Good morning! Results season is kicking off.

Spreadsheet accompanying this report: link (last updated to: 5th September).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

Anglo American (LON:AAL) (£26.9bn) | Merger of equals. $800m in pre-tax recurring annual synergies. AAL shareholders to own 62.4%. | PINK | |

Unite (LON:UTG) (£3.4bn) | Doc for takeover of Empiric. 94% of rooms sold. Reiterated guidance. EPS 47.5-48.25p. | ||

Dunelm (LON:DNLM) (£2.5bn) | Rev +3.8%, PBT +2.7% (£211m). In line with exps. Pleased with trading in new year, but yet to see consumer recovery. Consensus expectations suggest FY26 revenue growth of 4.6% and EPS growth of c.5%. | AMBER (Roland - I hold) [no section below] These results show the quality hallmarks I’ve come to expect from this family-owned business, including strong cash conversion, low debt and a sky-high 130% return on equity. Shareholders are well rewarded with dividends, with a total payout of 79.5p giving a trailing 7% yield. However, while sales and profits edged higher last year, Dunelm can’t escape the difficult consumer environment. Another risk is the imminent departure of CEO Nick Wilkinson, who leaves big shoes to fill in my view. His replacement seems well qualified, but I note that Wilkinson does not mention expectations in his final outlook statement, perhaps leaving the door open for his successor to take a fresh view. Dunelm’s goal is to expand its market share in homewares and furniture to 10%, from 7.9% currently. I rate the business highly and believe there’s further growth potential on a medium-term view. However, my feeling is that the share price may be up with events now, given the modest growth outlook and change of leadership. I’m going to maintain our neutral view until we hear from the new CEO. | |

Computacenter (LON:CCC) (£2.5bn) | Rev +30.8%, adj. PBT -3.8% (cc). Strong start to Q3. Continue to expect profit growth for full year. | ||

Alpha International (LON:ALPH) (£1.77bn) | Rev +34%, adj. PBT +25% (£27.9bn). Acquisition by Corpay to complete in Q4. | PINK | |

Gamma Communications (LON:GAMA) (£981m) | Rev +12%, adj. PBT +9%. Full year outlook: adj. EBITDA in line, adj. EPS slightly ahead. | AMBER/GREEN (Roland) Digging into the accounts suggests performance from the group’s continuing businesses was broadly flat in H1, with particular headwinds in the UK relating to macroeconomic conditions. The picture looks brighter in Germany, with two recent acquisitions adding 11% to H1 revenue and supporting longer-term growth aspirations. Fundamentally, I think this remains a decent business with attractive quality metrics. I’m conscious of the risk of further weakness but I believe the valuation looks reasonable and have upgraded our view by one notch to reflect this. | |

Gulf Keystone Petroleum (LON:GKP) (£399m) | Listing to increase liquidity, attract new shareholders, and increase access to capital markets. | ||

Metals Exploration (LON:MTL) (£386m) | Development and construction activities are progressing to schedule. | ||

Intuitive Investments (LON:IIG) (£230m) | Hui10 will provide its QR codes for Tuopai Shede’s bottles sold via the Lucky World platform. | ||

Midwich (LON:MIDW) (£211m) | Rev -2.7% (cc). Loss-making. Adjusted operating profit -23.4% (£16.6m). Exps unchanged. | ||

Gulf Marine Services (LON:GMS) (£210m) | PW: Rev +8%, adj. EBITDA. Leverage falls to 1.73x. Raises 2025 adj EBITDA guidance, 2026 EBITDA guidance unch. | BLACK (AMBER) (Roland) Today’s results emphasises EBITDA guidance while failing to mention a >20% reduction in earnings expectations for the year, which we’ve learned about from an updated broker note today. For this reason, I’ve labelled today’s update as a profit warning. While underlying trading remains positive, GMS now appears to be spending more on fleet capex and additional costs relating to a new leased vessel. This is the main reason for today’s downgraded earnings forecasts. I think the company’s disclosure today is poor and runs the risk of misleading investors. In addition to this, revenue growth expectations appear to be flattening out. While the debt-to-equity story remains intact and the shares trade at a significant discount to book value, I can’t get higher than neutral after today’s results and am curious to see if further bad news is likely later this year – geopolitical risks are mentioned as one reason for lower fleet utilisation in H1. | |

