Good morning! We'll try a very slightly different version of the summary table this morning, including the StockRanks. Hopefuly you like it. Cheers!

Sorry, we're out of time there, if tomorrow is quiet I'll do some catch-up sections! Thanks.

Spreadsheet accompanying this report: link (last updated to: 7th October).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

Unilever (LON:ULVR) (£114bn | SR49) | Q3 underlying sales growth 3.9%. 2025 full year outlook reconfirmed. Ice Cream Demerger expected to complete in Q4 2025. | ||

BHP (LON:BHP) (£105bn | SR93) | Not much forward guidance here. “Confident that BHP is positioned to deliver value and growth for you in the years ahead.” | ||

Lloyds Banking (LON:LLOY) (£50bn | SR67) | 2025 guidance revised: Return on tangible equity now expected to be c.12% (c.14% excluding the third quarter motor finance charge). Guidance at interim results: Return on tangible equity of c.13.5%. | ||

London Stock Exchange (LON:LSEG) (£45.2bn | SR44) | LSEG announces investment in Post Trade Solutions & Trading Statement | 11 banks have agreed to invest in Post Trade Solutions, taking a 20% stake for £170 million. TU: FY25 guidance unchanged except EBITDA margins are to increase by c.100 bps, at the top of guidance range. | |

Antofagasta (LON:ANTO) (£26bn | SR85) | FY 2025 copper production to be at the lower end of the guidance range (660-700Kt). 2025 net cash cost guidance lowered by 30 cents. Lowers capex guidance from $3.9bn to $3.6bn | ||

Intercontinental Hotels (LON:IHG) (£14.2bn | SR75) | Global RevPAR +1.4% YTD, after easing +0.1% in Q3. On track to meet full year consensus profit and earnings expectations. | ||

Kerry (LON:KYGA) (£11.1bn | SR34) | Volume growth of 3%. Pricing of +0.2%. Full year constant currency adjusted EPS guidance maintained. | ||

Rentokil Initial (LON:RTO) (£10.3bn | SR76) | Group Revenues +4.6% with Organic Revenue + 3.4%. Current trading in line with exps, outlook unchanged. | ||

St Jamess Place (LON:STJ) (£7.13bn | SR64) | Net inflows £1.76bn. Q3 “benefited from unseasonally high levels of client engagement and activity”, Given the uncertain consumer environment, “flows in Q4 may therefore be less strong by comparison.” | ||

Schroders (LON:SDR) (£6.11bn | SR87) | Net flows £4.4bn (Asset Management), £4.9bn (total excluding JVs and associates). AUM grows 5% to a new high of £817 billion. | ||

Inchcape (LON:INCH) (£2.71bn | SR83) | 8% organic revenue growth. Performance on track, FY 2025 guidance reiterated. EPS growth in-line with medium term target of >10% CAGR. | ||

Renishaw (LON:RSW) (£2.7bn | SR79) | Steady start to FY2026 in mixed market conditions, “in line with our expectations”. 2.8% constant currency revenue growth, 1.8% lower at actual exchange rates. | ||

Dunelm (LON:DNLM) (£2.31bn | SR75) | Q1 sales +6.2%. Gross margin up 80bps year-on-year. Full year outlook remains in line with the Board's expectations. | ||

AJ Bell (LON:AJB) (£2.24bn | SR68) | “A year of record growth, even though “uncertainty around government policy continues to cause disruption.” Underlying net inflows £6.2 billion. CEO comment: “The platform market opportunity is significant and the structural drivers of growth remain strong. Our dual-channel strategy, underpinned by ongoing investment in our brand and propositions, positions us well to deliver on this opportunity. We look forward to announcing the annual results for what has been another successful year for AJ Bell.” | GREEN (Graham) [no section below] I’ve been GREEN on this despite its high rating, due to what I perceive as exceptionally high quality. So far, this seems to be the right call as the company goes from strength to strength. Assets under administration have increased by 19% in a single year, with record gross and net inflows, and helped by an 11% tailwind from positive market movements. UK-based active fund managers might be struggling to generate inflows, but there is evidently no shortage of investor appetite when it comes to putting money into trusted platforms. AJBell is even attracting an encouraging level of inflows into its Investments arm, where its funds now have AUM of £6.8 billion. I feel I should reiterate that quality is spectacular (e.g. ROE is 47% per the StockReport) and this supports my continued positive stance here. | |

Harbourvest Global Private Equity (LON:HVPE) (£2.15bn | SR73) | NAV per share +6.2% to $57.55. Early signs of a recovery in private market exit activity. | ||

Mitchells & Butlers (LON:MAB) (£1.51bn | SR87) | CFO retirement after 15 years of service. Chosen successor is currently Finance Director - Food at Marks and Spencer Group plc. | ||

