Good morning! As noted in The Week Ahead, the post-Christmas updates from retailers are expected to kick off today. Update: Next (LON:NXT) came through with an update, we'll have to wait a little longer for the others.

We are done for today, see you in the morning! Graham.

Spreadsheet accompanying this report: link (updated to 16th December).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

GSK (LON:GSK) (£74bn | SR92) | Exdensur approved by Japan’s Ministry of Health for severe asthma and chronic rhinosinusitis with nasal polyps. | AMBER/GREEN = (Roland - I hold) [no section below] Exdensur (depemokimab) is reportedly one of the top new biologic drugs in GSK’s pipeline, with peak sales potential of up to £3bn. This new treatment has the potential to provide long-acting treatment for severe asthma and certain other respiratory conditions through twice-yearly injections – an industry first. Today’s approval in Japan follows recent approvals in the US, UK and EU, suggesting this could be a new blockbuster product for the company. As I commented yesterday, I believe GSK is in good shape currently, with a promising portfolio and reasonable valuation. My moderately positive view remains unchanged today. | |

Next (LON:NXT) (£16.6bn | SR64) | In the nine weeks to 27 December, full price sales were up +10.6%, vs. guidance for the quarter of +7.0%. Increases guidance for full year profit before tax by +£15m to £1,150m. PBT up 13.7% vs last year, EPS up 16.1%. | AMBER/GREEN = (Graham holds) As I trust Next's capital allocation skills, I am happy to mimic their buyback policy: if the share price is at a level where they would be happy to repurchase shares, then I'll probably be fully GREEN. Above that level, as they are now, I can be AMBER/GREEN at best, as the shares are unlikely to be dramatically undervalued. This update sets a very high bar for other retailers to follow in the coming days. | |

Rank (LON:RNK) (£450m | SR64) | Following discussions with the Board, the CEO intends to retire from 29th Jan 2026. The current CFO will be interim CEO. | AMBER ↓ (Roland) [no section below] Today’s news comes at a potentially challenging time for this bingo and casino group. The company suffered a €7.1m payment fraud in December, shortly after warning that changes to gaming duty in November’s Budget could result in additional annualised costs of c.£40m from April 2026, before mitigation. For context, house broker Shore Capital was previously forecasting pre-tax profit of £74.1m for FY27 (y/e June 27), but placed its estimates under review following the Budget. While I’m sure some mitigation will be possible, I expect an impact. For this reason my assumption is that current consensus forecasts are probably stale, with FY27 in particular likely to see significant revisions. Rank is expected to issue interim results on 29th January, when the interim CEO (and full-time CFO) will hopefully provide some more clarity on expectations. Until then, I think it’s difficult to take a conviction stance on this stock so I am going to downgrade our view to neutral, mirroring the StockRanks. | |

Caledonia Mining (LON:CMCL) (£387m | SR85) | The enacted provisions of Zimbabwe’s 2026 annual budget confirm the position outlined in Caledonia’s previous announcement. A higher royalty rate of 10% will only apply if the gold price is over $5,000 and other proposed changes have been withdrawn. | ||

Seeing Machines (LON:SEE) (£300m | SR27) | Seeing Machines will receive an accelerated lump sum royalty payment of c. US$14.1 million from a customer under an existing Automotive Program Guarantee. The company “expects to deliver improved positive cash flow in early 2026”. | RED = (Roland) It looks like this long-running and loss-making growth story may be nearing profitability. But after digesting today’s RNS, I can’t help wondering if this accelerated royalty payment (for cash previously expected over the next four years!) could be a bailout in disguise. Perhaps I’m being too cynical. But on current forecasts, Seeing Machines shares are trading on 15x FY28 forecast EBITDA. With another year of losses expected in FY26 and a major debt refinancing deadline looming, I think this is too expensive. The StockRanks view this as a Momentum Trap and I agree, so am leaving our negative view unchanged today. | |

KEFI Gold and Copper (LON:KEFI) (£134m | SR36) | Tulu Kapi project: contracting packages for capex and 50% of opex have been achieved, and the lead design and construction contractor has begun work. Various other milestones. The schedule remains for commissioning in late 2027 and full production in 2028. | ||

Jubilee Metals (LON:JLP) (£107m | SR24) | Received second instalment of $10m from Chrome One following sale of South African Chrome and PGM operations. Deferred payments of up to $50m and a minimum royalty payment of $12m are due at various future dates. | ||

