Good morning!

The team are all back from a great Mello event. More detailed feedback on that next week, but for the moment, we'll just say it was a great event and we loved hearing from companies, presenting our ideas and meeting everyone.

Report is complete.

Spreadsheet accompanying this report: link (last updated to: 10th November)

Companies Reporting

Name (Mkt Cap) | RNS | Summary | Our view (Author) |

AstraZeneca (LON:AZN) (£211bn | SR76) | Approved in the US for the treatment of adult patients with neurofibromatosis type 1 (NF1). | ||

Games Workshop (LON:GAW) (£5.31bn | SR71) | Core revenue ≥ £310m (H1 last year £269.4m) and licensing revenue ≥ £16m (H1 last year £30.1m). PBT ≥ £135 million (H1 last year £126.8m). | GREEN (Graham) Staying GREEN on this as I still do not consider it to be overvalued, given its remarkable success and tremendous quality. Since my last review, GAW’s share price has increased but so have its earnings forecasts - and therefore my view is unchanged. There is a level of valuation where I might moderate my stance, but we aren’t there yet. | |

Investec (LON:INVP) (£5.23bn | SR80) | Revenue +2.4% in Rands, down 0.6% in £. Adjusted operating profit +1.5% in Rands, down 1.4% in £. ROTE reduces from 16.4% to 15.7%. | ||

Londonmetric Property (LON:LMP) (£4.42bn | SR56) | EPRA earnings £148.6m (vs. £135.4m), EPRA net tangible assets £4.7bn. LTV at 35.1%, debt maturity of 4.2 years and cost of debt at 4.1%. “Our increased scale is presenting numerous opportunities.” | ||

JD Sports Fashion (LON:JD.) (£4.01bn | SR92) | Q3 LfL sales down 1.7%, organically sales up 2.4%. “Recent indicators have shown weaker macroeconomic and consumer external data points… we anticipate profit before tax and adjusting items to be within the lower end of current market expectations“ (£853 - £888m). | BLACK (lower end of range)/AMBER/GREEN (Mark) Bottom of the range works out to be roughly a 2% drop in PBT expectations, given their fairly tight guidance. It is undoubtedly a very tough retail environment and I can easily see a further downgrade coming. However, I believe that if it does, it will be slight and may indeed mark the nadir for short-term consumer sentiment. As such, this near-term concern doesn’t overcome my belief that 6-7x earnings is a very cheap price to pay for a business as well run as this. Apart from leases, this is business without any real leverage. This, plus their cash generation, could easily enable them to take advantage of weak conditions to acquire further retailers on the cheap. Hence I'm happy to remain mostly positive on the long-term future here. | |

Johnson Matthey (LON:JMAT) (£3.51bn | SR95) | Pro forma underlying operating profit up 38% at constant currency. Outlook unchanged. | ||

Lion Finance (LON:BGEO) (£3.38bn | SR79) | 3Q25 consolidated profit of GEL 547.2 million, up 7.5% year-on-year and 6.6% quarter-on-quarter, resulting in a nine-month cumulative profit before one-off items of GEL 1,573.5 million, a year-on-year increase of 20.3%. | ||

MITIE (LON:MTO) (£2.08bn | SR90) | Revenue +10.4%. Organic revenue +6.4%, plus 4% from acquisitions. Order book +7%. Average net debt rises to £332m. Full year guidance reiterated. | ||

Grainger (LON:GRI) (£1.4bn | SR53) | Net rental income +12%, pre-tax EPRA earnings +12%, FY29 guidance reiterated. | ||

Breedon (LON:BREE) (£1.1bn | SR50) | LfL revenue -3% YTD. Including acquisitions, revenue +9% YTD. Near term construction activity expectations have reduced in GB. Guidance: Underlying EBITDA for the year of between £275 to £280 million (interims: guided for low end of £291.4m to £311.5m range). | BLACK | |

Dr Martens (LON:DOCS) (£789m | SR94) | Full-price direct to consumer revenue growth 6%. Total revenue +0.8% at constant currencies. Adjusted PBT loss £9.4m (H1 last year: loss £28.7m). For FY26 we are trading in line with our expectations. Sell-side Adjusted PBT consensus range £53m to £60m. Tariff impact on these figures: high single digit £m headwind. DOCS expects to offset roughly half of this. | ||

Senior (LON:SNR) (£771m | SR57) | Healthy trading in the Period, full year performance anticipated to be comfortably above the Board's previous expectations. Group revenue increased by 5.9% YTD (at constant currencies), with Aerospace sales increasing 9.4% and Flexonics growing by 1.5%. | ||

