Good morning!

I quite enjoyed writing up the latest Week Ahead article - this looks set to be a big week in the markets.

Hanging up the pen there, thanks everyone.

Spreadsheet accompanying this report: link (updated to 16th December).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

British Land (LON:BLND) (£4.1bn | SR68) | Carter is stepping down after a total of 18 years at the company to become CEO of a GIC-owned logistics property business. | ||

Plus500 (LON:PLUS) (£2.5bn | SR93) | Revenue of c. $792m and EBITDA of c.$348m) are ahead of market expectations. Improved customer longevity, active customers -5% to 242k. | GREEN = (Graham) Continues the strong momentum it has had for years with another strong update, and I'm not going to attempt to stand in its way with a cautious stance. When I turned positive on this two years ago it felt very late to do so, but the share price has already doubled since then and it is still not at a particularly expensive rating (P/E multiple 12.5x with a very strong balance sheet, $0.8 billion of cash). | |

Renewables Infrastructure (LON:TRIG) (£1.65bn | SR75) | Previous £150m buyback programme that was suspended in November will resume, with £71.7m remaining. | ||

Oxford Nanopore Technologies (LON:ONT) (£1.36bn | SR35) | Revenue +22% to £223-224m, slightly ahead of guidance. “Continued progress on path to profitability”, ended year with £302m cash. | ||

Auction Technology (LON:ATG) (£395m | SR25) | Potential bidder FitzWalter disputes some of the points made by ATG last week. The PUSU deadline for FitzWalter to make a firm offer is now 5pm on 2 Feb 26. | PINK (AMBER =) (Roland) [no section below] Last week I commented on ATG’s disclosure that it had rejected 11 proposals from potential buyer FitzWalter. Today FitzWalter has provided its own response, criticising the Board’s track record, especially relating to the c.$100m acquisition of Chairish. Today’s statement also claims that ATG’s Board has previously told FitzWalter it was considering a partial disposal in preference to its possible offer – something previously unreported, as far as I am aware. In this vein, FitzWalter’s spokesman suggests that “a common thread amongst the Board’s recent actions has been to prevent shareholders having a chance to cast their own vote”. We don’t know the details of FitzWalter’s interactions with ATG’s board. But my view last week – “there could be an opportunity here, perhaps under new management” – remains unchanged. I think the core auction business could be attractive, but I’d be reluctant to back the current leadership. | |

Porvair (LON:PRV) (£392m | SR83) | Makes filters and consumables for molten metal industry, in particular aluminium filtration. Paying €20.5m. Drache 2025 revenue expected to be c.€20m. | ||

Public Policy Holding (LON:PPHC) (£264m | SR45) | Has filed an amended registration form in response to feedback from SEC. Proposed listing remains subject to regulatory approval. | ||

Impax Asset Management (LON:IPX) (£189m | SR82) | AUM -7% to £24.2bn. Net outflows of £1.6bn and market movement of £(186)m. Recent credit win following acquisition of two fixed income teams. | AMBER = (Graham ) There is no change to forecasts at Equity Development but it seems that a strong rebound in AUM is already needed to hit forecasts. More positively, the stock is potentially approaching deep value territory considering its high cash balance in September (covering about a third of the current market cap) and tangible equity of £90m. If AUM and earnings can stabilise from here, then I do think that the stock is absurdly cheap. But the pessimists have been right so far. | |

Knights group (LON:KGH) (£160m | SR78) | Underlying revenue +30% to £103.2m, adj EPS +11% to 14.09p. Net debt up 50% to £75.2m. FY outlook in line with exps. | AMBER = (Roland - I hold) While the headline figures look strong, the reality is that organic growth was just 2.6%. Meanwhile, a big rise in interest costs (and debt levels) caused adjusted profit margins to fall. Reported profit performance and free cash flow were weaker still, as the (real) costs of regular acquisitions and related activities flowed through to the bottom line. While I’m not a big fan of this business, I accept that continued growth may eventually lead to operating leverage and stronger profitability. Equally, putting a pause on acquisitions would probably result in improved cash generation and lower debt. On this basis, I think the valuation looks about right to me when the heavily-adjusted nature of earnings is factored in. I think it’s fair to maintain my neutral view following these in-line results. | |

