Good morning! Let's see which spooky companies wish to make announcements on All Hallows' Eve.

Nothing else of interest today, so have a brilliant weekend! Cheers.

Spreadsheet accompanying this report: link (last updated to: 21st October).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

Fresnillo (LON:FRES) (£16.6bn | SR86) | Entered an agreement to buy Probe Gold for CAD$780 million, (approx. US$560 million). Probe owns the multimillion-ounce Novador Gold Project, as well as an early-stage Detour Gold project, both located in Quebec. | ||

Raspberry PI Holdings (LON:RPI) (£698m | SR29) | CFO has informed the board that in the second half of 2026, after seven years including two years post-IPO, he intends to step down. | ||

| Anglo-Eastern Plantations (LON:AEP) (£512m | SR95) | Trading Statement | SP +7% Own fresh fruit bunches ("FFB") production increased by 7%. Improved output from young and matured palms. Bought-in production up 21% driven by new intake at recently commissioned HPP Mill. For the nine month period, CPO price rose 17% year-on-year. Cash and short-term investments of $240m. Outlook: biodiesel mandate in Indonesia likely to tighten supply and support CPO prices. | GREEN (Graham) Upgrading this to fully GREEN as I don't see any compelling reason not to at this point. As noted by Roland in August, this is an agricultural producer where there are no estimates in the market. However, we have learned through Goodwin and other examples that this is not really a good reason to be cautious on a share. With 30 years on the London stock market and dozens of dividends paid to shareholders, I trust this company enough to take a fully positive stance, as the numbers it posts are terrific. |

MHA (LON:MHA) (£439m | SR94) | On track to deliver full-year performance in line with market expectations (revenue £249.5m, underlying adj. EBITDA £44m). H1 revenue up 13%. | AMBER (Graham) H1 revenue is up 13%, including organic growth of 8.5%. I have zero criticisms of the company's performance since IPO and I note that this is a Super Stock according to the StockReport. However, I'm always a little careful with newly-listed stocks and I think there are some good reasons to maintain that caution for now. | |

TT electronics (LON:TTG) (£270m | SR70) | Largest shareholder DBAY opposes 155p takeover offer (cash & shares). TT notes that DBAY conditionally offered to acquire TTG for 122p, 127p and 130p. “...DBAY may in some respects have a different agenda to other TT shareholders.” | PINK (Graham) | |

Berkeley Energia (LON:BKY) (£130m | SR29) | Conchas project: positive results of a preliminary metallurgical test work program. Arbitration against Spain: timetable established by the Tribunal, with BKY’s Statement of Claim due early 2026. A$71 million in cash reserves and no debt. | ||

Defence Holdings (LON:ALRT) (£55m | SR19) | At-The-Market (“ATM”) equity issuance facility announced on 10th October. Raised £208k for additional working capital. | ||

Ariana Resources (LON:AAU) (£37m | SR31) | Major new soil geochemical programme undertaken at the >1Moz Dokwe Gold Project in Zimbabwe identified several areas for imminent drill-testing. Tavsan Gold Mine in Türkiye was commissioned during the quarter Raised A$11m through IPO. | ||

Prospex Energy (LON:PXEN) (£18m | SR13) | Prospex has 37% interest in this project. Consistent well performance PM-1 for the quarter meeting production expectations and driving continued strong operating cashflows. Gas production averaging ~80,000 scm per day. |

Graham's Section

TT electronics (LON:TTG)

Down 1% to 150p (£268m) - Response to announcement by DBAY - Graham - PINK

We have a little bit of boardroom drama to spice up proceedings this morning.

Yesterday at 11.48am, TTG’s largest shareholder made an announcement:

DBAY is happy with the progress the business is currently making, and is therefore not supportive of the Acquisition. Accordingly, DBAY does not intend to vote in favour of the scheme of arrangement at the court meeting…

With DBAY holding 16% of the company, this could pose a problem for the takeover, as I understand that a 75% majority will be required to get it over the line in its current form.

However, TTG has hit back this morning.

I appreciate their diplomatic opener:

The Board of TT has had dialogue with several shareholders and welcomes the views of all of its shareholders, including DBAY.

But then the reveal:

The Board of TT notes that, in the last three months, it has received three highly conditional unsolicited all-cash proposals from DBAY to acquire TT. The first was at a price of 122 pence per TT share, the second at 127 pence per TT share and the third, received on 7 October 2025, at 130 pence per TT share.

And the conclusion:

Against this background, the Board of TT believes that DBAY may in some respects have a different agenda to other TT shareholders.

