Good morning!

The Bank of England announces its interest rate decision at 12 noon today, with most economists predicting there will be no change to Bank Rate (4%), although there is an outside chance of an early rate cut.

Decision: rates are left unchanged but four of the nine members of the MPC wanted at 0.25% rate cut. In a surprising and new development, the summary and minutes of the meeting includes statements from every individual member of the committee. It sounds like there were some strong views, and everyone wanted to make sure they were heard!

The consensus is as follows:

CPI inflation is judged to have peaked. Progress on underlying disinflation continues, supported by the still restrictive stance of monetary policy. This is reflected in an easing of pay growth and services price inflation. Underlying disinflation is being underpinned by subdued economic growth and building slack in the labour market...

...The risk from greater inflation persistence has become less pronounced recently, and the risk to medium-term inflation from weaker demand more apparent, such that overall the risks are now more balanced. But more evidence is needed on both.

With inflation peaking, that sets the stage for a rate cut in December or February.

Today's report is finished - have a good evening.

Spreadsheet accompanying this report: link (last updated to: 31st October).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

AstraZeneca (LON:AZN) (£193bn | SR75) | Reiterates Total Revenue and Core EPS guidance for FY 2025 at CER. 9-month product revenue +11% at CER, 9M EPS +42% at CER. | ||

National Grid (LON:NG.) (£57.1bn | SR76) | Underlying EPS 29.8p, up 6%. FY26: “we expect strong operational performance… with underlying EPS expected to be in line with the 6-8% CAGR range from the 2024/25 baseline.” | ||

Diageo (LON:DGE) (£40bn | SR54) | Outlook: “Organic operating profit growth is expected to be low to mid-single digit, including the impacts of Chinese white spirits and a weaker US consumer environment” (and tariffs). | BLACK (AMBER/RED) (Mark) | |

BT (LON:BT.A).A (£17.9bn | SR72) | "We remain on track to deliver our financial outlook for this year, our cash flow inflection to c.£2.0bn in FY27 and c.£3.0bn by the end of the decade.” | ||

Smith & Nephew (LON:SN.) (£11.8bn | SR77) | Revenue (5% growth) and profit margin (19-20%) guidance unchanged; free cash flow guidance raised to around $750m (previously >$600m). | ||

Wise (LON:WISE) (£11.8bn | SR78) | SP -5% Continues to expect to move towards underlying PBT margin of c.16% for FY26, excluding one-off costs. This is the top end of medium-term guidance of 13-16%. Active customers +18%, revenue +11%, underlying operating profit down 15% (£132.8m). Underlying PBT down 17% (£122m). | AMBER/GREEN (Graham) [no section below] Please check out David Wordsworth in the comments section for a very helpful analysis of this one, which is far bigger than the typical mid-cap financial that I study. It has a grand vision: to become “the” network to move and manage the world’s money. I noticed an interesting debate in the comments section below about the threat of “stablecoins” (crypto assets backed by fiat). Wise refers to this threat in today’s report but personally I must admit that I don’t understand it: crypto, in my view, failed to ever deliver on its original promise of instant payments, while fiat currencies surprisingly did deliver instant payments, years ago. Wise’s infrastructure makes instant payments increasingly possible and in that sense it seems to be fulfilling what crypto coins were originally supposed to do. As for the investment merits of WISE stock right now, I’m happy to upgrade our view today having noticed the company’s very high quality metrics and the growth in the overall size of the business (18% customer growth year-on-year, with revenue approximately doubling over the past three years), which seems more important to me than short-term profit numbers. A US listing next year is likely to put upward pressure on the valuation too, as US investors tend to be more growth-oriented - and US growth stocks are in very punchy territory these days. | |

J Sainsbury (LON:SBRY) (£7.73bn | SR95) | SP +5% H1 sales and profit ahead of expectations and H1 profit after tax from continuing operations is £185m. Now expects Retail underlying operating profit of more than £1 billion for the year. Previous guidance: “around £1 billion”. £400m to be returned to shareholders following bank disposal: a £250m special dividend plus £150m additional buyback (split over FY26 and FY27). | GREEN (Graham) [no section below] We’ve been moderately positive on this one and I’m pleased to see that this has been rewarded with an “ahead of expectations” outlook. Retail sales are up 4.8% and like-for-like retail sales are up 4.5%, which means that retail underlying operating profit can stand still at just over £500m. In order to be consistent with our method, I’ll upgrade our stance on this to fully GREEN given that this is a Super Stock that has just delivered an “ahead” update. The stock is currently trading at around 14x earnings and it has traded higher than this before, although not significantly and not for very long. So I would assume that further gains will rely mostly on earnings growth over multiple expansion. Market share has been pretty stable around 15% for the last five years, putting SBRY in second place only to Tesco and materially ahead of each of the discounters. It seems to understand its place in the market well, and continues to execute. | |

