Good morning!

Warren Buffett on CNBC

I was very disappointed with yesterday's interview with Warren Buffett by Betty Quick of CNBC - what a missed opportunity - she asked him all sorts of dumb questions about current market volatility. When anyone even vaguely acquainted with Buffett's long term approach would have known exactly how he would reply - that he has no idea what the market will do in the next 10 weeks or months, but that he believes it will be significantly higher in 10 years, and that's all he cares about.

That really annoyed me - what a squandered opportunity - to be given access to interview arguably the world's most respected investor, in his twilight years, and to not even bother preparing intelligent questions. I must email Mr Buffett, to ask if he'll do an audiocast with me instead!

Consumer cyclicals

In the short term, the main indices are starting to look as if a short term bottom has been put in. Although one does wonder how much of this recovery has been manufactured by central banks & Govt action to prop up markets? In my world of UK small caps, it feels like a bull market again. We had a bit of a wobble, but remarkably little selling volume in small caps, when the main indices were falling over recently.

Most small caps I hold, that are reporting decent results, are going up again, even reaching new highs. So it looks & feels like a bull market to me still. Remember that the big indices have taken a heavy hit from oil & other resources stocks declining. That's not relevant to small caps, where I'm mainly focusing on cyclicals, especially UK/Western consumer cyclicals - where demand is rising, due to rising real wages, and the "tax cut" of lower oil, and low to negligible inflation.

That's the most healthy macro backdrop for consumer cyclicals that we've seen since 2007, in my opinion. So I reckon there's plenty of scope for companies in this area to out-perform, if they are well managed, and have decent products. The falling big indices therefore seems a red herring to me, and a false benchmark to follow. I prefer to follow FTSE Mid 250 Index (FTSE:MCX) and FTSE Smallcap Ex Investment Trusts Index (FTSE:SMXX) .

Goals Soccer Centres (LON:GOAL)

Share price: 155p (down 20% today)

No. shares: 58.5m

Market cap: £90.7m

Interim results to 30 Jun 2015 - it seems to be the outlook statement, more than the interim figures, which has triggered this morning's 20% fall in share price. So is this a buying opportunity? I've been following this company for years now, but the investment case has never looked right to me, on my assessment of risk:reward.

Earlier, the balance sheet was too highly geared. That's been sorted out now, with debt under control, but the roll-out has looked too slow, and too capital-intensive. It operates 5-a-side football centres. Now we have poor current trading to add into the mix.

Key numbers from the interims;

- Revenues flat at £17.1m

- LFL sales down 1% (2014: up 3%)

- Operating profit down 10.7% to £4.8m

- Big fall in P&L finance charge, from £1.0m in H1 of 2014, to £0.3m of H1 this year. Reason given is "due to the balance sheet restructuring completed in 2014"

- Underlying diluted EPS fell by 3% to 6.0p

- Underlying PBT increased by 1% to £4.5m

So clearly it's the lower finance charge which saved the day, and recouped the 10.7% drop in operating profit. However, the key number to focus on, as it reflects the actual trading of the business, is operating profit, and that's down 10.7%, so not good.

Current trading - the slightly negative trend in H1 has got a lot worse in Jul & Aug. Revenues were down 10% in the first 9 weeks of H2. Several credible-ish reasons are given - poor UK weather leading to people booking overseas holidays (confirmed by recent airline trading statements). Also the World Cup last year boosted the prior year comparatives.

To remedy this, marketing has been stepped up. However, in my book poor sales, plus additional marketing to boost them equals a doubly negative impact on profit.

All the gains of the last two years have been given up today:

Valuation - helpfully, the company gives full year guidance (ALL companies should do this!) and says it has revised this to a range of £9.3m to £9.8m for calendar 2015 at the PBT level. That doesn't sound too bad actually. Looking back at last year's numbers, it made £10.6m at the PBT level, so profits are dropping somewhat, but not a catastrophic amount by any means.

