Good morning!

In case you missed it, I did a write up on Waterman (LON:WTM) late yesterday. Looks a good turnaround situation, with further upside I think. My report is here, Waterman is right at the end. Also, am talking to management shortly, so may update on any key points from today's call.

Stanley Gibbons (LON:SGI)

Share price: 104.5p (down 27% today)

No. shares: 47.1m

Market cap: £49.2m

(at the time of writing, I hold a long position in this share)

Profit warning - oh dear, it's another profit warning, following hot on the heels of a previous warning on 23 Sep 2015. It might be useful to tabulate the contents of the two profit warnings, to see how they compare. Let's see if this works!

| Update dated | 23 Sep 2015 | 6 Oct 2015 |

| H1/H2 split | Expecting "materially higher revenues & profits" in H2 than H1 | "The Board expects that the Company will deliver materially higher revenue and profit in the second half of the financial year." |

| High value sales & H1 results | Uncertain whether these will complete by 30 Sep 2015. Material impact on H1 results if they don't | Some completed in September. H1 sales similar to LY, despite acquisitions. Profits expected to be "substantially below" H1 LY |

| Full year expectations | Still expect to meet full year market forecasts for y/e 31 Mar 2016 | On the basis of the performance in the first half, the Board now believes that, as a result of the weakness being experienced in our Asian operations and the continued illiquidity in high value stock items, it is unlikely that the Group will achieve the market forecast for the full year. |

| Online performance | Double-digit growth in total online sales. But new Marketplace is not performing well, being tweaked. Won't spend on marketing until response improves | "opportunity to materially grow shareholder value through the continued implementation of our online Marketplace and global auction business remains a positive proposition." |

| Cost savings | Annualised savings of £1.4m expected from integrating Noble Investments, and Mallett | "will benefit from a reduced fixed cost base and better cross selling of products and services across our customer base in the second half." |

Good, I'm pleased with that table - worth doing, as it contrasts the deterioration in outlook from the update only 2 weeks ago. Clearly they've failed to close the high value sales needed to meet their numbers.

Shareholders are justified in feeling annoyed that, having been reassured things would be alright for the full year just a fortnight ago, that is now being retracted.

Valuation - I've seen one broker note this morning which really slashes the forecast profit for this year, in half. EPS this year is now expected to be 8.7p. Therefore at the current share price of 104.5p the PER is now 12.0 - which looks sensible to me. Performance has been poor, forecasts have been slashed, and the share price has adjusted downwards accordingly.

Dividends - the broker is also now forecasting a halving of the dividend from 5.0p to 2.5p, so the support from a good yield has dropped away.

Net debt - is expected to be £17m at end H1, but should drop materially in H2, from planned reductions in stock.

My opinion - I'm not overly keen on this company, but the profit warning here looks to me like fairly transitory issues, which are already being fixed. That's important, as the nature of the problems determines if, and how quickly, the share price will recover.

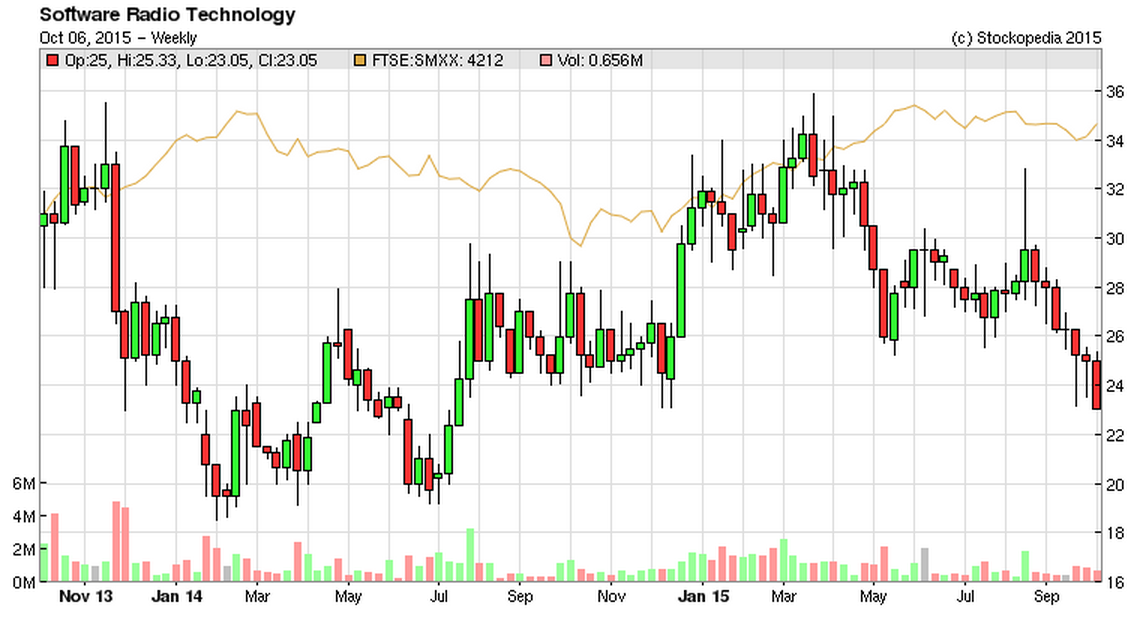

As you can see from the 2 year chart, this share has really been smashed down in price, and is starting to look potentially good value for a recovery maybe? That's why I picked up a little scrap of stock this morning. It's not a stock I will go into heavily, but think we could be near the bottom, as balance sheet support should kick in at or near this price.