PPHE Hotel (LON:PPH) (£737m | SR34) | Extends the existing £95.8m facility with Aareal Bank from its original maturity date of June 2026, with a new maturity date in June 2030. New rate will be 5.72% on 85% of the loan, vs. current rate 3.248%. | ||

XPS Pensions (LON:XPS) (£701m | SR59) | Revenue +13%, adjusted EPS +9%, actual EPS minus 32%. Net debt increases to £62m. Confident of achieving full year results in line with previous expectations. | ||

Close Brothers (LON:CBG) (£620m | SR67) | Motor finance: they “do not believe the proposed redress methodology appropriately reflects actual customer loss or would deliver a proportionate and fair outcome in its current form.” On track to deliver £20m savings in FY26. “Solid performance” in Q1. FY26 guidance remains unchanged. | ||

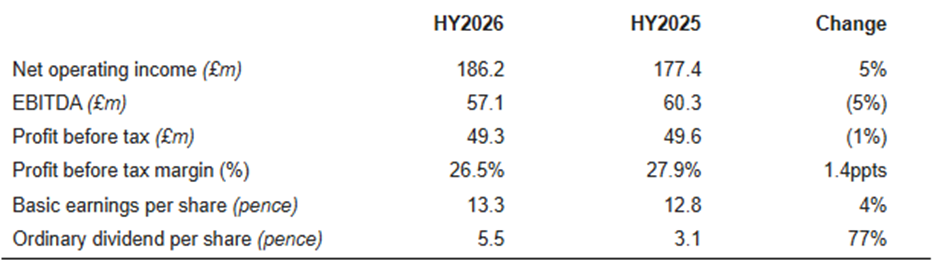

CMC Markets (LON:CMCX) (£581m | SR76) | H1 NOI +5% to £186.2m, EBITDA -5% to £57.1m, PBT -1% to £49.3m, EPS +4% to 13.3p, interim dividend 5.5p. | AMBER/GREEN (Mark) My concerns over the company’s move towards “DeFi” remain. However, client trading activity appears to be growing and improving Net Operating Income mostly dropping through to the bottom line. This means that today’s upgrade should drive a significant upgrade in EPS. Although the share price has responded in kind today, the value metrics remain compelling. While perhaps the biggest concern for quants - the very low Momentum Rank - will be corrected by this upgrade. As such, I think it makes sense to take a more positive view here. | |

Everplay (LON:EVPL) (£497m | SR78) | Mikkel Weider will become CEO from 1 January 2026. | ||

MHA (LON:MHA) (£474m | SR92) | H1 Revenue +13.2% to £121.3m, Adj. EBITDA +10.7% to £21.8m, Adj PBT +8.8% to £18.5m. | ||

Hollywood Bowl (LON:BOWL) (£453m | SR42) | CFO Laurence Keen becomes CEO of Canada division, Antony Smith will join the Board and leadership team as CFO on 2 February 2026. | ||

PayPoint (LON:PAY) (£412m | SR69) | H1 Revenue +6.7% to £144.1m, Adj. EBITDA -0.5% to £37.3m, u/l EPS - 2.6% to 26.7p. Net debt £84.0m (25H1: £86.8m). | BLACK (AMBER) (Graham) | |

Mountview Estates P.L.C. (LON:MTVW) (£361m | SR28) | H1 Revenue +1.3% to £37.9m, PBT -14.4% to £15.5m, EPS - 14.1% to 298.8p, Net assets flat at £103.5/share. | ||

Origin Enterprises (LON:OGN) (£349m | SR99) | Q1 Revenue +3.6% to €486.5m. | ||

PZ Cussons (LON:PZC) (£286m | SR61) | 26H1 LFL revenue growth +9%, due to growth of over 25% in Africa, driven by both price and volume. | ||

Norcros (LON:NXR) (£263m | SR84) | HY Revenue +1.3% to £184.3m (+0.8% CCY), U/L Op. Profit +7.4% to £21.9m, U/l EPS +11% to 16.2p, Net debt £30.7m (25 HY: £44.9m). | ||

McBride (LON:MCB) (£197m | SR78) | Currently anticipates that adjusted operating profit for the full year to June 2026 will be in line with analysts' expectations (adjusted operating profit for FY26 of £64.3m). | ||

Begbies Traynor (LON:BEG) (£184m | SR87) | Revenue +7% and adj. PBT +5%, Net debt £5.7m (30 Apr: Net cash £0.9m) | ||

Liontrust Asset Management (LON:LIO) (£181m | SR81) | Adj. PBT £15.7m (H1 last year: £25.8m). AUM sees £2.3bn of net outflows, falls to £22.0bn (from £22.6bn). £1.5m of cost savings to be delivered by June 2026. £10m share buyback (“Company's shares are significantly undervalued”). | AMBER/GREEN (Mark)