Auto Trader (LON:AUTO) (£6.68bn | SR54) | Revenue +5%, operating profit +6% (£200.1m). H1 is in line with expectations, and the full year outlook remains unchanged. | ||

IMI (LON:IMI) (£5.93bn | SR73) | Q3 organic revenue +12%.Full year guidance reconfirmed. | ||

ConvaTec (LON:CTEC) (£4.81bn | SR49) | CFO promoted to CEO. Group Financial Controller promoted to CFO. | ||

Howden Joinery (LON:HWDN) (£4.7bn | SR87) | YTD sales +3%. On track with the outlook for 2025, PBT to be in line with current market expectations. | ||

Hiscox (LON:HSX) (£4.55bn | SR60) | Written premiums +5.9%. Claims experience well within expectations. Change programme on track. | ||

Hikma Pharmaceuticals (LON:HIK) (£3.93bn | SR78) | Continues to expect revenue growth of 4% to 6%. Tightens core operating profit range to $730m - $750m, (previous range $730m - 770 million). | ||

Harbour Energy (LON:HBR) (£3.28bn | SR78) | Free cash flow outlook “reinforced”, production guidance upgraded. | ||

RS (LON:RS1) (£2.62bn | SR78) | H1 “as expected”, full year outlook unchanged. H1 revenue down 1% like-for-like, operating profit +3%. | ||

ITV (LON:ITV) (£2.57bn | SR82) | Performance for the 9 months to the end of September was better than market expectations. YTD Revenue+2% (+4% external revenue). £45m of total Group permanent non-content savings in 2025 as previously guided, £35m of additional savings. Net debt £508m (30 Jun: £586m). | AMBER (Mark) [no section below] | |

TBC Bank (LON:TBCG) (£2.4bn | SR64) | 3Q 2025 profit of GEL 368 million, up by 6% YoY, with ROE at 24.4%. Net Interest Margin flat Q-on-Q at 7.1%. Georgia CET1 16.7%, Uzbekistan CET1 18.5%. | ||

Vistry (LON:VTY) (£2.02bn | SR73) | Expectations for the year remain unchanged. Sales rate since 1 July is up 11% compared to the same period last year at 0.81 (2024: 0.73). Forward order book remains stable at £4.3bn (2024: £4.8bn). Build cost inflation for FY25 remains in line with expectations, tracking at low single digits. Expect to deliver a year-on-year reduction in the Group's net debt position as at 31 December 2025. | ||

Derwent London (LON:DLN) (£1.97bn | SR66) | Open market leases signed 10% ahead of ERV; £17.5m of new rent completed YTD (including renewals/regears), EPRA vacancy rate at 3.7%, £200m of disposals completed YTD, with a further £14m contracted. | ||

Osb (LON:OSB) (£1.88bn | SR93) | Net loan book +2% to £25.6bn, in line with guidance, 3m+ arrears reverted to 1.7% from 1.8% as at 30 Jun, in line with the previous trend. Common Equity Tier 1 capital ratio remained robust at 15.8%. On track for 2025 guidance. | ||

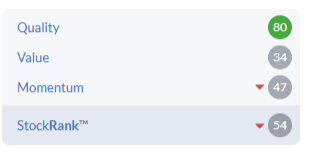

Tate & Lyle (LON:TATE) (£1.68bn | SR23) | Revenue -3% to £1.02bn, Adj. EBITDA -6% to £215m, Adj. PBT - 10% to £126m, Adj. EPS 21.3p, Net debt £952m (31 Mar: £961m). Outlook for the full 2026 financial year is unchanged. | AMBER/RED (Mark) [no section below] A forward P/E of 9 initially looks interesting for this household name in what should be a fairly defensive sector. However, they have £952m in debt, partly taken on to acquire ingredients manufacturer CP Kelco. This makes the rating far less attractive on a EV basis. Today’s results are adjusted to take account of that acquisition, but are uninspiring, and all key metrics down for the half-year. The outlook is in line, but this was cut (together with our view) following a profits warning at the start of October. I see no signs in these results that this isn’t a plodder on not that cheap a rating once debt is accounted for, so I maintain that broadly negative view, given the StockRank of just 23. | |

