Good morning!

I hope you had a nice weekend. Our spreadsheet is now fully up to date.

All done for now, thanks!

Spreadsheet accompanying this report: link (last updated to: 5th September).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

Phoenix group (LON:PHNX) (£6.7bn) | Op. cash generation +9% to £705m, CSM +10% to £3,567m. Outlook: “firmly on track”. | AMBER/GREEN (Roland) These figures look fine to me from a high level review. In my experience, Phoenix has a long track record of delivering on its guidance for cash generation and these results support current 2024-26 targets. In my view, the main risk here is that the company’s gradual pivot towards writing more new business and selling direct to customers may end up underperforming in terms of profitability and growth. However, there’s no sign of this yet, as far as I can see. With an 8.5%+ dividend yield covered by cash generation, I think this stock remains worth considering for investors seeking high yields. | |

Pan African Resources (LON:PAF) (£1.43bn) | FY26 production in line. Believes moving to Main Market would raise profile and attract new investors. | ||

| Sigmaroc (LON:SRC) (£1.29bn) | Interim Results | SP +6% Pro forma rev -1.1%. adj EPS +9.1% to 4.66p. Core volumes -3%. FY outlook in line with expectations. H2 to be similar to H1 in terms of underlying market conditions. Management focused on operational efficiency, with synergies set to exceed guidance given in May. A cyclical recovery in construction and steel markets (when?) will reverse current volume weakness, along with an expected increase in European defence spending. An encouraging start to the seasonally stronger second half. Panmure Liberum estimates: FY25 earnings forecast unchanged, small upgrades for FY26 and FY27 (0.8% increase for FY26, 1.4% increase for FY27). EPS estimates are 9.5p (FY26), 10.5p (FY26), 11.5p (FY27), vs. current share price 122.8p. | AMBER (Graham) [no section below] This "lime and minerals" Group has published another complicated set of results tables where I'm inclined to focus on the proforma results (for continuing operations). These tables show a mild decline in revenue but 1.6% underlying EBITDA growth (to £118m). Scrolling down to the actual financial statements I again - as last time - find that the actual profit figure is rather slim compared to the market cap: only £27m of after-tax profit from continuing operations, although this is a huge improvement on the £5m generated in H1 last year. The P/E multiple is modest but I'm not sure how much I can trust it, given the extent of the adjustments at play here. £26.5m of "non-underlying items" in H1 included some items I would be very reluctant to exclude from analysis, in particular share options expenses (£5.5m) and restructuring expenses (£1.7m), but there are seven other categories of non-underlying items! The balance sheet is also an issue: there are £670m of borrowings, over £600m of which is a "syndicated term facility" led by Santander and BNP Paribas. The rate here is reasonable (2-3.5% above EURIBOR) but it's a heavy debt load, no matter which way you look at it. The leverage multiple is officially 2x which is not distressed, but nor is it a level that I would consider to be particularly comfortable. Overall, therefore, I'm inclined to leave our AMBER stance unchanged. There's a lot that could go right for the company: a cyclical recovery in its end-markets, further synergies after the large acquisition it made last year, and a reduction in "non-underlying items" all spring to mind. But I'm inclined to think that the current market cap might be a fair one, when all is said and done. The StockReport agrees with me, awarding it a StockRank of 60 and a "Neutral" style |

Grainger (LON:GRI) (£1.42bn) | Expect improved shareholder returns, forecasting 50% EPRA EPS growth by FY29. | ||

Domino's Pizza (LON:DOM) (£824m) | Trialling new chicken sub-brand in 187 stores in NW Eng/NI. Will fulfil through existing supply chain. | ||

Cerillion (LON:CER) (£416m) | With existing customer, support existing consensus market exps - no change to forecasts today. | AMBER (Graham) This company has grown into a nice success story on AIM, and today’s news is positive, although the contracts were already expected and baked into forecasts. So there are no changes to forecasts at Panmure Liberum: EPS of 57.7p in FY Sep 2025, and then 63.5p the following year. Valuing it on next year’s earnings gives a P/E multiple of about 23x, in line with what you’ll find on the StockReport. The CEO top-sliced around current levels in Juneand therefore I’m inclined to leave our AMBER stance unchanged for now, given the fairly rich valuation. It does have impressive quality metrics and has grown steadily over the years, so if you can get comfortable with what it does (CRM solutions for telecoms companies), you might find that it’s worth investigating further. | |

