Good morning!

14.00: Today's report is now complete - wrapping it up for today, on a relatively quiet day for news.

Spreadsheet accompanying this report: link (last updated to: 10th November).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

British American Tobacco (LON:BATS) (£93.9bn | SR72) | Further to yesterday’s trading update, BAT confirms a £1.3bn extension to its current buyback programme for 2026. | ||

GSK (LON:GSK) (£72.7bn | SR92) | Early clinical data shows “durable responses in certain types of small-cell lung cancer” (around 13% of all lung cancer in the US). | ||

Anglo American (LON:AAL) (£34.4bn | SR66) | Anglo American merges with Teck Resources and will become Anglo Teck. The combined company will have “more than 70% exposure to copper” and will be based in Canada. | ||

Berkeley group (LON:BKG) (£3.43bn | SR66) | H1 26 revenue -7.8% to £1.179.5m, pre-tax profit -7.7% to £254m. NAVps +4.7% to £37.63 vs April 25. On track to deliver FY26 and FY26 pre-tax profit guidance. | AMBER = (Roland) [no section below] I have long held a positive view of this brownfield specialist housebuilder, but today’s results suggest there’s not yet any improvement to sluggish market conditions. Despite the fall in profits, net cash of £342m was stable vs H1. This demonstrates the sustainability of the £132m of buybacks undertaken during the period. The average price of these purchases is given as £37.19, which is marginally below book value so should have been accretive to net asset value per share. Despite this, I can’t help feeling that shareholders would have been better served by receiving this cash as special dividends, so that they could enjoy some tangible benefit from Berkeley’s surplus cash. After all, the share price is 11% lower than it was a year ago, despite a nine-figure expenditure on buybacks. How have shareholders benefited? I’m going to leave my previous neutral view unchanged today, on the basis that FY26 and FY27 guidance is unchanged, suggesting a c.9-10% return on equity. With the stock trading close to book value, Berkeley looks fairly valued to me until trading improves. | |

Volution (LON:FAN) (£1.22bn | SR58) | FY26 “started well”, organic revenue growth c.5%. Total revenue growth inc acquisition c.30%. Another acquisition announced today of AC Industries in Australia, for AUD150m. AC is a mine ventilation specialist. | AMBER/GREEN = (Roland) Today’s trading update suggests last year’s mix of modest organic revenue growth and strong acquisitive growth remains in place. Another acquisition announced today will expand the company’s footprint in the mining sector and seems fairly priced, if not cheap. This description also reflects my view of Volution as a whole – my impression is that it’s a decent quality business, with some respected brands and attractive market share. While leverage will increase markedly following today’s acquisition, I think it should remain manageable. I’m happy to maintain a broadly positive view to reflect the typical High Flyer combination of strong growth and a full share price. | |

| Firstgroup (LON:FGP) (£985m | SR82) | FirstGroup named as preferred operator for London Overground rail contract | Will become the new operator from May 2026 w/ initial 8yr contract + option to extend. Expected value around £3bn over eight years. | |

Cohort (LON:CHRT) (£518m | SR36) | Rev +9% to £128.8m, op profit -9.5% to £8.0m. Adj EPS -19.2% to 16.16p. Order book £604.5m, H1 book-to-bill 0.9x. FY26 outlook unchanged. Equity Development forecasts are unchanged: FY26E adj EPS: 60.1p FY27E adj EPS: 66.8p | AMBER = (Roland) Today’s results confirm a 70%+ H2 weighting to earnings, but the company expects “record” deliveries in H2 to support the current outlook and help to reverse a significant rise in debt. A modest reduction in the order book suggests that near-term growth could slow, but I don’t see any reason why this business cannot maintain its impressive long-term record. However, the valuation looks up with events to me and the H2 weighting remains a slight concern. For these reasons, I’m leaving our neutral view unchanged today. | |

Gulf Keystone Petroleum (LON:GKP) (£387m | SR70) | 2025 YTD production c.41,400 bopd, in line with guidance of 40-42 kbopd. Export sales restarted, $75m cash balance on 9 Dec 25. FY25 capex and cost guidance unchanged. | AMBER = (Mark) | |

