Good morning!

Today's Agenda is complete.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

Jet2 (LON:JET2) (£3.32bn) | EBIT to be towards lower end of consensus range, but premature to provide definitive guidance. | ||

International Public Partnerships (LON:INPP) (£2.19bn) | NAV up 2.8% to 148.7p (latest share price: 119.2p). | ||

Grafton (LON:GFTU) (£1.67bn) | Full year adj. operating profit to be broadly in line with the important Autumn period still to come. | ||

Genus (LON:GNS) (£1.65bn) | Rev +5%, adj. PBT +38% at constant FX (£74.3m). FY26 outlook in line with expectations. | ||

Safestore Holdings (LON:SAFE) (£1.36bn) | Continue to expect to be in line with EPS expectations for FY 2025. | ||

Currys (LON:CURY) (£1.24bn) | First four months of the year in line. Planning confidently for year, comfortable with consensus. | GREEN (Graham) Upgrading my stance on this to fully GREEN as it currently seems to have everything going for it, including strong share price momentum. If I was rating it purely on fundamentals, I'd still be a little cautious. But I do admire the company's performance, the clarity of its communication with its investors, and its shareholder orientation. | |

WAG Payment Solutions (LON:WPS) (£655m) | Confident in delivering full year guidance. | Ticker changing to EWG next week. | |

Alfa Financial Software Holdings (LON:ALFA) (645m) | Trading in line, on track to meet full year exps. H1 rev +22% at constant FX, H1 EPS +33%. | ||

Funding Circle Holdings (LON:FCH) (£425m) | On track to achieve medium-term guidance of revenue ≥£200m and PBT ≥£30m in FY26. | ||

Metals Exploration (LON:MTL) (£378m) | H1 record positive FCF $70.7m. H1 adj. EBITDA $72.3m. Gold production 40,985oz. | ||

Brooks Macdonald (LON:BRK) (£291m) | Funds under mgmt and advice +17% to £19.2bn. Net outflows £0.4bn. Adj. PBT -4.6% (£24.9m). | ||

Vertu Motors (LON:VTU) (£189m) | FY26 adjusted PBT expected to be in-line with current market consensus. LFL used car volumes and margins stable, new retail order book for September plate change slightly ahead of last year. Strong focus of cost control. Buyback continues. | AMBER/GREEN (Mark) [no section below] | |

Concurrent Technologies (LON:CNC) (£154m) | Secured a significant equipment programme contract with a prominent UK defence prime contractor for border protection in Europe, for an initial £4m. | ||

Beeks Financial Cloud (LON:BKS) (£144m) | Secured over $7 million of new Private Cloud contracts in August, underpinning the Board's FY26 expectations. | ||

Eurocell (LON:ECEL) (£135.8m) |

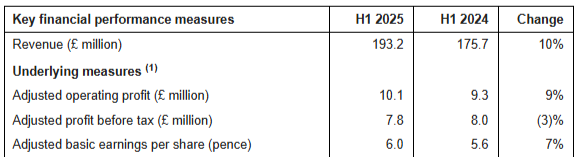

H1 Revenue +10% to £193.2m, organic growth -2%, Adj. PBT -3% to £7.8m, Adj. EPS +7% to 6.0p. Statutory EPS -45% to 2.9p. Net debt excl. Leases £29.0m (24H1: £4.3m). Interim dividend +5% to 2.3p. | BLACK (AMBER/GREEN) (Mark) | |

Speedy Hire (LON:SDY) (£111m) | Hire revenue is marginally behind the same period last year. Anticipates usual H2-weighting for revenue and profit. Expectations for the full year unchanged. | ||

Savannah Resources (LON:SAV) (£95.8m) | Expects to publish the updated JORC Resource estimates and Exploration Targets for the Project in the coming weeks. | ||

Shield Therapeutics (LON:STX) (£65.6m) | ACCRUFeR® assigned Priority Review in the US by FDA in children with iron deficiency anemia (IDA). Approval in the US is anticipated in 2026. | ||