Regional REIT (LON:RGL) (£203m) | Portfolio value -2% (like-for-like). EPRA NTA £328.7m. Unexpected lease breaks to impact income. | ||

Sylvania Platinum (LON:SLP) (£202m) | Rev $104m, EBITDA $29.3m. Net profit $20.2m on production of 81,002 4E PGM ounces. FY26 production target of 83,000 to 86,000 4E PGM ounces. | AMBER/GREEN (Roland) [no section below] Sylvania has achieved rising production against a backdrop of rising metal prices, while costs have remained stable. The results demonstrate how operating leverage can drive big profit gains for commodity producers. With production up 11% and PGM basket prices up 12%, the group’s net profit rose by 189% to $20.2m during the year to 30 June. Management warns that the ramp up of the Thaba JV is now expected to be slower than planned, but overall this still looks like a decent business to me. In terms of valuation, with the stock trading at 1.2x book value and a return on equity of only 8% last year, I think the High Flyer styling is probably fair. I can’t go fully positive here due to the valuation and commodity price risk. But I think a moderately positive view is reasonable given the likely tailwind from higher PGM prices. | |

Mobico (LON:MCG) (£199m) | Rev +7%. Adj. op profit £59.9m. Leverage 3x. No change to FY25 adjusted op profit guidance. | ||

Luceco (LON:LUCE) (£190m) | SP +9% | AMBER/GREEN (Graham) [no section below] Nice top-line growth at this lighting company isn’t matched by profit growth, largely due to the impact of recent acquisitions. I was AMBER/GREEN on this at the Q1 update in May noting that quality metrics had deteriorated as the company attempted to swallow the costs of recent acquisitions. That theme is evident again today, with profit growth held back again for the same reason. At least the leverage multiple has dropped back slightly to 1.6x, and management are confident. Overall I see little reason to change my stance: lighting companies ought to trade at cheap multiples in my view, due to volatile demand, and LUCEO is trading at around 9x next year’s forecast. Given the use of leverage and the messy impact of acquisitions, I retain my slightly cautious stance. | |

accesso Technology (LON:ACSO) (£172m) | Rev -1.9%, lower vols in early summer. “Cash EBITDA” -22% to $5m. FY guidance unchanged | ||

James Fisher And Sons (LON:FSJ) (£167m) | Rev broadly flat after disposals, adj PBT +4.7% to £4.5m. Debt reduced. FY outlook unchanged. | ||

Serabi Gold (LON:SRB) (£167m) | Midway through $9m surface drill programme. Extended Senna orebody, new discovery at Coringa | ||

Afentra (LON:AET) (£124m) | Rev -29%, adj EBITDAX -32% to $27.9m. Sales vol -22% to 700kbbl. | ||

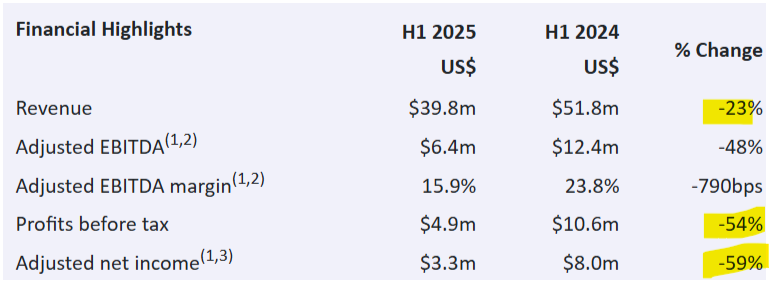

Somero Enterprises (LON:SOM) (£123m) | Rev -23%, PBT -54% to $4.9m. US -18%, Europe -51%. FY25 guidance unch, exp stronger H2. Forecasts unchanged at Cavendish, factoring in seasonally stronger H2 and the benefit of product launches. | AMBER/RED (Graham) This concrete screeding company still has a net cash position and is still profitable, so perhaps my maintenance of AMBER/RED is a little harsh. However, the last profit warning was only in July and I’d like to see a little more evidence of stabilisation before upgrading. I remain concerned that relatively new competitive pressures might be an even bigger problem for the company than the US economy. | |

Pebble (LON:PEBB) (£76m) | Rev -4%, PBT -10% to £2.6m. New wins offset softness in client spend. FY25 outlook in line. | ||