Hunting (LON:HTG) (£531m | SR92) | 2025 EBITDA to be at the lower end of the Company's published guidance range of $135-$145 million. Strangely there is no mention of revenues in this update. Restructuring has disrupted trading to certain businesses within EMEA. |

BLACK (AMBER) (profits at the lower end of the range) (Mark) | |

Wickes (LON:WIX) (£528m | SR89) | Overall Group revenue +6.9%. SaaS investment to cost £10m. “Comfortable with current consensus expectations for adjusted PBT in 2025.” | ||

Cerillion (LON:CER) (£434m | SR30) | Revenue c. £45.3m (2024: £43.8m), “reflecting the timing of contract wins”, and adjusted profit before tax slightly ahead of the consensus market forecast of £20.5m. | ||

Bloomsbury Publishing (LON:BMY) (£398m | SR49) | H1 Revenue -11% to £160m, U/L PBT -10% to £24.0m, Interim dividend +5% to 4.08p. Net cash £2.4m. Expects to deliver full year profit ahead of expectations. Academic & Professional division: Well documented challenging market conditions with UK and US budgetary pressures. Consumer division: in line with expectations versus a strong comparative. Harry Potter is still a bestseller. Other bestsellers from Gillian Anderson, Katherin Rundell, Sarah J. Maas. Estimates: previously reduced full year expectations for an adj. PBT of £41.6m will be beaten. The result in the prior year was £42.1m, and the new adj. PBT forecast for the current year from h2Radnor is £43.6m. | AMBER/GREEN (Graham) [no section below] BMY appear to be very happy with these results, despite lower revenues and profits than H1 last year, and is confident enough to increase the dividend despite a much lower cash balance (a “more efficient balance sheet”). Please note there was a large acquisition in May 2024 for $83m, so we’re not looking at a fully organic result. Even still, revenues are not doing particularly well against the prior year and the full-year revenue estimate at h2Radnor has barely moved on the back of today’s update (up by only c. £1m, and still 8% lower than the prior year). However, I’m happy to look past this as it can’t be expected that revenues will move up in a straight line in this industry. Profit margins are very healthy and there is no doubting the overall success of the business. The list of titles in H2 is impressive and I note that Jimmy Wales (Wikipedia founder) has a book coming out in late October that is certain to make it into many Christmas stockings. I’m happy to give this one an upgrade as time has passed since estimates were downgraded, and performance now appears to have stabilised. Indeed, this looks like a potentially interesting entry point at a PER of 12x and with the shares still significantly lower than the highs they reached in 2024. | |

Pensionbee (LON:PBEE) (£378m | SR22) | AUA +27%, revenue +32% (£11m), adj. EBITDA £1.3m. Cash £33m. | ||

Henry Boot (LON:BOOT) (£307m | SR93) | Completed the sale of a site with planning for 160 residential units in Queniborough, Leicestershire, to house builder HarperCrewe. Ungeared internal rate of return of 33% p.a. | ||

Redcentric (LON:RCN) (£217m | SR72) | Maximum payable is an enterprise value of £127 million. Expected to complete May 2026. Proceeds to be used to reduce debt (£41m currently drawn on RCF), return capital (most likely with a tender offer), and evaluate growth opportunities. | ||

Foxtons (LON:FOXT) (£167m | SR60) | Q3 revenue +3% to £49.0m, lettings +5% to £33.4m, Sales -7% to £12.5m, Financial Services +37% to £3.1m. Risk that Q4 Sales revenue falls below management's expectations. Full year adjusted operating profit is expected to be in the range of £21.5m to £23.2m (2024: £21.6m). | BLACK? | |

Guardian Metal Resources (LON:GMET) (£164m | SR23) | Fifteen diamond drillholes completed since early September | ||

Arbuthnot Banking (LON:ARBB) (£147m | SR65) | Funds under Management or Administration +24% to £2.5bn, customer deposits +17% to £4.4bn, customer loans -9% to £2.3bn. | ||

Savannah Resources (LON:SAV) (£98.1m | SR21) | Q3 2025 saw a continuation of soft demand across a number of end markets, mitigated through cost savings of £20-25m on an annual run-rate basis. Expect Continuing EBITDA for 2025 to be similar to 2024 figure of £143m. Broadly neutral FCF for the FY. | ||

Synthomer (LON:SYNT) (£93.1m | SR45) | Q3 2025 saw a continuation of soft demand across a number of end markets, mitigated through cost savings of £20-25m on an annula run-rate basis. Expect Continuing EBITDA for 2025 to be similar to 2024 figure of £143m. Broadly neutral FCF for the FY. | ||

Shield Therapeutics (LON:STX) (£78.6m | SR42) | Net revenue $13.1m $13.1m (25Q2: $12.8m ; 24Q3: $7.2m). Cash $8.6m after £1.5m placing. (25Q2: $10.8m). | ||

