Good morning! We are well into earnings results season now, so expect another interesting day.

07:50 Agenda Complete

13:30 Wrapping it up there - report is complete

Spreadsheet accompanying this report: link (last updated to: 5th September).

Companies Reporting

Name (Mkt Cap) | RNS | Summary | Our view (Author) |

Londonmetric Property (LON:LMP) (£4.21bn) | 5 transactions with NIY of 5.5%, adding £4.6m in rent with WAULT of 23 yr. Includes 5 Premier Inns. | ||

Energean (LON:ENOG) (£1.65bn) | Prod -5% to 138kboepd, PBT +24% to $110m. FY guidance cut to 145-155beopd (prev 155-165k). | ||

Playtech (LON:PTEC) (£1.23bn) | Rev -10%, adj net profit -12% to €16.6m. “Strong H1”, FY25 adj EBITDA to be ahead of exps. | ||

Trainline (LON:TRN) (£1.08bn) | H1 rev +2% w/ ticket sales +8%. FY26 adj EBITDA to be “top end” of +6%-9%. £150m buyback. | AMBER/GREEN (Roland) Trainline shares have been weak this year, despite seemingly strong trading. Today’s update flags up an 8% increase in ticket sales, but revenue growth of just 2% highlights the impact of a 0.5% cut to its UK commission rate in April. More broadly, I think this also emphasises key risks for this business – political and regulatory exposure and new competing ticketing systems. However, Trainline is good at what it does and has minimal competition, in the UK at least. The group’s international and B2B units are providing useful diversification to help offset changing travel habits among UK rail users. Quality metrics are now at levels I’d expect for a software business of this kind. With the stock trading on a P/E of 14, I think the valuation looks reasonable and am happy to maintain our moderately positive view. | |

Fevertree Drinks (LON:FEVR) (£915m) | Rev +2%, adj EBITDA +1% to £18.4m. Cash £130m. On track to deliver FY expectations. | AMBER/RED (Mark) The continued lack of top line growth for a company on this type of valuation has to be a major worry. Some will point to weak consumer sentiment and the transition of the US business to a royalty one. However, I think it is equally likely that the premiumisation trend in mixers has peaked, and any growth from here will have to be driven by expensive marketing campaigns or event sponsorship, rather than a growth in underlying consumer demand. | |

THG (LON:THG) (£415m) | H1 in line: rev -2.6%, gross profit -8.5%, pre-tax loss of £66.7m. Strong Q3, FY exps unchanged. | ||

Kenmare Resources (LON:KMR) (£280m) | Work started to connect two new dredges to WCP A. On track for FY production and cost guidance. | ||

Trifast (LON:TRI) (£119m) | Trading in first four months of FY26 has been in line with exps despite macro headwinds. | AMBER (Mark) [no section below] This is an in line AGM trading statement. Coming just two months after the last update, it is unsurprising that not much has changed. However, the last update was a profits warning, with a negative sounding outlook and brokers reducing EPS low double-digits. It does seem strange, then, that the shares have risen 20% since then, making them look significantly more expensive on near-term forecasts. However, the investment case here is largely based on their transformation program turning things around for later years. While downgraded near-term performance isn’t a great sign for success here, it probably isn’t enough to change our neutral view. | |

Cornish Metals (LON:CUSN) (£90.4m) | Excavation at South Crofty tin project started in August 2025, as planned. | ||

Scancell Holdings (LON:SCLP) (£88.6m) | Operating loss £15.0m (FY24: £18.3m), cash balance £16.9m (FY24: £14.8m) following £11.3m raise. “Cash runway through to the second half of 2026 with further upside opportunities.” | ||

Distribution Finance Capital Holdings (LON:DFCH) (£83.3m) | PBT +20% to £9.0m, Loan Book +21% £728m, cost of risk at 0.63% (30 June 2024: 0.61%), Adj. EPS +27% to 3.8p, Adj. TNAV 70.2p. “As a result of our strong performance, particularly in net interest margin, we expect full year profit to materially exceed current market expectations with an improvement in market expectations for FY26 also anticipated.” Panmure Liberum estimates: | GREEN (Roland) | |

Brave Bison (LON:BBSN) (£61m) | Acquisition: MTM London for initial cash-and-share consideration of £5m cash +£1m shares +£6m contingent consideration over 5 years. Results: H1 Revenue +19% to £12.0m, Adj. EBITDA +6%, Adj EPS -1% to 0.14p. Trading Update: FY25 trading ahead of market expectations and FY26 Board expectations upgraded as a result of the strong trading and the acquisition of MTM. | AMBER/GREEN (Mark) Lots going on here with another acquisition and Adj. EPS upgraded by 7% by their broker, Cavendish, in response. Cavendish also issue FY26 forecasts for the first time with 17% Adj. EPS growth penciled in. This makes the shares look good value on a forward P/E of 10.8, although once we take account of the adjustments made, this may be closer to fair value than their broker would have us believe. However, momentum is behind the company in share price, EPS and deal-making. While that impetus is there, it makes sense to remain broadly positive. | |

Lords Trading (LON:LORD) (£59m) | Revenue +8% to £232m, LFL +7%. Adjusted EBITDA -4% to £12.1m. EPS -14% to 1.32p. Net Debt down £15.4m to £20.9m. Interim dividend held. | ||

