Good morning!

Writing this on a Chromebook using hotel Wifi, hopefully you don't notice much difference! Cheers.

The FTSE was down 1.3% yesterday due to generalised jitters that markets are overvalued. Nvidia, the poster child of the AI/tech bubble, reports results today (after hours). The market learned this week that legendary invetor Peter Thiel had sold his entire stake in it ($100m). Softbank also sold its entire stake ($5.8 billion) and of course there was the recent disclosure of Michael Burry's short positions - Nvidia being his other major short, along with Palantir.

Nvidia is 7.5% of the S&P 500, and of course very highly-rated, so it makes sense that markets would worry in these circumstances - I think they should be worried! And as usual, US volatility is going to have some knock-on effects on UK shares, even if the logic for that is not always entirely clear.

The Agenda is complete.

Spreadsheet accompanying this report: link (last updated to: 10th November)

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

Lloyds Banking (LON:LLOY) (£52.6m | SR63) | Curve is a UK fintech operating a digital wallet platform that will improve the bank’s mobile payments offering. Not expected to have a material financial impact in 2025 or 2026. | ||

Sage (LON:SGE) (£10.4bn | SR44) | Rev + 8%, op profit +17% to £530m. Adj EPS +18% to 43.2p (in line). FY26 outlook: expect rev +9%, w/ improved margins. | ||

Severn Trent (LON:SVT) (£8.2bn | SR61) | Rev +18%< , adj PBIT +56.5% to £466m. Adj EPS +74% to 101.0p. New CEO appointed. FY26 guidance: net performance incentives now exp >£40m (prev. >£25m), op cost growth 5-8% (prev. <12%). Expect c.13% regulatory return. | ||

Smiths (LON:SMIN) (£7.9bn | SR69) | Q1 in line with exps, with revenue +3.5%. Approved further £1bn share buyback, FY26 guidance reiterated. | ||

Ithaca Energy (LON:ITH) (£3.9bn | SR98) | YTD production 115 kboe/d (YTD 24: 52.5 kboe/d), YTD opex $19.1/boe, YTD EBITDAX +98% to $1,501.2m. FY25 outlook unchanged for 119-125 kboe/d, expect higher production in 2026. | AMBER/GREEN (Roland) [no section below] I was AMBER/GREEN on Ithaca at the time of August’s H1 results, since when the shares have risen by a further 20%. Today’s update confirms further progress and reiterates full-year guidance. One possible slight niggle is that net debt rose from $671m to $1,064m in Q3. This appears to reflect a $238m increase in capex compared to the same period last year, plus the $136m completion payment for the Japex acquisition. I don’t have a particular problem with this level of leverage, but I think it’s worth monitoring whether debt levels continue to rise to fund capex – this might suggest the company is overpaying on the dividend and could be left vulnerable if oil or gas prices fell sharply. However, the benefits from the increased scale and lower cost per barrel of the group’s expanded portfolio are clear – full-year guidance implies opex of c.$19/boe, from $22/boe in 2024. Dividend guidance for a total payout of $500m is also reiterated today, with $167m already paid and a further $133m declared today. That underpins a c.9% yield at current levels. Current 2026 forecasts suggest a fairly flat performance next year and I would probably consider a neutral view if the stock became much more expensive. For now, I’m going to leave my view unchanged at AMBER/GREEN. | |

British Land (LON:BLND) (£3.8bn | SR65) | Underlying profit +8% to £155m, adj EPS +1% to 15.4p. Occupancy 95%, total property return 3.8%. FY26 outlook in line with exps. | ||

Rotork (LON:ROR) (£2.7bn | SR46) | Order intake +6% during 4mo to 31 Oct. End markets “remain supportive”. FY expectations unchanged. | ||

Jet2 (LON:JET2) (£2.59bn | SR60) | Rev +5%, PBT +1% to £800.3m. Record passenger numbers and profit. FY outlook in line with exps. | GREEN (Roland) | |

Hochschild Mining (LON:HOC) (£1.85bn | SR84) | Tiernan subsidiary has completed C$58.4m placing. HOC’s proceeds will be C$16.5m. HOC’s holding reduces to 61.9% fully diluted. | ||

Hill & Smith (LON:HILS) (£1.66bn | SR90) | Trading positive with good momentum in US business. UK more challenging. FY expectations unchanged | ||