Take off 21% tax, and that drops out at £7.3 to £7.7m earnings guidance for the FY 2015, or 12.5p to 13.2p EPS. So at 155p share price, my estimate for the PER is 11.7 to 12.4, which actually looks quite reasonable. Sure there is some debt to take into account - net debt is currently about £38m, but that looks reasonable against EBITDA, and also it is structural debt which is funding a ton of fixed assets, or £115.8m fixed assets NBV, to be more accurate. Therefore net debt is 32.8% of the book value of fixed assets, which seems fine to me.

I've had a quick look in the 2014 Annual Report, and all the property is leasehold, which is a pity. I would have liked to see some freeholds in there, which would have given more comfort on debt.

My opinion - I haven't got time to wade through all the narrative published today, but there are some positives in there - more new sites are being opened, the US site is doing well, with more planned.

The reality is that things rarely go smoothly with small caps - anyone who has run a SME themselves will confirm that profits rarely move in a smooth progression. In reality, you have good years and bad years, with the key thing being long term performance.

For that reason, I often take a close look at companies which disappoint in the short term, because (as long as you are highly selective) this can provide some excellent, good value entry points.

So am I tempted to buy into GOAL? In a word, yes. I've not bought any yet, but it's certainly a stock I'll be watching, and if they sell off some more, then I could be tempted to pick up a few. I'm not madly keen on their capital-intensive business model, and competitive pressures from cheaper Local Authority run centres is mentioned in today's narrative. So it's not a stock that I would load up into a big position, but it's starting to look tempting for a potential little dabble.

The key thing now is to get Googling, and asking friends, to see what customers think of these soccer centres. Declining sales is a warning sign that all may not be well. Companies which warn on profits can go into a long period of disappointing share price action, so I'm reluctant to dive in straight away. It's on my watch list now though, as potentially interesting, so I'll do a bit more research on it.

Note that the StockRanks system has again worked nicely here. The StockRank last night was low, at 40 - clearly the Stockopedia computers had picked up on the declining broker forecasts, and drifting share price, as the momentum score was low at 44. I'm using the StockRanks much more as a guide these days, as it often picks up on things I might have missed (such as small broker downgrades - which are an early warning sign that current trading isn't great).

Laura Ashley Holdings (LON:ALY)

Share price: 28.4p (up 2.2% today)

No. shares: 727.8m

Market cap: £206.7m

(at the time of writing, I hold a long position in this share)

Interim results 26 wks to 1 Aug 2015 - firstly, a hat tip to the finance team at ALY, who have published results a month more quickly than most companies reporting at the moment - prompt reporting is nearly always a good sign, of a business that has strong financial controls in place.

The key figures obscure the underlying picture, which is that the company is trading very strongly in the UK, where it operates its own stores. However, overseas trading (which is through franchisees) has been poor - mainly because about half the overseas trade is in Japan, which has been weak.

UK retail sales in H1 were up 7.0% on an LFL basis, which is a stonkingly good result. Note that eCommerce is an important element, at 19% of UK sales. PBT rose 150% in H1, from £1.2m to £3.0m (note that there is a strong H2 seasonality to profits, hence why these figures look small for H1).

International - as this is franchised, the sales figures don't come through, just the profit element. So it's actually a lot bigger than most people realise - at 296 franchised stores, and international actually generated 55% of PBT last year.

As well as Japan being weak, Russia & Ukraine are noted as also having affected results adversely. S.Korea & M.East are noted as better performing regions. The outlook for H2 is more upbeat, with these comments being specific to International;

We expect performance to improve during the second half of 2015. The Laura Ashley brand and product continues to resonate with our many worldwide customers. The acquisition of the Group's Asian head office in Singapore will lead the company's expansion into the Asian market.

I reported on the recent, somewhat bizarre decision to spend £31.1m buying a freehold office block in Singapore here on 30 Jun 2015. So please click on that link to refresh your memory on the deal, if you wish.

