Good morning! Let's see what Friday's news feed has for us.

There's nothing else where I feel I can add much value today, or where it's particularly interesting. So I'm going to call it there - see you next time! Cheers.

Spreadsheet accompanying this report: link.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

AstraZeneca (LON:AZN) (£237bn | SR79) | AstraZeneca's Calquence in combination with venetoclax has been approved in the US as the first all-oral, fixed-duration regimen for the treatment of adult patients with chronic lymphocytic leukaemia and small lymphocytic lymphoma. | ||

Anglo American (LON:AAL) (£42bn | SR55) | Underlying EBITDA of $6.4 billion (2024: $6.3 billion). $1.8 billion of run-rate cost savings delivered. Loss of $3.7 billion, including a pre-tax impairment of $2.3 billion relating to De Beers. | ||

SEGRO (LON:SGRO) (£10.8bn | SR77) | £99 million of new contracted rent commitments and 6.0 per cent growth in like-for-like net rental income. Estimated Rental Value +3.1 per cent in the UK. Occupancy increased 90 bps to 94.9%. Adjusted pre-tax profit +8.3% to £509m. | ||

TBC Bank (LON:TBCG) (£2.4bn | SR65) | FY 2025 profit of 1,420 million Georgian Lari, up by 9% YoY, with ROE at 24.2%. As outlined in the third quarter, group net profit for 2025 was below target. Total dividend per share for 2025 of GEL 8.87, an increase of 10% year-on-year. | ||

Chemring (LON:CHG) (£1.42bn | SR54) | FY26 outlook in line with the Board's expectations. H2 weighting slightly heavier than the prior year. | ||

Chrysalis Investments (LON:CHRY) (£464m | SR) | Proposed New Investment Policy, New Management Arrangements and Notice of EGM | The Board believes returning capital to shareholders on realisations is more appropriate than reinvesting in new investments. New investment policy is to effect an orderly realisation of its assets. | AMBER/GREEN ↓ (Graham) |

Tullow Oil (LON:TLW) (£155m | SR29) | Trading Statement & Ghana Petroleum Agreements Extended & Refinancing Transaction and Lock-Up Agreement & SPA to acquire TEN FPSO in Ghana | “2025 full year free cashflow was negatively impacted by the commodity price environment towards the end of the year and delays in receipt of Government of Ghana receivables and the second instalment of proceeds from the Kenya disposal.” Group working interest production in 2026 is expected to average 34-42 kboepd, including c.6 kboepd of gas. | |

Residential Secure Income (LON:RESI) (£103m | SR75) | Total EPRA return for the quarter of 0.5% (0.3p) to give EPRA NTA of 62.6p (£134.1mn) (last night’s share price: 55.4p). | ||

Smarter Web (LON:SWC) (market cap uncertain, SR23) | £225m raised, including £209m in equity capital. PBT £2.8m. Excluding one off gains and fair value adjustment, the result would have been a loss before tax of £1.5m. The operating business has continued to perform in line with expectations. At the year end, the Company held 2,660 Bitcoin, with a market value of approximately £220m. | AMBER/RED ↑ (Graham) I’ve been consistently RED on SWC as I viewed it as ludicrously overvalued. I no longer consider that to be the case. I still think it’s a very strange beast and I have zero temptation to get involved. But it seems to be worthy of an AMBER/RED today, on the basis that it might offer value at this level. Which is not something that I was able to say before. | |

Pulsar (LON:PULS) (£60m | SR41) | £7m of cost savings. ARR at year end increased to £64.5m, up £3.9m. Adjusted EBITDA +13% to c. £10.2m, in line with expectations. | ||

Rentguarantor Holdings (LON:RGG) (£41m | SR21) | Rob Rinder MBE will expand his role of brand ambassador to support the Company's mission. Issuing Mr Rinder with 348k warrants at exercise price of 33p (last night’s price 28.5p). | ||

Skinbiotherapeutics (LON:SBTX) (£15m | SR9) | NED is appointed to oversee the continuing investigation process on behalf of the Board. Existing external legal and professional advisers will support the process as necessary. | RED = (Graham) When the figures are in doubt, it is best to stay ultra-cautious. Investigations can be expensive, time-consuming and complicated. I’ll stay RED on this until we have more clarity. |

Graham's Section

Chrysalis Investments (LON:CHRY)

Unch. at 95.3p (£464m) - Proposed New Investment Policy, New Management Arrangements and Notice of EGM - Graham - AMBER/GREEN ↓

Perhaps naively I was GREEN on this fund in November when the NAV was 171.65p and the share price was 120p.

