Good morning! Expecting another busy day today in results season.

2pm: wrapping it up there, thanks everyone for the very useful comments which tipped me off on a few late stories!

Spreadsheet accompanying this report: link (last updated to: 5th September).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

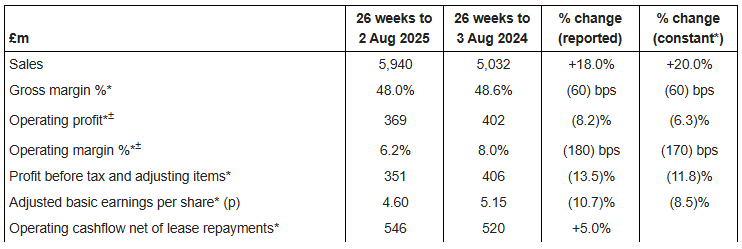

JD Sports Fashion (LON:JD.) (£4.48bn) | Cautious on trading environment, but full year adj. PBT expected in line. H1 adj. PBT -13.5% (£351m). | AMBER/GREEN (Mark) | |

Baltic Classifieds (LON:BCG) (£1.53bn) | Estonian car market depressed by new vehicle tax. Rev, profit growth to be 3-4% below previous exps. | ||

Yellow Cake (LON:YCA) (£1.23bn) | Intends to raise $125m at £5.64. Purchasing 1.33 million pounds of physical uranium. | ||

| Goodwin (LON:GDWN) (£837m) | Trading Update & Strategic Collaboration Agreement | SP +16% Activity and workload have continued to substantially move forward. Workload £357m as of August (+24% vs. April 2025). Refractory Engineering division: profitability significantly ahead of prior year - global market share and margin gains at GWDN's investment casting powder companies. Goodwin Steel Castings has memo of understanding for collaboration agreement with long-standing customer Northrop Grumman relating to four key defence programmes. Initial $16m order. Expected orders will likely develop to over $200m. Additionally, GDWN will serve as sole supplier for a component which could account for 25-30% of MoU value. | AMBER/GREEN (Graham) [no section below] Well done to Roland for upgrading this to AMBER/GREEN in July when the market cap was a mere £559m; it's close to touching £1 billion today! Today's RNS is about as pleasant an RNS as it's possible to read for a company that doesn't maintain official forecasts - which in itself is remarkable considering that this is now in the FTSE-350. But it's a family business with heavy insider ownership and has never shown much interest in catering to the City's normal way of doing things. I'm going to leave this on AMBER/GREEN today because a) it's a complex business with many parts, which I would need further time to research, and b) there are no available forecasts, so I have no idea what the P/E is. But this is a stock where independent investor research has paid enormous dividends (well done to Rhomboid!). |

Pinewood Technologies (LON:PINE) (£609m) | FY25 adj. EBITDA to be £15.5- 16m due to timing change and accounting impact of US buyout. | BLACK | |

| International Personal Finance (LON:IPF) (£436m) | Statement re: revised possible recommended offer | Breaking news (11.53am) Non-binding proposal to acquire IPF at 235p (shareholders also receive the 3.8p dividend which is about to be paid). Previous offer was 220p. | PINK (Graham holds) [no section below] I am among the (presumably many?) IPF shareholders who thought that IPF was worth more than the 220p offered by BasePoint Capital. It would seem that larger shareholders have been asked their views, as the potential buyers have felt it necessary to increase their potential bid to 235p. The premium to the pre-offer price is now c. 31-33%, depending on whether you are willing to treat IPF's September dividend as a gift from the buyer or not, while the premium on the original bid was only 25%. Some of the language in today's announcement strikes me as a little strange: BasePoint has completed its due diligence, but final approval from BasePoint's board has not been achieved yet. This is why PUSU (put-up-or-shut-up) deadlines exist: at some point, a buyer must make a binding proposal. The PUSU deadline now moves to 22nd October. I'm still not very excited to see IPF shares leave my portfolio at this new suggested price, but my vote isn't going to change the outcome. I'm happy to continue holding IPF, intending to either collect the 235p bid or else continue owning the shares if the deal falls apart. |