The very low Momentum Rank gives me pause for thought. However, in my opinion we are probably close to the bottom for UK equity outflows. AUM has stabilised here, and should benefit from a reversal in moves towards passive investing, plus any initiatives like a British ISA. As such I’m happy to keep our mostly positive view. | |

GreenX Metals (LON:GRX) (£115m | SR7) | High-grade copper intercepts, incl 1.5m at 2.7% copper & 55g/t silver | ||

Tracsis (LON:TRCS) (£95.9m | SR50) | FY Revenue +1% to £81.9m, Adj. EBITDA - 1% to £12.6m , Adj. EPS -1% to 24.8p, Cash £23.4m (FY24: £19.8m). | ||

Solid State (LON:SOLI) (£78.2m | SR48) | Custom Power, has secured several major orders with a total value of $7.4 million since end Sep. | ||

Ilika (LON:IKA) (£77.8m | SR30) | Expects 6m revenue £0.6m (H1 2024/5: £1.0m), EBITDA loss, excl SBP, expected to be £3.2m (H1 2024/5: loss of £1.9m). Cash £6.9m (H1 2024/5: £10.1m). | ||

Inspecs (LON:SPEC) (£71.8m | SR82) | Trading improved in October, with Tura recording stronger than expected sales and order books at the end of October 10% up on prior year. | BLACK | |

Naked Wines (LON:WINE) (£52.2m | SR85) | Performance has continued to be in line with FY26 guidance (revenue £200- £216m, adjusted EBITDA £5.5 - £7.5m, net cash £35 - £39m. | ||

hVIVO (LON:HVO) (£40.5m | SR43) | £5m early-phase clinical trial service contracts have been signed with five clients, including two returning mid-sized German pharma customers, since September. | ||

Cobra Resources (LON:COBR) (£34m | SR17) | Tests demonstrate that up to 90% of cerium can be removed from the aqueous solution before MREC precipitation. | ||

Artisanal Spirits (LON:ART) (£28.7m | SR20) | $3.2m of SMWS America shipments which were due to ship in November 2025, will be unable to clear US customs before the end of the year. Non-cash impact on the reported results for FY25 of c.£2.5m of revenue and c.£2m of EBITDA | BLACK | |

Poolbeg Pharma (LON:POLB) (£25.7m | SR19) | European Patent Office has granted Poolbeg's European Immunomodulator II patent application covering POLB 001 for the treatment of severe influenza. | ||

Ampeak Energy (LON:AMP) (£25m | SR22) | Has received the final tranche of £3.5m of the £8.5m loan | ||

Powerhouse Energy (LON:PHE) (£22.6m | SR3) | All three patents have now been granted to the Company in the US, one outstanding in Indonesia and two in Australia. | ||

Nanoco (LON:NANO) (£18m | SR17) | Gross amount agreed to be paid by LG to Nanoco is $5m. Litigation costs incurred by Nanoco to date total $0.6m | ||

Great Southern Copper (LON:GSCU) (£17.1m | SR2) | 32.5m gross raised by issue of 99.64m new shares at 2.5p, 10% discount to 20-day VWAP | ||

Europa Oil & Gas (Holdings) (LON:EOG) (£17m | SR33) | Granted a 5-year extension to the DL003 licence which holds the Company's West Firsby asset, as such the licence will now expire on 31 December 2030 | ||

Power Metal Resources (LON:POW) (£14.7m | SR62) | Diamond drill hole PR25_04A indicates a strong radiogenic lead signature typically associated with uranium mineralisation within a major fault structure. | ||

Eden Research (LON:EDEN) (£11.5m | SR21) | 3LOGY (predominantly known as Mevalone® outside of Italy) has been granted approval by the Italian authorities for use on numerous new crops in order to control Botrytis and a range of new diseases, including powdery mildew and Sclerotinia. | ||

@88E (£11.5m | SR20) | Fourteen new leases secured covering approximately 34,560 acres |

* Market caps at previous trading day’s close

Graham’s Section:

Games Workshop (LON:GAW)

Up 11% to £178 (£5.9bn) - Trading Update & Dividend - Graham - GREEN

Pleasant news from two brief RNS announcements. Firstly:

Games Workshop announces a trading update for the six months ended 30th November 2025. The Board's estimate of the results for the six months to 30 November 2025, at actual rates, is core revenue of not less than £310 million (2024/25: £269.4 million) and licensing revenue of not less than £16 million (2024/25: £30.1 million). The Group's profit before tax ("PBT") is estimated to be not less than £135 million (2024/25: £126.8 million).