Mincon (LON:MCON) (£68.3m | SR91) | SP +8% Traded as expected in the third quarter of the year with year-to-date revenue ahead of last year across all regions. Expects further growth in construction revenue in Q4 2025. Interim dividend unchanged. | AMBER/GREEN (Graham) [no section below] I gave this Irish company (that makes rock drilling equipment) a small upgrade in August as there were signs of life and the list of positives seemed to outweigh the negatives. I’m pleased to see that my faith has been met with an “as expected” trading update today, to which the market has reacted positively. Numbers are few in this update but all commentary is reassuring: a “root and branch” review has continued to improve gross margins: the half-year report had a similar theme, with the company finding “operational and sourcing efficiencies" to squeeze more profits out of their operations. I also note their continued progress in the construction sector, which means less reliance on mining. However, there is no mention of the elusive Greenhammer project in this update. With few numbers to analyse today but the commentary remaining very encouraging, I’m content leaving my stance unchanged. If progress remains consistent and the valuation doesn’t improve, this might even be worth a GREEN before too long. Let’s hope for a good cash flow result for the year, given net debt of around €23m at the interim results. | |

Chapel Down (LON:CDGP) (£60.1m | SR7) | Yield +56% to 2,882 tonnes (3.7 tonnes per acre). “The Board remains confident in underlying trading conditions and therefore achieving market expectations for 2025 FY.” | ||

Ariana Resources (LON:AAU) (£36.9m | SR30) | Exploration drilling commencing imminently. | ||

Metals One (LON:MET1) (£33.6m | SR4) | Agreement to evaluate and, if successful, treat historically abandoned uranium mine waste dumps to recover saleable uranium and other critical minerals concentrates at Thor (25%)/Metals One (75%)’s Colorado uranium claims. 2.5-4% royalty to Thor/Metals One. | ||

Shoe Zone (LON:SHOE) (£33.1m | SR56) | Revenue -7.6% to £149.1m, Adj. PBT -76% to £2.4m , Net cash £6.0m (FY24: £3.6m). No dividend. Cautious about the near-term outlook, with trading conditions expected to remain subdued. | AMBER/RED (Graham) There are some positives for shareholders to hold onto: net cash, no further EPS downgrade, and modest profitability. I'd like to send this back to AMBER but it's still a little soon for that, after three profit warnings and given how negative management are when it comes to the consumer sentiment they're facing. | |

Haydale Graphene Industries (LON:HAYD) (£28.1m | SR29) | £450k contract to fund a JustHeat winter deployment, and a grid stability trial. Free to consumer installation of JustHeat systems in fuel-poor households by March 2026. Brings cumulative contracted revenues over £1m. | ||

Gattaca (LON:GATC) (£26.6m | SR96) | FY25: NFI -3% to £38.8m, EBITDA +38% to £3.6m, u/l PBT +14% to £3.3m (upper end of guidance), u/l EPS +30% to 7.8p. Net cash £15.7m (FY24: £20.7m) FY dividend +20% to 3.0p. FY26 to achieve further growth in continuing underlying PBT, in line with the current market consensus of £4m. | GREEN (Mark - Hold) | |

Rentguarantor Holdings (LON:RGG) (£25m | SR11) | Q3 Revenue +92% to £752k, revenue per tenant +5.2% to £766. | ||

Sareum Holdings (LON:SAR) (£19.3m | SR11) | LBT £3.06m, Cash £3.5m (FY24: £1.5m) after £4.5m equity raise. | ||

Empresaria (LON:EMR) (£16.6m | SR87) | Statement of no intention to make an offer & Update following GM and end of offer period | Insufficient support for offer from shareholders. Joost Kreulen appointed Chair will support the company with extra work for six months. | AMBER/RED (Mark) [no section below] |

Power Metal Resources (LON:POW) (£15.6m | SR66) | Investment of £4m in Apex Royalties, a private, high growth, diversified, mining royalty company. | ||

GEO Exploration (LON:GEO) (£14.5m | SR22) | First two drill cores at lab for assay. | ||

Thor Energy (LON:THR) (£13.7m | SR42) | Agreement to evaluate and, if successful, treat historically abandoned uranium mine waste dumps to recover saleable uranium and other critical minerals concentrates at Thor (25%)/Metals One (75%)’s Colorado uranium claims. 2.5-4% royalty to Thor/Metals One. | ||

Nexus Infrastructure (LON:NEXS) (£11.1m | SR50) | Revenue +16% to £65.9m, Tamdown order book up 62%, Cash £10.9m (FY24: £12.8m). | ||

Newmark Security (LON:NWT) (£10.8m | SR89) | On track for strong H1 results with improved profitability. H2-weighted as before. | ||

Vast Resources (LON:VAST) (£10.1m | SR6) | £2m raised at 0.18p, 30% discount to last night’s close. |

Graham's Section

Shoe Zone (LON:SHOE)

Down 2% to 70p (£32m) - Full Year Trading Update - Graham - AMBER/RED

Shoezone is pleased to announce its unaudited full year trading update for the 52 weeks to 27 September 2025 ("FY 2025").