Redcentric (LON:RCN) (£202m | SR68) | Revenue -3.6% to £66.8m, op profit -2.4% to £3.6m. Adj net debt £41.8m. Focus on building a Managed Service business. Negotiations for sale of data centre business for up to £127m are progressing. | ||

dotDigital (LON:DOTD) (£197m | SR51) | Will begin £3m buyback programme from today in order to offset future dilution from employee incentive arrangements. | ||

Netcall (LON:NET) (£182m | SR59) | Jadu is “a UK-based provider of digital experience platforms”. Will strengthen Netcall’s presence in UK local government from c.1-in-3 to c.1-in-2 councils. Consideration up to £19.2m, Jadu has ARR of £5.9m. | ||

Optima Health (LON:OPT) (£171m | SR56) | H1 Revenue +17% to £59.5m, Adj. EBITDA -5% to £8.3m, PBT -18% to £5.4m, Net debt £4.7m (26H1: £0.6m) Commenced transformation programme to improve operating margins and indirect overhead efficiency. Anticipates this programme to begin delivering operating expenditure improvements from H2 FY27. | ||

Aptitude Software (LON:APTD) (£162m | SR38) | US-based global communications organisation, has renewed its Fynapse contract for a further three years for £7.6m total, at an increased annual contract value, which also includes the renewal of licences for Aptitude's leasing and revenue recognition engines. | ||

Fevara (LON:FVA) (£66.8m | SR51) | Revenue +4% to £78.8m , Ad. Op Profit +69% to £3.7m, Adj PBT +67% to £4.2m, Net Cash £2.6m (FY24:£8.0m). “The key northern hemisphere seasonal winter trading period has started strongly with outlook for existing markets ahead of last year and in line with expectations.” | ||

Made Tech (LON:MTEC) (£39.6m | SR65) | Revenue for H1 FY26 was +27% to c.£27.7m. H1 Adjusted EBITDA +33% to c.£2.4m. Net cash 30 Nov was £11.9m (31 Mar: £10.4m). As a result of the strong trading performance in the first half of the year, the Board now expects trading for FY26 to be significantly ahead of current market expectations, with revenue expected to be c.10% higher and Adjusted EBITDA margins increasing, reflecting improved operational gearing. | GREEN↑ (Mark - I hold) | |

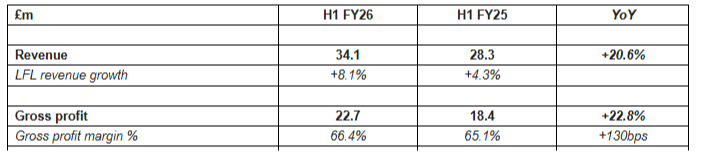

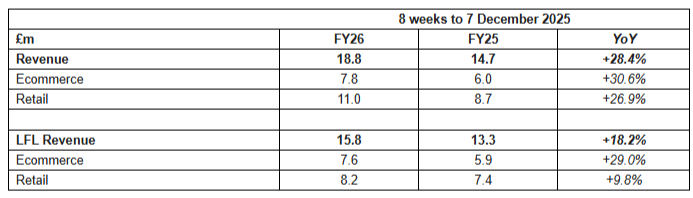

PROCOOK (LON:PROC) (£36m | SR68) | H1 Revenue +21% to £34.1m (+8% LFL), U/L EBITDA +129% to £2.3m, U/L LBT £1.5m (25H1: £1.8m LBT). Net debt £4.1m (25H1: £4.2m). 1st 8 weeks of H2: LFL Revenue +18%. Continued momentum underpins confidence in delivering a strong full year performance, in line with market expectations. (Revenue of £79.5m, and Op profit of £4.8m.) | AMBER (Mark) | |

Angling Direct (LON:ANG) (£35.8m | SR93) | £2.265 million undeployed from original £4.0m buyback so expiry date extended by a year to 10 Dec 2026. | ||