The share price is now only 95.3p (down 21%), and the last-reported NAV (December 2025) was 165.36p (down 4%).

So the discount to NAV has grown considerably wider: from 30% to 42%.

However, that’s based on their holding Klaria Pharma Holding AB (publ) (STO:KLAR)’s price at the end of December. Klarna has more than halved since then, and it just crashed 27% after a profit warning:

Chrysalis also has a massive exposure to Starling - and it’s not clear when the IPO of that business might happen.

Today’s announcement confirms that Chrysalis is going to wind down.

They start with the suggestion that their continued wide discount to NAV might partly reflect investor apprehension that they will make new investments:

The Company has returned over £100m of capital through share buybacks over the last two years in line with the Capital Allocation Policy ("CAP") adopted in March 2024. Whilst the discount to NAV has improved, it has not improved significantly. The Board believes that this persistent level of discount is a market driven issue but is also, in part, because of the perceived risk of reinvestment in the Chrysalis strategy.

They continue with the observation that the company has only returned 1.13x the value of the money it has raised since inception seven years ago. And that is measured in NAV.

At market value rather than official NAV, the shares trade at a 34% discount to the average price at which new money has been raised.

Conclusion:

Based on this historic performance, the Board believes returning capital to shareholders on realisations is more appropriate than reinvesting in new investments.

Turning to their current investment advisor, they say that it “has not developed its regulatory and operational capacity as envisaged” since March 2024.

They say they have sought to make changes to their agreement with the manager (“Chrysalis Investment Partners”, or CIP), but that their proposals have not been agreed to.

As a result, they have served notice on CIP. They might just manage the portfolio themselves after that:

Unless other arrangements can be reached with the Investment Adviser during its six month notice period, the Company's intention after the expiry of that notice period is to operate with a self-managed model in delivering the New Investment Policy…

CIP have published a response (not via RNS - I received it through PR channels). Among other things, it says that the self-managed option would have negative consequences for shareholders. I’ll publish their fears about the self-managed model in full, as I think it’s instructive and I don’t think it’s available via RNS.

Here are their objections (emphasis added):

The Board does not have the Adviser’s detailed knowledge of the assets, developed over many years, or the established relationships with portfolio company management teams to support an orderly and value-focused realisation process.

Nor does the Board, whose role it is to provide governance and oversight, have the expertise to run an investment mandate, even one in wind-down.

The Company is likely to permanently lose its board representation at Starling Bank, which accounts for more than half of the Company’s net asset value. The loss of influence at such a pivotal holding would materially weaken oversight and impair value realisation.

The Board’s proposed self-managed structure could ultimately increase annual costs for shareholders, given its stated intention to rely on external transactional services, such as accounting, legal or other advisory firms.

The Board is not incentivised to maximise value, whereas the Adviser is fully aligned with shareholders. A significant proportion of the investment team’s personal wealth is invested in the Company. Their interests are directly tied to maximising value for all shareholders over a reasonable period.

Graham’s view

I regret being fully GREEN on this in November, although I did at least acknowledge that their portfolio was heavily concentrated. It turns out that Klarna has hurt them more than their largest holding Starling in the short term.

At this point, I think it makes sense for me to downgrade to AMBER/GREEN. This recognises that there is still a wide discount - even wider than before - but also acknowledges the complexity involved.

It also acknowledges that the wind-down process could be problematic. If CIP’s warnings have merit, that would be bad news for shareholders here. On balance I’m inclined to think that CIP’s warnings do have merit, but that’s only based on an initial review. The Chrysalis board have hired a new NED with experience at Allied Minds (some of you will remember that one).

