Good morning! It's looking like another quiet Friday, but unfortunately we do have one profit warning to cover.

Today's agenda is now complete (07:39)

Today's report is now complete 12:55). Thanks for reading - see you on Monday!

Spreadsheet accompanying this report: link (last updated to: 5th September).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view |

|---|---|---|---|

Hays (LON:HAS) (£921m) | Net fees -8% YoY, with some recovery in temp/contracting. Targeting a further c.£45m of cost savings. Outlook warns of limited visibility. | AMBER/RED (Roland) The only real positives I can pull from today’s update are that seasonal demand for temp staff has improved in line with normal trends and that Hays is continuing to cut costs while improving consultant fee productivity. The lack of a further profit warning is obviously also good news. But it’s worth remembering that FY26 EPS forecasts have been cut by 80% over the last 18 months and the shares have a MomentumRank of just 7. With management emphasising the uncertain outlook and the group moving to a net debt position, I think it’s too soon to turn positive. I’m going to leave our moderately negative view unchanged today. | |

Ibstock (LON:IBST) (£528m) | PW: uncertain backdrop has led to weaker than expected demand. H2 adj EBITDA now to be “similar” to H1, vs prev. H2 weighting. Today's guidance implies FY25 EBITDA of c.£72m, versus £77-82m previously. | BLACK (RED) (Roland) Today’s warning is disappointing. I had hoped that Ibstock would strike a more positive note following July’s upgrade from peer Forterra. However, it seems that Ibstock’s underperformance has continued and today’s update warns of both weaker volumes and difficulty meeting pricing targets. Leverage is higher than at Forterra and I don’t think the business is cheap enough to justify a speculative turnaround buy. For now, I think the algorithms’ Falling Star status is apt. I am going to maintain Graham’s previous negative view today, given the specific additional risk from higher leverage. | |

VP (LON:VP.) (£231m) | Solid H1, with strong performance in Germany (especially Transmission) and good prospects in UK water, with an increase in activity expected in H2 and beyond. FY26 outlook in line with market expectations for revenue of £386m and adjusted PBT of £37.3m – albeit with a modest H2 weighting. | AMBER/GREEN (Roland) [no section below] Today’s in-line update seems fine to me and emphasises VP’s differentiation through its focus on various specialist sectors. The two main areas of weakness seem to be the “slow start to Network Rail’s CP7” regulatory period and weakness in General Construction demand, presumably also impacting the turnaround of the Brandon Hire Station division. Mark highlighted some quite aggressive profit adjustments in his review of VP's half-year results and I agree with his conclusions. However, my view remains that VP is probably a better business than the more generalist small cap equipment hire companies on the London market. I also like its family ownership, focus on ROCE and 7% dividend yield, which remains covered by forecast earnings. I’m happy to leave our moderately positive view unchanged today and believe there’s probably some value on offer here. | |

Premier Miton (LON:PMI) (£103m) | AUM -4% to £10.3bn YoY. Net outflows of £191m in Q4. Further £2m cost savings. FY results on 4 Dec. | AMBER/GREEN (Roland) Continued net outflows are a little disappointing, especially as some of them appear to come from PMI’s US equity funds. However, the stock remains cheap with roughly £100 of AUM for every pound invested. A potential 9% dividend yield is also tempting, with near-earnings cover and support from net cash. On balance, I think the shares are probably suitably cheap and have the potential to deliver a strong recovery, if investor inflows return to more normal patterns and start to favour active managers once more. | |

Enwell Energy (LON:ENW) (£58m) | All production licences [in Ukraine] currently suspended. Pursuing legal action and arbitration re. suspensions. Cash balance of c.$99.9m, primarily in Ukrainian Hryvnia. | AMBER/RED (Roland) [no section below] Net cash of $100m (c.£74m) amply covers the market cap, suggesting this could be an interesting deep value situation for further research. But the risks seem very high to me. The majority of this cash is held in Ukrainian currency (and presumably in local banks) and Enwell's oil and gas operations are currently suspended due to sanctions legislation. A costly legal dispute is ongoing with the Ukrainian authorities in an effort to lift the suspension, but I have no idea what the odds of success might be. This is far too risky for me, but a Contrarian style rating and deep discount to book value highlight the potential here. This might be worth a look for a special situations investor able to evaluate the legal situation (and Enwell’s petroleum assets) in more detail. | |

