Good morning and Happy Christmas Eve. This is likely to be an abbreviated report, with markets closing at 12.30 today for Christmas.

Recommended reading: the end of the year is always a good time to take a look at what's worked over the last 12 months -- and what hasn't. Ed and Mark have already been publishing on this topic in recent days. I'd recommend taking a look at these articles if you haven't already seen them:

- StockRank Review of 2025: Ed looks at the winners and losers from the year

- My biggest mistakes of 2025: Mark takes a critical look at his investing results from the last 12 months

- A year in value: was 2025 (finally) the year when buying the cheapest stocks proved to be a winning strategy?

Looking ahead, our 12 Stocks of Christmas series will kick off on Christmas Day with the first of 12 Super Stocks we think look interesting for 2026. You can read my recap of last year's selection and learn why we're changing the rules slightly here.

Today's report is now complete (11.30).

The DSMR will take a break now and will return on Monday 29th, when markets reopen. Happy Christmas!

Spreadsheet accompanying this report (updated to 24th November): link.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

BP (LON:BP.) (£66.8bn | SR87) | Agreed sale of a 65% shareholding in Castrol at an enterprise value of $10bn (EV/EBITDA of 8.6x). Net proceeds to BP will be c.$6bn, will be “fully utilised to reduce net debt”. | ||

Supermarket Income REIT (LON:SUPR) (£993m | SR81) | Three UK supermarkets at an average net initial yield of 5.5%. One from each of Tesco, Sainsbury’s and Waitrose, all with 10-year+ unexpired leases. | ||

Gulf Marine Services (LON:GMS) (£209m | SR73) | Agreed contract for Large-Class vessel in Middle East, spanning two years inc. options. Correction to yesterday’s contract details: duration should have been 1,624 days inc options, not 985. Zeus broker forecasts unchanged. | AMBER/GREEN (Roland) GMS seems to be gaining new momentum on contract awards after a slower spell this year that was perhaps partly due to geopolitical pressures. I’ve updated my chart showing the development of the group’s order backlog and estimate that it’s now close to previous highs once more. Continued deleveraging could support a return to shareholder returns next year and has de-risked the equity in the meantime. With a c.30% discount to book value even after this week’s gains, I’m happy to maintain a moderately positive view. | |

Regional REIT (LON:RGL) (£162m | SR58) | 3yr extension to debt facility that was due to mature in Aug ‘26. Outstanding balance reduced from £128m to £72.4m through debt reduction. Cost will rise from 3.4% to 4.1% when existing hedge expires. | AMBER (Roland) [no section below] Today’s news from this commercial property REIT appears broadly positive, as do recent disposals and revised management fee levels. However, November's Q3 update flagged up occupancy in RGL’s portfolio of just 76.8%, suggesting to me that further progress on disposals and/or new lettings remains a priority. For now, the dividend supports a 10% yield and appears to be covered by forecast earnings. With the stock also trading at c.50% below book value, I can see there could be an opportunity here. I don’t have the insight into RGL’s portfolio needed to form a strong view, but I do think it could be worth further research for investors with an interest in this sector. I’m taking a neutral view today to reflect this. | |

Roadside Real Estate (LON:ROAD) (£103m | SR33) | £17.8m acquisition of Gardner Retail, a portfolio of six petrol stations in south-west England. Purchase valuation is 8.5x EBITDA. | ||

Defence Holdings (LON:ALRT) (£40m | SR18) | Has agreed the appointment of a CEO subject to checks. The appointee is not yet being named. | ||

Tungsten West (LON:TUN) (£21m | SR16) | Completion of updated feasibility study. Begun project financing process. Cash reserves of £1m at 30 Sept, material uncertainty regarding going concern. | ||

Celsius Resources (LON:CLA) (£19m | SR24) | Has received interest in financing MCB Project from several international mining groups. Appointed financial advisory firm to assist with process. | ||

essensys (LON:ESYS) (£10m | SR24) | Bid discussions with Mark Furness remain ongoing (see here). PUSU deadline has been extended to 5pm on 23 Jan 26. | PINK | |

