Good morning!

Palantir Technologies (NSQ:PLTR) triumphantly announced results last night, beating estimates and talking about "the transformational impact of using AIP (their AI platform) to compound AI leverage".

Their Q3 revenue was up 63% year-on-year. The value of contracts signed was up 151% year-on-year.

And the company was profitable in the quarter, earning a GAAP net income of $476m.

They also raised their 2025 guidance: full-year revenue is now expected to be $4.396 - $4.4 billion, vs. the StockReport forecast of $4.17 billion. Adjusted income from operations is now expected to be $2.151 - $2.155 billion.

The software company earns nearly half of its revenue from US government contracts, but it also operates internationally - its UK website for example, notes that it has been supplying software to the NHS for several years.

A few interesting things about this.

First, the shares fell after the announcment, despite the company beating expectations and raising guidance. When after-hours trading had finished, the stock was lower than it had closed the prior day.

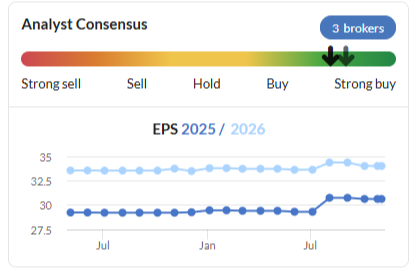

According to Bloomberg, Palantir has beaten analysts' revenue estimates for 21 consecutive quarters - so another beat was perhaps not a surprise!

Secondly, I note that Michael Burry (of "Big Short" fame) has just revealed in a regulatory filing that his hedge fund has a short position in Palantir, using puts, with a notional value of over $900 million.

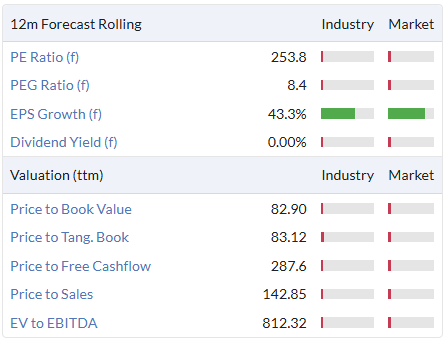

Thirdly, let's take a look at the Palantir valuation itself.

Note that it's expensive on every metric, with the only item in green being EPS growth - which is not really a valuation metric, but a feature of the company itself that is independent of the stock's valuation.

The stock's ValueRank is only 1. I don't think it's possible to score zero!

When I look at fast-growing companies, my last line of defence when it comes to justifying their valuation is to review their price to sales. Because if price to sales is somewhat sensible, then at least rising profit margins can help to make the overall valuation make sense.

Unfortunately, Palantir's price to sales multiple is over 100x.

Even if they achieved $4.5 billion of revenue next year, their forward price to sales multiple is still over 100x, given the current market cap of $491 billion.

I rarely short anything these days, a) because of the difficulty of timing a share price reversal, and b) because shorting is so expensive. Put these two facts together, and shorting usually doesn't work. The trader either faces a ruinous loss on a short sale, or the rapid time decay of options. I would certainly much rather face the time decay of options, if I had to choose, because at least the losses there are limited.

If I was tempted to short anything, I could certainly see myself shorting some AI mega-caps. Palantir would be high up on the list of candidates.

My old friend Tesla would be on the list too, although its ValueRank of 3 is much more impressive than Palantir's.

Today's report is complete. Cheers!

Spreadsheet accompanying this report: link (last updated to: 31st October).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

BP (LON:BP.). (£70.2bn | SR82) | Q3 profit $1,161m (Q2 $1,629m). Year-to-date profit $3,477 (last year: $2,340). Q3 profits ahead of expectations (Reuters). 2025 guidance: “bp now expects reported upstream production to be slightly lower and underlying upstream production to be broadly flat.” | ||