Iofina (LON:IOF) (£48.0m) | 74.3MT of crystalline iodine produced in August 2025, highest single month of iodine production. Cash reserve $1.8m following receipt of tax credit. | ||

Arecor Therapeutics (LON:AREC) (£25.3m) | Positive FDA feedback on Phase 2 clinical study design for ultra-concentrated and ultra-rapid acting insulin, AT278, in combination with an Automated Insulin Delivery (AID) system. Plans to submit the Phase 2 IND to the FDA during 2026 with the aim of commencing enrolment for the Phase 2 study later in that year. | ||

Power Metal Resources (LON:POW) (£21.4m) | £3m to take a 49% stake in Kingia, a Dubai Freezone company, to be renamed Minestarter, a blockchain enabled tokenisation platform for investment into early-stage mining ventures. | ||

Fusion Antibodies (LON:FAB) (£19.3m) | Revenue +72% to £1.97m. Loss £1.71m. Net cash £0.36m, after raising £0.56m at the end fo the year. Further £0.56m raised post period end. | ||

Transense Technologies (LON:TRT) (£19m) | Launched new, lower-cost versions of its Translogik TLGX3 and TLGX4 tyre inspection tools. No figures given. | (Reach announcement, not RNS) | |

essensys (LON:ESYS) (£14m) | Revenue down 20% to £19.2m, broadly in line with market expectations of £20m. Adj. EBITDA £1.3m+ versus £1.5m consensus (FY24: LBITDA £0.9m). Net cash £1.8m (FY24: £3.1m). £1.5m cost savings from closing 10 data centres. Outlook: “...we enter the new financial year with confidence in our ability to build on this momentum and deliver long-term value for both customers and shareholders.” | AMBER/RED (Mark) [no section below] | |

Defence Holdings (LON:ALRT) (£12.6m) | “First AI product underway for the UK Ministry of Defence, marking a commercially significant opportunity with long-term deployment potential.” No figures given. | ||

Gem Diamonds (LON:GEMD) (£9.4m) | Revenue down 42% to $54.4m, LBITDA $2.6m (24H1: EBITDA $19.1m), Net debt $28.2m (24H1: $7.3m). | AMBER/RED (Mark) |

Graham's Section

Currys (LON:CURY)

Up 18% to 128.67p (£1.46bn) - Strong start to year, new £50m buyback - Graham - AMBER/GREEN

We’ve been AMBER/GREEN on this retailer since last year. What particularly impressed me about it was the clear guidance it gave re: national insurance costs, but also the healthy balance sheet and net cash position. But it would be difficult for me to go fully GREEN on any stock in this sector.

Today the company reports that trading in the first four months of the year is in line with expectations and they are “comfortable with market consensus”.

That consensus is for an adjusted PBT of £170m (last year’s adjusted PBT was £162m, up from £118m the prior year).

Some other key points:

UK & Ireland like-for-like revenue +3%

TV, table and air fryer sales were down while gaming, AI computing, large appliances and others were up.

Nordics like-for-like revenue +2%

The pension deficit falls to £134m (March 2025), according to the actuarial calculation. That’s close to the deficit calculated on an accounting basis, which was £143m.

Net cash expected to be “at least £100m” at year-end, and that’s after pension contributions and capital returns.

Speaking of which, capital returns this year are about £75m, made up of a new £50m buyback and £25m of dividends.

The payment later this month (which has already gone ex-dividend) is the first dividend since 2023.

CEO comment:

"It's been a good start to the year, with encouraging performance across the Group. In the UK&I we're pleased with the trajectory in our growth areas of new categories, B2B and the Services that are so valuable to customers and to Currys. Credit was notably strong, and iD Mobile is on track to beat the 2.5m subscriber target we set for this year.

Our Nordics recovery continues to pick up pace. We continue to grow, improve margins and control costs well. We're confident that profit margins will step forward again this year.

Outlook

The guidance given today is “consistent with previous guidance”.