Everyman Media (LON:EMAN) (£32.4m | SR33) | UK Box Office performance in Q4 FY25 weaker than anticipated. Now expects revenue of no less than £114.5m (53-wk FY24: £107.2m) and EBITDA of no less than £16.8m (53-wk FY24: £16.2m). Previous Consensus: Revenue £121.5m and EBITDA of £19.9m. Net debt c.£24.0m at period end (2024: £18.1m). Canaccord Genuity 2025 forecast placed under review. | BLACK (RED =) (Roland) [no section below] It’s a nasty profit warning from this cinema group, with EBITDA guidance cut by 15%. Unusually, the company’s broker Canaccord has opted to place its 2025 forecasts under review (effectively withdrawing them) rather than updating them. This seems to suggest a lack of confidence in even today’s guidance (just three weeks from the year end). | |

Challenger Energy (LON:CEG) (£28.7m | SR42) | Uruguayan Ministry of Environment issued necessary permits to allow for acquisition of 3D seismic on AREA OFF-1. |

Roland's Section

Cohort (LON:CHRT)

Down 5% to 1,052p (£494m) - Half-Year Results - Roland - AMBER

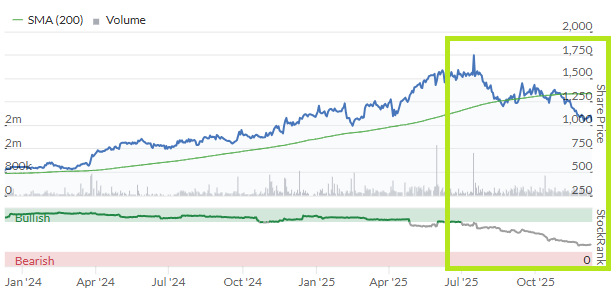

Shares in small-cap defence group Cohort have doubled over the last two years. But the stock is down by around one third from the highs seen earlier this year, perhaps reflecting the strong valuation the company reached over the summer.

Cohort’s previously high StockRank has also declined sharply, tracking the share price with impressive precision:

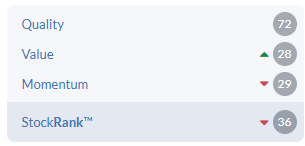

Our algorithms now classify Cohort as a Falling Star. This is a negative style that typically represents a quality stock that’s run out of momentum. We can see that this appears to be true here:

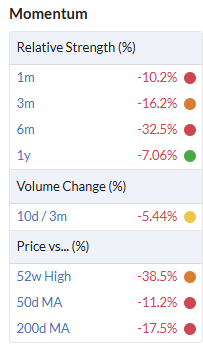

Cohort’s share price momentum has certainly been weak of late…

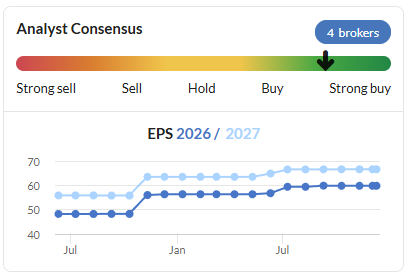

… but broker estimates have held up well:

Given this potential contradiction, I’m interested to see if today’s half-year results support a more positive view on this stock. After all, this business has an excellent long-term record of growth – Cohort has almost six-bagged over the last 20 years.

Half-year results summary

The initial reaction to these numbers from the market this morning has been negative this morning. I can see why this might be – the half-year has seen a drop in headline profits and an apparent weakening of the order book.

These figures cover the six months to 31 October 2025 - Cohort has a slightly unusual April year end:

Revenue +9% £128.8m

Adjusted operating profit -4% to £9.7m

Adjusted earnings per share -19.2% to 16.16p

Order intake: £122.3m (H1 25: £139.2m), representing book-to-bill of 0.9x

Order book of £604.5m at 31 October (30 April 25: £616.4m)

Interim dividend up 10% to 5.8p per share

Net debt: £32.5m

These half-year figures flag up two concerns for me:

H2 weighting: adjusted earnings of 16.2p represent just 27% of consensus forecasts of 59.8p per share. That leaves more than 70% of earnings to be generated in H2. Graham has previously flagged this H2 weighting as a potential concern, due to the risk that any shortfall could trigger a profit warning late in the year.

Today’s results provide some reassurance on this:

Our outlook for the full year remains unchanged. Increased delivery in both divisions is expected to contribute to the anticipated full-year growth in Group profit performance and adjusted* earnings per share.

