Good morning! I hope you had a nice weekend.

It's unusually busy for a Monday, as more companies pipe up with their Dec 2025 trading updates.

We're finished for today, thank you!

Spreadsheet accompanying this report: link (updated to 16th December)

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author |

|---|---|---|---|

Sigmaroc (LON:SRC) (£1.44bn | SR78) | Ahead of exps. Revenue +4%, adj EBITDA +16% to c.£262m. Adj EPS +26%, “to exceed prior EPS guidance by c.10%”. | ||

Great Portland Estates (LON:GPE) (£1.41bn | SR29) | Appointing Jayne Cottam as CFO from 16 Mar 26. Her previous role was as CFO at Assura REIT, prior to its merger with PHP. | ||

Dowlais (LON:DWL) (£1.24bn | SR64) | 2025 performance ahead of previous guidance. Revenue is expected to be c.£5bn, with adj op profit “no less than” £370m, at an improved margin of >7.4%. Adj free cash flow to be >£100m. | ||

Workspace (LON:WKP) (£806m | SR49) | CEO Lawrence Hutchings is stepping down today. He will be replaced by Charlie Green from 2 Feb 26. Green previously founded The Office Group/Fora, another workspace business. A new CFO will also join on 23 Feb 26. | ||

WH Smith (LON:SMWH) (£796m | SR31) | Leo Quinn appointed w/ effect from 7 April 26. Quinn was previously CEO of Balfour Beatty. Chair Annette Court will step down at February’s AGM. | RED (Roland) [no section below] I have to respect Graham’s previous RED view on WH Smith as the company does seem to be in a difficult situation right now, facing an FCA investigation and a sharp decline in profits. Even so, I think today’s appointment of former Balfour Beatty CEO Leo Quinn is intriguing and probably positive for shareholders. Quinn led an impressive turnaround at his previous firm, starting from quite difficult circumstances. He also has previous experience of working in the US, where WH Smith’s operations have run into problems. His appointment as executive chairman suggests to me that Quinn will take a very hands-on role, possibly delaying the appointment of a CEO until he has a clearer idea of the situation and strategy. | |

Allergy Therapeutics (LON:AGY) (£743m | SR13) | H1 revenue expected to be +7% to £36.3m, with £10.1m cash position. Commercialisation of Grassmuno has begun in Germany. Confident in delivering revenue growth in y/e 30 June 2026. | ||

Harworth (LON:HWG) (£539m | SR40) | “Headline sales”of £92.5m in H2, taking FY25 total to £110.2m. Including £58.2m of Industrial & Logistics sales (ahead of book value) and £52m of Residential (below book value). | ||

Griffin Mining (LON:GFM) (£491m | SR64) | Mining licence term of 26 years is “based upon” the latest mineral resource estimates. | ||

Marshalls (LON:MSLH) (£449m | SR56) | 2025 revenue +2% to £632m. Adj pre-tax profit to be in line with expectations. Despite subdued end markets, expected “further progress” in 2026. Interim CEO Simon Bourne has been made permanent CEO. | ||

Auction Technology (LON:ATG) (£436m | SR24) | On Friday, FitzWalter announced a possible cash offer of 400p per share. ATG reports this morning that its Board met on 18 Jan and concluded the offer undervalued the company. | PINK (AMBER =) (Roland) [no section below] | |

Property Franchise (LON:TPFG) (£323m | SR71) | Acquired 85% stake in Smart Advice Financial Solutions (SAFS), an appointed representative of Mortgage Advice Bureau. SAFS has 34 mortgage advisers, increasing TPFG’s network to 315 advisors. | ||

ACG Metals (LON:ACG) (£291m | SR55) | 2025 production of 39.2koz gold equiv, 3% above top of guidance range. 2026 guidance is for 20-22 ktpa of copper equiv. production, including 17.5koz of gold equiv. | ||

Ashtead Technology Holdings (LON:AT.) (£270m | SR40) | FY revenue to be c.£203m, with H2 +5% vs H1. FY25 adj EBITA ahead of exps due to stronger margins. | AMBER/GREEN ↑ (Roland) Today’s statement gives me confidence that the big acquisition in 2024 is performing acceptably and making a positive contribution to results. My main concerns are the lack of meaningful organic revenue growth last year (+3%) and the broader risk of a sector slowdown as oil prices ease. However, on balance I feel that Ashtead’s FY26 P/E of 8 and improving balance sheet justify a more positive view than we’ve taken previously, so I am upgrading our view by one notch today. | |

