Good morning! Company news is still a little light at the moment.

Today's Agenda is complete.

Spreadsheet accompanying this report: link (updated to 16th December).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

GSK (LON:GSK) (£77.4bn | SR91) | EU approval of Shingrix PFS & Positive phase 3 data for GSK’s bepirovirsen | PFS means prefilled syringe - a more convenient delivery method. Shingles affects c.1.7m each year in Europe. Bepirovirsen is a treatment for chronic hepatitis B, which affects >250m people globally. | AMBER/GREEN = (Roland - I hold) [no section below] I’ve commented on GSK several times already this year (here, here and here.) I don’t have anything to add today other than that from my layman’s perspective, these updates appear to provide further evidence of positive momentum within the group’s pipeline and portfolio. My broadly positive view remains unchanged. |

Reckitt Benckiser (LON:RKT) (£40.8bn | SR80) | Will return c.£1.6bn to shareholders through a special dividend of 235p per share, using proceeds from the sale of the Essential Home business. A 24 for 25 share consolidation will maintain share price comparability. | AMBER/GREEN (Roland) This divestment is aimed at making Reckitt a higher quality, higher growth business, more closely focused on its largest brands. On balance I think this is a reasonable expectation, with the caveat that the Mead Johnson baby formula business remains a potential millstone due to ongoing product liability legal actions. Reckitt shares aren’t cheap on a P/E of 17, but I see this as a reliable long-term defensive performer. On the basis that I think management is taking sensible steps to improve performance, I’m going to take a broadly positive view ahead of March’s full-year results. | |

HUTCHMED (China) (LON:HCM) (£1.80bn | SR28) | A trial of sovleplenib in patients with wAIHA has met its primary endpoint within weeks 5 to 24 of treatment. | ||

Intuitive Investments (LON:IIG) (£303m | SR48) | Agreement with China’s national certification agency allows for a pilot of a commercial Paperless Play Lottery - a “critical enabler” for the expansion of Hui10’s digital lottery platform. | ||

Henry Boot (LON:BOOT) (£295m | SR77) | The sale to Vistry delivered an internal rate of return of 9.2% and means that Hallam Land has exceeded its 2025 sales target, with a record 3,957 plot sales last year. | This is a Reach announcement, i.e. a non-regulatory press release. | |

Phoenix Spree Deutschland (LON:PSDL) (£154m | SR54) | Sales in December “materially exceeded” the company’s target, with €5.4m of notarisations. FY25 sales totalled 122 units (€36.0m). Phoenix intends to return capital to shareholders in 2026 through share redemptions. | AMBER (Roland) [no section below] This property company is engaged in a run-off strategy to liquidate its portfolio and return cash to shareholders. It’s not a stock I’ve looked at before, but a couple of things struck me as being potentially interesting about today’s announcement. The first is that capital will be returned by share redemptions. These aren’t the same as buybacks. The company will redeem shares at a value that’s expected – according to today’s announcement – to be aligned with IFRS equity value. In other words, the book value on the balance sheet. Checking the June 2025 accounts, my sums suggest a NAV per share of around 255p. With the shares trading at c.170p, there’s a potential value opportunity here that’s reflected in the stock’s current discount to book value. The second point I want to highlight is that the company’s previous guidance in November was that redemptions were expected to be in line with EPRA NAV per share. This is an industry-standard measure that’s typically higher than IFRS NAV – PSDL’s EPRA NAV was reported at 298p per share in the June 2025 interim results. In other words, significantly higher than the IFRS NAV per share of 255p. Unless I’m missing something, my conclusion from this is that expectations regarding shareholder returns have been downgraded today. I’m flagging Phoenix SpreeDeutsch as a special value situation that investors might find interesting for further research. I don’t have a strong conviction either way on this initial review, so I’m going to go AMBER today. | |

Topps Tiles (LON:TPT) (£87m | SR84) | Q1 revenue ex-CTD +3.7%, “outperforming the market”. CTD store disposals are complete and Fired Earth brand is now operational. | AMBER/GREEN = (Roland - I hold) A solid Q1 update, in my view, given the subdued market backdrop. I’m hopeful the full integration of trade distributor CTD following the completion of the CMA process may also help group performance. Looking back at last year’s results, I’ve flagged up concerns about the profitability of the group’s leasehold estate and the lack of free cash flow support for the dividend, but I don’t think these are significant enough to warrant a downgrade at this time. I’m leaving our view unchanged today ahead of a more in-depth half-year update in the spring. | |

