Good morning!

With so much US news this week, I've tried watching CNBC's "Closing Bell" in the evenings. But the problem with CNBC is that it's far too exciting - it gets my adrenaline going more than a scary movie! So I'm ending this experiment already. Long live newspapers!

All done for today, thanks.

Spreadsheet accompanying this report: link (last updated to: 31st October).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

Coca-Cola Europacific Partners (LON:CCEP) (£30.3bn | SR58) | Q3 rev +1.0%, YTD +3.3%, with volumes up 3.7% YTD. Full-year guidance unchanged. | ||

Marks and Spencer (LON:MKS) (£7.9bn | SR82) | H1 adj PBT -55% to £184m, due to cyber incident. H2 profit to be “at least in line with last year”. Consumer environment remains uncertain. | AMBER (Roland) I am impressed by the way M&S has handled its recovery from April’s cyber attack, but slightly disappointed that the “residual effects” are still ongoing and seemingly affecting trading results. I also note that the company’s house broker has cut its underlying forecasts for the current year, excluding the benefit of an impressively-prompt £100m insurance payout. While I am broadly positive about the medium-term outlook, I think the shares are probably fairly valued ahead of the key festive period, so I’m staying neutral a little longer. | |

Weir (LON:WEIR) (£7.5bn | SR77) | Rev +2%, with growing demand from copper, gold & iron ore. FY25 guidance reiterated; growth in constant currency revenue and op profit, with op margin c.20%. | ||

M&G (LON:MNG) (£6.5bn | SR57) | AUMA up 2.8% to £365bn vs Q2, Q3 new business net inflows of £1.8bn. Positive outlook. | AMBER/GREEN (Graham) M&G has tended to trade very cheaply since its demerger from Prudential, but in more recent times this has corrected. It still offers value at this level in my view: it doesn't suffer from the same problems as the smaller fund managers in this report, although it does have a few different ones, including a Life division that is probably in long-term decline. But I don't think anyone can deny that this is a highly credible organisation, and I view this as a blue-chip stock. | |

Barratt Redrow (LON:BTRW) (£5.3bn | SR41) | Reservation rate 0.57 (FY25: 0.59), due to lack of bulk sales. Order book at 26 Oct: 10,669 (Oct 24: 10,706). 60% forward sold for FY26, FY guidance unchanged, subject to Budget. | ||

Drax (LON:DRX) (£2.4bn | SR90) | Signed CfD contract with govt for operation of Drax from April ‘27-March ‘31. Strike price £109.90MWh on all four biomass units. Adj EBITDA exps unch. | ||

TP Icap (LON:TCAP) (£1.95bn | SR94) | Q3 rev +3% (CCY), with Global Broking +7% but Energy & Commodities -7%. “Remains comfortable” with market exps for FY25 adj EBIT. | AMBER/GREEN (Roland - I hold) [no section below] Today’s update from this FTSE 250 interdealer broker is in line, but doesn’t sound overly confident to me. The good news is that profit guidance is unchanged and the company’s core Global Broking business continues to trade well. TP ICAP is a market leader in this business, which generated 70% of profit in H1. However, revenue in the second-largest division, E&C, fell, as it did in H1. Instead of blaming market conditions, management says this drop is due to “competition for broking talent”. This issue has been flagged in every update this year, making me wonder whether some of the company’s top performers may have jumped ship following very strong results (and presumably big paydays) in 2023/24. Today the company says it has a “strong hiring pipeline” that’s expected to deliver results from 2026. We will see. I’m also a little frustrated by the seemingly slow progress with the company’s high-margin data business, Parameta Solutions. Parameta’s revenue growth seems slightly humdrum to me, at 5%, while a planned IPO in the US remains on ice while management “assess the appropriate timing”. I’ve been a fan of this business over the last couple of years, thanks to its low rating, high yield and improving profitability. The stock is also currently the longest-serving position in my SIF portfolio (since March ‘24). However, a falling MomentumRank means it’s getting increasingly close to a sale under my rules. To reflect this concern, I’m going to moderate my view by one notch today. | |

Lancashire Holdings (LON:LRE) (£1.55bn | SR80) | “Strong” Q3 with disciplined growth. GWP +7.4% to $1.8bn and investment return 5.6%. Renewal price index of 96%. Special dividend of 75c/share. | ||