Centaur Media (LON:CAU) (£66m | SR63) | Net cash £67m, planning to return £64m to shareholders at 48p per share. Has now completed plan to downsize cost base to support the remaining single trading business (Influencer Intelligence Limited). | AMBER/GREEN = (Roland) [no section below] The shares are trading at 44p today and a quick check with my online broker confirms that in small parcels, at least, they can be purchased at 44p. In theory, this means there’s an arbitrage opportunity here, given Centaur’s intention of carrying out a tender offer at 48p per share. In practice, I’m not sure if it’s worth pursuing, given the potential difficulty of buying in sufficient size to make the trade worthwhile and the risk that not all shares tendered will be repurchased. Once the tender offer is complete, my sums suggest around 12% of the current sharecount will remain, giving a market cap of c.£7m. With the remainder of the trading business now contained in a single (newly-formed) limited company, assessing valuation is difficult. A delisting also seems likely, as Mark commented in September. I’m going to leave our AMBER/GREEN view unchanged due to the theoretical value on offer. However, from my perspective, Centaur is now a special situation stock and is no longer something I’d consider buying for a regular share portfolio. | |

Zanaga Iron Ore (LON:ZIOC) (£64m | SR32) | Completed work that could deliver an additional $11bn in revenue over 30 years, while offering significant potential capex savings | ||

Windar Photonics (LON:WPHO) (£44m | SR8) | CEO steps down with immediate effect - his decision. He is “the founder and creative force behind Windar”, but “the Board believes there will be no change to the trading position of the business.” | ||

Kelso group (LON:KLSO) (£13m | SR36) | Opened a new holding in Saga. Purchased 400k shares at an average price of 386.5p in January 2026. Believe undervalued with strong prospects. | (Graham) [no section below] Saga is quite a popular idea in the UK share investing community, and not a new one - Kernow Asset Management talked about this at length at a Mello presentation in November! | |

Prospex Energy (LON:PXEN) (£12m | SR15) | CEO Mark Routh is retiring. He will be replaced by external hire Tom Reynolds “no later than 1 February”. Mr Reynolds has previously been CEO of a number of other energy businesses. | ||

essensys (LON:ESYS) (£9.4m | SR25) | Revenue -21%, adj EBITDA £1.3m (FY24:£(0.9)m). Net cash £1.8m. Data centre decommissioning project has delivered £1.5m in savings, Q1 FY26 “broadly in line” with expectations. Remain in discussions re. possible offer. |

Graham's Section

Next (LON:NXT)

Up 2.5% to £139.30 (£17.1bn) - Trading Statement - Graham - AMBER/GREEN =

(At the time of writing, Graham has a long position in NXT.)

It’s an ahead-of-expectations update, which is typical for Next.

Key points:

9 weeks to 27 December: full price sales +10.6%, vs. guidance for the quarter of 7%

Within that, international sales were up 38% (this has been a remarkable source of growth in recent periods).

Adjusted PBT guidance for the year (FY January 2026) increases by £15m to £1,150m.

The new PBT guidance represents year-on-year growth of 13.7%.

Earnings per share is anticipated to grow slightly faster, at 16.1%, to 738.8p (previous guidance: 729.4p).

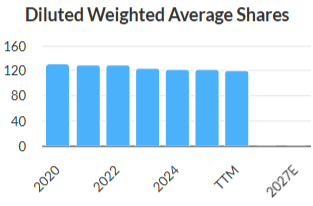

The share count has declined a little, boosting EPS, even though buybacks have not been prioritised recently:

Initial Guidance for FY January 2027:

Full price sales forecast +4.5%

PBT forecast also +4.5% to £1,202m

£768m of cash expected to be available for distribution to shareholders, assuming no acquisitions. Next points out this is 4.8% of their market cap.

Next also points out that combining these cash distributions with EPS growth of 4.3% would lead to a total shareholder return of 9.1%, assuming their P/E multiple is unchanged.

How many other UK companies provide such clarity? I can’t think of any!

The guidance above is for 52 weeks, but FY27 will have 53 weeks and so will be a little better than what is shown above (an extra £22m of PBT - Next makes £3m of PBT each day, on average!).

The rest of today’s statement provides lots more detail on everything - FY January 2026 performance, and FY January 2027 guidance.