Renalytix (LON:RENX) (£35m) | $4m of the company’s bonds are being converted to equity, improving net assets by $4m and saving up to $1.4m in interest. | ||

Sareum Holdings (LON:SAR) (£27m) | SDC-1801 preclinical study discontinued due to high incidence of safety issues in control group. Hoping to restart study. | ||

Premier African Minerals (LON:PREM) (£17m) | Confirms details of 10:1 share consolidation which will take place on 14 Oct 25. |

Roland's Section

Ibstock (LON:IBST)

Down 7% at 125p (£494m) - Third Quarter Trading Update - Roland - BLACK (RED)

Our research has shown conclusively that when a company warns on profits, a longer period of underperformance often follows – potentially including further profit warnings.

Unfortunately we have another example of this today from brickmaker Ibstock, which has cut its profit guidance for the second half of the current year (calendar 2025). Today’s warning follows an earlier cut to guidance in June, when Graham took a negative view of the situation.

H2 trading weaker than expected

Previous guidance from the company implied a moderate H2 weighting to profit, on the basis that sales volumes would increase during the second half of the year.

Unfortunately this hasn’t happened:

However, in light of softer market demand, sales volumes in the second half are now expected to be in line with the first half of the year, with continuing weighting towards new build residential customers

CEO Joe Hudson is now expecting a broadly flat performance in H2:

However, in light of softer market demand, sales volumes in the second half are now expected to be in line with the first half of the year, with continuing weighting towards new build residential customers.

There’s also a worrying comment on market dynamics which suggests to me Ibstock has failed to achieve the kind of price increases it was hoping for:

Market dynamics, coupled with the continued shift in sales mix towards new-build residential demand, have also limited the Group's ability to achieve targeted pricing levels.

Financial impact: adjusted EBITDA for the second half of the year is now expected to be “similar to the first half of the year”. This wording doesn’t seem to rule out a small reduction in profits in H2, but I’ve crunched the numbers below on the basis that a flat result is expected on a half-on-half basis:

H1 25 adj EBITDA: £36m;

Previous guidance (6 Aug 25): FY25 adj EBITDA in the range £77m to £82m;

Previously implied H2 adj EBITDA of £41m to £46m;

Today’s warning suggests H2 adj EBITDA of c.£36m, a 17% cut from the mid-point of previous guidance.

I don’t have access to updated broker notes today, but assuming a similar conversion to adjusted earnings in H2 would suggest FY25 earnings may now be around 6p per share, c.15% below previous forecasts of 7.1p.

Balance sheet & cash: the only positive I can see in today’s update is that the business seems to be operating more efficiently than previously and may have made some progress with managing debt levels and leverage.

Ibstock says that its manufacturing networks were operating “at higher levels of productivity”, in line with expectations. In addition to this, the company appears to have been getting a tight grip on its cash outflows:

A focus on cash management, with tight control of capital expenditure, working capital and discretionary spend enabled the Group to deliver a solid cash flow performance in the third quarter.

We aren’t given any numerical guidance on net debt today, but we are told that year-end leverage is expected to be “around 2 times”.

Leverage was 2.2x EBITDA at the end of the first half, so my hope is that Ibstock may report a slightly lower net debt figure at the end of the year – although I’m not all that confident of this. As Graham pointed out in June, it’s worth remembering the extra leverage adds specific risk for equity investors, when compared to peers with stronger balance sheets.

Outlook

Mr Hudson sounds cautious about the outlook today and refrains from providing any guidance for 2026:

Whilst it remains difficult to predict the pace and timing of market recovery, we will continue to focus on strong execution and progressing our long term strategic growth projects. These initiatives, combined with the increasing contribution from our recent investments, leave us well positioned to benefit as the market returns.