Likewise (LON:LIKE) (£69m) | Rev +10%, adj PBT +120% to £0.74m. Distribution reach is growing. On track for FY exps. | AMBER/GREEN (Graham) [no section below] No upgrade to forecasts at this floor coverings distributor yet, with Zeus leaving forecasts unchanged despite that “revenue performance to date is ahead of expectations”. The EPS forecast is 1.2p this year and then 1.6p next year (slightly increased from 1.5p due to a lower tax assumption). Roland was AMBER/GREEN on this in June and I’m happy to leave this unchanged today on the basis that the EPS forecasts appear to be solid and the stock is considered a “High Flyer” on the StockReport, with Momentum of 92. But personally I find this to be a sector (floor coverings) where it is extremely difficult to find high-quality buy-and-hold investment candidates, and a perusal of LIKE’s trading history shows that its track record is patchy. I would therefore view this more as a share to trade than to hold for the long-term. | |

Flowtech Fluidpower (LON:FLO) (£39m) | H1 in line. Rev +2.1% but LFL -11.8%. Op profit -33% to £0.8m. H2 improving, FY outlook in line. | ||

PCI- PAL (LON:PCIP) (£33m) | Rev +25% w/ ARR +25% to £19.3m. Adj PBT £0.81m (FY24: £(0.57m)). FY26 trading in line. | ||

Mast Energy Developments (LON:MAST) (£30m) | JV with Avanti-E to develop heat and power solutions. Short-term goal of 25MW, med-term 100MW. | ||

Getbusy (LON:GETB) (£29m) | Rev +2%, adj EBITDA +5% to £423m, but adj LBT £(666m). Expect FY25 ARR growth 7-10% | ||

Tialis Essential IT (LON:TIA) (£20m) | Rev -18%, adj EBITDA +11% to £1.0m. H1 delays, but contract wins in line & FY exps unch. | ||

Angle (LON:AGL) (£19m) | Rev -20%, H1 loss of £9.3m. US issues causing delays, FY revs now exp >£1.5m (prev. £3m) | BLACK | |

Quantum Base Holdings (LON:QUBE) (£11m) | £250k contract expansion with international security printer, revenue due in y/e April 2026. |

Graham's Section

Somero Enterprises (LON:SOM)

Down 2% to 220p (£118m) - Interim Results - Graham - AMBER/RED

It’s a dismal set of numbers from Somero, as expected:

It has been clear for some time that this concrete screeding company is under pressure:

They say they took a “disciplined approach to H1”, with the US being the key headwind:

North America revenue -18% due to dampened project starts and investment confidence linked to tariffs, elevated interest rates and restrictive immigration policies as previously reported

Their European revenue result is actually far worse, down 51%.

Management changes: they have a new CEO after the very long tenure of Jack Cooney finally came to an end in March.

New product launches: they launched an electric-powered boomed laser screed in January and have two other new products launching in H2.

Comment by the new CEO:

"I am proud of how the Company has navigated the challenges presented by the first half of the year. While macroeconomic uncertainty weighed on performance, our disciplined focus on operational efficiency and the enduring nature of our long-term growth drivers position us well for recovery as market conditions stabilize"

Estimates - no change to estimates at Cavendish, but they are factoring in a seasonally stronger H2 and the benefit of product launches, so I do think there is still a medium-high risk of another profit warning. The EPS forecast for the current year is 21 US cents (15p) and there are no 2026 forecasts yet, despite only four months left in the year.

Graham's view

I tend to agree with management's analysis that they have delivered a reasonable result in the circumstances - other companies might have fared even worse in the face of a 23% revenue decline.

But that will provide little comfort in the short-term: it is still difficult to get past a 50%+ decline in profitability.

The big question for me - running on similar themes to yesterday’s report - is whether Somero’s difficulties are truly attributable to the US economy, or whether there is more to it than that.

Ligchine has grown rapidly over the past decade and my understanding - albeit from a far distance - is that it now poses a much more significant competitive challenge to Somero than it did in the past (Somero previously appeared to have a monopolistic position).

Ligchine’s products do have a slightly different profile to Somero’s, but the primary difference is that they are much cheaper and can appeal to a wider audience.