Centaur Media (LON:CAU) (£52m) | Sale of The Lawyer for £43m on an enterprise basis, 16x FY24 Operating Profit. Cash on 9th September £24.5m. Sale expected to complete at the start of October. Net proceeds to be returned to shareholders. | AMBER/GREEN (Mark) [no section below] The Lawyer was always the most valuable part of Centaur and 16x operating profit seems a good multiple for this. This means that the company will have £67.5m cash (minus transaction costs) at the start of October compared to a market cap at close of £52m. The bulk of this is likely to be returned to shareholders so there is little reason for the shares to trade at a material discount to this. The remaining titles and business generated £15.5m of revenue in 2024 but it looks like only around £1.5m Adj. EBITDA, so perhaps another £5-10m to come from the sale of these. The downside is the group had £2.7m of central costs in 2024 including significant board pay packets. (There has been £3.4m spent so far in 2025 based on the £8.9m Y/E cash balance, £19m received for MiniMBA and current cash balance.) So, perhaps it will cost around £5m to sell the remaining businesses and close the company. Giving some margin of error, total return between £65-75m with £70m as a central case. So perhaps a further 10% or so upside to come from the current £62.9m market cap at 43p to buy. | |

Rentguarantor Holdings (LON:RGG) (£34m) | Rev +87% to £970k, op loss £443k. Cash £729k. Recently moved to AIM from AQSE. | ||

Tavistock Investments (LON:TAVI) (£25m) | Refocus on those who are no longer being supported by other advisory firms. Acquires 77% of Lifetime Financial Management Intermediaries Limited for £3.7m + £2.25m capital contribution + 4 year earn out capped at £9.9m in total. Lifetime LBT Y/E 31 March was £81k. | ||

Haydale Graphene Industries (LON:HAYD) (£23.6m) | Collaboration with Interfloor to integrate JustHeat heater inserts into their flooring systems. Cost restructuring in line, reducing cost run-rate to below £200k/month, down 70% on last year. Cash £1.92m. | ||

Defence Holdings (LON:ALRT) (£22m) | Project will enter “value realisation" in December. | ||

Petrofac (LON:PFC) (£21m) | Restructuring update: agreement in principle with Samsung & Saipem | Agreement will enable restructuring to proceed, expected to be completed Nov 2025. | |

Zinc Media (LON:ZIN) (£16m) | H1 Revenue +72% to £22.9m, Adj. EBITDA £0.9m (24H1: LBITDA £0.7m), Adj. PBT £0.2m (24H1: loss £1.3m), Net Cash £0.7m (24H1: £0.6m) |

* Market caps at previous trading day’s close

Backlog:

Nexteq (LON:NXQ)

Flat at 80p - Interim Results - Mark - AMBER/RED

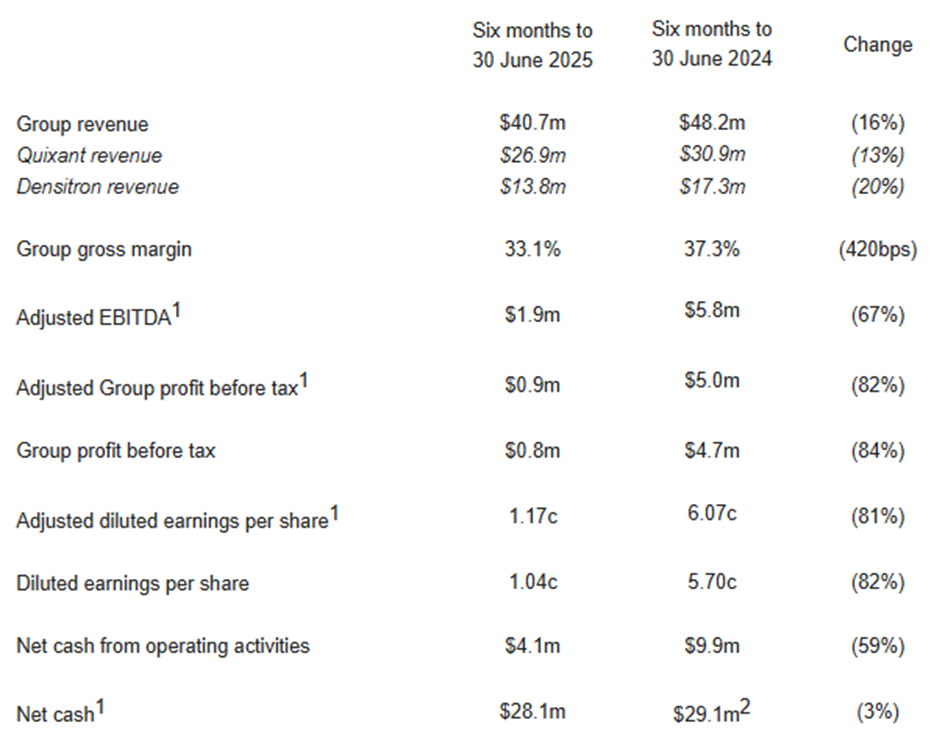

These results look pretty poor, with every metric apart from net cash down significantly:

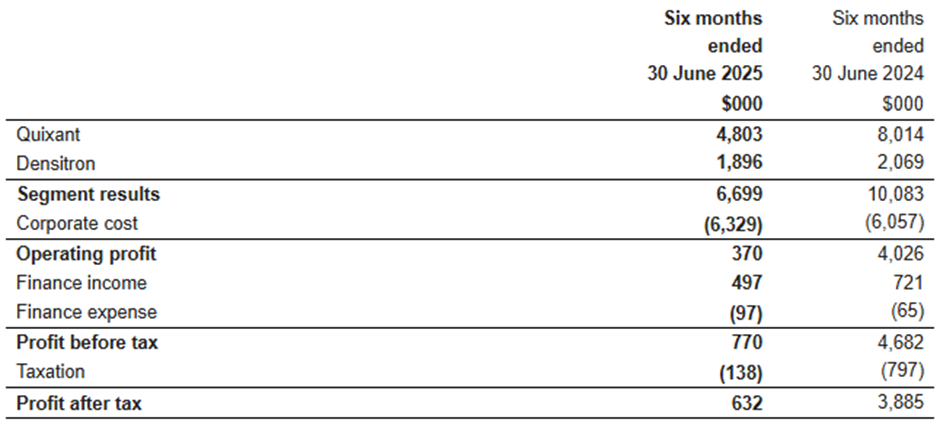

The segmental reporting shows that it is Quixant that has done the damage with operating profit there dropping 40%:

Densitron segmental profit only dropped 8% compared to the 20% drop in revenue. Given the scale of the central costs here, I think a lot of this may be subject to how these are allocated.

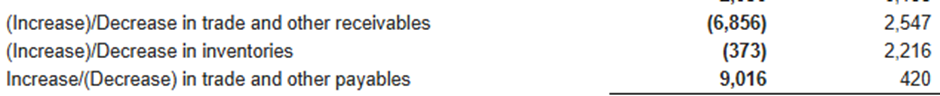

Cash flow has been good despite the weak results, with the cash balance only declining slightly despite a $3m dividend paid in the period, and an ongoing buyback. However, working capital moves have been the bulk of that:

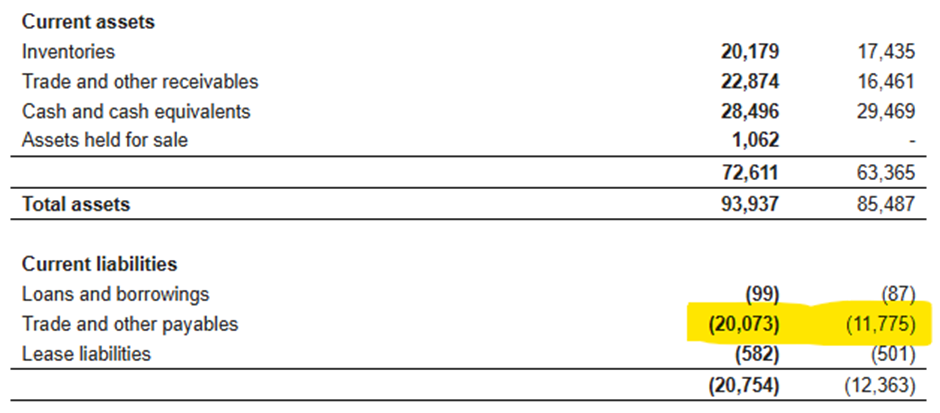

Looking at the balance sheet, this appears to be just a correction to previously unusually low payables, rather than a stretching of working capital:

The current ratio suggests that this is still a strong balance sheet.

For the full year, they say:

Revenue and profit before tax for 2025 expected to be in line with expectations as set out in July trading update.

Their broker Cavendish have Revenue of $85.5m and Adj. PBT of $3.6m. This looks quite a stretch for H2, which would have to deliver $44.8m of revenue and $2.7m adj. PBT. With a gross margin in the 30’s they will need to either beat that revenue figure, have a significant improvement in gross margin and/or some cost-cutting to reach that bottom line improvement on H1.

Valuation:

Even if they hit these challenging EPS figure they are on almost 24x forward earnings which seems far too high for this type of business. However, there is the significant cash balance to adjust for. This works out to be 34.8p/share. However, 20% of their earnings are forecast to be net interest in 2025, so the cash adjusted FY25E EPS is 2.67p. This is a more reasonable, but not cheap 16.9x earnings. Cavendish are forecasting a modest recovery in 2026 followed by a much better 2027. 2027E EPS is 6.3p adjusting for interest, making the cash adjusted P/E 7. We really should take forecasts that far out with a pinch of salt, though. As a wise friend once said “every company looks like a buy on brokers forecasts two years out”!

At least the management are doing something with the cash, they say:

The Board remains committed to allocating capital towards diversification of the Group's revenues into new market sectors, consistent with its growth strategy…The Group's capital allocation policy remains unchanged, with a cash generative business model and strong balance sheet with good liquidity allowing it to invest in the business to drive organic growth and take advantage of acquisition opportunities.