On Beach group (LON:OTB) (£403m) | Adj. PBT (excl. B2B) expected at £34.5-35.5m, vs. broker estimates of £2m profits from B2B and total adj. PBT £38.4m. | BLACK (AMBER/GREEN) (Graham) I'm only downgrading this by one notch, as the new profit guidance is only a small miss against consensus estimates. More worrying is the reduced visibility over next year's results, but management remain confident and have even announced a significant new share buyback programme. I still view this as a better-than-average company and so, perhaps foolishly, I'm only going to downgrade our stance on it by one notch today. | |

Metals Exploration (LON:MTL) (£366m) | Normal mining and gold processing operations not impacted by super-typhoon. | AMBER/GREEN (Mark) [no section below] Good news that operations are unaffected by the super-typhoon, meaning that there is no reason to change our previous mainly positive view. | |

Saga (LON:SAGA) (£314m) | Strong H1, ahead of expectations, gives confidence in achieving full year adj. PBT in line with last year. | ||

VP (LON:VP.). (£245m) | CEO intends to step down in March 2026 - “her decision”. Recruitment process commences. | ||

Andrews Sykes (LON:ASY) (£232m) | The board remains confident of full year results in line. Geographic diversification mitigating risk. | AMBER(Mark) [no section below] | |

Enquest (LON:ENQ) (£218m) | H1 production in line. Remains on track to deliver within guidance range of 40k-45k boepd. | ||

Redcentric (LON:RCN) (£211m) | Stable rev expectations. Confident in medium to long-term outlook. Anticipated sale of DC business. | ||

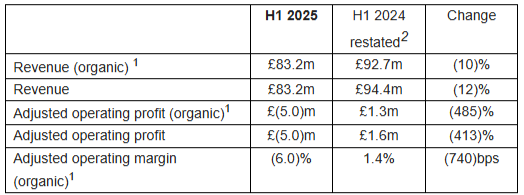

TT electronics (LON:TTG) (£192m) | Full year adj. operating profit to be in line. H1 rev down 6% organically, operating loss £5.1m. | AMBER (Mark) | |

ASA International (LON:ASAI) (£171m) | SP +15% H2 outlook remains positive, underlying & reported net profit to significantly exceed consensus. Company Profile: "one of the world's largest international microfinance institutions, providing socially responsible financial services to low-income entrepreneurs, most of whom are women, across Asia and Africa". | AMBER/GREEN (Graham) [no section below] We don't regularly cover this one but I'll try to pick out some of the most important facts from these interim results. The loan portfolio is up by 37% year-on-year to $541m, while H1 net profit has almost doubled to $26.8m. Overdue loans ("portfolio at risk") are only 2%. Finally, balance sheet equity has grown to $136m (£101m). The market cap is a very large premium to this, but the P/E on the StockReport is only 5x - so it's potentially cheap on earnings. The balance sheet is in US dollars but thirteen currencies are used by the company - I wonder how much of a role has been played by dollar weakness in these results? ASAI notes that the Ghanaian currency appreciated by 32% year-on-year, and in aggregate there was a $15.5m boost to the balance sheet (FX translation reserve) from currency movements, which is before any impact that currency movements might have had on earnings. Overall, I come away with a positive impression of ASAI. If I'm reading it right, the average exposure to each client ("gross outstanding loan portfolio per client") is only $210, with the company having 2.6 million clients. So there is tremendous diversification at that level, with the company also enjoying good diversification in terms of countries and currencies. As I'm not overly familiar with the business yet, I'll resist going fully GREEN on it yet. But it does strike me as interesting. | |

Accsys Technologies (LON:AXS) (£170m) | Revenue for 5mo to 31 Aug incl. JV +22% to €71.6m, in line with expectations. | ||

Avingtrans (LON:AVG) (£162m) | FY Revenue +14.5% to £156.4m, Adj. EBITDA slightly ahead of expectations at £16.7m, Adj. PBT +18% to £8.6m. Adj. EPS +28% to 23.7p. Q1 in line with management expectations. | ||

SDI (LON:SDI) (£104m) | Improvement in organic growth compared to last year, FY results in line with market expectations with an H2-weighting. | AMBER/GREEN (Mark) [no section below] | |

