Good morning!

Today's Agenda is complete. Spreadsheet accompanying this report: link (updated to 16th Decembeer).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

Shell (LON:SHEL) (£152bn | SR63) | Shell narrowed its projected range for fourth-quarter liquefied natural gas production to between 7.5 million metric tons and 7.9 million (Reuters). | ||

Experian (LON:EXPN) (£31.6bn | SR67) | “After a highly successful tenure as Chair”, Mike Rogers intends to retire at the AGM in July. Was on the Board for nine years, seven as Chair. | ||

Tesco (LON:TSCO) (£28.9bn | SR78) | Like-for-like sales: Q3 +3.1%, Christmas +2.4%. Total 19-week period: +2.9%. “Outperformed market on both value and volume basis”. Now expects FY26 adj. operating profit at upper end of the £2.9bn to £3.1bn guidance range. | AMBER/GREEN = (Mark) [no section below] There is a theory in food retail that if you win Christmas, you win the rest of the year, as customers tend to stick with a particular retailer into the New Year. While we haven’t seen all the supermarkets report, the figures here look pretty strong and potentially mark Tesco out as a Christmas winner. It doesn’t seem to be just sales either as they are now guiding profits at the upper end of guidance. However, the share price is off 6% today. It seems to be an issue of expectations management. The market actually expected UK Christmas sales to be stronger than they were, and the lacklustre performance of wholesaler Bookers may be giving some investors pause for thought. It is also worth bearing in mind that the rating on a number of valuation metrics looks a little higher than rivals such as Sainsbury’s and M&S. Historically, Tesco has generated higher returns on capital, so perhaps deserves a premium rating in the sector. Plus, this is the second minor upgrade in a row, meaning that it makes sense to stay broadly positive. | |

Associated British Foods (LON:ABF) (£15.3bn | SR86) | Primark has had a challenging start to the financial year, with a mixed performance. Food businesses also mixed. 16 week period: group revenue +1%. “We now expect Group adjusted operating profit and adjusted EPS to be below last year”. | BLACK (AMBER/RED ↓) (Mark) | |

Marks and Spencer (LON:MKS) (£6.76bn | SR52) | LfL food sales +5.6%, Fashion, Home & Beauty sales minus 2.9%. Food sales were strong while Fashion, Home & Beauty is “getting back on track”. Full-year guidance remains unchanged. | AMBER = (Mark) [no section below] This is another strong food sales number. Although, it is only a 2.3% increase by volume, as continued food price inflation plays its part in these figures. The rest of the business wasn't so great, seeing declines in LFL sales. Full year guidance being unchanged isn’t perhaps as impressive as it sounds, since it means a 20% fall in EPS. The good news is that the issues surrounding the cyber-attack seem to be in the past. If the company can deliver on the FY27 forecasts then this is going to start to look too cheap again. However, it feels a little early to upgrade our previously neutral view, given that it would be a big jump in EPS from FY26 to FY27, and Home & Beauty remains weak. | |

Computacenter (LON:CCC) (£3.28bn | SR87) | Buys a professional services business focused on the US enterprise market for up to $120m. | ||

Greggs (LON:GRG) (£1.81bn | SR70) | Q4 like-for-like sales +2.9%, total sales +7.4%. Full year like-for-like sales +2.4%, total sales +6.8%. Conditions remain challenging; gains in market share. Anticipates full year outcome in line with previous expectations. | AMBER = (Mark) [no section below] | |

Hilton Food (LON:HFG) (£445m | SR70) | NED becomes COO of the West region. APAC CEO becomes COO of the East region. New full-time Director of Investor Relations. | ||

Cerillion (LON:CER) (£363m | SR35) | Major new contract with Oman Telecommunications worth £42.5m, Cerillion’s largest contract win to date. “Helps to underpin existing market forecasts for FY26 and beyond.” | ||

Central Asia Metals (LON:CAML) (£345m | SR98) | Copper production of 13,311 tonnes. Zinc-in-concentrate production of 17,881 tonnes. Lead-in-concentrate production of 25,156 tonnes. Cash $80m. | AMBER/GREEN = (Mark) [no section below] | |

Beauty Tech (LON:TBTG) (£323m | SR-) | Continued to perform strongly through November and December. Anticipates that revenue and adjusted EBITDA for 2025 will be ahead of current market expectations (Will now be no less than £136.0 million and £35.5 million, respectively.) Remains confident in its outlook for the new financial year | ||