This one has been in the wars, with multiple profit warnings, leading to today’s full-year trading update that shows a marked deterioration in performance.

Key points:

Revenue -7.6% (£149.1m), “due to a decline in consumer confidence and the general negativity in the UK” (!)

Store numbers 269 (down from 297)

Adj. PBT £2.4m, in line with expectations (last year: £10m). Lower sales, lower margins, higher NICs, higher living wage.

Product margin is down by nearly 200 basis points, “primarily due to higher container prices for the first half of the year”, and their BOGOF promotion in February.

That’s pretty much all of the bad news - and it was already baked in by the previous profit warnings.

More positively, net cash has improved to £6m from £3.6m.

Dividends: this used to yield at a high level, if I recall correctly, but I think management must be doing the right thing by not declaring any dividends for now.

Outlook:

Management continue to be cautious about the near-term outlook, with trading conditions expected to remain subdued. We continue to monitor the macro-economic environment closely and await the outcome of the November UK Budget in the coming weeks. The Board is actively managing cash, which continues to remain healthy, providing resilience and flexibility in the coming months.

The Chairman makes a depressing comment about the “general negative economic and consumer sentiment in the UK”. It’s clear that Shoe Zone has a very negative impression of consumer sentiment right now.

Graham’s view

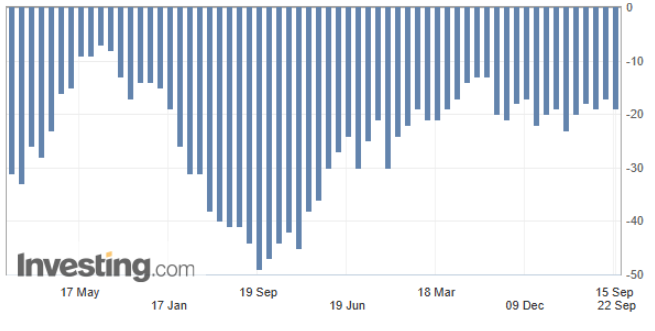

Here’s a 5-year chart of consumer sentiment in the UK (the GFK Consumer Confidence Index, published by investing.com).

Anything below zero indicates pessimism - it has been negative since 2016!

At a current level of -19, it does indicate pessimism. But it was around -50 three years ago! So I’m not sure if UK consumers are objectively any more depressed now than they usually are these days. Although I acknowledge that many companies do seem to have a more negative view than usual.

When it comes to Shoe Zone, I must admit that the contrarian in me does find it a little interesting at current levels. In the good old days of 2022-2023, it was earning annual net income of £10m+.

I’m also pleased to see the net cash balance. That alone means that I’m inclined not to be RED on it.

But what it sells is totally commoditised. Anyone and everyone can compete with it, from Primark to Lidl.

The absence of any moat puts a limit on my potential valuation, even if it was highly profitable.

The last profit warning was in August:

It probably is due an upgrade to AMBER soon, but for now I’d rather stay AMBER/RED. Management are doing their job and warning us that things are bad: if they start to sound a little more optimistic, and if the EPS forecast remains stable for a little longer, I might be able to send this back to a neutral stance. The turnaround potential is huge from the current market cap, but it’s far from guaranteed and still a little soon for me to get excited about that prospect!

Mark's Section

Gattaca (LON:GATC)

Up 10% at 93p - Final results - Mark (I hold) - GREEN

I previewed these results on The Week Ahead where I noted that after an initially positive response to an ahead trading statement in August, the shares slid down a wall of worry, caused by sector weakness elsewhere:

However, it seems that the smaller and nimbler recruiters are outperforming larger peers at the moment. Their trading statement said:

Improved margin conversion, due to a focus on costs and improved productivity, will result in FY25 Group underlying Profit before Tax in the range of £3.1m to £3.3m (FY24: £2.9m), marginally above current guidance of £3m.

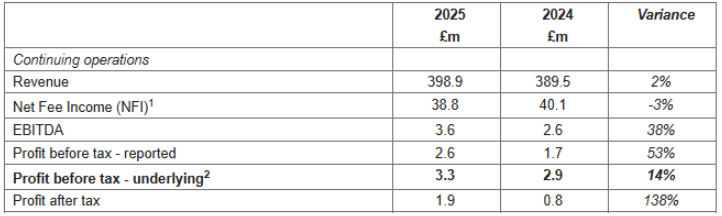

Today’s results, show underlying PBT coming in at the top end of that range:

This makes a roughly 10% upgrade to PBT since the start of August.

The Stockopedia consensus is for 6.6p EPS, so with fully diluted EPS coming in at 7.6p this looks like a more sizeable beat of around 15%.