EnSilica (LON:ENSI) (£50m | SR40) | Reiterates current guidance for FY May 2026 of revenues of £28 - £30m. More than 95% of revenues are already covered by existing contracts. EBITDA of £3.5 - £4.5m. | RED = (Graham) | |

Aptamer (LON:APTA) (£27m | SR34) | Revenue for H1 26 is £0.83 million, +27%. FY26 fee-for-service order book of over £2.0 million in new contracts. “Strong” sales pipeline of £3.1m. | ||

Galantas Gold (LON:GAL) (£16m | SR21) | Andacollo is a past-producing, large-scale open pit heap leach gold operation in central Chile. Total consideration $32m over years. Related party transaction: the asset is currently indirectly owned by Galantas’ SVP Operations. | ||

Eden Research (LON:EDEN) (£14m | SR15) | Mevalone has been granted approval by the French authorities for use on grapes to control downy and powdery mildew. | ||

Directa Plus (LON:DCTA) (£14m | SR30) | FY25 update: revenues €7.0m (FY24: €6.66m) and adjusted LBITDA broadly in line with expectations of c. €2.5m (FY24: €3.64m). Gross cash balance €1.5m. Board continues to “assess its optimum options to secure the requisite funding which will be needed in FY26 to support future growth.” | ||

Blackbird (LON:BIRD) (£10m | SR3) | Epidemic Sound’s music and sound effects catalogue will be integrated directly into elevate.io’s video editing platform. | This is a Reach announcement, i.e. a non-regulatory press release. |

Graham's Section

EnSilica (LON:ENSI)

Up 4% to 53.95p (£52m) - Trading Statement - Graham - RED =

EnSilica plc (AIM: ENSI), a leading fabless chipmaker of mixed signal ASICs (Application Specific Integrated Circuits), provides the following update on trading for the six months ended 30 November 2025…

We don’t study too many microchip companies in this report.

I haven’t looked at this one since its April profit warning, when I downgraded our stance on it to RED.

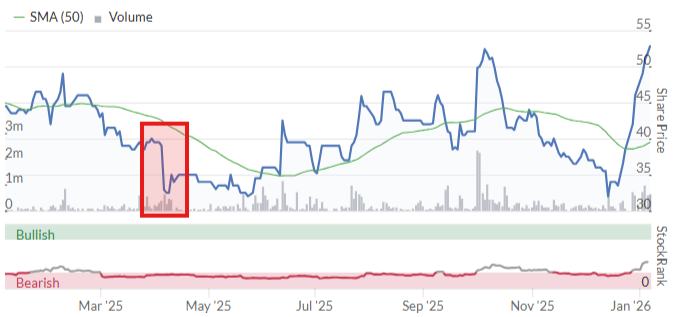

The share price has staged something of a recovery since then (the profit warning is highlighted below):

Today’s update is positive and reassuring:

The Company is pleased to report that it generated solid new business momentum across the Period alongside producing strong levels of Non-Recurring Engineering ("NRE") and recurring supply revenue from existing contracts, delivering revenue growth in excess of 35 per cent during the Period on a like for like basis.

H1 2026 revenues will be c. £12.7m, with positive EBITDA of £1.7m (H1 last year: EBITDA loss £0.2m).

Cash balance: £2m.

Outlook: they reiterate guidance for £28-30m of revenues, with EBITDA of £3.4m - 4.5m.

CEO comment:

"With business already booked to support £28 million to £30 million of revenue in FY 2026, and with several customer chip tape-outs scheduled for the second half of the financial year, we expect FY 2026 revenues to be weighted towards the second half.

Looking beyond FY 2026, the depth, quality and duration of our contracted and pipeline programmes point to a level of long-term value that is not yet fully evident in our near-term financials. As these programmes progress from design through tape-out into sustained production, our highly scalable model and underlying quality of the business will become increasingly apparent."

Graham’s view

It’s perfectly reasonable for the CEO to argue that the near-term financials don’t yet reflect the company’s progress, but as a value-biased investor I do have a tendency to wait for lots of evidence/proof before believing the story!

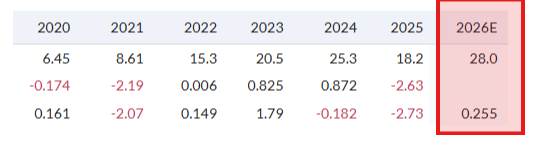

The historic financials here aren’t great in terms of bottom-line profitability:

Not being an expert in this industry, it’s hard for me to say whether or not Ensilica has any sort of sustainable competitive advantage - the financial results obviously do not indicate it yet.

The design, supply and manufacture of various types of integrated circuits is surely an intensely competitive space in which to operate. I’m not sure what a competitive advantage would even look like.