Let’s put these figures in the context of existing full-year consensus forecasts, remembering that GAW doesn’t provide guidance to the City in a conventional way.

Full-year revenue forecast: £611m.

Full-year PBT forecast: in the region of £230m.

The combined licensing and core revenue in H1 is £326m (with the licensing element being almost pure profit with few costs attached), so that’s over 50% of the full-year forecast. PBT for H1 is at least £135m, again well over 50% of the full-year consensus forecast.

The result: shares up by over 10% today, as the company continues to excel financially.

Dividend news:

The Board has today declared a dividend of £1.00 per share taking dividends declared so far in 2025/26 to £3.25 per share (2024/25: £1.85). This is in line with the Company's dividend policy.

The financial year ends in May, so there is still plenty of time for more of these. Total dividends declared in the previous financial year were £5.20, with dividend declarations in July, October, December, January and March. As with its financial guidance, Games Workshop tends to do its own thing when it comes to dividends - although based on the recent pattern, I’d look for one declaration in January and then another in March.

Graham’s view

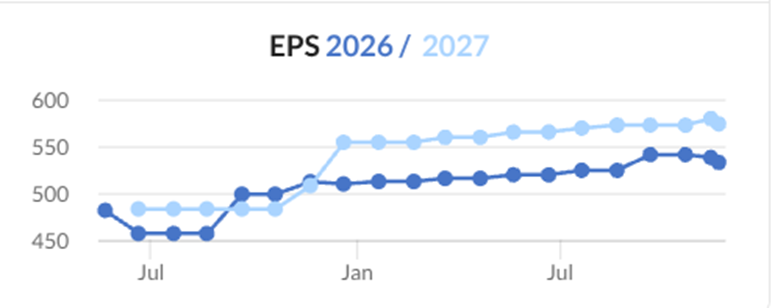

I was positive on this in July at a share price of £162. It’s a little bit more expensive now, but of course the EPS forecasts are higher now, too:

When it comes to exceptional companies and long-term winners, sometimes it’s best not to overcomplicate things. I’m going to stay positive on this today. Superman actor Henry Cavill is said to be producing and starring in Amazon’s new Warhammer TV show, although this may be years away from release. Something to look forward to, at least. The stock is trading at 29x earnings which I still do not consider to be overvalued, given the exceptional nature of the business and management. QualityRank is a perfect 100.

PayPoint (LON:PAY)

Down 16% to 544p (£345m) - Half Year Results - Graham - AMBER

The H1 numbers aren’t that bad for a stock on a cheap rating…

Net revenue +0.1% (£84.7m)

Underlying PBT down 4.5% to £25.7m

With higher adjusting items, actual PBT falls 14% to £19.9m.

Net debt is £84m, little changed year-on-year.

But they acknowledge “a generally weak economy and some specific business challenges”:

We expect underlying EBITDA for FY26 to be ahead of last year and broadly in line with current market expectations. While we continue to make progress towards delivering underlying EBITDA of £100 million in the current financial year – which remains a key financial objective the business is confident of reaching – it is likely we will take longer to do so.

“Broadly” means “below”, except in very rare circumstances (see yesterday’s report!). Two major challenges are presented: the Yodel/Inpost merger on the one hand, and slow progress at Obconnect on the other. Issues at Yodel/Inpost were reported by the BBC in September after many customers expressed dismay online (e.g. this Reddit thread).

Estimates

Thanks to Panmure Liberum for publishing on PayPoint today. We have the following updated forecasts:

FY March 2026 EPS forecast cut by 4% to 73.3p

FY March 2027 EPS forecast cut by 11% to 80.2p

With FY26 ending in a few months, it makes sense for the market to focus on what’s happened with the FY27 forecast, and mark the share price accordingly. While today’s 16% price drop does seem harsh, I can understand that investors might be particularly disappointed with obconnect, seeing as it's one of the growth areas within the business. It’s still very early days here: Obconnect revenues in H1 were just £1.9m (H1 last year: zero), i.e. 2% of PayPoint’s total net revenues. Panmure still expects PayPoint to hit its £100m EBITDA target in FY27. This milestone was not expected in FY26 anyway.

Graham’s view

There’s no getting away from the disappointment involved here. PayPoint seems to attribute blame to Inpost for the disruption at this parcel network, but PayPoint also has to accept responsibility for the “less favourable commercial terms” it agreed to as part of this deal, which it was willing to do so on the basis that it expected volumes in the combined Collect+ network to increase.