Adjustments:

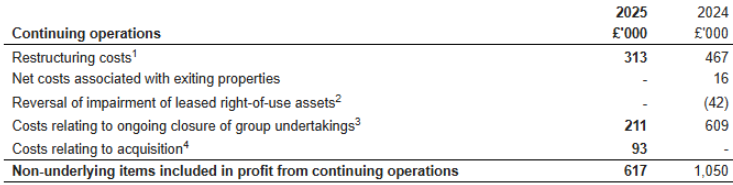

The EPS beat is on an underlying basis and while the scale of the adjustments may have decreased versus last year, we need to check these for validity. Here’s the details:

These look fairly normal. However, we need to be careful as restructuring costs are ongoing. They guide restructuring now as largely complete. It is also a bit disappointing that entities closed over two years ago are still generating ongoing costs:

Ongoing costs relating to closure of entities and operations closed more than two years ago. This includes those operations affected by the cessation of the contract with Telecoms Infrastructure business in 2018 as well as the ongoing closure costs of the Group's operations in Russia, South Africa, including late filing penalties in Qatar and impairment of certain capital working balances.

For the moment, we should probably give them the benefit of the doubt. However, I will be less forgiving if these costs continue to be incurred in FY26 at anything like the current scale.

Acquisitions:

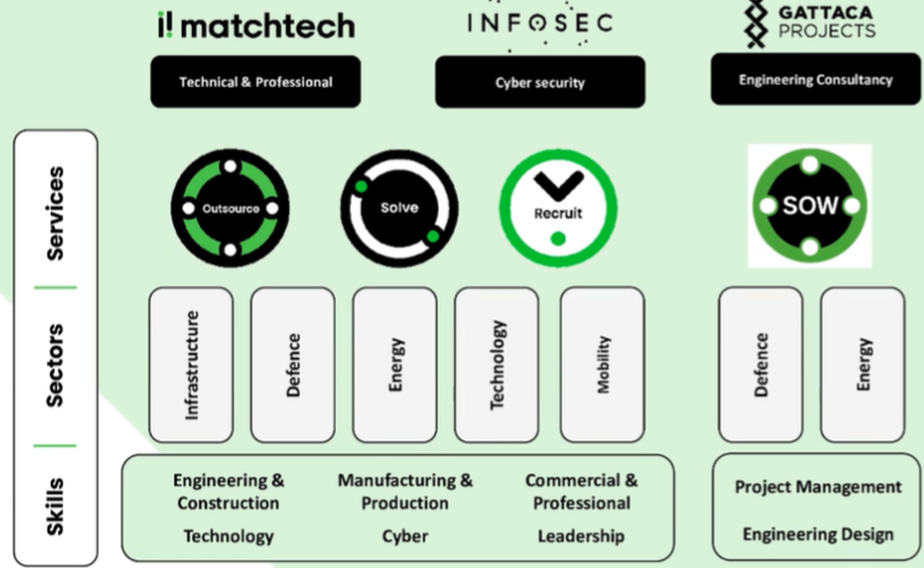

Shortly after year-end, the company bought cybersecurity specialist Infosec for an initial payment of £1.5m with deferred consideration of up to £0.6m. The group structure now looks like this:

While the acquisition is not of huge scale in itself:

In the year to 31 March 2025, Infosec had net fee income of £1.5m, generating an adjusted operating profit of £0.4m and had net assets of £1.0m as at 31 March 2025.

It opens up a new market for them, and represents cross-selling opportunities. It also has a strong brand name, which will be retained within the group. They make a number of key points around this both in these results and this morning’s IMC presentation:

They did a large amount of due diligence prior to making the acquisition, with a particular focus on cultural alignment.

Integration is going well and infosec should be operating on their central sales systems by January.

The infosec acquisition is not a founder looking for retirement but a team looking to accelerate the growth of the business.

The point around culture seems to be a key one as management emphasised this multiple times during the results presentation. Much of the work that CEO Matt Wragg has done since his appointment in 2022 has been making sure the culture of the business is one where employees want to work over the long term, and is consistent throughout the organisation

I think we can expect further bolt-on acquisitions to come, although they remain agnostic as to whether this comes in the form of individuals, teams or businesses. Again the key consideration appears to be cultural fit as they want to retain employees who can deliver long-term growth for the business rather than those looking for a short-term payday.