Genus (LON:GNS) (£1.58bn | SR67) | Strong start to the year, board expects FY adj PBT to be modestly ahead of current market expectations. | ||

WH Smith (LON:SMWH) (£776m | SR43) | Findings following the independent Deloitte Review & Board Changes | Deloitte review found that supplier income recognition has been overstated in North America. Mostly a timing issue. Now expect FY25 NAm trading profit of £5-15m (prev. c.£25m). CEO steps down with immediate effect. | |

Workspace (LON:WKP) (£774m | SR28) | Performance in line with exps. Improved retention and conversion from new enquiries. LFL occupancy -2.5% to 80%, LFL rent roll -3.3% to £107.1m. EPRA NTAV -6.8% to 721p. | ||

Beauty Tech (LON:TBTG) (£247m | SRN/A) | Strong trading in Oct/Nov. Board now expects FY25 revenue and adj EBITDA to be ahead of exps, at no less than £128m and £32.0m respectively. | ||

Eagle Eye Solutions (LON:EYE) (£82m | SR34) | Trading started well in H1, with new wins including North America. Confident in FY expectations. | ||

Likewise (LON:LIKE) (£70m | SR71) | SP -12% PW: YTD sales +8.9% but underlying PBT will now fall short of current market forecasts, albeit will be ahead of previous year. Zeus forecasts: FY25E EPS cut by 25% to 0.9p FY26E EPS cut by 24% to 1.2p | BLACK (AMBER/RED) (Roland) Today’s profit warning has had a surprisingly muted market reaction, in my view, given the scale of the cuts made by house broker Zeus. While I recognise that revenue growth is ongoing here, today’s update suggests cost pressures and possible underperformance in parts of the business may have led to falling profit margins. Today’s revised forecasts have left Likewise shares trading on a forward P/E of >20, which looks high to me given the loss of momentum. I’m inclined to be cautious here until there’s some evidence that profits are returning to growth. | |

Mulberry (LON:MUL) (£67m | SR33) | Rev -4%, but wholesale +36%. Operating loss reduced to £(4.9)m. Trading in line with board’s expectations. | ||

Kooth (LON:KOO) (£46m | SR46) | Acquired telehealth platform for 5-12 year olds from Kismet Health. Expected to help expansion into new states. Financials not material and not disclosed. | ||

Ondo InsurTech (LON:ONDO) (£43m | SR11) | Indiana Farm Bureau Insurance is expanding its use of LeakBot from 10,000 devices to 20,000. | ||

Manolete Partners (LON:MANO) (£39m | SR64) | H1 (to September) saw the first truck cartel claim “combined with a lower than average case settlement value during a quiet summer. Trading in September showed a marked improvement and this has continued into October. New case referrals remain buoyant, at close to record levels.” | ||

PCI- PAL (LON:PCIP) (£37m | SR34) | New integration to Epic, one of the world's leading electronic health record systems, enabling healthcare providers to process payments securely across any channel. | ||

All Things Considered (OFEX:ATC) (£23m | SR19) | Raising money at 125p (most recent close: 140p). “Net proceeds of the Fundraising will provide additional working capital and a strengthened balance sheet to continue ATC's growth strategy,” | ||

Creightons (LON:CRL) (£19m | SR69) | PBT down 11% (£1.5m). Customer issues have restricted growth. “Whilst it is not anticipated that all deferred sales will be recovered, the reinstatement and improvement of these issues is expected to contribute positively in the coming year.” | AMBER (Graham) [no section below] I’d like to be more positive on this but given these numbers, and the commentary accompanying them, I’m inclined to stay cautious. Mark was also AMBER on Creightons in July. The company says that the issues it has faced are beyond its control - such as a contract manufacturing customer delaying product launch until 2027 - but for me this only underlines the very average quality of that side of the business. It does still deserve to trade at a reasonable earnings multiple and based on twice the H1 figures, that multiple is currently 9x, making no adjustment for cash or debt. Cash is over £3m if you are willing to look past £2m of mortgage debt and nearly £1m of leases. This is a brand owner, deriving about a third of revenues from its own brands, although this category (like the company’s overall performance) isn’t growing. Overall, while I think there could be upside, I also think there’s every chance that the stock is fully valued here. So I’ll keep us neutral. | |

