Good morning!

Today's report is now complete (11.05). I'm wrapping it up there on a relatively quiet day for news. See you tomorrow!

Spreadsheet accompanying this report (updated to 24th November): link.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

Seplat Energy (LON:SEPL) (£1.5bn | SR94) | Two subsidiaries have completed the conversion of their onshore operated assets (in Nigeria) to the new PIA fiscal regime, which replaces the Petroleum Profit Tax regime. | ||

Pets at Home (LON:PETS) (£901m | SR82) | James Bailey appointed CEO with effect 30 March 2026. His previous role was as MD Of Waitrose for five years, prior to that at Sainsbury’s. | AMBER = (Roland) [no section below] The new CEO appears to be an experienced retailer who should have a thorough understanding of the group’s target customer base – Bailey was at Sainsbury’s for 20 years prior to leading Waitrose. He’ll need to navigate the retailer through a slowing market and freshen up its pet offering while maintaining price parity with online retailers – not an easy combination. However, Pets at Home’s 20%+ market share and higher-margin vet business provide the group with some degree of moat, in my view. I am mildly optimistic about the shares at current levels, reflecting the StockRanks’ Contrarian styling. I’ll leave my previous neutral view unchanged today as this isn’t a trading update, but look forward to hearing from the company next year. | |

Alfa Financial Software Holdings (LON:ALFA) (£641m | SR59) | CFO Duncan Magrath intends to retire at the end of 2026. He is thanked. | ||

Concurrent Technologies (LON:CNC) (£194m | SR67) | Planning delays have prevented a planned move to a new HQ property.The company has now taken a 10-year lease on a 14,800 sq ft office adjacent to its existing Colchester site. This will release additional manufacturing capacity. | ||

Gulf Marine Services (LON:GMS) (£187m | SR69) | Contract for two Large-class vessels in Europe spanning a total of 985 days. Contracted backlog increases to $540m. House broker Zeus leaves forecasts unchanged: | AMBER/GREEN ↑ (Roland) [no section below] In October I commented on the decline in Gulf Marine’s order book during 2025, following the cut to earnings forecasts in September. At the time, I took a neutral view. Today’s contract news reverses much of this year’s order book decline and the company’s house broker has left its forecasts unchanged again. With the stock trading at the lower end of the range seen over the last two years, I think it’s reasonable to move my view up by one notch. While there are risks here, I think the shares probably do offer some value at current levels. | |

Brickability (LON:BRCK) (£170m | SR76) | Renewed £60m RCF and £50m term loan for three years w/ two extension options. Same pricing as existing facilities, w/ £40m accordion. | ||

Mercia Asset Management (LON:MERC) (£126m | SR41) | Three Northern VCTs increase their 25/26 offers for subscription by a further £10m each, taking the total to £80m. | ||

Naked Wines (LON:WINE) (£52m | SR88) | Purchased c.2.8m shares at 72p for a total of £2m. See yesterday for comment. | ||

Pulsar (LON:PULS) (£51m | SR30) | Multi-year contract with international marketing and communications company. Expected to deliver ARR of €2.1m and €6.3m total revenue. | ||

Windar Photonics (LON:WPHO) (£42m | SR13) | SP -10% PW: Expects revenue of €6.5-6.8m, w/ EBITDA to be “neutral”. This is below expectations due to an order delay. Previous consensus was for revenue of €9.45m and EBITDA of €2.2m. | BLACK (AMBER/RED =) (Roland) Delays to a large order mean that revenue forecasts have been cut by c.30% and the wind turbine technology group is no longer expected to report its maiden profit this year. It’s the second consecutive year when order delays have caused a late downgrade, so while forecasts for 2026 are significantly stronger, I would be reluctant to pay too high a price for the stock without seeing some evidence of profitability. Fortunately, Windar’s net cash position should allow it to avoid any funding issues for the foreseeable future. However, after multiple downgrades this year, this alone isn’t enough to persuade me to change our cautious view on this stock. | |

Ariana Resources (LON:AAU) (£35m | SR35) | Mineralisation extended beyond current Dokwe Central resource, but DRC9 did not prove full limits of mineralisation for technical reasons. Drilling to resume in early 2026. | ||

Fiinu (LON:BANK) (£35m | SR11) | Continues to make progress with Conister Bank white-label partnership. Now targeting Q1 2026 launch (previously “before the end of this year”). In talks with other potential partners. | ||

Christie (LON:CTG) (£31m | SR72) | Strong trading: expects to report stronger full year performance from continuing operations than previously envisaged. | AMBER/GREEN = (Roland) A strong update to end the year, with higher fee levels and good activity levels reported across various divisions. While the company hasn’t provided explicit new guidance today, broker Shore Capital says it expects to see the bulk of FY26 adjusted profit now fall into FY25. Shore is waiting for a formal full-year trading update in 2026 before updating its forecasts, but I’m quite happy to maintain our recent AMBER/GREEN view today. Christie appears to be reasonably valued and moving in the right direction. | |