Princes (LON:PRN) (Approx. £1.2bn | SR n/a) - New Listing | This food group begins trading today. The offer price was 475p, giving a market cap of £1,162m. | ||

Trainline (LON:TRN) (£1.04bn | SR65) | Ticket sales +8%, revenue +2% to £235m. Op profit +38% to £68m. FY26 adj EBITDA guidance upgraded to +10-13% (prev. +6-9%). | AMBER/GREEN (Roland) [no section below] Graham and I have both been AMBER/GREEN on this rail ticket aggregator over the last few months. The shares have fallen heavily this year, but trading continues to improve and is now demonstrating the strong profitability I’d hope to see from a business of this kind, with an H1 operating margin of 29% and 42% return on equity. Such strong metrics seem at odds with a forward P/E of 12, but I think there are a couple of risks that prevent me going fully GREEN here. Around half the group’s profits come from its UK Consumer division, which helps travellers navigate the insane complexity of UK rail ticketing. It’s a great service, in my view, but it is exposed to regulatory risk and the potential for new competition from other ticketing systems. Both risks are in evidence this year. In April, the commission rate earned by Trainline on UK ticket sales was cut by 0.5%. In today’s results, the company notes that the expansion of TfL’s Project Oval contactless payment network is putting £150m of UK consumer ticket sales at risk [of being lost to Trainline]. Trainline is developing its own PAYG system, while the group’s expanding operations in Europe and its B2B division should help to dilute exposure to UK consumer ticketing. Even so, I think it’s fair to apply some discount for the unknown risk of future disruption. For this reason, I’ve left my view unchanged at AMBER/GREEN today. | |

Metro Bank Holdings (LON:MTRO) (£734m | SR54) | Reaffirming all guidance for FY25 and beyond. 12% lending growth vs H1, exit net interest margin of 3.03%. 9% reduction in run-off lending, freeing up capital. | ||

J D Wetherspoon (LON:JDW) (£725m | SR38) | LFL sales +3.7% in 14 weeks to 2 Nov, with total sales +4.2% YTD. Outperforming the wider sector. Outlook “slightly more cautious” ahead of Budget. | BLACK (AMBER) Graham) [no section below] JDW's share price is unchanged today but I think the market has been pricing in the obvious: that taxes and consumer sentiment are not providing a very healthy backdrop to trading for JDW, and that the upcoming Budget includes some risks. The shares are down 10%+ since August. In typical Tim Martin fashion, today's new guidance is not quantified in this announcement and investors are left to interpret the meaning of "slightly more cautious". But it's clear that the company is acting cautiously, with only 15 pub openings planned for the current year (an unchanged plan from that which was published in the most recent full-year report). At least like-for-sale sales growth of 3.7% in the Q1 period means that sales growth is keeping up with inflation, although I'm not sure that like-for-like costs can avoid rising faster than inflation. Certainly the company is doing a very good job of managing costs for now; earnings estimates in the market suggest that profits in the current financial year (FY July 2026) will match the prior year, which I would view as a minor miracle given the tax rises at work. I've been neutral on this stock and I'm happy to leave that stance unchanged today: I do view it as very well-managed and well-capitalised, and I would be glad to upgrade my stance when it's more clear that the company can maintain profits despite the ongoing - and forthcoming - changes to the tax code. | |

Ceres Power Holdings (LON:CWR) (£608m | SR22) | Agreement for production of Ceres' proprietary solid oxide fuel cell technology with Weichai, a global OEM/power systems developer in Shandong, China. | AMBER/RED (Roland) [no section below] This new agreement with Weichai is said to supersede “existing agreements with Weichai”. Checking previous years’ results, it seems Ceres was previously working with Weichai to develop stationary power units “based on the Ceres technology”. If I have understood correctly, today’s licensing deal means Weichai is ready to move from product development to production, becoming the fourth licensing partner to use Ceres technology in its product range. This certainly seems like good news. Unfortunately there is no guidance today on the expected revenue impact of this agreement, other than a mention that licence fees are not likely to be recognised until FY26 – so FY25 revenue expectations presumably remain unchanged. Ceres has been a jam tomorrow stock for as long as I can remember and has not turned a profit since its IPO in 2004. The question now is when – or if – this might change. CEO Phil Caldwell is targeting a 20% reduction in operating expenses for 2026. Based on H1 25, that could imply operating costs of £55-60m in 2026. With revenue forecast at £57m, the result may be close to breakeven – although broker forecasts suggest a net loss of c.£12m next year. I can see the bull case here for the business, but I’m not convinced the current valuation is attractive; Ceres is currently trading on 13x FY26 forecast sales. The share price simply looks ahead of events to me, something that’s also reflected in the stock’s Momentum Trap styling. | |

