Good morning! The festivities are well and truly over - but no January blues here yet!

Wrapping up today's report there - cheers!

Spreadsheet accompanying this report: link (updated to 16th December).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

GSK (LON:GSK) (£75bn | SR91) | Approval follows positive phase III trials where Nucala (mepolizumab) showed a significant reduction in the annualised rate of moderate/severe exacerbations. | AMBER/GREEN = (Roland holds) [no section below] Nucala is an established treatment for severe asthma that’s also used for COPD, among other respiratory conditions. Nucala sales rose by 13% to £1.4bn during the first nine months of 2025, making it an important ‘blockbuster’ medicine for the company. Gaining access to a potential new market in China, where c.100m people have COPD, could be an attractive commercial opportunity. Of course, we don’t yet know what uptake or pricing might be like in China, nor whether domestic alternatives might emerge. The country’s China First policy means that many western firms operating in China are seeing renewed pressure on pricing and from domestic competitors. Despite this caveat, today’s announcement looks positive to me. I don’t see any reason to change my previous view on GSK, which I believe is in a relatively strong place at the moment. The StockRanks also reflect this, with a score of 91 and High Flyer status. | |

HUTCHMED (China) (LON:HCM) (£1.74bn | SR27) | Phase II trial demonstrated “favorable trend” in survival. PDAC currently has five-year survival rate of under 10%. | ||

Senior (LON:SNR) (£847m | SR62) | Sale completed on 31 Dec 25, Senior will use initial cash proceeds (c.£150m) to fund debt reduction and £40m buyback. | ||

Auction Technology (LON:ATG) (£326m | SR22) | Board has rejected 11 unsolicited and “highly conditional” proposals from FitzWalter, its largest shareholder (c.21%). The most recent of these was on 23 Dec 25 for 360p per share in cash. The Board believes the proposals “fundamentally undervalue the Company”. | PINK (AMBER ↑) (Roland) | |

Kosmos Energy (LON:KOS) (£317m | SR28) | J-74 well completed in Ghana w/ 50m of net pay. Expect over 10k bopd, bringing Jubilee run-rate to nearly 70k bopd. Agreed debt covenant waiver ahead of refinancing. | ||

Henry Boot (LON:BOOT) (£298m | SR76) | The sale of this loss-making unit for £4m was agreed in September, funded with a £4m loan from BOOT for repayment over five years. The company may receive contingent payments in the future. | ||

Gulf Marine Services (LON:GMS) (£217m | SR76) | Two-year extension (1 firm, 1 option) of an existing contract for a mid-size vessel operating in the Middle East. Separate to extension announced on 30 Dec 25. | AMBER/GREEN = (Roland) [no section below] This is the fourth contract RNS since 23 December. GMS appears to have found some new momentum with customer orders. This has led to a welcome rebuild of the company’s order backlog, which I discussed here. Subsequent wins should mean the backlog is now over $607m. However, as Mark pointed out on 30 Dec, the company hasn’t commented on whether rates are still rising. We know that average contract rates rose by 10% to $36.0k during the first nine months of 2025, but that was during a period when the reported contract backlog was declining. We don’t know if higher rates are being maintained on these recent contracts – higher rates are crucial to improved profitability. Recent share price gains have reduced the value on offer at GMS, but I think the situation remains positive overall – debt is falling and the stock trades well below tangible book value. I’m leaving our view unchanged today. | |

Capricorn Energy (LON:CNE) (£131m | SR59) | SP +10% 2025 production of 20,175 boepd was ahead of mid-point guidance of 19,000 boepd. Received $43m from Egypt in December, year-end net cash was c.$103m. Broker Canaccord Genuity increases its target price to 410p (previously 358p). | AMBER (Roland) [no section below] A positive update highlighting useful debt reduction and a strong operational finish to the year. The group’s year-end net cash position of $103m now represents around half its market cap. In addition to this, the shares traded at a c.50% discount to their last-reported book value. While Capricorn’s past performance has been mixed, I think there could be some value here. However, realising this may not be straightforward given the group’s mix of assets and ongoing challenges. Personally, I would exercise caution without further research. A full-year trading update is expected before the end of January. On the basis of this very brief review, I’m going to mirror the StockRanks and stay neutral ahead of a more detailed update and full-year accounts. | |