Helios Towers (LON:HTWS) (£1.63bn | SR78) | Q3 Revenue +1% to $216m, Op Profit +38% to $78.1m, Net debt flat at $1.72bn. | ||

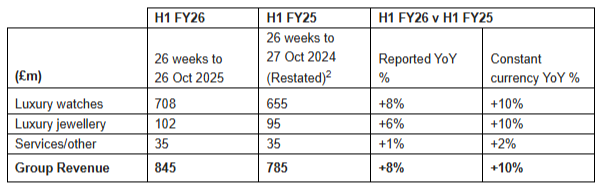

Watches of Switzerland (LON:WOSG) (£910m | SR69) | H1 Revenue +10% CCY to £845m (US +20% CCY). Reiterating FY26 guidance provided in July. | AMBER (Mark) | |

Workspace (LON:WKP) (£779m | SR26) | Workspace to acquire a minority equity stake in Qube for £3m which will largely be reinvested into The Old Dairy fit-out in Shoreditch. | ||

Ocean Wilsons Holdings (LON:OCN) (£318m | SR75) | NAV was US$812.4 million (£604.0 million) US$28.72 (£21.35) per share. Investment portfolio valued at US$355.5 million, which represents US$12.57 (£9.34) per share, with the balance of US$456.9 million held in cash, reflecting the proceeds from the Wilson Sons disposal. | PINK | |

Filtronic (LON:FTC) (£297m | SR61) | Secured a contract with a leading European aerospace manufacturer, to supply RF assemblies for integration into a major Low Earth Orbit satellite constellation programme, valued in excess of €7 million over three years. | AMBER (Mark) [no section below] Another decent contract win, showing their expertise is in demand, but at around £2m revenue pa (assuming smooth revenue booking), it is only around 3% of forecast revenues each year, meaning it doesn't move the needle much. It remains a great business, but it is expensive and the Momentum Rank continues to fall, so our previous caution remains warranted in my opinion. | |

Intuitive Investments (LON:IIG) (£218m | SR37) | “…has delivered further growth in its performance metrics since September and continues to anticipate further progress in the period to December 2025 with connected Lucky World shops increasing to c.9,000 and UGO UnionPay POS Terminals to more than 1,000…” | ||

Frontier Developments (LON:FDEV) (£190m | SR96) | “At just over two weeks after release, base game sales have now exceeded 500,000 units, with higher revenue than was achieved by Jurassic World Evolution 2 (Nov'21) in an equivalent period.” | GREEN (Graham) Despite the lack of visibility compared to many other companies I cover, and despite how expensively rated the stock is now, I think that Frontier does deserve a high rating given the success it has achieved by returning to its original strategy. The next Planet Zoo could reboot its financials once again, and there is every chance that Jurassic World could also continue to surprise positively. | |

ASA International (LON:ASAI) (£180m | SR80) | Geert Embrechts as Chief Financial Officer, joining from Rabobank where he currently serves as Chief Financial Officer of the Wholesale & Rural business unit. | ||

S4 Capital (LON:SFOR) (£139m | SR52) | Q3 billings +2% to £491m, Revenue -3% to £192m, Net revenue - 7% to £167m, “2025 like-for-like operational EBITDA target remains unchanged, broadly similar to 2024”. Month end average net debt for the third quarter £154 million versus £184 million last year. | ||

AFC Energy (LON:AFC) (£101m | SR4) | FY Revenue £107k (FY24:£4m), Cash £25.3m (FY24: £15.4m) after £25m fundraise in period. | RED (Mark) [no section below] You’d think that £170k of revenue this year compared to £4m last year and £1.3m forecast would cause some embarrassment amongst the board. However, I don’t sense a lot of contrition, perhaps because the CEO is relatively new. While he may be new to the job he appears to have retained AFC’s core technology: raising money from shareholders. Given that they raised £25m and have £25m, that means they burnt through about £15m in the year. They say that the business “has been fundamentally restructured…” , leading to “an annualised saving of c. £1.5m in FY26.” However this would only appear to lengthen the cash runway by a month or so in this Sucker Stock. | |

