Good morning!

This will be the quickest SCVR ever, as I have to leave home at 7:50 this morning, to head for Essex, to attend a memorial service, and then a family get together afterwards. I'll try to add a few more comments this evening, but it depends what time I get home.

Norcros (LON:NXR)

The CFO, Martin Payne, is stepping down, for career reasons, to join Polypipe (LON:PLP). The reason seems to stack up - PLP has a market cap of £630m (at 315p per share) against NXR £126m (at 206p), so it doesn't look to be a particular concern in terms of anything suspicious, or otherwise negative.

Trakm8 Holdings (LON:TRAK)

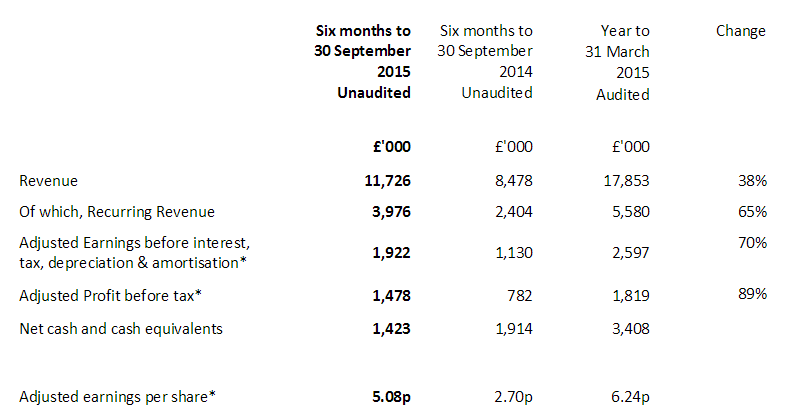

Interim results to 30 Sep 2015 - the headline figures look good;

Remember these are only half-year figures.

The good figures also come with a positive outlook statement;

The Group believes that we will continue to successfully execute our outlined strategy and as a consequence deliver growth in shareholder value. The second halves of our financial years have consistently shown increasing revenues including service revenues over the first half. This year we expect that this will be true again. This, along with a full period effect of DCS, means that we expect second half of the year revenues will be considerably ahead of the first six months.

At the time of our Final Results in July we indicated that we expected to modestly exceed the market's then current expectations. The Board is now confident that the results for the year ending 31st March 2016 will again modestly exceed the market's current expectations.

That's the way to do it! Setting forecasts sensibly, so they can be beaten (modestly!). Excellent stuff.

Net cash - in the highlights section, the company says it has £1,423k net cash. This seems to ignore £583k borrowings in current liabilities, and £2,943k borrowings in long term creditors. So I make it net debt of £2.1m. So an apparent anomaly there.

The company capitalised £581k of development costs in H1, against an amortisation charge of £282k, so the net benefit to the P&L is about £0.3m.

My opinion - a very nice growth company, with excellent management. The market cap is quite rich now, at £80.0m (at 265p), which is about 24 times this year's forecast earnings, falling to 17.3 times next year's (on broker consensus of 15.4p EPS in 2016/17).

If the company hits, or beats those numbers, then actually the valuation might even end up looking reasonable, or even good value. Therefore the way things look, I wouldn't be surprised to see this share power up to, and maybe beyond, 300p per share.

Plus500 (LON:PLUS)

The deal's off! I commented a while back that the 40p discount to the 400p takeover bid price, suggested that the deal may not go ahead, and so it has transpired.

I would expect shorters to have another pop at the shares now, so this could drop today. Lack of FCA approval by 31 Dec 2015 is given as the reason.

However, the company has come out with all guns blazing, saying that current trading is strong, announcing a $0.2121 per share interim divi, a $20m share buyback, and saying it had $95m in cash at 30 Jun 2015, and has generated further cash since.

Although note profits are said to be below 2014, so the major regulatory issues clearly had some impact.

It will be fascinating to see how this one plays out.

Bonmarche Holdings (LON:BON)

Interim results - turnover is up 6.5%, including a LFL increase of 2.0% for H1.

However, pre-exceptional profit is only flat against last year, at £6.4m, with pre-exceptional EPS also flat, at 10.5p.

Net cash looks good, at £18.6m.

Directorspeak/outlook - a bit wobbly, but the weather has been very mild (until a couple of days ago). Although I seem to recall it was also mild last year?

"Bonmarché's performance for the first half of the year has been satisfactory and we have made further progress against our strategic objectives. I am pleased with the improvement in store like-for-like sales, which is a testament to the value of our loyal customer base, in a market which remains challenging. I am also pleased with the progress being made by the new marketing and multi-channel teams to turn around online sales.

Trading conditions during November have been challenging, due to very mild, wet weather. Our expectations for the full year remain unchanged, provided that trading conditions normalise for the remainder of the financial year."

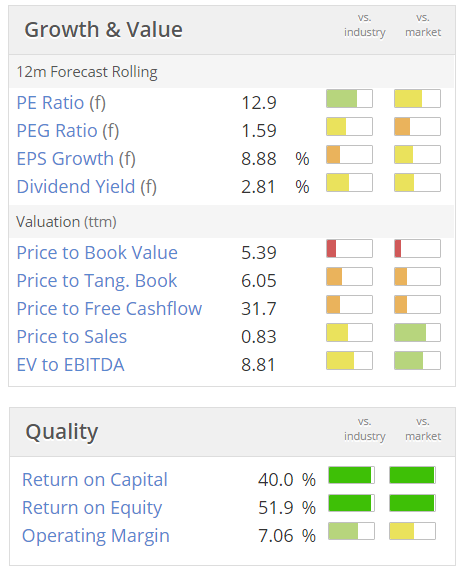

The valuation looks reasonable, but I suspect the shares might fall today, on the slightly wobbly outlook comments;

Note that the quality scores looks surprisingly good.

As with all retailers, wages costs will be the big problem in coming years, as the Living Wage gradually kicks in, and higher paid staff push for differentials to be maintained above the lowest paid. So the company might struggle to increase profits from here, possibly?

The company's cashflow looks very good, and it's self-financing its own expansion in new stores.

Right, I have to dash!

See you either later today, or more likely, tomorrow.

Regards, Paul.

(Usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.