Segmental reporting:

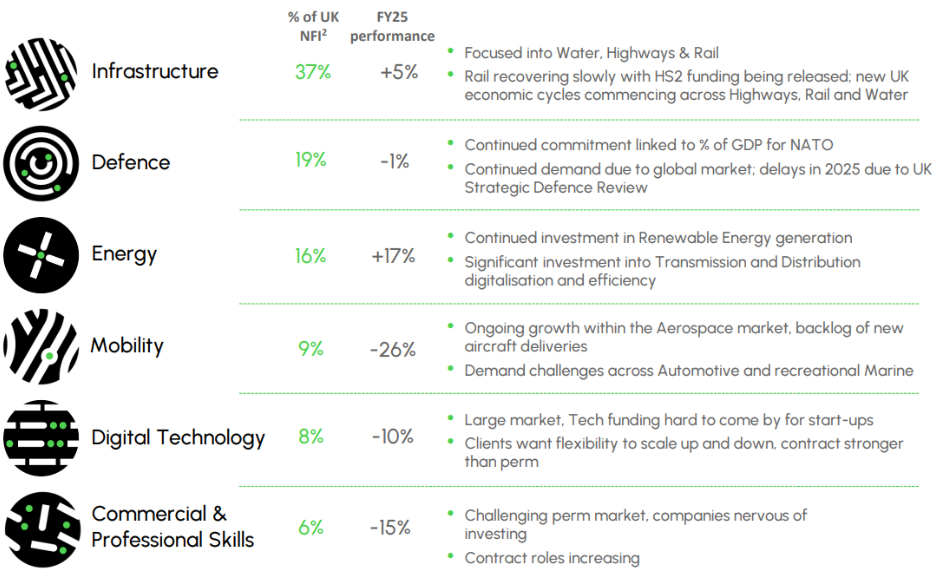

Gatacca have quite detailed segmental reporting. Infrastructure and Energy are the bright spots:

Automotive and Marine have been particularly challenging for their Mobility sector. Digital Technology and Commercial & Professional skills tend to be dominated by permanent recruitment and this has been a particular weakness throughout the recruitment sector.

Outlook:

Although labour markets remain very weak in the UK, they are forecasting further growth in earnings this year, saying:

Market conditions remain challenging, with permanent hiring remaining subdued, Gattaca sees growth potential in its chosen sectors having spent time rationalising and strengthening the Group.

The Group strategy remains consistent, with emphasis on having the right people and culture, complemented by bolt on acquisitions. Ongoing productivity improvements and robust cost control will support growth, whilst providing us the headroom to add further experienced people to the Group's sales teams.

They expect sales headcount to grow by 20-25 heads net of attrition in FY26. They are forecasting further growth in earnings this year with continuing underlying profit before tax, in line with the current market consensus of £4m. This is supported by the acquisition of Infosec, growth in sales headcount, further efficiencies in support functions, offset by usual inflationary pressures. This may see a challenge in difficult market conditions. However, the strong FY25 results today give confidence that they are looking to underpromise and overdeliver.

Balance sheet:

Net cash remains a significant part of the balance sheet. Although this has declined this year form £20.7m to £15.7m it is entirely due to an increase in trade and other receivables of £6.8m. Part of this is explained as:

In February 2025, the Group terminated the non-recourse element of its invoice financing facility, moving to a full recourse facility. Under the terms of the non-recourse facility, the trade receivables were assigned to and owned by HSBC and so were derecognised from the Group's Statement of Financial Position. In addition, the non-recourse working capital facility did not meet the definition of loans and borrowings under IFRS. Once that facility was terminated, any unpaid trade receivables held by HSBC were returned to Gattaca and re-recognised in the Statement of Financial Position, and Gattaca returned the cash loaned by HSBC in respect of those receivables, thus reducing the Group net cash position and increasing the trade receivables balance.

This structure is common amongst recruiters who have large receivables balances and investors always need to interrogate these off-balance sheet arrangements. In this case, closing the facility makes sense. Why pay extra financing charges when for most of their trading period they have net cash. They have an invoice financing working capital facility of £50m, which covers normal working capital swings.

Overall, the balance sheet looks very strong and the shares trade barely at a premium to tangible book value. However, it is worth noting that if they intend to grow the business then this will likely require extra working capital. Combined with payments for any bolt-on acquisitions this means that we can’t consider all of this cash balance as distributable.

Valuation:

With an inline statement for FY26, their broker Liberum keep their 8.3p EPS forecast for this year the same. This is a forward P/E of around 11. This looks reasonable value but doesn’t stand out for a people business. Investors are expected to receive about 5% in dividends next year at the current share price. This looks a lot better if one assumes that some of the net cash is distributable, and can be used for acquisitions, or failing that, buybacks. However, as I mention above, I think we can’t assume all of this figure is distributable in any valuation.

However, things start to get interesting further out. Liberum have 12.4p EPS forecast FY27 with a 6p EPS. This is on relatively modest increases in NFI, and shows that impact the scale will have if they can grow the business, and a relatively flat administration cost-base. This is a P/E of 7 and with a 6p dividend forecast the yield will be approaching 7% as well, making this the classic “square share” value play. I think this will require an assumption of a modest improvement in the UK job market to be achievable. However, it doesn’t assume any benefit should they find suitable bolt-on acquisitions. FY28 estimates are even better, but these have to be taken with a big pinch of salt at this stage.

Liberum say:

Management is looking to build a best-in-class proposition that will be highly geared into a market recovery when it comes. A CY26E EV/EBIT (ex leases) of just 2.8x is too cheap. Maintain 115p TP and Buy.

