Good morning!

I was just thinking how it was unusual not to see any profit warnings today, as they seem to be coming thick and fast on most days - which makes me nervous, given the high valuations a lot of small caps are currently rated at.

Then out pops a profit warning at 10:51 today;

DX (Group) (LON:DX.)

Share price: 42.25p (down 50% - but moving fast)

No. shares: 200.5m

Market cap: £84.7m

(at the time of writing this section I did not hold any shares in DX.. However, when they dropped further in price, I bought some - as explained below)

Profit warning - this is a courier firm, which floated in Feb 2014. It has looked an attractive value share for a while, with a PER and divi yield both around 7. However, things are cheap for a reason, and in this case I've kept away from it because the operating margin looked suspiciously high, given that it operates in a highly competitive sector. High margins don't usually last long, as competitors chip away at them.

So what's gone wrong? The company says that trading patterns in H1 have deteriorated. In this case, its financial year end is 30 June, so H1 is Jul-Dec inclusive.

In particular, the DX Exchange operation is experiencing a higher than expected level of volume erosion and there have been increased cost base pressures, mainly arising from driver resourcing issues (where there is an industry wide shortage). In addition, the new business pipeline in our parcels operation, while healthy, is converting more slowly. This means that while revenues for the first four months are 5.3% down against the prior period, the Board now expects that profits will be significantly below current market forecasts. The balance sheet remains robust, with low levels of net debt (30 June 2015: £1.8m). The Board anticipates the dividend payout for the full year to amount to 2.5p per share.

So to summarise;

- Volumes declining at DX Exchange faster than expected

- Higher cost of employing lorry/van drivers (due to industry shortage)

- Parcels - new business pipeline converting more slowly

- Revenues down 5.3% Jul-Oct 2015

- Profits significantly below market forecasts

- Dividend being slashed from 6.1p expected, to 2.5p

That's pretty bad, which the market has reflected by halving the value of the shares in the last 20 minutes. Dividend seekers in particular will be gutted by the slashing of the divis - it just goes to show that chasing a high dividend yield can be dangerous, as they are often unsustainable.

My opinion - I've questioned here before how this courier manages to make an 8.5% operating profit margin, when others in the sector struggle to make any profit at all? It could only mean that they have some particularly lucrative contracts, almost certainly the DX Exchange (used by lawyers, and similar, but it's in long-term structural decline as email increasingly replaces it for sending documents).

The slashing of the dividend by more than half removes a key support for the shares, and personally I remain reluctant to get involved in what seems to be a declining business. Bear in mind also that there is very heavy capex in the pipeline of £35m, as a new Midlands 44 acre distribution site is opened. So it looks like the company is conserving cash for that, by reducing the divis.

Overall, I think it's wise to value this company by theoretically reducing its margin from 8.5% to say 3.0%, which is probably a more sensible, sustainable level of profitability. For now though, with the shares in freefall, it's probably best for me to sit on the sidelines and wait a few weeks to see where the price settles.

Bad luck to holders here. As always though, if it looks too good to be true, then there's probably something wrong, lurking underneath. In this case, the problem is clearly that profits were unsustainably high. Reasonableness-checking a company's profit margin against the sector is always a good idea.

EDIT: I couldn't resist the falling knife at 36p, and have bought a few, about 20 minutes after writing the above article. I didn't expect it to fall this low, and think there might be an opportunity for a trade, on a bounce to say 50p, possibly?

EDIT2: Just doubled up at 31p. Fingers crossed. I don't think it's anywhere near going bust, so the fall this morning looks overdone now.

EDIT3: Hmmm, well as usual, my falling knife catching has not gone well, so far. What has been staggering, with DX Group now closing down 73% on the day, at 23p, is the extremely high volume of shares traded. This must mean some Institution(s) are dumping at any price.