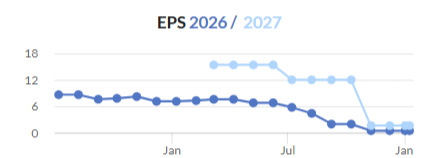

And I note that EPS forecasts have been soft even since the April warning:

I’m therefore on the fence between leaving this on RED and upgrading it back to AMBER/RED.

When I’m on the fence, my first check is the balance sheet. According to PanLib today (many thanks to them), the net debt forecast for FY May 2026 is £7.2m, an increase from the £6m at the prior year-end.

If the company was in net cash, I’d go back to AMBER/RED without hesitation.

As it has a material amount of net debt relative to the size of the company, and as EPS forecasts have generally trended downwards over the last year, I think staying RED makes sense.

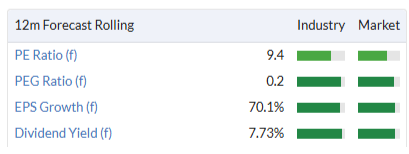

It’s not as if the stock is trading at a cheap multiple:

RED might be a little harsh, but that’s where I’ll leave this for now.

Roland's Section

Topps Tiles (LON:TPT)

+4% at 46p (£91m) - Q1 Trading Update - Roland - AMBER/GREEN =

(At the time of writing, Roland has a long position in TPT.)

Full credit to Topps Tiles for being only the second listed UK retailer (after Next yesterday) to release a post-Christmas trading update. Topps is currently a member of my SIF portfolio, so I’ve a keen interest in progress at this small-cap.

Today’s update covers the 13-week period to 27 December 2025 (Q1 FY26). It lacks some of the detail provided by Next, but it does contain some useful information for investors. Here is my summary of the main points:

Total group revenue +1.6%, including the impact of store closures at CTD Tiles (acquired in 2024)

Group revenue ex-CTD +3.7%, “outperforming the market”

Topps Tiles brand revenue +2% like-for-like

Trade sales +3.7%

Digital sales 19.7% of revenue (FY25: 19.0%)

Market conditions appear to remain challenging, with sales growth broadly in line with inflation. Looking at today’s figures, I would guess that sales volumes are probably flat or slightly negative.

However, efforts to gain market share gains through expansion in trade and online seem to be making progress – Topps says it outperformed the wider market in Q1. This could leave the group well positioned for when demand does become stronger.

Usefully, Fired Earth (a premium brand purchased out of administration in November) was up and running before Christmas, allowing the group to fulfil “strong demand from customer orders”.

CTD Tiles: one important area of progress recently has been the completion of the CMA process relating to Topps’ acquisition of Ceramic Tile Distributors (CTD Tiles) in 2024.

Topps paid £9m for certain assets and stores from CTD when that business went into administration, but the deal was called in by the CMA for investigation, preventing Topps from fully-integrating the business. That process is now complete and today’s update provides a useful summary of the situation:

“CTD operation is now smaller than it was”, operating from 22 stores versus 31 a year ago

CMA-mandated store disposals have completed, with the fourth and final disposal taking place in December

Remaining CTD stores delivered 4.7% LFL growth during the period

CTD performance in Q1 provides “a solid foundation” for the group’s plan to return CTD to profitability in FY26

Topps has been publishing revenue figures excluding CTD Tiles for some time now, but my hope is that this business will now be fully consolidated and no longer require exceptional reporting.

The appeal of CTD to Topps is that it provides exposure to the Architect & Designer and volume housebuilder segments. These are markets where Topps previously had “limited or zero representation”, respectively.

Management has previously said they believe CTD has the potential to contribute £30-£40m of profitable sales over the medium term.

Management changes: Alex Jensen replaced long-serving CEO Rob Parker on 8 December, after “a seamless transition process”.

Jensen’s last role was as CEO of National Express’s UK, Ireland & Germany business. Prior to that she had a career at BP, including leading the retail and B2B fleet services business as divisional CEO.

Topps’ CFO also left in September and his position is currently being covered by a (second) interim CFO. A new permanent CFO (appointed by Jensen) has been recruited from Watches of Switzerland Group and is expected to start work in “Spring 2026”.

Outlook & Estimates

Today’s update conspicuously lacks any mention of profitability or whether trading is in line with expectations for the current year. Admittedly it’s early in the year, so I wouldn’t read too much into this.

Fortunately, broker Zeus has shared an updated note on Research Tree today. Forecasts have been left unchanged, suggesting that today’s update is in line with expectations:

FY26E adj EPS: 4.4p

FY27E adj EPS: 5.4p

FY28E adj EPS: 6.5p

Topps normally issued a half-year trading update around the start of April, so I would guess the company may provide a more detailed update on trading at that time.

