Good morning! Wrapping up the report there, thanks for all the comments and the thumbs up! Graham.

Spreadsheet accompanying this report: link (last updated to: 15th October).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

GSK (LON:GSK) (£67bn | SR87) | Rev +7%, adj op profit +8% to £2,985m. FY25 guidance upgraded: rev +6%-7% (prev 3%-5%) and adj EPS +10%-12% (prev +6%-8%). | AMBER/GREEN (Roland) Today’s upgrade is modest but highlights good momentum in the key Specialty Medicines division. I’m cautiously optimistic that the long-running underperformance of this business may be in the past, with new management and signs of an improved pipeline. When paired with a modest valuation and useful 4% yield, I am quite happy adopting a more positive view than previously. | |

Glencore (LON:GLEN) (£42bn | SR23) | FY25 production guidance for key commodities maintained, outlook tightened to reflect one quarter remaining. | ||

Next (LON:NXT) (£16.4bn | SR63) | UK sales +5.4%, overseas sales +38.8% (vs guidance of 1.9% & 19.4%). FY PBT guidance upgraded by £30m to £1,135m. | AMBER/GREEN (Graham) The company which famously under-promises and over-delivers has once again over-delivered in Q3. The company is now anticipating an additional £112m of full price sales for the year, and an additional £30m of PBT. As the share price is too high for buybacks, a special dividend of £3.10 is planned. I'm going to take my cue from the company and leave our AMBER/GREEN stance unchanged, on valuation grounds, but I remain just as much a fan of this company and its management team as always. | |

Tritax Big Box REIT (LON:BBOX) (£4.1bn | SR65) | Aberdeen (LON:ABDN) will increase its stake in Tritax Management to 100% by 2029, from 60% currently. No change to management agreement. | ||

Primary Health Properties (LON:PHP) (£2.4bn | SR71) | CMA has cleared the merger. PHP expects to be able to begin combining the two businesses shortly, targeting run-rate synergies of at least £9m. | PINK | |

Elementis (LON:ELM) (£980m | SR58) | Q3 rev +2% to c.$152m. Adj op profit “improved”, with margins consistent with H1. FY guidance maintained despite weak market conditions. | AMBER (Graham) Revenue growth is flat to non-existent, but at least cost savings are keeping the company in the black. The net income consensus forecast for the current year is £75.5m. Despite the potential for continued interest from private equity, I'm inclined to think that the current valuation is generous enough, considering the lack of growth and low returns. | |

Oakley Capital Investments (LON:OCI) (£954m | SR57) | Q3 NAVps -1.5% to 730p, total shareholder return +9.4%. Investments of £56m and buybacks of £29m. | ||

Aston Martin Lagonda Global Holdings (LON:AML) (£659m | SR32) | Wholesale volumes -8%, rev -26% to £739.6m. Adj EBIT £(172.1)m. Reducing capex, continue to expect FY26 profitability and improved cash flow. | RED (Roland) [no section below] There’s no danger of me changing our RED view on this troubled supercar business. But I thought it might be worth a quick look at today’s results to highlight some of the reasons why Aston Martin is performing so badly. A good luxury brand must have pricing power and exclusivity – Ferrari epitomises this in the car world, with carefully controlled volumes and very high prices. According to Stockopedia data, Ferrari’s gross margin is about 50%. AI tells me that the Italian company sells around 13,000 vehicles per year. At the other end of the luxury scale, upscale volume manufacturer BMW has a gross margin of about 16% and sells about 2.2m vehicles a year under its main brand. Today’s accounts from Aston Martin show the company sitting uncomfortably in the middle, with neither volumes nor high margins. Figures for the first nine months of 2025 show a gross margin of 28% (YTD 24: 38%) and volumes down by 8% to just 3,352 vehicles. Average selling prices fell by 22% to £194k, as well, reflecting a sharp drop in the number of higher-margin Specials which are customised to buyer requirements. I can’t speak to the relative desirability of Astons when compared to other luxury sports cars. But today’s news that Aston Martin is cutting its 5-year spending plan on new models from £2bn to £1.7bn suggests it may become even harder for the company to develop new models to rival those from more profitable peers. At the same time, Aston’s net debt of £1.4bn (equal to annual revenue) suggests to me that the only people likely to make money from this business may be its lenders. | |