Journeo (LON:JNEO) (£87m | SR87) | £1.6m of orders for real-time information systems from Cornwall’s highway subcontractor. Expect £1m revenue in current year. | AMBER/GREEN (Roland) [no section below] Another useful contract win for this transport information systems provider. However, a £1m contribution to the current year is equivalent to just 1.4% of FY26 forecast revenue of £72m. Today’s update doesn’t mention expectations and there’s no updated broker note today either, suggesting expectations remain unchanged. I remain a fan of this business but would view this update as business-as-usual rather than exceptional. Indeed, I’d argue that RNS updates on this level are in danger of starting to look promotional. With the stock now looking more fully rated than in the past, I’m leaving our broadly positive view unchanged today. | |

Smarter Web (OFEX:SWC) (£85m | SR11) | Planning to move from Aquis market to LSE Main Market. Expect Admission on 3 Feb 2026. | ||

Iqe (LON:IQE) (£72m | SR21) | Performance at the upper end of the previously announced FY 2025 forecast range, with revenue of c.£97m and adjusted EBITDA of at least £2.0m. Enters 2026 with a strong Q1 order book. | PINK (RED =) (Roland) Trading was apparently better than expected last year, although it’s possible some of this was merely 2026 revenue brought forward into H2 2025. We are also told that the company remains in discussions with various parties for a possible sale of all or part of the business. But there’s no update on year-end net debt, other than to confirm the company’s lender has provided another covenant waiver. There could be a recovery or sale opportunity here. But IQE already has a market cap of nearly £90m, despite being dangerously indebted and loss making. I am not sure how much of a premium the company’s assets deserve – more research would be needed to carry out a sum-of-the-parts valuation. However, the debt situation alone means that the risk to equity is such that I have to maintain our negative view today. | |

Quadrise (LON:QED) (£56m | SR5) | Extension of the Exclusive Global Collaboration and Emulsifiers Sales Agreement with Nouryon, for the exclusive supply of goods, services and IP. | ||

Corero Network Security (LON:CNS) (£51m | SR10) | Revenue at the upper end of guidance and EBITDA ahead of guidance for FY 2025. Cash $4m. | ||

Onward Opportunities (LON:ONWD) (£45m | SR56) | NAV 143.7p, 11.1% return over 12 months. Top quartile NAV performance +50.2% since inception in March 2023. | ||

MicroSalt (LON:SALT) (£27m | SR1) | Unaudited sales for FY25 exceeded the Board's original revenue expectations of $2.0 million, increasing by 287% year-on-year to $2.14 million (2024: $745k). Continues to project 2026 sales to total $7.0 million, then $15m in 2027. | ||

Renalytix (LON:RENX) (£27m | SR5) | During the last quarter of 2025, RNX successfully completed three additional health care provider clinical integrations in the United States. | ||

Haydale Graphene Industries (LON:HAYD) (£23m | SR15) | Has carried out a £5.75m fundraising to complete the previously announced acquisition of SaveMoneyCutCarbon. The acquisition is “accelerating its transition from advanced materials innovator to a commercially scalable, graphene-enabled clean-technology platform with immediate market access.” | ||

Vulcan Two (LON:VUL) (£17m | SR26) | CFO steps down for personal reasons with immediate effect. Will continue to work with Vulcan Two in the finance team. New interim CFO hired (previously CFO at Boku | ||

Nanoco (LON:NANO) (£16m | SR11) | Nanoco filed an answer and counterclaims to a complaint by Shoei Chemical Inc in Virginia. Nanoco is seeking damages for infringement of patents. The case is expected to come to trial in 2026. | ||

Prospex Energy (LON:PXEN) (£12m | SR14) | Issuing up to £1.6m of loan notes that are convertible at 3p (current share price: 2.75p) and paying 12% interest. £1m of commitments so far. | ||

Bow Street (LON:BOW) (£9m | SR30) | Revenue for 4 weeks to 28th December +1.3% on a like-for-like basis. FY25 results to be in line with expectations. |

Graham's Section

Impax Asset Management (LON:IPX)

Down 1% to 148p (£188m) - Q1 AUM Update - Graham - AMBER =

(At the time of writing, Graham has a long position in IPX.)

