Good morning!

Wrapping it up there, thanks everyone! Spreadsheet accompanying this report: link (last updated to: 10th November).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

BHP (LON:BHP) (£113bn | SR94) | Agreement with Global Infrastructure Partners, a part of BlackRock, in relation to BHP's share of Western Australia Iron Ore's inland power network. GIP will provide $2 billion in funding for 49% stake. BHP retains full operational control. | ||

British American Tobacco (LON:BATS) (£94.2bn | SR72) | Full-year delivery remains on track. Now expects c.2% revenue and adjusted profit from operations growth for FY25. On track to reduce leverage to within 2.0-2.5x by end 2026. Buyback for 2026 increased to £1.3bn. | AMBER/GREEN = (Graham holds) This has been a comfortable hold for me for many years, paying large and consistent dividends even if capital gains have been harder to come by. The company's balance sheet has gradually improved and this has been reflected in a higher share price and earnings multiple (12x), and buybacks are becoming more aggressive and meaningful (more than 1% of the company's market cap being bought back annually). This helps to boost modest adjusted profit growth into more meaningful EPS growth. With a range of impressive brands in vaping, heated tobacco and nicotine pouches, BATS seems reasonably set up for the future and I therefore continue to hold it in anticipation of a reasonable total return. | |

Ashtead (LON:AHT) (£20.1bn | SR75) | H1 revenue, profit and free cash flow in line with expectations. H1 revenue +1%, adj. PBT -4% ($1,208m). Reaffirming full-year rental revenue, capex, and free cash flow guidance. Primary listing on track to move to NYSE in March 2026. | ||

Frasers (LON:FRAS) (£2.95bn | SR96) | Swindon Designer Outlet totals 250,000 sq. ft. The acquisition “highlights Frasers Group's steadfast approach to expanding its property portfolio”. | ||

Pennon (LON:PNN) (£2.52bn | SR40) | The new CEO’s notice period will end by June 2026. Outgoing CEO leaves December 2025. Chair will be Executive Chair during the interim period. | ||

Derwent London (LON:DLN) (£1.81bn | SR60) | Burberry's lease has been extended from 2038 to 2043 (without breaks), increasing the unexpired term to 17.6 years. Two new five-yearly fixed uplifts replace the previous 2033 rent review and 2038 expiry. | ||

Chemring (LON:CHG) (£1.31bn | SR58) | Revenue +2%, underlying operating profit +5%, PBT +31% (£67.7m). Net debt increases to £89m, driven by capital investment. Record order book. Expectations for 2026 operating performance remain unchanged, but with higher capex and finance charges. | ||

Moonpig (LON:MOON) (£675m | SR62) | SP +4% Revenue +6.7%, adjusted PBT +11.4% (£30.5m). £30m buyback completed, intention for £60m during the year. Overall trading performance in line, full year expectations unchanged. | AMBER/GREEN = (Graham) Overall, I’m inclined to leave our AMBER/GREEN unchanged today. I like the business and I like the stock. And I don’t think the valuation at £700m is unreasonable for new buyers (P/E multiple of 14x on current-year earnings). If it was unlevered, I’d be fully GREEN. But as I continue to perceive it as somewhat risky, I prefer a slightly more measured take. | |

Allergy Therapeutics (LON:AGY) (£657m | SR38) | Preliminary safety data from 48 participants demonstrate that a 2000-fold increase in dose of VLP Peanut has been safe and well tolerated. | ||

Thungela Resources (LON:TGA) (£525m | SR95) | Confident to achieve approximately 13.7Mt of export saleable production for FY25, above the guidance range of 12.8Mt to 13.6Mt. Benchmark coal prices have weakened. Net cash at 31 December 2025 is expected to range between R4.9 billion and R5.2 billion. “Cash preservation measures are required to remain cost competitive while maintaining balance sheet flexibility.” | ||

Applied Nutrition (LON:APN) (£500m | SR47) | SP +10% Strong momentum has continued and is also reflected in the current order book. Now expects that FY26 results are likely to exceed current market consensus estimates by approximately 10%. Expectations were: revenue of £122.3m and adjusted EBITDA of £34.4m. | GREEN ↑ (Graham) [no section below] Pleased to see that I upgraded my stance on this last time and I'll do it again today on the back of very impressive news. I'm now fully breaking my IPO rule to be cautious of newly-issued shares - APN was listed in October 2024, less than two years ago. But I guess rules are there to be broken! Please check my comments in September where I gave a list of reasons for thinking positively of this share. As far as today's update is concerned, not many details are given beyond that strong trading momentum has continued and that they are now forecasting a c. 10% beat for FY July 2026. It's an early stage of the year to make such a forecast so I wouldn't count on this being too precise, but if EPS did turn out to be 11.1p then the shares are now trading just a smidgen (this is a financial term) below a 20x P/E. For a fairly well-known consumer brand that is trading profitably with clean accounts, I don't view this as overpriced. | |

Metals Exploration (LON:MTL) (£381m | SR98) | Development and construction activities at La India continue to advance on schedule. Development was 24% complete at the end of November compared to the 20% forecast. | ||

Restore (LON:RST) (£326m | SR52) | FY25: full year adjusted profit before tax for continuing operations expected to be ahead of current market consensus on a continuing basis. FY26: despite £1m increase in business rates, adjusted profit before tax will be ahead of current market consensus. | ||

Henry Boot (LON:BOOT) (£298m | SR85) | Sales in North Yorkshire and Suffolk by Hallam Land. Boot CEO: “These transactions take the total plot sales for the year to 3,591, and demonstrates that housebuilders remain keen to acquire well located, consented land." | ||