Victoria (LON:VCP) (£62.9m | SR27) | H1 revenue -7% (Q1-11%, Q2 -2%) in line with previous guidance. U/L EBITDA +6% to £53m. Revenue for FY26 is expected to be slightly below FY25. Cost savings of £20m complete. | RED (Mark) [no section below] Things remain tough in this sector, although there are signs of an improving trend. Underlying EBITDA is up, but I can’t help feeling I am going to disagree with those adjustments when I see them. They highlight that “Group liquidity remains sufficient” but without giving us the overall net debt figure. To give some idea of scale, they recently refinanced their 2026 notes with “near-term senior debt maturities with €612million (£528 million) of 9.875% Senior Secured Notes due July 2029, and a new £130 million super senior credit facility maturing in January 2030.” They recently tried to refinance their €166.6m of outstanding 2028 3¾% Senior Secured Notes for 2031 notes with a 12% 2031 PIK note. That the 2028 holders refused, presumably shows that they would prefer some (slim) chance of being paid first or leading the restructuring rather than accept a much higher interest rate but no payment until 2031. All of this simply highlights that the equity here is at best an option, and if I wouldn’t be willing to take the risk of holding the debt here, why would I risk holding the equity? | |

Hercules (LON:HERC) (£31m | SR83) | Academy on course to train 2,000 students in the 2025 calendar year. | ||

Rockfire Resources (LON:ROCK) (£11m | SR27) | First drill hole complete. Five portable XRF spot samples have been taken, which average 6.7% Zn, 2.5% Pb and 42g/t Ag. |

Graham's Section

Frontier Developments (LON:FDEV)

Up 9% to 562p (£208m) - A STRONG LAUNCH FOR JWE3 & A SEQUEL FOR PLANET ZOO - Graham - GREEN

Frontier Developments plc…, a leading developer and publisher of video games based in Cambridge, UK, is pleased to provide updates on two of its flagship franchises: Jurassic World Evolution and Planet Zoo.

We’ve been reasonably positive on this one - see my coverage in June and then Mark in September.

So far, the bull thesis is playing out with Jurassic World Evolution 3 having launched successfully:

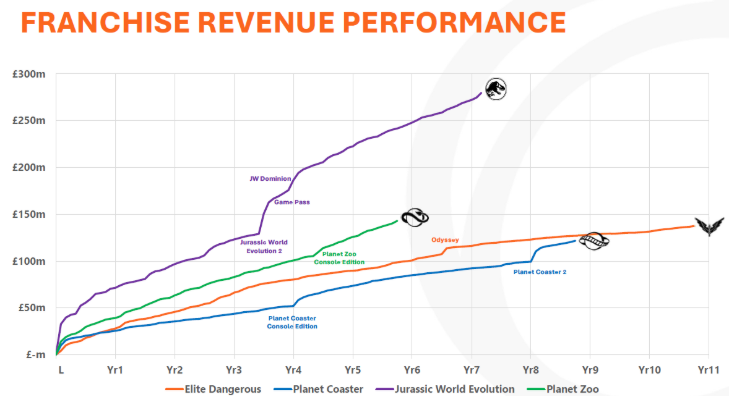

Excellent player engagement and critic reviews following its release on 21 October 2025 has delivered stronger-than-expected sales for Jurassic World Evolution 3, the third instalment in Frontier's biggest-selling game franchise, Jurassic World Evolution. At just over two weeks after release, base game sales have now exceeded 500,000 units, with higher revenue than was achieved by Jurassic World Evolution 2 (Nov'21) in an equivalent period.

This follows a pivot by Frontier back to its original strategy of focusing on grand “CMS” games (creative management simulation). This means the player building and managing a theme park, a zoo, or a dinosaur park. One of these might be entirely fictional, but it’s not hard to imagine how there might be commonalities between them all!

Here’s the trailer for the new edition of the fictional game that’s doing so well:

Review aggregation site Metacritic gives JWE3 a “Metascore” of 81/100 (based on critic reviews).

On Steam, the game scores 92% out of 2,447 reviews.

Let’s compare that to F1 Manager, the discontinued Formula One simulator series that is generally considered to be a flop and that played a big part in the collapse of the FDEV share price in 2022 and 2023.