Impax, the AIM listed specialist investor focused on the transition to a more sustainable economy, today provides an update on the development of its assets under discretionary and advisory management ("AUM") for the first quarter of its financial year.

I’ve held this share for a little over a year now, and thankfully the position is far too small to hurt me (less than 1% of my portfolio).

This is the only stock I voluntarily removed from my annual watchlist. This was a) due to already having plenty of other fund manager picks on the watchlist, and b) out of respect for the continued negative momentum that the business is suffering.

As a reminder, Impax experienced £13 billion of outflows in FY September 2025.

Having started the financial year with £37 billion of AUM, it finished it with £26 billion.

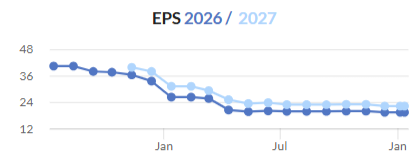

EPS forecasts halved:

The stock was “cheap” with an earnings multiple of 8x a year ago.

It is still “cheap” today, but of course the EPS forecast is a moving target:

Why haven’t I sold my position yet? Well, as already mentioned, the position at this point is too small to really hurt me, so it’s not urgent. And frankly I’m still intrigued as to whether it might stage a recovery!

Which brings us to today’s Q1 update (for October-December).

Key points:

Outflows £1.6 billion

Slightly negative market movements, compounding the decline.

Net result: AUM falls from £26.1 billion to £24.2 billion.

Comment by CEO Ian Simm:

"Net outflows during the quarter were driven by a small number of institutional clients, while net outflows in our wholesale channel continued to improve. Overall, net outflows have stabilised in recent quarters following a more challenging period around 12 months ago.

Looking ahead:

"While conditions remain challenging, we continue to see investor appetite for our investment approach and, for example, expect to onboard a new client in the second quarter within our fixed income business. This marks our first significant credit account win following the successful integration of the two teams that we have recently acquired as part of our aim to diversify our product range beyond our traditional strength in actively managed listed equities."

Estimates: thanks to Andy and the team at Equity Development, including analyst Paul Bryant, for continuing to provide detailed coverage of this name.

They have left their estimates unchanged today, including:

FY Sep 2026: revenues £129m (FY25: £141.9m). After-tax profit £22m (previous year: £20.3m).

FY Sep 2027: revenues £141.2m, after-tax profit £26.3m.

It is absolutely worth bearing in mind that there’s a high degree of uncertainty around these forecasts. I was far too optimistic about Impax this time last year, so I’m part of the problem!

This time last year, the forecasts were:

FY25 revenues £159m (actual result: £141.9m).

FY 25 after-tax profit: £30.6m (actual result: £20.3m).

It’s simple, really: if AUM continues to fall, then there is ultimately nothing that can stop the profit figures from falling, too.

Graham’s view

The latest estimates assume that AUM will improve from £26 billion at the end of FY25 to £28 billion by the end of FY26, and then to £32 billion by the end of FY27.

Is this realistic? I think so. Is it perhaps a little optimistic? Perhaps. As noted above, AUM has already fallen to £24 billion by the end of Q1. So a strong rebound in AUM (about 17%) is needed to hit forecasts now. At least markets have been very strong in Q2 so far. And Ian Simm has tried to strike a positive tone in today's commentary.

I moved down to a neutral stance on this in December and I’m inclined to leave that in place today. As a shareholder, I’d love to see some green shoots, but they are invisible to me so far.

Fundamentally, I do still think the stock is far too cheap - but only on the assumption that AUM stabilises. When it does, I’ll hopefully be quick to upgrade our stance on the stock.

As for my personal holding, I have an open mind about what to do with it - I could sell it and move on without any hard feelings, or I could add to it, if I start to see those green shoots of recovery. I’m happy to stay flexible for now, and my “AMBER” stance reflects that.