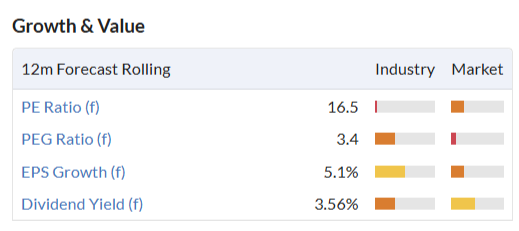

As things stand, Topps Tiles continues to look modestly valued:

Underperforming stores?

When Topps acquired CTD assets in 2024, the deal included a licence to operate 30 stores. While the CMA required the disposal of four locations, the reduction in CTD storecount from 31 to 22 over the last year suggests to me that some of the stores acquired may not have been performing as well as hoped.

I suspect this reflects a wider potential concern for Topps, which has c.300 leased stores. Total lease liabilities were c.£100m at the end of FY25 and servicing these entailed cash outflows of c.£22m.

The balance sheet also showed a net lease liability of c.£22m, suggesting a number of stores may be loss-making or underperforming.

Lease outflows certainly accounted for much of the group’s cash flow last year. My sums suggest net profit of £6.0m only converted into free cash flow of c.£2.8m in FY25.

That’s not sufficient to cover the £5.7m dividend declared for FY25, or the £3.9m of dividend cash outflows during the FY25 period.

In fairness, cash generation has generally been fairly good in this business and Topps still ended last year with net cash of £7.4m, excluding leases.

The company’s short average unexpired lease term of 2.5 years also means it has the flexibility to close or relocate stores quite quickly if needed. Short leases also mean regular renewals. These may offer opportunities for rent reductions, but could also see rents rise in popular locations.

Roland’s view

While I’d like to see more robust cash flow support for the generous dividend, I would hope that cash performance might improve as the CTD acquisition beds in and is finally properly integrated in the business.

We’ve been broadly positive on Topps Tiles recently and I don’t see much reason to change this today. The company is operating in a difficult market, with rising costs and somewhat stagnant demand. In this context, I think performance is pretty respectable, with the business well positioned to benefit when market conditions do start to improve.

Reckitt Benckiser (LON:RKT)

+0.3% at 6,080p (£54.6bn) - Special Dividend and Share Consolidation - Roland - AMBER/GREEN

This divestment is aimed at making Reckitt a higher quality, higher growth business, more closely focused on its largest brands. It’s a similar strategy to that pursued by Unilever (disc: I hold) which recently spun out its lower margin, slower-growing ice cream business.

Reckitt’s 2025 half-year results showed the Home Essentials division still generating a respectable 22% operating margin, but like-for-like sales were down by 6.5% and there was a 5% fall in volumes.

This contrasted with a modest increase in volumes and positive LFL sales for Reckitt’s core business.

My take from this is that Home Essentials brands such as Air Wick and Calgon are more vulnerable to substitution than flagship Reckitt brands such as Durex, Gaviscon and Strepsils.

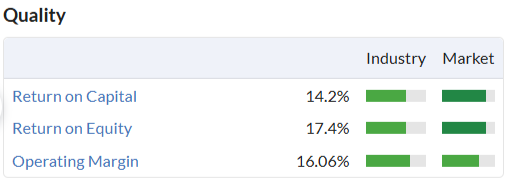

Reckitt expects this disposal to contribute to its target of reducing fixed costs to 19% of revenue in 2027, down from nearly 22% in FY24. Progress so far is yet to be reflected in the stock’s quality metrics, but I suspect these may improve when the 2025 year-end accounts are published that exclude Home Essentials.

Roland’s view

I think it’s probably fair to conclude that this disposal will improve the overall quality of Reckitt’s business. However, I’d caveat this – in the short term at least – with a reminder that the Mead Johnson baby formula business remains a potential drag on returns, due to ongoing product liability legal actions and stagnant growth.

Mead Johnson was a deeply misguided acquisition by previous management, in my view, and if I was a shareholder I’d hope for a disposal when the legal situation is resolved.

Reckitt shares aren’t cheap on a P/E of 17, but earnings are recovering and I see this as a reliable long-term defensive performer. Cash generation is also generally strong, supporting a dividend that hasn’t been cut for over 20 years (I think).

The group’s shares have recovered well over the last two years but remain below previous highs. On the basis that I think management is taking sensible steps to improve performance, I’m going to take a broadly positive view today. I’ll hope to take a more detailed look when the group’s 2025 results are published in March.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.