Good morning! Judging by Mark's Week Ahead article on Friday, this could be a pretty interesting week. I hope you're all doing well!

All done for today, thank you!

Spreadsheet accompanying this report: link (last updated to: 23rd September).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

AstraZeneca (LON:AZN) (£195bn) | Positive CHMP opinion for subcutaneous Saphnelo & US FDA Approves Tezspire in CRSwNP | Saphnelo: recommended for approval in EU for systematic lupus erythematosus, which affects 3.4m globally. Tezspire: approval broadens indication to a second disease, affecting up to 320m globally. | |

Plus500 (LON:PLUS) (£2.23bn) | 9M revenue +2%, customer income +8% to $536.7m, EBITDA +1% to $267.8m. FY26 revenue and EBITDA guidance unch. Market expectations: revenue and EBITDA of $749.5m and $343.0m | GREEN (Graham) [no section below] With Plus500 reiterating guidance, I have no reason to change my positive stance on this incredible share - the best-performing UK share since it IPO'd in 2013. The US futures business (us.plus500.com) is a key growth driver currently and segregated customer funds in this business have now crossed over the $1 billion mark. For the group as a whole, revenue growth for the first nine months of the year is now growing as quickly as I might have hoped, given the tariff tantrum that got markets moving in April. Revenue from spreads, commissions, overnight charges, etc. (collectively referred to as "customer income") rose 8% but performance was held back by "customer trading performance", i.e. customers made smaller losses this year than last year! I've criticised Plus500 for a long time for not hedging customer trades - it is happy to profit when they trade badly, and to take the risk of losses if they trade well. For the first nine months of 2025, customer trading activity lost $10.4m directly to Plus500, versus $46.6m in the same period last year. Regardless of my criticisms, there is no question that the company has been exceptionally profitable, year-in year-out. And it is now trying to be more selective when it comes to customer acquisition: new customers were down slightly compared to last year, but the average deposit per active customer doubled. This reflects the US futures business and the overarching strategy to find higher-value customers. With a very healthy balance sheet ($815m cash) and an ongoing focus on shareholder returns through dividends and buybacks, I see little option but to stay positive on this. The rolling P/E is 11x, without adjusting for the cash balance. | |

B&M European Value Retail SA (LON:BME) (£2.18bn) | PW: Found £7m of costs not recognised. H1 adj EBITDA now £191m (prev. £198m). FY26 adj EBITDA exp £470-520m (prev £510-560m). CFO leaves. | BLACK (RED) (Roland) | |

Sirius Real Estate (LON:SRE) (£1.49bn) | Near Munich, 27,180sqm lettable area. €3.4m rent roll, 7.8% yield. 94% occupied w/ 7.8yr WAULT. | ||

GlobalData (LON:DATA) (£924m) | PW: FY25 revenue to be in line with exps, but FY25 adj EBITDA margin now to be lower than expected. | ||

Galliford Try Holdings (LON:GFRD) (£525m) | Appointed to £3bn affordable homes 5yr framework by Hyde Group. Confirmed on all seven lots, targeting 1,500 homes/yr. | AMBER/GREEN (Roland) [no section below] This was a long-term holding for my SIF folio that I seem to have sold far too soon. While my reservations about this sector are unchanged (see here), Galliford appears to be continuing to win new work to support further growth. There’s no commentary on expectations today, suggesting to me that this new contract win may already be reflected in market forecasts. Personally, I wouldn’t be brave enough to buy into this business on a forward P/E of 15. But Galliford does seem in good health, with last year’s results showing a decent net cash position and improving margins. If the business continues to hit forecasts, I accept the shares could still be reasonably valued at current levels. The StockRanks are certainly positive, with a score of 97 and Super Stock styling. I don’t see any reason to change my previous AMBER/GREEN view today. | |

Avacta (LON:AVCT) (£284m) | Demonstrated favourable safety and tolerability, with lower toxicity compared to conventional therapy and “exciting efficacy”. | ||

