Good morning!

We are all done for today, thank you.

Spreadsheet accompanying this report: link.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

BHP (LON:BHP) (£142bn | SR90) | Underlying EBITDA up 25% to US$15.5 bn with an Underlying EBITDA margin of 58%. Underlying Attributable profit up 20%+ to US$6.2 bn. Underlying ROCE increased by around 3 percentage points to circa 24%. | ||

GSK (LON:GSK) (£89bn | SR93) | Exdensur approved by the European Commission & fourth tranche of share buyback programme | Exdensur is the first and only ultra-long-acting biologic in the EU to treat respiratory diseases. Approval based on four phase III trials. Statistically significant and clinically meaningful primary data across severe asthma and chronic rhinosinusitis with nasal polyps. | |

Antofagasta (LON:ANTO) (£36.9bn | SR81) | Full year revenue increased by 30% to $8.6 billion. EBITDA margin widened by nine percentage points to 60%. Underlying earnings +106%. On track to deliver 30% growth in production over the medium term. | ||

Coca-Cola Europacific Partners (LON:CCEP) (£32.8bn | SR63) | Preliminary Unaudited Results Q4 & FY 2025 & share buyback programme | Adjusted, comparable FX-neutral revenue +2.8%, operating profit +7.1% (€2.8 billion). Share buyback for up to €1 billion.FY26 guidance: revenue up 3-4%, operating profit up ~7%. | |

Intercontinental Hotels (LON:IHG) (£16.1bn | SR68) | Underlying revenue +6%, operating profit +12% ($1,265m). Global RevPAR +1.5%. New $950m buyback launched. | ||

Intertek (LON:ITRK) (£6.82bn | SR67) | Acquires Aerial PV Inspection GmbH, “a leading provider of high-speed TEK-powered inspection and diagnostic solutions for solar PV systems”. Limited financial information given. | ||

Zegona Communications (LON:ZEG) (£3.81bn | SR68) | Acquisition by AXA of a 40% stake in FiberPass can proceed to completion. Vodafone Spain (owned by Zegona) will generate upfront proceeds of €0.4 billion. FiberPass will be 5% owned by Vodafone Spain. | ||

Chesnara (LON:CSN) (£715m | SR44) | Buys Scottish Widows Europe SA, Luxembourg based closed life insurance business. Total cash consideration €110m. | ||

Applied Nutrition (LON:APN) (£604m | SR49) | “Very strong” performance in H1, revenue up 57% and EBITDA ahead of management expectations. More H1‑weighted revenue profile than in prior years. FY26 results will be ahead of updated market consensus expectations. | AMBER/GREEN ↓ (Mark) | |

Rank (LON:RNK) (£428m | SR47) | Interim CFO appointed, starts next week. Was CFO of Manchester United until 2024. | ||

ITM Power (LON:ITM) (£397m | SR22) | Revenue for FY26 is now expected to be between £40m and £43m, an 11% midpoint increase compared to the previous guidance range of £35m to £40m. Adjusted EBITDA and cash guidance remain unchanged. | ||

Idox (LON:IDOX) (£328m | SR70) | In October, the Board recommended an offer at 71.5p. | PINK | |

Boohoo (LON:DEBS) (£314m | SR31) | Has been preparing for an equity fundraise of approximately £35m. Expected reduction in the Group's net debt to Adjusted EBITDA ratio of less than 2x within FY27. Issue price 20p. Remains confident of delivering £50 million Adjusted EBITDA in FY February 2026. | AMBER/RED = (Graham) It would be defensible to upgrade this to a neutral stance today given all the work that is being done to repair the balance sheet. However, it seems to me that the market cap and enterprise value already price in a recovery, and so I'm not convinced that the shares are a bargain even if everything goes as planned. Given the uncertain future of fashion retailing, a moderately negative stance reflects my current view on the prospects here. | |

Empire Metals (LON:EEE) (£257m | SR20) | A total of 754 drill holes are planned using 3 AC drill rigs and 2 RC rigs and drilling is expected to be completed by mid-April. | ||

Sovereign Metals (LON:SVML) (£238m | SR14) | Non-binding Memorandum of Understanding signed with Traxys North America for the marketing of graphite from Sovereign's Kasiya Project | ||