Big Technologies (LON:BIG) (£256m | SR24) | Final settlement in Buddi Litigation of £38.5m. Continued mediation, with a view to settlement, with Sara Murray and associated parties. | ||

XP Power (LON:XPP) (£254m | SR52) | 2025 in line with expectations, with order intake +28% to £225.9m and revenue -4% to £229.7m. Book-to-bill 0.98x. | ||

Fintel (LON:FNTL) (£221m | SR36) | Buys Pearson Ham Group's market pricing business, a leading provider of proprietary pricing data to the UK insurance industry, for £11m. Initial cash £7.5m, defcon £3.5m. | ||

City of London Investment (LON:CLIG) (£196m | SR96) | FuM +4% to $11.2bn (Dec 2025). FuM $11.6bn as of 15th January. Total group net outflows $853m over the six months. “Strong market and investment returns over the six months led to net outflows from client rebalancing, asset allocation changes, and capital needs.” | AMBER/GREEN = (Graham) I can’t get truly excited about this while flows remain negative. On the other hand, I think it does have a potentially defensible niche. The way I see things, fund managers have to offer access to something that investors can’t do by themselves. Closed-end funds, particularly in emerging markets, strike me as an interesting asset class and one where investors can benefit from leaving the investment management to a fund manager like City of London. The other key point is that even with negative flows, AUM has been rising. So there is an element of stability here, despite negative flows. | |

M&C Saatchi (LON:SAA) (£153m | SR48) | LFL net revenue to decline around -7%, net revenue £210m, op profit £26m. Net cash £13m. 2026 outlook: “profitable growth”. | ||

Anpario (LON:ANP) (£98m | SR77) | Revenue c. £47m, adj. EBITDA not less than £9.4m, ahead of current market expectations. Net cash £12.4m. | GREEN = (Roland - I hold) I’m impressed by today’s upgrade (the sixth since March 2024) but aware that last year’s results have received a significant boost from the 2024 acquisition of Bio-Vet. Revenue growth is expected to fall from c.23% in 2025 to around 6% this year, reflecting the more moderate pace of organic growth in sales. The market certainly seems to be pricing for slower growth. When the increased net cash balance is factored in, investors appears to have shrugged at today’s increased profit guidance. While I do think there’s probably less value on offer than previously, the company’s track record of upgrades and balance sheet strength means that I’m leaving our positive view unchanged for now. | |

Panthera Resources (LON:PAT) (£54m | SR30) | MD: “The maiden drilling programme by Panthera at the Kwademen prospect has delivered outstanding high-grade intersections within several broad zones of mineralisation that remain open in multiple directions. This bodes well in a strong, rising gold price environment." | ||

Hercules (LON:HERC) (£46m | SR95) | SP -6% FY September 25 audit is well advanced, however, additional audit work required due to the Company's extensive acquisition activity in 2025. FY25 accounts to be announced in March 2026. | AMBER/GREEN = (Graham) I considered downgrading this to neutral, because taking nearly six months to publish accounts doesn’t really make sense for listed companies below £50m market cap. It always amazes me how much larger companies can often get their accounts done quickly, while tiny companies are still getting their numbers ready! In this case, I think HERC’s explanation does stand up to some scrutiny: over the last year they have made one important business disposal and have also made at least 3 acquisitions. So while the delay to the accounts is what we’d call an “amber flag” (i.e. halfway towards being a red flag), I’ll leave our previous stance unchanged. | |

Nexteq (LON:NXQ) (£42m | SR73) | FY25 trading is expected to be in line with market expectations. Adj. PBT not less than $3.6m. Outlook for FY26 remains in line with previous guidance. | ||

Christie (LON:CTG) (£31m | SR72) | FY25 performance from continuing operations considerably ahead of its previously upgraded expectations. Revenue >£70m, op profit >£6.5m. Average fee on business sales/purchases has considerably improved. Remains conservative in its outlook for delivering further profit growth in 2026. | GREEN ↑ (Graham) Even without outer-year forecasts, I’m happy to go GREEN on this after a very strong update. It’s usually a strong positive signal, in my view, when management are willing to divest and simplify. That has happened in this case, and Christie are very quickly reaping the rewards.The sale of Vennersys is only going to generate proceeds of up to £1.4m, assuming 100% of defcon gets paid. But it has additional benefits - such as freeing up management attention! On the basis of the new FY25 adjusted EPS forecast, this stock is only trading at 9x earnings.With a more focused group, and with a healthy net cash position that should also be taken into account, perhaps this is offering decent value? | |