Hargreaves Services (LON:HSP) (£223m | SR90) | All three business units have performed in line with expectations. | AMBER/GREEN (Roland) [no section below] The market seems a little disappointed with today’s AGM statement, so perhaps investors were hoping for an upgrade. Today’s update is explicitly in line, but existing expectations for this year show profit growth and look respectable enough to me. Usefully, the company includes details of current market consensus in today’s update, but unusually Hargreaves appears to have used statutory profit and EPS figures, rather than the adjusted figures normally highlighted by brokers for consensus forecasts. This means there’s a surprising mismatch between the company-provided EPS estimate of c.59p and broker consensus of c.53p. Even more unusually, Hargreaves’ reported figures are expected to be significantly higher than the adjusted figures. Checking last year’s results, adjustments were minimal, so we’ll have to wait until (at least) the H1 results to understand this situation in more detail. Regardless of this, I remain broadly positive on this business, as I discussed earlier this month. While I’d prefer to buy the shares at or below book value, I think the valuation remains reasonable and see no reason to change my view today. | |

Seeing Machines (LON:SEE) (£169m | SR14) | Selected to deliver an Advanced Development Project (ADP), directly with a Japanese OEM to deliver Driver and Occupant Monitoring (DMS/OMS). Expected production in H2 2028. | ||

Journeo (LON:JNEO) (£81m | SR91) | Purchase orders to supply platform display systems for the Metropolitan Transportation Authority ("MTA") in NYC. | AMBER/GREEN (Roland) [no section below] This is another order from Outfront Media Group for the NY Subway, suggesting this partnership is developing well. These displays will be placed on subway platforms and used for advertising, with delivery expected to start in H2 FY26. There’s no update from house broker Cavendish today so I assume the news is already reflected in current forecasts for next year – with perhaps the bulk falling into FY27. As Mark commented in September, Journeo doesn’t provide a consistent order book metric, so it’s hard to track progress exactly. While it’s tempting to assume that major contract wins such as today’s will lead to upgrades, my feeling is that regular wins are needed to simply keep the hopper full and meet expectations. I still have a favourable impression of this business, although I can’t help noticing that the CEO and CFO have both made six-figure share sales recently. The share price has doubled over the last year or so, so I can imagine this might be a good opportunity to lock in some profits on a trade. However, on a medium-term view I remain confident in the story here and am comfortable leaving our moderately positive view unchanged today. | |

Inspecs (LON:SPEC) (£58m | SR72) | SP +7% A shareholder with 5.5% of the company - a Norwegian hedge fund called First Seagull - demands that Board members with “potential conflicts of interest” recuse themselves from decisions, but does not name these members. It wants “adequate safeguards so that no influential insider may expropriate value from shareholders by resisting the best outcome”. Founder Robin Totterman has been under pressure to leave, and his successor has already been chosen. First Seagull is demanding a “sum-of-the-parts divestment”, i.e. for Inspecs to sell off each of its divisions individually, maximising the price received for each. They suggest that the Italian company Safilo is likely to pay the most for the Eschenback division. They believes total value is £110-130m, or £90-110m net of debt (90-110p). | PINK (AMBER/RED) (Graham) [no section below] I turned fully RED on this in July for a variety of reasons including what I perceived as poor investor communications, an earnings downgrade, a net debt position, and poor business quality. Since then, the situation has become more complicated with news of two potential takeover offers, including one from private equity (H2 Equity Partners) and one from a consortium that includes the founder of Games Workshop. An Italian eyewear company has also expressed a desire to acquire two parts of the company. Given the interest from both industry and private equity buyers, I don’t think my RED stance makes sense anymore. I’ll upgrade it one notch to AMBER/RED as we now know there is real interest from potential buyers, although we don't yet know what prices they might be willing to pay. Perhaps First Seagull’s analysis is correct, despite the company’s very poor financial track record. | |