Associated British Foods (LON:ABF) (£16.3bn | SR86) | 2025 adj. operating profit down 12%. Outlook: in 2026, we expect the Group to deliver growth in adjusted operating profit and adjusted EPS. | AMBER (Roland) [no section below] After September’s profit warning, It’s a relief to see results in line today. The financial headlines look broadly as expected to me, with a stable performance from Primark offset by a weaker performance in Groceries and losses in the sugar business. While the adjusted net cash position is reduced, it remains positive. A return on capital employed of c.10% isn’t a bad result in the circumstances, in my view, but highlights the capital-intensive nature of much of this group. The big news today is probably the strategic review, with the company suggesting it may consider separating Primark from the food business. I can see some logic for this as Primark would likely enjoy a higher rating as a standalone business. Today’s FY26 outlook commentary is a little frustrating, as once again ABF makes no reference to expectations. This means that investors without access to broker notes cannot be sure if the outlook remains in line with previous forecasts. Based on the modest decline in the share price this morning, my guess is that forecasts are broadly unchanged today, but we’ll have to wait for updated numbers to filter through to Stockopedia’s consensus estimates to be sure. The earnings trend has been persistently negative over the last year, however, suggesting to me that a forward P/E of c.12 could be high enough. I’m going to leave my previous neutral view unchanged. | |

IG group (LON:IGG) (£3.8bn | SR87) | Year end moves from May to December, “aligning IG’s reporting calendar with common market practice”. | GREEN (Graham holds) [no section below] I can only take IG's word that it prefers the financial year-end to match its calendar year-end. However, I'm not sure that I 100% agree with the statement that a December year-end is "common market practice" - companies tend to match the financial year-end with whatever suits them best, and sometimes this isn't December. For example, retailers might not wish to have their financial year-end during their post-Christmas sales. So companies are free to choose whichever financial year-end they choose, and investors tend to accept this. Personally, I am not looking forward to the complicated accounts that are sure to follow this decision from IG - but I don't really have any objection to IG's decision. | |

International Workplace (LON:IWG) (£2.2bn | SR52) | “We confirm our guidance for the full 2025 financial year” - cashflow to shareholders at least $140m, EBITDA at least $1bn in the medium-term. | ||

Serica Energy (LON:SQZ) (£853m | SR90) | Agreement with Finder Energy for a 40% interest in the P2530 Licence ('P2530' or 'Licence'), for an initial consideration of c.£500,000 (c.$650,000). | ||

Dominos Pizza (LON:DOM) (£744m | SR44) | Q3 total system sales +2.1%, like-for-like +1.0%. FY25 guidance unchanged, underlying EBITDA £130-140m. | ||

| Diversified Energy (LON:DEC) (£740m | SR41) | Strong Quarterly Results and Raises 2025 Financial Guidance | Production exit rate 1,144 MMcfepd (cubic feet). Average production 1,127 MMcfepd. 2025 Guidance: Raised Adjusted EBITDA ~7% and Adjusted Free Cash Flow ~5%. | AMBER (Roland) Today’s 3rd-quarter figures are strong in themselves, thanks to a big contribution from acquisitions and solid oil and gas prices. While an upgrade to full-year guidance is welcome, high leverage, continuous depletion and low profitability mean that I remain sceptical about the ability of this business to generate long-term shareholder value beyond its generous dividends. The 9% yield and single-digit P/E are appropriate for a business of this kind, in my view, which is styled as a Value Trap by our algorithms. I’m going to remain neutral today. |

| Chrysalis Investments (LON:CHRY) (£608m | SR59) | Trading Update | NAV falls 1.1% in the quarter. Fair value decline offset by FX tailwind and share buyback. Shareholder consultation update: a proportion of shareholders are seeking an orderly exit in a shorter timeframe. | GREEN (Graham) [no section below] These shares trade at a 29% discount to the NAV announced in today's update. It's a pretty interesting portfolio they are managing at Chrysalis, with an investment in Starling Bank representing nearly half of the total value. Other major positions include Klarna (which recently IPO'd in New York), Smart Pension, and wefox. These investment vehicles often trade at large discounts for extended periods of time, but this one looks like it could have a catalyst on the horizon: a consultation with shareholders has taken place, and management are now investigating how they might accommodate the different views they've heard - including the desire of some shareholders to exit their positions. They promise to make no new investments before next year's AGM, and will continue to plough money into buybacks. This suggests to me that the catalyst for value realisation could be sooner rather than later, so I'm happy to take an outright positive stance here. Please bear in mind however that their portfolio is not well-diversified and has only pockets of liquidity. Perhaps we will get a Starling IPO before too long? |