At the current market cap, the shares offer £129 of AUM for every £1 invested in the company. That’s absurdly cheap, if AUM stops falling. But that is the multi-billion dollar question. I thought environmentally-motivated investing was going to remain popular for the long-term, but I failed to predict the loss of some large mandates at Impax and what this would do to their financial profile. So far, I’ve been way too optimistic about this one.

The share price is down by 40% since the end of 2024 (and by about 90% since it peaked five years ago):

At some point it might even reach deep value territory: the cash balance was £65m as of September 2025, about one third of the current market cap. The most recent full-year dividend was 12p, and 13p is forecast for the current year - which would yield nearly 9% on the current share price if it was achieved.

A tantalising situation: if only performance could stabilise, the value on offer would be remarkable! But the pessimists have been right so far.

Plus500 (LON:PLUS)

Up 2% to £37 (£2.6 billion) - Year End Trading Update - Graham - GREEN =

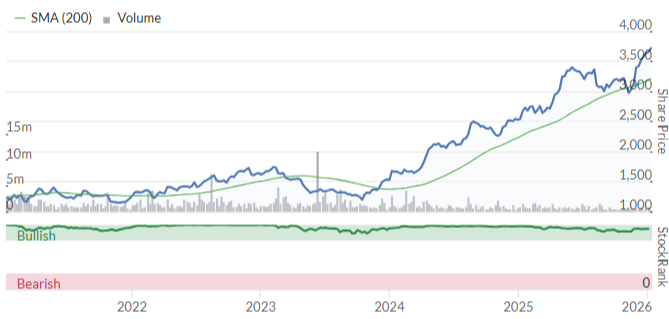

Abandoning my scepticism on this one was the right call:

I’ve been GREEN on this for quite a while now - since January 2024, to be precise, when the share price was £17.

At the time, it felt like I had turned positive far too late. But the share price has more than doubled again since then.

Today’s full-year update continues the positive momentum, as it’s ahead of expectations.

The Group delivered extremely strong financial results for FY 2025, with Revenue of approximately $792m and EBITDA of approximately $348m, both of which are ahead of market expectations

Expectations are helpfully provided: Revenue of $757.7m and EBITDA of $345.8m.

So revenue is ahead by 4.5%, and EBITDA is ahead by less than 1%.

Year-on-year progress: Let’s compare with the prior year: FY24 revenue was $768.3m, while EBITDA was $342.3m.

So PLUS was expected to see a modest revenue decline in FY25, and it grew revenue instead.

EBITDA was expected to grow very modestly, and it has slightly outperformed that.

So this is not a major upside surprise, but it’s enough to justify a 2% increase in the share price today.

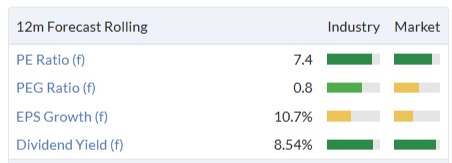

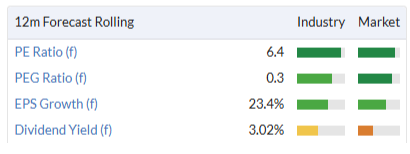

The stock never seems to trade at a very expensive share price, so it doesn’t rely on fast growth or on positive earnings surprises:

Cash balance: $0.8 billion as of December 2025, even after returning $380m to shareholders via dividends and buybacks.

Customer numbers: there’s a decline in active customers (254k falls to 242k) and new customers (118k falls to 104.5k), which is consistent with the company’s efforts to increase the value of its average customer.

A criticism (which I agree with in the past) was that Plus500 was seeking out the most inexperienced retail traders, accepting enormous churn and a low average value per customer.

Now that the company has grown so large, it’s taking a more mature approach to strategy. An impressive statistic provided is that 50% of OTC revenue has been generated by customers who have traded with Plus500 for more than five years. So it’s no longer fair to say that Plus500 are relying on new, inexperienced traders: it would be more accurate to say that they have a healthy mix of new and older business.

US futures: this very rapidly growing division gets its own section in today’s update:

Plus500 reinforced its position as a trusted, scaled and agile provider of global market infrastructure with two prestigious B2B partnerships in the US futures and prediction market spaces.