Profit before tax ("PBT") overall was slightly down, at £8.4m (2014: £8.5m) in H1.

Outlook - very good current trading is reported (this mainly relates to the UK, I think);

Trading for the five weeks to 5 September is up 5.7% on a like-for-like basis.

So with the UK still powering along, and a better outlook for International in H2, things seem positive to me.

Balance Sheet - absolutely fine. There was no bank debt at 1 Aug 2015, instead the company held cash of £20.2m. Although note that two days after that date, a £20.2m mortgage was drawn down to purchase the Singapore office building, with the balance of about £10.9m being funded from cash reserves.

Therefore on a pro forma basis, ALY now has net debt of £10.9m, but of course it also now owns a £31m freehold property. So the underlying picture is still very healthy. It introduces risk though - if the Singapore property market crashes, and/or if interest rates there shoot up. So let's hope the company really makes use of that impressive office block to dramatically increase its Asian operations, which it appears is their intention. Long term it could be quite exciting - they're clearly not messing around, buying a building of this size.

Please also note the pension fund deficit, which has come down slightly in the last 6 months, and is now reported at £17.5m.

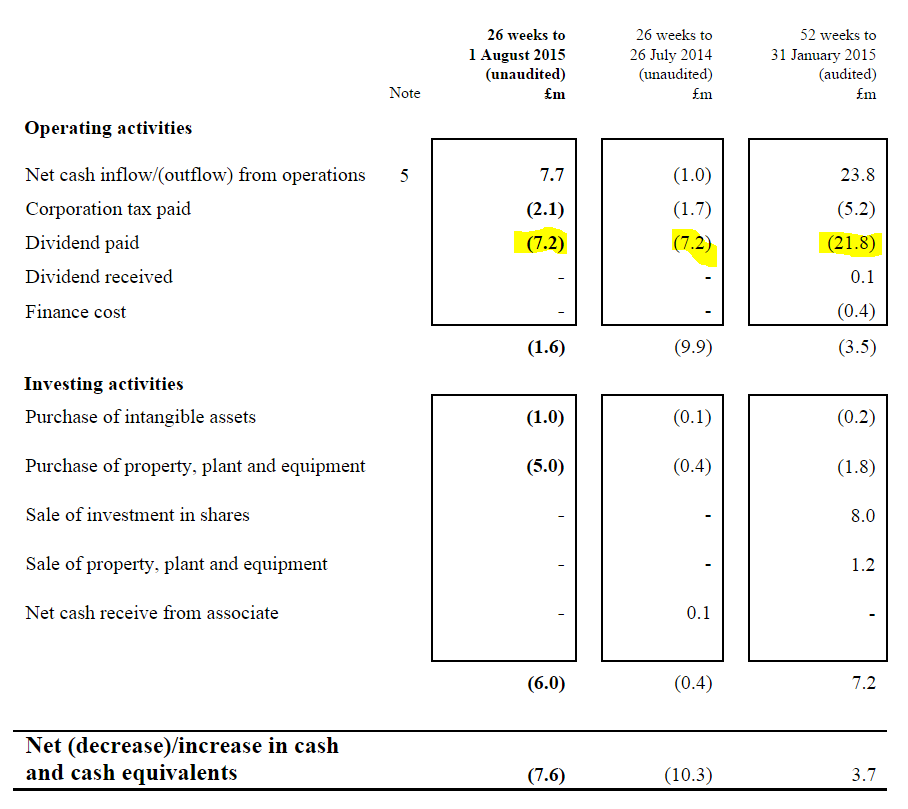

Cashflow - the company presents its figures in a peculiar way, so it looks from Stockopedia as if the free cashflow is weak. This is incorrect, because the company reports free cashflow after paying huge dividends, where of course it actually should be reported before dividends.