Key items that stand out to me are:

“Total interest expense of around £65m” - interest in the previous financial year was £73m, and in the year before that was £91m, calculated by adding up interest expense on loans, leases and the pension liability. The company’s improved financial position is being felt as this number continues to fall.

Pension contributions of £82m, slightly higher than previous guidance. Surely it won’t take long to repair the deficit after that contribution? The company says that it is only planning to pay £13m per annum for five years from 2026/2027, and contributions will cease thereafter. So it looks to me as if the pension issue has effectively been resolved now.

Long-term guidance: 3% adjusted EBIT margin is the target.

I’m reminded that the add-on services (especially finance options and warranties) are key to the business model, as gross profit margins on the goods themselves tend to be fairly thin. You can see from the long-term guidance that the EBIT margin target is very modest. The adjusted EBIT margin actually achieved in the most recent financial year was 2.6%.

Graham’s view

This business now appears to be in rude financial health, with the company even taking the view that it has £50m of surplus cash that’s now available for buybacks.

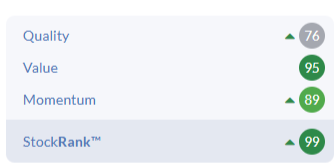

Given that it has a StockRank of 99, and is trading at a modest P/E of around 10x, I’m happy to temporarily raise my stance on this by one notch to GREEN.

My GREEN stance reflects that Currys has everything in its favour right now: strong trading, a moderate P/E multiple, a healthy balance sheet, and share price momentum.

I admire the clarity of its communication with inventors, and I think it’s also quite shareholder-friendly in terms of dividends and buybacks.

But for what it’s worth, this is not a stock that I personally would be willing to hold long-term. Note that its like-for-like growth is still modest, and its EBIT margin is never going to be all that high: 3% at best. There are natural limits to what it can achieve for shareholders, and sooner or later I think it is inevitable that it is going to have another rough patch - that is just the nature of its business.

So I’m GREEN now on the basis that current momentum is strong, but if I was rating it purely on fundamentals as a long-term hold, I’d still be a little cautious. I hope that’s clear!

Mark's Section

Eurocell (LON:ECEL)

Down 4% to 130p - Half Year Report - Mark - BLACK (AMBER/GREEN)

The headlines here look reasonable for a company operating in difficult end markets:

However, all of that gain comes from their recent acquisition of Alunet:

Group sales up 10% on H1 2024, or flat excluding Alunet, with organic volumes 2% lower

There is a slight benefit from pricing within their profiles division, but ultimately, trading in that part of the core business is flat, at best. Alunet does appear to have been a good acquisition so far, at least on sales performance:

Alunet post-acquisition sales were £17.7 million for H1, representing growth of 36% over the corresponding period in 2024, driven by market share gains

This has offset the weakness in the core business at the profitability level, at least on an adjusted basis. Adjusted operating profit in the Profiles division was only down 2% to £8.3m, whereas in their branch network adjusted operating profit was down £1.3m to £0.9m. This was despite 7 new branch openings in 2025.

Adjustments:

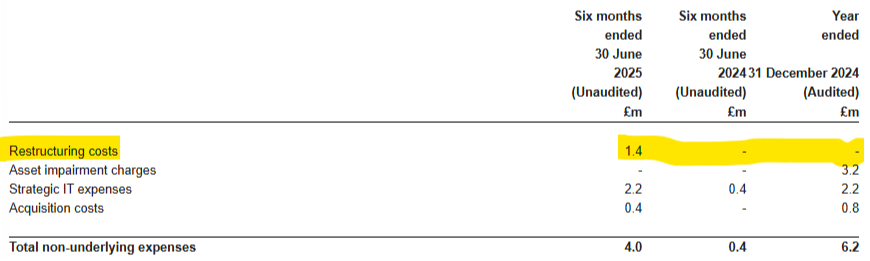

On a statutory basis, things look much worse, and the cause is significant “non-underlying” items:

Non-underlying items of £4.0 million in H1 2025 comprise strategic IT project costs of £2.2 million (including cloud computing and internal resourcing costs), restructuring costs of £1.4 million and Alunet acquisition costs of £0.4 million. Non-underlying items of £0.4 million in H1 2024 relate to strategic IT project costs.