Litigation Capital Management (LON:LIT) (£10m | SR23) | Following an unsuccessful claim, an Australian court has awarded costs totalling AUD32.4m | RED (Roland) This litigation funder has suffered a(nother) significant adverse cost award. Given that the June 2025 accounts already included a material uncertainty warning relating to the group’s debt situation, I see this as particularly bad news. While the June balance sheet showed net assets of over AUD100m, this figure is stale now and relies on these investments (legal cases) generating positive outcomes. I have no way to know how likely this might be nor which investments have now been realised through recent rulings. While the company is still holding out some hope of finding a buyer, I think there’s a risk this could be a zero for equity holders. In my view, the most likely outcome of the ongoing strategic review might be that LIT’s lenders take control of the business in order to secure maximum value from the company’s current run-off strategy. |

Roland's Section

Gulf Marine Services (LON:GMS)

Up 4% at 19p (£216m) - Contract (and correction to yesterday’s contract RNS) - Roland - AMBER/GREEN

Today’s contract award RNS is the second contract update in two days from jackup rig operator Gulf Marine Services. There’s also a correction to yesterday’s RNS.

You can see my comments on yesterday’s update here. However, as bohenie has pointed out in the comments this morning, these updates haven’t been written as clearly as they might have been.

Here’s my summary of the news, as I’ve understood it:

23 Dec: 2x Large-Class vessels hired in Europe for 1,624 days, including optional extensions (approximately 26 months per vessel). This was incorrectly stated as 985 days in yesterday’s RNS.

24 Dec: 1x Large-Class vessel hired in the Middle East for two years, including options (730 days)

These two hires take the total additional contracted backlog announced this week to 2,354 days.

In effect, this means that three of the company’s five Large Class (formerly E Class) vessels are now on contract for at least the next two years, including options.