TT electronics (LON:TTG) (£197m | SR48) | “As only 51.77% of shareholders by value voted in favour of the Scheme, the TT Board notes that the Acquisition will not now proceed.” | AMBER = (Mark) [no section below] This is another company where shareholders have voted down a bid from a trade buyer that was recommended by the board. The chances of it passing did look slim after 24.5% holder DBAY publicly said that they didn’t support the bid. The plot thickened after the Board revealed that DBAY themselves had tabled an inferior bid. However, the details of the vote released yesterday afternoon show that DBAY weren’t alone in opposing the 150p Cicor offer, and preferring that the company remained independent. In reporting this news, the company also included a trading update. “At least in line” is good news. However, it is worth noting that since I reviewed the company’s H1 results (when I said FY numbers looked a stretch), the broker EPS consensus for both forward years has been cut by a mid-teens percentage. So while shareholders rejecting a 150p bid suggests that there is still long-term value, the near-term rating isn’t inspiring, and there is much work still to do for the management to turnaround the business. So with a middling StockRank of 48, I’m sticking with our previously neutral view for the moment. | |

Dialight (LON:DIA) (£145m | SR81) | Now expects to exceed market expectations for Adjusted Operating Profit (prior consensus $8.6m EBITA) for the year ending 31 March 2026 and beyond. Non-Underlying costs for the year to be approximately $4m. Net debt closed at $10.3m on 31 December 2025 (30 Sep: $10.2m). | AMBER/RED = (Mark) | |

Kistos Holdings (LON:KIST) (£143m | SR55) | Production for 2025 averaged 9,000 boepd at the top end of guidance. 2025 proforma exit production rate was 22.7k boepd. FY26 proforma production guidance remains at 19-21kboepd. Adjusted net debt $81m. | ||

Quartix Technologies (LON:QTX) (£138m | SR80) | Revenue and adjusted EBITDA (under current accounting policies) are expected to be ahead of current market expectations. ARR +14% to £37m, FCF £5.1m, Cash £5.6m, Final Dividend 7.5p. | ||

Orosur Mining (LON:OMI) (£92.6m | SR29) | Infill hole results: o PEP072B - 47.60m @ 3.43g/t Au from surface o PEP073 - 104.45m @ 5.96g/t Au from surface o PEP074 - 71.35m @ 6.46g/t Au from surface Drilling restarts at Anzá after Christmas break. | ||

Rentguarantor Holdings (LON:RGG) (£45m | SR18) | FY Revenue +88% to £2.4m (£2.2m consensus). Adjusted operating loss £280k higher than expected (£416k prior consensus) due to accelerated marketing costs. | BLACK | |

Cobra Resources (LON:COBR) (£44.8m | SR19) | IP Survey defines two additional large scale chargeability targets. | ||

Palace Capital (LON:PCA) (£42.1m | SR54) | Palace Capital confirms it received a valid requisition notice seeking to appoint Christian Kappelhoff-Wulff and Valentin Pierburg to the Board and remove the current Executive Chairman Steven Owen with immediate effect. Company views Lakestreet’s comments about Steven Owen's remuneration as “inaccurate and misleading”. | ||

Mobile Streams (LON:MOS) (£39.7m | SR12) | The Acquisitions of Estadio Gana and Capital Media Sports will complete immediately on admission to trading on AIM which is expected at 8.00 a.m. today. Change of Name to Gana Media Group plc. | ||

Medpal AI (LON:MPAL) (£26.3m | SR7) | “MedPal app's AI now analyses aggregated user health data, including body mass index ("BMI"), to identify individuals who may benefit from clinically supervised weight management and GLP-1 treatments or other supplements or medicines that can be obtained via the Company's online MedPal Clinic.” |

Mark's Section

Dialight (LON:DIA)

Flat at 360p - Third Quarter Trading Update - Mark - AMBER/RED

The market reaction to the newsflow here is a mystery to me, with the shares having trebled since the Summer:

It kicked off with a 20% jump in share price in response to FY25 results, which in itself looked a little strange. While cost-cutting had got them back into profitability on an adjusted basis, there was still a huge statutory loss and the going concern statement said that:

…“the Directors have identified circumstances which give rise to a material uncertainty which may cast significant doubt on the entity's ability to continue as a going concern, meaning it may be unable to realise it assets and discharge its liabilities in the normal course of business.

When Graham reviewed their trading statement on 1st September, he continued to highlight the lack of balance sheet strength, although at that point the company said they were “confident of meeting current market expectations”. But it was all a bit confusing. They said:

Year-to-date adjusted operating profit at the end of August 2025 is expected to be strongly ahead of both the six months to 30 September 2024 ($0.9m) and the six months to 31 March 2025 ($3.2m).