Plus500 was appointed as the clearing partner for the CME Group's groundbreaking prediction market and event-based contracts platform, launched in partnership with FanDuel, North America's premier sports gaming company, which went live last month….

They point out that they have 16 global licenses including new licences secured in the UAE and Canada last year.

Outlook:

Plus500 remains strategically well-positioned to capitalise on both short-term market trends and longer-term, structural growth drivers in its addressable markets. These addressable markets are expanding as the Group maximises the compelling growth opportunities across both its OTC and non-OTC products, which includes its futures and prediction market businesses.

Graham’s view

For two years at this stage, I have abandoned my reservations on this one. It’s a proven money-making machine, and while I do feel safer owning shares in IG group (LON:IGG) (disclosure: long IG group (LON:IGG)) and putting CMC Markets (LON:CMCX) on my annual watchlist, there is little doubt in my mind that Plus500 is the most exciting investment out of these three companies. It does things its own way - whether that’s how it hedges customer trades, how it expands internationally, or how it returns money to shareholders - but it has proven that its approach works.

These might be my famous last words before Plus500 finally puts a foot wrong, but for the last few years I’ve accepted what the financials say: that this company knows what it’s doing.

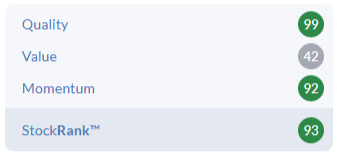

The StockRanks are convinced of its merits, too:

Roland's Section

Iqe (LON:IQE)

Up 23% at 9p (£89m) - Trading Update - Roland - RED

We’ve been consistently RED on this semiconductor wafer business for some time now (as have the StockRanks), due to declining revenues, a consistent lack of profitability and a problematic debt situation.

The shares fell a long way last year but have enjoyed a remarkable bounce this morning:

Let’s take a look at today’s news to see if it justifies a more positive view.

2025 year-end update

IQE enjoyed a “strong trading momentum in H2 2025” due to a variety of factors:

Faster than expected funding releases for some US military and defence programmes, bringing forward revenue expected in 2026;

“Higher than forecast photonics demand”, reflecting growth in the AI and data centre markets;

Increased sales of wireless products tied to new handset introductions (presumably smartphones) which benefited the group’s Taiwan operations.

Updated financial guidance: as a result, 2025 results are expected to be at the upper end of the previous guidance range:

Revenue of c.£97m (previously £90m to £100m)

Adjusted EBITDA of “at least £2.0m” (previously £(5.0)m to £2.0m)

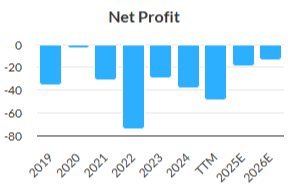

Of course, achieving £2m of EBITDA from nearly £100m of revenue is still a lamentable level of profitability that I expect will translate into a substantial full-year operating loss.

I note that the company has also not provided an update on year-end net debt today. Net debt was reported at £23.5m (excluding leases) at the end of June 2025.

That’s more than 10x today’s FY25 EBITDA guidance – an alarming level of gearing.

However, management does confirm that IQE’s lender, HSBC, has provided another covenant waiver in respect to the Q4 2025 EBITDA covenant test. I assume IQE would have failed the test if it had been applied.

Current trading

IQE claims to be entering 2026 with “a strong Q1 order book” but does not provide any financial details.

The company reports improved demand visibility across key segments including consumer mobile, data centre and AI-related photonics.

The momentum in wireless demand observed in Q4 2025 is expected to continue, supported by existing customers and recent platform wins.

Growth in data centre deployments and AI-enabled compute, alongside ongoing strength in consumer mobile is also supporting increased demand for the Group's photonics products.

Strategic Review

IQE has been carrying out a strategic review for some time, examining the potential for selling part or even all of its business. Today’s statement includes an update on this process (my bold):

The Board is negotiating non-binding offers for the Group as a whole in addition to separate bids for certain other Group assets with a view to maximising shareholder value. The Board is encouraged by the level of interest received and the recognition of the intrinsic value of the Group and its component parts.

September 2025: when assessing company commentary, it’s often helpful to check what management has previously said about the same topic.