Trying to pick out the most interesting bits from the review of FY Jan 2026:

Online UK full price sales growth has been quite good at 8.8% (year-to-date), and retail stores are holding their own 3.5%.

Online international sales are very impressive at 33% (year-to-date), and accelerated in Q4.

Finance income stable.

As we’ve noted previously in this report, Next has discovered how to spend very successfully on international marketing:

We were able to increase profitable marketing expenditure by more than anticipated.

Sales through our main European aggregator, Zalando, were better than anticipated following our transition to ZEOS's platform in August. This change improved stock availability by allowing the same stock-holding to serve both the Zalando and NEXT websites across Europe.

Balance sheet: it’s fair to say that Next runs an "optimised" balance sheet, increasing net debt as it becomes more profitable.

They are looking to maintain a constant net debt to EBIT ratio, at 0.63x.

I view this as a very conservative debt level, so it doesn’t concern me. This leverage multiple based on EBIT, not EBITDA, so it’s more cautious than a typical company would use. Many companies run a net debt/EBITDA multiple of 1-3x.

Instead, Next only allows itself to have a net debt to EBIT multiple of 1x.

This is the right thing to do, because after all it’s a retailer with significant lease liabilities which are considered separately (but most retailers don’t act like this).

Given the anticipated growth in profitability this year, they expect to increase net debt by £38m, which means more surplus cash available.

Graham’s view

This sets a high bar for the retailers that are about to follow with their own post-Christmas updates in the coming days - including Marks and Spencer (LON:MKS) and the supermarkets.

I’m obviously delighted with the performance of my Next shares - which are a two-bagger for me at this stage, not including dividends.

However, I’ve not been fully GREEN on the company as the valuation is now rather high, and I’m not expecting any buybacks in the foreseeable future, unless there is rapid earnings growth or a collapse in the share price.

At this valuation, being fully GREEN would not be prudent. I believe that Next are master capital allocators and if they aren’t buying their own shares at any significant scale, it’s a great sign (in my view) that the shares are not undervalued.

If I may quote from the most recent interim report:

Any share buybacks are subject to achieving a minimum 8% equivalent rate of return (ERR). As a reminder, ERR is calculated by dividing (1) anticipated NEXT Group pre-tax profits by (2) the current market capitalisation. Our latest guidance of pre-tax profits of £1,105m results in a buyback limit of circa £118 per share.

The new PBT guidance for FY 2027 is £1,202m. So in order to get an 8% return, the market cap would have to be less than £15.0 billion.

This actually makes my life very simple, if I follow Next’s view on their share price: below £15 billion, I’d (probably) be fully GREEN, as Next’s buyback policy would help to accelerate EPS growth from that level.

At the current £17bn market cap, I’ll stay AMBER/GREEN as I still like the company very much, but it’s probably not undervalued here, or if it is, it’s unlikely to be undervalued by all that much.

Indeed, if I didn’t have capital gains tax issues, I’d probably want to take profits here, at least with some portion of my holding. However, I’m locked in for the moment! So I hope they continue to show what best-in-class UK (and increasingly, international) retailing looks like. Poor consumer sentiment, economic challenges and higher taxes - Next does not need to reach for any of these explanations for their performance.

Roland's Section

Seeing Machines (LON:SEE)

Down 2.7% at 5.9p (£292m) - Agreement - Roland - RED =

Today’s RNS from this “advanced computer vision company” appears to be good news, but on closer inspection I think it also flags up a potential area of concern for equity investors.

Here’s a summary of the main headlines from today’s RNS.

Accelerated royalty payment

Seeing Machines will receive an “accelerated lump sum royalty payment of approximately US$14.1m” from an existing customer, described as a Tier 1 automotive customer (i.e. a supplier of major systems to automotive OEMs).

The company says this accelerated payment has been made possible as a result of a “material change” to a production program.

However, today’s RNS also makes it clear that this is not new money. This payment represents royalties that were already guaranteed and are simply being brought forward into a lump sum payment, having previously been expected over the next four years. Obviously we don’t know the full story here, but this seems a remarkable contraction of the previously expected payment timeline.

Trading update

There’s also a brief trading update in today’s RNS.

Automotive royalty revenues are expected to “increase materially over the next two quarters” driven by the rollout of General Safety Regulations across Europe. These regulations mandate increased fitment of driver monitoring technology in new vehicles. Seeing Machines expects to benefit from increased demand for its “proven” products.