But why not just quote the higher figure of the last H2, and why report an in-line TS for 5 months when you could wait a month and have the HY numbers? It seems that their adjusted figures appear to include a couple of one-off gains, and it was not clear that they had adjusted these out:

This result includes the benefit of a one-off Covid credit from the US Internal Revenue Service of $1.4m, as disclosed with the Preliminary Results in July 2025. The current year result has further benefitted from foreign exchange gains of circa $0.8m.

By the time the expected HY trading statement arrived, they said

Demand trends and operating conditions in the Group's end markets have remained soft with sales marginally down on the prior year as a result of tariff uncertainty, the softer macro-economic climate and the impact of this on the Group's hazardous end market sectors. The Group remains cautious on the sales outlook for the full financial year to 31 March 2026 due to this continuing uncertainty.

But cost-cutting rode to the rescue:

The continued benefits of the delivery of the Transformation Plan are that the Group now expects to significantly exceed the market expectation for Adjusted Operating Profit for the year ending 31 March 2026.

But they were clear at this point that this excluded the one-off gains.

Adding to the mystery, the broker consensus didn’t change:

Although we did get an Edison note at this point forecasting 17c of EPS for FY, which works out at around 12.6p. This suggests that, what I presume is research from Investec but we are unable to view, either isn’t being updated, or is not being captured by Refinitiv (Stockopedia’s data provider). Edison so far seems unwilling to commit to a FY27 forecast, meaning that this FY26 figure is all we really have to go on.

The results themselves added little new information, although the directors did consider that there is no longer a material uncertainty, which was good news.

Today’s trading update reveals a similar pattern, with ongoing sales weakness (not quantified) offset by better-than-expected cost-cutting, leading to:

The continued benefits of the delivery of the Transformation Plan means that the Group now expects to exceed market expectation* for Adjusted Operating Profit for the year ending 31 March 2026 and beyond.

They seem to be quoting EBITA here as the footnote says “Market expectation $8.6m EBITA (Earnings before Interest, tax and amortisation)”. Although this figure isn’t in the Edison note, they do forecast $17.1m EBITDA and depreciation is running at around $5.4m annualised including IFRS16. Meaning Edison were forecasting around $11.7m EBITA. Even with the company now saying they will beat the $8.6m EBITA figure, this looks a miss versus Edison’s figure. I can’t see any updated coverage to be sure. Presumably, their Broker and Financial Advisor, Investec, had a much lower figure in their research.

On top of this, EBITA is not Operating Profit. At the half-year, the company amortised $1.4m of intangibles, but capitalised $2m of intangible development. I’m going to be generous and assume they are now doing $10m EBITA, which means we have:

- $2.8m annualised Amortisation

- $2.6m annualised interest charge

- $1.8m annualised tax

= $2.8m adj. PAT

With a market cap of $194m, they look to be on a forward P/E of around 70. Plus H1 PAT was $2.7m, implying that H2 will be barely profitable, even on an adjusted basis.

These also adjusted numbers and exclude non-underlying costs, where they say:

We expect Non-Underlying costs for the year to be approximately $4m (prior period: $21.6m) consisting almost entirely of transformation related activity, which will contribute to ongoing upgraded financial performance.

Given that the adjustments were a positive $0.4m in H1, this means that they have spent $4.4m on cost-savings in H2, in order to broadly break even, if my calculations are in the right ballpark.

Mark’s view

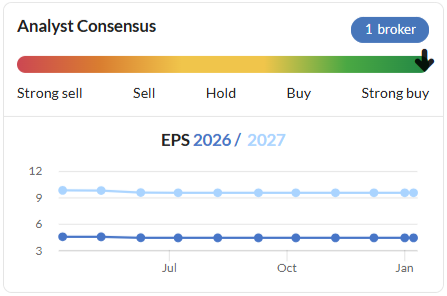

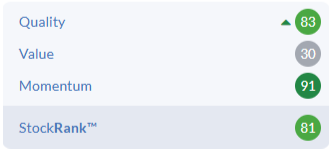

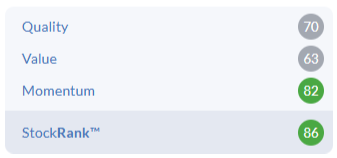

I know that I should be broadly positive on a High Flyer with this sort of StockRank:

Especially, as the material uncertainty, which has been one of the major sources of our negativity, appears to have gone away.

