Good morning!

All done for today, thanks everyone. Spreadsheet accompanying this report: link.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

Rio Tinto (LON:RIO) (£120bn | SR72) | Net cash generated from operating activities of $16.8 billion up 8% and underlying EBITDA of $25.4 billion up 9%. Profit after tax of $10.0 billion, down 14%. 2026 production and sales guidance and capital investment guidance are consistent with Capital Markets Day (4 December 2025). | AMBER ↓ (Roland) I admire this business and believe it will be a reliable long-term producer. But at nearly 3x book value, the valuation is starting to look quite strong to me given the very modest production growth that’s forecasts for FY26. If commodity prices remain stable – or rise – then I could be proved wrong. But I can’t help feeling that some of the good news is in the price here. I was AMBER/GREEN in April 2025, but the shares have risen by 70% since then. Right now, I’m more comfortable with a neutral view to reflect the miner’s heavy dependency on Chinese demand and commodity prices. | |

Centrica (LON:CNA) (£9bn | SR48) | Adj. operating profit £814m (2024: £1,552m). Actual operating profit £106m (2024: 1,703m). “The environment has been challenging, and performance has varied across the business.” 2026 outlook: “Retail” to be within £500-800m guidance range. “Optimisation” EBITDA around £250m, below £300-400m guidance range. “Infrastructure” EBITDA £500-650m. | BLACK (AMBER) (Roland) Centrica’s profits slumped last year, in large part because of a drop in both the volume and value of its gas and electricity production. Management is hoping that investments in big energy infrastructure assets such as Sizewell C and the Isle of Grain LNG terminal will provide more predictable earnings in the future. Meanwhile, the group’s Retail business – including British Gas – remains the UK’s largest energy supplier. I don’t have any overwhelming concerns, but my estimate of profitability suggests that after five-bagging since 2020, Centrica shares are probably priced about right at the moment. | |

Mondi (LON:MNDI) (£4bn | SR44) | “A prolonged cyclical downturn, yet we delivered a resilient full year financial performance… it remains unclear when geopolitical and macroeconomic conditions will improve.” 2025 revenue +3%, underlying EBITDA down 5%, PBT down 29% (€269m). | ||

Drax (LON:DRX) (£3.0bn | SR98) | Tolling agreement with Zenobē Coalburn Limited for 200MW (800MWh) of new BESS capacity. | ||

Safestore Holdings (LON:SAFE) (£1.73bn | SR75) | Like-for-like revenue +4.2%, average storage rate +4.8%. Three new stores opened (one in London, two in Paris). New store openings remain on track. | ||

Pantheon International (LON:PIN) (£1.61bn | SR n/a) | New arrangement follows “a rigorous benchmarking exercise against our peer group, and a period of negotiation with Pantheon.” Monthly management fee falls to 1% (previously 1.5% up to £150m and 1% above that, with an additional fee on undrawn commitments). | GREEN = (Graham) This is a nice little tidying-up exercise that also helps to showcase the independence of the Board in relation to the investment manager. PIN is 5% of my portfolio and I continue to believe that the discount to NAV combined with ongoing share buybacks makes it a very interesting idea. So I’m staying GREEN. | |

Capita (LON:CPI) (£426m | SR77) | Renewal with an existing UK client valued at £137 million for a total term of up to 10 years. | ||

Ab Dynamics (LON:ABDP) (£285m | SR45) | Interim CFO was previously CFO at Chemring for eight years and before that at Avon Rubber. | ||

Boohoo (LON:DEBS) (£252m | SR27) | Upscaled fundraise to approx £40m. Raised money at 18p, 5% discount to close on 17th February. NED steps down, which “will facilitate participation in the Fundraise by certain funds” managed by him. | AMBER/RED = (Graham) | |

Kitwave (LON:KITW) (£248m | SR97) | SP down 1% Revenue for the 3mo ended 31 Jan was in line with the prior year period, but an unfavourable revenue mix (hospitality was weak) meant that gross margin fell. Inflationary pressures also continued. Operating profit for the period was materially behind the Board’s expectations. Cautious on outlook for the remainder of the year. | PINK (also BLACK) (under offer) (Graham) [no section below] | |