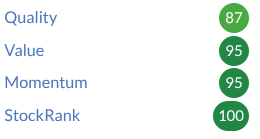

Northern Bear (LON:NTBR) (£18m | SR100) | Adjusted operating profit £4.1m (H1 last year: £1.7m), includes non-recurring £1.3m profit. Group continues to trade slightly ahead of current market expectations | GREEN (Graham) Reverting back to fully GREEN here on the basis of the stronger cash position, which reduces the risk level. There are still plenty of risk factors, including the weather, but the stock still trades cheaply against earnings at this level, and it pays a dividend. One of the better nano-caps we look at here, in my view, and it has a StockRank of 100. | |

Zoo Digital (LON:ZOO) (£10m | SR42) | Operating loss $1.2m (H1 last year: loss $2.5m). Trading in line, confident on track to deliver full year results in line with market expectations. |

Graham's Section

Northern Bear (LON:NTBR)

Down 3.5% to 124p (£17m) - Interim Results - Graham - GREEN

It’s not every day I get to cover a company with a StockRank of 100!

We’ve been moderately positive on this one - clearly we should have been more positive:

Let’s get the bullet points from today’s interim results:

Revenues +31% (£49.4m)

Operating profit £4.1m (H1 last year: £1.7m)

The operating profit figure for H1 this year includes a £1.3m “non-recurring” profit.

The company is at pains to not say what the non-recurring profit relates to, other than that it “arose from the Group's normal trading activities”.

Interestingly, when the company initially mentioned this mysterious profit in an October trading update, they said it was “approximately £1.0 million”. It has since grown to £1.3m.

If I was to quibble with their presentation, I would say that they could have left this unusual item, whatever it is, out of their “adjusted” operating profit. If the point of adjustments is to show performance that might be repeatable in future, would that not make sense?

The company does helpfully point out that without this item, EPS would be 15p rather than the 21.9p that was officially recorded.

For those who may be unfamiliar, Northern Bear is a group of businesses in Northern England that provide a range of building services: fire protection, roofing, electrical, etc.

Outlook reads well, albeit with some disclaimers. Given the strong share price movement seen in recent weeks, I can understand some profit-taking this morning:

The Group has again traded very well during the first half of FY26 with strong underlying trading performance across all divisions.

Market conditions are largely flat within our major regions and we are finding market pressures starting to affect some of our businesses…

…the Group continues to trade slightly ahead of current market expectations. In addition, the full year outcome for FY26 is expected to be broadly consistent with the strong underlying profit performance for FY25 after adjusting for the non-recurring operating profit referred to above and trading losses and related closure costs in H Peel & Sons Limited (in FY25). This is on the assumption, inter alia, that current market conditions do not worsen, there are no further one-off non-recurring losses, the additional investment in operations continues to meet revenue expectations and that there is no major weather-related disruption.

For FY March 2025, the company made a full-year operating profit of £3.4m, and it adjusted this up to £3.8m to exclude the costs to close a loss-making business.

So it sounds like we are headed for another c. £3.8m operating profit result for FY March 2026.

This implies a very large H1-weighting, as the company already booked £2.8m in H1 (excluding the one-off profits).

Estimates: Hybridian have in fact pencilled in £4m of adj. operating profit for this year, which seems more reasonable than only £3.8m. Northern Bear only needs £1.2m of op. profit in H2 to hit this! They report a “stable” order book, implying a normal level of visibility.

Graham’s view

I’m happy to revert back to GREEN here, a stance that we did take a year ago, with the deciding factors being cash flow and the balance sheet.

With companies of this size and at such lowly ratings, one or two good years can transform the valuation after you take cash and debt into account, and my impression is that this may be happening here.

- Sep 2024 balance sheet: net debt £1.4m.

- Sep 2025 balance shet: net cash £3.8m.

Following very best practice, the company points out that its net cash/debt position is highly variable and can change by £1.5m in days. So they also provide this information:

The lowest position in the Period was £0.6m net cash, the highest position was £4.7m net cash, and the average was £2.7m net cash.

In the interim results last year, they said:

The lowest position in the Period was £2.5m net bank debt, and the highest position in the Period was £0.1m net bank debt, and the average was £1.5m net bank debt.

From this point of view, the change in the average was over £4m.

