still needs to show that the increasing scale of its store estate and complexity of its menu will deliver attractive returns. But I have to admit I am feeling more positive than I expected to at the end of this review.

One caveat to this is that today’s results and in-line outlook statement have come less than a month after the company issued a profit warning:

Earnings forecasts have trended lower since September last year and we know that, statistically, companies often underperform following profit warnings.

Arguably it’s too soon to really know if the outlook for the remainder of the year will be in line with these lower expectations. Greggs is still very much exposed to cost inflation and any weakness in consumer spending.

On the other hand, the stock has significantly de-rated over the last year. The share price is down by around 50% and the P/E has fallen from 21 to just 13:

I am tempted to upgrade our view to AMBER/GREEN today. But on balance, I feel that it’s probably prudent to maintain our neutral view a little longer until there’s more clarity on whether profit expectations really have bottomed out. AMBER

Filtronic (LON:FTC)

Up 1% to 154p (£338m) - Final Results - Roland - AMBER

Filtronic plc (AIM: FTC), the designer and manufacturer of products for the aerospace, defence, space and telecommunications infrastructure markets, announces its full year results for the 12 months ended 31 May 2025.

Today’s blowout results are outstanding, but are no better than expected to my eyes, with revenue and diluted earnings almost exactly matching Stockopedia's consensus figures of £56m and 6p respectively.

Revenue up 121% to £56.3m

Pre-tax profit up 294% to £13.4m

Diluted earnings up 329% to 6.05p per share

Net cash: £10.8m (FY24: £4.2m)

We know that Filtronic has gone gangbusters with SpaceX this year. The satellite internet company contributed 83% of last year’s revenue as it retrofitted Filtronic’s E-Band power amplifiers into its base stations. That’s an astonishing and risky level of customer concentration, in my view.

Investors have enthusiastically rewarded this lucrative streak of growth – Filtronic’s share price has risen by 750% in two years:

However, we know less about what may be coming next. Demand from SpaceX is expected to ease, with major new sales phases to be based on new technologies not yet in production.

Credibly, given what must have been a powerful focus on delivering for SpaceX, Filtronic has made some progress at diversifying its revenue streams over the last year.

Recent wins have included European defence primes BAE Systems and Leonardo and rival space operators such as Airbus/OneWeb and the European Space Agency.

As a result, the revenue outlook for the next year is broadly flat, with a return to growth expected in FY27.

However, achieving these wins and making the necessary investment in R&D and manufacturing has left Filtronic with a significantly increased headcount and cost base:

Filtronic’s salary costs rose by 78% to £6.4m last year, with associated increases in other overheads.

As a result, the 24% operating margin achieved last year is expected to reset to a much lower level from FY26 onwards, resulting in a sharp fall in profits.

Outlook & Estimates

Unchanged broker forecasts today suggest earnings will fall by nearly 50% this year, with only a limited recovery in FY27.

With thanks to broker Cavendish, we have unchanged forecasts today for FY26 and newly-introduced forecasts for FY27, suggesting incremental earnings growth from FY26 (i.e. still a long way below FY25):

Source: Cavendish | Revenue | Adj EPS |

FY25 Actual | £56.3m | 6.05p |

FY26E | £54.0m | 3.2p |

FY27E | £60.0m | 3.9p |

These forecasts suggest Filtronic’s operating margin will drop to c.15% in FY26, which I'd consider more typical for a high-tech manufacturer of this kind.

This leaves the stock trading on a FY26E P/E of 47, falling to a P/E of 39 in FY27.

Roland’s view

I am full of admiration for what Filtronic has achieved to date and I recognise the company’s track record of outperforming expectations over the last 18 months:

However, I think it’s fair to say that this has largely been achieved from single product sales to a single customer, resulting in an exceptional and potentially unrepeatable level of profitability.

This level of concentration carries a lot of risk and I think Filtronic has done quite well to start mitigating this while still delivering to SpaceX’s satisfaction.

However, when looking ahead, I think it makes sense to value the business based on expectations for a more diversified revenue base. This seems likely to entail lower margins, as the company spends more on R&D and produces a more mixed range of products (in lower volumes) for a variety of customers.

I have maintained an AMBER/GREEN view on Filtronic for some time in hope of an upgrade to the outlook for FY26. But this has not been forthcoming and I can’t help noting that share price momentum has weakened recently, with a higher proportion of sellers than usual in recent weeks:

On balance, I think there’s a risk Filtronic’s valuation will reset to reflect a more normalised pattern of growth and profitability.

I’d probably be positive on the stock below 100p, as I do see this as a potential long-term growth story. However, at current levels, I don’t feel I have any choice but to adopt a neutral view after today’s results. AMBER

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.