Pharos Energy (LON:PHAR) (£97.7m) | H1 WI Production down 4% to 5,642 boebd, Revenue flat at $65.6m, Net loss $2.2m (24H1: $2.7m loss), Net cash $22.6m (31 Dec: $16.5m). 2025 production guidance range narrowed to 5,200-6,000 boepd. | ||

Savannah Resources (LON:SAV) (£97m) | H1 Operating Loss £1.63m (24H1: £1.89m), Cash now £13.3m (24H1: £21.6m) following £4.8m fundraise post period end. | ||

Borders and Southern Petroleum (LON:BOR) (£96.7m) | H1 Operating loss $441k (24H1: $578k loss), Cash $3.2m (31 Dec: $2.1m) following £2.2m raise. | ||

Chapel Down (LON:CDGP) (£72m) | H1 Revenue +11% to £7.9m, Adj EBITDA -23% to £1.23m, Net Debt excl leases £11.3m (24H1: 5.8m). Net Assets -7% to £32.2m. “...remains confident in achieving market expectations for 2025 FY, thereby delivering strong sales growth and a return to full profitability.” | AMBER/RED (Mark) [no section below] | |

Made Tech (LON:MTEC) (£60.5m) | FY Revenue +20% to £46.4m, Adj EBITDA +47% to £3.5m, Adj. PBT +104% to £2.9m, contract backlog +52% to £92.2m, Net cash £10.4m (FY24: £7.6m). “Strong start to FY26 with revenue, Adjusted EBITDA and cash conversion in line with management's expectations.” | ||

Time Finance (LON:TIME) (£54.6m) | SP -5% | GREEN (Graham) Stubbornly staying GREEN on this despite some mild market disappointment today. That may be to do with new Cavendish forecasts that are not madly exciting. However, it seems to me that little has changed. Strong Q1 lending should feed through and support revenue forecasts. I guess it might be difficult for the company to keep arrears and bad debts at their current very low levels - a nice problem to have. On balance, I'll stick to my guns here. | |

Everyman Media (LON:EMAN) (£37.4m) | H1 Revenue +21% to £56.5m, EBITDA +33% to £8.2m, Net Debt £24.2m (24H1: £25.8m). Currently trading in line with market expectations for the full year ending 1 Jan. | ||

NAHL (LON:NAH) (£27.7m) | H1 Revenue -1% to £19.2m, u/l operating profit +74% to £3.2m, Net debt £5.6m (31 Dec: £7.1m) | ||

Tekcapital (LON:TEK) (£23.5m) | Net Assets +10% to $77.4m, operating expenses reduced by 50%, PAT -72% to $5.4m, $2.3m raised via share placing. | ||

First Property (LON:FPO) (£22.5m) | Expects recovery in profits to be sustained for the current financial year. Exchanged for one UK & one Romanian property for £4m after costs. | ||

Petro Matad (LON:MATD) (£15m) | Heron-2 acid job according to plan but need completion and pumping to get a definitive result in this re-test. | ||

Directa Plus (LON:DCTA) (£11m) | H1 Revenue +15% to €3.90m, LBT €1.66m (24H1: €2.48m), Net cash €1.61m (31 Dec: €3.28m). Remains confident of a material improvement in EBITDA for FY25 compared with FY24. |

Graham's Section

On Beach group (LON:OTB)

Down 14% to 222p (£348m) - Pre-Close Trading Update - Graham - BLACK (AMBER/GREEN)

A profit warning hits a stock we were positive on:

FY25 adjusted PBT on a continuing basis (excluding B2B) is expected to be in the range of £34.5m - £35.5m.

Note that FY25 ends in September 2025, i.e. the financial year is just about to end.

Checking the footnote:

Consensus FY25 Adjusted PBT, per the Group's corporate website, is £38.4m. The average of house broker estimates for profits associated with B2B operations is £2m.

Subtracting one number from the other implies that PBT excluding B2B was supposed to come in at £36.4m.

The range given (£34.5-35.5m) therefore says that the ex. B2B result will be a miss of between 2.5% - 5% [as noted in the comments, the miss is bigger than this if the B2B result is included!]

At first glance, I would say that the share price reaction - down 14% - seems a rather harsh verdict.

Some other key points from today’s update:

Total transaction value +11% to £1.23bn

Summer 25 bookings up 12%, “significantly ahead of the package holiday market”.

Winter 25 bookings are also up by 12%.