Conduit Holdings (LON:CRE) (£538m | SR30) | Growth in gross premiums written of 8.5%. Strong investment return of 5.4%. Outlook: market conditions remain adequate although some rate softening has occurred and is expected to continue. | ||

Bluefield Solar Income Fund (LON:BSIF) (£428m | SR39) | Persistent discount to NAV for over three years. Following engagement with shareholders, starts a Formal Sale Process. The board remains open to all options. | PINK | |

Vanquis Banking (LON:VANQ) (£292m | SR86) | Customer balances +18% y/y and full-year guidance increases. Net receivables +21%. NIM guidance reduces to >16.5% (previously >17%). Other guidance unchanged. Limited liability to motor finance: £3m provision. | AMBER/GREEN (Graham) [no section below] I turned AMBER/GREEN on this in August when we had a stabilising update at the company’s interim results: it had previously given a downgrade to its medium-term forecasts back in March. Today’s update reads well to me: strong growth in customer balances and in receivables, and it remains on track for “low single-digit ROTE” this year. There are perhaps two small negatives. The first is the reduction in net interest margin (NIM) guidance, although this is well explained by the company targeting growth in low-margin Second charge Mortgages. While the margin will be lower than previously forecast, the actual net interest income result will be in line. The second slight negative is the £3m provision for motor finance redress, with a warning that an additional £4m liability could arise. I previously thought that Vanquis might not have to pay any compensation under this redress scheme, as it didn’t pay discretionary commissions linked to interest rates. However, it turns out that 2% of motor finance commissions paid by Moneybarn have been above 35% of the total cost of credit and 10% of the loan amount. Still, these are small numbers compared to the overall size of the Vanquis group. Overall, I remain comfortable with my moderately positive stance here: the shares offer a discount to tangible book, a bank that is earning low but positive ROTE, and the potential for this to improve as it both scales up and delivers its planned cost savings. The CET1 capital ratio may have reduced to 17.4%, but this would generally be considered extremely safe in the banking industry. | |

Redcentric (LON:RCN) (£191m | SR65) | Managed Services Provider H1 revenue reduces to £67m, in line with management expectations. Adj. EBITDA improves to £9.1m, modestly above management expectations. | ||

Kitwave (LON:KITW) (£173m | SR50) | H1 trading has been as anticipated; the Board expects profits to be in line with market expectations for FY Oct 2025. CFO will retire, be succeeded by KITW’s Financial Controller. | ||

Braemar (LON:BMS) (£76m | SR75) | FY26 board expectations unchanged, with H2 market conditions improving. H1 revenue down 16%, underlying operating profit down 30%. | ||

Headlam (LON:HEAD) (£46m | SR27) | SP -12% Challenging market dynamics and execution. Revenue down 5%. The Board expects full year performance to be below expectations. Comprehensive programme of restructuring, cost reduction and operational improvements. Potential property disposals to boost the company's financial position. | BLACK (RED) (Graham) [no section below] We were AMBER/RED on this as recently as October, and our concern is justified by a serious profit warning today. In hindsight, it was not a great sign to see the CEO leave his position with immediate effect and with little ceremony. I'd have zero desire to go bottom-fishing here, as floor coverings is one of the most difficult sectors in my experience. There's an old Carpetright near me, frozen in time since it went into administration in July 2024, to remind me of that! Headlam is operating without a permanent CEO at the moment, instead being run by its Chairman. It's also carrying a net debt position of £24m although against that it says that its property portfolio is worth £94m (2023 valuations). So maybe there's some hidden value? If property disposals can reduce debt as planned then solvency will not be a problem and I'll be able to get this off RED reasonably soon. But for now only a purely negative stance makes sense. Even before today's warning, the company was not forecast to make any real profits for the next several years. | |

Water Intelligence (LON:WATR) (£45m | SR77) | The Group continues to be in-line with expectations for 2025 and is increasingly confident about expectations for 2026. 9-month revenue +9.2%, EBITDA +14% ($12.7m). | ||