More specifically, the company says that the order book reported today includes £145m of revenue deliverable in H2. As of early December, management says that revenue cover for the full year is 96%.

This doesn’t guarantee Cohort will meet full-year earnings forecasts, but it does seem broadly encouraging.

Commissioned research house Equity Development has left its FY26 EPS forecast unchanged at 60.1p per share today.

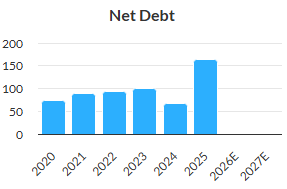

Net debt: Cohort has historically tended to run a net cash position, albeit with occasional forays into net debt. The H1 figure of £32.5m is certainly higher than I’ve seen before from this business and represents a c.£38m outflow from a net cash position of £5.3m at the end of April 2025, just six months ago.

This move into a net debt position was highlighted in October’s AGM update and is said to reflect “planned capital expenditure and working capital build ahead of record planned deliveries in H2” (my bold).

The H2 EPS weighting and net debt swing are clearly two sides of the same coin. According to today’s Equity Development note, delivering on earnings forecasts is expected to result in a move back into net cash by the end of April 2026.

Divisional commentary

Cohort is a group of semi-autonomous businesses which operate with the support of group-level strategic leadership and financing. The company divides its reporting into two segments:

Communications and Intelligence (revenue +13% to £62.2m, op profit +23% to £10.4m, margin 16.8%):

Revenue in the MCL business (surveillance technology) fell from record levels last year, but this was offset by a contribution from January 2025 acquisition EM Solutions (satellite comms).

Management sounds bullish about the outlook for EM Solutions (an Australian firm), but I notice Cohort has logged £20.9m of provisions against this acquisition in today’s accounts. These are said to “include additional provisions against trade and other receivables and for other contractual obligations, including product warranty and alignment with Group policies”. It’s not clear to me if some of these provisions could require future cash outflows, so this could be something worth watching.

Elsewhere in C&I, losses were reduced in the EID business (advanced naval/military comms). The order book edged higher to £203.6m (April 25: £202.4m) due mainly to good order intake at MASS (electronic warfare)

Sensors and Effectors (revenue +3.7% to £66.6m, op profit -40% to £3.2m, margin 4.8%):

Profitability fell sharply due to higher levels of activity on lower margin projects at ELAC SONAR and SEA, in particular “the Italian sonar programme”.

The division's closing order book was £400.9m (April 2025: £414m), with a strong pipeline. Among the opportunities highlighted are for Krait (counter-drone systems) and sonar solutions for both manned and unmanned vessels.

Outlook

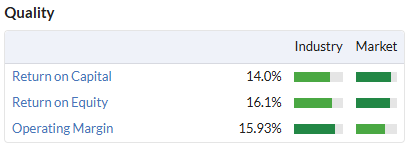

As I mentioned above, Equity Development has left forecasts unchanged today. Its estimates suggests adjusted earnings will rise by around 10% in both FY26 and FY27:

FY25 actual EPS: 54.4p

FY26E adj EPS: 60.1p

FY27E adj EPS: 66.8p

These numbers put Cohort shares on a FY26E P/E of 17, falling to a P/E of 15 in FY27.

Roland’s view

Today’s results seem a little mixed to me.

The C&I division appears to have attractive profitability and has delivered good growth in H1. However, the order book was more or less flat, perhaps suggesting this growth rate is likely to level out.

Similarly, S&E suffered a sharp drop in margins due to the product mix – it’s not clear to me whether this is likely to reverse.

In terms of the near-term outlook, my guess is that the most likely cause of a profit warning this year will be a delay to some deliveries, rather than an outright shortfall in orders.

Looking further ahead, I don’t see any reason why this company can’t maintain its long-term growth record.

However, my view is tempered by the stock’s current negative momentum and the risk – as I see it – that full-year profits could slip slightly below expectations.

The profitability of this business also remains somewhat average:

Trailing 12-month operating margin: 9%

Trailing 12-month return on capital employed (ROCE): 10.1%

Taking all of this into account, I am going to leave Graham’s previous neutral view unchanged today. I think this is fundamentally a good business with a strong long-term record, but the valuation looks fair to me and I am a little wary about buying into the current negative share price trend.