In this case, IQE said in September that it was “already in receipt of an approach from a potential offeror” for the whole group, with other “additional early-stage expressions of interest” received as well.

In addition, management said in September that the group was already in discussions relating to the sale of its Taiwan business. If concluded, the proceeds were expected to be used to repay its HSBC credit facility and other debt.

Based on today’s commentary, I am not sure there has been all that much progress since September.

Roland’s view

Today’s update is relatively good news, in the sense that 2025 results will be at the upper end of guidance.

But we’re starting from a low base. Broker forecasts suggest the group will remain loss making for at least another year. No asset sales have yet been agreed. Leverage looks unsustainable to me.

Unless some kind of sale is agreed, my impression is that IQE will remain reliant on the support of its lender to avoid defaulting on its debt.

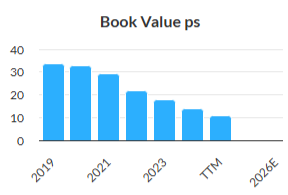

While the shares continue to trade below book value, book value has declined steadily in recent years and these assets haven’t been sufficiently productive to generate profits for IQE since 2018. A modest discount may be justified until the situation changes.

More broadly, I think equity investors need to consider the level of recovery or sale value that may already be priced into the stock.

IQE has a market cap of £88m after this morning’s gains. That seems ample to me for a business with c.£100m of revenue that’s expected to have generated c.£80 million in losses over the last three years:

There’s also the risk that the lender will decide to change tack and pursue repayment of its debt. In that scenario, the shares could lose most or even all of their remaining value.

If I wanted to do further research here and consider the turnaround opportunity, I’d want to learn more about the company’s product offerings and physical assets, with a view to building a sum-of-the-parts valuation.

There could be hidden value here. But while I’d like to see this UK specialist manufacturer recover, IQE’s debt situation alone means that I have no choice but to maintain our RED view on this stock today.

Knights group (LON:KGH)

Unchanged at 186p (£160m) - Half Year Results - Roland - AMBER

(At the time of writing, Roland has a long position in KGH.)

This legal group is a holding in my rules-based SIF portfolio. In my last look at the business, I highlighted the lack of organic growth last year and the heavy adjustments to profits. Given this, I’m interested to see that the organic growth issue, at least, headlines today’s half-year results:

Strong first half with a firm return to organic growth; confident in delivering full year

Let’s take a look.

Half-year results summary

Today’s interim numbers cover the six months to 31 October – Knights has an April year end.

Revenue: group revenue rose by 30% to £103.2m, excluding a minimal contribution from a Crime business that’s now been sold. However, this only translated into a 2.6% increase in organic growth. The difference between organic and total revenue growth reflects the recruitment of an additional 46 fee earners onto the company’s platform.

CEO David Beech claims to have “firmly returned the Group to organic growth”, but I’m not sure I’d describe a sub-inflation increase as firm organic growth.

Profits: turning to earnings, underlying pre-tax profit rose by 12.5% to £16.4m.

Profit growth below revenue growth tells us that margins have fallen and Knights confirms this. The group’s underlying PBT margin fell from 18% to 16% in H1. Management says this was due to higher National Insurance costs, interest costs and planned IT investment.

The continued increase in headcount makes it hard for me to split out higher unit costs per employee from the impact of higher employee numbers.

However, I can evaluate the impact of higher finance costs. These appear to have accounted for 4.2% of revenue in H1, up from 3.6% in H1 25. This suggests that interest payments accounted for c.0.6% of the reduction in margins in H1, with higher employee and IT costs accounting for the remainder.

Net debt rose by 50% to £75.2m vs H1 25, while finance costs climbed 51% to £4.4m.

More recently, net debt was £64.8m at the end of April 2025, so rose by £10.4m in H1.

Today’s H1 results report c.£15m in cash paid relating to acquisitions and capex of c.£3.7m. This gives a total of around £18.7m, suggesting to me that at least some of the company’s H1 expenditure may have been covered by free cash flow.

Cash flow: as I’ve explained previously, I think Knights Group’s calculation of free cash flow is overly adjusted and excludes real costs that are of interest to equity investors.