Surface Transforms (LON:SCE) (£23m | SR33) | Revenue +120% to £18m, operating loss reduced from £23m to £9m. Outlook: revenue expectations of c. £27m for 2026, with an EBITDA breakeven. | ||

Neo Energy Metals (LON:NEO) (£18m | SR4) | £8 million strategic investment to advance the Beisa Uranium and Gold Project. £1.5m has been advanced with shares placed at 0.9p (latest SP: 0.79p). Also, there has been a placing to raise a further £1m. The strategic investor has the right to invest £6.5m of convertible loan funding. | ||

Cambridge Cognition Holdings (LON:COG) (£13m | SR6) | Sales orders up 73%. Revenues down 10%, “broadly in line”. Adjusted EBITDA loss in line with market expectations (2024: loss £43k). Net cash £0.2m. Order book £16.9m. “Enters 2026 with a strong pipeline of opportunities” | ||

Thor Energy (LON:THR) (£12m | SR33) | Receipt of the cash completion payment for A$2,250,000. Commencing in September 2026, three successive annual deferred completion payments totalling A$3,937,00 until September 2028, payable in cash, shares or a combination at Tivan's election. |

Graham's Section

City of London Investment (LON:CLIG)

Down 0.5% to 384p (£195m) - Trading Update - Six months to 31 December 2025 - Graham - AMBER/GREEN =

City of London (LSE: CLIG), a leading specialist asset management group offering a range of institutional and retail products, provides a trading update for the six months ended 31 December 2025. The numbers that follow are unaudited.

This investment manager has traditionally been associated with emerging market closed-end funds, but its offering is more diverse these days.

Unfortunately the flows here remain negative, which becomes apparent as soon as you scroll down a few paragraphs.

At least funds under management have been going up:

Funds under Management ("FuM") increased by 4% to $11.2 billion as of 31 December 2025 as compared to $10.8 billion as of 30 June 2025. FuM growth has continued into 2026 with assets totaling $11.6 billion as of 15 January 2026.

Context: FUM rose from $10.2 billion to $10.8 billion in the previous financial year, despite nearly $1 billion of net outflows.

And it’s a similar story in the last six months, although the outflows have been worse considering that it’s just a six-month period: FUM has risen from $10.8 billion to $11.2 billion, but H1 outflows have been some $850 million.

Checking the Q1 update, I see that these H1 outflows have been roughly similar between Q1 and Q2 (a little higher in Q2 vs. Q1).

So there is really nothing positive in the numbers as far as flows are concerned.

The flows are described as arising from “client rebalancing, asset allocation changes, and capital needs.”

In more detail:

Most client outflows were driven by two main factors:

o Portfolio rebalancing, where strong performance and asset‑allocation reviews prompted shifts back to target weights.

o Strategic or structural changes, such as pension funds reaching funded status and moving to liability matching strategies; consultant changes, particularly for OCIO (Outsourced Chief Investment Officer) clients, which often catalyse pre-determined manager changes; transitions to passive strategies resulting in the liquidation of active mandates and withdrawals to meet funding or cash‑flow needs for capital projects.

Performance: at least this looks pretty good for the H1 period, with strong benchmark outperformance from two strategies.

Checking the annual results, I see that all of these four “CLIM” (City of London Investment Management) strategies outperformed their benchmarks last year.

There was “a broad narrowing of closed-end funds ("CEF") discounts and corporate initiatives within the investment universe.”

Obviously this isn’t something that’s consistently repeatable - fund discounts can’t narrow ad infinitum - but it’s still welcome news.

An interesting point:

The CEF structure is arguably the best vehicle for delivering returns from active management and this was aptly demonstrated by strong net asset value ("NAV") performances over the period from several of our largest portfolio holdings.

We would expect CLIG to take this viewpoint but I am inclined to agree. Closed-end funds don’t have to worry about redemptions, after all, so they have far more freedom than open-ended funds. But there are counter-arguments to this view.