Perhaps what has spooked the market is the outlook for Summer 26, which implies less visibility on the outlook for next year:

Summer 26 bookings currently reflect the later booking trend as reported across the market, with bookings being made increasingly closer to the date of departure.

Also, OTB is giving up on its B2B segment entirely: a “strategic decision”. The segment will see an orderly wind-down.

CEO comment has a a positive tone:

"I am pleased to report another year of significant growth with record TTV of £1.23bn, representing a 11% increase on FY24. Our core B2C business has again outperformed the market, underpinned by the Group's asset light, cash generative model and balance sheet strength…

"It remains clear that customers are still prioritising their holidays with our Winter 25 bookings up 12% and we are confident that Summer 26 will continue to build, notwithstanding the later booking patterns. The Board and management team remain focused on delivering the Group's medium-term ambition of TTV of £2.5bn, EBITDA of £100m and Adjusted PBT of £85m and I look forward to updating further at our final results in December."

For context, TTV last year was £1.2bn, EBITDA was £38m, and adjusted PBT was £31m.

Share buyback: in a separate RNS, the company lays out plans to buy back up to £25m of its shares, for cancellation. That’s a significant amount: 7% of the current market cap.

At the interim results to March 2025, OTB reported a net debt figure of £29.5m - but this looks seasonal.

Graham’s view

The combination of a profit warning and a buyback announcement is always a little strange; it’s clear that OTB management remain confident in their prospects, as they reiterate their ambitious targets.

I am going to have to give this stock a downgrade today. In addition to the minor profit warning, I also have to take into account the later booking patterns and the reduced visibility it implies, which raises the risk of future profit warnings.

What could have changed to make people book holidays later - surely it hints at some degree of consumer weakness, i.e. question marks over holiday affordability?

Checking the StockReport for an overview, OTB gets a “Neutral” score with a StockRank of 50. Stockopedia’s algorithms aren’t seeing stand-out quality or value here, which is fair enough. Personally, I do still view this as a better-than-average company - as an online business that continues to grow its market share, I would rate it higher than the market currently does:

The question is whether I go to AMBER or stay at a more optimistic AMBER/GREEN. When I’m unsure, I let the balance sheet decide - and in this instance, it’s a little complicated. As noted above, OTB reported net debt of £29.5m as of March 2025. But they also had £224m of cash in trust: customer prepayments are a huge part of the financial structure.

With enormous customer cash being released to OTB seasonally (when the customers have taken their holidays), OTB is looking pretty strong to me from a financial point of view.

So I’m only going to downgrade it by one notch today, to AMBER/GREEN.

Time Finance (LON:TIME)

Down 5% to 56p (£54m) - Final Results & Q1 Trading Update - Graham - GREEN

As pointed out by a helpful reader, there is a double helping of announcements from SME lender TIME today: final results along with a separate Q1 trading update.

The results are for the year ending May 2025, and I don’t think there are any surprises. We already had a trading update for these results back in June. PBT is confirmed at £7.9m (up 34% year-on-year), while EPS is 6.3p (up 31%).

Outlook: “at least in line with expectations” for FY May 2026.

CEO comment provides a nice overview of the past four years:

Both from a financial and operational perspective I am very pleased with the performance of the Group over the course of our four-year strategic plan which concluded with the financial year under review. During that four-year period our lending book has grown from £113m to £217m; our Revenue from £24m to £37m, PBT from £2m to £8m, and Net Tangible Assets from £29m to £44m. At the same time arrears have fallen from 12% to 5% and secured lending, namely Invoice Finance and Hard Asset Finance, has moved from 52% to 83% of the total lending book…

Let’s skip ahead to the Q1 trading update:

Lending up 30% to £28.5m year-on-year.

Revenue +3%, PBT +11% (£2.1m).

Net tangible assets +14% to £45.6m (year-on-year)

There is a lag in revenue growth vs. lending growth - it takes time to generate interest on new loans.

I’ve highlighted net tangible assets as it’s a useful anchor for valuation. In this case, TIME trades at a premium to net tangible assets, suggesting that the market rates it highly, but perhaps also making it vulnerable to pull-backs on any small disappointments (as may have happened today).

Arrears/bad debts: no change in the arrears or bad debt rates year-on-year.