On Metacritic, the F1 Manager games (2022, 2023 and 2024) all received scores of 79 to 81, the same as Jurassic World Evolution 3.

However, on Steam, F1 Manager 2022 received “mixed” user reviews: 65% positive feedback. The subsequent titles improved this to 77% and 79%.

A couple of things I’d take from this information:

Maybe it’s best to ignore Metacritic when it comes to predicting commercial success? I’m sure the critics have good reasons for their views, but they rated all of these games similarly.

Similarly, I’m going to put more weight on reviews at Steam (the digital distribution platform) from now on, as it’s far more reflective of the public mood - which makes sense, seeing as games enjoy thousands of reviews on there.

These review ratings help to confirm that FDEV did learn from the initial failure with the first F1 game, and the follow-up F1 titles were a big improvement.

But the main takeaway from today is the FDEV is succeeding by doing what it knows best: grand CMS games in large open areas. Focusing on its niche is working.

And in that regard, we have more news today:

Frontier is excited to reveal that the CMS game scheduled for release in financial year 2027 (1 June 2026 - 31 May 2027) is a sequel to Planet Zoo, Frontier's biggest selling game to date. Released in 2019, Planet Zoo has sold over 5.5 million units worldwide and generated over £145 million in revenue as of 31 October 2025.

Graham’s view

I’m going to take our view on this back up to fully GREEN.

Yes, there is no denying that it’s expensive now:

Let me reiterate my standard warning that it’s not without risk: there is always the potential for its next release to flop, just like F1 Manager did.

However, that risk is mitigated by the company focusing on sequels to titles that have a large fanbase and where FDEV has particular development strengths (CMS).

Also, shareholders must accept the annual revenue figure isn’t smooth: it depends on which games are released in particular years, and this will change every time.

Here’s an interesting chart from last year’s results presentation which is very helpful for us to visualise this. It shows spikes in franchise revenue when there are new releases. The success of each financial year basically depends on how many of these spikes happen to occur in a 12-month period, and how steep they are:

Upgraded forecasts: we have new estimates from Panmure Gordon (many thanks) which I should share here:

FY26 revenue £93.9m (previous estimate £91.1m)

FY26 EBIT £9.5m (previous £7.6m)

They also make small positive adjustments to FY27 and FY28.

Adjusted operating profit - a figure similar to EBIT - was £13.2m in FY25. Therefore, even with these upgrades, the company is not currently expected to match FY25’s profitability in FY26. EBIT is not expected to get back to £13m+ until FY28.

There is no way to invest in FDEV without being comfortable with this ebb and flow, and with the inherent uncertainty of profit forecasts.

Despite the lack of visibility compared to many other companies I cover, and despite how expensively rated the stock is now, I think that Frontier does deserve a high rating given the success it has achieved by returning to its original strategy. The next Planet Zoo could reboot its financials once again, and there is every chance that Jurassic World could also continue to surprise positively. I’m excited to see what this can achieve next!

Mark's Section

Watches of Switzerland (LON:WOSG)

Up 6% at 415p - H1 FY26 Trading Update - Mark - AMBER

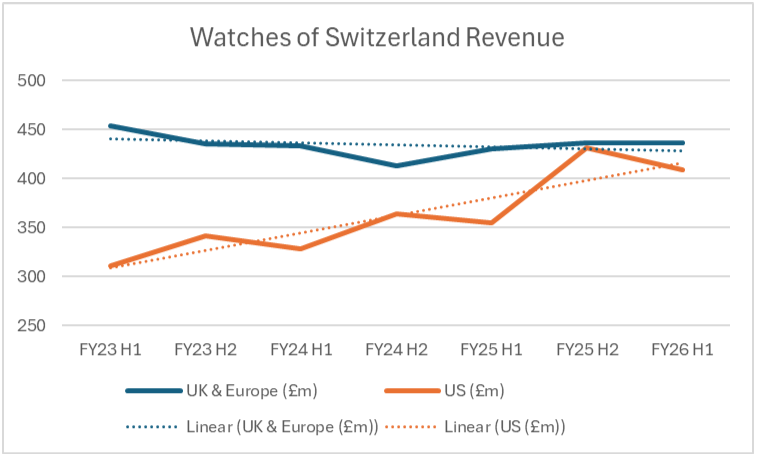

The headline of +10% revenue for the half versus last year hides a tale of two regions:

US revenue £409 million, +20% at constant currency, +15% at reported rates vs prior year…

UK revenue £436 million, +2% vs prior year, +5% adjusting for showroom closures

Claiming the UK would be +5% adjusting for showroom closures seems a bit of selective reporting as they also are keen to point out:

We continue to make good progress with our showroom development programme, with several flagship refurbishments and new boutiques completed in H1 FY26, and further high-profile openings planned for H2 FY26.