Foxtons (LON:FOXT) (£165m) | To be funded through existing cash and RCF. Will continue to acquire lettings portfolios. | ||

Concurrent Technologies (LON:CNC) (£162m) | Rev +26%, PBT +17% to £2.3m. Order intake +25% to £17.8m. FY25 outlook ahead of exps. | ||

Gaming Realms (LON:GMR) (£149m) | Rev +18%, driven by brand licensing. PBT +19% to £4.2m. FY25 outlook in line with expectations. Canaccord Genuity revised estimates: FY25E EPS: 2.9p (prev. 3.0p). | AMBER (Roland) Today’s results are marred by a big hit to UK-derived revenues from a regulatory change in April. However, progress outside the UK was strong, with 19 new partners added and US revenue up by 22%. Profitability remains strong and the balance sheet is also in good health. While I feel that the capitalisation of software development costs does flatter profits, I still think this looks like a decent business. I’ve turned neutral today to reflect a declining trend in earnings and the risk that a UK recovery will take some time. But I think the shares could start to offer some value if they get much cheaper. | |

Treatt (LON:TET) (£132m) | Trade buyer Natara (owned by Exponent Private Equity) has offered 260p per share in cash. | PINK (Graham) | |

Avation (LON:AVAP) (£106m) | FY June 2025 revenue approx. $110m (cons: $102m). Exec Chair: AVAP is strongly cash-generative. | ||

Iqe (LON:IQE) (£84m) | SP -9% Macro uncertainty, market weakness, funding delays. FY25 revenue now expected at £90-100m. (StockReport: £118m). Exploring the sale of the entire company now in addition to the sale of its Taiwan operations. | PINK/BLACK (RED) There’s a lot happening here today with a profit warning and news that they have expanded the scope of their strategic review to include the possible sale of the entire company. It looks to me as if they may be in need of a bailout and so I’m as bearish on it as I’ve ever been. | |

Journeo (LON:JNEO) (£79m) | Crime and Fire Defence Systems: framework agreement valued at up to £5m with UK utility company. | AMBER/GREEN (Roland) [no section below] A promising-sounding start to Journeo’s ownership of CFDS, which it acquired last week. As I discussed at the time, the CFDS deal looked reasonably priced, but this new business is slightly outside Journeo’s core markets and has delivered inconsistent performance over the last few years. If Journeo can deliver broader-based and more consistent growth for CFDS, I think the acquisition could create attractive shareholder value over time. No change to our view today. | |

Fiinu (LON:BANK) (£58m) | Made an £8m acquisition in August. Results to June: zero revenues. | ||

Works co uk (LON:WRKS) (£33m) | LfL sales outperforming wider market. Confident in delivering FY26 exps (adj. EBITDA £11m). | ||

Tissue Regenix (LON:TRX) (£21m) | H1 revenue -6%. Uncertain economic conditions. 2025 adj. EBITDA to be in line with 2024. Estimates: Cavendish withdraw forecasts. | ||

Chill Brands (LON:CHLL) (£9m) | Chill is SYP’s brand expansion partner. Facilitating route to market via Chill’s distribution network. |

Graham's Section

Treatt (LON:TET)

Up 18% to 264p (£156m) - Statement re Recommended Acquisition of Treatt Plc - Graham - PINK

Another day, another acquisition.

The stock has been a very poor performer in 2025, down over 40%:

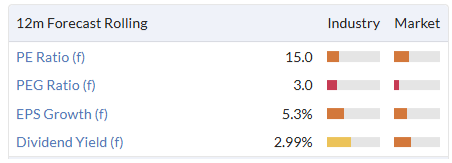

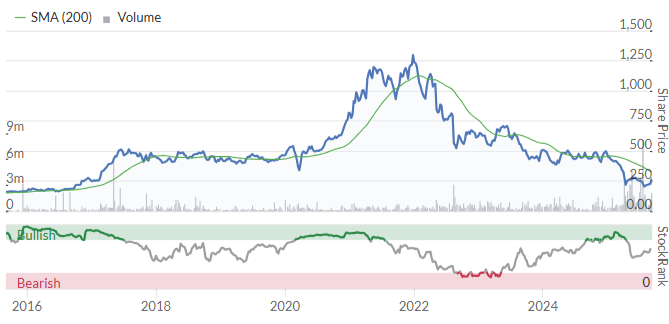

The previously high-rated ingredients business has drifted into “value” territory:

Exponent Private Equity, a mid-market private equity firm, have noticed the value on offer and they arrive today with an offer of 260p per share, through one of their investee companies.