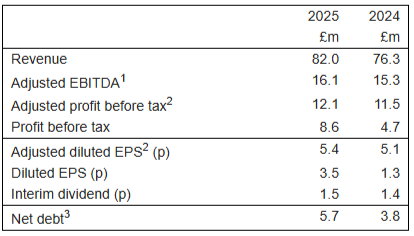

Begbies Traynor (LON:BEG) (£177m | SR84) | H1 Revenue +7% to £82m, Adj. EBITDA +5% to £16.1m, Adj. PBT +5% to £12.1m, Adj. EPS +6% to 5.4p. Net debt £5.7m (24H1:£3.8m). Confident of delivering full year results in line with current market expectations. | AMBER/GREEN = (Mark) | |

Stelrad (LON:SRAD) (£172m | SR80) | Renewed £100 million Facility is for an initial three-year term, with an extension option for two further years. Debt leverage ratio is expected to improve further during the year supported by strong cash management (2024: 1.37x). | ||

Gateley (Holdings) (LON:GTLY) (£140m | SR50) | H1 Revenue +9.3% to £94.3m (organic +8.6%), u/l PBT -10% to £9.5m, Net debt £19.6m, Interim dividend held at 3.3p. Management is confident of meeting full year consensus expectations. | ||

Kistos Holdings (LON:KIST) (£122m | SR47) | Entered into a binding agreement to acquire a 5% WI in Block 9 and a 20% WI in Blocks 3 & 4 from Mitsui E&P Middle East B.V., both located onshore in the Sultanate of Oman for $148 million, effective 1st Jan 2025. Expected to add 25.6 mmboe of 2P reserves net to Kistos at $5.80/boe of 2P reserves. Additional estimated production of approximately 9,000-10,000 boepd net to Kistos in 2025. | ||

Scancell Holdings (LON:SCLP) (£106m | SR16) | Progression free survival (PFS) of 74% at 16 months compares favourably to standard of care PFS of 50% at 11.5 months. | ||

Pharos Energy (LON:PHAR) (£79.7m | SR79) | Year to date average production of 5,391 boepd net, in line with 2025 guidance of 5,200 to 6,000 boepd. We expect full year production to be in line with the YTD average production. Cash balances at 7 December 2025 of c.$16.6m (31 Dec 2024: $16.5m). | ||

Venture Life (LON:VLG) (£77.2m | SR50) | Completed the sale of its Ultradex and Dentyl brands for an enterprise value of up to £4.5 million on a cash free, debt free basis to Covestus Holdings. | ||

Naked Wines (LON:WINE) (£51.3m | SR81) | H1 Revenue -20% to £89.5m, Adj EBITDA +112% to £3.6m. LBT £3.0m (25H1: £5.6m loss). Performance is continuing in line with FY26 guidance. | ||

Oxford Metrics (LON:OMG) (£48.8m | SR71) | Revenue +8% to £44.8m, Adj. EBIT +29% to £2.2m, Adj. EPS -49% to 1.55p, dividend held at 3.25p. Cash £37.3m (FY24: £50.7m). Q1 trading to date in line with the Board's expectations. | AMBER/GREEN ↑ (Mark - I hold) Varied approaches to adjustments and forecasting make it difficult to determine exactly how in-line these results were. However, there are several positive signs that make it look like the worst is in the past for this high-margin business. Incremental half-on-half revenue growth at Vicon, plus a 21% increase in order intake, and cost-cutting returned them to positive EBIT. At Smart Manufacturing they delivered 38% organic revenue growth, in a manufacturing market that declined during the period, and this business is starting to make a meaningful contribution to the group. As such, a forward EV/EBIT of around 4 makes this look too cheap, and I am tentatively upgrading our view to reflect those improving signs. | |

Cobra Resources (LON:COBR) (£42.4m | SR18) | Additional test work by the has shown that 100% of the (low value and relatively abundant) cerium content can be removed from the PLS at ambient temperature and pressure with minimal loss of the high-value magnet and heavy REEs (principally dysprosium and terbium). | ||

Ariana Resources (LON:AAU) (£35.7m | SR32) | Hongkong Xinhai Mining Services to provide the Company with A$8m in immediate funding and to conduct a Metallurgical Sampling and Testwork Programme and to progress the Definitive Feasibility Study at the Dokwe Gold Project. | ||

Renalytix (LON:RENX) (£29.5m | SR9) | “While the timing of commercial outcomes-particularly with large healthcare systems-remains difficult to predict, the Board and management are confident that the foundations being put in place today position the Company well for sustainable revenue growth, increased operating leverage, and long-term value creation for shareholders.” | ||

Insig Ai (LON:INSG) (£27.5m | SR4) | H1 Revenue +164% to £438k, Operating Loss £1.1m, Cash £0.03m (24H1:£0.23m), £1m raise post-period end. | ||