They use an EV measure, but I am a little disappointed with a 115p target price on this basis. Either they don’t really believe their own forecasts, or there are other (unmentioned) factors where they feel low valuation metrics make sense. Of course, it may just be the usual broker behaviour where they only increase target prices when the share price approaches it!

Risks:

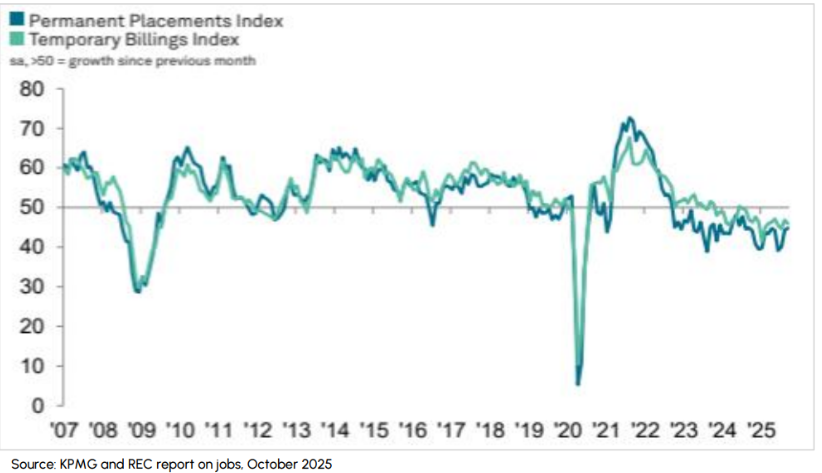

There is a big debate over whether recruiters are suffering from market wekness or increased competition from more direct routes such as the likes of LinkedIn or AI. The graphs that Gatacca show in their presentation certainly suggest that weak market conditions are the primary cause:

Gatacca certainly feel that candidates and employers need the confidence of an ongoing human relationship to make job/hiring decisions. However, this may change over time as technology adoption becomes more normal.

Acquisitions are also a risk in this sector, and Gatacca feel the strength of their culture and the high level of work they do prior to agreeing any deal mitigates these, but at the end of the day, key-person risk remains as it does with any people business.

Mark’s view

I am pleasantly surprised by these results. Being at the top end of previous guidance suggests that momentum is with them, and I see their guidance for further growth in earnings in FY26 as achievable even in weak end markets. As such, they continue to outperform larger peers, while trading on a very modest rating. I think we have to be careful using pure EV measures given the working capital nature of the business, but even excluding net cash they look cheap on forward measures. There is always that chance that they perform much better if/when better market conditions return. I am happy to keep our GREEN view (and keep holding).

Hunting (LON:HTG)

Up 4% at 340p - Q3 2025 Trading Update - Mark - BLACK (AMBER)

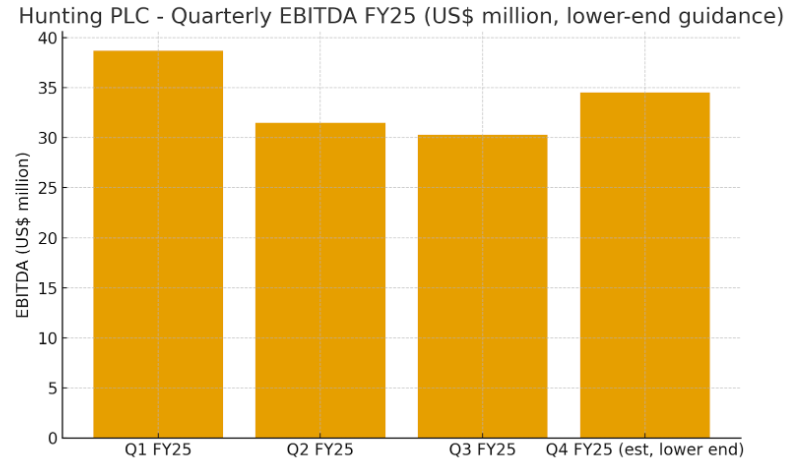

We marked this as BLACK this morning as the key metric for the year is reduced:

2025 EBITDA outturn is expected to be at the lower end of the Company's published guidance range of $135-$145 million, representing strong year-on-year growth compared to 2024.

We don’t get revenue figures in the quarterly result, but doing the maths you can see this is a weaker quarter. Q3 EBITDA works out to be $30.1m meaning a slightly worrying trend:

It seems that there are a number of positives:

The Hunting Titan operating segment reports stronger profitability compared to the prior year…

Trading within the North America operating segment has been marginally ahead of expectations, due to strong OCTG sales in the period

Subsea Technologies operating segment delivered better results throughout the quarter as orders for ExxonMobil Guyana and TPAO in the Black Sea were progressed.