Roland’s view

Ibstock is one of the UK’s two largest brick producers, together with Forterra. Both companies seem to have followed similar strategies during the downturn that’s hit the sector since 2022, cutting back production, upgrading factories and positioning for a recovery.

However, for some reason Ibstock has not executed this strategy as successfully as Forterra, which upgraded its profit guidance when it issued interim results in July. Forterra also has significantly lower leverage than Ibstock.

Of course, Forterra’s fortunes may also have reversed in H2 – we haven’t yet had an autumn trading statement from this business. Some business surveys have certainly suggested that construction project decisions have slowed since the summer, as investors await November’s Budget announcement.

I think the question investors considering Ibstock must now ask are:

Is the company cheap on a cyclical view?

Are there any balance sheet concerns that could threaten an equity recovery, when demand improves?

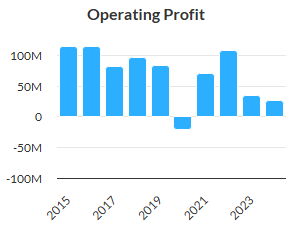

Valuation: Stockopedia’s historic accounts for Ibstock show the company’s earnings have averaged 11.8p per share since its 2015 flotation.

At today’s share price of c.120p, that’s equivalent to a cyclically-adjusted P/E (CAPE) of about 10. That might not be bad value, given how the group’s profitability can improve rapidly in stronger markets:

After all, earnings have peaked at over 20p per share in the past and the company has previously paid quite attractive dividends.

However, for a heavily-cyclical business, I'd generally look for single-digit CAPE ratio. I am not convinced that Ibstock is truly cheap at current levels, especially when its debt is factored into the valuation -- today's guidance implied an EV/EBITDA ratio of almost 10x.

Balance sheet: Ibstock’s debt levels are not critical at the moment, but my concern with today’s statement is that the company seems to suggest that both margins and volumes are falling below expectations. That’s not a good combination for a capital-intensive manufacturer and it highlights the commoditised nature of Ibstock’s products.

While leverage may have improved slightly over the second half of this year, I don’t have a lot of confidence in this and would not be surprised to see a further dividend cut unless the market outlook for 2026 improves fairly rapidly – arguably unlikely.

Conclusion: as I discussed in a recent article on brickmakers, I think it makes more sense to focus on a business showing positive momentum than one that appears to be struggling to meet its targets.

Graham took a RED view on Ibstock in June, while I suggested in September that AMBER/RED might be more fair. With hindsight, Graham’s caution looks to have been well judged.

Firstly, I don’t think this business is truly cheap when the valuation is adjusted for debt levels, which also add risk. Secondly, I would like to see an updated outlook for FY26 to get some confidence in current market forecasts, which strike me as a little optimistic.

I would hope to be able to moderate this rating if trading does improve as hoped in 2026. But I’d rather wait for some evidence of a turnaround before taking a more positive view. One early clue may be if Stockopedia’s algorithms upgrade the stock from its current Falling Star styling – a negative style that can be a warning of prolonged underperformance.

Premier Miton (LON:PMI)

Down 5% at 60p (£93m) - Q4 AUM Update and Notice of Results - Roland - AMBER/GREEN

We’ve already had AUM updates from Liontrust, Impax and Polar Capital this week. All three reported net outflows for the previous quarter, although these were minimal at Polar due to its greater exposure to US tech stocks.

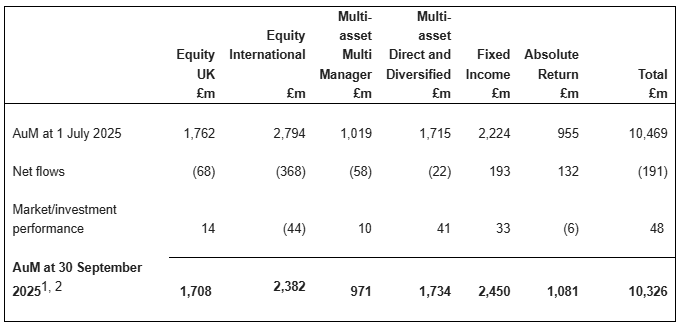

Unfortunately Premier Miton has not managed to buck the trend. AUM fell slightly to £10.3bn during the three months to 30 September thanks to £191m of outflows – a slight increase from the £173m net outflow reported for the previous quarter.