And while they don’t have clear opportunities for acquisitions, there is an ongoing buyback. While management will no donut

Mark’s view

Those who believe that forecasts out to 2027 are realistic, or even that the company can return to the heights of 2023, will see this company as cheap. However, far forward broker forecasts typically tend to be far too optimistic, and in the meantime it looks like they have a lot to do in 25H2 to reach even the modest expectations for this year. We’ve not looked at this company on the DSMR for over a year; last time was when it warned and lost both CEO and CFO. The new management team appear to have steadied the ship, but with forecasts lower than after the first profits warning but the shares trading at the same price, and the risk of a third profits warning high, this has to remain AMBER/RED.

Roland’s Section:

Distribution Finance Capital Holdings (LON:DFCH)

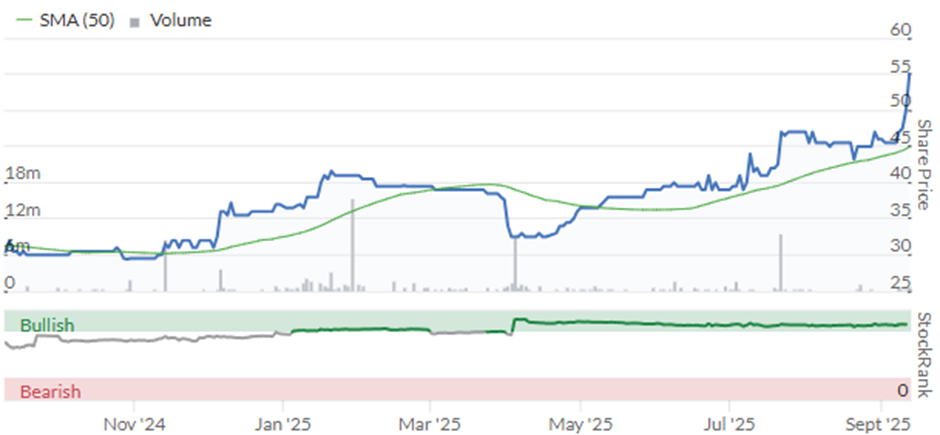

Up 8% to 54p (£90m) - Half-year Report - Roland - GREEN

Full year profit expected to materially exceed current market guidance

This specialist lender’s core business is providing inventory financing to dealers and manufacturers in sectors such as caravans/motorhomes, boats and commercial transport. It’s recently also started moving into direct-to-consumer lending on these assets. Graham has been GREEN on this stock for some time now and recent share price performance has rewarded this confidence. Today’s half-year results show good growth in both lending and customer deposits and include a significant upgrade to 2025 expectations, with a more modest upgrade to FY26 as well.

H1 results highlights

Today’s results show most numbers moving in the right direction:

New lending up c.17% to £828m to 1,491 dealers (H1 24: £710m, 1,250)

Loan book +21% YoY to £728m

Adjusted pre-tax profit up 20% to £9.0m

Net interest margin +0.1% to 7.9%

Cost-to-income ratio -1.5% to 57.3%

Return on equity +0.8% to 11.3%

The group has a UK banking licence and funds its lending from customer deposits collected under the DF Capital brand. While consumer interest rates edged lower, the company doesn’t seem to have had any problem attracting additional deposits to support increased lending:

Savings deposits +18.8% to £688m vs prior year

Average customer rate for retail deposits: 4.8% (Dec 24: 5.16%, June 24: 5.10%)

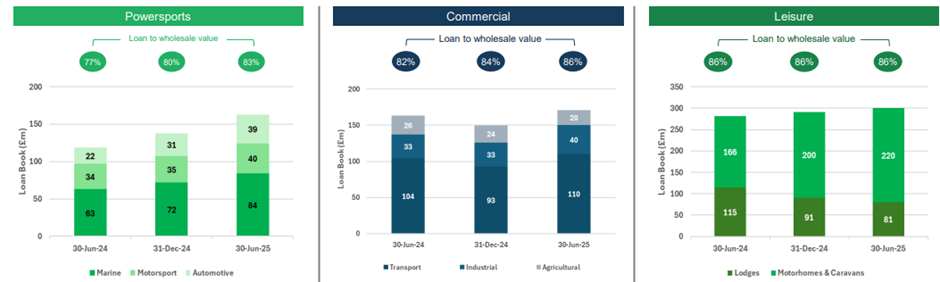

Trading commentary: the company’s largest lending market by value is leisure (Motorhomes & Caravans), where it provides inventory finance for manufacturers and dealers.

Demand for caravans is said to have softened, but motorhome demand remains strong, maintaining the double-digit growth rates seen in recent years. DFCH says it’s the market leader in this segment and has been taking share from competitors. The company is now leveraging this market share and distribution reach to expand into lending directly to consumers who are buying motorhomes/caravans.

Elsewhere in the consumer segment, demand for luxury cars and boats is also said to remain strong.

In the commercial segment, plant and machinery demand has shown good growth, supported by infrastructure spending and manufacturing modernisation. However, agriculture demand has been weaker, due to weather conditions and government policy uncertainty.

To further diversify its loan book, the company has recently entered the renewables sector and is starting to offer loans on solar panels and batteries.

Balance sheet: growth in lending and deposits is reflected in a 2% increase in net assets to £117.6m, compared to December 2024.