A stronger cash position means the company is less risky, can invest flexibly into its existing businesses, can think about acquisitions, and can more easily afford to pay its dividend. So I think fully GREEN is appropriate here now.

Roland's Section

Likewise (LON:LIKE)

Down 12% to 24.6p (£62m) - Trading Update - Roland - BLACK (AMBER/RED)

Shares in flooring distributor Likewise have performed well this year, aided by a number of earnings upgrades. Unfortunately, the company has issued a profit warning today. This appears to suggest that respectable revenue growth has not been sufficient to outweigh the impact of higher costs.

Trading update & revised guidance: today’s update reports sales growth of 7.2% so far in the second half of the year. While positive, that’s below the 10.2% achieved in H1, giving year-to-date revenue growth of 8.9%.

Within the group, sales in the Likewise Floors business rose by 13.3% during the period. This suggests to me that the Valley wholesale business (acquired in 2022) may have underperformed.

Management strikes a bullish note on trading in “challenging markets”:

This has all been achieved in what would still be considered challenging markets, compounded by the hottest summer on record and demonstrates consistent increases in share over the last five years.

… but then goes on to cut profit guidance for the year:

Due to increased costs and an imbalance in the revenue increases across the Group's various activities, Underlying Profit Before Tax will fall short of current market forecasts, however the Group will produce Profit significantly ahead of previous years, notwithstanding absorbing the additional National Insurance Contribution costs.

The company’s comment about an imbalance in revenue growth across its business is a little vague, in my view. But if I’ve understood correctly, I think it may support my idea that parts of the business (Valley?) have underperformed, resulting in a hit to overall margins.

Updated Estimates

With thanks to house broker Zeus for making its notes available on Research Tree, we have updated forecasts today. While revenue estimates have been tweaked slightly higher, there are big cuts to earnings expectations:

FY25E adj EPS: 0.9p (-25% vs 1.2p previously)

FY26E adj EPS: 1.2p (-24% vs 1.6p previously)

Even after this morning’s share price drop, these forecasts leave Likewise on a FY25E P/E of 27, falling to a P/E of around 21 in 2026.

Roland’s view

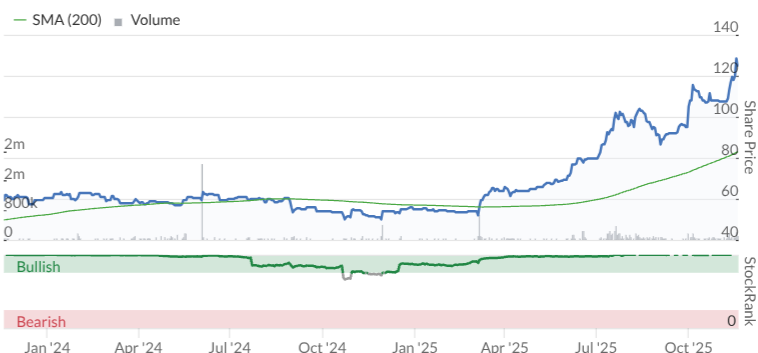

Likewise was styled as a High Flyer by the StockRanks prior to today’s warning, thanks to a string of earnings upgrades this year:

That run of upgrades has clearly now ended, with earnings forecasts for 2025 and 2026 now cut to levels lower than any previous consensus forecast this year.

With the benefit of hindsight, there was some clue to today’s warning in September, broker Zeus raised revenue forecasts but left earnings forecasts unchanged. It was clear that rising costs were preventing the kind of operating leverage we might hope to see from rising sales.

Looking at today’s forecasts, revenue growth is expected to be c.8% in 2025 and 2026. In my view, that’s respectable, but not overly exciting against a backdrop of low single–digit inflation.

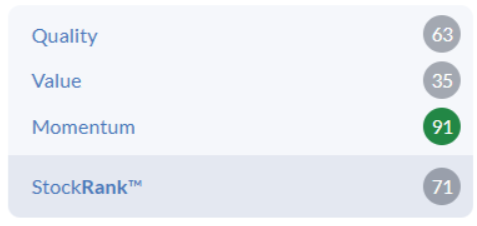

As Graham pointed out in September, flooring can be a difficult sector with inconsistent profitability. I’m surprised today’s share price drop hasn’t been greater. A forward P/E of 20+ for a low margin distributor doesn’t seem to offer any margin of safety, in my view. I suspect the StockRanks will show a sharply reduced MomentumRank after today’s updates are digested, resulting in a loss of the stock’s High Flyer styling:

Given what we know about profit warnings often signalling the start of a longer period of underperformance, I’m going to take a cautious view today. AMBER/RED.