Hargreaves Services (LON:HSP) (£218m) | Sale of land generating rent from wind farms/access agreements. £8.8m cash upfront plus £3.8m contingent amount due by Sept 2029. | AMBER/GREEN (Roland) [no section below] I’m a long-term fan of this business. Longserving CEO and 8% shareholder Gordon Banham has a strong track record of delivering on his promises over time, in my view. The shares have certainly been a profitable investment for patient investors who’ve taken the opportunity to buy below at a discount to book value at various times over the last decade – most recently in 2022/23. Today’s disposal is at a premium to balance sheet value of £7.4m, presumably based on historic cost. However, the sale price is in line with a more recent independent valuation of £12.6m, if we’re willing to include the expected £3.8m of deferred consideration. This will be contingent on future wind yields – these can be uncertain, as investors in TRIG (disc: I hold) and UKW have found over the last two years. Commentary from other renewable operators has suggested the market for asset sales has become more difficult over the last year, so I’m encouraged by this deal, which seems to suggest the company’s target of £27m of renewable asset disposals is realistic. Hargreaves has been gradually monetising its extensive land assets for some years, while developing its continuing businesses in Services (bulk earthworks for infrastructure projects) and raw material trading. Shareholders have benefited through some generous dividends. The current valuation looks reasonable to me, especially given forecast net cash of £32.7m at the year end. This should comfortably support the near-6% dividend yield. Although the stock now trades at a premium to book value, I’m happy to maintain a positive view today. | |

Seraphim Space Investment Trust (LON:SSIT) (£192m) | Portfolio valuation up by £58.3m (28.9%) to £259.8m. NAV per share +23.2%. 66% of the portfolio has robust cash runway. | ||

City of London Investment (LON:CLIG) (£188m) | Funds under Management +4% to $11.2 billion. Net outflows $419m. | AMBER/GREEN (Roland - I hold) As a long-term shareholder I am happy to see higher FUM, as it should generate additional fee income to improve cover for the 9% dividend yield. I’m also encouraged by the strong investment performance against (most) benchmarks, as it suggests CLIG’s teams are finding attractive opportunities and executing on them successfully. The remaining issue – as for so long – is the lack of inflows from new or existing clients. Gains in FUM during the quarter were entirely driven by $861m of investment gains, which offset net outflows of $419m. Unless this situation improves, I suspect the shares will remain fairly valued at current levels. Despite this, I think there’s enough value on offer to leave our moderately positive view unchanged today. | |

Secure Trust Bank (LON:STB) (£169m) | FCA proposed redress scheme is towards the extreme end of outcomes. STB to increase provision by approximately £16 million to a total of £21 million. | AMBER (Graham) Downgrading this to neutral has been a really difficult decision as I still believe in the value on offer here for patient, long-term shareholders. However, long-term may also mean long-suffering as the accounts are likely to be messy for the time being as the bank digests the costs of shutting down its vehicle finance businesses, while also complying with the FCA's redress scheme for motor finance customers. I agree with the stock's very high ValueRank and would like to upgrade my stance on this again as soon as possible - perhaps when we get a little bit more clarity and a sign that trading has stabilised. STB's "core" business is doing ok but arrears in the non-core segment haven't improved as anticipated. This is one I'm going to be watching very closely for a buying opportunity. | |

DP Poland (LON:DPP) (£78m) | Renewed agreement for 10 years to 31 August 2035. A further 10 year renewal option would extend it to 2045. | AMBER (Graham) [no section below] This is really just a box-ticking exercise as it essentially allows the company to continue operating for another ten years, and legally it looks set up to continue for another 20 years. Recent interim results (to June) showed that the company remains loss-making as it has been for many years. Fortunately, the losses are small (£460k in H1) and there is £3.5m in the bank. With 117 operated stores plus another 90 franchised stores trading as “Pizzeria 105”, the market cap is potentially cheap against 200+ pizza outlets, but the lack of a decent track record would keep me cautious. | |