In addition to CLIM, CLIG also owns Karpus Investment Management (KIM), and performance from KIM strategies also looks fine for the six-month period. Maybe hugging the benchmarks a little too tightly? Although it seems to have a much higher weighting in fixed income, which would make variance from benchmarks more difficult to achieve:

Graham’s view

I’m going to leave Roland’s AMBER/GREEN stance unchanged.

I can’t get truly excited about this while flows remain negative.

On the other hand, I think it does have a potentially defensible niche. The way I see things, fund managers have to offer access to something that investors can’t do by themselves. Closed-end funds, particularly in emerging markets, strike me as an interesting asset class and one where investors can benefit from leaving the investment management to a fund manager like City of London.

The other key point is that even with negative flows, AUM has been rising. So there is an element of stability here, despite negative flows.

I would however be wary of relying on the dividend. Underlying basic EPS was 36.7p in the last financial year, while the total dividend for the year was 33p.

Christie (LON:CTG)

Up 17% to 140p (£37m) - Full year Trading Update & Completion of Vennersys Sale - Graham - GREEN ↑

This is a fantastic trading update from a stock that I had previously written off as being rather boring.

Thankfully, we have been somewhat positive on it, as the news has been reasonably positive in recent months.

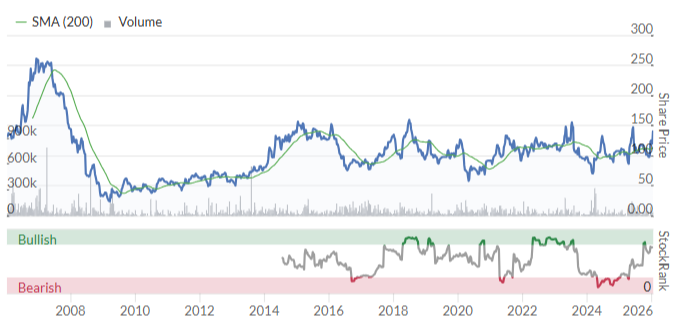

This chart might help to explain why I became rather bored of this one. It has traded within a range for the past decade (and results didn’t suggest that it deserved to break out of this range).

But perhaps that’s about to change now?

Today’s update:

The Board of Christie Group plc (CTG.L) is pleased to advise that, further to its trading update on 23 December 2025 and following uncharacteristically strong invoicing in December, it now anticipates reporting a FY25 performance from its continuing operations considerably ahead of its previously upgraded expectations.

Revenues will exceed £70m (2024: £59.2m) and operating profit will exceed £6.5m (2024: £3.5m).

Previous expectations were for revenues of only £65.9m.

The reason for the improvement: the average fee charged by its business advisory service has “significantly improved”.

The other activities within its “Professional and Financial Services” (PFS) division are also reported to have seen some growth, as has the “Stock and Inventory Systems and Services” division.

The loss-making “Vennersys” business will hurt the final result for the year, but that business has now been sold. The profit guidance shown above is for continuing operations only.

Cash balance: over £9m.

Outlook: they are keen to point out how much selling Vennersys has helped.

Our 2025 results better reflect the earnings potential of our continuing brands…

We believe the volume of transactions we consistently advise on and our immersion in our specialist sectors - combined with our diversified and complimentary service offering - gives us an unrivalled insight to support our clients. We expect economic conditions to remain challenging for many businesses in our chosen sectors. However, demand for our own services appears robust and as long as lending conditions remain supportive, we remain optimistic for the year ahead and beyond.

Estimates: Shore Capital have declined to reinstate forecasts for future years yet. At this stage they only offer FY numbers (revenue £79m, adj. PBT £5.4m, adjusted EPS 15.8p).

Graham’s view

Even without forecasts, I’m happy to go GREEN on this after a very strong update.

It’s usually a strong positive signal, in my view, when management are willing to divest and simplify. That has happened in this case, and Christie are very quickly reaping the rewards.

The sale of Vennersys is only going to generate proceeds of up to £1.4m, assuming 100% of defcon gets paid. But it has additional benefits - such as freeing up management attention!

On the basis of the new FY25 adjusted EPS forecast, this stock is only trading at 9x earnings.With a more focused group, and with a healthy net cash position that should also be taken into account, perhaps this is offering decent value?