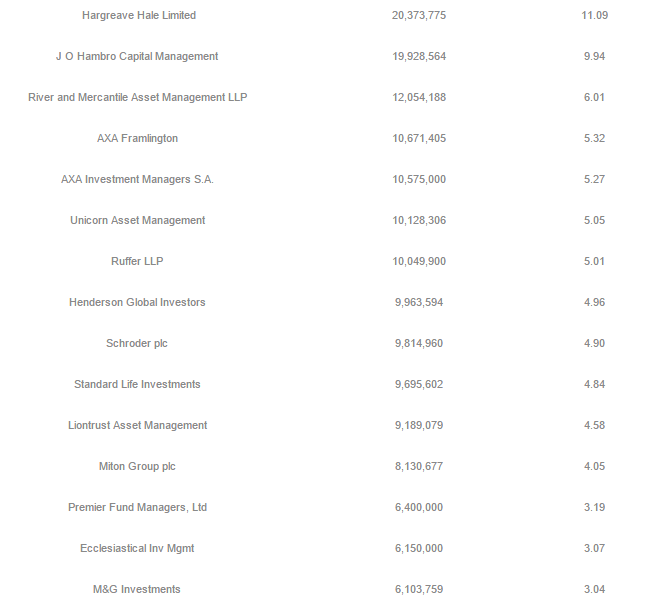

If you look at the list of Institutional shareholders for DX Group, it's like a Who's Who of small cap fund managers. Now of course everyone gets plenty of stocks wrong, it's par for the course. But I've been flagging for a long time that DX's profits looked unsustainable. How come none of these fund managers thought about that? It really makes you wonder what due diligence do they actually do?

With all the excitement going on with DX (Group) (LON:DX.) I haven't even got round to looking at Stanley Gibbons (LON:SGI) next, which has been on my to do list all morning. I'm astounded that DX has fallen as much as it has - there must be Institutions dumping positions - 19m shares traded today at the time of writing, that's almost 10% of the shares in issue, and that total will go higher. So there will no doubt be some RNSs updating on >3% holder positions.

EDIT: at the close of the day, 53.4m shares had traded, of 200.5m in total issued.

DX is yet another example of Private Equity selling a pup to the stock market. Their IPOs really do have to be treated with the utmost suspicion, in my view.

Stanley Gibbons (LON:SGI)

Share price: 98.5p (down 9.6% today)

No. shares: 47.1m

Market cap: £46.4m

(at the time of writing, I hold a long position in this share - subsequently sold - as explained in the end of this section)

Interim results to 30 Sep 2015 - the market already knew that this collectibles group has been performing poorly, as there were two profit warnings in Sep & Oct. I compared the two profit warnings here on 6 Oct 2015.

Even so, these H1 figures are worse than I was expecting. On 6 Oct the company said that H1 profits would be "substantially below" H1 last year. What the company calls "trading profit" has collapsed, from £6.1m last time in H1, to just £456k this time. This measure of profit doesn't include the £1.1m costs of internet development, nor pension fund costs, or share options. Once you include those costs, the company is loss-making. So a dismal performance.

With my finger now hovering over the sell button, the only things that could stop me selling would be the balance sheet, and the outlook.

Balance sheet - net assets look good, at £81.9m, but once intangibles are written off, then NTAV is £42.8m. That supports 92% of the market cap, so it seems strongly asset backed.

Note also that the balance sheet is dominated by £54.9m of inventories (of collectibles), which are in the books at cost. The big question is, whether there is good upside on that cost, when these items are sold?

Note that there is a £6.0m pension fund deficit.

A concern is that debt has shot up - with a £6.8m bank overdraft, plus an £10.3m in loans. This concerns me. If the bank gets jittery, then they could force a fire sale of stock at below book cost. Net debt of £17.0m is therefore a worry.

Outlook - this sounds altogether more positive;

The Board expects that the Group will deliver materially higher revenue and profit in the second half of the financial year than in the first half, partially assisted by this year's auction calendar being more heavily weighted towards the second half. The Group also continues to work on a number of initiatives with the aim of delivering substantial sales from our sizeable stockholding of rare collectibles, particularly philatelic.