Defence Holdings (LON:ALRT) (£54m) | ”...continues to execute its strategy with financial discipline, maintaining a robust balance sheet and significant headroom to support ongoing delivery.” | ||

Various Eateries (LON:VARE) (£18m) | SP +25% Rev +6% (£52.4m), ahead of exps (£50.7m). Adj. EBITDA at least £1.1m versus market expectations £0.4m. Momentum has continued into FY September 2026. Cash at bank of £8m. New Zeus forecasts: FY5 adj. LBT £2.9m (previously LBT £3.6m). FY26 adj. LBT £2/5m (previously LBT £4m). | AMBER (Graham) [no section below] A huge share price reaction today but please bear in mind that Hugh Osmond owns 64% of this company, so the free float is only worth about £8m even after today’s gains. Revenues are 3% ahead of expectations and these expectations must have been quite modest, given that full-year like-for-likes are only 2%. This is said to be ahead of the wider market. The really good news is that greater efficiency has had a remarkable impact on the bottom line, even despite higher min wage and NICs. The strong cash position is worth highlighting but I can’t turn positive on this on the basis of positive EBITDA. Checking forecasts from Zeus (with thanks to them for publishing today), I note that the company is expected to remain loss-making in the current financial year in terms of the pre-tax result. | |

Prospex Energy (LON:PXEN) (£18m) | Gas production has resumed after detection of a leak in April. Prospex owns 7.24% of the field. | ||

Zenith Energy (LON:ZEN) (£15m) | Italian subsidiary agrees to acquire solar energy projects with combined capacity of 22 MWp. Total portfolio 98.5MWp. | ||

ARC Minerals (LON:ARCM) (£15m) | Zambian JV between subsidiary Unico Minerals and Anglo subsidiary has by mutual agreement been terminated. |

Graham's Section

Secure Trust Bank (LON:STB)

Down 5% to 844p (£161m) - FCA Consultation on Motor Finance Redress - Graham - AMBER

The STB share price has already been under a lot of pressure this month:

On October 9th, the shares fell 20% after a profit warning. As we didn’t get to look at it that day, here are the details of that warning:

The overall net lending book declined 4.1% in Q3 due to the “run-off” of Vehicle Finance, a market that it is exiting and that it now describes as “Non-Core”.

“Core” net lending grew by 10.3% (Retail Finance 9.1%, Real Estate Finance 12.6%).

The vehicle finance book is shrinking faster than STB expected - but remember that it’s no longer making loans under this heading. Surely there can’t be that much variance in how quickly customers are repaying?

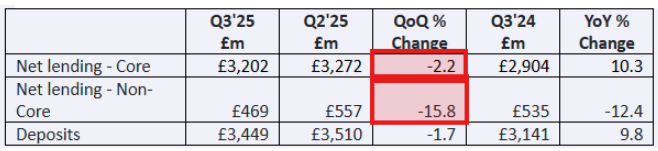

This table shows that the Vehicle Finance book fell 15.8% in the quarter, and even the “Core” book fell by a few percent:

As far as the profit outlook is concerned, this strikes me as even more important:

The Vehicle Finance business also incurred higher than anticipated impairment charges for the year-to-date with expected improvements in probability of default rates not yet being fully reflected in the IFRS9 accounting models. Underlying arrears and default rates in the portfolio remained stable but have not improved on H1 2025 to the extent anticipated.

The first sentence makes it sound like an accounting issue, but actually there is a real problem: arrears and default rates not improving.

It’s always very disconcerting when I see this sort of two-pronged failure: the loan book is shrinking faster than expected (which I guess includes car loan refinancings/early payments), and at the same time arrears and default rates aren’t improving as anticipated. So there’s less interest being received both from good borrowers and bad borrowers

On top of the above, “management also expects that the exit from Vehicle Finance may require additional provisions for onerous supplier contracts associated with new business originations”.