It sounds like Somero is trying to gain broader appeal with one of its new products. It says that it is reaching out to a new type of customer with this offering:

Looking ahead to H2, the Hammerhead by Somero will broaden our reach into the mid-range concrete contractor segment with a solution designed for quality, ease of use and affordability. This segment is significantly larger than the Company's traditional commercial customer base and has different needs necessitating a tailored offering.

Whatever the truth is, it’s undeniable that Someros’ financial performance has struggled to make any progress since 2021.

My suspicion is that the competition has indeed taken away some portion of Somero’s pre-2022 customer base, and put pressure on pricing.

Overall, I think I’m going to leave our existing AMBER/RED stance unchanged.

The company does have a healthy net cash position ($24.6m) and is still profitable, so I’m not concerned from a balance sheet point of view.

But the last profit warning was in July and I’d like to see a little more evidence of stabilisation before upgrading back to neutral or higher.

Roland's Section

Gamma Communications (LON:GAMA)

Up 7% to 1,138p (£1.05bn) - Roland - Half-year Report - AMBER/GREEN

Double digit growth driven by strong German performance. Full year Adj. EBITDA in line with market expectations and Adj. EPS slightly ahead.

The market has reacted positively to today’s results from this technology group, which operates in the UK and Germany and specialises in providing voice, mobile and video communications solutions for business and other organisations.

H1 results summary

Sales rose by 12% to £317m during the half year, aided by some acquisitions in Germany and “low single digit UK revenue growth” due to macroeconomic conditions.

Management warn that after a strong H1 in 2024, UK business confidence has gone into reverse since the November 2024 budget. Gamma says it saw a sharp reduction in the number of cloud seats added (i.e. users) compared to last year.

Frustratingly, Gamma makes us drill down into the footnotes to find a split between organic and acquisitive growth.

It’s worth checking though, because it turns out that organic growth slowed to just 1% during the first half of this year. The remaining 11% revenue growth in H1 came from acquisitions. It looks like performance from the continuing business was pretty flat in H1.

Turning to profits, again the picture is somewhat mixed, with some heavy adjustments needed to create today’s increased earnings:

Adjusted pre-tax profit up 9% to £61.0m

Reported pre-tax profit down 10% to £43.5m

When adjusted profit is 40% higher than reported profit and the two figures are moving in opposite directions, which figure should we use?

Checking the adjustments shows the main two items are amortisation of acquired intangibles (£9.6m) and “exceptional items” (£7.3m).

The exceptionals include £5.1m in costs relating to the acquisition of Starface (c.£165m) and a £2.2m charge relating to the company’s move from AIM to the Main Market.

I’m willing to accept these as genuine one-off items. But my usual approach in these situations is to check the cash flow statement to see how much free cash flow a business has generated during the period. This provides a useful sanity check for adjusted profits.

In this case, I estimate underlying free cash flow of c.£35m for H1, which looks like a close match to the group’s reported net profit of £32.4m for the half year. For the avoidance of doubt, I think this is a good result in terms of cash conversion – but for me, it calls into question some of the company’s adjustment choices.

My personal measure of H1 adjusted pre-tax profit would be the reported figure of £43.5m plus £7.3m in exceptionals. This gives a figure of £50.8m, which is a 4.7% increase from the comparable figure in H1 24.

The good news is that profitability remains relatively good, with an operating margin of 14% and trailing 12-month return on equity of 25%.

While Gamma has moved into net debt following the German acquisitions, leverage is minimal and doesn’t concern me given the group’s record of cash generation.

Trading commentary: Gamma CEO Andrew Belshaw says both of the firm’s German acquisitions (Starface and Placetel) delivered “double digit proforma revenue growth” against the same period last year.

He seems confident about prospects and says the group’s aim remains to “build a German business of comparable scale to the UK”. For context, the UK generated 74% of revenue in H1, so if Gamma can achieve this it could become a significantly larger business.

AI gets an obligatory mention in relation to the group’s Contact Centre offerings, which are said to have been improved with AI. However, trading has slowed, with 23,000 seats added in H1 versus 48,000 seats during the same period last year.

Customers are said to be choosing cheaper product options where possible, but Gamma’s new PhoneLine+ product for SMEs is allowing the company to compete at this end of the market and continue winning new business.