I’m glad to see that the Treatt share price is currently above this level, suggesting that at least some shareholders expect a better offer than that.

260p is only a 16% premium, which I consider to be a very poor level. What is the opposite of “generous”?

Equity investors, particularly those of us who take single-stock risk in small-caps and mid-caps, should be targeting annual returns of greater than 10%, in my view. The effort and the risk involved in buying into these types of shares must come with a suitably large reward. So 10%+ should be a normal target, to make it worthwhile.

Therefore, if we are going to hand over our best ideas to new owners in exchange for a one-time cash injection, I would expect a 20-25% premium to the existing share price at a minimum, and even at that level I wouldn’t necessarily agree to it. For example, I’m not in favour of the takeover offer at International Personal Finance (LON:IPF) (I hold), where a 25% premium was offered.

But Treatt has struggled this year, and this has opened the door for an opportunistic approach, hoping to take advantage of stale bulls in the stock.

Our most recent coverage was in July when Mark (who held shares in Treatt at the time) was neutral on it following another profit warning.

That profit warning was blamed on “high citrus oil prices affecting buying patterns” and the US economy (consumer confidence plus geopolitical and tariff uncertainty).

It’s rare that companies will explicitly acknowledge when they are failing under pressure from competition - but my understanding is that there are newer and cheaper alternatives to Treatt’s ingredients in the market. A period of higher prices may have accelerated a transition to these cheaper alternatives.

The company has been plodding for some time: it had a terrific growth spurt from 2015-2018, but has made limited progress since then in terms of profitability or share price. Its valuation became particularly overheated in the bull market of 2021-2022:

But that doesn’t excuse a low-ball offer, or excuse management for recommending it.

The proposed buyer is Natara, another ingredients company serving the flavour and fragrance industry, which is owned by Exponent Private Equity.

Natara’s perspective is that competitive pressures are indeed a factor, and they mention this prominently:

Given the macroeconomic headwinds affecting the industry, including competitive pressures, subdued North American consumer confidence, a weaker US dollar and volatility in citrus prices, combined with Treatt's specific trading challenges, Natara believes Treatt is at a critical inflection point. To restore performance and unlock long-term growth, Natara believes the required investment, capital commitments and operational measures can be more effectively achieved under private ownership, allowing the business the flexibility to execute its strategy away from the uncertainty and ongoing costs associated with public markets.

Treatt’s directors seem to agree:

While the Treatt Directors recognise that improvements in market dynamics and Treatt's execution of its evolving strategy should support a recovery in Treatt's operating and financial performance, they also acknowledge that this could take some time and remains subject to significant uncertainty as to the external factors affecting Treatt's business and the delivery of internal systems and organisational improvements.

Graham’s view

While I’m not particularly excited about Treatt’s future, I would be inclined to vote against this takeover as a matter of principle. A takeover premium of 16% should be seen as a negotiating tactic by the potential buyer, not the final offer. I hope that Treatt’s shareholders resist this 260p offer, and today’s share price suggests that many of them are not.

I note that at the last full-year results, the company reported net assets per share of 232p, almost fully tangible, with land and buildings held at historical cost (no revaluation to their actual current values).

Net debt was negligible.

So there is no question of the company being in any financial distress.

If Treatt's shareholders accept this offer, it could embolden more private equity firms to swoop in and attempt to take shares private at similarly ungenerous premiums. Let's see what they do!

I can find no mention of "irrevocable undertakings" to support the deal in today's announcement, besides from Treatt's directors who hold barely any shares in the company. So the major shareholders are still free to make up their minds on this one.

Iqe (LON:IQE)

Down 8% to 7.9p (£77m) - Graham - PINK/BLACK (RED)

Feeling vindicated with my scepticism towards this one - most recently RED in May when the share price was about 10p.