Ocean Wilsons Holdings (LON:OCN) (£324m | SR74) | The Court has confirmed that it intends to hand down judgment as to the sanctioning of the Scheme as soon as possible. Dissenting shareholder Arnhold has presented its objection. | ||

AdvancedAdvT (LON:ADVT) (£259m | SR34) | Revenue +28% (£25.4m), +10% organically. Adj. EBITDA +76%, ahead of management exps, +45% organically. H2 trading is in line with management exps. | ||

Zotefoams (LON:ZTF) (£220m | SR82) | SP -11% Performance in line with Board’s expectations. Q3 revenue £38.2m in line with prior year on a constant currency basis. Year-to-date revenue +7% at constant currencies. Outlook in line. | AMBER/GREEN (Roland) Zotefoams’ strong H1 growth was not repeated in Q3. However, the company’s claims of expected seasonality and timing issues don’t seem unreasonable to me when reviewed against the H1 figures. What this update does highlight – once again – is Zotefoams’ dependence on Nike and perhaps one or two other key customers. This would discourage me from wanting to pay a high multiple for the shares. Forecasts appear to be unchanged today, but the valuation of the stock has risen since my review in August.,While I remain broadly positive, I think it’s prudent to moderate my view slightly today. | |

dotDigital (LON:DOTD) (£209m | SR41) | SP +4% Revenue in line, profitability slightly ahead of expectations. Adj. PBT +13% (£19m). FY26 outlook: well positioned to deliver results in line with expectations. FY27 Estimates (Canaccord Genuity): revenue £100.6m, adj. PBT £21.2m. | GREEN (Graham) [no section below] I conservatively left this on AMBER/GREEN in July when the company published its full-year trading update (share price at the time: 73p). Today's results show the company beating its adjusted PBT estimate by £700k, with the result coming in at £19m vs. the £18.3m that they had previously guided towards, and this is accompanied by an encouraging outlook statement. The company provides marketing automation software and e-commerce personalisation tools that "generate FOMO", among other objectives, and I have a generally positive impression of the business. The main factor holding me back from greater enthusiasm has been the lack of strong organic growth, which I think sould be possible in this software sector. Full-year revenue growth at constant FX for FY25 is 7% (not all organic) and similarly the growth forecast for next year is 8%, not all organic. The company is buying in growth, but I'd really like to see it do 10% organically. However, I am willing to upgrade our stance on this to fully positive today, as the valuation does seem pretty compelling to me: ARR is now £72.6m in their "core" business, which means the shares are only trading at 3x ARR, which would be considered extremely low in a US context. That's before taking into account the strong net cash position and generally sturdy balance sheet. So I think it's worth being fully GREEN on this one now. | |

Smiths News (LON:SNWS) (£157m | SR99) | Op profit ahead of expectations, driven by collectables. Rev -1.7%, adj op profit +2.43% to £39.1m. Total dividend for year of 8.55p. | GREEN (Graham) | |

Focusrite (LON:TUNE) (£140m | SR92) | Rev +6.6%, op profit £9.4m (FY24 £5.7m). These are 12-month figures due to changing year end. FY outlook (y/e 28/02/26) in line with exps. Cavendish estimates for FY Feb 2027 (12-month calculation): revenue £172.2m, adj. EBITDA £28.7m, adj. PBT £16.6m. | AMBER (Graham) [no section below] This is an example of a company that already changed its financial year-end. In this case, it was from August to February - no sign of "common market practice" here! (see our comment on IGG above). The result is that TUNE isn't publishing audited full-year results until FY February 2026, which will be an 18-month period. And so instead of getting full-year results today, we get unaudited interim results for the 12-month period to August 2025 (confused yet?!). Today's outlook is in line, and I can confirm that Cavendish have left their revenue and adjusted EBITDA forecasts unchanged. The results in general aren't bad: there's a small reduction in net debt (to £10.8m, which is modest), and revenue is up 8.8% on an organic constant-currency basis, although adjusted profits are a little lower. I am tempted to ugrade our stance, but the change in financial year-end is bothering me: I can't see why they needed to change from August to February. I can see why they would be very concerned about performance in a period when they suffered US tarriffs and had to raise their prices. Even if they have managed to skate through this period in a reasonable way, I'd like to leave our neutral stance unchanged for now. | |