Acquisition costs are clearly one off. Restructuring costs are fairly large, and it always seems a bit off that companies like to claim the credit for the costs savings benefit on the bottom line, while excluding the costs of doing so. However, unlike Alumasc who also reported this week, these do appear to be unusual, as they didn’t occur in prior periods:

However, I do have an issue with IT costs being excluded:

Strategic IT expenses of £2.2 million (H1 2024: £0.4 million; FY 2024: £2.2 million) relate to costs incurred on strategic IT projects involving 'Software as a Service' arrangements and internal resourcing costs which are expensed as incurred rather than being capitalised as intangible assets.

Such items are considered to be non-underlying in nature because they relate to multi-year programmes to deliver strategic IT implementations which are material in size. In 2024/25, our strategic IT projects comprise the replacement of our Enterprise Resource Planning ('ERP') system, including a new trade counter system for the Branch Network. The expected cost of the system replacement is in the region of £10 million over the 2024-26 period.

Having an ERP system seems the normal part of doing business, and they are presumably doing this because it generates higher sales, or enables them to have lower costs. In 2027, I doubt they will be excluding the benefits of this system as non-underlying. I have some sympathy for the view that these are large upfront costs with payback over the long term, and presumably don’t meet the requirements to capitalise this spend. However, to my mind this is no different to any other company that chooses to invest in headcount now to capitalise on a perceived opportunity in the future and faces reduced profits in the short term. In my opinion, it is for the company to set out the cost-benefit argument to shareholders and let them decide if it makes sense, not simply exclude all such costs.

Balance sheet:

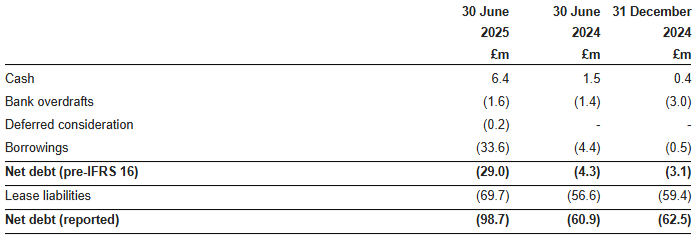

While the acquisition of Alunet has maintained their adjusted PBT, it has had an impact on their net debt:

The cash flow statement shows that they paid £20.2m in cash for Alunet, net of cash acquired. Which means that net bank debt has gone up by £5.7m, and their payment of £3.9m dividends and buyback of £3m of shares during the period has largely been debt funded.

They are operating well within their £75m RCF, and have a current ratio of 1.56, with payables matching receivables and a slight increase in inventory no doubt reflecting the Alunet acquisition, so there are no immediate concerns for solvency. Indeed, with the interim dividend increased by 5% and buybacks flagged to continue, the company seem confident in the near-term cash flow generation, or at least their headroom to the RCF limit.

However, there is little in the way of tangible asset downside protection, with net assets declining slightly, and intangibles increasing significantly as presumably much of the value in Alunet was intangible. There is also £3.5m of current contingent consideration, £0.1m of deferred consideration and £0.5m of short-term provisions, which I would treat as debt, since they will be paid in cash within the next year. This is one of the downsides of Alunet doing so well compared to their core business, it increases the chances of the contingent consideration being paid. There is currently a further £8.5m of non-current deferred and contingent consideration on top of this.

Outlook:

There’s no specific guidance given, but what they do say is:

While demand in our core RMI market remains sluggish, we have seen some modest early signs of an improving picture in new build housing, albeit from a very low base. We are therefore continuing to focus on cost reduction and operational improvements to drive efficiency and mitigate against the impact of delayed market recovery. Whilst the full year outlook is below our previous expectations, the medium and long-term growth prospects for the UK construction market remain attractive and we are well positioned to drive sustainable growth in shareholder value.