Unfortunately, volumes have gone the wrong way as the disruption experienced by customers has inevitably dented their enthusiasm to keep using the service:

We believe the immediate impact of this operational disruption has now reduced, largely managed through proactive actions from the two businesses and we expect to see volumes through the Collect + network recover as we move into the traditional peak trading period.

There must be a risk that customers are unwilling to risk sending Christmas presents through the network in November/December, with the service having just had major issues in September.

Embarrassingly, this is a watchlist stock for me and a company where I’ve been a long-term fan and previously a shareholder. My positive view expressed in September can’t be maintained after a profit warning like this, at least not in the short-term, so I’ll cut our stance today all the way to neutral.

Having said that, I calculate the P/E as 7x based on the new FY27 EPS forecast. And I don’t think the news today greatly invalidates the long-term worth of the business, even if it does face some serious challenges in the short-term. If you’re a long-term investor and a contrarian like me, you might be tempted - I am! But in the short-term, consistent with our understanding of profit warnings, I’m neutral.

Mark’s Section:

CMC Markets (LON:CMCX)

Up 23% at 255p - Interim Results - Mark - AMBER/GREEN

The market has liked these results this morning from this spreadbet and investing products supplier. The numbers themselves are not particularly impressive:

Net Operating Income is up 5% but PBT is essentially flat. With costs rising by a similar amount:

Total operating expenses were £136.5 million (HY2025: £123.9 million), reflecting a further £5.2 million provision for industry-wide margin netting in Australia, concluding the remediation due on this matter. Excluding this, costs remained well managed and in line with internal expectations

Margin netting in is the practice of offsetting multiple financial obligations to arrive at a single net amount, which reduces risk and capital requirements. However, the practice of "margin discounting" for retail clients has been prohibited by the Australian Securities & Investments Commission (ASIC). The view is that this leads to excessive leverage and may lead to unexpected margin calls. Because consumers are considered to have been harmed by this practice, companies that operated this, such as CMC, have to make consumer redress. This should be a limited amount rather than an ongoing cost. Although I am always a little but sceptical when a company declares that this is fully provisioned. There are plenty of examples, such as PPI and phone-hacking, where the eventually redress was many times the original expectations of the companies involved.