Solid State (LON:SOLI) (£81m | SR39) | H1 rev >£85m, with PBT £4.75m (H1 25: £61.8m & £2.5m). Strong performance in defence and security. 31/10 order book £96.6m. Trading in line with FY exps. | ||

EnSilica (LON:ENSI) (£42m | SR28) | Rev -28% to £18.2m, with chip supply revenues “doubled” to £5.7m. Breakeven EBITDA after reclassifying R&D tax credit. Outlook: confident can return to profitability. | ||

Ariana Resources (LON:AAU) (£35m | SR31) | Drilling underway, initial 26-hole 4,000m RC drilling campaign to test four targets and identify future targets. Initial assays expected before year end. | ||

Aptamer (LON:APTA) (£22m | SR33) | Contract value “up to £617,000”; the third project with this pharma company using the Optimer platform. Total signed contract value of £1.75m YTD (+46% YoY). Confident of FY26 growth. | ||

Vianet (LON:VNET) (£19m | SR64) | H1 revenue flat at £7.7m, with 84% recurring revenue. Adj op profit +10.4% to £1.58m. “Performed well” despite November Budget uncertainty. FY outlook unchanged. | ||

Cordel (LON:CRDL) (£14m | SR20) | Rev +8% to £4.8m, gross margin 75%, with pre-tax loss reduced to £358k (FY24: £1.2m). Several new railroad contracts in FY25. Outlook: confident of “strong growth” in FY26. | ||

LMS Capital (LON:LMS) (£12m | SR41) | £1.6m capital return in July, hence 30 Sept NAV -£1.5m to £29.8m (+£0.1m adjusting for return). |

Graham's Section

Smiths News (LON:SNWS)

Up 3% to 65.05p (£161m) - Preliminary Results - Graham - GREEN

Smiths News (LSE: SNWS), the UK's largest news wholesaler and a leading provider of early morning end-to-end supply chain solutions, today announces audited results for the 52 weeks ended 30 August 2025…

This has been a controversial stock here - I’ve been optimistic that it still has a few puffs of value left in it, despite being in a declining industry, and I’ve put it on GREEN, despite this small problem!

Fortunately, it continues to make money, and has beaten expectations with these results.

Some key bullet points:

Revenues down 1.7% on a 52-week basis

Adj. operating profit £39.1m, ahead of expectations. (Canaccord Genuity were forecasting £37.4m).

On a comparable 52-week basis, adj. operating profit is £0.9m ahead of last year.

The company already said they were trading “slightly ahead” of expectations in September, but that seems to have concealed the full extent of the positive performance.

Dividend: final dividend of 3.8p results in a total dividend for the year of 5.55p (last year: 5.15p). Plus there is a special dividend of 3p, bringing total dividends for the year to 8.55p (last year: 7.15p).

Cash was boosted by £5.4m from administrators of McColl’s Retail, and the company moves into a modest net cash position both at year-end and as an average throughout the year (£3.3m).

Statutory results: it’s great to see that adjustments to the results are light. Actual operating profit is £41.2m, higher than the adjusted result, and after-tax net income is £28.3m.

Outlook: very positive, with “resilience in news and magazines market and ongoing operating efficiencies in the business model underpins confidence”

Collectables are big business and highly profitable for everyone who touches them, including Smiths News. The World Cup and Pokémon's 30th anniversary are expected to boost this segment in FY26. FY26 is expected to be in line with current market expectations.

Estimates: the company says that market expectations for the current year are for adjusted operating profit of £36.7m.

Checking Canaccord Genuity’s note, I see that they had been very optimistic, forecasting £38m of AOP for FY26. They bring that down slightly to £37.5m.

So if estimates are to be believed, AOP is headed for a c. 6% fall this year, on a c. 3% revenue decline.

That’s the risk: that temporary bonuses such as collectable football cards aren’t enough to offset declining newspaper circulation, and then operational leverage works in reverse - resulting in outsized declines in profitability.