And then go on to list a series of expansions or relocations, including in the UK. Overall, this is just a continuation of recent trends, with the UK revenue flat and the US expanding quickly:

This half revenue is actually below H2 last year, but there appears to be a strong seasonality in the US business, so shouldn’t be particularly worrying. What is worrying when they have such a large exposure to the US is tariffs. Here they say:

Additional 39% tariff in place since 7 August 2025 on landed cost of Swiss imports. We understand negotiations between governments are still taking place. We are closely monitoring tariff developments and brand responses. To date we have not seen any significant change to consumer behaviour.

This scale of tariff is no doubt why the shares have been weak since the summer:

They say there is no significant change to consumer behaviour, but this could be due to many reasons:

Inventory: It will have made sense to build up inventory in the U.S. ahead of the tariff effective date, which may delay how quickly retail price increases hit consumers.

Buying behaviour: we may be seeing consumers buy ahead of perceived upcoming price rises.

Lower price rises: the tariff is paid on the import cost not the RRP, so overall prices may only rise 15-20% if the full tariff was passed on.

Margin share: it is not clear who will absorb the tariff - brands, WOS, or customers. In reality this may be shared.

Luxury: watches are a luxury good which are largely sold on the wealth that they signify to those who observe the wearer. Having a more expensive good may actually increase this signalling and make them more desirable.

Only the last point is really positive, with all of the other signalling pain delayed rather than cancelled. Balancing any impact on new watch prices, used watch prices may strengthen, as they look comparatively better value, but this remains a modest part of the overall business.

Valuation:

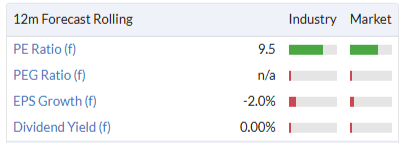

The current sub-10x P/E makes the company look reasonable value for a luxury retailer (although this is not a brand owner so shouldn’t be compared directly to luxury brands):

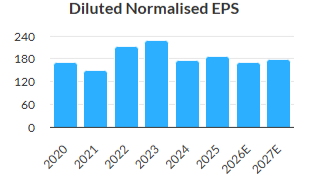

While the overall EPS growth rates may be unimpressive, when I separate out the US from the UK, there is no doubt that the US remains a growth business. Costs are an issue though, and the overall EPS trend is not particularly encouraging:

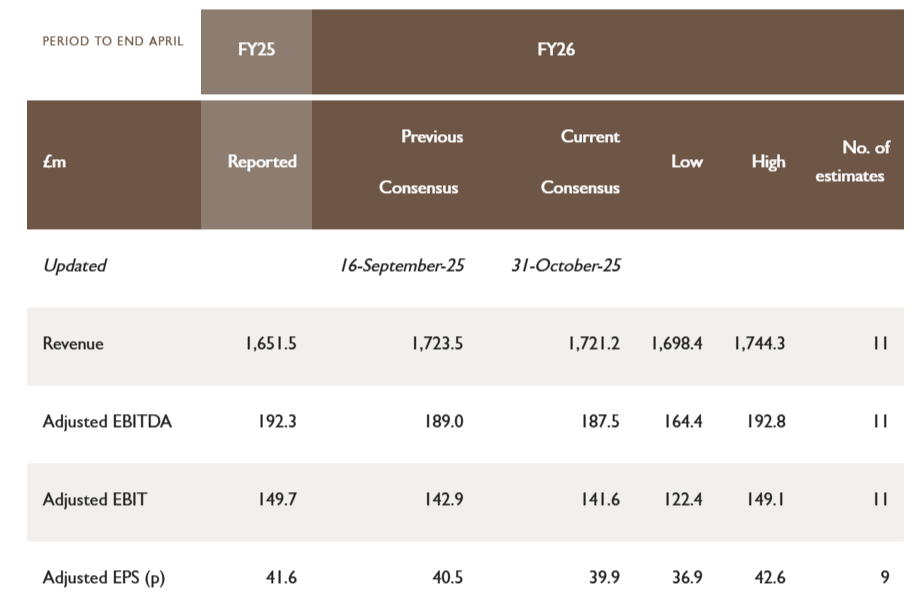

The biggest issue is the unknown impact of the tariff situation. The company helpfully provides current consensus on their website:

The current consensus is for a 8.23% EBIT margin. Therefore, any impact on gross margin from tariffs would have an outsized impact on EBIT and EPS, as this would drop straight through to EBIT.