CEO comment reiterates some points made in the final results, but finishes with an emphasis on responsible lending:

Net arrears and Net Bad Debt write-offs also continue to be well within our target ranges and underline our commitment to responsible and sustainable lending. The Board, therefore, retains confidence that the Group is positioned for further growth and will build increased value for its shareholders over time."

Forecasts: Cavendish has published maiden forecasts for FY27.

Revenue £40.6m (+5% vs. FY26 forecast £38.5m)

PBT £9.4m (+12% vs. FY26 forecast £8.4m)

Graham’s view

This has been a great performer in recent years and now trades at a premium level.:

The latest share price gives a P/TNAV multiple of 1.18x - undoubtedly a premium level. On current year earnings forecasts, the P/E multiple is 8x.

Having previously been AMBER/GREEN, I turned fully positive on this in March, after a positive trading update. The share price is only marginally higher now than it was then. I’m inclined to leave our positive stance unchanged, as it seems that little has changed over the past six months.

I do acknowledge that the earnings forecasts for FY27 aren’t madly exciting. But the overall picture continues to seem quite pleasant and promising.

Mark's Section

TT electronics (LON:TTG)

Unch. at 107p - Half-year Report - Mark - AMBER

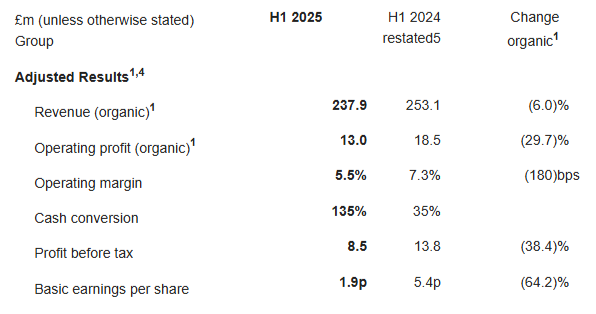

What makes TT Electronics interesting is not that it is a formerly well-regarded company that has fallen on hard times. Nor is it that today’s HY results show it is struggling with organic growth, and that, combined with cost inflation leads to increasingly poor figures as we go down the income statement:

These sorts of results are pretty common at the moment. What makes this interesting is that when Volex made a cash and shares offer priced around 140p in November last year, the board rejected a higher offer saying:

The TT Electronics Board also announces that it has recently received and rejected an all-cash indicative proposal from another party at a significantly higher value than the Volex Proposal. There are no ongoing discussions with this party.

The TT board clearly think that the issues they face are temporary and that the current share price of just over £1 undervalues the business, but looking at today’s figures are they deluded? Well, the issues they face are largely region-specific.

Regional breakdown:

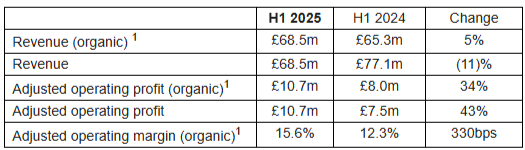

The results of their European business are very credible:

It is worth noting that they also closed 2 UK sites so reported revenue is actually down. However, the outlook for the remaining European business is strong as they say “Overall order intake for the region was pleasingly strong, with book to bill well over 100% and we expect continued growth in the second half of the year.”

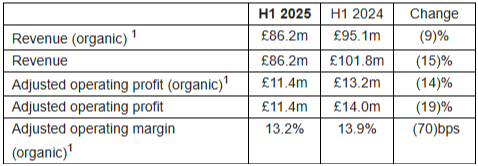

The Asia business has some challenges, reflecting customer uncertainty around tariffs, but is still very profitable:

The real issue is the significantly loss-making NA operations:

When I looked at their FY results in April, they were bringing in consultants to their Cleveland site, and they report on progress here:

Our Cleveland site leadership team is now up to full strength and progressing through key improvement workstreams of contract profitability, operational efficiency including a thorough overhaul of demand, production and resource planning. Encouragingly, production efficiency levels at the site are significantly improved, the need for re-work and scrap levels are reducing, headcount savings are contributing. As noted previously, the full benefits of the improvement plan are expected to be realised over the longer term, driven by the need for increased manufacturing volumes.