Videndum (LON:VID) (£30m | SR34) | SP -45% Main components of a refinancing proposal now agreed in principle. They include a £70m placing & a £23m debt for equity swap. | RED = (Roland) [no section below] | |

80 Mile (LON:80M) (£26m | SR50) | Received approval from Greenland govt for sale of Kangerluarsuk zinc-lead-silver project. Will receive 392,939 Amaroq shares and $1.5m conditional on a future discovery. | ||

Robinson (LON:RBN) (£21m | SR72) | 2025 revenue expected to be c.£56m, in line with 2024. Adj op profit to be ahead of 2024 and in line with expectations. Outlook: 2026 adj op profit to be “slightly lower than 2025”. Cavendish broker forecast updates:- FY25E adj EPS 12.9p (+3% vs 12.5p previously) - FY26E adj EPS 12.3p (-16% vs 14.6p previously) | (BLACK) AMBER/RED ↓ (Roland) [no section below] Today’s update from this packaging group is a bit of a mixed bag, but ultimately it’s a profit warning for 2026. While sales volumes in the UK have improved this year and are expected to support improved 2025 profits, the company reports “a reduction in volume” in Denmark and “some challenges” emerging in Poland as customers come under “severe pressure from retailers” to cut costs. The company continues to release value from its balance sheet with the sale of surplus properties. It’s recently agreed the sale of two properties in Chesterfield for a total value of £2,125k. These had a book value of £610k. The cash will be used to reduce debt. Looking ahead to next year, further progress is expected in the UK, but pressures in Denmark and Poland mean that adjusted profit (excluding property sales) is expected to be lower than in 2025. I would imagine this reflects lower expected capacity utilisation in DK/PL, causing fixed costs to eat into margins. Given the material cut to FY26 forecasts (see left), I’m going to move our previous neutral view down by one notch today. | |

Metals One (LON:MET1) (£20m | SR6) | $4m loan to Lions Bay by way of 12-month promissory note bearing interest at 20% annually. | ||

Mothercare (LON:MTC) (£14m | SR48) | H1 revenue -45% to £11.6m, adj EBITDA -53% to £0.8m. Pre-tax loss of £1.1m. Breached lending covenant, lender remaining supportive. | RED | |

Shearwater (LON:SWG) (£10m | SR47) | Expansion of government contract for provision of threat intelligence services. Expanded contract has total value of c.£1m over three years. Supports delivery of existing FY26 expectations. |

Roland's Section

Christie (LON:CTG)

Up 15% at 139p (£37m) - Trading Update - Roland - AMBER/GREEN

Mark covered professional services group Christie yesterday when the company announced the disposal of a loss-making subsidiary.

Today we have a trading update indicating that results for the year to 31 December are now likely to be ahead of previous forecasts:

The Board of Christie Group plc (CTG.L) is pleased to advise that following stronger than anticipated trading, particularly during the last three months of 2025, it now expects to report a stronger full year performance from its continuing operations than previously envisaged.

A number of positive points are highlighted:

“Encouraging activity levels across [the] Professional & Financial Services division”

“Particularly strong invoicing now expected to be achieved in Q4”

Christie & Co will have advised on the sale or purchase of over 1,000 businesses in the UK, “but at markedly improved levels of average fee compared to 2024”

Strong valuation activity in both Christie & Co and Pinders (finance brokerage)

Renewals performance at Christie Insurance “is also expected to be stronger than original expectations”

Strong H2 trading is expected to be reflected in “a positive and improved year end cash position”.

Updated estimates

One thing the company doesn’t tell us today is the likely impact on profit.

Turning to Research Tree, there’s an updated note from broker Shore Capital, but they too have chosen not to update forecasts until Christie publishes its formal FY25 trading update, presumably early in the New Year.

Fortunately, Shore Capital’s analysts have provided some guidance as to the likely impact of today’s upgrade. They say they expect FY25 adjusted operating profit to be closer to current FY26 forecasts than existing FY25 estimates.