Corero Network Security (LON:CNS) (£45m | SR11) | Management reaffirms guidance for 2025 of revenue $24.0 - $25.5m (FY 2024: $24.6m) and EBITDA $1.5m loss - $0m (FY 2024: $2.5m profit). | ||

OPG Power Ventures (LON:OPG) (£22m | SR93) | Buyback offer - similar to tender offer - at 6.27p (latest price: 5.45p). Proposes cancellation of AIM listing. | PINK GN note: Major shareholder owns 51.5%. | |

Tpximpact Holdings (LON:TPX) (£13m | SR60) | “Confident in achieving the full-year guidance previously provided for Adjusted EBITDA of £6-7m” (sic). | ||

| Velocity Composites (LON:VEL) (£12m | SR54) | Trading Update | SP -17% FY25 and FY26 revenue will be lower than current market expectations, though adjusted EBITDA for both years is expected to show improvement on prior years. New estimates from Canaccord Genuity: FY October 2025 revenue £20.7m (previously £23m), FY 2026 revenue £20m (previously £26.6m). FY October 2025 adjusted pre-tax loss £0.9m (previously £0.7m loss), FY 2026 adjusted pre-tax loss £0.6m (previously £0.3m profit). | BLACK (AMBER/RED) (Graham) [no section below] The last time we looked at this was when it issued a revenue warning in May, and Mark commented at the time that it was a big miss. Today we have another very large revenue miss including over £2m that has disappeared from FY October 2025 - the financial year that ended a week ago - and a major cut to the FY 2026 forecast. Real profits remain beyond the foreseeable future, and this is a company that hasn't made a profit in the last decade. As a supplier to aerospace manufacturers, it appears to lack both revenue visibility and negotiating power, given the ease with which customers can apparently move to facilities that don't use VEL's composite kits. The net cash position has reduced to zero and I may need to turn fully negative on this before too long, if the trend of poor trading continues. |

Graham's Section

M&G (LON:MNG)

Up 1% at 272.4p0.9p (£6.5bn) - Graham - AMBER/GREEN

Significantly larger than most fund managers we cover, M&G is an enormous asset manager that includes a wide range of mutual funds and institutional mandates.

Let’s try to understand today’s Q3 update. Here are the key points:

AUMA up 3% in the quarter to £365 billion

£1.5 billion of net inflows from external clients in the Asset Management division.

£2.0 billion of net outflows in the Life division (this is in the table, not in the headlines!).

Both divisions saw their AUMA increase during the quarter. But long-term, the Life division might not be terribly exciting, as it includes many old funds that will be wound up sooner or later.

In Asset Management, there is a nice little tailwind on the way:

Momentum expected to continue in coming months, as we begin to generate new business flows through our partnership with Dai-ichi Life.

Dai-Ichi is the third largest life insurer in Japan. The two companies announced their strategic partnership back in May, with M&G becoming Dai-ichi’s preferred asset manager in Europe, but there are many other aspects to their planned cooperation.

$5 billion of new business is expected over five years - that may not be very large in the context of M&G’s entire business, but the two companies working together will enjoy the benefits of international scale.

Graham’s view

M&G is such a large (and quite complex) organisation that I almost need to treat it like I do the High Street banks: I accept that I’m never going to understand every facet of them, but I try to take a big-picture view when I can.

Ultimately I treat M&G the same way I treat Aberdeen (LON:ABDN), which is to say that I put it in a separate category to the smaller fund managers we cover in this report. They both take care of very large institutional mandates - from sovereign wealth funds, pension funds, charities, etc. - that to some degree separate them from the ebb and flow of retail investor sentiment.

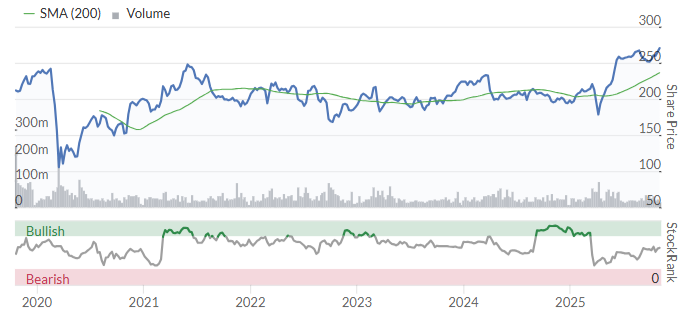

Since its demerged from Prudential and IPO’d, it has tended to trade very cheaply, although in more recent times this has corrected:

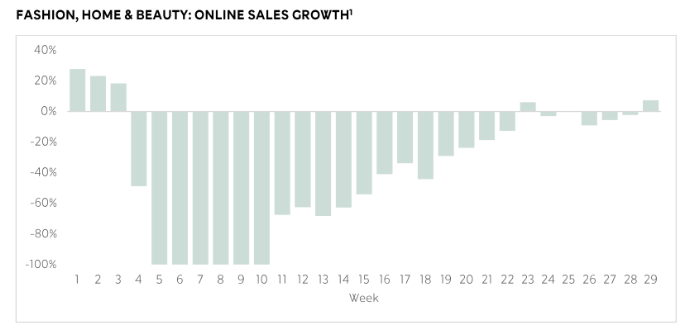

It does still appear to offer value at this level:

I wouldn’t mind owning some M&G shares at this level and so GREEN is a plausible stance for me, but I note that Roland was merely AMBER in September. So I’ll be a little bit cautious and hike our stance by only one notch, to AMBER/GREEN.

Roland's Section

Marks and Spencer (LON:MKS)

Up 1% to 389p (£8.0bn) - Interim Results - Roland - AMBER

When I covered Marks & Spencer’s full-year results in May, the company was still in the throes of dealing with the aftermath of a major cyber attack. While the FY25 results were pretty strong, the company was expecting a £300m hit to profit from the attack and the timetable for a return to normal was still unclear.

At the time, I said:

I think there’s the potential for a sluggish return to normal customer behaviour and perhaps some extra costs. I’m staying neutral for now, but would hope to turn positive again later this year.

The cyber attack is now over and operations are (nearly) back to normal – so today’s half-year results provide us with a good opportunity to revisit this business. M&S was on a positive trend prior to the attack – can CEO Stuart Machin (who I think has done an excellent job) regain this momentum?

H1 26 results summary

Today’s financials are a mixed bag, as I would expect given the scale of disruption faced by the company during the half year. There are also a few points that need explanation, which I’ll return to shortly:

Revenue up 22.5% to £7,942.3m

Adjusted pre-tax profit down 55.4% to £184.1m

Reported pre-tax profit down 99% to £3.4m

Adjusted EPS: 6.6p

Dividend per share up 20% to 1.2p

Adjusted return on capital employed: 12.4% (HY24: 15.0%)

Revenue: this number immediately looks odd – how can sales be up by over 20%? The answer is that M&S has consolidated its share in Ocado Retail into its accounts this year, meaning that Ocado sales are added to revenue.

Previously, the Ocado stake was accounted for as an equity investment, meaning that M&S only reported its share of Ocado’s profit/loss in its accounts.

Oado contributed £1,4799.9m of revenue in H1, on which it generated an adjusted operating loss of £3.1m.

Stripping Ocado’s sales out of the group total shows us that M&S revenue fell slightly in H1:

Food up 7.8% to £4,531.9m

Fashion, Home & Beauty down 16.4% to £1,697.6m

International down 11.6% to £255.8m

Total revenue ex-Ocado down by 0.3% to £6,462.4m

Profit: impressively, M&S has already received a £100m insurance payout for the cyber attack. This has been added into H1 adjusted profit. In my view, this is a slightly odd choice.

The company incurred £101m of cyber-related costs in H1. Understandably, these were treated as an adjusting item. However, for the company to then include the matching insurance payout as a contribution to profit gives a somewhat distorted view of underlying trading profits, in my opinion.

Stripping out the insurance payout from profit gives me an adjusted pre-tax profit figure of £84m for H1, down by 79% from £413m in HY25.

Trading commentary: One reason for this large fall is that the stronger-performing Food business has a much lower margin than Fashion, Home & Beauty (FHB) – the Food operating margin was 5% last year, compared to 11% for FHB.

As a result, adjusted profits have been hit hard by the decline in FHB sales since the cyber attack.

Food sales rose by 7.8% in H1, contributing a divisional operating profit of £89m. Volumes rose by 2.8%, with larger basket sales (over £30), up 12%.

This side of the business seems to have benefited from the predominance of in-store shopping, versus online/click and collect in FHB.