So that makes for a trifecta of bad news from Vehicle Finance. At least we know these aren’t going to be ongoing problems!

The “Core” business was reported to be still trading in line.

Profit outlook:

Whilst the Board now expects the Group's underlying profit before tax for FY25 to fall below market expectations by up to £9 million, due to the performance of Vehicle Finance, it remains confident of c. 30% year-on-year growth in underlying profit before tax.

View on the profit warning: we’ve been AMBER/GREEN on STB, and I’d be reluctant to downgrade to neutral on the back of this warning, as all of the bad news warning relates solely to a segment that is in wind-down.

For context, adjusted PBT at STB last year was £39m. And that was after taking a £62m special impairment charge related to the FCA’s “Borrowers in Financial Difficulty” review, which affected many companies in the sector. For a company with a market cap (today) of £161m, these are enormous profit figures.

I suppose the problem is that it’s all so complicated: do investors need to focus on the “Core” business only, or should they look at the overall “Adjusted profit before tax pre impairments” (which the company highlights), including vehicle finance?

Or how about adjusted profit before tax?

Or (the worst options) actual profit before tax, or actual net income!

I guess I’ve talked my way into downgrading this to a neutral stance, due to the complications.

Personally, I still see an enormous amount of value at the current market cap. But here at the DSMR we are trying to be disciplined, which typically means downgrading stocks when they issue bad news.

And the statutory result could be poor here, after all provisions and impairments.

Speaking of which, here is today’s news:

FCA consultation paper on its proposed redress scheme is towards the extreme end of outcomes previously expected from the Supreme Court judgment

STB expects to increase its motor finance redress commission provision by approximately £16 million to a total of £21 million

£16m is about 10% of the current market cap, after today’s share price fall; it’s a material amount, but it doesn’t fundamentally change the investment story here, in my view.

Checking last year’s full-year results again, I find tier 1 capital of £350m, and balance sheet equity of £360m (almost fully tangible).

So an additional £16m charge isn’t a game-changer, in my opinion.

The company’s calculations say the same thing:

On a pro forma basis, as at 30 September 2025 STB had a Common Equity Tier 1 ("CET1") ratio of 13.3%1. STB estimates that the additional expected provision of £16 million1 will reduce CET1 ratio by c. 50 basis points to 12.8%1, significantly above the Group's regulatory requirement of 9.6%.

Also worth noting that the FCA’s current proposed redress scheme (which I view as a worst-case scenario for the industry) would only result in an additional £6m provision, according to STB. There is still time for the consultation to soften the redress scheme.

Graham’s view: I’m going AMBER on this today, for two main reasons:

Discipline: we tend to downgrade stocks that issue profit warnings, because bad news tends to be followed by more bad news. Ed has written about this for years, e.g. see here.

Complexity: even though my personal view is that this stock offers excellent value, I acknowledge that the results are going to be highly complex, with a range of provisions, impairments and one-off costs. The motor finance compensation is not responsible for all of this complexity - the company’s own decisions and the manner of presentation also play a role.

I do hope to take a positive view on this again before too long, but for now I’m neutral.

The ValueRank is 97, but it’s not easy to buy against the type of news flow that STB has produced

Roland's Section

B&M European Value Retail SA (LON:BME)

Down 18% at 179p (£1.8bn) - Update on FY26 Guidance and Directorate Change - Roland - BLACK (RED)

Commiserations to shareholders here – today’s update from the value retailer is B&M’s second profit warning in three weeks. I covered the previous update here on 7 October.

The short version of today’s update is that the company has cut its full-year profit guidance range by c.7.5% after discovering a £7m accounting error in its H1 accounts.

The company is commissioning a third-party review of this issue and CFO Mike Schmidt intends to step down, although he will stay with the company until a successor has been appointed.