Regional REIT (LON:RGL) (£173m | SR67) | SP down 4% | BLACK (AMBER/RED ↓) (Roland) [no section below] I took a neutral view on this commercial property REIT in December when it refinanced its banking facility. However, I flagged up the risks posed by low occupancy. These were confirmed today, as the continued decline in rental income has prompted a c.25% broker earnings downgrade and 20% dividend cut. While it seems encouraging that disposals are being made in line with book value, this makes me wonder if RGL is selling off its better assets to deleverage and retaining lower-quality buildings. Broker Shore Capital also highlights today that December’s refinancing is expected to result in the blended cost of debt rising from 3.3% to 5.5% over the next two years, putting further pressure on earnings. With the stock trading at a 40%+ discount to NAV, there could be some value here. But I’d want to do more research to understand the quality of RGL’s properties and the reasons for low occupancy. Consistent with our views on profit warnings and special situations, I’m downgrading our view by one notch today. | |

Arbuthnot Banking (LON:ARBB) (£142m | SR49) | FY Dec 2025: pre-tax profits at the upper end of consensus market expectations (£22m to £24m). | ||

Jubilee Metals (LON:JLP) (£127m | SR36) | H1 copper production +8.7% to 1,543t. FY26 guidance remains within 4,500-5,100t range depending on impact of rainy season on production. | ||

R E A Holdings (LON:RE.) (£59m | SR96) | Total FFB harvested +1.1% to 851,785t. Palm Kernels -1.1% to 43,798t. Extraction rates stable. Very high rainfall. Average CPO selling price realised was $853/t. Average selling price for CPKO was $1,629/t. | ||

Cobra Resources (LON:COBR) (£45m | SR17) | Completed 18 drillholes totalling 3,200m. Found “broad zones of visible oxide and primary copper mineralisation” in 10/18 holes. Results anticipated in March. Cobra has a 12-month option to acquire Manna Hill. | ||

Celsius Resources (LON:CLA) (£34m | SR30) | Company has requested ASX trading halt pending an announcement “in relation to a capital raise” on or before 23 Feb 26. AIM shares will continue trading. | ||

Checkit (LON:CKT) (£19m | SR37) | FY26 revenue -2% to £13.7m, ARR -1% to £14.3m. Adj EBITDA “at break-even”, ahead of market expectations after £4m cost savings. Net cash of £3m at year end. | ||

88 Energy (LON:88E) (£13m | SR11) | Gross (2U) Best Estimate of 507m barrels of oil and natural gas liquids (422MMbbl net). “Farm-out discussions and well planning underway targeting the multi-zone Augusta Prospect”. |

Graham's Section

Pantheon International (LON:PIN)

Unch. at 374.59p (£1.61bn) - Reduced management fee arrangement - Graham - GREEN =

This has been a very pleasant investment for me. On paper I’ve gained about 19% in less than a year, while taking very little company-specific risk.

According to the August 2025 factsheet, the largest individual exposure was Kaseya (1.3%of the portfolio) with the top 5 companies adding up to 6% of the portfolio. That is excellent diversification in my book. The second-largest holding is the Norwegian software company VIsma, which is likely to have a London IPO at some point this year.

And the trust also continues to trade at an interesting discount. NAV per share for December 2025 was reported at 510.6p, so the current share price is a 26.6% discount to that.

What makes it particularly attractive to me is the company’s willingness to fund continuous buybacks while this discount persists.

From the December update:

Share buybacks completed in the seven months to 31 December 2025 were £44.9m. The Distribution Pool balance as at 31 December 2025 was £61.5m, providing a strong source of liquidity to support PIN's active capital management and allocation policies.

The £61.5m “Distribution Pool” is explicitly designed to enable future share buybacks.

So we had c. £45m of buybacks in the first seven months of the current financial year. We have £61.5m available for future buybacks.