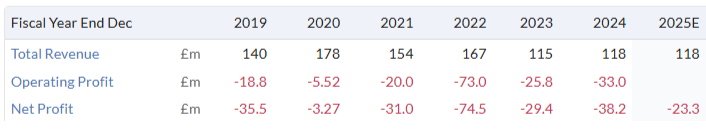

It continues to trade poorly:

As previously noted, trading in H1 2025 was impacted by macroeconomic uncertainty and as a result, some end customer demand was fulfilled with existing inventory. The Group has continued to experience weakness in wireless markets, largely as a result of softness in mobile handset sales, and this is expected to persist through 2025. In addition, delays to federal funding cycles in US military and defence sectors are resulting in the deferral of orders into 2026.

New guidance: revenues of £90-100m (StockReport suggested £118m) and adjusted EBITDA of between minus £5m and plus £2m.

Strategic Review: they continue to explore the sale of their Taiwan operations, as they have done for some time. They are “progressing negotiations with multiple parties”.

…it is expected that the proceeds from such sale will be used to fully repay the Group's Revolving Credit Facility with HSBC Bank and Convertible Loan Notes issued in March 2025, as well as providing IQE with cash to invest in its core operations.

But there’s more to it than that: IQ now looking to explore “the potential sale of the Company and is seeking buyers”, i.e. they are looking for a takeover of their entire business, and at least one potential buyer is open to this idea:

IQE is in receipt of an approach from a potential offeror at the time of this announcement. There can be no certainty either that an offer will be made nor as to the terms of any offer, if made.

Graham’s view

While IQE operates in the technology sector, it seems to be a low-margin manufacturer at its heart.

With manufacturers in any industry, EBITDA is not a metric that I think adds any value: the “D” (depreciation) is too large.

But if a manufacturer is unprofitable even at the EBITDA level, I do treat that as a serious red flag.

When it comes to possible takeover talks, my working assumption must be that the company is now looking for a bailout. The sale of Taiwan operations, if it occurs, will be used to repay debt. But if that doesn’t work out (and it has been in the works for a long time), then a takeover of the entire business might be the next best thing.

Results for last year showed the company finished with net debt of £19m, up from £2m the prior year.

The depreciation charge was £20m, underlining my view that EBITDA is meaningless.

While I have to colour this “PINK” as it’s now technically in an offer period, my view remains firmly RED - this is a poor-quality investment and I suspect that management are increasingly desperate for a solution to their problems.

Roland's Section

Gaming Realms (LON:GMR)

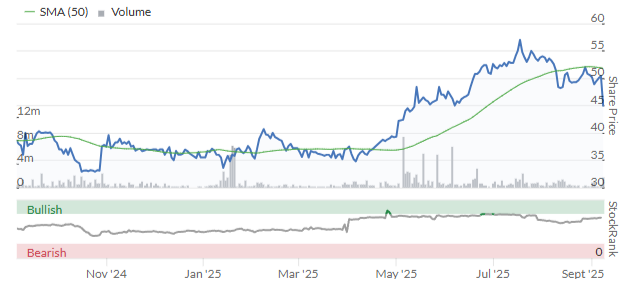

Down 11% to 44p (£129m) - Roland - Interim Results - AMBER

Today’s half-year results appear to be in line with expectations and broker estimates from Canaccord Genuity are unchanged today. So it’s not immediately obvious why shares in the owner of Slingo (a mix of slots and bingo) have fallen so sharply this morning.

My guess is that a big hit from regulatory changes in the UK may have spooked some investors, especially as it’s masked stronger growth elsewhere:

For some background on this business, Graham was GREEN following the company’s 2024 FY update in February.

I moderated our view to AMBER/GREEN in March following the release of the company’s 2024 results, when I noted unchanged earnings estimates and capitalisation of development costs (which tends to flatter earnings).

Let’s take a look at today’s results.

H1 results summary

Today’s figures cover the half year to 30 June 2025 and include some seemingly strong headline numbers:

Revenue up 18% to £16.0m

Adjusted EBITDA up 30% to £7.5m

Pre-tax profit up 19% to £4.2m

These figures highlight the group’s attractive profitability, with an operating margin of 25% and a trailing 12-month return on equity of 22.6%.

The only caveat I’d add to this is that as previously, profits were significantly flatted by the capitalisation of software development costs. While this is a common industry practice, the impact is material.

Gaming Realms only amortised £2.2m of intangible assets in H1, but capitalised £3.4m of development costs (mostly software developers’ salaries). If the company had followed the more conservative practice of expensing all costs as incurred, then pre-tax profit for the half year would have been around 28% lower, at c.£3.0m.

As a result, the stock’s P/E ratio would be significantly higher – perhaps in the low 20s, prior to today’s drop.