Let’s step through the news.

Accounting error: while preparing its half-year accounts, B&M discovered “approximately £7m” of overseas freight costs that had not been correctly recognised in cost of goods sold. This error followed a computer system update earlier this year.

The issue has been resolved but the company warns the impact on the outlook for FY26 is “material”.

Impact: H1 adjusted EBITDA is now expected to be £191m, instead of £198m previously – a reduction of £7m. This implies an H1 EBITDA margin of 6.9%, versus 7.2% previously.

Revised FY26 outlook: as a result, B&M has cut its FY26 adj EBITDA guidance to £470-520m. This is a reduction of around 7.5% from the previous guidance of £510-560m.

However, in numerical terms EBITDA guidance has been cut by £40m, versus a £7m reduction to H1 EBITDA. Intuitively, this seems like a bigger cut than we might expect to see for the issue described.

The company doesn’t highlight any other issues today but says the FY outlook has been recalculated based on “revised second-quarter margin run rates” (my bold).

I wonder if this suggests that the extra costs only apply to Q2 trading, not to H1 as a whole. If so, that would magnify the potential impact on H2, especially given B&M’s typical H2 seasonality.

Working through the numbers gives me:

Seasonality: today’s revised EBITDA guidance suggests a 40/60 H1/H2 split, taking the mid-point of guidance. This would be a similar H2 weighting to last year. Applying the extra £7m of costs pro rata to the increased revenue expected in H2 would give me c.£16m of additional costs.

Q2 + H2: adding £16m to £7m gets me to about £23m of additional costs/margin impact

That’s still a long way short of the £40m cut to today’s FY26 EBITDA guidance. I wonder if the £7m of unrecognised costs actually applied to a timeframe that was shorter than one quarter; that would magnify the FY impact.

The problem here is that I don’t know the margin assumptions being used for H2 or the timeframe over which costs were not being recognised. The company didn’t split out quarterly EBITDA in its H1 update and hasn’t been explicit today about the timeline.

Another issue that’s likely to have a big impact on FY EBITDA and earnings is the potential range of revenue outcomes for the year – the company reiterates this guidance today:

As previously disclosed, B&M UK's like-for-like ("LFL") sales are expected to be the principal driver of the outcome within this range, for which we reaffirm our assumption of a second half UK LFL percentage growth rate of between low-single-digit negative and low-single-digit positive levels.

A performance at the upper end of the range could drive positive operating leverage, boosting profits and operating margins – whereas a weaker result will have the opposite effect.

Roland’s view

Today’s profit warning extends a fairly dire run of downgrade for B&M over the last 18 months:

I’d previously turned neutral here on the basis that B&M’s problems seemed like they should be fixable by the highly-experienced new CEO, Tjeerd Jegen

However, I don’t have enough information to make the numbers add up in today’s update.

I’m also concerned by how low the group’s margin expectations appear to have fallen:

FY24 EBITDA margin: 11.5%

FY25 EBITDA margin: 11.1%

FY26 revised EBITDA margin guidance (mid-point, consensus revenue): 8.5% (prev. 9.2%)

More broadly, I’m worried about the risk that trading in H2 could still end up falling below revised guidance.

In today’s RNS, the new CEO seems to suggest that returning to historic levels of profitability might be a medium term goal:

The Group continues to expect that with LFL growth, future adjusted EBITDA margins for B&M UK can stabilise at low-double-digit percentage levels over the medium term.

As Mark has commented in the past, when a company talks about the medium term, it often means the short term outlook is not very good!

Today’s update has left questions unanswered, at least for me. It also highlights a sharp fall in margin expectations – and says nothing about leverage, which will presumably now be higher than expected at the end of the year.

My previous move to a neutral view appears to have been premature. I am going to drop down to RED ahead of B&M’s H1 results being published (due 13 Nov). As things stand, I wouldn’t want to invest here without more information.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.