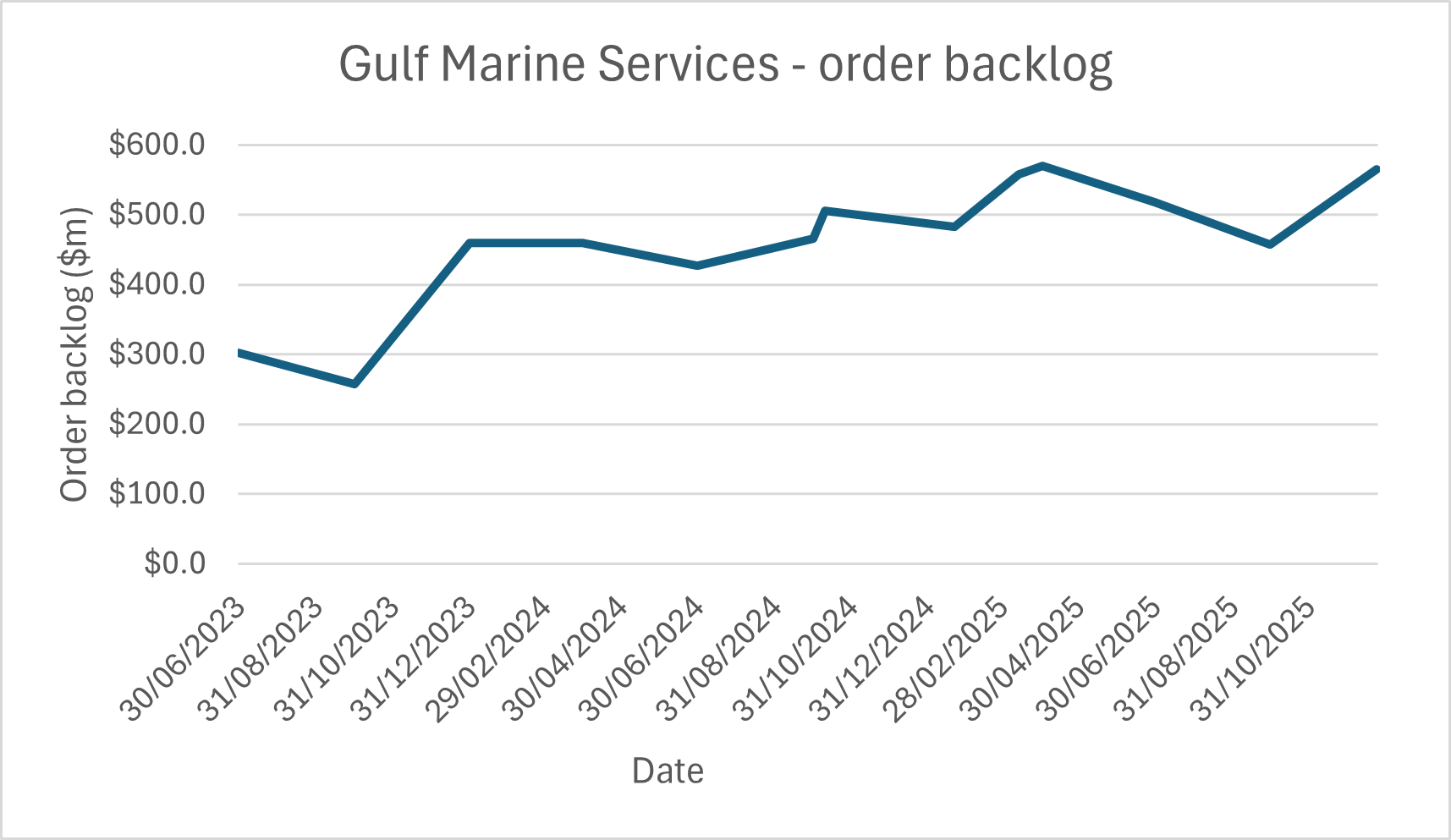

Order backlog: yesterday we learned that the group’s contract backlog had recovered to $540m.

The company hasn’t provided a further update today, but based on the $35k average day rate reported in H1 (across all vessel types), I estimate a further addition of at least $25m is likely today – presumably more, given this latest contract is for the largest class of vessel.

Updating the chart I’ve shared previously using yesterday’s company-reported figure and my conservative $25m estimate shows that Gulf Marine’s order backlog is now approaching new highs again:

I’ve previously commented on the declining backlog reported between February and September, but this no longer seems to be an issue. I wonder if it might have been due to geopolitical factors rather than any weakness in underlying demand.

Broker forecasts: house broker Zeus has left forecasts unchanged once again today. This perhaps suggests that these contracts are largely within its existing estimates for 2026, which already show a significant recovery in earnings after a cut to expectations earlier this year:

FY24 actual adj EPS: 3.4c

FY25E adj EPS: 3.3c

FY26E adj EPS: 3.9c

Roland’s view

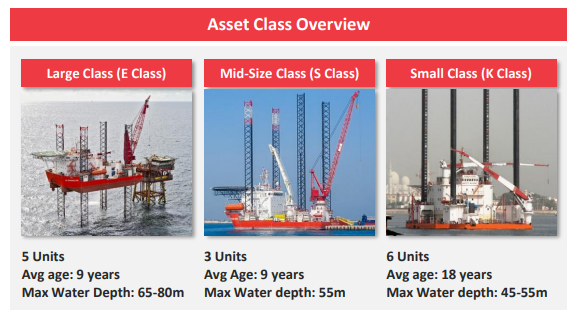

The obvious question here – so far unanswered by the company – is over its plans for fleet replacements or expansions. GMS took one leased vessel onto its books this year to meet additional demand, but other than this there’s been no change.

In fairness, replacements are probably not a pressing issue yet. The company’s two largest classes of vessels have an average age of under 10 years. It’s only at the smaller end of the fleet where the average age is higher, at 18 years. This snapshot is taken from the Q3 2025 update:

For now, the focus remains on deleveraging, with a return to dividend payments and/or share buybacks planned when net debt/EBITDA falls to 1.5x. That’s expected to happen in 2026. Deleveraging in this way has supported a recovery in book value and de-risked the investment.

I upgraded my view from neutral (AMBER) to moderately positive (AMBER/GREEN) on the strength of yesterday’s update.

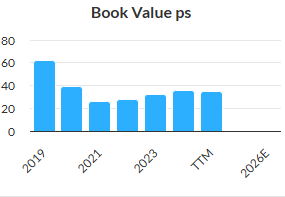

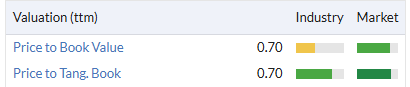

Gulf Marine’s share price has now risen by around 15% this week, reducing the scale of the discount to book value on offer:

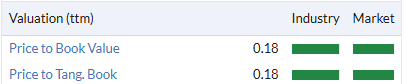

However, at 18p the shares are still well within the 15-20p range where they’ve traded for much of the last two years and are around 30% below their last-reported book value of 26p per share.

With evidence of improving momentum and continued deleveraging, I think there’s probably some value here and am maintaining my AMBER/GREEN view on this stock.

Litigation Capital Management (LON:LIT)

Down 16% at 7.2p (£8.6m) - Adverse Costs in Class Action Investment - Roland - RED

This Australia-based litigation financing specialist has had a bad year:

Litigation financing is not a sector we cover very often, due partly to the difficulty in understanding the prospects or likely value of a company’s investment assets – the legal claims that it’s funded.