It's always dangerous catching a falling knife, so I'll watch to see how sentiment plays out in the coming weeks, before possibly adding more if it continues falling. Some people like to wait until the price has started an upward trend, which is a very sensible strategy. I usually buy too early.

This fall looks a very extreme reaction. Has the company really lost two thirds of its value this year? Surely not? Hence why I think a rebound could occur at some point, but I don't know when unfortunately - that depends on market sentiment, i.e. the balance of buyers & sellers.

Software Radio Technology (LON:SRT)

Share price: 23.75p (down 5% today)

No. shares: 127.5m

Market cap: £30.3m

(at the time of writing, I hold a long position in this share)

Trading update - today's update covers the six months to 30 Sep 2015, in advance of interim results due out on 10 Nov 2015.

I was hoping for somewhat better figures than are given today, since there was a positive contract win announcement that I reported on here on 21 Aug 2015. Today's H1 update says;

- Revenue of £3.6m (down a third on H1 LY)

- Loss before tax of £0.7m (versus a profit of £0.5m H1 LY)

- Cash of £2.3m at 30 Sep 2015 (note there was a loan of £1m at 31 Mar 2015, which if still in place, suggests net cash is now £1.3m)

So that's clearly a disappointing performance. However, the outlook for H2 sounds more promising, and is based on firm orders:

As at the period end the Company had an order book of £3.6 million of confirmed orders scheduled for delivery before 31 March 2016.

In addition, the Company expects to receive and deliver new orders during the second half of the financial year.

So it seems that a strong H2, and hence full year, should be possible, likely even.

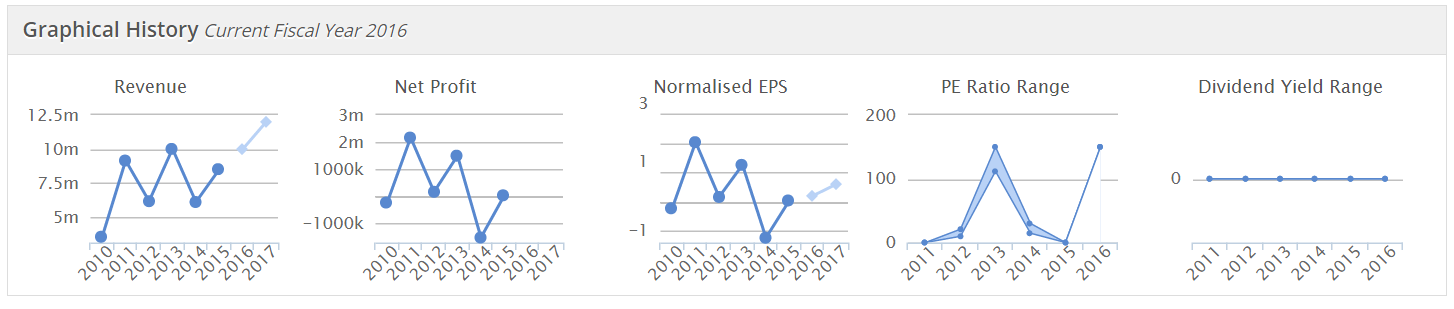

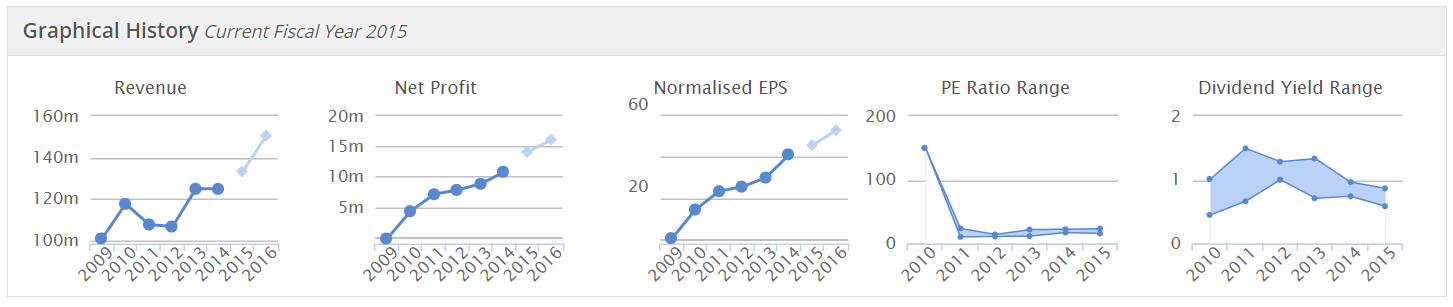

Valuation - a note from the house broker today says that they expect the company to meet, or beat its full year target of £10m turnover, and breakeven profitability. So how do you value a company with erratic profitability? (see historical graphs below):