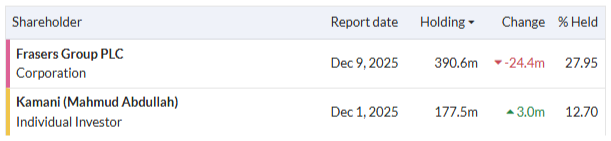

Springfield Properties (LON:SPR) (£154m | SR99) | H1 Revenue +2% to £108m, Adj. Op. Profit -13% to £5.6m. Adj. EPS +6% to 2.61p. Net bank debt £39.6m (25H1: £62.9m). | AMBER/GREEN = (Graham) There's a very significant H2 weighting baked into the forecasts now as H1 revenues and profits have dipped compared to H1 last year. There is a regular element of seasonality at this company but even so, the market may be a little worried about the ability of Springfield to hit full-year numbers. I'm happy to maintain our moderately positive stance given the discount to TNAV and the modest debt level (£40m). | |

Taylor Maritime (LON:TMI) (£111m | SR96) | Agreed to sell a Handysize vessel. Figures released on completion. Previous handysize sale was for $15.3m gross. | ||

1Spatial (LON:SPA) (£80.5m | SR37) | Continued to experience a significant H2 weighting in its trading, reflecting the seasonal skew in the Group's software renewals. Revenues now expected to be approximately £34.5 million (Stocko: £36.6m). Net Debt c.£3m. | BLACK/PINK (Mark) [no section below] | |

Braemar (LON:BMS) (£70.8m | SR46) | James Gundy, Group CEO to step down as Group CEO and as a director of the Company at the next AGM to be held on 2 July 2026, after which he will remain with the business and focus on his shipbroking activities. CFO Grant Foley to become CEO. | ||

Agronomics (LON:ANIC) (£61.9m | SR34) | NAV +12% to 13.78p. Net investment gains £10.7m. | ||

MTI Wireless Edge (LON:MWE) (£44.4m | SR87) | Revenues c.$51.5 million, at the high end of the range of current market expectations. EPS to be significantly ahead of current market expectations. Net cash $9.4m significantly ahead of current market expectations ($7.5-8.5m). | AMBER/GREEN = (Mark) | |

Defence Holdings (LON:ALRT) (£32.8m | SR27) | Launch of a structured Accelerator programme directly aligned with the Strategic Defence Review’s emphasis on faster capability translation and software-defined defence. | ||

Tpximpact Holdings (LON:TPX) (£32.4m | SR95) | £11 million contract uplift as part of an ongoing strategic delivery partnership with HM Land Registry. | AMBER/GREEN ↑ (Mark) | |

Haydale (LON:HAYD) (£31.9m | SR10) | Revenue £2.51m after discontinuation of some operations. Adj. Op Loss £4.02m. Net Debt £0.14m (FY24: £0.31m net cash) prior to £5.75m gross raise post period end. “...we expect to deliver positive EBITDA within 12 months of the SMCC acquisition.” | ||

Kavango Resources (LON:KAV) (£31.8m | SR4) | Technical Report for the Karakubis Project located in the Kalahari Copper Belt, Ghanzi District, Western Botswana, has been released. | ||

Sareum Holdings (LON:SAR) (£24.9m | SR5) | Has restarted the Phase 2-enabling toxicology programme for SDC-1801, a selective TYK2/JAK1 inhibitor being developed as a potential treatment for a range of autoimmune diseases. | ||

Aptamer (LON:APTA) (£24.3m | SR29) | Phase 1 work has demonstrated the feasibility of developing high-affinity Optimer® binders suitable for potential use within Metir's Pathogen Detector system. | ||

Rockfire Resources (LON:ROCK) (£16.6m | SR21) | Multiple high-grade zinc and germanium lodes have been confirmed in the 5th drill hole in this campaign. | ||

Kelso group (LON:KLSO) (£12.8m | SR33) | 130k shares bought in CVS at 1,387p average. | ||

Transense Technologies (LON:TRT) (£9.5m | SR59) | SAWsense Revenue +74% to £0.66m, Translogik revenue +13% to £0.59m. Total revenue incl. Royalties -8% to £2.26m. Adj. EBITDA -59% to £0.33m. Net Cash £0.92m (25H1: £1.19m). “Pipeline opportunities in both SAWsense and Translogik continue to expand in scale and quality…” | AMBER/RED = (Mark) |

Graham's Section

Boohoo (LON:DEBS)

Down 9% to 20.4p (£314m) - Response to speculation and planned fundraise - Graham - AMBER/RED =

It’s interesting that despite this company branding itself as “Debenhams Group”, it has been unable to change its legal name from boohoo group plc.