So I’m going to take my stance down by one notch. A big discount to NAV always gets me interested, but I have to acknowledge that shareholders here do face some big risks, most notably execution risk (will the wind-down be successfully managed?) and concentration risk.

An overview of the portfolio, to help you see the concentration:

Starling 53%

Smart Pension 15%

Klarna 11%

Wefox 7%

Brandtech 4%

No other position is larger than 3%.

I don’t know how quickly they can sell out of Klarna but that one in particular looks like it could be a massive drag on short-term performance.

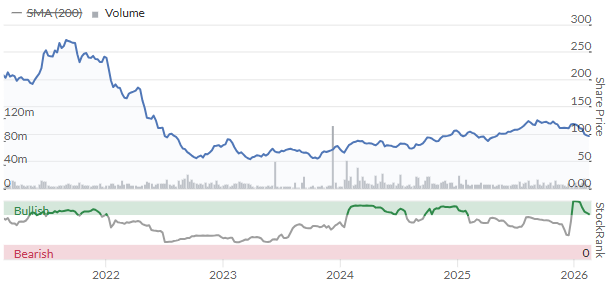

The long-term Chrysalis share price (5 years): it has done ok for anyone who bought after the post-Covid crash.

Smarter Web (LON:SWC)

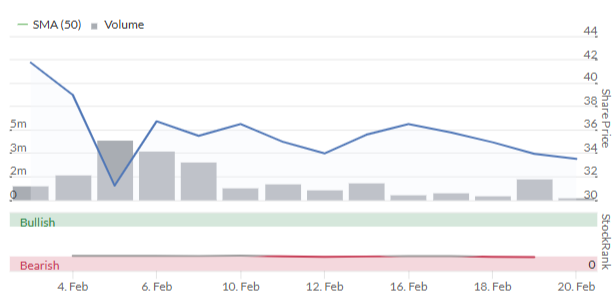

Down 4% to 32.76p (market cap uncertain) - Full Year Results - Graham - AMBER/RED ↑

Stockopedia is treating this as a new listing. It moved directly to the Main Market from Aquis at the start of this month, bypassing AIM:

For those who might not be aware, it is the biggest “Bitcoin Treasury” company in the UK, and also has a small web development business attached.

The CEO announced grand ambitions as the shares started trading on the LSE:

We remain committed to building a British success story that contributes meaningfully to the UK economy, showcases the ambition of the UK's entrepreneurial spirit, and demonstrates the role that Bitcoin, as a form of digital capital, can play in supporting the growth of modern businesses."

My first task is to get a handle on the correct share count, as the company has been aggressively raising funds.

This has been entirely rational behaviour by the company, as far as I’m concerned. It’s what you should do when you’re overvalued!

The most recent subscription agreement, outlined on Christmas Eve, allows for the almost continuous sale of new shares by the company’s broker.

The announcement said that total voting rights would reach 350 million after the sale of 63.2 million new shares.

So it seems to me that the correct market cap to use is £115m, not the number shown on the StockReport.

However, I’m wondering if perhaps the company might be running out of new investors?

15th Jan 2026: £1.7m raised

26th Jan 2026: £0.5m raised

2nd Feb 2026: £0.1m raised

9th Feb 2026: £0.5m raised

16th Feb 2026: £0.2m raised

These numbers seem to be getting smaller. Less than £200k was raised in the most recent announcement.

And it would make sense to stop issuing new shares when the shares are much more keenly priced in the market.

The first of the raises mentioned above was at 51p, while the most recent was at 38p. And the share price now is less than 33p.

Let’s turn to today’s full-year results.

Key points:

Pre-tax loss of £1.5m before one-off gains and fair value adjustments

Pre-tax profit £4.3m after those gains and fair value adjustments

Finished the year with 2,600 bitcoin with market value of approx £220m.

2026 year-to-date, the bitcoin price is down 24% in GBP:

But SWC’s year end is October. Since then, the Bitcoin price is down by 40% in GBP.

So let’s apply a 40% haircut to SWC’s year-end BTC holdings. That gives a current value of £133m (before any purchases made since then).