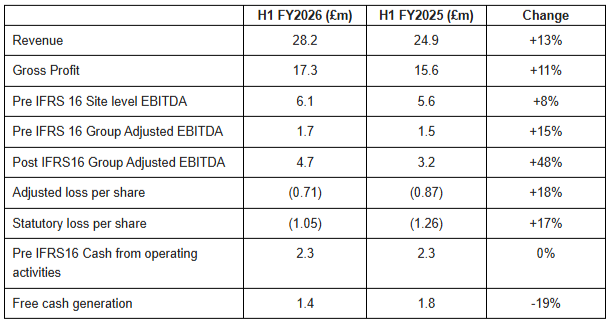

XP Factory (LON:XPF) (£20.1m | SR31) | H1 Revenue +13% to £28.2m, Adj. loss per share 0.71p (25H1: 0.87p loss). Net debt £5.3m (31 Mar: £4.9m) Budget outcome expected to be neutral to modestly positive after detailed evaluation with net lower business rates offsetting higher than planned NLW increases. CFO leaves at the end of the FY. | AMBER/RED = (Mark) With much to do to hit FY forecasts following these interim results, and doubts over whether their pursuit of revenue growth will ever deliver acceptable shareholder returns, I don’t see any reason to change our previously negative stance. While the CFO leaving looks planned, it also raises questions why he would choose to exit now if they were just on the cusp of very rapid growth in profitability. | |

Tungsten West (LON:TUN) (£19m | SR19) | £4.0 million Bridge Facility from existing investors will provide sufficient working capital to enable progress toward the conclusion of the debt and equity elements of the Project Financing. | ||

Sareum Holdings (LON:SAR) (£17.9m | SR3) | “With strengthened intellectual property, a clear operational roadmap, active business development initiatives, and sufficient financial resources, the Company enters the new period with confidence and a clear set of value-creating milestones ahead.” | ||

IXICO (LON:IXI) (£10m | SR35) | Revenue +13% to £6.5m, LBITDA £1.3m (FY24: LBITDA £1.7m), Cash £3.5m (FY24:£1.8m) after £3.7m net raise. “... we enter 2026 with confidence and excitement.” | ||

Diales (LON:DIAL) (£9.4m | SR82) | Revenue flat at £43m, u/l PBT +17% to £1.4m, Net Cash £3.0m (FY24: £4.3m), dividend flat at 1.5p. |

Graham's Section

Moonpig (LON:MOON)

Up 4% to 223p (£702m) - Half-year Financial Report & CEO succession update - Graham - AMBER/GREEN =

We’ve been moderately positive on this one, and so far at least, that stance appears to be working out in terms of the company’s financial performance - although the share price has been static.

Some key bullet points from today’s interim results:

H1 revenue +6.7% (£168.6m)

Gross margin reduces from 59.2% to 57.6%

Adjusted PBT +11.4% to £30.5m

Actual PBT moves from a £33.3m loss to a £26.6m profit.

It’s a clean profit figure, with nearly 90% of the adjusted PBT figure converting into real PBT.

The stock now offers a modest dividend yield (with its first dividend having been announced last year), and the interim payment gets boosted by 25% to 1.25p.

The company clearly feels that it’s time to start returning money to shareholders, and it continues to target a £60m buyback - very substantial relative to the size of the company, and its market. Half of that was achieved in H1.

Net debt has consequently increased from £96m (April 2025) to £124m (October 2025).

Only a very small portion of that figure (£12.2m to be precise) relates to leases; the net debt is primarily made of ordinary bank borrowings.

The leverage multiple as calculated by the company, and including leases, is 1.24x, which is considered modest leverage in a banking context. So we can understand why the company feels bold enough to carry out this large buyback.

Also, there is “seasonally strong cash generation” in H2, and the leverage multiple is expected to fall back to 1x by April 2026. 1x is their medium-term target.

CEO comment:

"We have delivered a strong first half, with continued momentum at the Moonpig brand complemented by a return to growth at Greetz. Customers are engaging more deeply than ever - more than 50% of customers are now using our innovative creative features to make their cards ever more personal - and our Plus subscriber base continues to grow. Experiences has also shown encouraging recent trading, with improved performance in the second half to date, including across Black Friday. This strong momentum across the Group, together with our sustained investment in innovation, data, and AI, has underpinned our strong EPS growth…

As we’ve noted before, the performance of Moonpig’s divisions has been very mixed: the core Moonpig brand is strong (+9.4%), Greetz in the Netherlands is muted (+1.3%), while Experiences is in decline (-8.9%). The company says that recent improvements in its Experiences division “were not reflected in H1 revenue”, but that its performance has improved in H2.

Outlook: in line.

Overall Group trading performance has remained in line with our expectations since the start of the second half. Growth remains underpinned by consistent strong revenue growth at Moonpig and positive trading momentum at Greetz. Current trading at Experiences has been encouraging, with improved performance in the second half to date. Our expectations for the full year remain unchanged.

Graham’s view

I’ve found this share quite interesting, as it’s a well-known, trusted consumer brand with a leading market position in two markets (UK and the Netherlands) - this already puts it in a premium category.

So I’m already inclined to rate it more highly than average. The questions then become a bit more complicated: growth prospects, management skill and financial quality.

In terms of growth, I am inclined to view personalised cards as a long-term growth opportunity - it will only become more affordable and more accessible over time.

Management skill? A bit more complicated, but I think this is also a positive factor. The company will soon be getting a new CEO, who is the current COO of Auto Trader.

I like this hire, as Auto Trader is another trusted online brand. The new CEO takes up her role in March 2026.

Finally, financial quality: again, I have a mostly positive view. I have viewed the buyback as slightly aggressive and perhaps unnecessary, but I don’t have a huge problem with it.

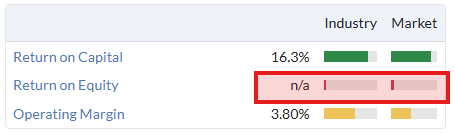

In terms of quality metrics, the company has suffered from large impairments which have hurt its statutory results and also its metrics.