It was not entirely clear to me if they are referring to a further deterioration in trading, and hence this is a profits warning, or whether they are referring to the May trading statement when they said:

…we now expect adjusted profit before tax for the year in the core business to show nominal improvement over 2024, before any impact from the Alunet acquisition.

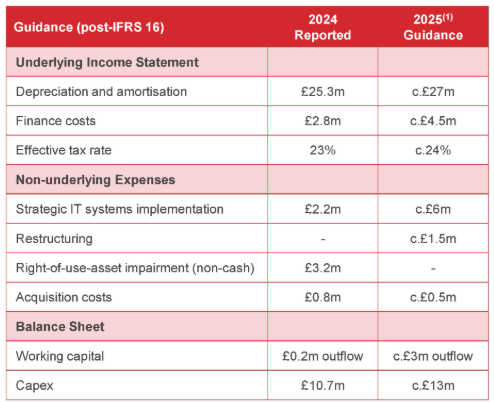

This is not helped by the lack of broker coverage that is visible to individual investors. However, given that the H1 adjusted PBT for the core business was down 14%, I think I’d assume that the FY numbers will have been downgraded slightly today and this will be seen in the Stock Report as these work their way through. Listening to their results call, it seems clear to me that this is a further profits warning, just one that is not yet quantified to us. They provide guidance in their results presentation, but only for accounting adjustments:

The last downgrade in May saw brokers hold the FY26 estimates, but I think there is also a risk of a minor downgrade here, as we are now less than four months away from FY26 and there doesn’t seem to a chance of a short-term turnaround in prospects:

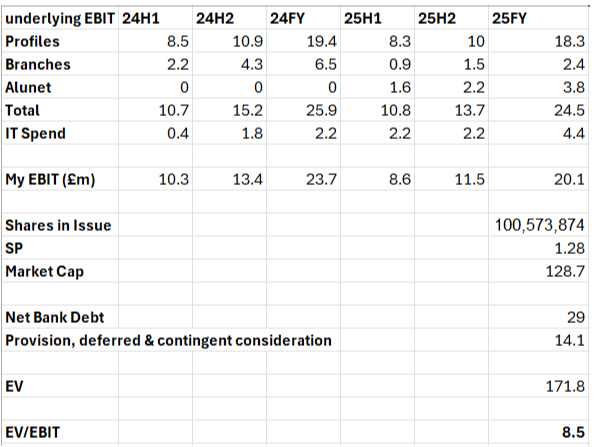

Valuation

Again it is difficult without updated broker forecasts. Last year EBIT in H1 was lower than H2, and I expect similar seasonality. These are my guesses for EBIT:

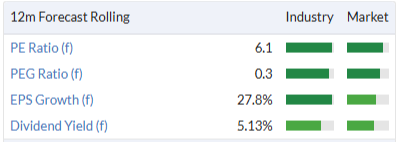

So if my guesses are in the right ballpark we have a EV/EBIT of around 8.5. This isn’t expensive, but perhaps not as good as the current headline numbers in the Stock Report based on previous FY26 estimates would have us believe:

[Edit: on the results call, the company have confirmed that the brokers’ notes this morning had PBT in the range £19-20m, and they are feel these are reasonable. Hence my figures for £20m EBIT are probably a bit light versus the brokers notes as finance costs will undoubtedly be more than £1m.]

Still, the dividend is reasonable, and there are lots of signs that these should be close to trough figures. I agree with them when they say:

…the medium and long-term growth prospects for the UK construction market remain attractive and we are well positioned to drive sustainable growth in shareholder value.

It is also worth nothing that similarly-value Epwin, recently received an offer from a privately owned European building products supplier. Similar industry players may be willing to take the medium and long-term view to build scale acquiring UK building products companies.