Happily, we don’t have to worry about the balance sheet here. Net cash rose by 28% to £19m in H1, aided by c.£2.3m of favourable working capital movements.

Trading commentary - UK takes a regulatory hit

The company continued to expand its reach in H1, adding 19 new partners globally. These included the US, Canada (BC), Brazil, Colombia and Europe. Six unique new Slingo games were also released, taking the total distributed games portfolio to 95.

According to a Canaccord Genuity note available on Research Tree this morning, the company now has a total of 244 partners.

I think we can understand today’s fall more easily if we drill into today’s revenue numbers. These show a more mixed performance for the half year:

Content licensing revenue: up 4% to £11.7m

Brand licensing revenue: up 623% to £2.4m

Social publishing down 7% to £1.9m

Content licensing: Gaming Realms’ core business is distributing games through partners (typically gaming operators) into regulated markets. The first half of this year saw a mixed performance.

According to the commentary, UK content licensing revenue fell by 13% in H1 due to staking limit changes introduced in April 2025. This trend is said to have reduced to a 9% decline by August, as updated games were certified and released.

Ex-UK content licensing revenue rose by 18% during H1, with the US up by 22%.

Brand licensing rose by 623% to £2.4m due to the “completion of a significant brand deal during the period”. The geographic market for this deal wasn’t disclosed, but as I’ll explain below, I am guessing it may have been the USA.

Geographic breakdown: you’ll notice I’ve used percentages above when discussing content licensing revenues in different markets, not monetary amounts. So it’s not entirely clear how much revenue the UK contributes.

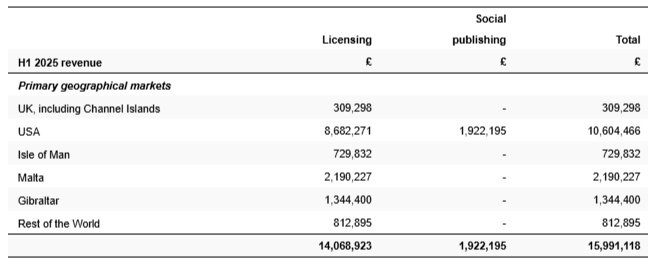

There’s a reason for my vagueness. Although Gaming Realms’ results do include a segmental breakdown with revenue generated by geography, these numbers don’t add up in the same way as the percentages I’ve listed above. The licensing column also appears to include both content and brand licensing:

I believe this split reflects the company’s use of operations in Malta, Gibraltar and the Isle of Man. Gaming Realms generated 30% of its licensing revenue in these markets in H1, but these locations are obviously unlikely to be home to 30% of the company’s end-users.

Use of these offshore locations is pretty standard in the UK online gaming sector due to the tax and regulatory benefits they provide. My best guess is that most (but not all) of the revenue from these three markets is effectively UK revenue.

In corroboration of this, today’s note from Canaccord Genuity indicates that “c.29%” of content licensing revenue is generated in the UK – so that would have been around £3.4m in H1.

I am also going to speculate that the “significant brand deal” that closed in H1 was in the US – that would explain the mis-match between 54% growth in US revenue to £8.7m and the reported content licensing increase of 22% for the US.

Social Publishing: this part of the business is described as “B2C freemium games to the US”. I assume this means Gaming Realms’ own online operations in the US, rather than those of its licensing partners.

Revenue fell by 7% to £1.9m in this division in H1, which we are told is due to a 44% reduction in marketing spend during the period. It looks like this is a business where churn is high, and consistent promotion may be required to maintain user growth.

The company says this is a timing issue and higher marketing spend in H2 is expected to support “stronger revenue levels”.

Outlook

Today’s management outlook statement seems pretty clear to me:

Trading in the first half of 2025 was in line with expectations, and the Board remains confident that the Group will maintain this positive trajectory through the remainder of the year.