However, there is so much uncertainty here, with different figures being quoted by the company, a lack of broker coverage (at least viewable by us), quoting EBITA while capitalising development costs, and the sudden reappearance of material adjustments. None of this builds my confidence that this is a company that has put a difficult past behind it. Combined with what looks like an incredibly high P/E, at least if my attempt to make sense of the mess of figures is right, I can’t help but keep our negative view of AMBER/RED.

Associated British Foods (LON:ABF)

Down 12% at 1890p - Trading Update - Mark - BLACK (AMBER/RED ↓ )

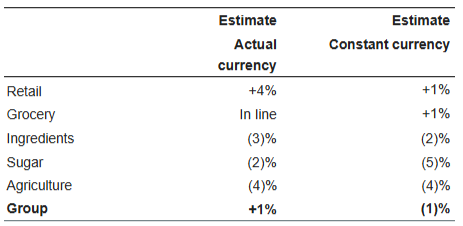

This doesn’t sound the worst profit warning, given that previous consensus was for only a 1% rise in EPS:

We now expect Group adjusted operating profit and adjusted EPS to be below last year, reflecting the guidance by segment set out above.

However, the new guidance means that revenue is now forecast to be £19.3bn versus the £19.9bn in the StockReport:

Partly this seems to be currency effects, but also specific weaknesses. Sugar and agriculture were already expected to be weak, but they are joined on the naughty step by the ingredients business:

In the US, we had expected ongoing consumer weakness to lead to lower sales. In our cooking oils and bakery ingredients businesses this year, the impact has been more acute than anticipated and we are more cautious on the outlook. As a result, we now expect both our Grocery and Ingredients segments to deliver adjusted operating profit for the full year that is moderately below last year.

The weakness in Primark is a little worrying, as you would expect that their value-orientated offering would resonate with the cash-strapped consumer in difficult market conditions. They claim that in the UK they have gained market share, despite LFL sales growth of just 1.7%. We have to be a little careful, as companies can always choose their comparatives, but if this is the case there must be a significant number of clothing retail losers out there yet to report Christmas trading. This also may be a worrying number for Shoezone investors, as this company tends to lactate their stores close to Primark in order to generate price-conscious footfall. Brokers are forecasting a 5% recovery in revenue there for their FY , and virtually flat Primark LFL sales over the key Christmas trading period might not help them achieve this.

The real damage in Primark is said to be in Europe where LFL sales were down 5.7%. The response was higher clearance sales in order to reduce stock, impacting profitability. They do say:

We have a broad range of initiatives in place and planned for the coming months, which we expect to drive improved sales and profitability, particularly in Europe. However, if Primark's current sales trends were to continue in the second half, we would expect the adjusted operating profit margin for the full year to be approximately 10%, similar to the first half, as we continue to invest in growth. It should be noted that in the first half of 2025 we had a non-recurring benefit to profit of £20m.

Without them really revealing what has gone wrong in Europe, it is really hard to judge whether their initiatives will have the desired impact.

Mark’s view

We’ve held a neutral view here in the past, as family controlled firms, such as this, tend to be good at taking decisions that deliver long-term shareholder value rather than looking for short-term market-pleasing headlines. However, looking at the chart, this has gone nowhere for a decade, and the 3% yield doesn’t exactly offset the capital loss:

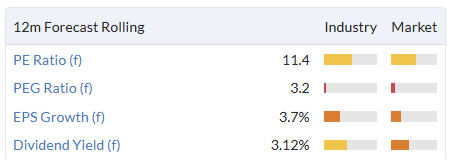

The forward rating isn’t crazy. However it doesn’t stand out in either the market nor its sector:

The algorithms actually rate this a Super Stock as it scores well on all three factors:

However, I think there are reasons to think that this will be short-lived. FY26 results being lower than FY25 will see Piotroski score fall, impacting the Quality Rank. The Momentum rank will also react to this, plus today’s share price fall. The Value Rank may not be as severely hit as the others as the declining EPS will be offset by the lower share price. However, the net effect will be a much lower StockRank.

This is clearly not a terrible company, but I struggle to see where the shareholder returns will come from from here. It is a combination of mature food businesses that generate pretty low returns on capital, together with a retail operator that appears to be struggling to resonate with its customers, at a time where being good value should give it an edge. While the profits warning may not be the most severe type, in keeping with the Stockopedia research in this area, I’m reducing our view to AMBER/RED to reflect the near-term outlook.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.