Graham’s view

The value investor in me wants to believe - and still thinks - that the bad news is sufficiently priced in here:

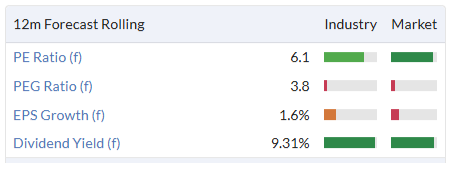

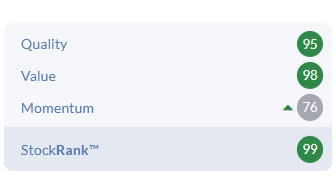

The StockRanks are convinced, too, calling this a Super Stock:

But of course the StockRanks aren’t taking into account the industry outlook. They are looking at current strong profitability, accompanied by a modest revenue decline. If the revenue decline accelerates, as many investors expect, this could be disastrous for the bottom line.

However, there’s an interesting focus in the company's report today on “new verticals” - some areas of potential growth. I wouldn’t be so bold as to think that SNWS is going to suddenly create new revenue streams that will be large enough to replace their declining businesses, but I do think it’s worth considering their potential.

Two efforts that stand out:

Recycling: volumes up 49% to 2,500 tonnes in the last 12 months, and they have a new MD of Recycling.

Additional categories to existing customers: a trial with Hallmark, resulting in cards being offered in 175 stores and 63,000 cards sold in FY25.

It’s too soon to say how successful these ventures might be, but there is at least some potential for green shoots of growth.

The company has reported free cash flow of £36.1m for the year, and while over £20m is being spent on dividends, that still leaves plenty of cash to support these new ventures.

With legacy (but still profitable) businesses such as this, I think some investors might sometimes underestimate their ability to invest for growth - I would argue that something similar happened at PayPoint (LON:PAY).

For now, I’ll admit that SNWS is probably on a slow march to extinction - but the length of this march is highly uncertain, and there could be some interesting diversions along the way.

Roland's Section

Zotefoams (LON:ZTF)

Down 11% to 400p (£197m) - Trading Update - Roland - AMBER/GREEN

In August, I commented on the “rapturous” reception to Zotefoams’ half-year results and admired the improvement in profitability and upgraded full-year profit guidance.

I maintained a positive view based on the valuation and outlook, but did reiterate concerns about the weaker H2 outlook and continued dependence on a single large customer.

Zoatefoams’ share price performance since then has justified my confidence, I think. But today’s trading update appears to have struck a bum note with the market, so it looks like this could be a good time to revisit my view.

Let’s take a look.

Q3 trading

Zotefoam’s H1 results were boosted by two factors in particular – a 19% increase in sales to Nike (to £37.0m) and a 49% rise in North American Transport & Smart Technologies revenue, to £8.8m.

After this record result, trading softened during the third quarter.

Q3 revenue fell by 3.8% to £38.2m, although the company says this was a flat result on a constant currency basis. Performance was mixed across the group’s operating regions:

EMEA: Q3 revenue was down by 1%, with “anticipated moderation and seasonality” in consumer goods offset by strong demand in Transport & Smart Technologies.

Nike’s H1 growth was driven by stock builds for new product launches, so perhaps this shouldn’t be a surprise – but it is still a reminder of Zotefoams’ dependence on its largest customer, which generated nearly half H1 revenue.

Overall EMEA revenue rose by 7% during the first nine months of 2025.

North America: Q3 revenue fell by 16%, “due largely” to the timing of issues in Transport & Smart Technologies, together with “subdued demand” in Construction & Other Industrial, where revenue fell by 12%.

As I mentioned above, Transport & Smart Technologies revenue in this region rose by 49% in H1 – so the claim of timing issues doesn’t seem unreasonable to me.

However, continued weak demand in Construction & Other Industrial seems to echo the H1 result (-17%), with Q3 sales down by 12%. In H1, Zotefoams said the decline was caused by “operational challenges at the key customer limiting their ability to meet market demand” – as with Nike, it sounds like Zotefoams sales in this segment may also depend heavily on a single customer.

Asia: revenue remains low at £1.1m, but there was continued “good growth” during the quarter from the T-FIT insulation business.

Looking ahead, the main story in Asia is the continued ramp up of the company’s new operations in Vietnam. This is a key market for the Consumer & Lifestyle vertical, due to the number of big consumer brands with manufacturing operations in the region – Zotefoams’ recently appointed Asia MD was previously Nike’s General Manager for Asia.