Based on current trends, the US will be about half of revenue this year. We don’t get a breakdown of the product split by region but 84% of overall sales in H1 were in the watch segment:

We also don’t know the split between new and used. However, their five-year plan presentation said they believe that by FY28 the second hand watch business will grow to the point where it represents 20% of the value of new Rolex sales in the US. This is one brand, but their major one. I think we can guesstimate that it is probably about 15% used watches by revenue this year.

So my guesstimate for US new watch sales in FY26 is £1,721m x 50% region x 84% watches x 85% new = £614m. Each 1% tariff related gross margin impact would impact EBIT by £6.14m. If we assume say 5% GM impact this would take £30.7m out of EBIT, which would drop EBIT and presumably EPS by around 22%. Of course, not all of this will impact FY26 as we are already half-way through. Plus presumably analysts may have included some of this impact as part of the recent decline in EPS consensus. The scope for a large miss in FY27 remains even if recent revenue growth trends in the US continue.

The market has liked this update this morning with the share rising 7%, presumably buoyed by the statement that they haven’t seen any significant change to consumer behaviour in the US. It seems to me that they aren’t out of the woods yet on this, and they probably have the choice between eating a significant gross margin hit or raising prices that will have an unknown impact on consumer behaviour.

Mark’s view

When Graham reviewed this in September he was hovering between AMBER and AMBER/GREEN, due to the lack of clean accounts, brand ownership or quality metrics. Only the P/E of around 8 kept him interested. However, with the share price now almost 25% higher, the analysts consensus lower, and a potentially large future tariff impacted as yet unaccounted for, it is probably best to moderate our view back to AMBER.

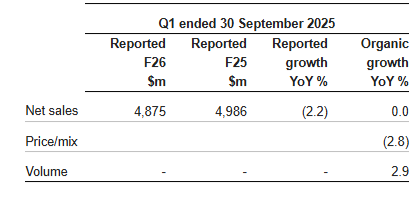

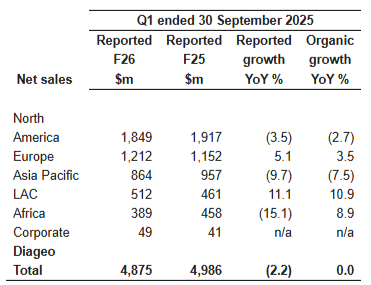

Diageo (LON:DGE)

Down 5% at 1715p - FY26 Q1 trading statement - Mark - BLACK/AMBER/RED

Overall revenue is down due to disposals, and flat organically as weaker pricing offsets all of the volume increase:

It is the US and China that are weak:

The overall impact appears to be a modest profits warning, although it would be nice if they quantified this further, given the organic aspect:

Organic net sales growth - we expect to be flat to slightly down including the adverse impact from Chinese white spirits and a weaker US consumer environment than originally planned for.

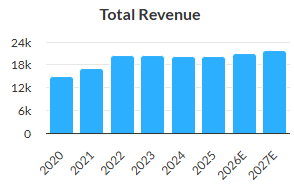

Overall, it looks like this will be the fourth year of flat revenue, which in an inflationary period for the world is poor:

Like many companies their answer is cost-cutting and they say that their “cost savings guidance of c.$625m over the next 3 years fully on track.” However, this isn’t enough to avoid a decline in earnings, even more so after today’s trading update makes it into the consensus:

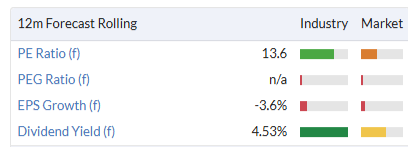

Many investors view this sort of company as a stable business throughout all market conditions. The P/E of around 13 seems high for a company with so many years of no growth, but this is why it is green against its industry but not thE overall Uk market:

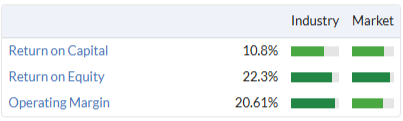

As a brand owner it should be able to continue to generate reasonable operating margins which are typically above 20%. However, its decent Returns on Capital mean nothing if it can’t deploy additional capital to grow sales and EPS:

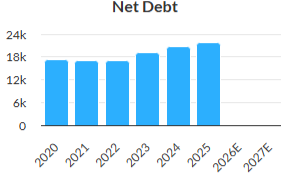

The dividend yield is reasonable, but not stand-out and given that net debt has been increasing, this is at least partially, debt-funded:

On cash flow they say:

We remain committed to delivering c.$3bn free cash flow in fiscal 26 and returning to well within our target leverage ratio range of 2.5 - 3.0x no later than fiscal 28. This will be supported by appropriate and selective disposals over the coming years, with plans progressing well.

Selling assets in order to pay down debt and maintain a dividend may be the right thing to do, but it hardly inspires confidence in a growing future. I think there are some structural/ethical headwinds too:

Problem drinking

A UK study into alcohol consumption in 2018 found that:

Drinkers consuming more than the government’s low-risk guideline of 14 units (around one and a half bottles of wine or six pints of beer) per week make up 25% of the population, but provide 68% of industry revenue.

The 4% of the population drinking at levels identified as ‘harmful’ (over 35 units a week for women, over 50 units a week for men) account for almost a quarter (23%) of alcohol sales revenue.

I don’t think I can be too critical as I both drink alcohol and some of Diageo’s products. There may also be some significant cultural differences around the world. However, with harmful drinkers making up around a quarter of alcohol sales, this makes me a little bit uncomfortable with Diageo as an investment due to both the ethics and risks of further regulation.

Demographic differences

The US is a key market for Diageo and here, at the start of this year Time Magazine reports that:

…research from the National Institute on Drug Abuse shows that lifetime drinking, past month drinking, and past year drinking among young people began to decline around the year 2000. That means that such declines have especially impacted Generation Z, defined as anyone born from 1997 to 2012, and some Millennials, born between 1981 and 1996. A 2023 survey from Gallup found that the share of adults under age 35 who say they ever drink dropped ten percentage points in two decades, to 62% in 2021-2023 from 72% in 2001-2003.

Overall, US alcohol consumption was still up, but similar trends hold across many developed countries - young people are drinking less. This may act as a demographic headwind for producers.

Weight-loss jabs

The Guardian reported earlier this year that:

…the first clinical trial of its kind has found that semaglutide, distributed under the brand name Wegovy, cut the amount of alcohol people drank by about 40% and dramatically reduced people’s desire to drink. Researchers said the study backed up anecdotal evidence from patients and doctors that semaglutide can lead to a sudden loss of longing for alcoholic drinks.

Recent studies suggest about 12% of US adults are currently taking weight-loss jabs, so while the absolute numbers may not be a significant impact for Diageo on their own, there appears to be a correlation between problem drinking and obesity. Combining these factors I can easily see a 5% revenue risk to Diageo in developed countries from these treatments.

Alcohol-free products

Offsetting these trends is the tendency for companies to produce alcohol-free versions of popular drinks. While the idea of an alcohol-free spirit seems pointless to me (at least while it is priced at a premium to cordials), high-quality alcohol free beers are increasingly popular. Diageo may well benefit from this trend for their Guiness brand (especially if margins are higher due to the lack of alcohol duty). However, they will not benefit as much as some other brewers who have more beer and less spirit offerings.

Mark’s view

Roland rated this AMBER at the start of August. The share price is a bit lower today but then so is the broker consensus:

This will take a further tumble when today’s update is digested into the StockReport. The StockRank is likely to fall further in the short term too:

Without the headwinds I mentioned then I would agree that the quality metrics that Roland mentioned would warrant a neutral view. However, a high historical Return on Capital does nothing for shareholders unless the company can re-invest capital at similar rates to generate growth. Instead the message from the company is one of selling off assets in order to pay down the debt and maintain the dividend. I am also much more negative on the potential impact from the trends towards lower alcohol consumption on the company, hence it’s an AMBER/RED for me, until there are clear signs that they can grow their sales above inflation over an extended period of time.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.