Panthera Resources (LON:PAT) (£44m | SR24) | Claim against Govt of India by subsidiary Indo Gold. Procedural calendar for phase one has been issued. Hearing set for 14-19 Dec. | ||

Petra Diamonds (LON:PDL) (£39m | SR24) | First two tenders of FY2026 delivered US$52 million with average prices +53% over Q4 FY 2025 due to product mix. | ||

80 Mile (LON:80M) (£31m | SR52) | Independent assessment of Jameson Land Basin (in which 80 Mile will have a 30% interest) estimates 13.03 billion oil barrels. |

Graham's Section

Next (LON:NXT)

Up 7% to £143.60 - £17.6 billion - Graham - AMBER/GREEN

(At the time of publication, Graham has a long position in NXT.)

The company which famously under-promises and over-delivers has once again over-delivered in Q3:

In the thirteen weeks to 25 October, NEXT full price sales were up +10.5% versus last year. This was +£76m ahead of our guidance for the period of +4.5%.

Full price sales were up 10.3% in H1, and that rate of growth has continued in Q3, despite the company’s view that it would soften.

Normally I don’t expect the market to react much when Next over-delivers, because I assume that everyone is expecting it - keeping its guidance low is what Next does.

However, in this case, the scale of the beat against guidance strikes me as rather large.

UK growth has strolled in at 5.4%, well ahead of the bearish 1.9% guidance. Growth here in H1 was even higher, due to favourable weather and M&S disruption.

But it’s the company’s overseas sales that are particularly eye-catching, up 38.8%. This is double the company’s guidance.

There were clues that international online sales were doing very well already over the summer, with the company saying that it realised it could spend more profitably on international marketing than it previously had forecast.

[Our previous analysis of Next: July (by myself) and September (by Roland)]

That is the main theme again today: the company increased international marketing spend by 50% rather than the 25% it said that it originally planned to spend - although did it really intend to only spend that much?

The increase in marketing expenditure was driven by the strength of the returns we were able to achieve. Our marketing budget is an estimate, not a fixed sum. As long as returns remain above our hurdle rate, we will continue to carefully increase our investment.

New guidance: still expects the rate of growth to soften in Q4, although it’s now less pessimistic.

We are increasing our guidance for full price sales in the fourth quarter from +4.5% to +7.0%. This adds a further £36m of full price sales to our forecast.

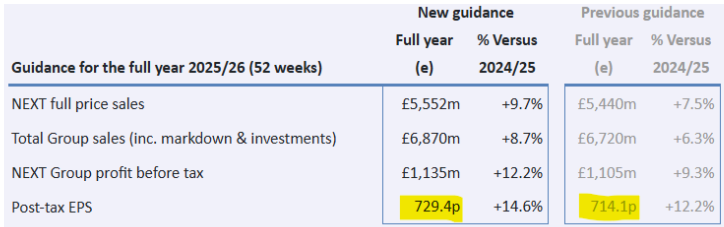

The increase in sales in Q3, along with our improved sales guidance for Q4, means that we are increasing our full year guidance for profit before tax by +£30m to £1,135m.

So the company is now anticipating an additional £112m of full price sales for the year, and an additional £30m of PBT (implies a 27% pre-tax profit margin).

However, if Q4 full price sales were up 10.5%, continuing the trend of the year so far, this would add another £18m to full price sales, and therefore an additional £5m to PBT.

That strikes me as a reasonable estimate, although I do respect Next’s reasons for planning for something worse than that. They do set out sensible reasons for expecting growth to moderate in Q4. And in any case, another £5m in PBT would only increase the forecast by one half a percentage point, so it’s no big deal.

The net result of it all is that Next’s own EPS estimate gets a 2% increase. Imagine if every company was as transparent as this!