The further action announced in June is to close their Plano site:

In late June we took the difficult decision to close our components site in Plano which has been running at an annual loss of c. £6 million. Production will cease and we expect to close the site by the end of 2025. The costs of closure in the first half, including severance costs and inventory write-downs, are £6.7 million and are reported in items excluded from adjusted operating profit; the cash cost of the closure is expected to be c£4 million, of which £2-3 million will be incurred in the second half.

The overall impact should be a significantly better H2 for North America:

With the planned closure of Plano in the second half together with the benefits of the last time buy and the contribution from the Cleveland improvement plan, the region is expected to show a return to profit in the second half, though will still be loss-making for the year as a whole.

Operating losses in NA were £4m, and with £5m of losses this half, this is a decent turnaround, although with significant exceptional costs.

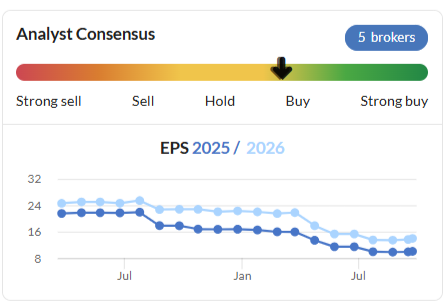

Mere mortals such as us don’t have access to broker coverage here, but when I looked at the FY results I concluded that the FY outlook read like a profits warning. It seems the brokers agreed as the trend has been downwards here for some time:

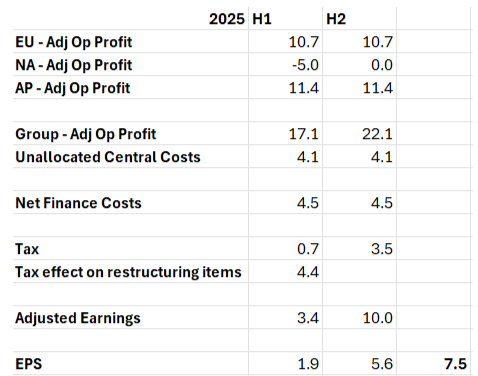

It does seem to have bottomed, though, and in today’s results they say that “The Board therefore expects full year adjusted operating profit to be in line with market expectations.” The consensus in Stockopedia is for 10p adj. EPS for the full year, and 14p the following year. With just 1.9p adjusted EPS reported in the half year, this leaves a lot to do in H2. However, just eliminating losses in North America would see them get most of the way there:

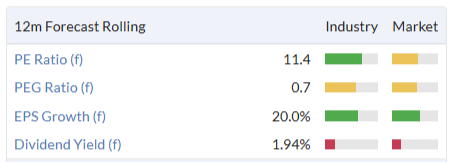

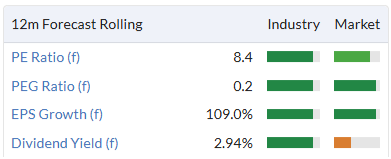

I’d say that overall there is still work to do to hit those forecasts, but they are not unreasonable. This makes the shares look reasonable value:

I’d take that dividend forecast with a pinch of salt as a relaxation of banking covenants likely prevents them from paying one in the short term. However, on an earnings basis, this looks cheap for a recovery stock that may have further to go.

The downside of all of these changes is that there will be significant exceptional costs associated with these closures and restructuring. I am generally more forgiving of these when they appear to be genuinely one-off rather than a way of permanently inflating earnings. The cash impact of these does need to be included, which is why cash flow and debt are important to consider.

Debt:

They generate a reasonable operating cash flow in the half as the cash restructuring costs are £1.4m, much lower than the headline figure. Capex is being tightly controlled meaning that depreciation is running ahead of that. Working capital is broadly neutral meaning that net debt reduces:

At 30 June 2025 the Group's net debt was £87.7 million (31 December 2024: £97.4 million). Included within net debt was £14.4 million of lease liabilities (31 December 2024: £17.3 million). Excluding lease liabilities, net debt was £73.3m (31 December 2024: £80.1 million).

Their current ratio is reasonable at 1.9, with borrowings and most of the lease liabilities non-current. However, they tend to hold a relatively large cash balance of £55.7m versus £129m of bank debt, suggesting that the balance sheet net debt may not be representative of the average position.