accesso Technology (LON:ACSO) (£124m | SR61) | SP -17% Expects 2025 in line. One customer renews for an extra year in 2026, “on revised commercial terms”. Another major customer indicates that it will not renew after January 2026. “The Board currently expects the net revenue impact to be offset, at a Cash EBITDA level, by current initiatives focused on further improving our operational efficiency.” | BLACK (RED=) (Graham) The size of this profit warning is unclear to me, as today's RNS doesn't help to quantify it. We aren't given any numbers relating to the gross profit that has been lost by a customer walking away, how much gross profit has been recovered thanks to the renewal by another customer, or the potential value of the company's own self-help initiatives. Hopefully we'll have fresh forecasts to share with you soon, but in the meantime I'm relieved that we were RED on this and have no desire to change that RED stance stance today. At least the company might still remain profitable and with a net cash position, so that this could be an interesting contrarian pick when the dust has settled. | |

Avation (LON:AVAP) (£87m | SR42) | Six-year lease agreement with Clic Air, a Colombian airline, for an ATR 72-600 aircraft. | ||

Ten Lifestyle (LON:TENG) (£69m | SR61) | New multi-year contract with an existing client to launch a fully digital customer experience to c.1 million of the bank's premium clients in the Europe region. | AMBER = (Graham) Recent announcements have been positive and this valuation on adjusted earnings is tempting (12x adjusted earnings for next year). I also think that over time, the growing ranks of high-net-worth individuals should provide plenty of opportunites for companies like Ten Lifestyle. As such, I’m very tempted to upgrade this to AMBER/GREEN today. But in principle, I don’t think that’s the right response to a fairly vague contract announcement. If today's news was a little more concrete, I would be happy to do so. For, I’m going to leave us on AMBER. | |

Skinbiotherapeutics (LON:SBTX) (£43m | SR15) | 1. Appoints a new NED. 2. The Group FD is promoted to CFO on the Board. | ||

Palace Capital (LON:PCA) (£39m | SR52) | The largest shareholder in PCA is “deeply troubled by the excessive amount of remuneration that Steven Owen continues to extract for himself and the value destruction that shareholders suffer as a result.” | No view (Roland) [no section below] In today’s announcement, 22.5% shareholder Lakestreet Capital highlights some surprising remuneration figures that are potentially reducing the capital available for shareholder returns. Chairman Steven Owen apparently receives a £220k salary that exceeds the previous £195k remuneration provided to the company’s previous five-person board of directors. Lakestreet says this remuneration is equivalent to nearly 23% of the net property income from Palace’s two remaining properties. Apparently, Owen’s total earnings could potentially be boosted to £720k this year due to incentive plan payouts he has “reallocated” to himself from other leavers. Remarkably, perhaps, Owen has also secured a 12-month notice period even though he is leading the company through a finite liquidation strategy. I have not verified any of these claims and don’t have much familiarity with this business. But if correct, some of these numbers do seem egregious to me in the context of the small size of Palace Capital’s remaining business. Lakestreet is seeking to oust Steven Owen and manage the sale of the remaining assets without any fees in order to maximise shareholder value. Palace Capital’s shares trade at 15% discount to their last reported NAV of 224p, so there could be some value here. However, this is clearly a special situation where minority shareholders may struggle to influence the outcome. I’m not going to take a view today as I haven’t done the necessary research. N.B. Palace has issued a response saying the Board (led by Steven Owen) will consider the proposals. | |

Fiinu (LON:BANK) (£33m | SR9) | First ever unaudited, Group-wide net profitable month in November 2025, including exceptional items. £5.34 million cash. | ||

Power Metal Resources (LON:POW) (£17m | SR57) | Power Metal Resources has achieved a 20% stakeholding in the Project. Comprehensive data review and prospectivity re-assessment completed. | ||

Croma Security Solutions (LON:CSSG) (£10m | SR66) | Acquires a locksmith in Taunton, Somerset. £0.47 million including defcon. Also buys the freehold retail property it trades from. |

Graham's Section

Ten Lifestyle (LON:TENG)

Up 2% to 73.2p (£70m) - Ten wins new fully digital contract - Graham - AMBER =

This is a “Medium” contract according to TENG's framework, meaning that it has an annualised value of £0.25 - £2m:

Ten Lifestyle Group plc (AIM: TENG), the global concierge technology platform driving customer loyalty for financial institutions and other premium brands, is pleased to announce that it has won a new multi-year contract with an existing corporate client to launch a fully digitally customer experience programme to around one million of the bank's premium clients in the Europe region. The Group already provides concierge services to the bank's private banking customers across global markets.