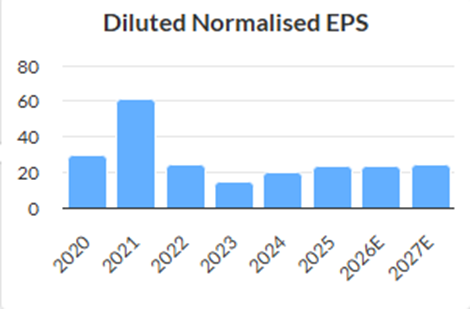

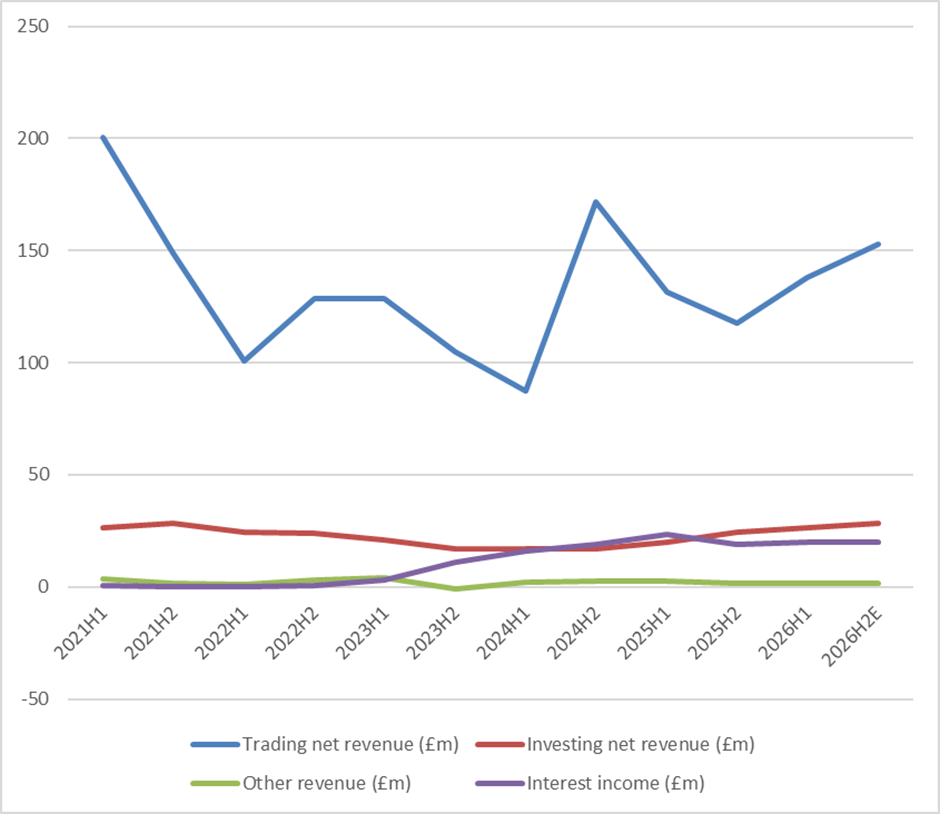

Costs are always a concern here as CMC Markets have a history of spending big on developing new products. The share price dropped below £1 in late 2023 as a period of weaker Net Operating Income coincided with a period of increased investment in a new non-leveraged UK platform:

The combination lower NOI and higher costs led to a significant drop in EPS:

EPS and the share price only recovered when this IT spend was reigned in. As far as I can tell, the unleveraged platform has never gained any traction in the UK.

It is this history that also means I get worried when I read things like this:

As announced at our FY2025 results in June, we are pushing aggressively into Web3 technology because of the pending decentralisation of financial markets (DeFi) through product tokenisation, blockchain, multiasset wallets and stablecoin clearing and payments. DeFi is going to redefine the financial markets allowing clients to seamlessly trade thousands of financial products in real time, twenty-four hours a day, 365 days a year. Products will not just be limited to cryptocurrencies but all major financial products, including shares, FX, commodities, indices and options.

In my opinion Cryptocurrencies are currencies, but they are bad ones. Their volatility largely makes them unsuitable for the main functions that a currency should accomplish, namely:

- a medium of exchange for goods and services,

- a unit of account to measure value,

- a store of value for saving, and

- a standard of deferred payment for future transactions.

However, that volatility makes them excellent instruments for speculation, and it is surely this factor that means CMC and other similar companies are aggressively pursuing this area. I believe this opens them up to several risks beyond just IT overspend, including increased hedging risk, and regulatory risk. The more that CMC looks like a pure gaming company and the less like an investment business, the more scrutiny it may come under from the Exchequer.

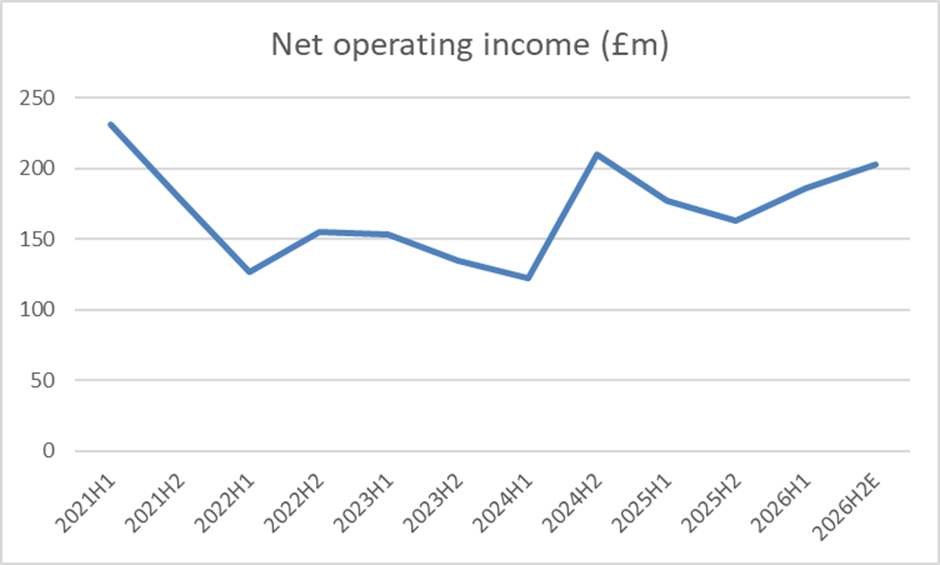

None of that matters in the short-term as the good news today is that H2 is trading better than expected:

As a result - and following a strong start to H2, including the significant growth of our neobank API business - the Group now expects net operating income to be approximately 10% ahead of current market expectations for FY2026

With them giving the expected size of the upgrade and the current consensus (£353.9m) it makes it easy to estimate H2 NOI of around £203m. Putting this in a historical context, this is a decent improvement compared to last year:

Based on recent trends form the Investing side of the business, I can also guesstimate how this is split:

All things being equal, an additional 10% of NOI from Trading Revenue should drop straight to the bottom line, giving a £35m boost to operating profit. However, there is also updated guidance on costs in today’s update:

FY2026 operating expenses expected to be marginally ahead of consensus, predominantly due to the Australian remediation

So this is ahead, but in a bad way! However, with this linked to the Australian remediation, with £5.2m provisioned in H1. So overall, I’d guess costs can’t be more than £10m above consensus including some extra variable remuneration, meaning at least a £25m increase in PBT. Using H1 tax charge of around 27% this gives an additional £18m of PAT. I am expecting EPS to be upgraded by around 26%, which explains why the share price has been so strong in response today.