This is due to the fractious shareholder register:

Turning to today’s news, we have confirmation of a fundraising to help repair the balance sheet:

Debenhams Group (AIM: DEBS), a leading online platform, today announces in response to speculation that it has been preparing for an equity fundraise of approximately £35 million... The Planned Fundraise will create additional liquidity and, in the Board's view, will deliver the optimal capital structure for the Group, with an expected reduction in the Group's net debt to Adjusted EBITDA ratio of less than 2x within FY27.

At the same time, discussions are ongoing with the lending syndicate for “greater financial flexibility” with “improved covenant amendments”. Not the sort of thing that you would hear from a financially healthy business, but Debenhams/boohoo can’t be accused of ignoring the problem.

The issue price for the fundraise is 20p (explaining the drop in share price to around that level today).

And we get a trading update, although the most recent one was in late January, so no change is to be expected:

The Board remains confident of delivering £50 million Adjusted EBITDA in the current financial year to 28 February 2026 ("FY26") in line with its previously upgraded guidance… The Board also remains confident of double-digit Adjusted EBITDA growth in the financial year ending 28 February 2027.

PLT: PrettyLittleThing was previously held as an “asset held for sale”, with its results excluded from headline figures. Its performance has improved and it hasn’t been sold, so it’s now being treated as a normal part of the group.

Deleveraging Plans: they are exploring various options including “strategic IP licensing”, “supply chain partnerships”, “other capital financing options”, “non-core asset disposals at best possible value”.

There is good detail provided on future financial plans: lease costs, capex and working capital.

The main metric is the leverage multiple itself, which is seen falling to c. 2x “within FY27” and they will target less than 1x “by the end of FY27”.

In a separate RNS today, they say that the company has “received additional indications of support from some of its largest institutional shareholders”. Support is “in excess of £24 million”.

That’s still short of the planned £35m fundraise, but I would say it’s not bad considering that the original 7am announcement this morning seems to have been unplanned, and that £24m of support had been received by 8am.

Graham’s view

I already upgraded our stance on this from straight RED to AMBER/RED in January, just a few weeks ago, at the time of the positive trading update.

While today’s update is negative in the short-term (taking the share price immediately down to the fundraising price), I wonder if it might be positive in the long-term?

The major problem here has been the balance sheet, but the company is being highly proactive in fixing it, and £35m of additional equity will give it a great deal of additional breathing room. Total net debt at the last set of interims (to August) was £111m, although with seasonality I’m not sure what the relevant max/min figures are.

The counter-argument to optimism is simple enough: the business is still loss-making and is forecast to remain loss-making in the short-term.

Forecasts: Checking Panmure’s most recent forecasts, I see that positive EBITDA of even £53m in FY February 2027, was still expected to result in a pre-tax loss. A big reason for this forecast loss was the large interest bill (£17m).

Fresh equity could significantly reduce the interest bill and help Debenhams/boohoo turn positive again before too long.

I do wish that the company would stop headlining EBITDA and give us more meaningful profit measures to focus on. EBIT, which excludes interest costs, would be fine by me.

But that’s not going to happen, due to high depreciation charges (which are non-cash). The company says it is going to focus on cash flow metrics instead. Personally I prefer to include depreciation charges even when it’s uncomfortable.

Conclusion: This is a complicated story which I feel requires the creation of a financial model to really understand. In order to come up with a conclusion today, I’m simply going to take the latest market cap (£314m), and add the most recent financial net debt figure (£111m). That gives an enterprise value of £425m.

Against that I’ll take the average EBIT forecast for the next two years: I get £16m.