And in the previous financial year, FY May 2025, there were £53.5m of buybacks.

The year before that was even more extreme: nearly £200m of buybacks.

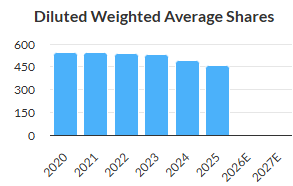

This is a company that is serious about reducing its share count while trading at a discount to NAV.

Of course sceptics may argue that the true NAV may be lower than what is presented. It’s correct that private equity valuations are inherently uncertain.

From my point of view, the discount to NAV is already more than sufficient to price in this uncertainty.

Today’s news: this is a nice little tidying-up exercise that also helps to showcase the independence of the Board in relation to the investment manager.

The Pantheon International Board has negotiated with the manager, Pantheon, and changed the management fee as follows.

New fee: 1% of NAV.

Previous fee: 1% of NAV over £150m, 1.5% of NAV below £150m. Also 0.5% on undrawn commitments (amounts that PIN has agreed to invest with a private equity manager, but have not yet been called by that manager).

The new fee is much simpler and also cheaper. Today’s announcement says that it would have saved £5.3m if implemented in FY25.

Performance fee - there is a 5% performance fee and this is unchanged, but it has a very demanding hurdle. The hurdle is currently 668p and the performance fee is not triggered below that level.

Graham’s view

I had a phase last year when I got very interested in PE investment trusts (e.g. see here), and I’m glad I did!

The trust did lose its long-standing investment manager, Helen Steers MBE, who retired last summer. But her colleague Charlotte Morris remains in place and has been at Pantheon for 19 years, including many years managing PIN.

This is 5% of my portfolio and I continue to believe that the discount to NAV combined with ongoing share buybacks makes it a very interesting idea. So I’m staying GREEN.

Boohoo (LON:DEBS)

Up 5.6% to 19p (£264m) - Result of Fundraise and Board Change - Graham - AMBER/RED =

This follows on from the news on Tuesday that Boohoo/Debenhams (I’ll call it Debenhams from now on) was seeking to raise £35m at 20p.

They’ve raised more than that, but at a lower share price: £40m raised (gross) at 18p.

After investment banking expenses, they’ve raised £38.7m net.

CEO comment:

"We are pleased with the strong level of support from new and existing shareholders. The success of the fundraise demonstrates the strength of support for our multi-year turnaround strategy. The fundraise will deliver an improved capital structure for the Group, providing us with greater financial flexibility to execute our turnaround strategy and deliver value for all shareholders."

Dilution: 222.2 million shares, which increases the share count by a sixth. So it’s a noticeable dilution, but probably well worth it in the circumstances.

The reference to covenant amendments in yesterday’s legal fundraising announcement is key, in my view:

Net proceeds of the Fundraise are intended to create additional liquidity which, in turn, will deliver improved covenant amendments. This will provide greater financial flexibility as the Group works to deliver its turnaround and associated growth plan.

In a situation where covenant amendments are needed, the bank’s cooperation is essential. So in truth they may have had no other choice but to raise these funds.

Investor demand is said to have been “significantly in excess of £35m”, but the lower issue price of 18p undermines that statement somewhat - if it had been possible to raise at 20p, I presume they would have done that.

Graham’s view

I stayed AMBER/RED on this on Tuesday for valid reasons, I think (that the enterprise value already prices in a substantial turnaround).

The announcement of the company raising an additional £5m at a lower issue price doesn’t really change that.

At the new share count, the market cap of the company is c. £300m. I look forward to finding out how much of the fundraising proceeds gets converted into debt reduction, and how much gets absorbed into the business for other purposes.

My overall moderately negative stance is consistent with the StockRanks, who see little value here yet. Maybe the company’s turnaround efforts can change my mind and improve the StockRanks over time - it will be worth following.