Volution (LON:FAN)

Up 5% to 643p (£1.28bn) - AGM Trading Update & Acquisition - Roland - AMBER/GREEN

Volution produces ventilation equipment for residential and commercial property. The company owns some well-known brands, including Vent-Axia and Manrose. Graham took an AMBER/GREEN view on the stock in March this year, since when it’s continued to perform quite well:

We have two RNS updates from the company today, one providing a brief trading update and one detailing the group’s latest acquisition.

AGM Trading Update

This update covers the four months to 30 November 2025 and has been issued ahead of today’s AGM. It’s short but broadly positive, I think:

FY26 has “started well” with total revenue growth of “just over 30%”;

Organic revenue growth was c.5% (constant FX)

Last year’s acquisition of Fantech contributed a further 25% to revenue growth

Operating margins have “remained strong” and are said to be in line with the prior year, on an organic, adjusted basis

we expect to deliver another year of good growth in revenue, operating profit and cash generation.

Broker consensus estimates have gradually edged higher over the last year. I don’t see anything in today’s update that’s likely to change these forecasts, except perhaps the future contribution from today’s acquisition.

Acquisition: AC Industries

Volution has been a fairly acquisitive business and today’s deal continues this trend.

The group has acquired Australian firm AC Industries, which “designs, manufactures and supplies specialist ventilation ducting solutions for secondary ventilation in underground mines”.

ACI is described as a “leading manufacturer and supplier” in this field and is said to be the “clear market leader in Australia”, with growing international reach:

Serving over 150 mines in 15 countries (120 in Australia);

Over 80% of customer sites are gold or copper mines, remainder are zinc/nickel/diamond/tin

Strong record with “loyal, blue chip customer base and high repeat revenue throughout the life of mines”.

Volution already has some exposure to the mining sector through last year’s acquisition of Fantech, which serves “some above ground mining applications”. ACI will form part of the group’s Australasian region alongside Fantech.

Financials: Volution will pay up to AUD179m for ACI. This will be structured with an initial payment of AUD150m (c.£75m) and contingent payouts in 2027 and 2029 totalling up to AUD28.9m (c.£14.5m).

Funding will come from existing debt facilities and group leverage at completion is expected to be c.1.8x leverage – a little high, but not alarmingly so. For contrast, FY25 year-end leverage was 1.2x.

ACI generated revenue of AUD47.7m and adjusted EBITDA of AUD17.1m for the year ended 30 June 2025. Using these figures, Volution is paying an EBITDA multiple of 8.8x - 10.5x, depending on contingent payments.

For contrast, Volution currently trades on an EV/EBITDA multiple of 15.2x according to Stockopedia, suggesting Volution may be able to benefit from the re-rating effect of adding lower-rated earnings to its higher-rated equity.

Roland’s view

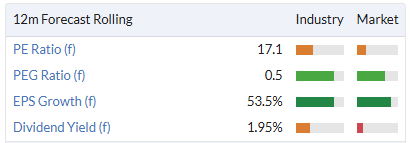

Volution is styled as a High Flyer by the algorithms and the shares do not look obviously cheap to me:

The company has a material amount of debt, too – a figure set to increase sharply after today.

Having said that, I think there’s some evidence that this is an above-average quality business. The QualityRank is 84 and key quality metrics look quite strong to me:

A mid-teens return on capital is respectable, in my view, especially for an acquisitive business, while double-digit margins suggest buyers value Volution’s brands and products, giving the firm some pricing power.

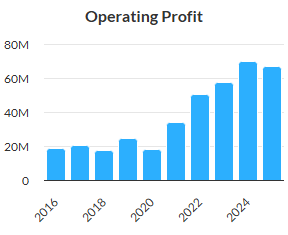

Profit growth is also strong, if inconsistent, on a 10-year view:

It's clear that some of this profit growth has been driven by acquisitions. The mix of organic and inorganic growth is certainly an area I’d look at more closely if I was studying the business.