Roland's Section

Ashtead Technology Holdings (LON:AT.)

Up 12% at 374p (£303m) - Full Year Trading Update - Roland - AMBER/GREEN ↑

This subsea equipment supplier to the offshore energy sector is one of the top movers on the London market this morning after issuing an ahead of expectations 2025 trading update.

Here are the main points:

Full year revenue is expected to be around £203m (2024: £168m)

This represents organic growth of 3% and a total year-on-year increase of c.21%, due to acquisitions

Full-year adjusted EBITA is now expected to be “slightly ahead of market profit expectations”

Company-compiled consensus forecasts are for FY25 revenue of £205.8m and adjusted EBITDA of £57.7m (FY24 actual: £50.3m).

What it means:

We can see that full-year revenue guidance is actually slightly below forecast. The improvement in profits has come from higher profit margins than previously expected.

In addition, it seems clear that revenue growth last year was driven almost entirely by acquisitions, with organic revenue growth minimal

In today’s update, Ashstead says that margin improvement has come from two main areas:

The integration of Seatronics and J2 Subsea (acquired in Q4 2024) is now complete. Cost savings have been higher than forecast and there has been a reduction in low margin activities in the acquired businesses.

Across the wider group, “business mix enhancements” and “a focus on operating efficiencies” have helped to improve margins.

Balance sheet: in line with guidance, leverage was reduced to less than 1.4x at the year end (H1 2025: 1.6x). Management expects leverage to fall below 1.0x by the end of 2026 – a comfortable level.

Outlook: Ashtead reports “improving momentum in our business as we enter 2026”, but there’s no specific 2026 guidance today. Instead, CEO Allan Pirie makes this comment:

We are focussed on executing our strategic growth plans and remain confident in the Group's ability to generate significant value for shareholders over the medium-term.

Roland’s view

As we have commented before, a focus on the medium term outlook can sometimes mean the short term is less certain.

In Ashtead’s case, I’m reassured that the £63m acquisition made in 2024 appears to be making a positive contribution to the group’s business and to have been integrated successfully.

While I’d want to review the unadjusted full-year results to gain more confidence, comparing the variation in profit and revenue from last year suggests to me that Seatronics and J2 Subsea may have generated an adjusted return on capital of c.9% in their first year.

Assuming further improvement in future years, this will hopefully help support the group’s very respectable existing profitability:

Ashtead warned on profits in July 2025 but has since maintained in-line guidance. I’m pleased to see I moved our view back to neutral following August’s in-line trading update.

I think we might argue that the lack of guidance for 2026 today means there’s still some risk this year could fall short of expectations.

I don’t have access to any updated broker forecasts today. But consensus forecasts available on Ashtead’s website suggest a modest level of growth this year.

My decision today is whether to upgrade our view from AMBER to AMBER/GREEN. My main concern is the possibility that the wider oil market could be slowing to reflect the impact of lower oil prices.

However, after a significant de-rating last year, the shares are now trading on a FY26 forecast P/E of 8. At this level I think some caution is already priced in, especially given the group’s reduced leverage.

A low StockRank of 40 and Falling Star styling suggest some caution is warranted. However, I suspect the algorithms may take a more positive view when today’s ahead statement and FY25 results are incorporated. Given the modest valuation, I’m going to tentatively move our view up to AMBER/GREEN today.

Anpario (LON:ANP)

Up 5% at 499p (£102m) - Full Year Trading Statement - Roland - GREEN =

(At the time of writing, Roland has a long position in ANP.)

This AIM-listed manufacturer of animal feed additives has upgraded its 2025 profit guidance (again!) this morning. It’s a holding in my SIF portfolio with a track record of upgraded over the last year:

Here’s a summary of updated 2025 results guidance:

Revenue up 23% to £47.1m (FY24: £38.2m)

Adjusted EBITDA “not less than £9.4m” (FY24: £7.0m)

Net cash at 31 Dec 25 of £12.4m (FY24: £10.5m)

Consensus expectations prior to this announcement were for figures of £45.5m, £8.2m and £12.0m, respectively.

The story behind today’s upgrade: Anpario saw stronger than expected trading during the second half of last year. This includes the first full-year contribution from Bio-Vet, which was acquired in September 2024. Management says integration is “progressing well” and Bio-Vet saw “one of its highest ever half-year sales performances” in H2 2025.