If the company generates over £52m of after-tax net income in the current year, as expected, it will have done that despite having balance sheet equity of minus £50m (October 2025 figure).

Indeed, write intangibles down to zero and the company has balance sheet equity of minus £184m.

The company enjoys a very large and negative working capital balance, which is considered a desirable/lucky place for a company to be, as suppliers fund the business. Current assets are £30m, while current liabilities (excluding debts/leases) are about £95m.

Overall, I’m inclined to leave our AMBER/GREEN unchanged today. I hope I’ve made it clear that I like the business and I like the stock. And I don’t think the valuation at £700m is unreasonable for new buyers (P/E multiple of 14x on current-year earnings).

If it was unlevered, I’d be fully GREEN. But as I continue to perceive it as somewhat risky, I prefer a slightly more measured take.

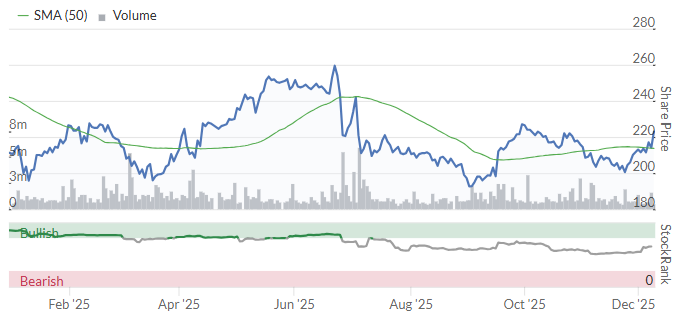

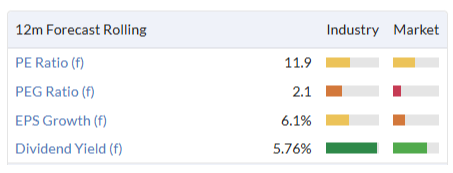

British American Tobacco (LON:BATS)

Down 2% to £42.18 (£92bn) - 2025 H2 Pre-Close Trading Update - Graham - AMBER/GREEN =

(At the time of publication, Graham has a long position in BATS shares)

At the half-year results, BAT said it was expecting “Revenue growth at the top end of 1.0-2.0% guidance range”.

It confirms this today with 2% revenue growth expected, along with 2% growth in adjusted profit from operations.

One thing to watch out for: “adjusted” means “adjusted for Canada”. The company was hit by a major lawsuit there, which was settled this year. It will be fascinating to see what the unadjusted results look like!

Other key points:

Double digit growth in “New category” revenue in H2, an acceleration. The full-year growth for this category will be mid-single digits.

“Excellent” performance from Velo nicotine pouches, Velo Plus to be profitable for the full-year.

The 2026 outlook is a little weak compared to what the company expects over the medium-term::

Confident in sustainably delivering mid-term growth algorithm from 2026 (+3-5% revenue, +4-6% APFO and +5-8% adj. diluted EPS), with 2026 performance expected at the lower end of the range

Buybacks: at the interim results, BATS increased its 2025 buyback from £0.9 billion to £1.1 billion.

Today it announces that the 2026 buyback will be £1.3 billion. An impressive figure, even for a £92bn market company - and it helps to boost the EPS outlook. Note that EPS growth is expected to grow 1% faster than profit growth over the medium-term.

Despite large buybacks and dividends, leverage is reducing towards their 2.0-2.5x target range, which is targeted by the end of 2026 (again this is excluding Canada’s impact on the figures).

CEO comment:

While there is more to do, we continue to prioritise investment in our most profitable markets and categories, driving accelerating New Category contribution, in line with our Quality Growth approach. We remain confident in delivering our mid-term algorithm next year.

Guidance: in detailed technical guidance for FY25, they disclose a 3% FX headwind. There will be 95% operating cash flow conversion and gross capex of £650m (same figure as they said last time).

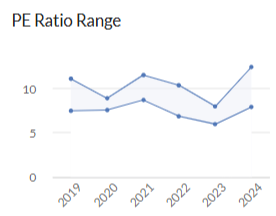

Graham’s view

I don’t see any reason to change from the view I expressed last time: that this offers medium risk and medium reward. It’s no longer as appetising as it was at a single-digit multiple:

On the other hand, the regulatory outlook, broadly speaking, seems to have calmed down. The compensation scheme in Canada is expensive but it settles a long-running dispute. And while I don’t claim to have any special regulatory expertise, the news on this front is quieter now than I remember it being for some time.

Vuse, glo and Velo are free to grow, as smokers continue the switch away from traditional combustible cigarettes, and these brands are growing as planned.

This has been a pretty comfortable hold for me for many years: the share price has taken a long time to recover from the slide it suffered in 2018, but it has been a remarkably consistent dividend payer. And now buybacks are ramping up as the company’s balance sheet has improved (the company is considered investment-grade by all ratings agencies).

Overall, therefore, compared to other riskier bets in my portfolio, this one doesn’t worry me so much.

Mark's Section

Oxford Metrics (LON:OMG)

Up 1% at 43p - Audited Preliminary Results - Mark (I hold) - AMBER/GREEN ↑

History:

Oxford Metrics has been on a bit of a rollercoaster journey in the last decade:

Its Vicon division became a global leader in motion capture having successfully expanded into life-sciences, where it is used for clinical gait analysis, elite sports performance labs, and other research. It also expanded in entertainment as major studios adopted Vicon systems for large-scale cinematic motion capture, plus video games demanded more realistic movement of characters.