Shareholder rewards: the company expects to generate £425m of surplus cash this year. However, “our share price is currently much higher than our buyback limit which, based on our latest guidance, is £121 per share.” They don’t buy back their shares unless they get an 8% yield (forecast PBT divided by their market cap). Again - imagine if every company was as transparent, and as clear-headed as this!

As the share price is too high for a buyback, Next’s assumption is that it will pay a special dividend of £3.10 per share.

Graham’s view

It would not be too difficult to argue that performance here is so good, with continued growth and international expansion in the face of cutthroat competition and economic headwinds, that I should upgrade our view to fully GREEN.

However, I think my reasons for not being fully GREEN are still valid.

First, the sector: I view Next as a rare “last man standing” in retail, with only a few peers that can match it.

However, it is still a retailer, subject to all of the economic and operational risks that plague the sector.

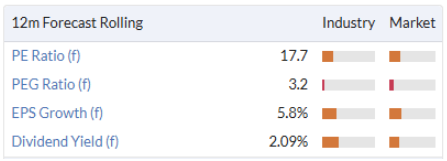

I think modest earnings multiples make sense in this industry, but the market has refused to do that for Next in recent times. It seems that other people like this share as much as I do:

The company itself provides a neat way of deciding whether or not its shares offer value: are they willing to buy them?

Buybacks happen when they can get an 8% pre-tax yield. At the standard rate of corporation tax, this implies a 6% after-tax yield or a P/E multiple of less than 16.7x.

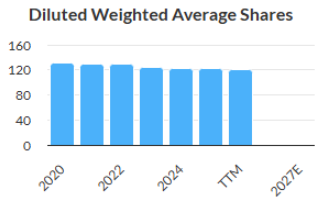

With many of the shares in my portfolio, share buybacks are the cherry on top: the added boost that confirms and seals the investment thesis for me.

Indeed, share buybacks were one of the reasons I got into Next in the first place, and they have played a big part in boosting returns since I invested back in 2017. The share count when I invested was around 147 million, versus 116 million today.

Therefore, I am going to leave our AMBER/GREEN unchanged today, but I don’t think that takes anything away from how much I appreciate this company and its management team.

Elementis (LON:ELM)

Down 2% to 167p (£967m) - Third Quarter Trading Update - Graham - AMBER

This is an in line update, “despite the ongoing weak market conditions”.

We last mentioned this one in May, when Roland noted a track record of weak revenue growth and variable profitability, culminating in the sale of the company’s “Talc” business.

The remaining chemicals business provides “performance-driven additives that help create innovative formulations for consumer and industrial applications” - the industries it serves are many and varied.

Let’s pick out some key points from today’s update:

Revenue up c. 2% quarter-on-quarter, or flat on a constant currency basis.

Adjusted operating profit “improved against the prior year, driven by self-help and cost-control actions”.

$12m in cost savings by year-end, completing the $30m of savings that were targeted since late 2023. An additional $10m of cost savings now targeted and halfway towards completion.

Consistent with what Roland said earlier this year, revenue growth is flat to non-existent, but at least cost savings are keeping the company in the black. The net income consensus forecast for the current year is £75.5m.

Board changes: after various significant milestones for the company, the Chair has seemingly decided that his work is now done, and is stepping down. A NED is also leaving, as the company doesn’t need such a large board any more.

Checking their website, I find 11 directors currently listed, including Christopher Mills of Harwood fame. Harwood and its funds previously owned about 4% of the company - I’m not sure if this is still the case.

CEO comment covers the themes we mentioned above:

"I am pleased to report that we have delivered a resilient third quarter performance, despite the continued softness in the coatings markets, demonstrating the strength and quality of our business and our commitment to delivering outstanding value for our customers. While revenue was broadly stable on the prior year period, our margins remain healthy due to the benefits of our proactive operational efficiency initiatives as we create a simpler, leaner Elementis. With market demand in coatings likely to remain soft, we remain focused on executing our Elevate Elementis strategy - designed to accelerate sustainable growth and deliver attractive returns."