It's fortunate that they waited until after their H1 results were published, before fundraising. If they had raised before their H1 results, it could have been at 10-12p instead:

Roland's Section

Rio Tinto (LON:RIO)

Down 4% at 7,064p (£120bn) - Final Results - Roland - AMBER ↓

Today’s results from Rio Tinto are in line with production guidance and – perhaps – in line with profit expectations (see below).

The upshot is that Rio’s profits were flat or lower last year, depending on which measure you prefer:

Revenue up 7% to $57,638m

Underlying earnings flat at $10,868m

Profit after tax down 14% at $9,955m

Free cash flow down 28% to $4,025m

The dividend is unchanged and remains in line with the company’s 60% payout ratio:

Underlying earnings per share flat at 669.2 cents

Dividend flat at 402 cents per share

The Reuters newswire is describing these results as below consensus expectations – citing a Visible Alpha consensus forecast for underlying earnings of $11,030m. However, the consensus figure provided on Rio’s website is $10,883m, while the figure from Stockopedia’s data provider was $10,741m. So I don’t think this is a serious miss.

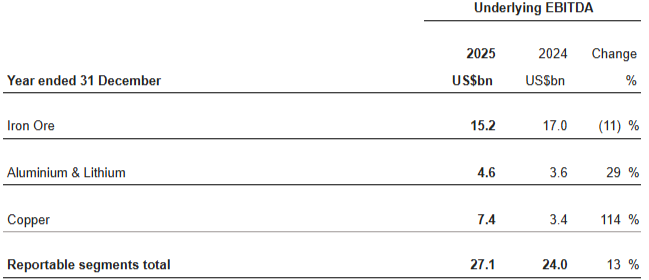

Results by commodity: to understand the lack of movement at the bottom line last year, it’s useful to consider the segmental results. Rio now reports results from three divisions:

Iron ore: lower profits reflect flat production (327.3mt) and an 8% fall in the average realised price to $90/t.

Aluminium & Lithium: a healthy increase in profits reflects higher production (Bauxite production +6%, Alumina production +4%, Aluminium production +3%) and a 17% increase in the average realised aluminium price.

Copper: Rio’s copper production rose by 11% to 883kt last year, while gold (produced at Oyu Tolgoi) increased by a healthy 65% to 464koz.

Cash flow & Balance sheet: Rio’s net debt rose by 162% or $9bn to $14.4bn last year. This primarily reflects a $2.7bn increase in capital expenditure to $12.3bn and the $7.6bn cash outflow relating to the acquisition of Arcadium Lithium last year.

As we saw yesterday with Pan African Resources, many miners appear to be ramping up their spending at the moment.

I don’t see any concerns with this level of leverage – the only worry is whether Rio is deploying its capital in ways that will generate attractive returns.

Outlook

2026 guidance is unchanged from December’s capital markets day and suggests Rio’s output of key commodities will be broadly flat this year, with only small variances.

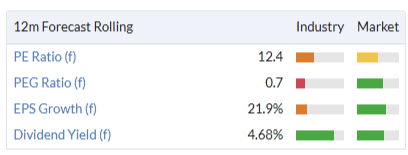

However, the increase in copper and aluminium prices over the last 12 months means that 2026 earnings expectations have steadily ramped higher:

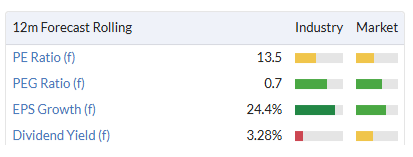

Current forecasts leave the stock on a P/E of 12.4 for the year ahead:

Roland’s view

Like several of the big miners, Rio is trying to bolster its presence in copper and other metals expected to be in high demand for electrification and infrastructure projects.

However, iron ore remains the cash cow of the group, generating 56% of EBITDA last year and a superb 39% return on capital employed. Returns from the other divisions were in the low-mid-teens – respectable, but not necessarily able to drive the monster cash flows of the iron ore business, which generated $6.1bn of free cash flow last year (150% of the group total!).

This could change over time, of course, depending on long-term commodity prices and Rio’s success at gaining scale in copper.