FES to contribute c.$3 million to the Group's EBITDA result for 2025.

The Group's Asia Pacific operating segment has continued to trade in line with expectations.

However, the issues in EMEA have dominated results:

The restructuring within the EMEA operating segment continues, with the facilities being closed in the Netherlands and Norway in the period, coupled with the opening of the Group's larger facility in Dubai, UAE. This led to some disruption to trading during the quarter.

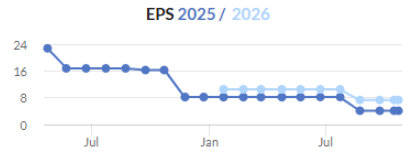

The impact of this is relatively minor, with Zeus taking 4% out of their FY25 EPS estimates and 1% out of FY26, to give 35.4c and 40.2c respectively. Indeed, the trend here has been continuously downwards for the last 18 months or so:

While the impact at least seems partially a temporary one, I can’t help feeling going from $30m EBITDA in Q3 to almost $35m in Q4 looks a stretch. It looks to me like a further small miss is on the cards. The order book is also down at the end of Q3. Although Zeus suggest that this is partially contract timing, saying:

Order book reduced, new contract bids upcoming. Hunting’s order book has now moved to c.US$416.4m as of the end of September 2025, from US$473m as of the end of July. This reflects a lack of significant new contract wins in recent months. Nevertheless, we understand there are new OCTG tenders coming through in the Middle East (including from KOC and Bahrain) expected to be awarded in the coming months, and new Subsea opportunities in 2026 as deepwater offshore projects continue to be brought forward globally. As such, we could see a return to order book progress, and the revenue visibility this underpins, going forward.

The market seems relatively sanguine about this with the shares up around 4%. However, I suspect that this is largely about the price of oil being up 5% today on news of stronger US sanctions on Russian oil. While the outlook for the company is definitely linked to the oil price, i’m not sure the relationship is as direct as today’s traders seem to think.

Valuation:

35.4c FY25E EPS is 26.6p. So at 340p this is a 12.8x P/E, with FY26E EPS rising to 30.2p giving an 11.3x earnings multiple. On top of this there is net cash anticipated to be c.$40-$45 million. However, for a $700m market cap this doesn’t really move the valuation needle much. These sort of multiples aren’t particularly cheap in the sector, and Zeus has to argue that Hunting deserves a premium to the sector to get to their price target, saying:

On valuation, Hunting is currently trading on a 2026 EV/EBITDA of 4.4x. This compares with other UK-listed oil services companies which are on an EV/EBITDA of around 4.0x. In our view, Hunting’s level of intellectual property, business position and positive momentum should justify a further premium to this level. Using around 6.0x 2026 would imply a valuation of around 450p for Hunting, which we believe is fully achievable given further positive momentum for the business.

The real question is where we are in the cycle. If one takes the view that we are early in the recovery, and that the discount to TBV suggests that there is further to come as these assets are made productive again, then this is probably still good value:

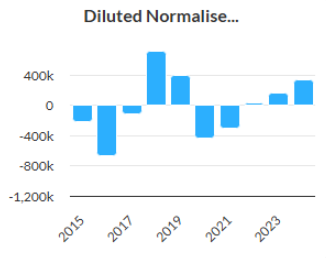

However, the long term history suggest that even if there is some strong years to come, they will be followed by some weak ones:

We are already several years into the recovery here and the declining brokers trend doesn’t give much confidence that we are suddenly going to see much better financial results. My past optimism seems to have been repeatedly dashed on the rocks of reduced forecasts.

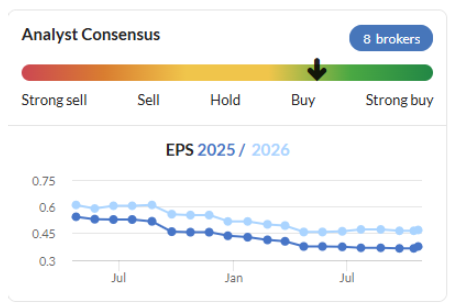

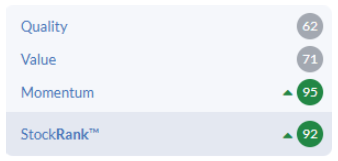

The momentum Rank does the heavy lifting on the StockRank, and Momentum traders may well want to hang on, but I wonder for how long it will remain top decile once the the share buyback is exhausted early next year:

Mark’s view

We had this as GREEN recently, but I moderated our view slightly to AMBER/GREEN after the H1 results due to a very cautious H2 outlook statement. I said the risk of a short-term warning looks to have increased, which has proven prescient. The share price has risen slightly since then but the EPS continues its downward trend. As such, my confidence that we are at the start of a strong recovery has started to wane. On balance, I think we have to take a more neutral view until its clear that the current issues have worked their way through the results and the company starts to upgrade its guidance again rather than downgrade it. AMBER.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.