Graham’s view: I can’t fault the TTG board, as they have recommended the highest-value bid (155p made up of 100p cash plus shares in the Swiss buyer). That is their job - to maximise value for shareholders and seek out the highest bid.

However, it’s also true that DBAY have every right to vote against the takeover and to ask that the company continue as an independent business instead.

DBAY are a sophisticated bunch and they clearly believe that the stock is worth much more than the 130p they were willing to pay for it. They might think that it is worth 180p or more today, in which case it makes sense that they would not be interested in a 155p cash-and-shares offer.

I haven’t got any strong view on Cicor Technologies (CICN), the prospective buyer, but I do agree with Mark’s instinct to bank gains around the current level rather than holding on to receive cash plus CICN shares.

Bravery could be rewarded with a competing bid from DBAY (although that seems unlikely after their three prior bids were rejected at lower levels), or a higher bid from Cicor to get it over the line.

Some will argue that investors should have been informed about the DBAY bids. While I don’t think that every speculative takeover bid should be reported to the market, I think that an offer from the company’s largest shareholder could have been revealed. If I was a former TTG shareholder who had sold out in the market at 95p last week, I’d now feel very annoyed that I didn’t know about all these takeover offers in the background!

MHA (LON:MHA)

Up 0.5% to 154.75p (£441m) - Trading Statement Graham - AMBER

MHA (AIM: MHA), a leading professional services provider of audit and assurance, tax, accountancy and advisory services, is pleased to announce an update on trading for the six months ended 30 September 2025 ("H1 26")

It’s a fairly straightforward “in line” update from MHA, an accountancy firm that’s part of Baker Tilly International.

Expectations for FY26: revenue of £249.5m, underlying adjusted EBITDA of £44m.

For context, here are the results for FY March 2025: revenue of £224m, adjusted EBITDA £41.1m.

The company IPO’d in April 2025: we took an initial look at it here and then its June trading update here.

H1 result: revenue up 13%, with 3% from one acquisition and 1.5% from another. I make that organic growth of 8.5%.

Company commentary:

Despite market uncertainty in FY26 to date, the Group has continued to see rising demand for high-quality advisory services. Increasing regulatory complexity continues to be a key driver, supported by a well-established focus on growing market sectors.

Graham’s view

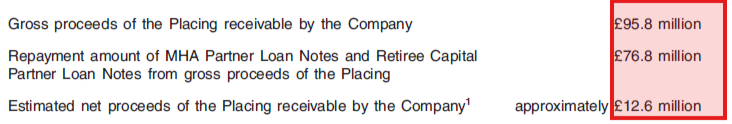

I was just reviewing the admission document this morning, to recall how much of MHA’s IPO fundraising went to the company rather than to selling shareholders.

I’ve found the answer, and the structure is a little more complicated than usual:

In plain English, £76.8m went to former and existing partners of the company, while the company itself was left with £12.6m, plus the £2m proceeds of a small retail offer. So about £15m went to the company.

Therefore, when they say:

The Group completed a successful AIM IPO shortly after the period began in April 2025, raising gross proceeds of £97.8m to be used, amongst other things, to invest in technology, including AI, and support further bolt-on acquisitions to accelerate growth.

…it does not mean that £97.8m is being invested into technology, AI and acquisitions. I think that actually about £15m of additional funds were made available for those purposes.

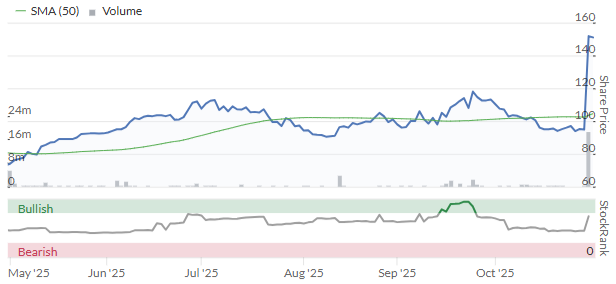

But MHA shares have performed very well so far:

While I’m delighted to see IPOs back again, I think it is right to remain cautious, in general, with newly-listed shares.

I would have particular caution in this case because a) professional services can be a minefield for investors, and b) this IPO was mostly used to enable insiders to exit their positions.

I’m keeping an open mind and will happily upgrade our stance if the company continues to perform well, and I note that this does quality as a Super Stock. But personally my stance on this one is neutral.