The wide range of value for a "Medium" contract makes it a little tricky to understand whether or not this news is material to the company's outlook.

For context, the current year's revenues (FY August 2026) are forecast at £73m, up from £69.6m last year.

So It would have been most helpful for us if today’s RNS had been accompanied by a very brief trading update, to clarify whether or not the new contract results in any change to current growth expectations. For now, I’m going to assume that the news merely underpins expectations, without changing them.

Graham's View

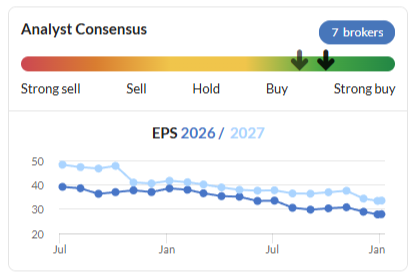

If you’re happy to value this stock on adjusted EPS forecasts, the current-year P/E ratio is only about 14x, falling to 12x for the following year (please note that the actual EPS forecast for FY 2027 is 6.3p, which differs from what you'll find on the StockReport).

And the balance sheet should be fine, with a decent net cash position reported at the last full-year results (thanks to a small placing earlier in the year for £6m).

I’ve been a little sceptical of this share due to what I perceive as low pricing power in the concierge industry, and limited historical profitability.

However, recent announcements have been positive and the valuation on adjusted earnings is tempting. I think that over time, the growing ranks of high-net-worth individuals should provide plenty of opportunites for companies like Ten Lifestyle.

As such, I’m very tempted to upgrade this to AMBER/GREEN today. But in principle, I don’t think that’s the right response to a fairly vague contract announcement. If today's news was a little more concrete, I would be happy to do so. For, I’m going to leave us on AMBER.

accesso Technology (LON:ACSO)

Down 17% to 269p (£103m) - Graham - BLACK (RED =)

I’m relieved to see that I was RED on this in July, after it issued another summer profit warning.

That profit warning was blamed on “customer dynamics at key venues”, i.e. external factors, and it was accompanied by the news of the loss of a large contract for 2026.

Today’s profit warning is all about 2026 contracts. 2025 is in line, but 2026 is not.

First, a renewal:

In July 2025, the Group announced that a product utilised by a major customer was not expected to continue beyond the end of 2025. The Group now confirms that this customer has indicated its intention to continue with the solution for an initial one-year period from 1 January 2026, on revised commercial terms.

When the loss of this agreement was first announced, we were told that it would hit Accesso’s gross profits by c. $6m.

As the renewal is on “revised commercial terms”, i.e. a discount, we can not expect that the full $6m of gross profit is going to be recovered.

And then the bad news:

Separately and unrelated to the above, another major customer has indicated its intention not to renew its agreement for the same software solution beyond its contractual expiry on 31 January 2026.

The gross profit impact of this is not disclosed but surely it would be prudent to assume it’s at least $6m.

Net profit was previously forecast at $14m for FY Dec 2026. So the loss of several million dollars of gross profit would be highly material.

Unfortunately, today’s update doesn’t help us to quantify the hit that it's going to take.

Outlook

Looking ahead, the Group continues to proactively support customers as they manage persistent macroeconomic challenges. While the combined financial impact of the recent contract developments is still dependent upon the outcome of negotiations, the Board currently expects the net revenue impact to be offset, at a Cash EBITDA level, by current initiatives focused on further improving our operational efficiency.

The company is covered by (among others) Hardman Research, but I don’t see any update from them yet today.

Graham’s view

This stock has been a consistent source of bad news in recent years, and I’m relieved that we’ve not attempted to catch the bottom at any point:

External factors have been blamed, and of course I agree that there are pressures in the leisure industry, but this is an international business (reporting in USD) and it should be benefiting from wide geographic diversification. It can’t simply blame the UK consumer.

I suspect that competition has heated up a little when it comes to ticketing solutions - with strong evidence of this being that a major customer was willing to walk away, but then it was tempted back by a discount.

In theory, Accesso’s customers should be somewhat “sticky” - how often should a theme park really want to consider changing its ticketing software? In practice, the answer seems to be: surprisingly often!