Graham’s view

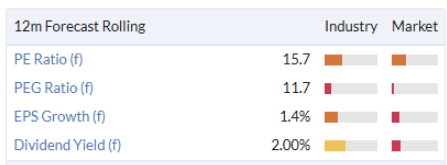

Chemicals are not my specialty, but I’m inclined to agree with Roland’s AMBER point of view.

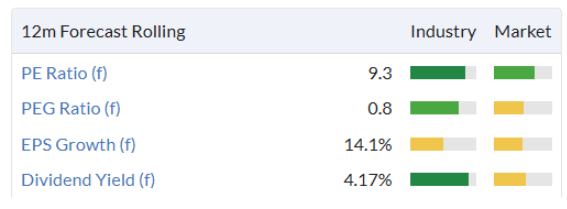

To my eyes, this seems fully valued, and the StockRanks agree (ValueRank only 39):

Having said that, it wouldn’t surprise me if takeover talks popped up again -a private equity firm made an offer for Elementis last year. Private equity in particular seems to like the chemicals sector, and so it would be no surprise at all if Elementis found itself in play once again.

But I'm inclined to think that the current valuation is generous enough, considering the lack of growth and low returns, with the company’s main source of progress currently being found in cost cuts. There’s nothing inherently wrong with that, but I would still argue that there are plenty of more appetising investment candidates than this one.

Roland's Section

GSK (LON:GSK)

Up 1.5% at 1,668p (£68bn) - 3rd Quarter Results - Roland - AMBER/GREEN

Shareholders in GSK might understandably feel they’ve missed the boat over the last decade. Since 2016, FTSE 100 rival AstraZeneca has almost tripled in value, while GSK shares have remained rangebound:

Can GSK finally escape its long-term trading range? Past performance has been held back by patent expiries and an underperforming pipeline of new drugs. But there have been significant changes under outgoing CEO Emma Walmsley, while her successor, Chief Commercial Office Luke Miels, has played a key role in improving pipeline performance over the last eight years.

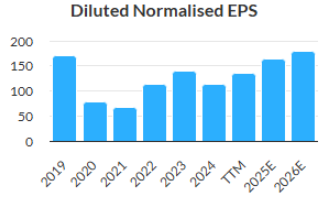

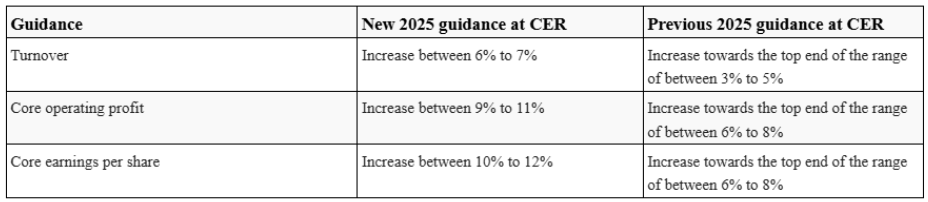

My feeling is that the tide may finally be turning. GSK has set a target of reaching £40bn revenue by 2031, from £31bn in 2024. It’s too soon to know if this is achievable. But today’s third-quarter update does include upgraded full-year guidance, which could help investor confidence in the improving trend suggested by earnings forecasts:

Third-quarter summary

Today’s Q3 numbers certainly seem healthy, with the caveat that pharmaceutical firms have complex accounts and are some of the worst offenders when it comes to relying on adjusted profits!

On a constant currency basis, GSK’s revenue rose by 8% to £8,547m in Q3. Revenue for the first nine months of the year rose by 6% to £24,049m, suggesting a sequential improvement in Q3.