Anglo-Eastern Plantations (LON:AEP)

Up 7% to £14.05 (£547m) - Trading Statement - Graham - GREEN

Thanks to a reader for pointing out that I omitted this one from the table this morning.

It’s a fine update from the palm-oil producer AEP, with everything moving in the right direction:

Own production of fresh fruit +7% (improved output from young and matured palms).

Bought-in production +21% (new crop intake at a recently commissioned mill in Indonesia).

Therefore total production - their own, plus that which they bought in from 3rd parties - rose 8%.

Palm kernel production rose 14%.

And even better than this, average crude palm oil price is up 17% this year compared to last year.

Here’s a long-term palm oil chart from tradingeconomics.com:

This is public information, of course, but when it’s combined with nice news re: production, I can understand why the AEP price might be on the rise today.

Balance sheet: rock solid with $240m (£183m) of cash and short-term investments.

Remarkably this has risen from $183m (Dec 2024), despite paying over $25m into dividends and buybacks. Note to self: the cash flow statement will be worth a second glance at the full-year results.

The company’s explanation is very simple:

The increase reflects resilient cash generation and strategic capital management, reinforcing the Group's capacity to fund future growth and deliver long-term value to shareholders.

Development: planting and replanting continues in line with a 5-year plan, and an eighth processing mill is expected to finish construction in December.

Acquisition: there is a $9m acquisition to expand the landback and increase available supply for the new mill.

Outlook: everything is positive here, too.

CPO prices are likely to trade within a steady range through the remainder of the year. The planned implementation of Indonesia's Biodiesel B50 mandate, targeted for mid-2026 to replace the current B40 program, is expected to raise domestic consumption. This development is likely to tighten supply and provide support to CPO prices going forward.

Graham’s view

I’ll happily upgrade this to GREEN.

It has an extraordinarily long track record as a listed company that includes a few decades’ worth of dividend payments. So I don’t need to treat this as a typical “foreign” stock.

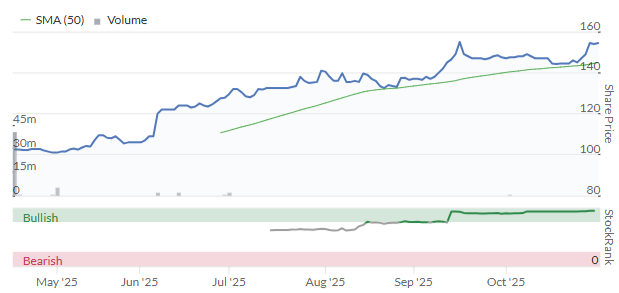

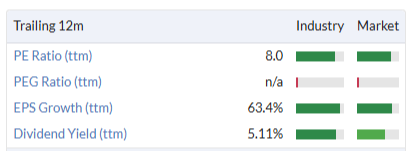

And even though agriculture is not a sector where I feel particularly at home, the numbers here are tantalising, despite the share price having already doubled this year:

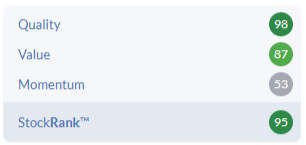

Stockopedia’s calculations agree that the numbers are attractive, calling it a Super Stock:

Note the key difference between this and MHA: they are both Super Stocks, but one has a long and proud track record as a listed company, while the other is a newcomer to public markets. I will always feel more comfortable investing in a business that has been listed for at least a few years. AEP has been listed for 30 years now.

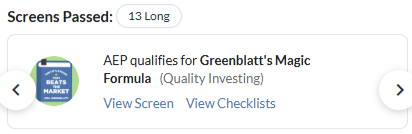

I also note that AEP passes 13 bullish stock screens - is this some kind of record?

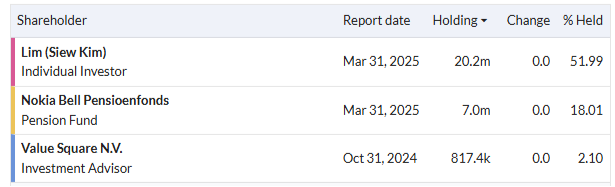

More detailed research could look into AEP’s major shareholders:

The late Lim Siew Kim was a board member for 29 years, including pre-IPO. She passed away in 2022. She was the daughter of Tan Sri Lim Goh Tong, who founded Genting Group.

Apparently she had six children - so her shareholding is probably in their hands now, in some form or another. There is no sign of any selling from them yet. Indeed, their percentage ownership has increased slightly, thanks to the buyback programme.

An intriguing share where I don’t see any reason to hold back from a fully positive stance.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.