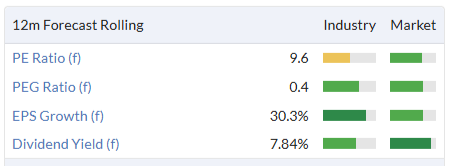

Food operating margins fell to 2% (HY25: 5.1%) due to higher levels of discounting and waste, but waste levels are now returning to normal. M&S has commendably provided a Next-style chart in today’s report to illustrate this:

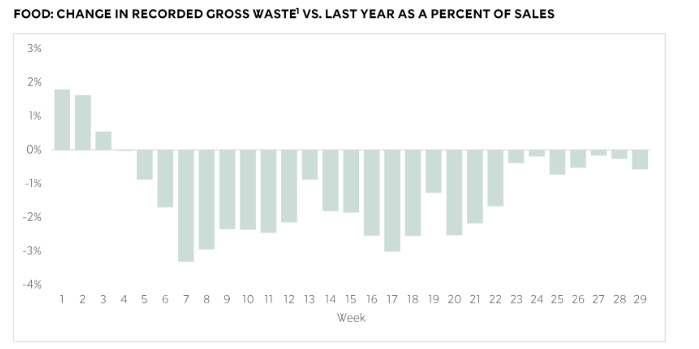

Food, Home & Beauty: this side of the business has suffered harder and longer from the cyber attack. Sales fell by 16.4% and FHB operating profit was just £46.1m, reflecting an operating profit of 2.7% (HY25: 12.0%).

As regular shoppers will know, online ordering and click and collect were suspended for a long time, while in–store availability was also affected. However, online sales growth has now turned positive again:

Balance sheet/cash flow: it’s fortunate that M&S entered this period with net cash of £438m (March 25) excluding leases. More than £100m of cyber-related costs and £245m of capex contributed to a free cash outflow of £193m in H1.

As a result, net cash dropped to £176m before lease liabilities, while the inclusion of lease liabilities relating to Ocado Retail lifted the group’s reported net debt to £2.5bn (HY25: £2.2bn).

Statutory net debt is a big number here, but I don’t see too much to worry about at this point, assuming trading continues to recover as expected.

Outlook

We are confident we will be recovered and back on track by the financial year-end. In the second half we therefore anticipate profit at least in line with last year, as the residual effects of the incident continue to reduce in the coming months.

Following the attack, M&S adopted a policy of fixing things the right way and taking the opportunity to upgrade technology where necessary. While this probably wasn’t the cheapest or quickest approach, I think it’s the correct choice and is likely to pay off over time.

In the near term, I suspect this year’s results will depend heavily on whether trading returns to normal over the key festive period. Watch out for M&S’s post-Christmas update.

With thanks to house broker Shore Capital on Research Tree, we have updated forecasts today.

Shore’s analysts appear to be surprised by the speedy insurance payout, which wasn’t previously factored into their forecasts. This has led to some confusing wording in today’s note, which I’ve tried to decipher below:

Adj PBT: Shore’s previous forecast was for FY26E adj PBT of £600m, excluding insurance (£100m received in H1).

Today’s updated FY26 adj PBT forecast is for £655m, including £100m of insurance. This means the new base forecast for trading adj PBT is £555m. That’s effectively a significant cut from Shore’s previous forecast, perhaps because the aftermath of the cyber incident is dragging out longer than expected.

Shore’s EPS forecasts reflect the company’s approach – FY26 EPS estimates rise today because they now include insurance, whereas previously they didn’t! Forecasts for later years have been trimmed, but only very slightly:

FY26E adj EPS: 23.4p (prev. 20.6p)

FY27E adj EPS: 33.9p (prev. 34.4p)

FY28E adj EPS: 35.6p (prev. 36.2p)

Looking through to FY27 puts M&S shares on a forecast P/E of 11.5 – significantly cheaper than Tesco, for example.

Roland’s view

My concern in May was that a recovery to full trading volumes and margins might take longer than initially expected. To an extent, I think this caution was justified – today’s mention of “residual effects” makes it clear that operations and trading have not yet fully returned to normal.

What’s more difficult is deciding whether to go AMBER/GREEN, or leave my view unchanged at AMBER.

I’d like to be more positive, but I’m aware that the company’s house broker has – technically – cut its forecasts 4today.

In addition to company-specific challenges, there’s also the risk that November’s Budget could create further cost headwinds for retailers.

It’s a finely-balanced decision, but I’m going to stay at AMBER today and revisit the situation after Christmas.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.