Lack of pricing power is always an excellent reason to be cautious and I’m not even going to consider changing our stance away from RED today.

And I’m dismayed to see that the share is now down by 90% from its peak in 2018.

Adding insult to injury, Accesso has been buying back its own shares on the way down. At least it did have a net cash position to fund this activity (net cash $25m as of June 2025).

I do think that the company to remain profitable (at a lower level) and with positive net cash. This gives it some decent potential recovery prospects for the patient - and for those who are willing to accept the high probability of continued profit warnings.

But in the short-term, I think it’s sensible for us to stay RED on this. The bear case is simple enough: external factors working against it, and customers who aren’t showing much loyalty, resulting in highly vulnerable EPS forecasts. The 2026 EPS forecast has already fallen from nearly 50p to 35p, and is going to fall further

With a share price of 269p, this isn’t screaming “buy” to me yet.

Accesso’s July profit warning was couched in positivity. Today’s profit warning isn’t like that, thankfully, but it does fail to provide any helpful detail on how much revenue or gross profit has been lost, or how much of the loss will be offset by the company's various initiatives. So I’ve found these important updates from the company to be much less helpful than they could have been.

RED it is, then.

Roland's Section

Auction Technology (LON:ATG)

Up 19% at 321p (£390m) - Statement regarding Possible Offer - Roland - PINK (AMBER ↑)

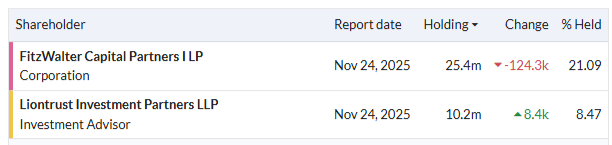

Today we learn that since 11 September 2025, “online second-hand goods marketplace leader” ATG has received (and rejected) 11 “highly conditional proposals” for a cash takeover from its largest shareholder, private equity group FitzWalter Capital.

Latest offer: we are told that the most recent of these offers came on 23 December, when FitzWalter made a possible offer of 360p per share in cash for the group.

The board rejected this offer “on the basis that the proposals fundamentally undervalue the Company”.

ATG’s board says it would have preferred to keep these discussions private, but has made today’s statement ahead of a promised public statement from FitzWalter:

FitzWalter's latest proposal came with an irrevocable commitment to announce the terms and nature of its proposals on 12 January 2026 - the Board is requesting FitzWalter either to make a firm offer on terms which reflect fair value or confirm its intention not to make a firm offer...

The commentary in today’s RNS suggests to me that ATG’s board may not have a very positive relationship with its largest shareholder:

The ATG Board also believes that the repeated approaches, many of which were at the same proposed offer price, do not indicate an intention from FitzWalter to work towards a recommendable transaction, and the proposals represent an opportunistic attempt to acquire the Company at a time when ATG's public market valuation is disconnected from the Company's fair value.

This reported behaviour seems to be a little at odds with FitzWalter’s claim on its website that it’s “uncommonly decisive” and that “those we engage with are always able to know where we stand”.

What is fair value for ATG?

It’s not surprising to me that ATG’s Board believes FitzWalter’s approaches are below fair value for the business. Auction Technology was floated in 2021 and after an initial pop, its shares have traded steadily lower:

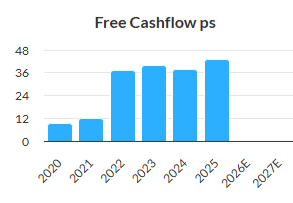

Even after this morning’s share price pop, the shares are still only trading on 11x FY27 forecast earnings. Perhaps more significantly, the stock is also only trading at around 11x trailing free cash flow – a metric that’s been consistently strong since IPO:

Private equity buyers are always keen on cash-generative businesses, so it’s not surprising FitzWalter might want to acquire the business at this level.

Of course, there are some reasons why ATG’s share price performance has been so poor.

We last covered Auction Technology in August, when the group combined an acquisition announcement with a profit warning. I adopted an AMBER/RED view at that time, noting that the acquisition looked expensive and that the trading update on the day seemed to suggest falling margins – potentially as a result of lower average sale values.

Broker estimates did indeed drift lower following August’s statement.