However, the company carried out a share buyback during H1, repurchasing 7% of its shares. This means the increase in tangible net assets per share during H1 was much greater, rising by 10% to 70.2p. This nicely demonstrates the value creation that’s possible when a lender or property business buys back shares below book value (assuming it has the surplus capital to do so, as DFCH has done).

The bank’s regulatory Common Equity Tier 1 ratio (CET1) fell to 19.7% during the half year (FY24: 21.6%), which I assume is at least partly due to the buyback. However, this is still a very comfortable and prudent level of coverage, well above regulatory requirements and higher than most other UK lenders.

Credit performance: the number of dealers in arrears remained unchanged at 2.5% during the half year. However, the percentage of the loan book in arrears did increase to 0.9%, from 0.6% at the end of 2024.

The company says this is due to a small number of larger dealers falling behind with repayments. To give a flavour of this, lending to the borrowers who are in arrears accounted for 1.8% of the loan book at the end of June, up from 1.2% at the end of 2024. There’s always a risk the situation will worsen, but I don’t see too much to worry about here. Bad debt levels look manageable and all of the company’s lending is secured.

In his interview with Graham in April, CEO Carl D’Ammassa explained that loans are made at a discount to wholesale value. This means that recovering the loan principal on repossession is not generally an issue. Today’s slide pack confirms this, suggesting lending is typically c.85% of wholesale value:

D’Ammassa said the main risk of serious losses is if dealers sell vehicles but don’t use the cash to repay the associated inventory loan. I am not sure how often that happens, but I’d imagine it’s a risk that’s closely monitored.

Profitability & Upgraded expectations

In early July, the company guided that full year results would be in line with expectations. So I’m interested to see what has changed over the summer. Looking at today’s outlook guidance, the expected size of the year-end loan book is unchanged, at £750-800m. What has changed is the expected profitability of this loan book. Lending margins are now expected to be significantly higher than previously thought, with net interest margin (NIM) guidance increased to c.7% over the medium term, from 6% previously. This is a big increase and is the main driver for today’s upgrade.

The feeling I get is that lending interest rates have remained quite firm, despite two recent cuts to the Bank of England base rate. Meanwhile, interest rates on retail savings have edged a little lower. This combination of factors demonstrates DF Capital’s pricing power and is supporting a pretty strong net interest margin.

Outlook & New Estimates

The company’s comment on profit expectations includes the word “materially”, suggesting an increase of at least 10% to FY25 forecasts:

As a result of our strong performance, particularly in net interest margin, we expect full year profit to materially exceed current market expectations with an improvement in market expectations for FY26 also anticipated.

Fortunately we have an updated broker note from Panmure Liberum today that includes revised earnings estimates and confirms this is a very significant upgrade:

FY25E EPS +25.4% to 7.7p (prev. 6.2p)

FY26E EPS +7.6% to 8.6p (prev. 7.9p)

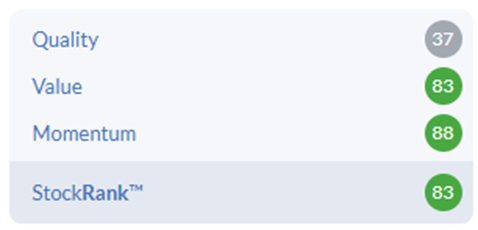

These forecasts leave the stock trading on a FY25E P/E of 7, falling to a P/E of 6.3 for FY26. It’s also worth remembering the stock continues to trade at a >20% discount to its net asset value.

Roland’s view

Today’s results look strong to me and suggest DF Capital’s is executing well in markets where it’s competitive and has scope for growth. I’m also encouraged by the improvement in profitability (return on equity), despite a slight increase in bad debt levels. If the company can reach its FY28 target of “mid-teens” ROE, then I think it would be fair to expect the stock to be trading in line with book value, or perhaps even at a small premium. In addition, I would guess that improving profitability should gradually lead to a higher quality score for the stock, complementing its strong value and momentum ranks:

Specialist lenders have the potential to generate attractive returns and strong growth, but as we’ve seen before in recent years they can also run into problems unexpectedly. I think DF Capital looks in good health, with strong growth prospects and a potentially attractive valuation, so I’m going to maintain our GREEN view today. However, I’ll echo Graham’s previous caveat that this is a stock I’d probably restrict to a relatively small position within a portfolio.

Trainline (LON:TRN)

Up 8% to 281p - Trading Statement - Roland - AMBER/GREEN

Robust first half performance, improved profitability guidance and announcement of an enhanced £150 million share buyback programme