Here’s how those numbers look at the moment, prior to any upgrades:

FY25E adj PBT: £1.8m

FY26E adj PBT: £2.8m

Roland’s view

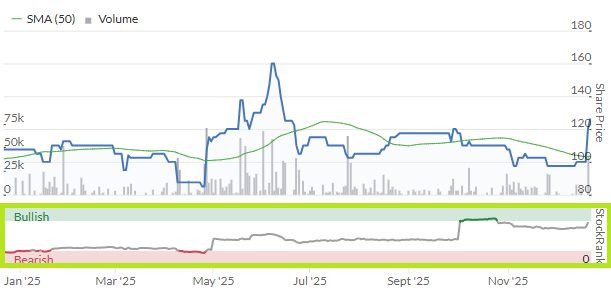

Christie shares haven’t moved all that far in 2025, but there’s been a welcome uptrend in the StockRank and I think recent newsflow from the company probably supports a more optimistic view:

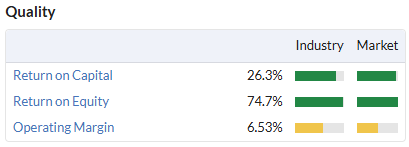

The company’s profitability has improved over the last year and the commentary on fees in today’s trading update suggests this process may have continued in H2:

Although we don’t have updated forecasts yet, Shore Capital’s commentary suggests to me that a substantial part of the growth forecasts for FY26 is now likely to be seen in FY25 results. That brings the valuation down to a relatively reasonable level:

One caveat to this is that FY26 results could look a little flat if the growth seen in 2025 does not continue into next year.

I look forward to a fuller update from the company in early 2026. For now, this business seems to be moving in the right direction while remaining reasonably valued. I am quite happy to leave our recent AMBER/GREEN view unchanged.

Windar Photonics (LON:WPHO)

Down 10% at 39p (£37m) - Trading Statement - Roland - BLACK (AMBER/RED)

This Danish company makes hardware and software for wind turbines and has a track record of downgrading full-year guidance due to order delays.

In June, Mark reported on a downgrade to FY24 guidance due to the impact of an order shipped late in 2024 that didn’t meet accounting requirements for FY24 results.

Today, the company says that delays finalising an order in China “with significant gross value” mean that 2025 results will now be below previous expectations.

Revenue guidance has been cut by c.30% today, while EBITDA guidance has been reduced to breakeven (although full credit to the company for actually including this information in the RNS):

2025 revenue between €6.5m and €6.8m (previous consensus forecasts €9.45m)

2025 EBITDA to be “neutral” (previous consensus forecasts €2.2m)

Management makes the point that this still represents a record level of revenue and a more positive result than the EBITDA loss reported in 2024. They say that demand for Windar’s technology “continues to strengthen” as customers become aware of its ability to “improve wind turbine power output by 2-4%”.

The company also says that products for the delayed order are “ready to ship” and the order will now move into FY26.

Updated estimates & Outlook

CEO Jørgen Korsgaard Jensen sounds an upbeat note on 2026 prospects, as is to be expected:

The tests completed on new turbines in North America and Germany bode well for the business and with the manufacturing capacity now in place to deliver to meet increased sales, together with our balance sheet strength, the business is well placed to grow again in 2026.

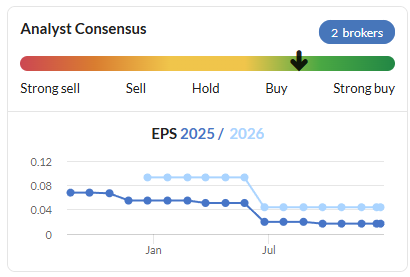

However this optimism is not entirely supported by today’s updated note from house broker Zeus – for which many thanks.

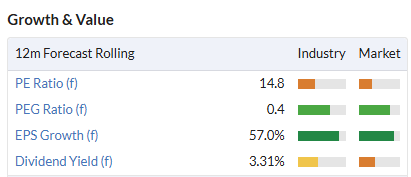

Zeus’s analysts have cut their forecasts for both 2025 and 2026 today, albeit they are still forecasting material growth and profitability for 2026:

FY25E adj EPS: (1.1)p (previously 2.2p)

FY26E adj EPS: 3.8p (previously 5.1p)

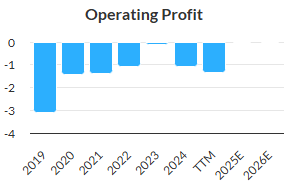

These estimates leave Windar on a 2026E P/E of 10 – potentially cheap for a growth stock. However, today’s downgrade is not the first this year, leaving me to conclude that this business has continued problems with revenue visibility and perhaps over-optimistic guidance:

Roland’s view

While Windar Photonics products sound useful and exciting in the world of wind turbines, the company has not yet made a profit and has just pushed back forecasts of profitability for a further year.

Without further research, I am not sure what kind of margins and returns might be achieved here if the business can reach a sustainable scale.

While the company’s net cash position should eliminate any risk of near-term fundraising requirements, the StockRanks were already taking a dim view of this share ahead of today’s warning:

Mark cut our view on this stock to AMBER/RED in June. I am going to leave this view unchanged today, to reflect the combination of poor trading and net cash.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.