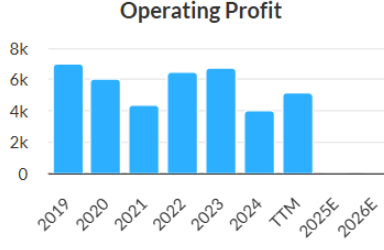

Profitability was also strong. The group’s core (adjusted) operating profit rose by 11% to £2,985m in Q3, accounting for almost 37% of the year-to-date figure of £8,149m. These figures give an adjusted operating margin of around 34%.

Turning to the reported accounts shows an operating profit of £6.8bn for the year to date, giving a still-impressive 28% operating margin – although this reported profit measure does tend to be more volatile than the company’s preferred core metric:

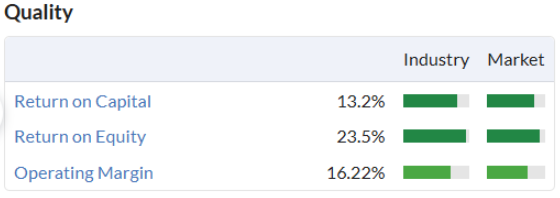

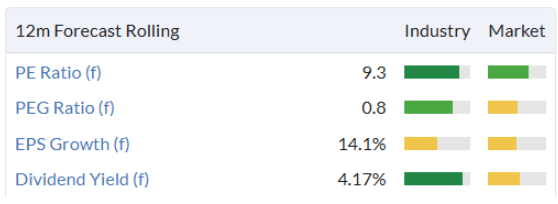

The improvement in reported margins this year looks likely to drive upgrades to the group’s quality metrics, which are already fairly respectable:

Like reported profit, cash generation can always be variable here, although it’s generally quite good. Today’s results show cash flow from operations of £6,254m for the first nine months of the year, providing a decent match with operating profit (£6,832m) for the same period.

GSK’s debt levels have come down and stabilised in recent years and I don’t have any concerns in this regard.

Trading commentary: sales growth was strong across most of the group’s operations in Q3. Specialty Medicines doing particularly well and is the driver of today’s upgrade.

Specialty Medicines: +16% to £3.4bn (HIV +12%, Respiratory, Immunology & Inflammation + 15%, Oncology +39%)

Vaccines: +2% to £2.7bn (Shingles +13%, Meningitis +5%, RSV +36%, Influenza -22%, Established Vaccines -8%)

General Medicines: +4% to £2.5bn (Respiratory +7%, Others n/c)

Outlook

The company helpfully provides clear guidance on (adjusted) expectations, which I’ve reproduced below:

It looks like the upgrade is driven wholly by Specialty Medicines, where the outlook has been improved to “mid-teens percentage” sales growth, compared to “low-teens percentage” previously.

The wording of guidance for Vaccines and General Medicines is unchanged today, suggesting a slight decline and broadly stable results, respectively.

Interestingly, applying the guidance above to last year’s core EPS suggests a 2025 core EPS result of 159.3p suggests 2025 core EPS of 175p to 178p, from perhaps 171p previously.

That’s significantly higher than the 163p consensus shown in Stockopedia, so we could see some upgrades filter through in the coming days.

Roland’s view

For complex big cap stocks such as this, we can only hope to provide a top level overview and analysis. However, the big picture looks broadly favourable to me.

With GSK shares still only trading on a forward P/E of 10, I can see significant scope for a medium term re-rating if the company can demonstrate consistent success with new products.

The future success of the pipeline remains a key uncertainty – I certainly have no way of knowing how likely it is. But it seems that higher ratings are available to companies that do convince the market of their future growth potential – AstraZeneca currently trades on a forward P/E of 16. Applying this multiple to GSK’s share price would give a figure of c.2,700p!

I was AMBER on GSK in July when the company reported a setback with a new cancer treatment. However, this has since been reversed and Blenrep has now been approved in both the EU and USA. It’s seen as a potential blockbuster over time.

More broadly, today’s upgrade gives me confidence that the high-value Specialty Medicines business is performing well in a number of areas. When paired with the modest valuation and stable balance sheet, I think it’s right to upgrade my view to AMBER/GREEN today.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.