If I was happy to use the FY 2028 EBIT forecast alone, that would be £22.7m.

My valuation metric is therefore EV/EBIT, and I get 26.5x or 19x, depending on how optimistic and forward-looking I allow myself to be.

Unfortunately I still think this is rather expensive for a struggling and fairly commoditised set of clothing-focused retailers.

There’s no rule which says that EV/EBIT should be low (relative to a normal P/E multiple), but I’d like to see a modest EV/EBIT multiple in a situation like this, where the company is struggling and discussing covenants with lenders.

That’s not the case: EV/EBIT is higher than the P/E multiple I’d pay for the business.

On that basis, I’m going to leave this on AMBER/RED. Even if the balance sheet is repaired as expected, I’m not sure that these shares offer much of a bargain at this level.

Springfield Properties (LON:SPR)

Down 5% to 123p (£147m) - Interim Results - Graham - AMBER/GREEN =

Springfield Properties (AIM: SPR), a leading housebuilder in Scotland focused on delivering private and affordable housing, announces its interim results for the six months ended 30 November 2025.

Let’s skim these results, which are said to be in line:

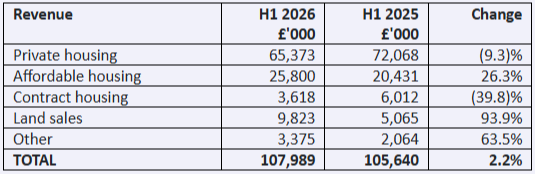

Revenue +2% overall, led by affordable housing (+26% to £25.8m) and land sales (+92% to £9.8m)

Revenue fell in private housing, the largest category (down 9% to £65.4m), which apparently was expected.

Gross margin falls 190 basis points to 15.8%

Adjusted operating profit down 13% to £5.6m

Revenue overview:

For the full year, the company says they are still on track to deliver revenue growth in private housing.

H1 completions were only 316 (H1 last year: 361). Although looking into the details, it seems that completions in this H1 period were for more valuable properties, on average, compared to H1 last year (the private housing average selling price rose from £313k to £344k).

In terms of the accounting, the adjustments are light (less than £1m), so I do consider these to be clean results.

Net debt falls from £63m a year ago to £40m.

CEO comment:

Looking to the full year, we continue to expect to deliver underlying growth when excluding the exceptional contribution of land sales to FY 2025. We are hopeful that an increase in consumer confidence following the publication of the UK Budget, along with interest rate cuts, will provide a boost to homebuying. We are continuing to perform well in affordable housing, with almost all of our FY 2026 forecast revenue already delivered or contracted. Accordingly, we remain on track to deliver results for the full year in line with market expectations and look forward to reporting on our progress."

There is a large deal to provide nearly 300 homes for the workers of Scottish Hydro Electric Transmission plc (“SSEN”), at six sites across Scotland. These will be delivered over the next three years. Springfield won’t sell them at first - they’ll lease them out, and then sell them some years later. This deal is at the “initial agreement” stage.

I suppose the prospect of collecting rents for a few years before selling on these makes it a little riskier than simply selling them to SSEN. Hopefully they’re going to collect premium rents, to help insulate them from this risk a little?

Balance sheet: there are net assets of £172m, with only £5m of intangible assets. That should be a nice level of asset backing against a market cap of sub-£150m. That’s an 11% discount to official tangible NAV.

Graham’s view

Roland was AMBER/GREEN on this in December and I’m inclined to leave that unchanged today.

The market appears to be a little disappointed, and I can see that revenue growth was very limited, with weakness in the main category, but I think the positives still outweigh the negatives:

Significantly reduced net debt year-on-year

Outlook in line with expectations for the full year

Market cap at a discount to tangible net assets

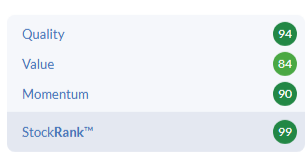

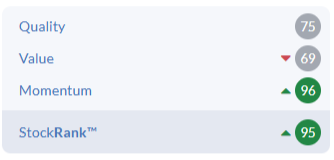

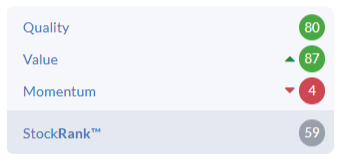

The StockRanks strongly approve, too:

Let’s check in on the estimates from Cavendish which have been republished today.