Sure enough, today’s interim results include a company-calculated measure of free cash flow of £14.7m.

Turning to the cash flow statement, my more standard calculation produces a more modest free cash flow estimate of £5.0m. This excludes £10.2m of acquisition costs, £2.6m of deferred consideration and £0.6m of share buybacks.

I would argue my estimate is more realistic, at least from an equity perspective. The figures above imply a net cash outflow of £8.4m in H1, which is a fairly close match to the £10.4m increase in net debt.

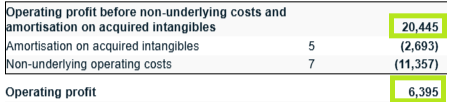

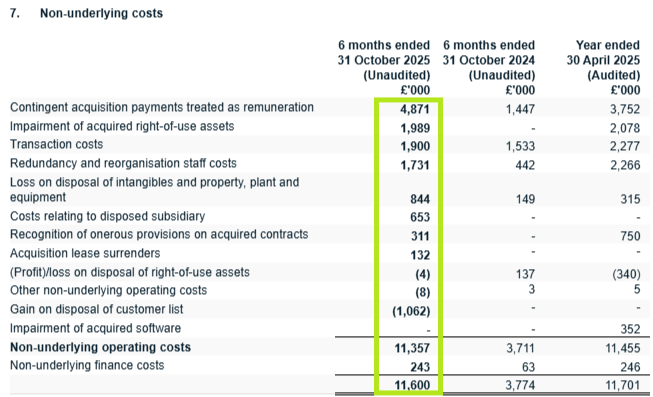

Profit adjustments: I can’t comment on these results without once again mentioning the scale of the profit adjustments. Underlying operating profit in H1 was three times greater than reported operating profit:

The bulk of this difference comes from our old friend “non-underlying costs”. As usual, these relate almost entirely to acquisitions and the consequences thereof:

For a business whose business model is built around a roll-up model of regular acquisitions, I prefer to view such costs as business-as-usual rather than exceptional. They certainly seem to recur with regularity!

As a result of these costs, Knight’s reported pre-tax profit fell by 73% to £2.4m in H1.

At a post-tax level, the group reported a loss of £259k, or (0.3)p per share.

Outlook

The company says the second half has started well, benefiting from a return to organic growth and the contribution from recent hires and improved retention.

The Board is confident of delivering full year results in line with expectations.

An updated note from Equity Development confirms that its forecasts remain unchanged today, with a FY26 adjusted EPS estimate of 26.7p.

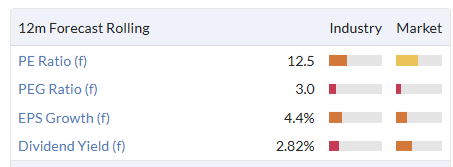

That’s in line with the 26.8p consensus in the StockReport and prices Knights on seven times FY26 forecast earnings.

Roland’s view

It might be fair to argue that the relative size of these costs will diminish as the business expands. When the company gets large enough, its overall profitability and cash generation may improve. I’m not entirely convinced of this though, given that staff costs (to fee earners) are by far the largest cost. These are surely likely to rise in proportion to revenue.

Regardless of this, today’s cash flow and profit figures seem to confirm my previous view that Knights is largely funding its expansion through debt, while delivering hardly any organic growth from the businesses it acquires.

As you can probably guess, I added Knights to SIF because I was following my rules-based stock selection process. This is not a stock I’d be likely to choose otherwise.

The shares may look cheap when compared to adjusted earnings, but I think that’s because the market is pricing in the high level of adjustments and limited cash generation. In my view, the dividend yield is a more objective measure of the valuation here:

However, while I’m not a big fan of this business, I don’t see any serious fundamental problems with today’s results.

A slowdown in the rate of acquisitions would probably improve cash generation and support debt reduction. Conversely, continued acquisitions could, eventually, result in improved real profitability and justify a higher valuation.

CEO David Beech’s 22% shareholding is also an attraction for me, providing an incentive to generate long-term shareholder value.

I took a neutral view on Knights in September and am going to leave this unchanged today, mirroring the StockRanks:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.