In 2012 it launched Yotta, providing cloud-based tools for local authorities to manage highways, street assets, lighting and environmental infrastructure. This was sold to Causeway Technologies for £52 million, giving the company a huge cash balance.

Motion Capture:

However, in recent years the Vicon business has struggled. It has maintained a 60%+ gross margin, suggesting that it retains a significant moat. However, weakness in academic budgets, especially in the US where funding has been cut to many institutions. Combined with this, one of the fears is that AI solutions will be able to do more of what Vicon currently provides for customers. Their solution is a recently launched markerless technology. However, this has yet to have widespread adoption amongst customers.

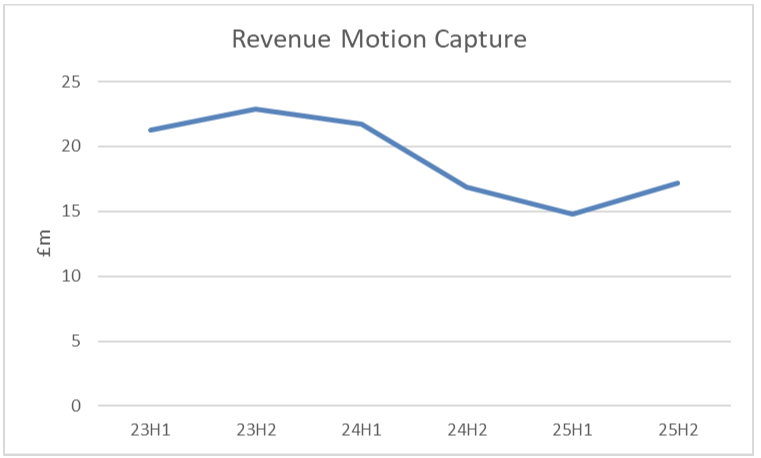

To get a better picture of what’s going on, I’ve broken out the revenue by half-year. Vicon shows a recovery in H2, but it is some way below the peak of two years ago:

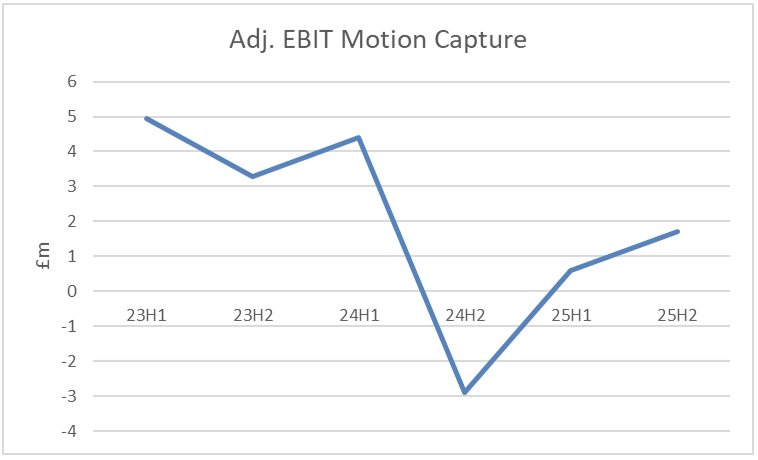

At the adj. EBIT level, this shows the strong operational gearing you get with such a high gross margin product:

One thing that bodes well for this division is that order intake is improving:

Order intake in the Motion Capture division during FY25 was up 21% to £34.8m (FY24: £28.8m), demonstrating positive underlying demand.

The correlation between order intake in a period and the subsequent revenue is unlikely to be high, but it is worth noting that this may indicate a recovery towards FY24 revenue levels. This looks good considering the challenges key academic customers face remain.

Smart Manufacturing:

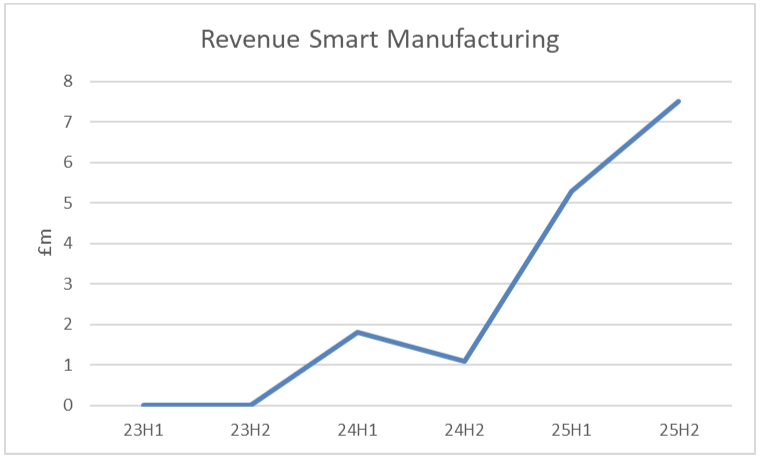

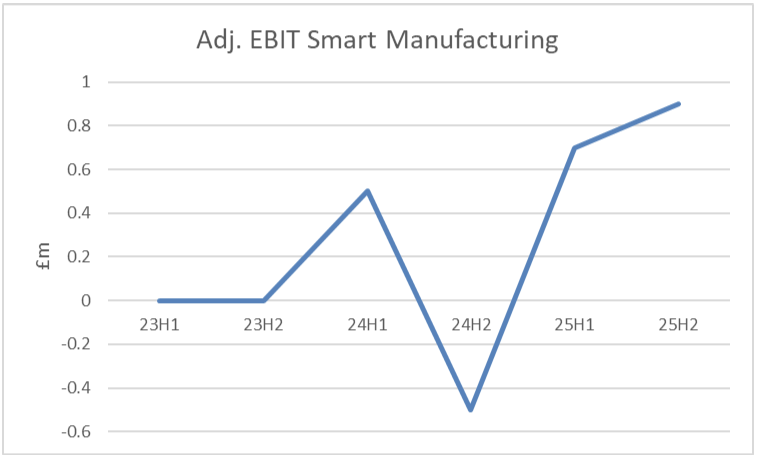

The other thing the company has done in order to attempt to diversify away from the volatile Vicon revenue is to enter the Smart Manufacturing space. Here they have seen significant growth:

However, they are using their cash balance to buy businesses, so you would expect them to be growing. I’ve got to say, I was a little sceptical of this strategy. It felt like a move of desperation, not strategic forethought. However, I may be eating my words on this one as organic growth looks very strong:

Revenues in Smart Manufacturing included organic growth of 38%.

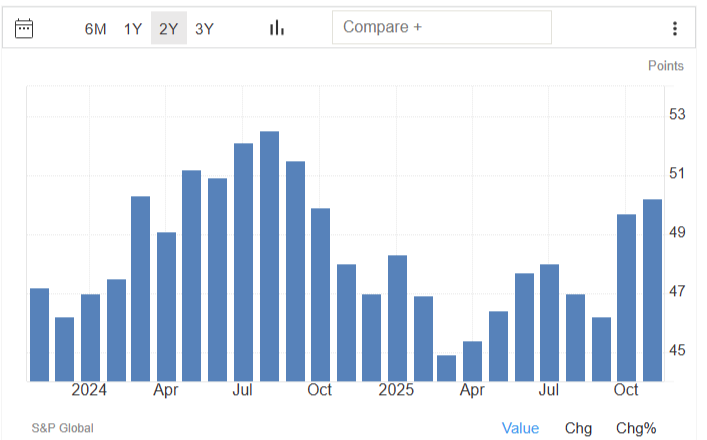

This is a great performance, given that UK Manufacturing PMI has indicated manufacturing as a whole contracting during this reporting period:

[Chart: Trading Economics (> 50 = growth, < 50 = contraction)]

Smart Manufacturing is not as high-gross-margin business as Motion Capture, which means that this growth doesn’t have the same operational gearing:

This is now consistently profitable, and contributing to the group results.

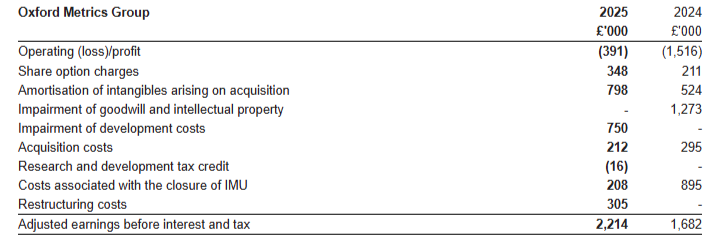

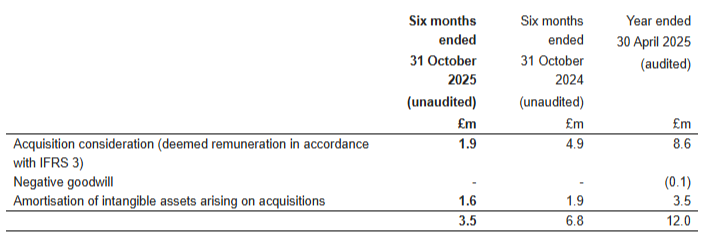

Adjustments:

Unfortunately, things are not as good on an unadjusted basis. Indeed, they report a statutory operating loss. Here are the details:

I expected to find some skeletons here. However, all of these look to be either non-cash or a one-off. My common critique of companies wanting shareholders to recognise all the benefits of acquisitions and none of the costs applies here, but the amounts don’t look out of place. And like many companies, the scale of the SBP charge means at the very least we should be using fully diluted share counts in any valuations.

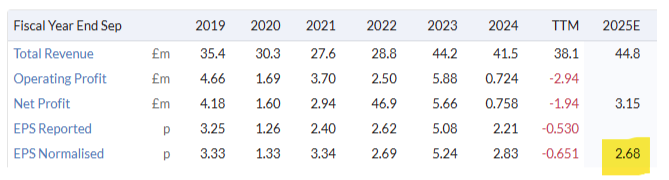

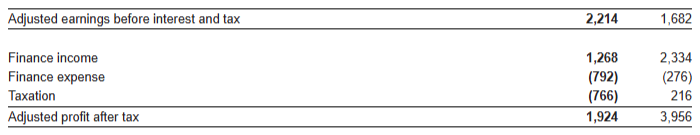

Earnings:

While Adj. PBT is up, the Adj. diluted EPS has almost halved to 1.15p, and this looks like a big miss on the 2.69p consensus in Stockopedia:

They have been hit by three things:

Lower finance income

Higher finance expense; and

A big swing in taxation.

Finance income is impacted by lower cash balances but also accounting adjustments, they say:

Interest received in cash for the year was £1.7m (FY24: £2.4m) The variance between interest received and finance income reported in the income statement reflects accrued interest, arising from the timing difference between the recognition of interest earned and the actual receipt of cash payments.

The jump in Finance Expense is left unexplained in the notes and narrative, which looks like it needs explaining to me.