The recent failed effort to merge with Glencore means investors are perhaps waiting to see what CEO Simon Trott’s next plan is.

In general I see this as an attractive diversified miner, with good scale and quality assets. I have little doubt Rio will still be digging stuff out of the ground profitably for decades to come.

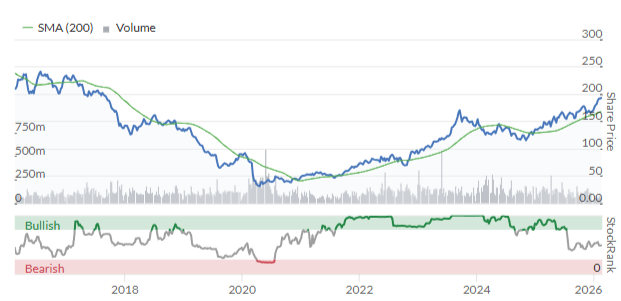

As a potential investor, I think the real question right now is over valuation. Rio Tinto shares are at an all-time high, but its profits are not:

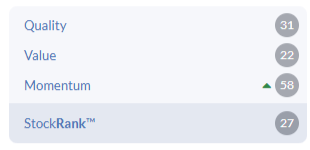

Are Rio shares too expensive? Stockopedia styled the shares as a High Flyer ahead of today’s results, with a strong MomentumRank but more average quality and value scores. I’m not sure today’s results will change these figures all that much:

P/E ratios can be a little misleading for miners, as they are often quite low when close to the top of the cycle. In this case that’s not really the case, suggesting a couple of contradictory possibilities to me:

We’re not near the top of the cycle yet;

Rio shares are too expensive!

I am not sure which of these are more likely. However, I would note that the stock is now trading close to three times its net asset value. For a business that digs things out of the ground, I think book value can be useful when cross-referenced with return on equity.

Rio’s ROE has tended to average around 20% thanks to the super profitability of its Pilbara iron ore mines. For a business with this level of profitability I’d be happy to pay 2x book value. This would imply a return on my cost of equity of 10%.

I am not sure I’d want to pay 3x book value, unless I was confident the business could deliver a sustained or improved profitability and some volume growth.

In fairness, it is completely possible that Rio Tinto will do exactly that through judicious investment in long-term projects. I would need to do more research to understand the company’s pipeline.

However, on a more near-term view, I think it’s worth remembering the company’s heavy exposure to macroeconomic factors, particularly in China.

While it’s tempting to think about the growth story for miners in terms of copper and giant US data centres, the reality is that China buys around three quarters of seaborne iron ore shipments. Many of these come from Rio’s mines in Australia.

China also buys around half the world’s copper and alumina. Again, some of this almost certainly comes from Rio Tinto.

Chinese demand supports a big chunk of Rio’s profits.

While I think Rio Tinto shares might be attractive at current levels, but this relies on a bullish view for commodity prices and demand.

My preferred approach with big miners is to buy them when the outlook is a little less rosy and they are somewhat unloved. To paraphrase Warren Buffett, an investor can pay a high price for a cheery consensus.

I was AMBER/GREEN on Rio Tinto in April 2025, when the group’s market cap was £71bn. Today it’s 70% higher, at £120bn. I’m not sure if the increase in valuation is matched by an increase in earning power, so I’m going to move down one notch and take a neutral view today.

Centrica (LON:CNA)

Down 5% at 186p (£8.6bn) - Preliminary Results - Roland - BLACK (AMBER)

British Gas owner Centrica has reported a big fall in profits for 2025 this morning and trimmed its guidance for 2026. The company has also decided to suspend share buybacks.