Unlike Impax, for example, market and investment performance wasn’t strong enough to cancel out the outflows, resulting in an overall reduction in AUM:

Management commentary emphasises the areas of strength:

We saw encouraging momentum in our fixed income and absolute return strategies during the Quarter, with combined net inflows of £325 million. This reflects growing investor confidence in our approach to capital preservation and delivering strong returns. We also have a robust pipeline of new business building across these areas.

Unfortunately, the US and European equity strategies saw outflows totalling £347m.

To help offset this continuing drag on profitability, the company has announced plans for a further £2m of cost savings, in addition to the £3m announced in April 2025.

Changes are also being made to senior management with the aim of improving performance. Premier Miton’s UK Equity and Global Equity teams are both getting new leaders. The company’s well-known Head of Equities, Gervais Williams, is moving to become Chair of the Equities Business, “providing experienced oversight and continuity”.

Roland’s view

Today’s results have received a cool reception from the market, wiping another 5% from Premier Miton’s market cap.

I think it’s a little disappointing that the group’s large international equities mandate hasn’t performed more strongly given its US exposure, but on balance I don’t think there’s anything too worrying here. The shares remain cheap relative to AUM, with today’s market cap giving buyers around £100 of AUM for every £1 invested.

That’s a similar valuation to other cheap UK fund managers such as Liontrust.

Consensus forecasts price the shares on around 10x earnings, with a possible 9% dividend yield that’s almost covered by forecast earnings. Premier Miton still had nearly £30m of net cash at the end of March, too, providing further support for the valuation.

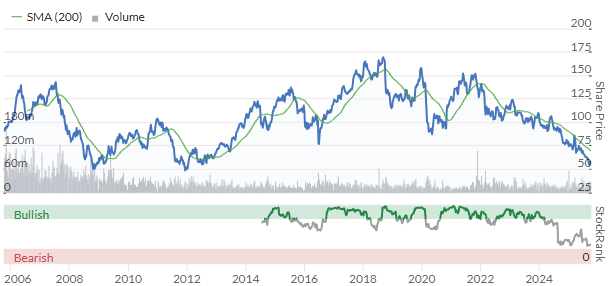

The StockRanks also have a favourable view, styling PMI as a Super Stock:

The bear view is that there’s still a risk that some active managers will not fully recover from the long-running decline in UK investor flows. But on balance I think most of the bad news is priced in here. I’m also mindful of the way that even modest inflows can drive positive operating leverage and a strong recovery in profits.

I’m comfortable leaving our AMBER/GREEN view unchanged today.

Hays (LON:HAS)

Up 5% at 60p (£964m) - First Quarter Trading Statement - Roland - AMBER/RED

UK-listed recruiters have been some of the most unloved stocks on the London market for a long while now, but Hays shares have risen (modestly) after this morning’s update, so I thought it might be worth a look.

To set the scene, this FTSE 250 firm’s share price is currently at a post-2011 low:

The StockRank tells the story, with an ultra-low MomentumRank:

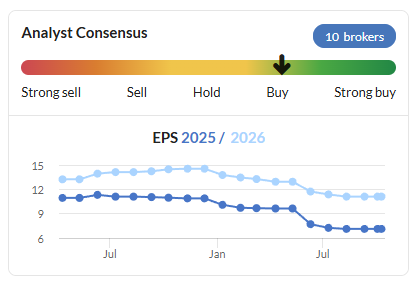

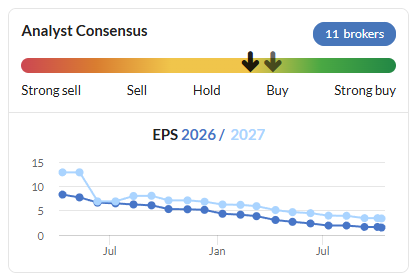

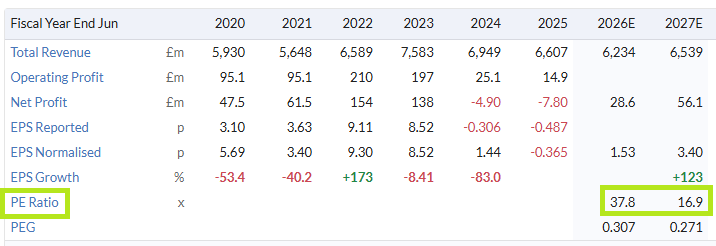

This is understandable when FY26 earnings forecasts have been cut by more than 80% over the last year:

First Quarter Trading

I’d struggle to describe today’s quarterly statement as upbeat. But perhaps there are one or two positives among the headlines:

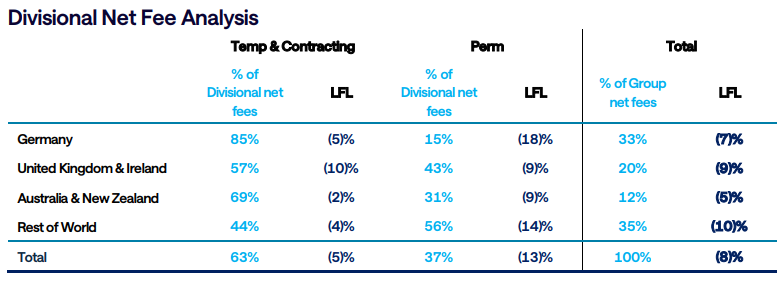

Group net fees down 8% YoY, with Temp & Contracting down 5% and Perm down 13%

Temp & Contracting volumes have rebuilt through the quarter in line with normal seasonal trends

Perm markets “remain challenging with longer time to hire”

Consultant net fee productivity growth +7% YoY, with a 15% reduction in headcount YoY

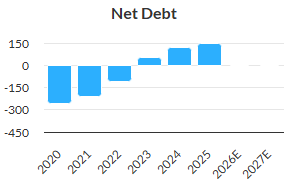

Net debt c.£40m (30 June 25: £37m net cash) reflecting seasonal/timing factors

Quarterly cost base reduced to £74m (from £75m in 4Q25), targeting a further £45m of cost savings by the end of FY29

LFL performance was negative in all the group’s divisions. It’s notable that countries where Hays did see growth, such as the US and Spain, are not large enough to be reported separately:

Balance sheet: like most UK-listed recruiters, Hays entered this downturn with a large year-end net cash balance. This has gradually been eroded:

Although this picture might be more favourable if lease liabilities are stripped out, the direction of travel is pretty clear. Today’s reported net debt of c.£40m doesn’t look high enough to be a serious concern for me, but it does highlight the need for further efforts to cut costs.

I wonder if Hays (and some competitors) were too slow to reach when problems started to emerge in 2022/23.

Outlook

CEO Dirk Hahn says he believes headcount is “appropriate for current conditions” and is expected to remain stable in Q2. The company will continue to reduce its cost base, though, which does make me wonder where the savings will come from in the absence of headcount reductions.

Commentary on the next 6-12 months is understandably cautious:

Given ongoing macroeconomic uncertainty, we expect near term market conditions to remain challenging and, although we have limited forward visibility, we believe this is likely to persist through FY26

I expect broker forecasts to remain unchanged today, suggesting that Hays shares remain quite highly rated on a near-term earnings outlook:

Whether the FY27 forecast will prove reliable remains to be seen.

Roland’s view

The decline in earnings has been long and painful here and I would be reluctant to call the bottom just yet. While recruiters have been reliably cyclical in the past, any signs of recovery seem to keep getting pushed into the future.

I think it’s worth asking if something has changed in this sector, perhaps linked to the combination of LinkedIn and AI allowing employers to screen and recruit more efficiently directly. I don't have any particular insight this sector - and having been self-employed for 18 years, I don't have any recent experience of it either! But I'm increasingly starting to suspect that something may have changed.

In summary, there may be some slight positives to today’s update, but I don’t see enough to justify upgrading our view so will leave Mark’s previous AMBER/RED view unchanged.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.