The difference in tax charge is entirely down to the treatment of deferred tax liabilities, something I tend to ignore, personally. Given the number of adjustments they (mostly validly) make above these lines, I am surprised they don’t adjust these numbers to reflect underlying performance too. Broker Progressive don’t seem to like the adjustments that have been made as they report -0.1p EPS for FY25. Panmure Liberum goes with the company’s 1.5p. Again, I’m surprised the brokers don’t take a view on these finance and tax effects.

Forecasts:

PL have 2.3p EPS for FY26 and 2.7p EPS for FY27. Progressive are more optimistic with 2.8p and 3.2p for the same periods. However, they did drop their FY26 number by around 3% following today’s update.

PL sees the cash balance declining in FY26 to around £35m, although mainly due to the payment of the dividend. However, Progressive are expecting cash to build despite a large dividend payout to £38m. So it seems fair to say that the consensus here will hide quite a variation of individual views.

It is also unclear if the forecasts have taken this into account:

The Group's business activities and revenues are weighted toward the final third of the calendar year. Having noted comments from shareholders, and to aid the Group in the orderly preparation of its financial statements, the Directors recognise that presenting financial statements that have a more balanced first half and second half weighting is in the best interests of the Group.

Accordingly, the Directors are considering that for the Group's next financial year (which would otherwise end on 30 September 2026), its accounting reference date be extended by three months to 31 December 2026.

Many investors, including myself, don’t like changes of year-end as the risk is that companies do this to either mask or put-off bad news, or they are struggling to get an audit in on time. However, in this case, it seems unlikely that these are the reasons. The key is that the company is making this change early in the year, after they have released audited results on time. So I am happy to take them at their word on this.

Cash flow:

Cash flow in these results is much stronger, benefitting from both working capital flows, and that some of the charges referred to above are non-cash:

Operating cash inflow increased significantly to £6.7m (FY24: cash outflow £0.4m), benefitting from a £4.9m improvement in working capital, realised through the continued focus on inventory optimisation and operational discipline.

The company does capitalize significant intangibles of around £3.3m, and they have around £1.4m of lease payments split between principle and interest in the cash flow statement, which need to come off to calculate free cash flow of around £2m. Net cash has declined from £50.7m to £37.3m, but almost all of this decline is due to the dividend payment, which was held despite being uncovered and ongoing share buyback. They initially allocated £10m to this and have spent £8.6m to date, but I expect this to be extended further. In terms of other uses of the cash, they say:

We continue to only pursue small, bolt-on opportunities that align with our strict criteria and mantra: to find the right acquisitions, at the right price, for the right reasons.

It is worth noting that the sharecount is down to 115m, versus 124m weighted average in 2025, and 131m weighted average the year before. This should have a positive impact on EPS going forward, making those targets easier to hit. Flat is going backwards here, and we should be mindful of that in future reporting.

Dividends:

The company continues to pay an uncovered dividend, citing their large cash balance. However, the consensus was for this to rise to 3.6p, but it was held with these results. Perhaps a 7.5% yield versus a 8.5% yield doesn’t matter that much to the investment case. However, again, broker views vary significantly. PL are forecast flat dividends. Progressive see this rising to 4.1p next year and 4.5p the year after, for a yield exceeding 10%.

Outlook:

Things appear to have started well in FY26:

The Group has begun FY26 in line with expectations. The focus remains on growth with the merger of the Smart Manufacturing businesses into one trading company and structure, the continuation of a group wide cost efficiency drive and advancement of the Motion Capture product roadmap.

The risk is that this combination exercise drives further exceptional costs, but in general I am a believer that if companies make acquisitions, they should be looking for synergies.

Valuation:

Cash is a big part of the capital structure here. With £37.3m at the year end, the Enterprise Value is £12.2m. Unlike some companies, they are doing something with that cash - paying uncovered dividends, buying back shares and looking for bolt-on acquisitions. This means that I believe an EV valuation is fair. I don’t think EBITDA is a good measure for companies that capitalise intangibles so adj. EBIT is probably the best comparator. Here PL are higher, forecasting £2.8m and £3.4m FY26/FY27, whereas Progressive are at £2.7m and £3.3m. This gives an EV/EBIT of 4.4 dropping to 3.6 x the following year. Seems cheap for a business with 65% gross margins.

Mark’s view

Roland downgraded our view to AMBER when the shares were around 60p in June following weak Interim Results, citing concerns over the outlook and the risk of a major acquisition causing problems. While I have questions over how in-line these results actually were, Roland’s concerns should now be assuaged; they now only seems to be flagging the possibility of bolt-on acquisitions, and the outlook looks better. Economic conditions for both of their business units continue to look challenging, but there are signs that they are bucking these trends. Order intake at Vicon increased 21% and organic revenue in Smart Manufacturing was an impressive 38%. This gives greater confidence that when they say they are trading in line, they mean it. There is still some doubt as to exactly what in-line means due to varied approaches to adjustments and forecasting between brokers. However, the shares are now around 43p and an EV/EBIT of around 4 gives a lot of wiggle room. It is very cheap, even if there is some debate over exactly how cheap it is. Hence, I am tentatively raising our view today to AMBER/GREEN to reflect that improving outlook for both business units.

XP Factory (LON:XPF)

Down 4% at 11p - Interim Results - Mark - AMBER/RED =

Lots of metrics appear to be going in the right direction here:

The company presents us with three different measures of EBITDA, but they are wasting their time, in my opinion; I fundamentally disagree with the use of EBITDA for this sort of business. In experiential leisure, things get worn and will need replacing over time. Plus IFRS16 may treat rents as depreciation and interest, but these still need to be paid in cash.