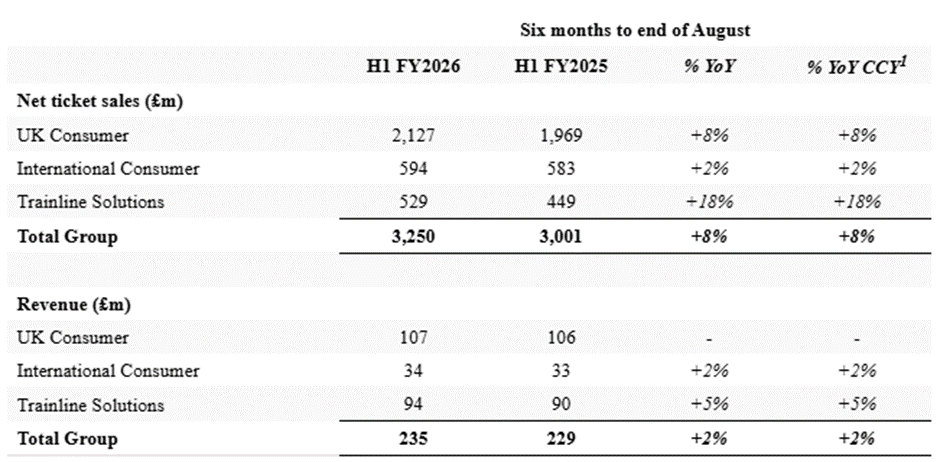

Today’s half-year update from the rail ticketing specialist covers the six months to 31 August. They show strong growth in ticket sales (+8%) but rather more modest growth in total revenues (+2%):

As the management commentary explains, this result is in line with expectations. Reduced revenue growth reflects the reduction in Trainline’s UK headline commission rate from 5% to 4.5%, which took effect in April 2025. Other adverse factors in the UK include the expansion of TfL’s own contactless payment network and a greater shift towards lower-revenue on-the-day travel.

Despite this, both the company’s revenue metrics are trending towards the upper end of management’s FY26 guidance:

Group net ticket sales +8% (guidance: 6%-9%)

Group revenue +2% (guidance: 0%-3%)

In International sales, Google changes and reduced demand from US tourists held back foreign travel sales. This seems to have offset growth in France relating to the expansion of Trenitalia services.

The strongest performing part of the business was actually the B2B Trainline Solutions division, where revenue rose by 5%. This unit supplies ticketing for travel management company clients, mainly for business travel. Ticket sales rose by 18% to £529m, with international B2B sales through the company’s API up by 55% in Europe.

Updated FY26 guidance:

Trainline expects H1 EBITDA growth to be above the full-year guidance range of 6%-9%. As a result, the company now expects full-year adjusted EBITDA growth to be at the top end of this 6%-9% range.

Share buyback:

Trainline has repurchased £71m of shares from its existing £75m buyback programme. When this is complete, the company now plans to launch a new £150m buyback. My sums suggest these buybacks should meet my rule-of-thumb target for an 8% pre-tax return, so I can’t really object, despite my preference for dividends in such situations.

Roland’s view

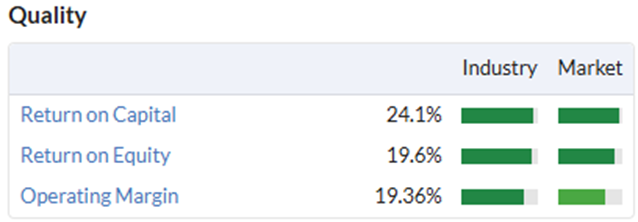

I have been something of a late convert to this stock. While I’ve always felt it was a useful business whose mastery of UK rail ticketing should be lucrative, historic low profitability and poor quality metrics discouraged me:

However, progress since the pandemic has been impressive. The group’s quality metrics are now showing the kind of values I would hope to see from a software business of this kind:

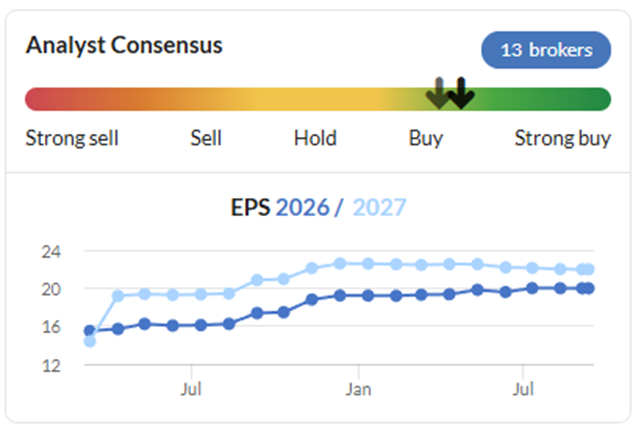

At the same time, the shares have fallen sharply this year despite unchanged forecasts for double-digit earnings growth:

This has left the stock trading on a modest forecast P/E of around 14, with double-digit forecast earnings growth and the scope for further growth in the UK and Europe. This valuation seems very affordable to me – potentially cheap on a long-term view.

The main risk I can see is that regulatory or government intervention of some kind could end up throwing a spanner in the works in some way. We’ve already seen Trainline’s commission rate cut. Other possibilities might include changing ticketing systems, or restricting Trainline’s access to them. Personally, I think this would probably be short-sighted given the evident complexity of these systems. As Fire Juggler points out in the comments today, Trainline has been in business 25 years and has not attracted any serious UK competitors yet. Compare that, for example, to areas such as travel comparison sites, where there’s plenty of competition.

The level of political/regulatory exposure here means I’m reluctant to be fully positive. But I am happy to maintain Graham’s previous view of AMBER/GREEN.