A declining debt level will mean lower interest charges and help them achieve their EPS forecasts, however with £73m net bank debt compared to a £192m market cap it is large enough for us to consider adjusting P/E ratios or using EV measures, which would make the company look slightly less good value.

Mark’s view

The continued strength of the ongoing EU and AP regions and the progress in restructuring NA means that things are looking better than the initial headlines in these results might have us believe. However, hitting FY targets looks to rely on them getting those problematic NA operations to at least break-even for H2. They appear to be doing the right things but there is always scope for delays or the US administration to throw further spanners in the works on tariffs or similar. If they do hit forecasts, then they look cheap, especially as the H2 momentum will carry into next year. The debt reduction means that the risk of solvency issues is also decreasing, but remains a possibility if the NA turnaround is not successful or other regions face issues. Given that there is still work to do to make their NA operations break-even and hence turnaround the group finances, I am going to keep our neutral AMBER rating. However, I can see what may attract an acquirer or shareholder with a long-term view.

JD Sports Fashion (LON:JD.)

Down 1% at 88p - Interim Results - Mark - AMBER/GREEN

The sales figures here were known when Roland reported on them in August, with the big jump due to acquisitions. Group revenue was up 2.7% on an organic basis and down 2.5% on a like-for-like, i.e. excluding new store openings. Today’s results show that the acquisition-led growth hasn’t translated to increase profits, even on an adjusted basis:

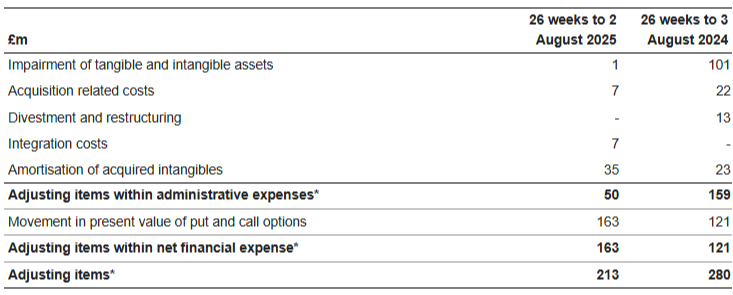

Well known cost-increases have balanced out the increased sales. There is also a very big gap between adjusted and unadjusted figures. However, the bulk of this is the movement in put and call options related to a non-controlling interest:

There are a few other things in here that will be cash costs, but given the relative size, we can pretty much take the adjusted figures. 4.6p adjusted EPS leaves a bit to do in H2 to hit the 11.9p EPS forecast. There is usually a H2 weighting, and there are reasons to be cautious over the second half:

FY26 guidance

• Anticipate LFL sales will be below FY25

• Acquisitions made during FY25 to add c.10% to total sales in FY26

◦ A full year of Hibbett and Courir, adding c.£1bn of incremental sales vs FY25 at a c.6.5% margin(1)

• New space impact (net) on total sales of c.4%

◦ We anticipate c.75 to 100 net new stores in FY26

• Additional opex in FY26 of £50m+, outside of normal inflationary increases, including: (i) UK labour costs, and (ii) a higher proportion of technology investments falling into opex as opposed to capex

• Partially offsetting these increases will be:

◦ Cost savings and efficiencies across our key markets in FY26 of c.£30m

◦ Integration synergies in the US following the Hibbett acquisition - half-to-two thirds of c.US$25m annualised savings expected in FY26, weighted to H2

However, overall they say:

We expect to be in line with current market expectations for FY26 profit before tax and adjusting items (PBTAI), with limited impact expected from US tariffs this financial year

Free cash flow is negative for the half, but again reflects seasonal bias:

Net debt excluding lease liabilities is £125m, versus £41m net cash a year ago, but this is not really significant in any valuation.

Mark’s view

This is a challenging market for retail, particularly in the UK due to cost rises and the US due to tariffs. However, JD seem to be managing it as best they can. Apart from lease liabilities, there is little financial leverage, which may allow them to take advantage of further acquisition opportunities. In the meantime, they have the ability to grow modestly through more store openings. With 75-100 planned this year, there doesn’t seem to be any sign of oversaturation. With the FY results guided in line with an EPS that would put them on a P/E of 7, I see nothing in these results to change our broadly positive AMBER/GREEN view.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.