For FY May 2026, they suggest:

Revenue £243.8m

Adj. EBIT £16.2m

Adj. PBT £12.6m

These forecasts, and the forecasts for FY27 and FY28, have been left unchanged today.

There is an H2-weighting, especially when it comes to profitability. H1 has seen the company achieve 44% of expected full-year revenues, but only 35% of expected full-year EBIT.

So I think I do have to acknowledge that there is a vulnerability to a profit warning, later in the year.

But we weren’t outright positive on this to begin with: only moderately optimistic! And I’m happy to stay that way today.

Mark's Section

MTI Wireless Edge (LON:MWE)

Up 9% at 56p - Trading Update - Mark - AMBER/GREEN

Given the events of 2025, it is perhaps unsurprising that an Israeli company with a defence division is trading well. Although they said that “all three divisions [are] contributing strongly”, it is the defence business that is highlighted as the key area of outperformance.

This has led to a beat at three levels:

FY2025 revenues of approximately $51.5 million, which is at the high end of the range of current market expectations

EBIT up 30% on FY24, leading to EPS significantly ahead of current market expectations

net cash at the end of FY2025 to be approximately $9.4 million, being significantly ahead of current market expectations

This is undoubtedly good news and in the only updated brokers’ note I can see on Research Tree, Shore describe it as a “Very positive trading update.” However, I can’t help being a bit underwhelmed when I go through the details:

On revenue, Shore say this “is in line with our forecast and at the high end of the range of current market expectations.”

For EPS, Shore say “increased profit will lead to adj .EPS for FY25F being significantly ahead of expectations at c.5.8c vs our 5.1c”. This is a 14% beat. Market convention tends to be that “significantly ahead” is 20% or more. This may be because Shore is at the upper end of consensus. However, on the Stock Report the consensus is 5.2c, making this more like a 12% beat.

On cash, Shore had $8.5m pencilled in so $9.4m is comfortably ahead, but at 11% higher, I’m not sure they should be bringing out the word “significantly” again.

This isn’t to say that the company isn’t trading well, and that this isn’t good news, just that it feels like they have over-egged the pudding somewhat with the language used.

My scepticism is also founded in recent history. The company have consistently described themselves as operating in high growth areas: Communications Technology, Water management and Defence. For example, in early 2023 they said:

The macro trends for all three remain positive: from the continuing roll-out of 5G cellular connectivity; to tackling the growing global issue of water scarcity; and the significant increases in international defence spending.

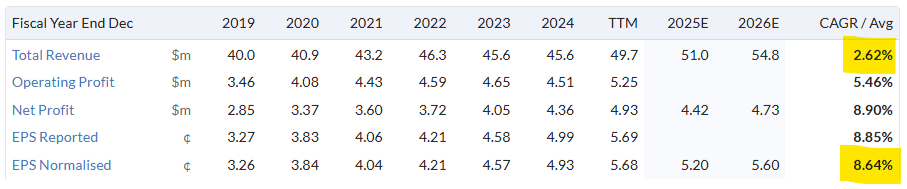

Yet looking at the numbers, 5-yr revenue CAGR has been lower than global inflation, and only strong cost control means that EPS has grown:

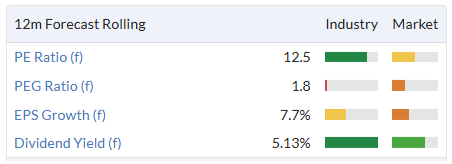

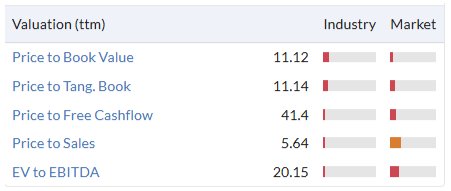

Valuation:

Shore say they won’t update forecasts until Final Results are published next month, which leaves us somewhat in the dark. I’d guess they will probably upgrade future year EPS by a similar amount to today’s share price rise, making these valuation metrics look similar to today’s numbers:

The valuation is not expensive for a stock with a high Quality Rank:

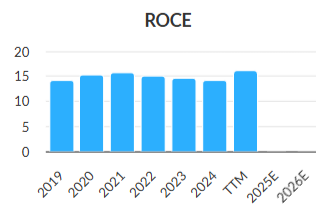

And, while the ROCE isn’t that high, their mid-teens number should be ahead of their cost of capital and is very consistent, suggesting a reasonable competitive advantage:

However, so far, that ROCE above their cost of capital has not generated any shareholder value, as they have been unable to deploy additional capital in order to generate sales growth.

Mark’s view

A long-term family holding gives some comfort for a foreign-domiciled business listed on AIM without significant links to the UK in terms of operations. And I can’t help thinking that family ownership has led to a preference for stability over growth in the past.

The future investment case boils down to whether today’s announcement marks a step change in growth for the business. If the strength of defence spending in Israel means that they are able to generate strong growth going forward, and recent news is a sign of that delivery, then the valuation is modest. However, if this is yet another case of them describing the high-growth potential of their business, but that never ends up in strong revenue growth rates, it is probably overvalued on a PEG ratio of 1.8.

When we have looked at this recently on the DSMR, we have been willing to give it the benefit of the doubt, with a broadly positive view of AMBER/GREEN. While I may question some of the language used in today’s announcement, it is an ahead statement across multiple dimensions, so it makes sense to keep that stance.

Tpximpact Holdings (LON:TPX)

Up 5% at 35p - Contract Uplift - Mark - AMBER/GREEN ↑

Newsflow has certainly been strong this month for this supplier of IT transformation programs to the public sector, with the following contract wins

11 Feb - £22m over 2 years with NHS England

12 Feb - £39m over 4 years with DEFRA

Today - £11m uplift to existing Land Registry contract

In each case, their broker, Cavendish, say that these wins underpin their existing forecasts, rather than lead to upgrades. Today saying:

TPXimpact has secured an £11m contract expansion of its four-year £49m HM Land Registry (HMLR) partnership, which expands the value of the Group’s largest contract as it enters its fourth year (May 2026-27), and contributes to progressively derisked FY27E expectations.

These announcements, together with a guidance to that they were trading in-line for the FY when they released HY results in December, have transformed the share price:

I think it's fair to say that the market had priced almost zero chance of them hitting brokers forecasts, when they went into their interim results announcement at 15p/share, as they were trading on a forward P/E of about 4.

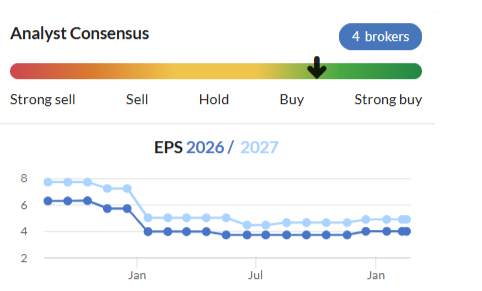

And there were good reasons for the market to have doubts. At the start of 2025, the broker consensus had dropped precipitously:

I last reviewed this a year ago on the DSMR when the share price was 26p and the company had warned. Having run my own valuation numbers at that time, I reduced our view, saying:

While the reasons for the miss here are largely out of the company’s control, this update highlights that this isn’t the highest-quality business. They have less control over their destiny than I’d like to see in a business. This isn’t ridiculously expensive, but it no longer looks cheap on the forward numbers despite an almost 20% fall in price today. So, I am downgrading this to AMBER.

It seems that the weakness over the past year has been due to delays to government spending, rather than anything untoward in the business. However, my point stands about their reliance on fickle government contracts.

Valuation:

Despite a rather meteoric recent rise in share price, the rating still isn’t particularly high. Cavendish calculate a forward P/E of around 10 dropping to around 8 for FY27. Net debt that looked a little precarious at £8.5m last year, is forecast to drop to a much more reasonable £2.7m.