So far the company has tended to alternate between good years (when it is profitable), and bad years, when it's usually around breakeven, or a loss.

Valuation therefore rests on what you think the company can do in the future. It says that the potential pipeline is huge (a figure of £200m was mentioned on 21 Aug 2015), so if the company does win some really big maritime mandates for its location & identifying equipment, then the hoped-for surge in sales & profits could eventually happen.

Balance sheet - generally OK, although inventories were high last time. The cash position looks OK-ish. The company has only done small cash calls in the past, so the number of shares in issue has only risen from 97.8m in 2010, to 127.5m now, demonstrating that the company has avoided the plummeting share price & confetti share issues that plague so many similar small growth stocks.

My opinion - I jumped the gun by buying some stock on 21 Aug 2015, which was a mistake, as I'm underwater a fair bit on this already.

Surprisingly, since I've been very rude about his company in the past, the CEO Simon Tucker wants to talk to me in a couple of weeks' time. I suggested to him a Q&A session by telephone, which I can record & publish on my AudioBoom channel, which he's agreed to do.

Actually, I'm hoping to do lots more CEO/FD interviews, for interesting small caps, as I think it's a really interesting way for other investors to hear a CEO answer questions from a real investor, rather than a stage-managed PR-based interview, with soft questioning. I don't do that. If it's worth talking to management, then you might as well dig into the issues, and get to understand the positives and the negatives a bit better.

I see from the mailing list here, that lots of PR companies & brokers read my reports, so do get in touch if a company I write positively about wants to take me up on the offer of a recorded phone call that I can publish for other investors to listen to. Or, if a company that I've slated wants a chance to give their side of the story!

My audiocasts are getting 1,000 to 3,000 listens, so this is a potentially good way to reach out to the PI community, via me. Also, I make my interviews interactive, and invite readers to submit questions to me before the interview, and I then ask most or all of the most interesting ones. Directors are not told what the questions are in advance, so we get authentic, spontaneous replies.

Overall, with SRT I think the jury is out. A breakeven result for this FY seems likely, so it remains to be seen what happens in future.

A few quick snippets;

Avon Rubber (LON:AVON)

Up 4.1% today to 999.5p, on the back of a positive trading update:

Avon is pleased to report that the financial year has ended strongly.

This was primarily driven by the receipt and rapid fulfillment of a late order for respirators from a customer in the Middle East. This, together with strong trading in our North American law enforcement market, leads the Board to anticipate that the adjusted operating profit for the year will be significantly ahead of current market expectations.

As reported in the 2 September 2015 trading update, a number of high value Middle Eastern opportunities remain in the pipeline and we still expect to see the benefit of these orders in 2016.

Sounds great. I don't know how to value this company, as it's not clear how sustainable future earnings will be, but it certainly has a superb track record in recent years. Well done to shareholders.

ST Ives (LON:SIV)

Results for the 52 weeks to 31 Jul 2015 look solid. Underlying EPS is up 9% to 20.32p, which looks to be ahead of consensus of 19.0p, assuming that the figures are calculated on the same basis.

At a share price of 195p, that puts the PER at a reasonable 9.6.

Sounds great - until you look at the balance sheet, which is far too weak to make this an investment that I would consider. NTAV is negative, at £50.3m. There's also a pension deficit of £27.6m, and gross debt looks high at £79.2m. That reduces to net debt of £62.8m when year-end cash is taken into consideration. Mgt stress that this is only 1.4 times EBITDA, but it just looks too much, to me.

Debt is fine in the good times, but when recession hits, and turnover/profits plummet, a weak balance sheet, top heavy with worthless intangibles, and a ton of bank debt, can suddenly mean a company is in crisis.

Should people care? That'e entirely up to you, I just point out the things that concern me - armed with the facts, you can do what you want. The record on divis has been good here, with decent increases each year since 2009, and a yield of over 4% now.

All done, see you in the morning!

Regards, Paul.

(of the companies mentioned today, Paul has long positions in WTM, SGI, and SRT, and no short positions.

A fund management company with which Paul is associated may also hold positions in companies mentioned.

NB - these reports are just Paul's personal opinions only. They are not advice, nor recommendations)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.