Outlook:

Looking ahead, the Company remains focused on executing its strategy, strengthening the operating business, progressing its acquisition pipeline, and managing its Bitcoin treasury in a disciplined manner. The Board enters Financial Year 2026 with confidence, supported by a strengthened balance sheet, an expanding operating platform and a clear strategic roadmap for long-term value creation.

Graham’s view

I’m going to have to do some back-of-the-envelope calculations, and I apologise for any errors.

My assumptions:

The bitcoin they held at the end of October are now worth £133m.

Their unusual bitcoin-backed loan note is still a liability worth c. £11m (though it may have reduced).

Their operating business is breaking even (probably false but let’s just assume it).

This gives a current value of £121m, which is reassuringly close to the current market cap of £115m.

However, that market cap assumes 350 million shares outstanding. And that’s only true based on the company issuing lots of shares and raising lots of cash since the financial year-end in October, and into the future:

November: they raised £0.4m

December: nothing raised

Jan/February: £3m raised total

Over January and February, I count circa 6.3 million new shares issued.

Unless I’m mistaken, that still leaves 57 million new shares under the subscription agreement that have not yet been placed by their broker.

If the broker managed to get them away at 25p for example, that would raise an additional £14m (gross). But it's also possible that they might end up selling them at 10p - I don't know.

So if the true share count is 350 million, I think we should also add in about £17m to the NAV. This gives about £138m of value.

So in my eyes, SWC shares could genuinely be trading at a discount to fair value now.

That doesn’t make them a bargain.

In particular:

The operating business may have a negative value, not a neutral value as I assumed.

It’s not clear to me how desperate the company and its broker might be to sell the remaining 57 million new shares. They might keep selling all the way down, or they might stop diluting at some point.

Also, please bear in mind that my calculations are very rough and may be flawed.

I’ve been consistently RED on SWC as I viewed it as ludicrously overvalued. I no longer consider that to be the case. I still think it’s a very strange beast and I have zero temptation to get involved. But it seems to be worthy of an AMBER/RED today, on the basis that it might offer value at this level. Which is not something that I was able to say before.

Skinbiotherapeutics (LON:SBTX)

Down 4% to 5.5p (£15m) - Independent Investigation Appointment - Graham - RED =

Before getting into today’s update, I wanted to catch up on Monday’s announcement.

Here are some snippets from Monday’s announcement. Referring to their former CEO (emphasis added):

In addition to the initial concerns around his conduct, in light of the newly available information, the Board has reason to believe that the former CEO has misrepresented material information to the Board and senior management, the Company's auditors and advisors…

The Board currently expects that the FY25 Accrued Royalty Income, which amounted to £0.77m, will be removed from the FY25 accounts….

The Board is confident, however, in the underlying financial health of the business due to its robust cash position (£2.92m as at 13 February 2026).

FY25 total sales were £4.6m, so £0.77m is a very material figure for this company.

The pre-tax loss for the year was £0.7m.

Revenue and the loss will of course have to be restated, if the royalty income is invalid.

The Board said that they think the real FY25 operating loss will be £1.47m, and issued an official profit warning for FY26.

Today’s announcement: they have appointed a NED, the Chair of their Audit Committee, to oversee the investigation.

This NED only joined the Board in January and so cannot be accused of failing to spot the problem before it happened.

Graham’s view

I’m obviously staying RED on this. The profit warning is no surprise - when the CEO abruptly left, it made sense to presume that FY26 expectations would not be met.

Where I do slightly take issue with the company’s statement is when it refers to its confidence in its "underlying financial health” due to its “robust cash position”.

That £2.9m figure is indeed robust, but only if we presume that the company is soon going to stop running an annual operating loss of c. £1.5m.

Forecasts in the market suggested that SBTX would be around breakeven this year, and then maybe earn a small profit next year.

Based on recent developments, I would now presume that the company is going to make a meaningful loss in both of those years.

That doesn’t mean their £2.9m cash balance is insufficient. But when the figures are in doubt, it is best to stay ultra-cautious. Investigations can be expensive, time-consuming and complicated. I’ll stay RED on this until we have more clarity.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.