2025 results highlights

These results are not great, but the 2025 figures do appear to be in line with consensus expectations:

Adjusted EBITDA down 38.5% to £1,417m

Adjusted operating profit down 47.6% to £814m

Reported operating profit down 93.8% to £106m

Adjusted EPS down 41.1% to 11.2p

Dividend up 22.2% to 5.5p per share

The group’s reporting is now split into three segments, giving us an idea of where the shortfall occurred last year:

Retail (British Gas & business energy services): adjusted EBITDA unchanged at £0.6bn, with adjusted operating profit down 20% to £0.4bn;

Optimisation (principally trading & related activities): adjusted EBITDA down 50% to £0.2bn, with adj op profit down 33.3% to £0.2bn, “reflecting challenging market conditions for Gas and Power Trading”;

Infrastructure (power generation, gas production and storage, meter asset provider): adjusted EBITDA down 50% to £0.7bn, adj op profit down 62.5% to £0.3bn, “impacted by lower achieved prices, pausing of Rough storage activities and nuclear outages”.

Incidentally, Centrica has altered its reporting segments this year. While the new structure seems logical enough to me, it does also make comparisons with prior periods a little more difficult…

Underlying much of last year’s poor infrastructure result was the simple reality of unfavourable commodity price movements. This was unfortunately combined with a reduction in production volumes:

Gas:

Average achieved gas price fell by 19% to 107p/therm

Total Spirit Energy production fell by 21% to 10.5mmboe, with disposals accounting for half of the decline

Gas storage in Rough fell by 80% to 8bcf as operations were paused due to uneconomic gas market conditions

Nuclear:

Average achieved nuclear power price fell by 32% to £90/MWh

Nuclear outages also caused a 12% fall in generation, to 6.6TWh

Cash flow & Balance sheet

Centrica made record profits when gas and power prices spiked in 2022/3 following the start of the war in Ukraine. This left the group with a c.£2.7bn net cash balance, which is gradually being deployed.

Last year saw net investment double to £1,096m, driven by infrastructure investments in Sizewell C nuclear (£387m), Isle of Grain LNG acquisition (£200m) and Meter Asset Provider (£271m). These were partially offset by £131m of disposals.

At the same time, operating cash flow fell by 40% to £695m last year, due to the factors I’ve discussed above.

After adding in £827m of share buybacks, the end result was that net cash fell from £2,858m to £1,487m last year.

Against this backdrop, I’m not surprised the Board has opted to suspend share buybacks to free up cash for continued infrastructure investment. Perhaps this should have happened sooner.

Outlook

At this stage in the year, guidance ranges are quite wide. Even so, management is already convinced that the Optimisation business will underperform its guidance range:

Retail expected to be “wtihin £500-£800m EBITDA guidance range”;

Optimisation expected to deliver EBITDA of “around £250m”, below £300-400m guidance range

Infrastructure expected to be between £500-650m

Net interest expense is expected to increase to c.£100m – this could have been avoided with more cautious use of buybacks

This guidance appears to factor in a lot of uncertainty – based on the numbers above, total segmental EBITDA could range from £1,250m to £1,700m!

I don’t have access to broker notes for Centrica, but prior to today analysts were forecasting a 24% increase in earnings in 2026.

Today’s c.5% share price fall suggests to me that these expectations will be trimmed slightly, but that cuts to earnings forecasts will be relatively modest at this early stage in the year.

Roland’s view

Centrica’s strategy is to expand its portfolio of infrastructure assets with sales tied to long-term contracts. Sizewell C, Grain LNG and the Meter Asset Provider business are given as examples of assets that should provide “more stable and predictable earnings”.

Alongside this, presumably, the Retail business will remain the UK’s largest energy supplier, supporting both commodity-type revenue and the growing Home Services business, which should be less affected by fluctuating energy prices.

This seems logical enough to me, but there’s probably a limit to what I’d want to pay for such a business. Today’s results (using adjusted operating profit) give the group a 2025 return on capital employed of 10%. While I think this figure might improve a little, I think the group’s combination of capital intensive and regulated businesses is likely to mean that this is a fair estimate of sustainable, long-run profitability.

On that base, the current valuation looks about right to me:

Centrica shares have five-bagged from the lows seen in 2020.

However, the picture is different today and I think much of the value in the business is probably now reflected in its valuation. I am inclined to agree with the StockRanks today and adopt a neutral view on Centrica.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.