It also seems to me that the big difference between site-level and group figures is an argument for why this shouldn’t be listed!

They helpfully break out what they consider maintenance capex:

£2.2m invested in growth capex, and £0.5m in maintenance capex

However, with their PP&E depreciation charge standing about £2.5m, either they have got their depreciation policy wrong, or the maintenance capex is low mostly due to timing effects. As their newer facilities become worn, that figure will go above their depreciation charge.

With this going on, it makes sense to focus on cash flow. They claim free cash generation of £1.4m but they didn’t pay a dividend or buyback shares and net debt increased by £0.4m. They benefited from £0.7m of working capital flows, so must be excluding that £2.2m of growth capex in this figure. The problem is that this can be hard to define. Plus if they had maintenance capex closer to their depreciation charge this would be wiped out.

I don’t doubt that this is a business that can grow revenue. It has several positive characteristics that help with this: a negative working capital model, it tends to get landlord incentives paid up front when it opens new venues, and experiential leisure is one of the only bright spots in hospitality over the last few years.

I think there are risks that these trends reverse at some point, and while XP consider Boom to have outperformed, there is no getting around the negative LFL numbers here:

The Boom Battle Bar estate has performed creditably in a challenging environment. Whilst UK like-for-like growth for the period was negative 6.8%, the performance reflects favourably compared to the industry-wide negative like-for-like growth of 8.4%. Turnover grew 16% to £20.4m, reflecting the full year effects of sites opened and acquired in the prior year together with a new site opened in the period.

Here’s their broker Cavendish’s take on this:

Our forecasts are unchanged but we note delivery will depend on crucial Christmas trading. Despite the challenging backdrop and softer LFLs, the implied 2H performance is not out of kilter with XP’s historic 1H/2H weighting. Our FY26E forecasts imply YoY growth of 13% for revenue and 18% for adj. EBITDA (Pre-IFRS16) and are both in line with the prior year’s 2H weighting of 57% and 78%, respectively. Clearly there is some work to do. However, EH LFLs are +8.3% for the 9 weeks to 30 November, and while Boom LFLs are down 9.8%, corporate pre-bookings are at record levels for the key Christmas period.

Cavendish are forecasting that this revenue growth eventually leads to much improved profitability, which will make the shares look cheap - a P/E below 4, if you are willing to take 2028 adjusted EPS forecasts. However, no dividend is forecast and with adjusted EPS coming in at -0.71p for the HY versus 0.6p forecast for the FY, any miss this year will no doubt cascade forward through the forecast window.

Adding to the impression that the future may not be as bright as the forecasts would have us believe:

After six years and a successful transformation of the group since joining, Graham Bird, the Group's Chief Financial Officer, has informed the board of his decision to retire from the board effective 29 March 2026 in order to devote more time to his other interests.

I’d come across Graham in the past when he headed up the then Gresham Strategic Microcap Fund and he presented at some shareholder events. He was an experienced and knowledgeable investor, and I always wondered why you’d want to get a real job if you could be an investor. He maybe wondered the same thing when he joined XP when it was Escape Hunt just before the COVID lockdowns almost wiped out the business! It is certainly true that he’s put the business back on a firmer footing, and this change looks like a planned move, rather than anything more sinister. However, if the company was only a year away from a big jump in profitability, would you really choose to pass on the batton now?

Mark’s view

Graham rated this AMBER/RED after their full year results were released in September. With much to do to hit FY forecasts following these interim results, and doubts over whether their pursuit of revenue growth will ever deliver acceptable shareholder returns, I don’t see any reason to change that view.

Begbies Traynor (LON:BEG)

Flat at 110p - Half-year Results - Mark - AMBER/GREEN

Most of the key figures here are going the right way:

5.4p EPS has them doing exactly half the 10.8p EPS they need to do to hit FY numbers, and the revenue is exactly half the revenue forecasts. It is perhaps no surprise that they say:

Confident of delivering full year results in line with current market expectations

But given that they are having the benefit of acquisitions, perhaps many would hope they do a little better?

Two property services acquisitions completed after period end will contribute in H2 with full year impact in FY27

As a people business, to grow, they need to hire or acquire, and to keep people they have to keep remuneration competitive:

Direct costs increased by 9%, which includes the impact of national insurance of £0.6m, and cost increases from team growth, senior hires and inflation. Administrative expenses increased by 5%, £0.1m of which is the impact of national insurance increases, together with costs associated with team growth, inflation and operating costs.

This means there is unlikely to be any significant operational gearing and EPS here grows slower than revenue in this half on an adjusted basis.

Of course, they want us to ignore acquisition costs from these figures, but as a serial acquirer, this seems more far-fetched than many companies that make one-off acquisitions or are acquiring IP. At least these are lower for this half year:

Net debt is up, and while it is fairly insignificant for a group of this size, it shows that these acquisitions mean that dividends and buybacks were mostly debt-funded in this period. Overall the balance sheet looks in good shape, though, but as with many people businesses, there’s little in the way of tangible backing.

Mark’s view

Graham upgraded his view here very recently, following their latest acquisition. He liked the ability for the bolt-on acquisition strategy to keep delivering growth and the natural hedge against economic weakness of its restructuring & insolvency services. I tend to be a bit more circumspect on the rating I would consider cheap for people businesses, and I don’t tend to pay up for inorganic growth. However, there is no doubt that this company has its attractions for those who value steadiness highly. Hence I’m in no rush to flip flop over the AMBER/GREEN stance.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.