I would imagine that brokers will also upgrade forecasts for FY27, which were for flat EPS on FY26 by a similar amount. This means that the valuation metrics largely stay the same today:

The cash balance is down slightly, but not enough to cause concern. This remains a company with significant net cash, although not all of that will be distributable, due to the need to keep regulatory capital on hand. This means that Value Rank will remain high, but perhaps more importantly the Momentum Rank will take a much-needed leap once the current figures are crunched by the algorithms:

Mark’s view

My concerns over the company’s move towards “DeFi” remain. However, client trading activity appears to be growing whether it is driven by “TradFi” or “DeFi”. The ability for improving NOI to mostly drop through to the bottom line means that today’s upgrade in NOI expectations drives a significant upgrade in EPS. Although the share price has responded in kind, the value metrics remain compelling. While perhaps the biggest concern for quants - the very low Momentum Rank - will be corrected by this upgrade. As such, I think it makes sense to take a more positive view here of AMBER/GREEN. However, I remain wary of any signs of cost overruns, given their history.

JD Sports Fashion (LON:JD.)

Down 3% at 78p - Q3 2025/26 TRADING STATEMENT - Mark - AMBER/GREEN

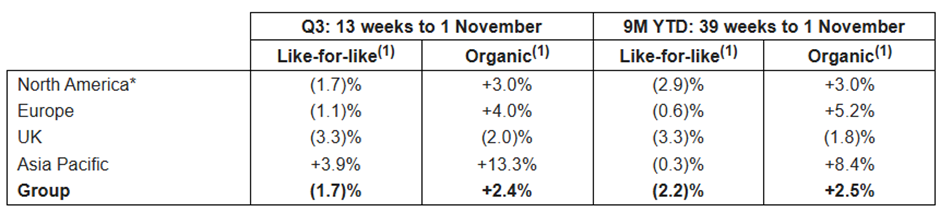

While organic sales figures here are ok, any growth coes form store openings, with like-for likes down:

North America and Asia Pacific show some improving trends in Q3 versus H1 but it is not enough to avoid a mild profits warning:

Mindful of incrementally weaker macro and consumer indicators in recent weeks, we are taking a pragmatic approach to the FY26 outlook ahead of our peak trading period in Q4. Anticipate FY26 profit before tax and adjusting items (PBTAI) to be within the lower end of current market expectations(3,4)

Helpfully, they quantify these as “FY26 PBTAI is £871m, with a range of £853m to £888m”. The market appears to have largely expected this as the share price has come off around 25% from its October peak:

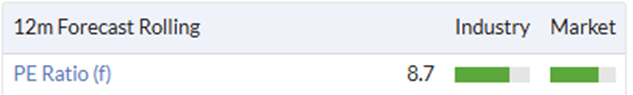

It is also worth noting that the range was quite tight here,and a shift from £871m to £853m is only a 2% downgrade. This means the valuation metrics largely stay the same:

The Momentum Rank may take a slight hit from this downgrade, but it is likely to remain a highly-ranked stock:

Mark’s view

Following their HY results in September, I was happy to keep our mostly positive view of AMBER/GREEN. The share price then was 88p and today it is 78p, so I don’t see that, what works out to be roughly a 2% drop in PBT expectations, should change this. It is undoubtedly a very tough retail environment and I can easily see a further downgrade coming. However, I believe that if it does, it will be slight and may indeed mark the nadir for short-term consumer sentiment. As such, this near-term concern doesn’t overcome my belief that 6-7x earnings is a very cheap price to pay for a business as well run as this. Apart from leases, this is business without any real leverage. This, plus their cash generation, could easily enable them to take advantage of weak conditions to acquire further retailers on the cheap.