Mark’s Section:

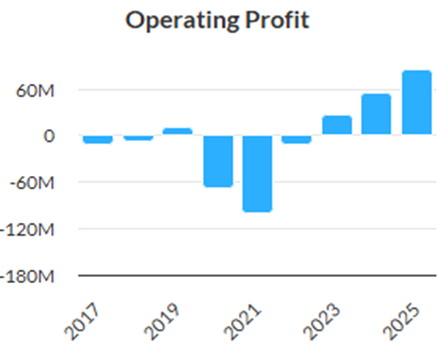

Brave Bison (LON:BBSN)

Up 15% to 75p - Acquisition & Trading Update / Interim Results - Mark - AMBER/GREEN

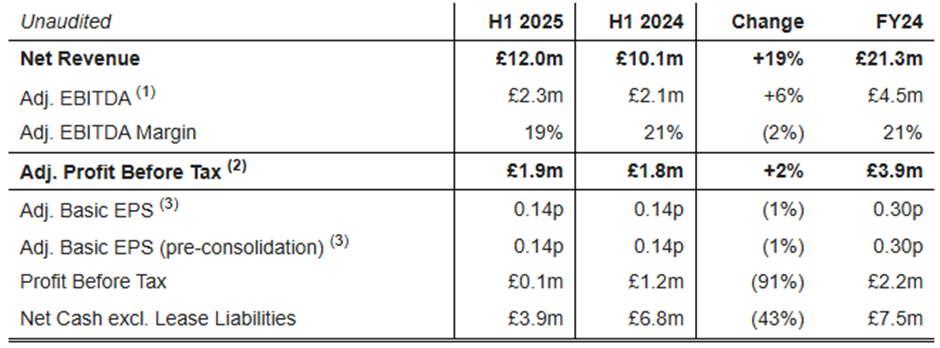

There’s a lot going on here so let’s start with the Interim Results. These look a little uninspiring:

The revenue growth is largely a function of the large acquisitions they have made, although they say their existing business traded better than expected. They do say that:

Adj. EBITDA margin reduced from 21% to 19% year-on-year following the acquisitions of Engage Digital Partners and The Fifth, both of which were loss-making at the time of completion but are expected to contribute positively within 12 months

Which explains why revenue growth hasn’t positively impacted the bottom line. Indeed, they announce that they are trading ahead of expectations:

As a result of stronger than anticipated trading in the second half of 2025 and the acquisition of MTM announced separately today, the Board now expects the Group to exceed current market forecasts for FY25 and increases Board expectations for FY26

This half will now not just include the impact of Builtvisible and The Fifth, but the Mini-MBA acquisition that completed post-period. Today they also announce another acquisition, MTM London:

Initial cash consideration of £5 million and initial share consideration of £1 million. Further cash and share consideration of up to £6 million payable over 5 years and self-funding, subject to continuing employment and business performance. Total maximum consideration of £12 million.

This is said to be earnings enhancing:

Acquisition increases Brave Bison pro-forma adjusted EBITDA to £9.4 million and underlying pro-forma basic EPS by 13%, before cost savings from property and central overheads

However, like previous deals, there is an equity component, which means that the impact on EPS is a little more complicated. Plus they now have net debt, whereas, at the start of the year they had significant net cash:

Net debt at the end of FY25 expected to be £4-5 million, equivalent to 0.5x pro-forma EBITDA

Leverage of this level doesn’t look reckless, even for a people business, where the asset-backing is limited. However, it should adjust our valuation. Here, I turn to their broker, Cavendish to untangle the details. They upgrade their 2025F EPS by 7% and introduce a FY26 forecast. They now have Adj. EPS rising 9% from 6.05p in 2024 to 6.95p in FY25 and then a further 17% to 8.35p in 2026.

This makes them still look pretty cheap on a forward P/E of 10.8 and then around 9 the year after. However, I think some caution is required. Firstly, this sort of business should be cheaply valued. The second is the sheer scale of the adjustments:

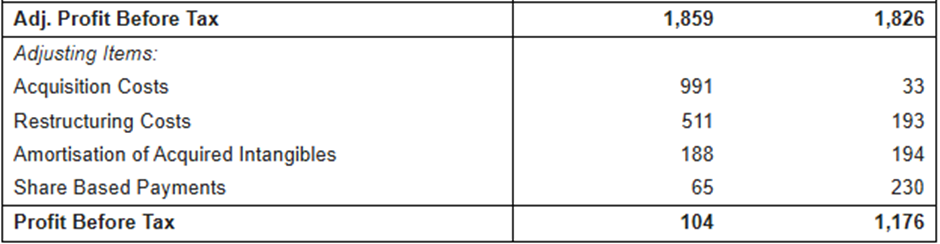

This is understandable in a period where they have made or integrated so many acquisitions, and it is normal to exclude these as one-off. However, you have to question how one-off acquisitions are for this business, given the sheer number completed. In my mind, companies can’t both claim the benefits of acquisitions and expect the market to value them on inorganic growth rates, yet exclude all the costs associated with these. I have previously commented on the Share-Based Payments charge. Management here take a below market salary and make up the difference through options. While this no doubt aligns their interests to wider shareholders, it means that the adjusted profits are flattered by the lower pay. The options are now well in the money as well, given the recent share price strength. At least SBP charge is lower in this half.