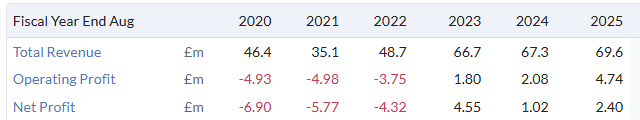

November’s full-year results provided some further detail on the performance of the business over the year to 30 September:

Revenue up 9% to $190.2m (+4.4% organic)

Adj EBITDA -4% to $76.8m

Operating loss of $134.2m

Adj earnings -2% to 37.9 cents per share

Adj net debt +52% to $174m

Revenue growth last year was driven by acquisitions and an increase in the company’s “take rate”, which rose from 4.5% to 4.8% of gross merchandise value. This was driven by an increase in value-added services such as shipping or payments – the actual value of items sold remained broadly unchanged at $3.3bn.

The modest increase in organic revenue wasn’t enough to offset higher costs, either, confirming my fears of falling margins.

These results included a $150.9m goodwill impairment charge relating to previous acquisition, which drove the reported operating loss for the year. Stripping out this non-cash charge suggests that underlying FY25 operating profit might have been c.$17m. That would be equivalent to a 9% operating margin – significantly lower than the margins achieved in prior years following the IPO:

Falling margins and rising leverage are not generally a positive combination, but that seems to be what we have here. Year-end leverage of 2.2x EBITDA (FY24: 1.4x) was relatively high for a listed business.

The main reason for the rise in net debt was the purchase of US Art & Antiques auction group Chairish for $85m in August.

I’d be more relaxed about this if ATG had a strong track record of creating value from acquisitions – but given the size of last year’s impairment charge, I am not convinced of this. I think it’s also worth noting that despite being the second-largest such platform in the US, Chairish was loss-making at an EBITDA level in 2024.

The one saving grace I can find in last year’s results is the strength of ATG’s cash generation.

My sums indicate ATG generated free cash flow of c.$39m, prior to $16.5m of share buybacks. That’s equivalent to a free cash flow yield of 7% at today’s market cap.

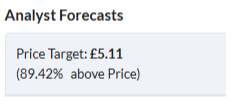

On this basis, I would agree with ATG’s Board that 360p is probably too low. Valuing the stock with a 5% free cash flow yield would give a share price of around 480p – much closer to analysts’ average target price:

However, one caveat I’d add to this is that last year’s results were clouded by the impairment charge and over $10m of acquisition and integration costs which were treated as exceptionals. There were also some large working capital movements, relating in part to Chairish.

I’d have to do further work to form a view on the likely sustainable, continuing free cash flow from ths business. I assume FitzWalter’s analysts have done this work, though, hence their interest.

Roland’s view

I have mixed views on this business as a potential investment.

On the one hand, management has previously said it expects to achieve $8m of cost savings by FY27, following the acquisition of Chairish. This could improve the underlying profitability and cash generation from the business.

The enlarged scale and market reach provided by Chairish could also be beneficial, as the company explains:

[…] the acquisition expands ATG's buyer reach, adding 4.5m monthly visits to ATG's existing A&A traffic of 25.5m monthly visits. Importantly, through the cross-listing of inventory, ATG can drive growth by expanding the value proposition for buyers whilst enabling sellers to increase inventory sell-through by helping them reach more buyers.

On the other hand, I can’t help feeling that this is a business relying on acquisitions to mask slowing sales growth. The purchase of Chairish looked quite expensive to me and I would argue that last year’s $150m impairment charge effectively represents a significant destruction of shareholder value.

My view that ATG may have overpaid for some past acquisitions is also reflected in the low returns on capital achieved by this business since its IPO:

When I add to this the group’s relatively high leverage and (in my view) profligate use of cash on share buybacks, the picture looks less appealing. These returns must be well below the group’s cost of capital. Unless ROCE improves, my feeling is that creating sustainable shareholder value could be difficult.

Even so, I can’t help feeling there could be an opportunity here, perhaps under new management. This is a sector and a product that I have some past familiarity with. In my view, it should be a profitable and cash-generative operation.

I assume this view is also shared by the team at FitzWalter Capital.

Given the uncertainty on a potential bid and the lack of recent trading data, I’m going to adopt a neutral view today ahead of two key diary dates in January:

12 Jan: deadline for promised statement from FitzWalter;

22 Jan: ATG scheduled trading update for three months to 31 Dec 25.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.