Last year’s results reported 5.7% organic revenue growth and 16.2% inorganic (i.e. from acquisitions). Today’s AGM update also reports c.5% organic revenue growth so far in the current year. When price rises are taken into account, these figures suggest to me that underlying demand growth in this business may be relatively modest.

Of course, Volution may still be able to generate value for its shareholders by acting as a consolidator and benefiting from economies of scale. The firm’s results in recent years suggest to me this strategy could be working well.

There’s also the potential for an increase in demand if construction in commercial and residential markets picks up in the UK and other key markets. More broadly, structural trends such as energy efficiency and changing building regs seem likely to require an increase in mechanical ventilation in new-build properties.

I can see quite a lot to like about this business, with the caveat that a) it’s not cheap and b) there’s a meaningful level of gearing. To reflect this balance I’m going to leave Graham’s previous AMBER/GREEN view unchanged today.

Mark's Section

Made Tech (LON:MTEC)

Up 17% at 31p - Trading Statement - Mark (I hold) - GREEN ↑

The headline to this trading statement tells us this is going to be good news:

Trading significantly ahead of expectations

This is driven by good sales momentum:

Revenue for H1 FY26 was c.£27.7 million (H1 FY25: £21.8 million), representing a year-on-year increase of c.27% following good Sales Bookings momentum in the second half of FY25.

And importantly, given many companies are struggling with increased costs at the moment, this shows some modest operational gearing:

Adjusted EBITDA for H1 is expected to be c.£2.4 million (H1 FY25: £1.8 million), c.33% up on the equivalent prior year period. This represents an increase in margin from 8.2% to c.8.7%, a result of operational efficiencies, offset by a higher than target contractor base.

It is not all good news, though. Contracted Backlog is down, and they say “Sales bookings for H1 FY26 were softer than the strong prior year performance.” This takes the shine off an otherwise excellent trading statement. Although they feel their sales pipeline is strong.

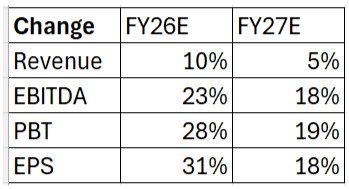

Forecast changes:

Overall they say revenue is 10% ahead of expectations, and margins higher, but we need to turn to their broker, Canaccord, who say:

Upgrading EPS by +18%: We lift our FY26-27 revenue forecasts by 5%-10% and EPS by 18%-30%; we expect the latter to grow at an impressive 34% FY25-27 CAGR, benefiting from continued operating leverage.

This isn’t entirely helpful, so I’ve calculated what the scale of the upgrades actually are:

The 31% EPS upgrade for this year is, of course, significant. The bad news is that the upgrade for FY27 is lower at 18%. However, this does show that this improvement in trading is not a one-off. If these 2027 forecasts are realistic, then EPS will have doubled in three years which is a 25% CAGR.

Risks:

A couple of risks remain here. The first is that the adjusted numbers don’t reflect reality. However, looking at the last set of results, I don’t see anything obvious. No exceptionals or impairments for the last period, and they didn’t capitalise any intangible development. There was a large SBP charge. When Graham looked at this in the Final Results he chose to include this as a real cost. I am more circumspect with this, as changes in share price can have a big impact on the year-to-year charges. At a bare minimum we should be using the fully diluted share count of 159.5m shares in any valuation, not the 149.3m weighted shares in issue at the full year.

The second risk is the public sector exposure here. Government budgets are under pressure, and while digital transformation is often part of those cost-saving initiatives, there may be no escaping the overall weight of spending cuts. I think this is why their backlog has reduced in this update, given the recent Budget uncertainty. However, this could also be cause for optimism, if decision-making has been held-off, but only temporarily.

Cash flow:

Free cash flow remains reasonable for a business growing at these rates:

Net cash as at 30 November 2025 was £11.9 million (FY25: £10.4 million; H1 FY25: £9.1 million), reflecting the continuing strong operating cash flow conversion of the business. Made Tech remains debt-free.

However, there is no dividend or buyback so shareholders presumably will want to ask questions about what they intend to do with this cash, now it is becoming a significant part of the capital structure. Canaccord don’t change their year end cash forecast in this update, but they do add £1m to the FY27 year end forecast balance.