Overall, this means that the company trades much closer to what may be considered fair value, than an initial look at the forecasts may suggest. When I looked at this earlier in the year, on release of the FY Results, Cavendish said they found the valuation here “highly compelling given it trades on an FY1 adj P/E of just 8.1x versus peers on 9.3x, whilst retaining significant net cash and growing net revenues by 20% in FY25E.” Now that the company is trading above this level, Cavendish say:

Brave Bison looks highly compelling trading on a basic adj P/E of 7.8x versus peers on 15x.

In today’s note, they provide the list of peers to get to 15x. However, they didn’t seem to provide this list in the note that accompanied the Final Results. It may be that there has been a strong market rally in the marketing sector recently, or perhaps more likely, they have modified the list of peers!

What isn’t included in a simple look at the figures is the ability for the Green brothers to keep doing deals that add value to the business. The Momentum Rank is strong here, and likely to get a further boost when the algorithms process today’s small upgrade in EPS:

So it makes sense to keep holding while the Momentum remains. Longer term, the history of acquisition-led roll-ups in the marketing space is not good. Although, so far the Green brothers have avoided the debt and generous earn-outs that have proved the undoing of many similar endeavours.

Mark’s view

It’s not as cheap as it was, and questions remain over the valuation trade offs between options and salary, and acquisition-led growth vs acquisition costs. However, Momentum is behind the company in share price, EPS and deal-making. While that impetus is there, it makes sense to remain broadly positive. AMBER/GREEN

Fevertree Drinks (LON:FEVR)

Up 8% to 844p - Interim Results - Mark - AMBER/RED

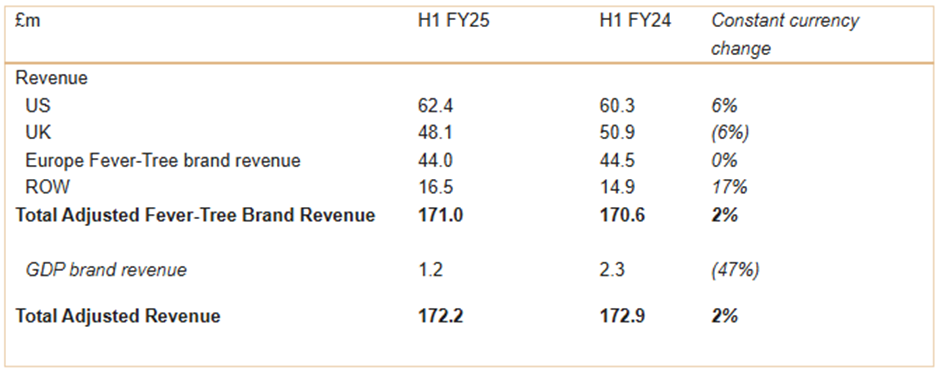

It is a rather lacklustre half from this former growth stock:

Pretty much all the numbers are flat, although not helped by currency headwinds.

Cash is up, but this largely due to the sale fo the US business in return for a cash consideration and license fee:

QUOTE

As part of the long-term strategic partnership, Molson Coors acquired an 8.5% stake in Fevertree Drinks plc (post-issue) for consideration of £71.0 million. To assist with the transition of operations, Molson Coors acquired the local trading entity Fevertree USA Inc for consideration of $23.9 million in cash.

END QUOTE

Geographically it is the UK business that is struggling. The Rest of World is growing well, although off a lower base:

The company seems happy with these figures saying:

The Group has made a good start to the second half of the year across our regions and we remain comfortable with full year market expectations.

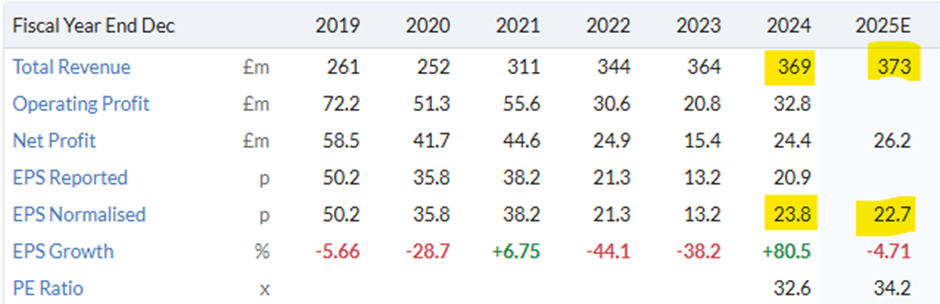

However, in line hardly looks challenging, with forecast being for modest revenue growth and declining EPS:

This makes the valuation metrics here look a little bonkers:

No doubt the bull case is that the brand recognition and Molson Coors deal mean that growth is expected outside the forecast window. However, if they have been unable to deliver this so far, I don’t see why this should now drastically change. Others will take heart that CM have put money into the equity here. However, in my experience large corporates are equally likely to fall for narratives or focus on past glories as investors.

Mark’s view

We were neutral on this when we last reviewed it. However, the continued lack of top line growth for a company on this type of valuation has to be a major worry. Some will point to weak consumer sentiment and the transition of the US business to a royalty one. However, I think it is equally likely that the premiumisation trend in mixers has peaked, and any growth from here will have to be driven by expensive marketing campaigns or event sponsorship, rather than a growth in underlying consumer demand. It’s an AMBER/RED for me on pure valuation/lack of growth concerns.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.