While the recent contract wins didn’t lead to any forecast upgrades, I wouldn’t be surprised if there are more in the pipeline, that may lead to upgrades. Cavendish have a 45p fair value estimate, which isn't that far above the current price, and may lead some to conclude that the good news has now been mostly priced in. However, they do hint that they may be in a position to increase this in the future, saying:

Combined with improved cash flow, reduced debt, and evidence of top-line growth, conditions are combining to generate the groundswell for a rerating which should enable a positive review of our reiterated 45p target price with continuing proof of execution.

Mark’s view

The algorithms rate this a Super Stock:

I am always a little wary when the Momentum Rank is doing the heavy lifting and isn’t backed up by equally positive broker trends. However, in this case there have been fundamental changes, with the market going from not believing the broker numbers at all to there being the potential for an upgrade. Given that the rating is still modest, and the balance sheet is strengthening, I think a slightly more positive view is justified. AMBER/GREEN

Applied Nutrition (LON:APN)

Up 7% at 258p - H1 FY26 Trading Update - Mark - AMBER/GREEN

A short but very positive update for the Half Year from this sports nutrition, health and wellness brand.

The Group delivered a very strong performance in the first half of the financial year, generating revenue of £74.5 million, an increase of 57% on H1 FY25 (£47.6 million). EBITDA for the period was also ahead of management expectations.

Leading to:

Reflecting the strong first‑half performance, the Group now anticipates that FY26 results will be ahead of updated market consensus expectations. Management currently expects full‑year revenue of approximately £140 million.

This means that H2 is roughly going to be the same as H1, meaning little half-on-half growth. The address this saying, the January peak Health, Fitness & Wellbeing period was particularly strong. I have noticed an interesting trend amongst younger fitness enthusiasts of asking for sports nutrition products as Christmas gifts, and I think this must play a part, too. An H1 seasonality does makes sense here.

£140m is also about 5% above consensus. However, there isn’t much sign of operational gearing with this beat, with Cavendish increasing their EBITDA and EPS estimates by 4%, and Panmure Liberum by 6% (giving roughly the same estimates now).

Valuation:

With the share price up 7% or so today, the valuation metrics largely stay the same, making the TTM metrics look very punchy:

5x sales, in particular, means that a lot of future growth is priced in already.

Growth is certainly something they haven’t struggled with historically. Revenue has growth a whopping 45% CAGR, and EPS 34%, meaning that this is not actually that expensive if they keep these sorts of growth rates up for the next 5 years or so. The problem is that EPS growth into FY27 is forecast to be just 10%:

This isn’t something that changes with today's update. Both Cavendish and PL go for around 11% EPS growth for both next year and the year after. Many will point to the history of this company beating expectations and growing rapidly. However, they need to beat current expectations by a big margin to justify the current valuation, and a huge one to make this undervalued at the current price. There are additional sales channels coming on stream, and I don’t doubt they can grow from here. Just that growth becomes more difficult the bigger a company gets, and I’m not sure what their moat is apart from a strong brand. Brand is a moat but one that can easily be breached by competitor advertising, if the prize is big enough. The high operating margins at the moment suggest to me that they will face increasing competitive pressure.

Mark’s view

Graham rated this GREEN following their last ahead statement in December, and I think while the Momentum Rank remains high, we should have a positive view:

However, I struggle to get behind the current valuation, unless we face the goldilocks scenario where the company continually upgrades FY27 and FY28 expectations for EPS growth significantly above the current 11% forecasts, and they face no increased competitive threat. There is enough caution for me to be more AMBER/GREEN on this based on current forecasts for a significant moderation in growth rates going forwards.

Transense Technologies (LON:TRT)

Up 2% at 64p - Interim Results - Mark - AMBER/RED

This drops below our normal market cap limit but seeing as I previewed these results in the Week Ahead, I thought it was worth looking at. In TWA, I said:

The Stockopedia research into profit warnings suggests that it is too early to consider something like this as a recovery stock, as the risk of further bad news is too high. However, if the HY results released on Tuesday don’t show any issues with the balance sheet, then it may be worth adding to investors’ watchlist for when that Momentum Rank starts to turn upwards…

If the balance sheet looks weak on Tuesday, investors may want to exit and take any price they can get.