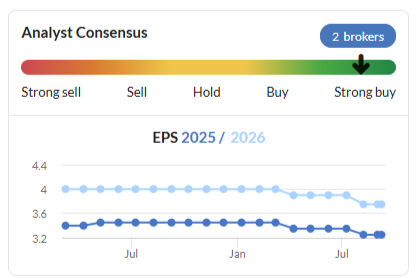

Canaccord Genuity has left its revenue forecasts unchanged today but has trimmed EPS estimates slightly:

FY25E EPS: 2.9p (prev. 3.0p)

FY26E EPS: 3.5p (prev. 3.7p)

As I’ve commented in March, these estimates are lower than the consensus figures shown in Stockopedia of 3.25p and 3.75p for FY25 and FY26 respectively. However, the consensus view has been declining in recent months, so perhaps Canaccord are right to be more cautious:

Roland’s view

Gaming Realms’ business model appears to be continuing to deliver attractive growth outside the UK. But today’s results provide a useful reminder that businesses of this type are often vulnerable to regulatory change, sometimes unpredictably so.

Progress remediating the impact of April’s changes seems positive, but we don’t yet know if UK revenues will return to pre-April levels in the near future.

Another concern, for me, is that the company’s habit of capitalising development costs means that its shares may be more expensive than they might seem, on a cash-earnings basis.

Finally, we can see that at least one broker covering this stock has trimmed its earnings estimates today.

My overall impression is that the impact of April’s UK regulatory changes may have been a little more severe than expected. But on balance, this still looks like a highly profitable and cash-generative growth business to me.

In terms of valuation, applying a reduced share price of 44p to Canaccord’s FY25 earnings estimate of 2.9p gives a P/E of 15 – broadly unchanged from the stock’s pre-results valuation.

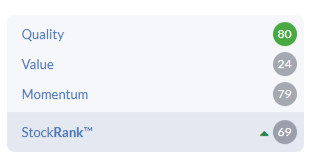

Stockopedia viewed the stock as a High Flyer ahead of today’s results, but I suspect this could change when today’s results and updated estimates are digested by the algorithms. The ValueRank is already weak and I expect a drop in MomentumRank following today:

I am inclined to trim our view to AMBER today, given the negative reaction to today’s figures and the recent declining trend of earnings estimates. However, I think any further weakness could leave this stock attractively valued and worthy of a closer look.

Phoenix group (LON:PHNX)

Down 6% to 625p (£6.3bn) - Roland - Interim Results - AMBER/GREEN

Life insurance and retirement specialist group Phoenix has become a popular choice for investors seeking high yield investments. The stock is up by more than 20% year-to-date, despite this morning’s 6% drop:

However, today’s half-year results appear to have disappointed the market, despite the company’s clear statement that Phoenix is “firmly on track to meet 2026 targets”.

The company has also taken this opportunity to inform the market that it will be changing its name to become Standard Life plc in March 2026. Phoenix already controls this brand and uses it within its operating businesses.

Half-year results summary

I should start with a caveat – I’m not an expert in life insurers, whose accounts are deep and complex. However, I do have some interest in Phoenix and its various UK peers, which all offer very high and seemingly sustainable dividend yields.

In my view, a few key points can give us a flavour of the strengths and any weaknesses in today’s numbers, without requiring actuarial training to understand!

Phoenix helpfully provides a table with most of the key metrics at the top of its results. These are the numbers I normally focus for an initial review – the company reports on each of them in more depth further down.

Dividend: the first point many shareholders will check is the dividend:

Interim dividend up 2.6% to 27.35p per share

This looks fine to me. It’s in line with the company’s commitment to a progressive payout and – as we’ll see shortly – the c.£275m cost is comfortably covered by surplus cash.

Cash: surplus cash is a key output from this type of business. It’s used to support the dividend, meet regulatory requirements and help fund organic growth. Phoenix reports two measures:

Operating cash generation up 9% to £705m

Total cash generation down 17% to £784m

Operating cash generation represents money remitted to the group from the ongoing operations of its subsidiaries – effectively recurring cash generation.

As is common across this sector, this comes from a mix of “surplus emergence” generated by its insurance policies (e.g. when they mature) and so-called “management actions”.

Management actions are basically activities carried out to optimise returns from the assets that underpin its insurance policies. They might include changes to asset allocation and other such activities.

Surplus emergence generated £411m in H1, with management actions contributing £294m.

The important point I always check here is that operational cash generation is covering the group’s operating costs, dividends and debt interest.

In this case, cover looks comfortable – these recurring outgoings totalled £459m in H1, leaving £246m of surplus operational cash generation. One caveat to this is that Phoenix says the timing of new bulk annuity business means that the H2 surplus is likely to be lower.

Total cash generation includes operating cash (recurring) and non-recurring items such as one-off returns of capital from group companies and “non-recurring management actions”. These are inherently likely to be lumpier, so I don’t think today’s drop in total cash generation is a major concern.