When Graham last covered Litigation Capital Management in February, he noted that the stock might be trading at a discount to book value but commented that “it’s not easy for me to trust the valuations of legal cases”.

Events since then have proved the wisdom of this view. Litigation Capital Management has reported a number of adverse legal rulings this year, leaving it exposed to significant cash outflows and investment losses.

Strategic review: the company launched a strategic review in September to consider the possibility of a sale and confirmed that in the meantime, it was transitioning to a run-off model “to realise value for shareholders”.

Material uncertainty: unfortunately, October’s full-year results also included a material uncertainty warning that prompted house broker Cavendish to withdraw its forecasts:

Given the number of adverse case outcomes in recent months, which have impacted cash inflows and increased indebtedness, the Directors have considered a range of scenarios, including plausible downside scenarios, and note that in certain circumstances, further case losses could lead to a breach of LCM's debt covenants.

In its results, the company noted that it was in discussion with its lenders, whose current intention was to remain supportive while LIT completed its strategic review.

Further adverse rulings: today’s update seems likely to add significantly to the financial pressures on the group.

The company’s claimants have been unsuccessful in another Australian legal case known as the QLD Electricity Claim.

The Federal Court of Australia has required the claimant to meet the costs of the defendants, which total AUD32.4m.

LIT has insurance in place which will reduce this liability to AUD19.9m.

This case was co-invested with investors in LIT’s Fund 1, who will cover a further AUD7m.

This leaves LIT exposed to a payment of AUD12.9m.

The company is appealing this judgement and is also considering the possibility of a separate appeal “against the quantification of these costs”. According to CEO Patrick Moloney, this was a very complicated situation:

This is a very expensive and complicated piece of litigation which has resulted in large cost orders in favour of the respondents. This quantification was of ordinary and not indemnity costs orders and so are not a reflection of the conduct of the claimant or LCM or of the strength of the claim.

The comment above only highlights why I personally avoid this type of business. There is simply no way I can understand the potential value or likelihood of success of any of LIT’s investments. It’s entirely a black box, requiring me to trust management judgement.

Roland’s view

Litigation Capital appears to be in a difficult situation. I think there’s a risk shareholders could end up with a zero if the company isn’t able to generate some positive cash flow fairly soon.

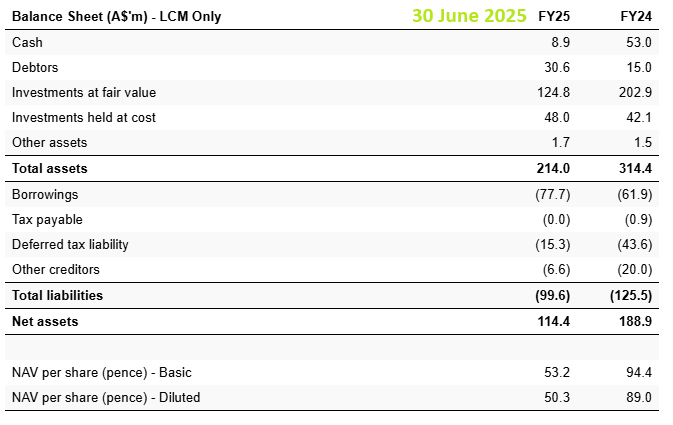

While the company reported a balance sheet net asset value of AUD114m at the end of June, this was supported by investments (legal cases) valued at AUD172.8m. These were offset by AUD77.7m of borrowings.

Although these accounts are now nearly six months old and therefore quite stale, the figures do suggest a big discount to book value.

In reality, I suspect any discount is much smaller and may be difficult to realise.

The reason for this is that LIT’s investments are illiquid and subject to a wide range of valuation uncertainty.

The group’s debt, on the other hand, is very certain and subject to lending covenants. If the company can’t generate a positive cash flow from its overall investment portfolio, it’s left at risk of being unable to service its debts. That seems to be what has happened this year.

The shares have now fallen by over 90% this year. Today’s drop means the market cap has fallen below our £10m limit.

I also note that interim results for the six months to 30 June 2025 haven’t been published yet. If LIT doesn’t issue these results by the end of December, its shares will be suspended.

Our coverage will probably terminate here unless LIT delivers a surprise recovery.

In my view, the opaque nature of the group’s assets and its mounting debt liabilities means the most likely outcome now may be that LIT’s lenders assume control of the business, wiping out shareholders. I see this as a stock to avoid.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.