As you can see from the condensed cashflow statement (below) published today, the company pays out very high divis, which are looking a bit of a stretch. So the 7%+ dividend yield may not be sustainable. Although I looked at this a few months ago, averaged over several years, and came to the conclusion that it looked just about sustainable.

Clearly the controlling Malaysian shareholder likes his divis - which is great, as we minority shareholders get to enjoy them too, and note that Directors here are paid relatively modest salaries - which to my mind indicates a shrewd controlling shareholder who is not going to let management ratchet their rewards to excessive levels, or dream up a VCP (the laughably termed "value creation plan" that Directors at companies like Vislink (LON:VLK) are trying to use as a method of plundering the company for their own personal gain).

So whilst some people may not like the shareholding structure here, with one dominant shareholder, it can potentially come with benefits too - such as keeping Director pay under control, and operating the business with a view to long-term success, rather than chasing short term financial goals. I've not seen anything to suggest that the major shareholder has in any way harmed the interests of minority shareholders, so personally I am happy to be along for the ride.

My opinion - I really like this share. It looks reasonably priced, soundly financed, and the UK part of the business seems to be trading its (floral patterned) socks off! With international looking better for H2, and with clearly a major Far Eastern expansion in the pipeline, through franchisees to keep the risk low, I think there's a lot to like about this share as a long term core position. We're paid thumping great divis whilst we wait for the shares to re-rate too, which is always pleasant, especially in a low interest rate environment.

The chart looks quite nice too - ready for another move up, who knows?

Monitise (LON:MONI)

Share price: 2.98p (down 48.7% today)

No. shares: 2,200.3m

Market cap: £65.6m

Results y/e 30 Jun 2015 - a total train wreck! Key figures;

Revenue down 5.7% to £89.7m

EBITDA loss of £41.8m

Capitalised into intangibles £40.8m

Therefore on a cash basis, the loss was £82.6m!

The only figure that really matters now, is how much cash is left in the bank before they go bust? There was £88.8m cash remaining (down £58m in a year!), so by the looks of it, there's only enough in the tank for about another year.

However, they are cutting costs, and management reckon they can get to breakeven before running out of cash, saying;

Going concern

At 30 June 2015, the Group had cash of £88.8m. The Directors have prepared a cash flow forecast, including reasonable sensitivities, which shows sufficient funding to see the Group to break even and beyond. The forecast includes cost savings which will be generated from the business optimisation programme begun during the last financial year, encompassing further headcount rationalisation, exiting from non-core geographies and further property rationalisation. Furthermore, capital expenditure is expected to be substantially reduced during the year ending 30 June 2016 following the development and launch of the new platform in April 2015. This new platform is expected to drive a new, higher margin revenue stream. The Directors therefore confirm that they have a reasonable expectation that the Group will have adequate resources to continue in operational existence for the foreseeable future and accordingly these financial statements are prepared on a going concern basis.

My opinion - Monitise has never had a viable business model, something that was glaringly obvious - I shorted this share when it was over 20 times the current price, but unfortunately didn't have the patience to keep the position running. Pity.

It's very much in the last chance saloon now, with enough cash to give it one last chance at creating a viable business. Is it worth a punt? I don't think so, as the market cap is still lofty, at £65.6m. They say that "we expect the cash position to be in excess of £45m throughout FY16 - well fine that sounds reassuring, but it's only an aspiration. In my experience when businesses like this downsize in a rush to reach breakeven, all sorts of liabilities can come out of the woodwork - redundancy payments, penalties for surrendering leases, etc.

I'd have a punt on it if the mkt cap fell to say £10m, or about 0.5p per share.

I see the CEO has decided to return to America, for "personal reasons". Hmmmm.

Isn't it staggering to think that this had a mkt cap over £1bn as recently as 2014? It's amazing the over-valuations that many investors will give to blue sky projects that have failed to demonstrate any commercial viability, in bull markets. Bottom line is this - if you are selling a product or service which costs more to produce than you can sell it for, then you don't have a business, you have a charity - which is subsidising its clients.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.