Valuation:

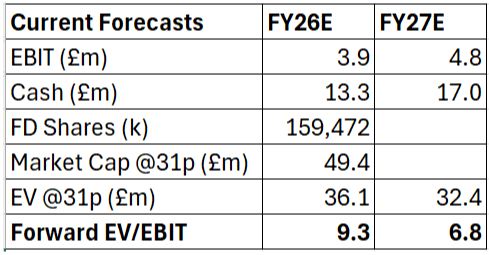

With a share price that has risen this morning and forecasts adjusted, I need to do my own valuation. Given the significant cash balance, and not being a big fan of EBITDA, I think EV/EBIT is the best measure to use:

This figure looks too cheap to me for a business growing the bottom line at 25% CAGR, especially if you believe those 2027 forecasts.

Mark’s view

This comes pretty close to meeting Ed’s rules for a potential high-return drift stock:

The company says it’s trading “ahead of expectations” ✓

The share price jumps 10% or more on the day ✓

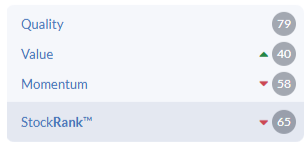

The StockRank is above 75 ❌

Ed found that "significantly ahead” tended to give higher returns, and I agree that a 31% upgrade to this year’s EPS forecast classifies as significantly ahead.

The share price jump is around 17% so far. Ed’s research is based on the day’s close so there is a risk that selling later in the day takes this below the threshold. However, the rationale behind this is that the ahead statement has to be unexpected. Eventually shareholders get used to some stocks always beating expectations (perhaps due to a canny management guiding their broker conservatively). When stocks like this issue an ahead update the market doesn’t react and an in-line statement is often treated like a profits warning. With Madetech this doesn’t seem to be the case. After a positive response to a big upgrade in July, the shares hit 40p (which, to be fair, looked a pretty rich valuation at the time).

The shares have drifted down over the intervening period, to as low as 26p recently, presumably as the market priced in the risk of a miss due to Budget uncertainty. My take is that this "significantly ahead” did surprise the market based on the chart above.

Where the shares are let down is on the StockRank. Ed’s research demanded that the StockRank be above 75, and while not terrible, there is a gap here:

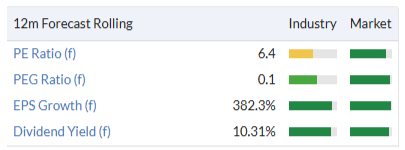

This worries me less than the other factors, as the Momentum will clearly be weak where the market was pricing in a potential miss. The Value Rank is also below what I’d normally want to see for an investment. However, this is partially due to the backward-looking calculation of the Value Rank for a stock that is growing quickly. This is certainly not an asset play, and now the cash is building, I’d like to see them consider paying a dividend. But overall, the Value metrics don’t look terrible here to me, even before this upgrade:

Indeed, my own calculations make this look too cheap on an EV/EBIT, at least for those willing to put some faith in FY27 forecasts at this stage. Importantly for my value bias, the share price so far has risen less than the upgrade in EPS, making buying today at 31-32p look better value than buying yesterday at 26-27p, at least on simple earnings multiples.

Putting all this together, I am willing to overlook the lower StockRank and have been buying this morning with a view to benefiting from the “drift”. I am also going to put my mouth where my money is and tentatively upgrade this to GREEN.

Gulf Keystone Petroleum (LON:GKP)

Down 1% at 176p - Operational & Corporate Update - Mark - AMBER

Production is pretty much in the middle of guidance:

Gross average production of c.41,400 bopd in 2025 year to date (as at 8 December 2025), in line with tightened 2025 annual guidance of 40,000 - 42,000 bopd

But it also bodes well for FY26 that the exit rate looks higher:

Gross average production in December to date of c.44,000 bopd

However, despite the ability to export via the Turkey pipeline, this looks to be the maximum well output, which is subject to natural decline, as they say:

Smooth transition from trucking sales to pipeline exports via the Iraq-Türkiye Pipeline on 27 September 2025, with volumes quickly ramped up towards full well capacity

In January this year, gross average production was c.47,900 bopd, showing the impact of well decline. They have a couple of easy and relatively inexpensive well workovers that will increase production next year, but any significant uplift will probably require an increase in capex.