It is probably not the most auspicious start, that they appeared to have spelt their name wrong in the RNS title: “Transense Technlgy - Interim Results”. Perhaps we can be generous and suggest they went for a minor abbreviation.

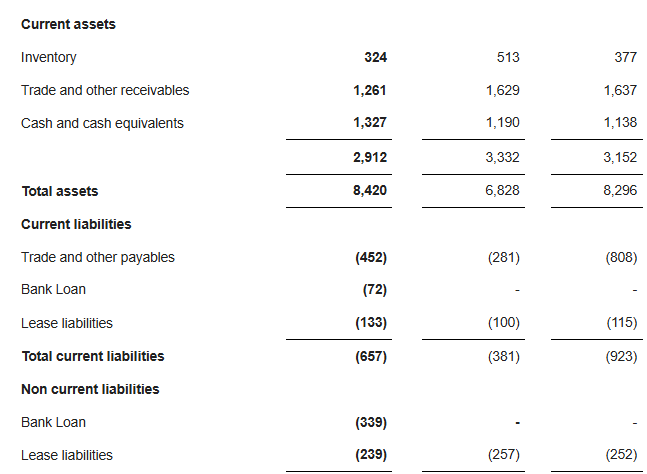

So it no surprise that I turn to the balance sheet first:

Net Cash declines to £0.92m from £1.19m the year before, and £1.14m at the year end, so this is declining but not at a particularly worrying rate.

Inventories and receivables are down, and payables up on a year ago, suggesting a working capital benefit, but the moves are relatively small and don’t look out of place. Overall, the current ratio continues to look strong.

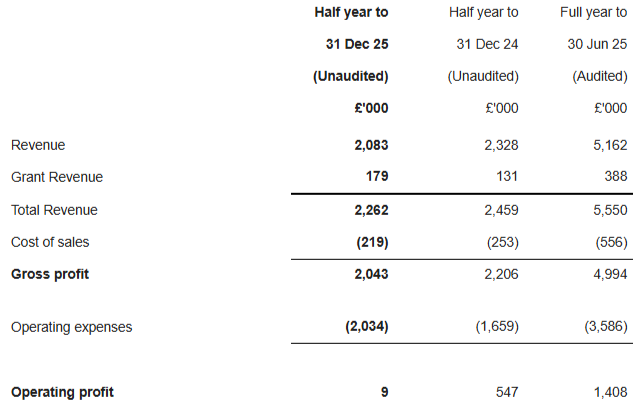

Profitability is nothing to write home about, at barely break even:

However, I didn’t expect much, given they had a huge multi-year profits warning less than a month ago. Here’s how that breaks down:

SAWsense:Revenue was up 74% to £0.66m there seems to be momentum here, with 6 live projects and 3 new customers added since July 2025.

Translogik: Revenue is up 13% to £0.59m, but they say that lead times to adoption and ramp up of new customers have been taking longer than previously expected.

Bridgestone iTrack royalty: Revenue down 35% to £1.01m, after the royalty rate per installation decreased by 40%. There was some volume growth but this was below expectations.

It is the reduction in this last revenue stream that is particularly painful as royalties are very high margin.

Outlook:

This is a little terse:

Pipeline opportunities in both SAWsense and Translogik continue to expand in scale and quality and we reman [sic] highly confident from our broader dealings with customers that they continue to have a strong desire to adopt our products…The board are satisfied that the plan which has been implemented consistently is still well-grounded, and that the key to success lies in determined continued focus on execution.

And the presence of another spelling mistake, suggests we may want to be worried when they say the “key to success lies in…execution”.

Overall, though, I see that a recovery is possible here, based on the underlying growth rates and some of the forward indicators. I think it is too soon to start basing a valuation on the 8.7p of EPS forecast for FY27, even if this was cut significantly after last month’s warning. However, if they got close to that figure they would be looking very cheap.

Mark’s view

As I said in The Week Ahead, the risk of further bad news following a profits warning is too high to consider investing for a recovery now. However, a look at the balance sheet here suggests that they do have some time to turn things around. As such, I keep our broadly negative view of AMBER/RED until there is some signs that the 2027 estimates are achievable and/or the Momentum Rank returns to a more reasonable level.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.