Outlook

The outlook for the remainder of 2025 is expected “to be underpinned by our expanded German business”.

Adjusted EBITDA is expected to be in line with market forecasts, while adjusted EPS will be slightly ahead.

However, the outlook for 2026 looks more mixed. The company warns of headwinds from lower gross profit per unit that result when UK customers switch from copper to fibre connections, as part of the ongoing copper network switchoff.

Increased competition is also said to be putting pricing under pressure in the enterprise sector of the market. Gamma is targeting £6-8m of cost savings in the UK through a restructuring that could affect 5% of group staff.

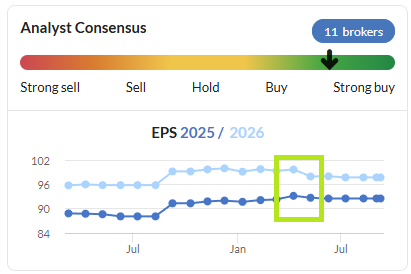

The impact of this mixed outlook statement on expected earnings is helpfully clarified in an updated note from Progressive on Research Tree today – many thanks:

FY25E EPS: 94.1p (+2%, prev. 92.7p)

FY26E EPS: 96.0p (-2%, prev. 97.7p)

Applying this revised FY25E EPS figure to today’s share price gives a forecast P/E of 12, with a c.2% dividend yield.

Roland’s view

While some of my comments may sound a little cautious, I do have a fairly favourable view of this business. It’s not the most exciting way to invest in tech, but I think Gamma seems fairly well run, with attractive profitability and continued growth potential (unless you think telephony will become redundant!).

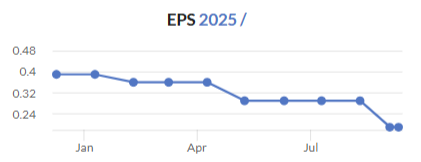

I took a neutral view on this stock in May when I suggested that “consensus estimates could fall a little lower”. That turned out to be correct, especially with regard to 2026:

Today’s results are marginally positive for 2025 and slightly negative for 2026. I would guess there’s still some risk the outlook could weaken further, as well.

However, on a longer-term view I think there’s a decent story here and I would argue that the valuation is starting to look quite reasonable after a significant decline this year:

Gamma’s trailing 12-month operating profit gives the stock an EBIT/EV yield of around 9%. That looks potentially attractive to me, if the business can continue to grow as planned in Germany.

I’m going to upgrade our view by one notch to AMBER/GREEN today, to reflect the mixed outlook but sound fundamentals. I’ve also added the stock to my personal watch list for further research.

Gulf Marine Services (LON:GMS)

Down 5% to 17p (£201m) - Roland - Half-year Report - BLACK (AMBER)

GMS, a leading provider of advanced self-propelled, self-elevating support vessels serving the offshore oil, gas and renewables industries, is pleased to announce its interim results for the six months period ended 30 June 2025 (H1 2025).

We’ve covered this business quite regularly in the past, so I’d suggest checking back through the archives for some of the backstory. The investment case has been based on the business deleveraging and converting debt to equity, aided by positive market conditions and a discounted valuation.

GMS shares have tripled in three years. But today’s results have received a poor reception from the market, despite seemingly including a slight upgrade to 2025 EBITDA guidance.

While I can see some positives in today’s results, I think there are some good reasons for today’s share price drop:

Debt reduction is running behind previous expectations

Despite today’s apparent upgrade to EBITDA guidance, broker Zeus has slashed earnings forecasts by more than 20% today for both 2025 and 2026.

Let’s take a look at the key points from today’s report to try and understand what’s happening.

The main headline figures make it clear that real profits fell sharply during H1, despite higher revenue:

Revenue up 8% to $87.1m

Adjusted EBITDA up 6% to $50.8m

Net profit -47% to $3.9m

Leverage ratio: 1.73x EBITDA (H1 24: 2.62x)

Net bank debt: $179.4m (H1 24: $238.5m)

Revenue: the 8% increase in revenue reflects an improved average day rate of $35.1k (H1 24: $32.4k) and initial income from an additional leased vessel that was in service for the final two months of H1.

To some extent this increase was offset by a reduction in fleet utilisation to 87% (H1 24: 91%), which management say was due for scheduled maintenance, mobilisation for new contracts and “geopolitical instability in the Middle East”.