Outlook

Zotefoams says that revenue for the year-to-date is up by 5% to £115.7m (+7% constant currency) and gross margins are said to be “in line with the prior year”, suggesting a figure in the low 30s%.

After upgrading guidance with the H1 results, full-year expectations for revenue and adjusted pre-tax profit remain unchanged today at £154.4m and £20.5m, respectively.

Looking ahead, our order book provides good visibility for the remainder of 2025 and as a result, the Board remains confident in its ability to meet market expectations for the full year.

Today’s commentary implies that Q4 revenue is expected to be £38.7m. That’s similar to Q3 revenue, so hopefully should be achievable – and largely visible to management at this point in the year.

Roland’s view

My view on this business remains unchanged – I think it’s a nice niche specialist with improving profitability, but I’m concerned by its dependence on Nike and perhaps one or two other key customers.

What has changed since August are the outlook and valuation.

When I reviewed August’s interim results, profit guidance for the year had been upgraded and the shares were trading on a FY25E P/E of 11.

Today, the stock is trading on a current year P/E of around 13 and profit forecasts are flat. Given the level of customer concentration here, this isn’t a stock I’d pay a high multiple for, even if profitability does continue to improve (see my comments in August).

While the StockRank has risen since August, the algorithms now class this as a High Flyer, suggesting some downside risk if the pace of earnings growth isn’t maintained.

Existing FY26 forecasts are presumably unchanged today, suggesting EPS growth of c.10% next year and implying a FY26E P/E of 12.

While I think a little more caution is justified than in August, I also think it’s reasonable to argue that the growth plan laid out by CEO Ronan Cox at the start of his tenure remains on track. On this basis, I’m going to cut my view by one notch to AMBER/GREEN today.

Diversified Energy (LON:DEC)

Up 9% to 1,050pp (£815m) - 3rd Quarter Results - Roland - AMBER

For some background on this US consolidator of onshore oil and gas wells, see my previous coverage in August.

Move to US listing: one point I made in my previous coverage was to question why Diversified was UK-listed at all, given its focus and physical presence is entirely in the US. This anomaly looks likely to disappear shortly. In October, Diversified announced plans to move its primary listing to New York later this year, if approved by shareholder vote. The company plans to retain a secondary listing in the UK.

With that housekeeping out of the way, let’s take a look at today’s third-quarter results. These include an upgrade to full-year EBITDA and free cash flow guidance and reiterate full-year production expectations.

Q3 highlights

A few points stand out to me from these figures:

Production up 36% to 1,127Mmcfe/d (million cubic feet equivalent/day - DEC is primarily a gas producer)

This increase in production suggests that most of the 41% increase in production implied by the Maverick acquisition earlier this year has now been realised, offset perhaps by normal age-related declines elsewhere in the portfolio

Revenue up 105% to $500m

Adj EBITDA up 149% to $286m

Adj FCF up 157% to $144m

The increase in revenue and profitability seems to have been driven by a combination of higher production (from acquisitions) and a 35% rise in realised oil and gas prices. These comfortably outweighed an increase in operating costs:

Average realised price +35% to $3.98/Mcfe ($23.88/Boe)

Total revenue including derivatives/disposals up 50.6% to $4.82/Mcfe ($28.92/Boe)

Adjusted operating cost per unit up 22.4% to $2.08

Adjusted EBITDA margin: 66% (Q3 24: 48%)

I would guess that a recent spike in US natural gas prices could support a further increase in realised prices in Q4, if the situation remains stable:

Upgraded 2025 guidance

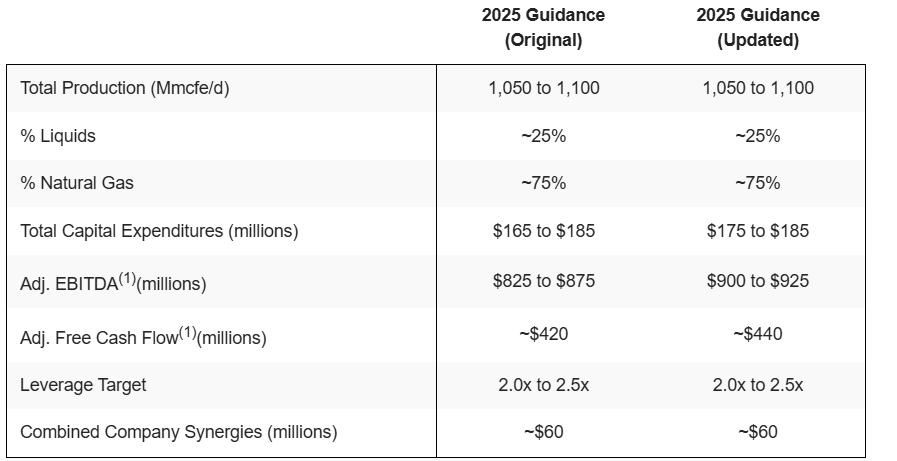

The company has helpfully provided a table showing upgraded and previous guidance.

We can see that production expectations for the year are unchanged, but there is a 7% upgrade to adjusted EBITDA and a 5% upgrade to adjusted free cash flow, using mid-point estimates:

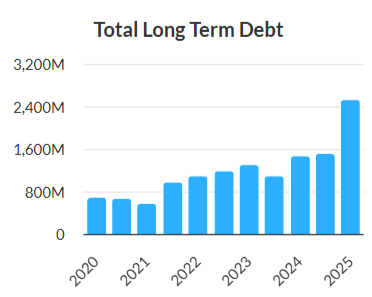

Leverage & net debt: DEC’s net debt/adjusted EBITDA leverage has fallen from 3.0x at the end of 2024 to 2.4x at the end of September.

This level of leverage is above my comfort zone for a business of this type, but leverage is a core part of Diversified’s business model. The reduction in leverage this year reflects the increase in EBITDA, rather than any material debt repayment:

Dec 24 net debt: $1,640m

June 25 net debt: $2,550m

Sept 25 net debt: $2,454m

The increase in debt this year reflects the acquisition of Maverick and maintains a long-term trend:

Today’s Q3 figures show finance costs of $55m in Q3, up by 40% vs Q3 2024.

West Virginia ‘Mountain State Plugging Fund’: this was announced in October, but was flagged again in today’s update. I don’t feel I can let it pass by without comment.

A big part of the story for this business are the decommissioning liabilities DEC will eventually face on its large portfolio of oil and gas wells, most of which are relatively mature. In my view, this large future liability is one reason for the company’s low rating by the stock market.

Given this, I was interested to see that the company is setting up a well plugging fund to meet its future decommissioning liabilities in West Virginia:

DEC will contribute $3.5m per year for 20 years, giving a total of $70m

This is expected to compound to be worth $650m at the end of this period, which is expected to support the retirement of c.20,000 wells

The fund will be held by a specialist insurer, which will guarantee DEC’s $70m contribution

In the meantime, DEC will plug a further 1,500 wells over the next 20 years (c.75/yr)

In principle this seems a good idea, but I am a little sceptical about the $650m expected target. If I’ve understood correctly, this expectation is based on the assumption that the investments in the plugging fund will grow at an annualised rate of 20% for 20 years.

To me, this seems quite an aggressive assumption. But perhaps it will be achievable.

The plugging fund isn’t entirely altruistic, either. DEC has its own well plugging unit, Next LVL Energy, which is said to be a leading operator in the region and is expanding steadily. So it seems likely that DEC may eventually receive much of the plugging fund as future revenue.

Roland’s view

As you may be able to tell, I am a little sceptical about DEC’s long-term prospects. In my personal view, this business is based on a model of making regular debt-funded acquisitions, maximising upfront cash generation and kicking the can down the road for as long as possible on decommissioning.

Of course, I could be entirely wrong. And even if I’m right, this won’t necessarily prevent DEC providing attractive shareholder returns over the coming years.

The quarterly dividend has been left unchanged today and forecasts suggest the stock could offer a 9% dividend yield. Strong gas prices could also support the full-year result.

However, the depreciating nature of the company’s assets and its high leverage mean that a low rating is appropriate here, in my view.

The StockRanks also reflect these qualities with a Value Trap style and low quality and momentum ranks:

On balance, a high yield and single-digit P/E seem appropriate to me, so I’m going to leave my previous neutral view unchanged today.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.