In what can be a novelty for the company, they have also been paid for export pipeline sales. They currently receive c.$30/bbl which they say is an uplift to what they get on local sales. However, local sales are paid on delivery, whereas in the past payments for export could be protracted. While they are getting a premium, can deliver greater capacity and are being paid relatively quickly on 30-day terms this is good news. However, the lack of uplift on price so far means that the optimism around the pipeline reopening at the end of September was relatively short-lived:

They have $75m in cash yesterday, and confirm guidance on costs, meaning that the generous dividend here is likely to be maintained. Now the pipeline is open, I think we can expect some of the capex that has been on hold over the last few years to be prioritised. However, I don’t see why they shouldn’t also be able to maintain that impressive forecast yield, assuming no more political upsets:

There is further possible upside to operating cash flow if they can increase production, negotiate a higher rate on export barrels, and/or be paid for aged receivables from the KRG. However, the former will require increased capex and the latter two, a successful conclusion to protracted multi-party negotiations. The experience of the pipeline closure and re-opening perhaps suggests that shareholders shouldn't hold their breath on these. However, for many a 10% yield makes the possibility worth the wait.

Mark’s view

The re-opening of the pipeline is good news, giving a route to produce higher volumes and getting paid a premium to local sales. However, this guidance shows that it will be some time (and capex) before production can be materially higher. There may be further upside if there is a successful conclusion to negotiations. However, history suggests these will take longer than expected, and there is the risk that any eventual deal may be less favourable than the current temporary agreement. Given the obvious political risks here, I am struggling to consider a short-term upgrade in our stance, despite obvious positive attributes, of which a 10% dividend yield remains a big one. AMBER

PROCOOK (LON:PROC)

Up 22% at 40p - Interim Results - Mark - AMBER

Some decent figures here in a very difficult consumer market:

They benefit from decent LFLS, store growth and improving gross margins. They remain loss-making but given this is a retail business, it is H2 that delivers all the profit. So importantly, H2 is going well so far:

These are said to be in line:

This continued momentum, despite the subdued consumer environment, underpins our confidence in delivering a strong full year performance, in line with market expectations

Helpfully, they confirm what these are:

Company compiled consensus average of analysts' expectations for FY26 revenue of £79.5m, and FY26 operating profit of £4.8m

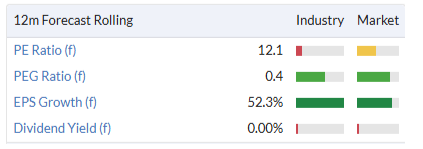

I can’t see any updated broker coverage today so assume these remain valid. These represent only 14% revenue growth, so with +21% in H1 and +28% in the first two months of H2, I can’t help feeling the management are holding something in reserve here. The market certainly has come to that conclusion this morning, lifting the shares by over 20%. This makes it very hard to come to an informed view.

If we are to believe the management and brokers and these are simply in line, then this looks too expensive when you add a 20% + share price to an already rich forward multiple for a retailer:

However, if you assume that an upgrade is all but certain once the next few weeks of Christmas trading are known, then 25% revenue growth puts them closer to delivering FY27 figures in FY26. This would still be a 14x P/E which is punchy, but may not be out of place for a company delivering such rapid revenue growth.

The broker consensus isn’t exactly confidence inspiring and any beat may simply reverse previous downgrades:

The balance sheet doesn’t look particularly strong with a current ratio less than one and not much tangible asset backing. However, this isn’t out of place for a retailer, and usually doesn’t make it a high-risk investment, at least during periods of positive growth.

Mark’s view

All of this makes it really hard to have a view. On one hand this looks set up to beat expectations and they are clearly getting things right with consumers as they deliver LFL sales significantly above general market trends. However, with the shares jumping 20%+ today, the market is already pricing in a beat, especially as the multiple still looks punchy. Our last DSMR view was RED, but that was from 2023 when the company was struggling, so this provides little guidance. Overall, I’m going to sear some chicken in the pan, and go for a neutral view. AMBER

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.