Jet2 (LON:JET2)

Up 3% to 1,339p (£2.7bn) - Half-Year Results - Roland - GREEN

I took a positive view on holiday operator Jet2’s results in July. But in September, the company advised investors that operating profit could be at the lower end of the consensus range this year due to limited visibility on bookings in “a less certain consumer environment”.

The good news today is that there is no further hedging on guidance – the company simply says it’s trading in line with expectations.

H1 results summary

Jet2 says today’s H1 results show record passenger numbers, revenue and profitability. Despite “a fast-moving, late booking market”, passenger numbers rose by 5.6% to 14.1m. This wasn’t quite enough to absorb an 8% increase in seat capacity to 15.98m, causing the average load factor to fall to 88.2% (2024: 89.8%).

Even so, this performance supported a decent set of financial results:

Revenue up 5% to £5,342.2m

Pre-tax profit up 1% to £800.3m

Earnings per share up by 8% to 300.4p, aided by buybacks

Interim dividend up 2% to 4.5p per share

New £100m buyback programme

Profitability remained very strong. While the H1 operating margin of 13.4% (H1 25: 13.8%) reflects peak summer trading (H2 is normally loss making), my sums suggest a trailing 12-month return on equity of 23.6%. Although this is below the c.30% figure reported last year, it’s still a stronger result that’s in line with the group’s historic range.

Trading commentary: the mismatch between profit and revenue growth tells us that Jet2 has not been able to fully pass on all cost increases to its customers.

Reading the management commentary suggests the main area of cost growth was in the holiday business:

Hotel accommodation costs increased 7% to £2,295.3m (2024: £2,137.2m) primarily due to inflationary rate increases of 6%, an increased proportion of bookings to higher star rated hotels, plus customer volume growth, partially offset by a 2% currency benefit for Euro-denominated hotel costs.

There were also cost increases in other labour-intensive areas, such as airport handling, staff costs and in-resort transfers.

Balance sheet: this business is also differentiated by its very strong balance sheet. Jet2 had gross cash of almost £3.4bn at the half year, with net cash of more than £2bn including all debt and lease liabilities.

The strength of its balance sheet gives Jet2 the option to invest and manage its operations for quality long-term growth, in a way that might not be possible if it had less flexibility.

Although it’s worth noting that the cash balance includes around £1.3bn of customer deposits on advance bookings (and hence future obligations), this isn’t uncommon in this sector. The only time it could become a problem would be if Jet2 had to stop operating normally, as it did during the pandemic – hopefully an unlikely scenario.

Buybacks: I am not always a fan of buybacks, but Jet2’s profitability and valuation at 1.3x book value mean I’m quite comfortable with the decision to repurchase more shares. My sums suggest such spending should generate a double-digit return on investment, in addition to providing a useful boost to earnings per share.

Outlook & Estimates

Guidance is left unchanged today, with Jet2 helpfully specifying a consensus operating profit forecast of £453m – broadly unchanged from last year.

The actual result may be influenced by start-up costs at the company’s new London Gatwick base, but I don’t see this as a concern given the company’s disciplined record of expansion.

Broker Shore Capital has provided updated forecasts today, leaving FY26 almost unchanged, but trimming its earnings estimates for the following two years:

FY26E adj EPS: 222p (prev. 223.2p)

FY27E adj EPS: 195.3p (prev. 218.6p)

FY28E adj EPS: 216.1p (prev. 238.6p)

Taking FY27 as the lowest of these prices Jet2 on a P/E of seven after this morning’s gain – that still looks reasonable to me.

Roland’s view

This business is inescapably cyclical and is also exposed to commodity prices and general inflation. However, I believe it’s well run, very profitable and currently quite reasonably valued.

While there’s obviously some uncertainty about the outlook, I can see plenty to like here on a medium-term view and share the StockRanks’ view of this as a Contrarian stock.

I’m going to take a chance and leave my GREEN view unchanged today.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.