Following the completion of the integration and rationalisation of recent acquisitions, the Group expects to benefit from a reduced fixed cost base and better cross selling of products and services across our customer base in the second half.

My opinion - this is a finely balanced situation. I can see how, with patience, the shares might recover. Set against that, H1 was a lot worse than I expected, and questions have to be asked about management competence here.

Support from divis is falling away, as the interim divi has been passed.

Overall, I'm not comfortable with this one any more, so have decided to ditch my small position for a small loss (it was a recent purchase). I can see the case for holding on, but there are other fish to fry, so it's not for me any more.

Castings (LON:CGS)

Share price: 460p (down 2.6% today)

No. shares: 43.6m

Market cap: £200.6m

Interim results to 30 Sep 2015 - it's always such a pleasure, and so quick, to review results from this UK engineering company. No adjustments, no highlighted items, just crystal clear numbers.

Also, the narrative is just a few bullet points. This is the full narrative (excluding legal disclaimers) below;

Sales for the six months ended 30 September 2015 were £65.0m (2014 - £63.6m) with profit before tax of £9.51m (2014 - £8.34m). Sales revenue has been affected by the general reduction in raw material prices during the period making it difficult to directly compare to the previous year.

It was reported at the Annual General Meeting in August that sales volumes were maintaining at reasonable levels. It appears for the next three months that orders and schedules will remain at a similar level. It is anticipated that the profits for the full year will meet market expectations, unless there is a sudden and unexpected change in the economic climate that would affect the outcome.

An interim dividend of 3.38 pence per share has been declared and will be paid on 4 January 2016 to shareholders who are on the register at 27 November 2015.

Balance sheet - just fantastic! Net assets are £122.5m, all of which are tangible.

Working capital is very strong, with net current assets of £54.7m, and a current ratio of a very strong 3.6 (anything over about 1.5 is good).

There is cash of £31.9m, and no debt.

Overall then, I would say there is at least £40m of surplus capital on the balance sheet, so that's about 20% of the market cap. That provides a big safety buffer, and provides firepower for potential acquisitions.

This is one of the balance sheets out there.

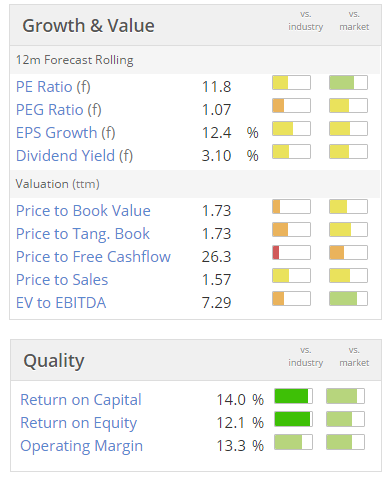

Valuation - in my view, this looks a quality business, at a reasonable price.

My opinion - I probably should have been buying some of these today, instead of catching falling knives!

My main reservations with Castings is that its profits have been somewhat unpredictable in the past. However, it looks a really solid, traditional company, performing well, with a great balance sheet, at a reasonable price.

Providing profits are sustainable, then it looks a nice company to research and maybe take a position in. There is some exposure to automotive, they make turbochargers I think, so that would need checking. Also currencies might be an issue too.

Well, what an exciting, if rather unprofitable, day!

I hope you enjoy the weekend, and see you back here on Monday.

Regards, Paul.

(of the companies mentioned today, I have a long position in DX., and no short positions.

A fund management company with which I am associated may also hold positions in companies mentioned.

I get so sick of repeating this, but it STILL doesn't seem to sink in with a few people - read my lips - I DO NOT GIVE ADVICE OR RECOMMENDATIONS ON STOCKS! The whole point is that readers are meant to make up your own minds! These reports are purely my personal opinions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.