Mark’s view

It’s hard to say for certain if this is another profits warning, but I’m taking the cautious view and assuming it is, hence we should consider it BLACK. On a wider view, I downgraded this to AMBER/GREEN following the preliminary results but stuck my neck out to keep the same view following the profits warning in May. This looks to have been a misjudgement as we have had a further downgrade today on a weak outlook. However, the valuation still looks modest for a company that must be much closer to the low-point in trading than any cyclical high. While I don’t like some of the adjustments, the Alunet acquisition is doing well, and the ongoing buyback plus small dividend increase suggest confidence in the future, even if hey aware largely debt funded in this particular six month period. As such, I see little reason to change that view now, especially since industry peer Epwin recently received a takeover offer.

Gem Diamonds (LON:GEMD)

Down 33% to 4.5p - Half Year 2025 Results - Mark - AMBER/RED

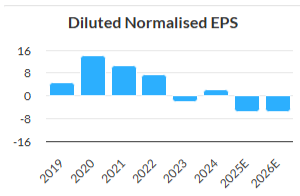

This falls below our normal £10m market cap cut-off but given that it still has a sizeable turnover, it is worth commenting briefly on as a cautionary tale. Historically, the company has reported strong EPS. Indeed, the annual EPS figure in 2020-2022 exceeding today’s share price, even after converting from USD:

Today’s results are poor. Revenue takes a hit, down 42% and there are two reasons. Lower production and much lower commodity pricing:

Recovered 47 125 carats (H1 2024: 55 873 carats)

Average price of US$1 008 per carat achieved (H1 2024: US$1 366 per carat)

Historically, the revenue has been highly dependent on them finding large diamonds, but the timing of this is uncertain. The problem isn’t this dynamic, which is normal in the industry, but that the business isn’t robust enough to cope with these conditions. They are left cutting a workforce and scaling back waste stripping:

Key short-term cashflow optimisation measures implemented include the short-term reduction of waste and access to additional Satellite Pipe ore to be treated, workforce rationalisation due to the scaled-back activities and a reduction in corporate costs.

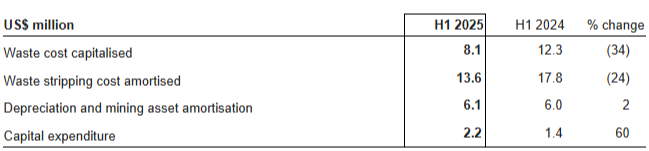

The effect is to reduce the life of the mine by four years to 2035. The real issue, though is that they capitalise their waste stripping. So while they report a LBITDA of $2.6m in these results, even at a reduced rate they had an $8.1m cost of waste stripping on top of that. While many companies can cut their capex completely in hard times, that just isn’t possible here:

This means that net debt has ballooned to $28.2m, and increase of $20.9m in the last six months. Some of those facilities expire in December 2026, which will come around very quickly if they are unable to refinance soon.

Their solution is to cut costs, and they aim to save $1.7m a month in labour costs, which would be around $20m a year and presumably get them close to cash flow break even. However, it will involve making over 20% of the workforce redundant, something that will be politically sensitive in a country where alternative employment opportunities are low.

The other fundamental problem with the company is its structure. Despite the large losses, the company had to pay out around $5m in royalties and $9m in tax on the prior year profits. There is also a 30% government-owned minority interest and this appears to be paid at the subsidiary level. This means that the government’s interest get paid first. So in 2024, the company declared an $8.1m PBT, and $2.9m was allocated to equity holders and $5.2m to the government minority interest. Many will say that this situation is only right; after all, the company is a guest in this country. However, it doesn’t make me want to be an owner of the equity here.

Mark’s view

Not all is lost, cost-cutting together with an improving diamond market, or a string of large diamond finds would mean that the company survives and generates positive cash flow again. However, they have been forced to take short-term actions to survive that are against their long-term interests. Lower waste-stripping has reduced their life of mine. Labour force reductions risk their relationship with their host community, and make it hard to maintain production and hence economies of scale. In terms of view, this has to be AMBER/RED, at best. However, the real learning here is that how a company chooses to account for essential costs, expensing or capitalising them, really matters. Investors need to read the cash flow statement as well as the income. As does the corporate structure. When minority interests take much of the upside, without bearing much of the downside costs, this is a structure most equity holders will want to avoid.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.