Good morning!

Connect (LON:CNCT)

Share price: 168.5p

No. shares: 244.3m

Market cap: £411.6m

I am writing part of this report the previous evening, as there probably won't be time to write it up in the usual time. On 14 Oct 2015 here I wrote up my review of the results for y/e 31 Aug 2015 from Connect - a specialist distribution company (formerly Smiths News).

Whilst the business seems to be performing alright, I have concerns over its weak balance sheet, which are summarised as follows;

- NAV of only £9.2m

- Taking off intangibles of £174.8m reduces NTAV to minus £165.6m

- Current ratio of 0.71 seems weak

- Net debt of £153.4m is higher than I would like

- I suggested that an equity raise of c.£166m would be sensible, to restore NTAV to around nil.

Telecon with CFO, Nick Gresham - one of the company's advisers suggested that it might be useful for me to discuss my balance sheet concerns with Connect's CFO, and so we had a chat today by telephone.

In most situations (where it's a proper company as in this case, and not some blue sky, or overseas rubbish on AIM), I'm more than happy to engage with companies, and put their point of view across too, so that investors can make up your own minds. It's important to have a right to reply if a commentator is saying negative things about your company.

Here were the key points made by Connect's CFO to me today;

- Net liabilities were minus £60m at the time of the demerger from WH Smith, so the balance sheet has improved from what was inherited.

- Post-acquisition of Tuffnells, the business should generate strong free cashflow, such that it is expected to reduce net debt to c.£100m by 2018.

- A £55m equity fundraising was done as part of the financing package to acquire Tuffnells.

- Net debt to EBITDA is currently 2 times, well within the banking covenant of 2.75 times, so the CFO feels they have adequate headroom.

- "I am comfortable with both the supply, and the cost of bank debt"

- Pension deficit - is very small, compared with say Wincanton (LON:WIN)

- Freeholds - of c.£25m book value, and current market value is about the same, which provides some balance sheet strength.

- Total bank facilities are £250m, provided by a syndicate of 5 banks, so again plenty of headroom is available. Available until Nov 2018.

- Acquisitions - none in the pipeline short term, possibly more in future, if so likely to be smallish.

- If market conditions deteriorated, then Connect could reduce its dividends to prioritise reduction in bank debt/ strengthening its NTAV position.

- The company does not want to dilute existing shareholders with an equity fundraising, when it doesn't see a pressing need to do so. This is always an option for the future though, if circumstances warranted it.

My (revised) opinion - overall I was reassured by this conversation, and whilst I would prefer to see a stronger balance sheet at Connect, I accept that the current situation looks stable & sustainable for the time being. Maybe I am a bit too paranoid about balance sheets? Although I do feel that a strong balance sheet protects the downside for investors, if/when things go wrong.

On balance I would still prefer to see the company reduce its very generous dividend yield somewhat, and focus more on debt reduction & building balance sheet strength. However, after talking to the CFO, and his justifications for the current position, I feel a bit more relaxed about the issues we discussed. On reflection, me describing the high dividend yield as "reckless" was probably a bit over the top!

4imprint (LON:FOUR)

Share price: 1296p (down 2% today)

No. shares: 28.0m

Market cap: £362.9m

Trading update - this company is a "direct marketer of promotional products", and operates mainly in the USA.

Today it says;

The Group has continued to experience strong organic growth in the period since the announcement of its half year results on 29 July 2015, with the balance between new and existing customer orders consistent with previous periods. The Board expects percentage revenue growth in the high teens for the year as a whole, while delivering its objective of maintaining constant overall operating margin percentage.

This strikes me as a bit unclear. It's fine to give additional detail like this, but investors really just want a simple statement saying whether or not the company is going to meet market expectations for the year (on profits). No mention is made of that in today's statement. Omission usually means it's fine, because if they were trading below expectations, then they would have to say so, but it does introduce doubt into my mind (i.e. that they might be trading a little below expectations, but want to avoid saying so).

Revenue growth "in the high teens" is obviously good, although note that revenue growth in H1 was 20%, therefore it sounds as if H2 growth will be perhaps c.15%, which would give high teens for the year as a whole. So growth is slowing somewhat. However, that seems consistent with broker expectations, which I see are for turnover growth of 16.6% for this full year.

The operating margin was 6.4% last year, so on forecast turnover of $485m, that equates to $31m operating profit this year (remember this company switched to dollar reporting recently).

EDIT - I have subsequently confirmed that 3 brokers covering FOUR have all published notes today leaving their estimates for this year unchanged - i.e. this update is indeed consistent with market expectations.

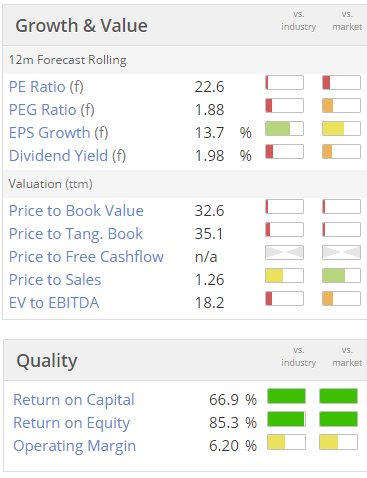

Valuation - it's looking very fully valued now, especially as growth is slowing;

My opinion - this seems a very good company, and the shares have done really well, but personally I would be taking profits now if I held, given that growth is slowing, and the valuation is very full now, or even a bit over.

There again, it's looked pricey all the way up, so if you had worried too much about valuation then you'd have missed the big rise (as indeed I did!)

Coms (LON:COMS)

Share price: 1.03p (up 17.1% today)

No. shares: 1,389.5m

Market cap: £14.3m

Interim results to 31 Jul 2015 - I had a quick look at these figures earlier this morning, purely out of curiosity to see how close to going bust it was. However actually things look as if they are being turned around quite well.

It is around breakeven on continuing ops in H1 - not bad, considering all the disruption from changing management, doing an emergency fundraising, etc. An onerous lease of £30k per month (9 years remaining) has been exited, which is clearly good news.

The Directorspeak is positive.

Balance sheet - still quite weak, but not a disaster. I'd say they will need another top-up fundraising at some point.

My opinion - I've taken this share off my Bargepole List today, as it no longer looks to be in critical condition, and who knows, maybe a decent turnaround is underway?

It's not yet clear to me that the business is worth £14.3m, mind you. So more investigation would be needed to ascertain where the company is going, and whether it has a more viable business model second time around?

Clearly, as you can see from the 2-year chart below, a lot needs to be done to restore shareholder value. It's doubled from recent lows, on relief that the company isn't likely to go bust. However that doesn't on its own make it a good investment from here. More work is needed to research the new business plan I think.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.