More broadly, the company says it saw a “broad-based increase in performance”, with Asia showing the most significant growth and a strong performance in the Americas and Europe.

Today’s update doesn’t break out the split between organic revenue and Bio-Vet. We do know that Bio-Vet contributed £3m of sales in H1 (13.2% of H1 sales).

Assuming a similar rate of contribution in H2 suggests Bio-Vet may have contributed £6.2m of revenue last year. This gives me an organic revenue growth estimate of 8.6%.

One positive is that Anpario appears to have kept costs under control despite integrating Bio-Vet. The group’s operational gearing means that a 3.5% increase in 2025 revenue expectations has translated into a 14.6% rise in adjusted EBITDA guidance. This reflects fixed operating costs that remain unchanged with higher sales, boosting profit margins.

House broker Shore Capital now expects to see an adjusted operating margin of 17.2% for 2025, from 15.0% previously.

Updated broker estimates

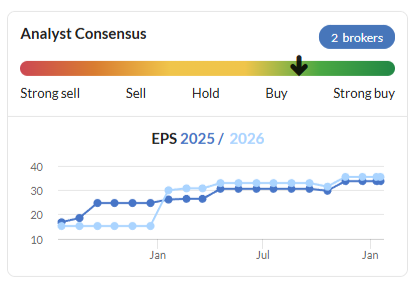

Our thanks to Shore Capital for sharing an updated note on Research Tree this morning, with significant upgrades to earnings estimates for both FY25 and FY26:

FY25E adj EPS: 36.9p (+15% vs 32.0p previously)

FY26E adj EPS: 38.8p (+13% vs 34.3p previously)

Shore notes that this is the sixth upgrade since March 2024 and the fourth since January 2025.

Roland’s view

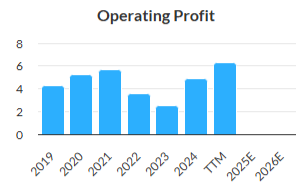

After a difficult period the company appears to be rebuilding its performance and profitability quite successfully. Factoring in today’s upgrade suggests 2025 operating profit should be above the previous 10-year high in 2021:

This has translated into a very encouraging share price performance, with the stock more than doubling from its 2023 lows:

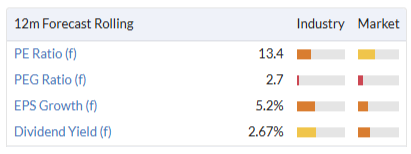

The valuation remains largely unchanged today from September, too. In fact, today’s share price gain of c.5% and mid-teens EPS upgrades means the stock is now actually a little cheaper than it was yesterday:

I was GREEN on Anpario in September, following a previous upgrade. I should theoretically maintain this view following today’s upgrade.

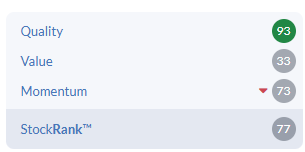

The only factor that gives me pause for thought this morning is Anpario’s High Flyer styling and the expectation of slower growth in 2026. This is mirrored by a falling StockRank which scores highly for quality, but less well for value and momentum:

The boost from the acquisition of Bio-Vet appears to have provided a large – albeit unspecified – boost to 2025 profits. Barring any further deals, Anpario will become reliant on organic growth in 2026.

Shore Capital’s updated 2026 forecasts suggest sales growth will slow to c.6%, while earnings per share growth will fall to 5.1%. The broker doesn’t expect any further improvement in margins in 2026 either, beyond that achieved in 2025.

This slowing growth is reflected in the rather high PEG ratio in the graphic above – well above the 1.0x threshold commonly used as a value indicator.

I do think there may be slightly less value on offer here than previously. On the other hand, Anpario’s track record of outperformance is very encouraging – our research has found upgrade cycles often continue for longer than expected.

The valuation also seems more reasonable when the £12m cash balance is considered (12% of the market cap). The market cap has risen by £4.2m today, meaning that nearly half today’s share price gain is covered by the c.£2m increase in year-end net cash guidance.

A £1.2m increase in forecast pre-tax profit is only being valued at c.£2m market cap, even though earnings are expected to rise further in 2026.

Given the company’s balance sheet strength and recent track record, I’m going to leave our GREEN view unchanged today.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.