Liontrust Asset Management (LON:LIO)

Up 4% at 293p - Half-year Financial Report - Mark - AMBER/GREEN

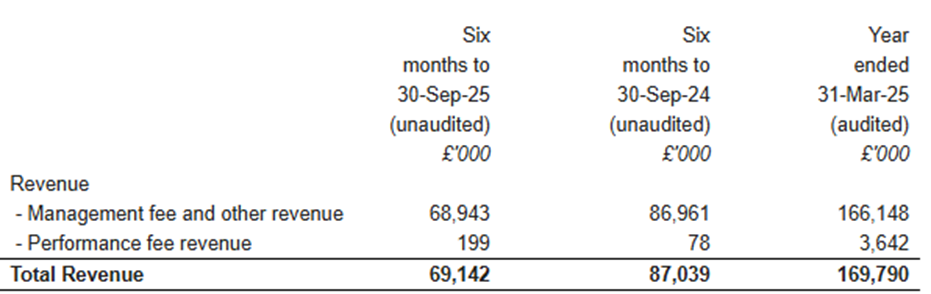

It is a pretty big drop in profitability in H1 with Adjusted PBT dropping 40% to £15.7m. Management fees are down, and performance fees are negligible (although they were in 25H1 too):

This is driven by both lower AUM and fee compression:

However, there are signs of stabilisation: with AUM flat at 12 November at £22.0bn and them saying:

The engagement with clients has strengthened our confidence in the outlook for flows. The engagement and strong Liontrust brand engender both loyalty in existing clients and, allied to distinct processes and long-term performance, will lead to increased flows in time. This is demonstrated by recently winning two institutional mandates in aggregate of around £250 million which will soon be funded.

It seems that high concentration of global stock markets in US megacaps on historically high valuations is giving investors pause for thought around passive investing (and rightfully so, in my opinion).

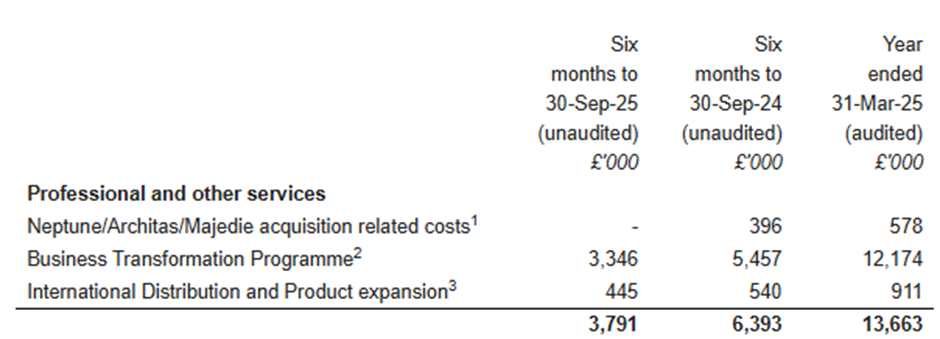

The statutory results are even worse, and while many are standard such as the amortisation of acquired intangibles, and severance costs are almost zero in this half, there remains a large ongoing charge for Business Transformation, which they choose to adjust out:

They claim this is all explained in the Chair’s statement but I can’t see anything. Things like this are usually large software systems such as the dreaded ERP implementation, but spending such huge sums without explaining the costs and benefits in the accounts looks remiss to me.

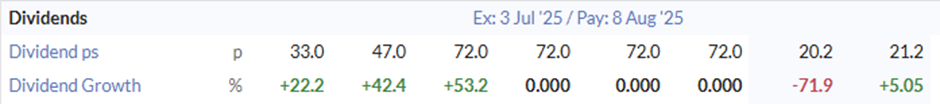

This is a company that paid a huge dividend for a number of years but ultimately was forced by ongoing market conditions to slash it by over 70%:

Their interim dividend is now declared at 7.0p versus 22p the year before. However, they also feel that they have additional spare capital:

As at 30 September 2025 the Company had surplus capital after foreseeable dividends of over £30.3 million (as set out in note 1d below). In accordance with our new Capital Allocation Policy and the Board's belief that Company's shares are significantly undervalued, the Company will initiate a share buyback programme with an aggregate value of up to £10 million, to be phased over the period to 30 June 2026. The shares purchased by the Company will be cancelled.

This is 5.6% of the current market cap, so while it isn’t huge, it will add shareholder value to those who agree that they are undervalued. Despite an analyst consensus that looks like this:

I am inclined to agree with them. With huge UK equity outflows in response to budget fears in October, that money may have come out of the market, but may well head back into it when we have greater clarity. Plus initiatives like a British ISA or mandating the default allocation of DC pension contributions as a proportion of UK stocks, if they also arrive in the budget, could have a positive impact on flows and sentiment here.

Mark’s view

The very low Momentum Rank gives me pause for thought. However, in my opinion we are probably close to the bottom for UK equity outflows, and as such I’m happy to keep our AMBER/GREEN view.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.