Perhaps unsurprisingly, lower utilisation seems to have been concentrated among K-Class vessels, which I believe are GMS’s smallest and oldest units.

There are obviously cyclical and geopolitical risks here given the group’s location and exposure to the oil industry. But on balance, I don’t see much to worry about at the revenue level.

Profits: we need to understand the bridge from the increase in adjusted EBITDA down to a near-50% drop in net profit:

Gross profit down 7.7% to $35.9m due to an increase in depreciation and amortisation charges, which rose by 30% to $22.1m.

Depreciation and amortisation are charged to cost of sales (above gross profit in the P&L) and reflect higher capital expenditure and drydocking costs as GMS maintains its fleet, plus additional costs relating to the newly-leased vessel.

This highlights how inadequate EBITDA is as a profit measure for companies with expensive, depreciating assets. Periodic maintenance and improvements are not optional if the fleet is to remain commercially attractive.

Moving further down the income statement, there is some good news:

Pre-tax profit up 70% to $16.8m - several factors were at play here.

Overheads remained flat as a proportion of revenue, while interest costs fell by $4m to $8.1m as debt fell and lower interest rates kicked in.

GMS also benefited from a $1.4m non-cash credit to profits in H1, reflecting the reversal of a previous impairment charge.

Unfortunately, more bad news awaits in the tax section of the income statement:

Total tax charge $12.9m (H1 24: $2.5m)

Profit after tax down 47% to $3.9m

The big increase in the tax charge here reflects an increase in tax provisions of $11.5m in the accounts. There are a number of moving parts here, including a final settlement of the Saudi tax claim reported earlier this year, for which GMS has now paid $5.7m.

I’m not going to delve into the moving parts – the key point here is that this change in tax provisions is expected to be a one-off. It’s not the cause of today’s broker downgrade.

Outlook

The company emphasises a secured backlog of $517.4m (H1 24: $426.8m) and says demand for its vessels remains strong.

GMS’s guidance today is for 2025 adjusted EBITDA of $101-109m (previously $100-108m). 2026 EBITDA guidance is unchanged at $105-115m.

In addition, the plan to begin shareholder returns is said to be on track (I believe this means from 2026 onwards).

Unfortunately, I believe that investors reading the outlook statement alone run the risk of gaining a misleading impression.

The real story today seems to be the ongoing increase in depreciation costs (excluded from EBITDA) and the resulting downgrade to profit forecasts for both 2025 and 2026.

While it’s easy to see the increase in depreciation in today’s H1 figures, I can’t find any commentary in the RNS to suggest this level of increase is expected to be ongoing or to suggest that EPS will fall below expectations this year.

Sadly, this is another example of unequal access to information for investors who don’t receive broker notes.

With thanks to Zeus for making their coverage available on Research Tree, we are able to see a more complete picture of expectations for the current year:

FY25E Revenue unch at $184m

FY25E EPS -25% to 4.4c

2026 forecasts have also been cut:

FY26E revenue -3% to $200.9m

FY25E EPS -29% to 3.9c

The main theme here is the sustained increase in fleet costs and the impact of additional costs relating to leased vessels.

This increased expenditure also seems likely to slow debt reduction – Zeus now expects net debt of $160.7m at the end of 2025, compared to $137m previously.

Roland’s view

The good news here is that business still seems strong and the debt-to-equity conversion story remains intact. GMS’s net asset value rose by 6.2% to $406.6m during the half year (around 26p per share).

However, I feel the story may be slowing. On several previous occasions, we’ve commented on the eventual need for GMS to start spending more money on its fleet in order to expand or upgrade it. It looks like this may be starting to happen.

I also wonder if the profitability of the leased vessel will be lower than the company’s owned fleet, given that this additional vessel was acquired when market conditions were quite buoyant.

While GMS shares continue to trade around 25% below book value, the return generated on the company’s assets is only around 6%.

I also think it reflects poorly on management that no mention of revised earnings expectations was included in today’s RNS.

We were AMBER/GREEN on GMS previously, but I don’t think this is justified following today’s news.

I’m going to move down one notch to AMBER today, in reflection of the solid order backlog and modest valuation. However, I can’t see much to entice me into the shares at this level and will be keen to see if any further bad news follows later this year.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.