Phoenix notes that it has already cumulatively generated £2.6bn of cash since the start of 2024, more than half its 2024-26 target of £5.1bn.

Capital: this is a complex area, but the factors are surplus capital generation, coverage of regulatory requirements and leverage.

Surplus capital generation is a close relative of cash generation, but not an exact match!

In this case, the group’s “Solvency II” capital position improved slightly, with surplus capital rising by £0.1bn to £3.6bn, after allowing for the 2025 interim dividend.

This is a regulatory measure of capital and this increase improved Phoenix’s Solvency II coverage ratio by 3% to 175%. That’s towards the top end of the company’s target range of 140% to 180%.

The group’s leverage ratio reflects debt usage and some other factors. It improved (i.e. fell) to 34%, from 36% at the end of 2024.

Phoenix is targeting a 30% leverage ratio by the end of 2026. Management says it remains on track, “albeit the path will not be linear”.

For contrast, Aviva (disc: I hold) recently reported a 32.3% leverage ratio, while Chesnara reported 31%. So the Phoenix figure does not seem unusual for this sector, but is perhaps slightly above average.

Earnings & Shareholders’ Equity: the final element of the accounts worth checking is the profit and loss statement and the resulting impact on shareholders’ equity on the balance sheet.

IFRS accounting rules mean that the statutory figures here are often not that meaningful as comparisons, as they can be skewed by large mark-to-market valuation changes.

In this case I think the most useful measure is probably adjusted operating profit, which rose by 25% to £451m. This was driven by growth in the group’s main operating businesses, Pensions and Savings and Retirement Solutions.

This fed through to a 10% increase in Contractual Service Margin (CSM) to £3,567m. This reflects expected future profit from the group’s portfolio of (long term) insurance contracts.

This business model entails carrying a huge body of assets and liabilities on the balance sheet, which should be evenly matched. Phoenix has reported £310.0bn of assets today and £308.2bn of liabilities.

The various movements in the value of these assets (mostly on paper) resulted in a statutory loss of £156m during the period.

This contributed to a 6% fall in adjusted shareholders equity fell by 6% to £3,443m. This was slightly below JPMorgan forecasts, according to the Reuters newswire.

Obviously we wouldn’t want to see equity continually falling. But IFRS accounting means there will be some volatility in equity that won’t necessarily reflect real-world cash generation.

I tend to share the company’s view that surplus cash generation and capital generation are the key measures to follow.

The main risk with equity, in my view, is that it could be wiped as a result of some long-term miscalculation or change in expectations of future cash flows and liabilities. I see this as a long tail risk with this kind of business; unlikely, but not impossible.

Trading commentary: Phoenix was historically a closed-book specialist, buying existing portfolios of insurance policies from other companies and running them to completion. The group did well at this, but was starting to struggle for growth.

As a result, recent years have seen an expansion in the group’s new business operations, in an effort to generate sustainable growth.

Progress in H1 included FCA approval for “our own in-house Retail advice proposition”, supporting planned product launches. This will presumably include pensions and other retirement savings and investment products.

Another growing area of new business is individual annuities. The company launched “Annuity Desk” for Standard Life customers in H1 to help digitise this service.

Bulk annuity premiums are a key source of earnings, too. New deals were low in H1, at just £0.8bn. However, this is a lumpy market and £2.9bn of new deals are said to have been completed or gone exclusive since the end of June, somewhat redressing the balance.

Outlook

CEO Andy Briggs sounds confident:

Firmly on track to deliver all our financial targets which support our progressive and sustainable dividend policy

I don’t have access to broker notes for this business but expect forecasts to remain broadly unchanged. On that basis, Phoenix shares are trading on a forward P/E of c.10x, with an 8.8% dividend yield.

Roland’s view

Phoenix has proven expertise at running closed book portfolios and has done well in this business. I’ve followed this company for several years and guidance for cash generation and dividends have been consistently met or exceeded.

I think it’s fair to argue that there’s more uncertainty about new business growth and profitability, but I’m encouraged by progress so far and don’t see any reason to change that view today.

I think a moderately positive view makes sense today. This is a large, complex business and the shares are not as cheap as they were. But I think there’s a good probability Phoenix will be able to maintain and extend its attractive dividend record, which I would see as the main reason for holding the shares.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.