Management is also confident in the continued growth of the Guardian Aftermraket solution, with quarterly sales expected to exceed 6,000 units by Q3 FY26 (Jan-Mar 2026). In November, the company said Q2 FY26 Guardian sales had “surpassed 2,600 units”, suggesting a rapid ramp up of sales may be underway.

Outlook

Today’s guidance suggests long-suffering shareholders can be hopeful that Seeing Machines is at last nearing profitability:

The accelerated cash generated from this payment and associated revenue recognised will further increase profitability and cash generation in the second half of FY2026. The third quarter of FY2026 represents a significant financial milestone for the Company as it will be the first quarter of generating positive earnings and cash.

However, the obvious question for me is whether the business would have been profitable and cash generative in Q3 if the royalty payment schedule had remained unchanged. This isn’t made explicitly clear, but my guess is that it might not have been.

Debt refinancing risk

Today’s RNS also highlights a second potential concern for investors. CEO Paul McGlone’s comment reminds investors that Seeing Machines has $47.5m of convertible notes that may need refinancing by October 2026:

We are now well positioned to continue executing our strategy, build cash reserves, and progress a range of options to meet our convertible note obligations in October 2026.

Checking last year’s annual report I see that the conversion price of these notes is 9.95p, or around 50% above the current share price:

If the shares reach the conversion price then they will be converted into new shares. This would result in the issue of up to 386.4m new shares, or around 8% of the current share count.

Dilution is never ideal, but this is fairly modest and doesn’t seem a big worry to me. If I was a shareholder, I would be much more concerned about what might happen if the share price doesn’t rise far enough to trigger conversion. This looks more likely to me and in this scenario, Seeing Machines will have to refinance or repay these notes.

The lender, Magna International, is a major car parts manufacturer so may have an interest in remaining invested in Seeing Machines. However, debt is always senior to equity and the terms of any refinancing would be likely to favour Magna over existing equity investors.

Equally, Magna might not want to remain invested in SEE, in which case the company may need to secure refinancing elsewhere.

Roland’s view

I am only speculating, but my guess would be that today’s announcement is all about debt refinancing. Consider the facts:

Seeing Machines is receiving an accelerated royalty payment that would previously have been earned over four years

The royalty payment is coming from an unnamed “Tier 1 automotive customer”

Seeing Machines also has $47.5m convertible notes that are owed to a Tier 1 automotive customer (Magna International)

There may be no connection between the royalty payment and the convertible notes, of course. This could just be a fortunate coincidence.

It’s also worth noting that the company’s share price could yet reach the 9.95p level required to convert the debt to shares, in which case the liability could disappear.

Personally, I’m not convinced conversion is likely, at least not based on fundamentals.

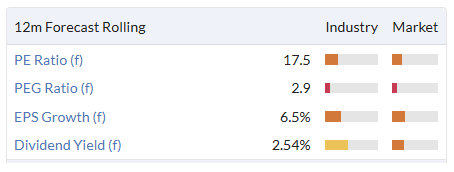

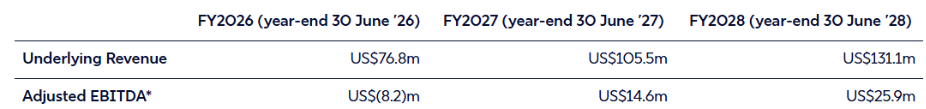

Seeing Machines helpfully provides analyst consensus forecasts on its website for the next three financial years:

Based on the current market cap of c.£300m, Seeing Machines is trading at around 15 times FY28 forecast adjusted EBITDA.

That seems a pretty full valuation to me, without much fundamental support. This is a view also reflected by the StockRanks and SEE’s Momentum Trap styling:

With revenue approaching $100m a year, Seeing Machines seems to have become a substantial business. I’m excited to see this long-running growth story may be nearing profitability and success. This company has been a jam tomorrow stock for as long as I’ve been investing in shares.

However, with a debt refinancing deadline looming and at least one more year of losses expected, I think there’s a risk that further borrowing or fundraising could be needed on terms that might not be very attractive for current shareholders.

Seeing Machines shares would have to be a lot cheaper for me to become interested. I’m going to leave our RED view unchanged today.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.